ACH vs Credit Card Payments Choosing the Right Mix for Your Business

The core difference between ACH and credit card payments really boils down to a simple trade-off: ACH offers a low-cost, direct bank-to-bank transfer that's perfect for large or recurring payments, while credit cards provide instant authorization and are what most customers expect, but at a much higher cost. The right choice for your business depends on whether you're trying to cut costs or make the sale as fast and convenient as possible.

Understanding Your Core Payment Options

For any merchant, deciding between the Automated Clearing House (ACH) network and credit card networks is a foundational business decision. These two "payment rails" are the paths money takes from your customer to your bank, and they directly impact your profit margins, cash flow, and even how you run your daily operations. Getting a handle on how they work is the first step to building a smarter payment strategy.

An ACH payment is essentially a digital check. It’s an electronic transfer that moves money directly from one bank account to another, completely bypassing card networks like Visa or Mastercard. This direct route is what makes the processing fees so much lower, but it comes with a catch—it’s a slower journey, often taking a few business days for the money to actually land in your account.

On the other hand, a credit card payment is all about speed. It leverages those massive card networks to instantly check if a customer has enough credit to make a purchase. That immediate approval and convenience is why customers love them, but it costs you. Merchants pay a fee on every single transaction, which can really eat into profits, especially on bigger-ticket items.

At a Glance Comparing ACH and Credit Card Payments

This table gives you a quick, high-level look at the key differences to keep in mind as you weigh your options.

| Factor | ACH Payments | Credit Card Payments |

|---|---|---|

| Typical Cost | Low, flat fee (e.g., $0.25–$1.50) | Percentage + flat fee (e.g., 1.5%–3.5% + $0.30) |

| Settlement Speed | Slower (2-5 business days) | Faster (1-3 business days) |

| Best Use Case | Recurring billing, B2B invoices, large payments | E-commerce checkout, retail POS, one-time sales |

| Dispute Risk | Lower risk (bank-to-bank returns) | Higher risk (consumer-friendly chargebacks) |

| Customer Adoption | Requires bank account info, less common for retail | Nearly universal, high consumer preference |

These fundamental trade-offs are just the beginning of the story. While ACH and credit cards are the main players, businesses in certain markets might also use local payment systems like Hong Kong's Faster Payment System (FPS). For most businesses, the smartest move isn't picking one over the other, but learning how to offer both strategically to get the best of both worlds.

Analyzing Transaction Costs and Merchant Fees

When you're weighing ACH vs. credit card processing, the first thing that hits you—and your bottom line—is the cost. Every single sale is impacted by processing fees, so getting this right is non-negotiable for your profitability. These two payment methods couldn't be more different in how they're priced, and that difference can have a huge effect on your business.

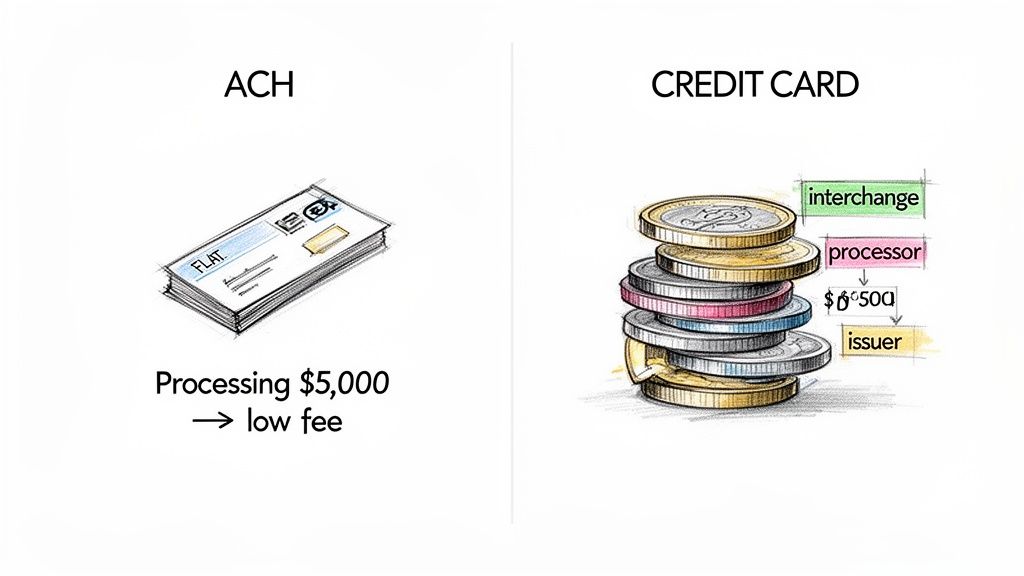

ACH payments are prized for being straightforward and cheap. They're direct bank-to-bank transfers, so they don't have all the middlemen that inflate credit card transaction costs.

Because of this, ACH fees are usually just a small flat rate. Most processors will charge you somewhere between $0.20 and $1.50 per transaction. Some even cap the fee at around $5, no matter how large the payment is.

Credit card fees, on the other hand, are a whole different beast—they're complicated and a lot more expensive. They run on a percentage-based model, often called interchange-plus pricing. This means you're charged a percentage of the sale plus a small fixed amount.

Breaking Down Credit Card Fee Complexity

That percentage isn't one simple charge. It's actually a stack of different fees that go to various players: the bank that issued the card (interchange fee), the card network like Visa or Mastercard (assessment fee), and your payment processor (their markup).

And the rates aren't static. They can swing wildly depending on a few key factors:

- Card Type: A premium rewards card costs you more to accept than a standard debit card.

- Transaction Method: Taking a card in person is usually cheaper than an online payment because the fraud risk is lower.

- Merchant Category Code (MCC): Your industry classification plays a role in the rates you're assigned.

For a merchant, this complexity is more than just a headache—it’s a direct hit to your revenue. The shifting, layered nature of credit card fees makes financial forecasting a guessing game and consistently chips away at your margins, especially as your sales volume climbs.

A Practical Cost Comparison

Let's run the numbers on two common business scenarios to see just how big the impact is.

Scenario 1: A $100 Recurring Subscription Payment

- With ACH: Your fee might be a flat $0.50. You pocket $99.50.

- With a Credit Card (at 2.9% + $0.30): The fee is $3.20. You're left with only $96.80.

Over a year, that seemingly small difference adds up to $32.40 in lost revenue from a single customer. Imagine that multiplied by hundreds or even thousands of subscribers.

Scenario 2: A $5,000 B2B Invoice

- With ACH (fee capped at $5): The fee is just $5.00. You keep a massive $4,995.00.

- With a Credit Card (at 2.9% + $0.30): The fee balloons to $145.30. You only keep $4,854.70.

In just one high-value payment, choosing ACH saves you over $140. This is exactly why ACH is the go-to for B2B companies, property managers, and any business that handles large invoices. As you analyze your own payment costs, remember to factor in all the variables, including understanding transaction fees that might be unique to your industry or the software you use.

Ultimately, while credit cards are a must-have for most retail and online checkouts, their costs go beyond just the fees. The associated dispute risks can be even more damaging. A high chargeback rate not only costs you money but can also put your entire merchant account at risk. That's why managing those initial transaction fees is only half the battle; finding ways to prevent disputes is just as critical. You can see how different alert plans compare by checking out the pricing for Disputely's services.

How Settlement Times Impact Your Business Cash Flow

Beyond the processing fees, the next thing you really need to look at is settlement time. This is simply how long it takes for the money to go from your customer’s account to yours, and it’s a massive factor in the ACH vs. credit card decision. This delay directly impacts your cash flow, affecting everything from buying inventory and paying suppliers to simply making payroll. The difference in speed here can make or break your operational rhythm.

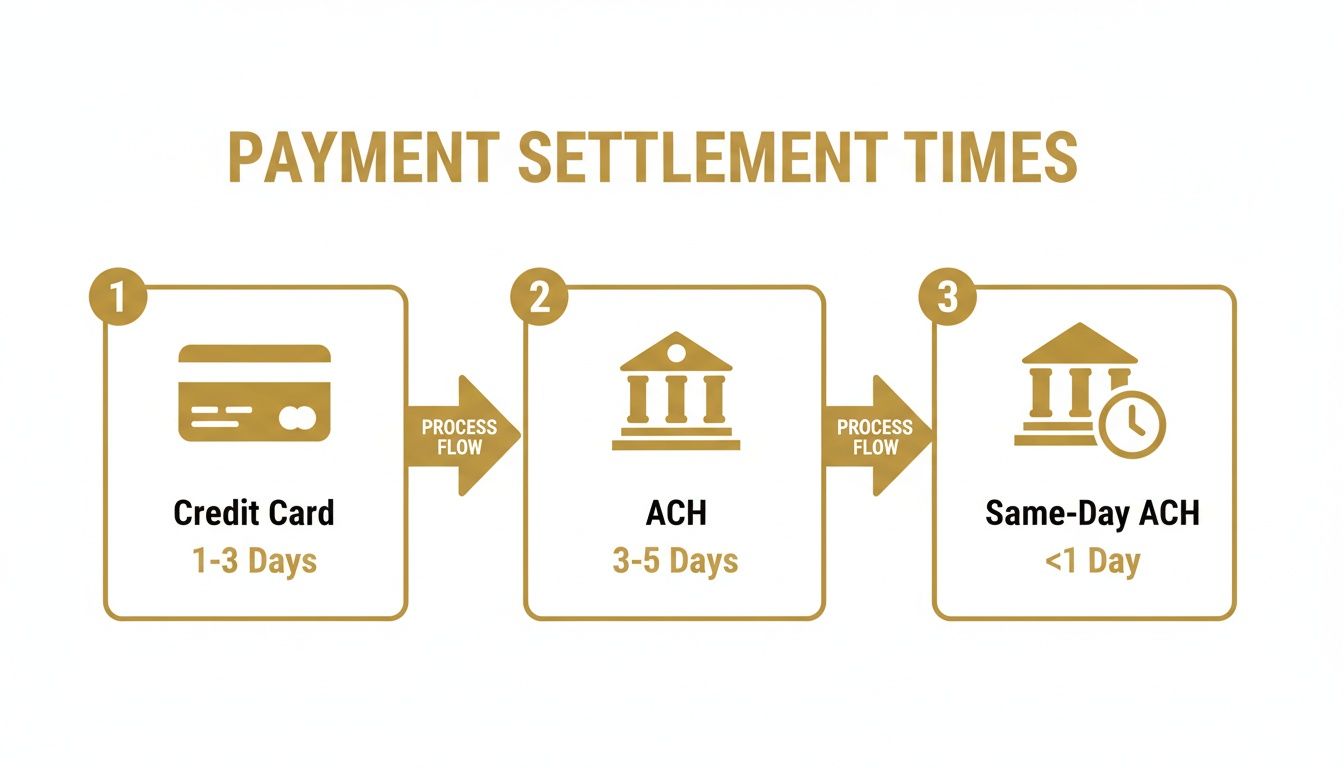

Credit card payments are designed for speed. When a customer pays, you get an authorization in seconds, and the money usually lands in your merchant account within 1-3 business days. That quick turnaround gives you predictable cash flow you can count on.

ACH payments, on the other hand, march to a different beat. They're processed in batches, which means traditional ACH transfers take longer to clear. You’re typically looking at a settlement time of 3-5 business days. This means you have to be much more deliberate with your financial planning. A sale you make on Monday might not turn into usable cash until Friday or even the following week.

The Rise of Same-Day ACH

For a long time, the slowness of ACH was a dealbreaker for businesses that couldn't afford to wait for their money. But the introduction of Same-Day ACH is changing the game. This service pushes ACH transactions through to be processed and settled on the same business day, creating a fantastic middle ground between the low cost of traditional ACH and the speed of credit cards.

It’s still not as instant as a credit card authorization, but Same-Day ACH is a huge improvement for cash flow. It’s especially useful for payments where time is critical, like:

- Urgent vendor payments: Making sure your suppliers are paid on the dot to keep your supply chain running smoothly.

- Last-minute payroll: Fixing a payroll mistake or making an off-cycle payment without missing a beat.

- Expedited customer refunds: Keeping customers happy by getting their money back to them faster.

The real takeaway here is that the right settlement speed depends entirely on your business model. Faster isn’t just a nice-to-have; it's a strategic tool for staying nimble and avoiding operational headaches.

Matching Settlement Speed to Your Business Needs

So, how do you choose? It comes down to a trade-off. For some businesses, the cost savings from ACH are easily worth the extra wait.

Take a SaaS company with predictable, recurring monthly revenue. They can easily absorb a 3-5 day settlement window because their income is steady. The significant savings on processing fees directly boost their profit margins, making the wait a smart financial move.

Now, think about an e-commerce store with high inventory turnover and razor-thin margins. They might absolutely depend on the faster cash flow from credit cards to restock hot-selling items. A few days' delay could mean a stockout and lost sales. This is also why payment holds can be so devastating; knowing how to deal with a Shopify payment hold is a non-negotiable skill for online sellers who need that consistent cash flow.

Ultimately, this choice is less about raw speed and more about financial stability. Look at your business cycle and be honest about your needs. You'll quickly see whether the lower costs of ACH justify the wait or if the immediate liquidity from credit cards is essential to keep things running.

Navigating Disputes, Fraud, and Chargeback Risk

Payment disputes aren't just an operational headache; they're a direct hit to your bottom line. How you handle this risk is a massive part of the ACH vs. credit card decision, because their dispute systems operate in completely different universes. Getting this right is crucial for protecting your revenue and keeping your business in good standing.

Credit card disputes, which we call chargebacks, are famously tilted in the customer's favor. The major card networks, like Visa and Mastercard, have built a system that makes it almost frictionless for a cardholder to dispute a charge—often with just a few taps in their banking app. This is great for consumer confidence, but it can leave merchants holding the bag.

On the other hand, ACH disputes, known as returns, operate under the much stricter, bank-to-bank rules set by the National Automated Clearing House Association (NACHA). The list of valid reasons for an ACH return is short and specific (think unauthorized debits or wrong account numbers), and the process is far more formal. This structure means ACH returns are much rarer and harder for a customer to initiate without a truly legitimate claim.

The High-Stakes Game of Credit Card Chargebacks

For any business accepting credit cards, the chargeback process is a constant threat. The moment a customer files a dispute, the funds are typically yanked from your account, and you're hit with a separate chargeback fee that can sting anywhere from $20 to $100. You then have a very short window to fight back by providing a mountain of evidence in a process called representment.

If you lose, you're out the revenue, the product you shipped, and the penalty fee. But the real danger goes much deeper.

Every single chargeback pushes up your chargeback-to-transaction ratio. If that ratio creeps over the card networks' threshold—usually around 0.9%—you can be slapped with huge monthly fines, get put on a high-risk monitoring list, or even lose your ability to process credit cards entirely.

This infographic breaks down the typical settlement times, which also plays a role in how long your funds are exposed to this risk.

As you can see, credit card funds hit your account faster, but that speed comes with a trade-off: a higher risk of the transaction being reversed by a chargeback weeks or even months down the road.

A Proactive Defense: Chargeback Alerts

Luckily, the credit card world has an ace up its sleeve that just doesn't exist for ACH: chargeback alerts. Services from companies like Ethoca and Verifi, which can be integrated through platforms like Disputely, act as an early-warning system. They intercept a customer's complaint before it escalates into a full-blown, damaging chargeback.

This gives you a critical 24-72 hour window to resolve the problem directly, which usually means issuing a refund. While you still lose that one sale, you completely dodge the chargeback fee and, more importantly, protect your chargeback ratio and the health of your merchant account. For any business serious about credit card processing, alerts aren't a "nice-to-have"—they're essential.

With Americans using credit cards for an estimated 70.6% of all retail spending in 2024 and 85% of in-store transactions now being cashless, the sheer volume of payments makes this a bigger issue than ever. More transactions inevitably mean more disputes.

Comparing Risk Profiles and How to Fight Back

Because the risks are so different, your defense strategies for ACH and credit cards have to be, too.

ACH Risk Mitigation: Here, your biggest worry is a payment failing because of insufficient funds (NSF) or a typo in the account number. Your defense is all about front-end prevention:

- Account Verification: Before you ever pull a payment, use a service like Plaid or run micro-deposits to confirm the bank account is real, valid, and has money in it.

- Ironclad Authorization: Make sure your agreement to debit the customer's account is crystal clear, follows NACHA rules to the letter, and is easy to pull up if needed.

Credit Card Risk Mitigation: With cards, the primary enemy is the chargeback, which can come from legitimate issues or from "friendly fraud" (when a customer disputes a charge for a product they received). Your defense needs multiple layers:

- Top-Notch Customer Service: Use clear billing descriptors on bank statements, make your refund policy easy to find, and communicate openly to stop issues before they become disputes.

- Fraud Filters: Always use Address Verification System (AVS) and CVV checks to weed out obviously fraudulent transactions at the point of sale.

- Chargeback Alerts: This is your non-negotiable safety net. Implement an alert system to deflect disputes and protect your merchant account.

- Smart Representment: For the chargebacks you know are invalid, you have to fight smart. Having a solid, evidence-based process is key to winning your money back. You can learn more about how to win more chargeback representments in our comprehensive guide.

Ultimately, ACH has a lower built-in risk because of its rigid, bank-controlled structure. But credit cards, while riskier, come with a sophisticated toolkit that allows you to proactively manage and mitigate that risk. The right choice comes down to your business's tolerance for risk and your commitment to putting these defenses in place.

Strategic Use Cases: When to Choose ACH or Credit Card

Knowing the difference between ACH and credit cards is one thing. Knowing exactly when to use each is what really sets a smart payment strategy apart. This isn't about finding one "best" method; it's about matching the right payment type to the right situation to optimize for cost, customer experience, and security.

Getting this wrong can quietly drain your profits. For example, accepting a credit card for a large B2B invoice can cost you hundreds in fees. On the other hand, forcing a first-time online shopper to use ACH might spook them into abandoning their cart.

Let's break down the ideal scenarios for each, so you can build a more flexible and intelligent payment system.

When ACH Payments Are the Smartest Choice

ACH really shines when cost-efficiency and payment reliability are more critical than instant speed. Its low, flat-fee structure makes it the undisputed champion for certain types of transactions that are foundational to many business models.

Think about these ideal use cases for ACH:

- Recurring Subscriptions and Memberships: If you run a SaaS company, a gym, or a subscription box service, ACH is a powerful tool for keeping customers around. Bank accounts don’t expire or get canceled nearly as often as credit cards, which means ACH payments have a much lower failure rate. This directly reduces involuntary churn.

- High-Value B2B Invoices: Once you start dealing with payments over $1,000, the percentage-based fees from credit cards get expensive fast. A $10,000 invoice could easily cost $300 to process with a credit card, while a fee-capped ACH transfer might only cost $5.

- Property Management and Rent Collection: Landlords and property managers benefit hugely from using ACH to collect monthly rent. It automates the entire process, cuts down on administrative work, and stops high credit card fees from eating into rental income.

The rule of thumb for ACH is simple: use it for trusted, ongoing relationships and high-value transactions. In these cases, the customer is usually happy to take an extra minute to link their bank account for a more secure and cost-effective payment.

Where Credit Cards Reign Supreme

Credit cards are the engine of modern commerce. They're built for speed, convenience, and turning browsers into buyers. Their real value is in removing friction right at the moment of purchase, which is absolutely critical for any consumer-facing business.

Here’s where credit cards are basically non-negotiable:

- E-commerce Checkouts: For any online store, especially for a customer's first purchase, credit cards are a must. Shoppers expect a quick and familiar checkout, and asking for bank details can feel invasive and is a known cause of cart abandonment.

- Retail Point-of-Sale (POS): In any brick-and-mortar shop, from a local coffee spot to a retail boutique, the instant authorization of credit and debit cards is essential for keeping lines moving and making the experience smooth.

- Customer Acquisition and Impulse Buys: When a customer is new or making a spontaneous purchase, the path of least resistance always wins. The sheer convenience of a credit card is often the deciding factor in capturing that sale before they have second thoughts.

The dominance of credit cards is hard to overstate. It's estimated there will be 631 million active credit card accounts in the United States by 2025, and credit cards are used for over 65% of all online purchases. This massive adoption makes them an indispensable tool. You can dig into more of this data in this detailed report on credit card statistics.

Adopting a Hybrid Payment Model

At the end of the day, the most successful merchants don't force everyone into a single payment lane. They build a hybrid model that offers both ACH and credit cards, then strategically guide customers toward the best option for the situation.

For instance, a SaaS company might require a credit card for a free trial signup to make it as frictionless as possible. But once that user becomes a paying subscriber, the company could offer a 5% discount for switching their recurring payments to ACH. This simple move saves both the company and the customer money over the long term.

This blended approach gives you the conversion power of credit cards when you need it and the cost savings of ACH where it makes sense, creating a truly optimized payment strategy.

Building an Optimized and Secure Payment Strategy

The whole ACH vs. credit card debate isn't about picking a single winner. The smartest merchants I know build an intelligent, blended strategy. A great payment stack uses the unique strengths of both methods to optimize every single transaction for cost, customer convenience, and security. It’s about ditching the one-size-fits-all approach and making deliberate choices based on what the payment is for.

This balanced approach comes down to understanding the core trade-offs. Credit cards are unbeatable for convenience and are non-negotiable for snagging new customers, especially in e-commerce where a fast checkout is everything. But those high processing fees and the constant threat of chargebacks can eat away at your profitability and cause major operational headaches.

Then you have ACH. It's a powerful, low-cost workhorse that absolutely shines in certain situations. For recurring subscriptions or large B2B invoices, the cost savings are huge and go straight to your bottom line. The real trick is knowing how and when to steer customers toward the right payment rail.

Creating a Resilient Payment Ecosystem

Building this kind of hybrid model means more than just slapping two payment options on your checkout page. It requires a proactive game plan to manage costs and cut down on risk across your entire payment operation. A truly resilient strategy is built on three pillars.

- Segment Your Transactions: Take a hard look at your revenue. Figure out which payments are a perfect fit for the low-cost reliability of ACH (think recurring membership fees) and which ones need the quick, smooth experience of credit cards (like first-time online purchases).

- Incentivize Cost-Effective Behavior: Gently nudge customers toward ACH when it makes financial sense for you. You could offer a small discount or waive a convenience fee for anyone who switches their recurring payment from a credit card to a bank transfer.

- Implement Proactive Dispute Management: Stop treating chargebacks as an unavoidable cost of doing business. Given the high stakes of credit card disputes, having a solid mitigation plan isn't optional anymore.

A truly optimized payment strategy treats dispute management not as a reactive, administrative chore, but as a core pillar of financial health. Proactively preventing chargebacks is just as important as reducing processing fees—it protects both your revenue and your ability to do business.

The Non-Negotiable Role of Dispute Mitigation

While ACH returns are rare and operate under strict bank rules, credit card chargebacks are a constant, serious threat. The financial hit goes way beyond the lost sale; you're also looking at penalty fees and even the risk of your merchant account getting shut down. This is exactly why a tool like Disputely, which helps you intercept disputes before they escalate into damaging chargebacks, is so crucial.

By plugging in chargeback alerts, you’re creating a safety net. It gives you a chance to resolve customer issues directly without putting your merchant account in jeopardy. This kind of proactive defense is the final, essential piece of a secure payment strategy. It lets you accept credit cards with confidence, knowing you have a system in place to control the risks that come with them. At the end of the day, taking definitive control over your payment operations—from fees to fraud—is how you slash costs and lock in long-term growth.

Frequently Asked Questions

When you're weighing ACH vs. credit cards, a lot of specific questions tend to pop up. Here are some straightforward answers to the most common ones I hear from merchants, designed to help you build the right payment strategy.

Can I Dispute an ACH Return Like a Credit Card Chargeback?

Not really. The two processes are worlds apart and you can't treat them the same way. ACH returns operate under strict rules set by NACHA and are handled directly between the banks. As a merchant, your window to challenge a return is incredibly small, and the grounds for doing so are very limited—it's nothing like the formal representment process for credit cards.

With a credit card chargeback, you get a chance to build a case. But with a legitimate ACH return, the money is usually pulled from your account almost immediately. There's very little room for recourse.

How Can I Encourage Customers to Pay With ACH?

Getting customers to switch from their go-to credit card to ACH is all about smart incentives and clear communication. A lot of businesses see great results by offering a small discount, a one-time credit, or by dropping a service fee for anyone who signs up for ACH auto-pay.

Another effective angle is to frame ACH as the more secure, "set-it-and-forget-it" option, which is perfect for recurring bills. The savings you'll see over the long run, especially for subscription businesses, easily makes up for the small cost of the initial incentive.

The best way to pitch it is as a win-win. It's not just about saving your business money; it's about offering your customers convenience and even savings, which helps build a stronger relationship.

What Is the Greatest Risk of Only Accepting Credit Cards?

Hands down, the biggest risk is getting buried in chargebacks. Every single credit card payment can be disputed, and if you breach the chargeback thresholds set by the card networks (usually around 0.9% of your transactions), you're in for a world of hurt.

The fallout can be severe. We're talking hefty monthly fines, higher processing fees, and in the worst-case scenario, having your merchant account shut down. For a business that only takes cards, that’s a death sentence. It’s why you have to treat chargeback management as a core part of your operations, not an afterthought.

Do Most Payment Processors Support Both ACH and Cards?

Yes, absolutely. Most of the major players you'd think of—Stripe, Adyen, Authorize.net—offer all-in-one solutions that let you process both credit cards and ACH payments. This means you can handle everything from a single platform.

Just keep in mind that turning on ACH usually involves a separate setup step. You'll need to get proper customer authorization, called a mandate, to stay compliant with NACHA rules. This is often handled smoothly using an account verification service like Plaid.

Unchecked chargebacks are a silent killer, draining your revenue and putting your merchant accounts at risk. Disputely acts as your safety net, using chargeback alerts to intercept disputes before they escalate into damaging chargebacks. Protect your business and see how much you could save today.