Alternative methods of payment: Boost Sales and Customer Trust

When we talk about alternative methods of payment, we're referring to any way a customer can pay that isn't cash or a major credit card. Think of options like digital wallets (like Apple Pay), Buy Now, Pay Later (BNPL) services, and direct bank transfers. These methods give customers more ways to pay, which can make a huge difference at checkout.

Why Alternative Payments Are Now Essential for Growth

Your checkout page is more than just a place to collect money—it's one of your most powerful tools for conversion. Sticking only to traditional credit cards is like building a single-lane dirt road for your business when your customers are expecting a multi-lane superhighway of payment choices. This isn't just a trend; it's a fundamental shift in customer behavior that makes a diverse payment stack a must-have for any modern business.

For merchants in any industry, from subscription boxes to high-risk sectors, offering payment methods that people know and trust is a game-changer. The impact on cart abandonment alone is massive. If a customer gets to your checkout and doesn't see their preferred option, they're much more likely to just leave. Offering choices like digital wallets or local bank transfers can even open up entirely new global markets where credit cards aren't king, but mobile payments are everywhere.

Meeting Modern Customer Expectations

Today’s shoppers crave speed, security, and choice. A clunky checkout experience that doesn't deliver on these is a direct path to lost sales. For example, a customer who loves the one-tap convenience of Apple Pay might ditch their cart if they have to dig out their wallet and manually punch in their credit card numbers.

The core idea is simple: Make it as easy as possible to pay. When you add alternative payment methods, you're not just slapping a few more logos on your checkout page. You're showing your customers you understand and respect their financial habits.

This small adjustment does wonders for building trust and keeping customers coming back. It tells them your brand is current, secure, and genuinely focused on their experience—a huge competitive edge.

The Hidden Challenge of New Dispute Types

But, and this is a big but, this new world of payments isn't without its challenges. While alternative payment methods can seriously boost your sales, they also introduce a whole new set of dispute types. These often don't play by the same old chargeback rules you're used to from Visa and Mastercard, which can get confusing fast.

- BNPL Disputes: These often pop up from "buyer's remorse" instead of actual fraud. They still function a lot like chargebacks, though, and can put your merchant accounts at risk.

- Digital Wallet Conflicts: They're generally secure, but when a dispute does happen, tracing it back to the original funding source can be a real headache, making the whole representment process more difficult.

- Irreversible Bank Transfers: These are great because they're final, but that also means there's no room for error. This opens up new avenues for fraud, since customers can't rely on a traditional chargeback to get their money back.

To succeed, you can't just accept new payments; you have to get smart about managing the new kinds of disputes that come with them. Diving into the broader fintech landscape can reveal some incredible fintech opportunities and potential. The trick is to balance this expansion with a solid strategy to protect your revenue from these new and emerging risks.

Breaking Down the World of Alternative Payment Methods

Jumping into alternative payment methods can feel like exploring a new city without a map. There are countless options out there, each with its own language and local customs. To make sense of it all, we can group them into three major categories that every merchant needs to get a handle on.

Don't think of these as a dry, technical list. Instead, see them as different checkout experiences you can offer your customers. Each one solves a unique problem, whether it's the need for speed, affordability, or just a simpler way to pay. Understanding these practical differences is the first step toward building a payment stack that actually boosts your sales instead of getting in the way.

H3: Digital Wallets: The Kings of Convenience

Digital wallets, or eWallets, are basically the express checkout lanes of the internet. They securely store a customer's payment info—like credit card details or bank account numbers—on a device, making one-tap payments a reality. You know the big names: Apple Pay, Google Pay, and PayPal.

For the customer, the appeal is a no-brainer. No more digging for a physical card or manually typing in 16-digit numbers and shipping addresses. This seamless experience translates directly into higher conversion rates for you. When a purchase is that easy, people are far less likely to abandon their carts. In fact, one study found that mobile wallet payments are expected to account for 30% of point-of-sale transactions, which shows just how much people value this kind of speed.

H3: Buy Now, Pay Later: The Conversion Booster

Buy Now, Pay Later (BNPL) services are a lifeline for customers who want something now but would rather spread the cost out over time. Services like Klarna, Affirm, and Afterpay plug right into your checkout, offering shoppers instant, short-term financing—usually in a few interest-free installments.

This is an incredibly powerful way to increase both your conversion rates and average order values. A shopper who might think twice about a $400 purchase is often perfectly comfortable with four interest-free payments of $100. For merchants, this means selling more high-ticket items and connecting with a wider audience, especially younger shoppers who are often cautious about traditional credit card debt. The explosive growth of the BNPL market proves there's a huge consumer appetite for more flexible ways to manage money.

H3: Direct Bank Transfers: The Low-Cost Powerhouse

Direct bank transfers, also known as Account-to-Account (A2A) payments, are the most direct route from your customer's wallet to yours. They let people pay straight from their bank account, completely bypassing the traditional card networks. Innovations like India's UPI and Brazil's Pix have made these transfers instant, secure, and wildly popular.

The biggest win for merchants here is the cost. Because you're cutting out the middlemen (the card networks), transaction fees are significantly lower than the typical 2-3% you'd pay for a credit card transaction. This makes them a fantastic choice for businesses trying to protect their profit margins. On top of that, these payments often settle instantly and are considered final, which can dramatically reduce the risk of chargebacks.

Each of these payment categories brings something different to the table and speaks to different customer habits. The goal isn't to pick just one, but to figure out which combination will work best for your audience and your business.

To make this even clearer, here’s a quick side-by-side look at how they stack up.

At-a-Glance Comparison of Key Payment Categories

This table offers a simplified overview of the most popular alternative payment types, highlighting the essential characteristics for merchants.

| Payment Category | How Customers Pay | Typical Merchant Cost | Key Regions |

|---|---|---|---|

| Digital Wallets | One-tap payment using a stored card or bank account on a mobile device or browser. | Based on underlying card (e.g., 2.9% + 30¢). | Global (North America, Europe, Asia-Pacific) |

| Buy Now, Pay Later | Customer chooses an installment plan at checkout and pays over time. | Higher than cards (e.g., 4-6%), but boosts order value. | North America, Europe, Australia |

| Direct Bank Transfers | Authorizes a direct debit from their bank account via an online portal. | Very low (often a flat fee or <1%). | Europe, Asia-Pacific, Latin America |

At the end of the day, offering the right mix of payment methods is all about giving your customers the freedom to pay in a way that feels comfortable and convenient to them. When you offer a diverse set of options, you build trust, eliminate friction at checkout, and set your business up for real, sustainable growth.

The Hidden Risks of Buy Now Pay Later

Buy Now, Pay Later has exploded in popularity, and for good reason. It's a powerful tool for boosting conversions, increasing average order values, and making checkout feel almost frictionless. But while the immediate sales lift is tempting, BNPL quietly introduces a unique and often overlooked set of risks for merchants.

The whole model is built on deferred payment, which completely changes a customer’s relationship with their purchase. It lowers the barrier to entry, making it easy to click "buy" without the immediate sting of a full payment. This psychological gap between getting the product and actually paying for it creates the perfect storm for "buyer's remorse," which is a huge driver of BNPL disputes.

The Rise of Buyer's Remorse Disputes

Think about it: if a customer regrets a purchase they made on a credit card, their first thought is usually to return it. With BNPL, the path of least resistance is often much simpler—just dispute an upcoming installment. For you, the merchant, this dispute looks, feels, and hurts just like a traditional chargeback, complete with financial penalties and dings to your merchant account health.

While providers like Klarna or Afterpay handle the upfront credit risk (making sure you get paid), they usually wash their hands of the messy dispute process. That part is left to you. You're stuck with the cost and administrative headache of a chargeback-like dispute that came from an entirely different payment system.

This isn't a small trend. The global BNPL market is on a rocket ship, projected to hit an incredible US$560.1 billion in transaction volume by 2025. This growth is driven by massive consumer demand, particularly from younger shoppers, but it's also pouring fuel on the fire of dispute risk. For subscription businesses, the problem is even worse. During economic downturns, some merchants see 20-30% higher dispute rates on BNPL compared to standard card purchases. You can dive deeper into this trend by checking out the full research about alternative payment methods.

Friendly Fraud in a New Disguise

It's not just about genuine regret, either. The BNPL structure can be an open invitation for friendly fraud. A customer can get their product, use it for a few weeks, and then dispute an installment by claiming it never arrived or wasn't as described. Splitting the payment into smaller chunks over time simply creates more opportunities for these kinds of claims to pop up.

The real problem is that while BNPL providers take care of the lending, merchants are left holding the bag for everything that happens after the sale. You get the conversion boost but inherit a complicated new dispute channel that behaves just like the chargebacks you’re already fighting.

To offer BNPL without it eating into your profits, you need a modern defense. The goal is to get ahead of these disputes before they officially hit your accounts and cause damage.

Why a Proactive Defense Is Crucial

Relying on the old way of reactively fighting chargebacks just won't cut it against the unique challenges of BNPL. The sheer volume and speed of these disputes require a proactive strategy. This is where a chargeback alert system becomes absolutely essential.

An alert system is your early warning signal. It notifies you the second a customer starts a dispute with their BNPL provider or card issuer. This gives you a critical—but short—window of 24 to 72 hours to step in and resolve the issue directly, usually by issuing a refund. That simple act stops the dispute from ever becoming a formal chargeback, protecting your merchant account and saving you from expensive fees.

Understanding Real-Time Bank Payments and Their Risks

Beyond digital wallets and buy now, pay later, there's another major force in alternative payments: real-time bank payments. You might hear them called Account-to-Account (A2A) payments, but the concept is simple. They create a direct, lightning-fast connection between a customer's bank account and yours, completely bypassing the old-school card networks.

This model has absolutely exploded in popularity worldwide. Just look at India's Unified Payments Interface (UPI) or Brazil's Pix—these systems are processing billions of transactions every single month. Customers love them because they can pay securely right from their bank with a quick QR code scan. It's incredibly seamless.

The Merchant Appeal: Low Fees and Instant Funds

For merchants, the draw of A2A payments is undeniable. The biggest win? A massive cut in transaction fees. By ditching the card networks and their typical 2.5% to 3.5% cut, you can process payments for a tiny fraction of the cost, often just a small flat fee.

Speed is the other game-changer. Credit card funds can take days to actually show up in your account, but A2A payments often settle almost instantly. This kind of immediate access to your cash is a huge operational advantage, especially if you're a smaller business or run on a subscription model where predictable cash flow is king.

This shift is already happening in a big way. Real-time A2A payments now power 30% of point-of-sale volume through digital wallets in key markets. The trend is so powerful that by 2028, APMs like A2A are projected to make up 58% of all ecommerce sales. But for high-risk merchants, this growth comes with a catch: the final, irreversible nature of these payments can lead to a surge in friendly fraud. You can learn more by checking out a great report on the rise of global A2A payments on mckinsey.com.

The Critical Downside: Payment Finality

Here's the rub. The greatest strength of A2A payments is also their biggest risk: payment finality. Unlike a credit card payment, most A2A transactions are irreversible. Once that money leaves the customer's account, it's gone for good. There's no built-in chargeback process for a customer to lean on if they're unhappy or have been scammed.

This completely changes the dispute dynamic. At first, "no more chargebacks" sounds like a dream come true for a merchant. But it opens up a new, dangerous door for fraud. Scammers can easily trick customers into authorizing payments, knowing full well there's no way to claw the money back through the bank.

While you may not face traditional chargebacks with A2A, you're not immune to disputes. Dissatisfied customers will still contact you directly, and if their issue isn't resolved, it can lead to negative reviews, social media backlash, and damage to your brand's reputation.

The reality is, even without chargeback fees hanging over your head, you can't just ignore customer complaints. The risk simply moves from your processor account to your public reputation, and in the long run, losing customer trust can be far more costly.

The Need for Proactive Monitoring

Because A2A payments are so final, you can't afford to just sit back and wait for problems to arise. You need a proactive strategy to spot and solve issues before they blow up. This is exactly where a pre-dispute monitoring strategy becomes an essential safety net.

Even without official chargeback alerts, a good monitoring system can protect you in other critical ways:

- Pattern Recognition: It helps you spot strange transaction patterns that might point to an organized fraud ring targeting your business.

- Customer Service Triage: By tracking customer inquiries tied to A2A payments, you can quickly identify recurring problems—like a confusing product description or consistent shipping delays—and fix the root cause.

- Internal Issue Flagging: Monitoring can help you catch a broken internal process before it impacts thousands of customers and causes widespread frustration.

Ultimately, adopting A2A payments requires a new way of thinking. You get the incredible benefits of lower fees and faster cash, but you trade the familiar chargeback system for a different set of risks. A solid monitoring plan is non-negotiable for managing those risks, protecting your customers, and making sure this powerful payment method works for you, not against you.

Getting APMs Live in Your Checkout

Alright, so you’ve decided to offer alternative payment methods. That’s the easy part. The real work begins when you start weaving them into your checkout experience. This isn't just about flipping a switch in your payment gateway; it's about being deliberate and creating a payment flow that feels right for your customers, your business, and your own internal team.

Whether you're on Shopify, WooCommerce, or a custom build using a processor like Stripe, the goal is the same: make it smart. A great rollout means you have to think like your customer. What payment options do they already trust and use daily? The answer is going to be wildly different for a merchant selling across Europe compared to one focused solely on North America.

Choosing the Right Payment Mix for Your Audience

Adding new payment methods isn't a game of collecting logos for your checkout page. It’s a strategic choice driven by data and real customer behavior. A poorly matched payment stack can be just as damaging as having too few options—it just creates confusion and operational headaches without actually boosting your sales.

Your decision should really boil down to three key questions:

- Who are you selling to? Take a hard look at your customer demographics. Younger shoppers might be all about BNPL services like Klarna, while your international customers are probably looking for familiar, local bank transfer options.

- Where are you selling? Geography is everything. If you have a big customer base in Germany, offering Giropay is a no-brainer. Selling in Brazil? You absolutely need Pix. Don't fall into the trap of assuming a globally known name is the top choice in every local market.

- What's your business model? If you're running on subscriptions, you need to prioritize methods that handle recurring billing without a hitch. Digital wallets are fantastic for this because they help cut down on churn from expired credit cards. BNPL, while it's getting better, can still add a layer of complexity to recurring payments.

Navigating the Operational Hurdles

Let’s be honest: adding new payment options brings new operational headaches. The biggest one for most businesses is reconciliation. Trying to manage different settlement times, fee structures, and reporting formats from multiple providers can quickly spiral into a nightmare for your finance team.

Imagine trying to manage a handful of different foreign currencies without a central bank. Each payment method deposits money on its own schedule and presents data in its own unique way. This makes it incredibly difficult to get a single, clear picture of your daily sales and cash flow. You need a streamlined process, usually helped along by your payment processor or accounting software, to keep things from getting out of control.

Integrating new payment methods without upgrading your backend processes is like installing a high-performance engine in a car with old brakes. You get the speed and power upfront, but you're not prepared for the risks that come with it.

You also have to pay close attention to the fee structures. A BNPL provider might charge a 4-6% fee, which is a big jump from a typical card transaction. You have to model these costs carefully to make sure your profit margins aren't getting eaten away by the very tools meant to increase your sales. This kind of financial planning is absolutely critical.

The Non-Negotiable: Upgrading Your Dispute Management

Now for the most important piece of the puzzle. Expanding your payment options must go hand-in-hand with an upgraded dispute management system. Each new payment method brings its own unique flavor of disputes, from simple buyer’s remorse claims on BNPL to friendly fraud with digital wallets. Sticking with your old, reactive chargeback process is a recipe for disaster.

This is especially true for merchants on platforms like Shopify, where keeping disputes under control is crucial for maintaining a healthy account. If you want to protect your store, it's a smart move to connect your Shopify store to a chargeback alert system and get out ahead of problems. Proactive monitoring becomes your first line of defense, letting you intercept disputes before they blow up into damaging chargebacks that hurt your dispute ratio and put your entire merchant account at risk.

Your Essential APM Rollout Checklist

To make sure your launch goes off without a hitch, follow this checklist. It will help you cover all your bases, from the initial research to post-launch management, so you’re ready for both the opportunities and the challenges.

- Dig Into Customer Data: Use your analytics to see where your customers are coming from and what devices they’re on. Let that info guide your APM choices.

- Check Your Processor’s Capabilities: Make sure your current payment processor (like Stripe or PayPal) actually supports the APMs you want and that you understand their integration process.

- Calculate the True Cost: Model the fees for each new payment method. You need to know the real impact on your bottom line.

- Update Reconciliation Workflows: Figure out how you'll manage and reconcile payments from all these new sources to avoid accounting chaos later.

- Integrate a Dispute Alert System: Before you go live, connect a service like Disputely to monitor all your transactions—from both traditional and alternative payments.

- Train Your Support Team: Get your customer service crew up to speed on how each new APM works so they can confidently handle any questions or issues that come up.

Building a Proactive APM Dispute Prevention Strategy

Jumping into alternative payment methods can open up a world of new customers and sales. But that growth only counts if you can actually keep the revenue. That’s where we need to shift from theory to a real action plan, focusing on the single best way to protect your bottom line: a proactive dispute prevention strategy.

Think of a modern chargeback alert platform as a smoke detector for your business. Its job is to spot the very first sign of trouble—a customer starting a dispute—and give you a chance to act before a small issue erupts into a costly fire. This approach is what ensures your new payment options are adding to your profits, not draining them.

How Proactive Alerts Protect Your Business

Instead of waiting weeks for a formal chargeback notice to show up, a proactive system catches the customer's complaint right at the source. It plugs directly into card network programs like Visa’s Rapid Dispute Resolution (RDR) and Mastercard’s CDRN, which banks use to flag potential disputes the moment they happen.

Here’s the breakdown: when a customer calls their bank about a charge, the bank opens an inquiry on one of these networks. An alert platform catches that signal in real-time and immediately notifies you. This gives you a critical window of 24 to 72 hours to solve the problem directly, usually just by issuing a refund.

That simple, automated action stops the inquiry from ever becoming a full-blown chargeback. You sidestep the nasty fees, protect your merchant account’s dispute ratio, and keep your payment processors happy.

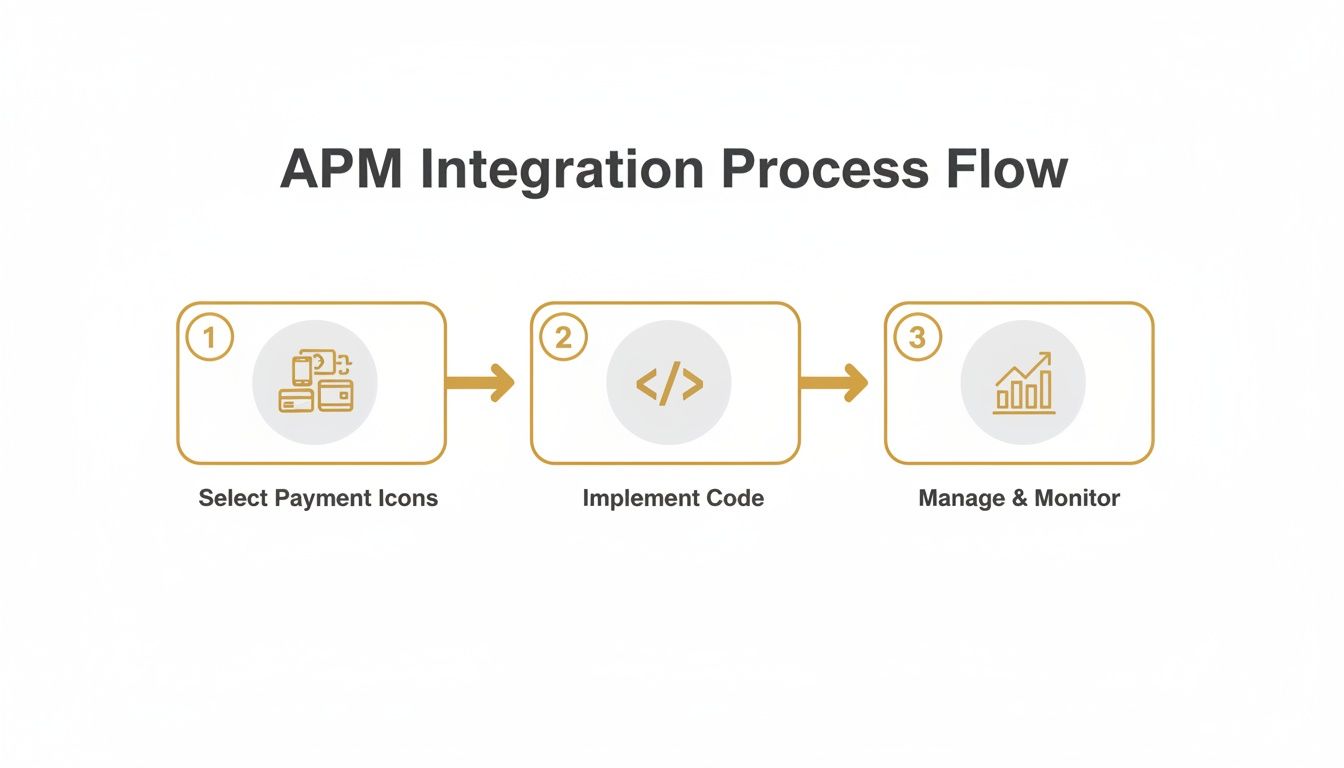

This flow chart gives a great visual of how to bring APMs into your business while keeping a close eye on risk.

It’s a good reminder that once you’ve got everything set up, the ongoing management is just as important as the initial integration.

A Unified Defense for a Fragmented System

One of the biggest headaches with APMs is that every single one has its own unique dispute process. A BNPL dispute over buyer's remorse is handled totally differently than a friendly fraud claim made through a digital wallet. Trying to keep up with all of them manually is a recipe for chaos.

A chargeback alert platform brings order to that chaos. It creates a single, consistent safety net that covers all your transactions, no matter how a customer paid.

- Traditional Credit and Debit Cards: The classic source of chargebacks.

- Digital Wallets: Catches disputes that start from the card stored in Apple Pay or Google Pay.

- Buy Now, Pay Later: Intercepts issues before they turn into the kind of penalties that can get your account suspended.

By watching every transaction, the system makes sure no dispute falls through the cracks. To really get a handle on all this, smart businesses lean on data analytics in financial services to spot trends and fine-tune their prevention strategies.

Implementing Your Prevention Strategy with Disputely

Getting your defenses up and running is surprisingly simple. A platform like Disputely can connect to your payment processor—whether it's Stripe, PayPal, or Shopify Payments—in just a few minutes.

Once it's connected, you can set up automated rules to deal with alerts as they come in. For example, you can tell the system to automatically refund any dispute under a certain dollar amount, which frees up your team from having to handle every little thing.

This automated, real-time response is the secret to stopping up to 99% of chargebacks. It keeps your dispute ratio in a healthy range, helps you avoid being placed in costly monitoring programs by the card networks, and prevents processors from holding your funds. With a clear, pay-per-alert model, the ROI is easy to see. You can check out a full breakdown of the https://disputely.com/pricing to see which plan fits your business. This is how you make sure your move into APMs is a secure and profitable one.

Frequently Asked Questions

Diving into the world of alternative payment methods always stirs up a few questions. Let's tackle some of the most common ones we hear from merchants just like you.

Which Alternative Payment Method Is Best for My Subscription Business?

If you're running a subscription or recurring revenue business, digital wallets like Apple Pay and Google Pay are tough to beat. Their real magic lies in how they handle recurring billing. Because the card details are tokenized and updated automatically by the issuer, you can say goodbye to a huge chunk of churn caused by expired cards.

While some Buy Now, Pay Later services are starting to support recurring payments, they can be a bit tricky. Their structure can sometimes lead to higher dispute rates. A smart approach is to pair any alternative methods of payment you add with a solid dispute alert system to keep that risk in check from day one.

Do I Need a New Payment Processor to Accept APMs?

Probably not. Most of the big players—think Stripe, Adyen, and PayPal—have already done the heavy lifting. You can usually just flip a switch in your dashboard to enable options like Klarna, Afterpay, or digital wallets. No need to rip out your existing setup.

The key, though, is to make sure your dispute management tool plays nicely with everything. You need a system that gives you a complete view, covering every single payment method you accept, without any blind spots.

How Can I Offer BNPL Without Increasing My Chargeback Rate?

This is a big one. The best way to offer BNPL safely is to get ahead of disputes with a proactive chargeback alert service. A lot of BNPL disputes aren't fraud; they're simply cases of buyer's remorse. Catching these issues before they escalate into a formal chargeback is crucial for protecting your merchant account.

An alert platform taps into the card networks and notifies you the moment a customer complains to their bank. This opens up a small but vital window for you to step in, issue a refund, and resolve the problem directly. The chargeback never gets filed, and your processing history stays clean.

If you have more questions about managing disputes, our team is always ready to help through our Disputely support page.

Ready to protect your revenue and embrace new payment methods without the risk? Disputely integrates with your payment processor in minutes to stop up to 99% of chargebacks before they happen. Get started with Disputely today and secure your checkout.