Can a paypal payment be reversed: what you need to know

Yes, a PayPal payment can be reversed, but the "how" is what really matters for your business. It's not just about losing one sale; it's about understanding the different ways a transaction can unravel—from a straightforward refund to a damaging chargeback that comes straight from the customer's bank.

Understanding How PayPal Reversals Work

Think of a payment reversal as an umbrella term, not a single action. Underneath it, you'll find several different events that can send money back to a buyer, and each one comes with its own risks and requires a specific game plan. If you don't get the differences, you're opening your business up to high dispute rates, painful fees, and even restrictions on your PayPal account.

The second a customer starts a reversal, it kicks off a process that can tie up your funds and demand your immediate attention. It’s a huge headache for merchants, and frankly, a common source of total confusion.

For instance, a customer might spot what they think is a double charge on their statement. To them, opening a "dispute" feels like just asking a question. But in the world of payment processing, that "question" is a formal request to reverse the transaction, which can automatically put a hold on the funds and create a major issue.

A "dispute" isn't just a simple inquiry—it's the first official step in a process that can escalate into a full-blown reversal. This misunderstanding alone is a frequent cause of friction between buyers and sellers.

We're going to pull back the curtain on this whole process. We’ll walk through each type of reversal, so you can stop reacting to problems and start strategically protecting your hard-earned revenue.

The 5 Reversal Scenarios Every Merchant Should Know

When you hear "PayPal payment reversal," it's easy to think of it as one single thing. But that's not the whole picture. It's really an umbrella term for five completely different situations, each with its own rulebook, risks, and path to resolution. Knowing which one you're dealing with is the first, most crucial step to protecting your revenue.

Not all reversals are created equal. Some are simple customer service moves, while others are serious financial disputes that can put your entire business account on the line. Understanding the difference helps you react smartly instead of panicking.

Let's break down the five ways money can get pulled back from your account after you've made a sale.

1. Seller-Initiated Refunds

This is the most common and least painful type of reversal. Think of it as a goodwill gesture that you’re in complete control of. Maybe a customer wasn't happy with their purchase, or you accidentally sent the wrong item. You log into your PayPal dashboard and issue the refund yourself.

Because you're the one starting it, there’s no dispute, no claim, and no black mark against your account’s health. It’s a standard part of doing business and, honestly, a great way to build customer trust. You lose the sale, sure, but you sidestep the fees and penalties that come with the more serious reversals.

2. PayPal Buyer Disputes and Claims

This one feels more like internal mediation, with PayPal playing referee between you and your customer. It starts when a buyer opens a dispute in PayPal's Resolution Center. The most common reasons are "Item Not Received" or "Significantly Not as Described."

This is the customer’s first official step to say, "Hey, there's a problem here." PayPal will usually put a temporary hold on the funds while you and the buyer try to work it out. This is your chance to provide tracking info, offer a partial refund, or find another solution. If you can’t reach an agreement, the buyer can escalate the dispute to a "claim," and that's when PayPal steps in to make the final call.

3. Credit Card Chargebacks

A chargeback is the heavyweight champion of reversals—and the one you want to avoid most. You can think of it as a formal lawsuit filed with the customer's bank. The buyer bypasses PayPal entirely, goes straight to their credit card company, and the bank yanks the money right out of your account.

Chargebacks are expensive. They almost always come with a non-refundable fee of $20 or more, and you have to pay it even if you win the case. They also hit your dispute rate the hardest, which can lead to big problems like account limitations or even getting shut down. Even a temporary hold on your funds can create serious cash flow headaches, a common issue for merchants facing a sudden spike in disputes. To learn more about how to navigate these challenges, check out our guide on what to do when you have a Shopify payment hold.

4. Bank Reversals (ACH Returns)

This kind of reversal is the digital version of a bounced check. It happens when a customer pays directly from their bank account (an ACH payment), but the transaction fails. The reason could be anything from insufficient funds to a closed account, or the customer simply told their bank to stop the payment.

Unlike a chargeback, this isn't necessarily a fight over the product's quality. It's a payment processing failure. Still, the end result is the same for you: the funds are clawed back from your account, and you might get hit with a fee for the trouble.

These core reversal types—refunds, chargebacks, and authorization reversals—each carry different financial implications. Refunds and chargebacks can incur processing fees on the return transaction, while authorization reversals happen before settlement, saving you those costs. You can explore more about these distinctions in PayPal's guide to bank reversals.

5. Unauthorized Transaction Claims

Finally, an unauthorized transaction claim is like a security alarm going off. It’s triggered either by PayPal’s own fraud systems or by the account holder reporting that a payment wasn't made by them.

This happens when a transaction is flagged as potentially fraudulent—meaning the real owner of the PayPal account or credit card didn't approve it. Sometimes, PayPal’s own algorithms catch it and reverse the payment proactively. Other times, a customer reports their account was hacked. If you followed all the rules for PayPal's Seller Protection, you're often covered in these cases. You’ll still need to provide proof you shipped the order to the address listed on the transaction details page.

The Anatomy of a PayPal Payment Reversal

When a customer wants their money back, it kicks off a chain reaction you need to be ready for. It’s not just a single click; it's a process. And once you understand how it works, that first dispute notification in your inbox won't seem nearly as intimidating.

It all starts with an alert from PayPal. The second that happens, they place a temporary payment hold on the funds from that transaction. The money is frozen right there in your account. This is standard practice—they're just making sure the cash is available if the case ends up going in the buyer's favor.

The Evidence and Response Phase

Next, you'll get a formal request from PayPal for your side of the story. This isn’t a friendly suggestion; you’ll have a hard deadline, usually about 10 days, to submit everything you have to prove the transaction was legitimate. Responding on time is non-negotiable. If you miss that window, you automatically lose.

This is the moment all your record-keeping pays off. If the buyer claims they never got their order ("Item Not Received"), your shipping confirmation and tracking number showing delivery are your golden tickets. If the claim is that the item was "Significantly Not as Described," you'll need to pull out product photos, the original listing description, and any emails or messages you exchanged with them.

Think of it like you're building a legal case file. Your response needs to be clean, organized, and packed with facts that directly counter what the buyer is claiming. A messy, incomplete response is almost as bad as not responding at all.

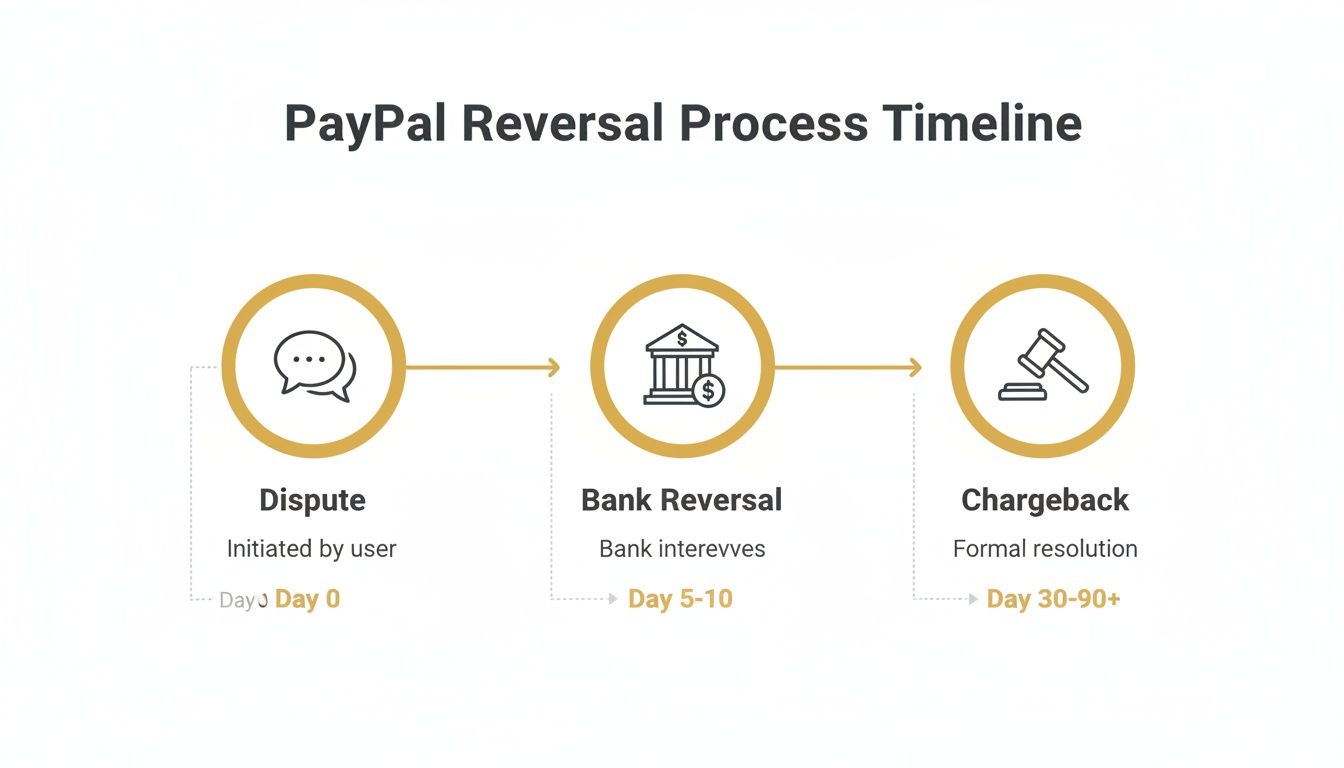

This timeline gives you a bird's-eye view of how a dispute, bank reversal, or chargeback plays out from start to finish.

As you can see, each path is a little different. That's why figuring out exactly which type of reversal you're dealing with is always step one.

Understanding the Financial Stakes

The hit from a payment reversal is much bigger than just the cost of the original sale. With PayPal processing over $1.5 trillion in payments in 2023, these reversals have become a huge operational headache for businesses. On average, merchants are hit with 679 chargebacks a month, sinking around 30 hours of work into just managing them. That's a massive drain on your resources. For a deeper dive into these numbers, you can explore the full 2023 financial results here.

But the damage doesn't stop at lost revenue and wasted time. There's more to worry about:

- Frozen Cash Flow: While a case is open, that money is locked up and you can't touch it. This can put a real squeeze on your day-to-day operations.

- Dispute Fees: If the reversal comes from the buyer's bank (a chargeback), PayPal will charge you a non-refundable fee—currently $20 in the US—and you have to pay it even if you win the dispute.

- Account Health Risks: Too many disputes can seriously damage your standing with PayPal. It could lead to them holding a percentage of your funds in a reserve or, in the worst-case scenario, shutting down your account for good.

That sinking feeling when a dispute notification hits your inbox is all too familiar. It’s tempting to get frustrated, but winning a dispute isn't about getting into an argument. It’s about building a rock-solid case file.

Think of it like this: you're the detective, and PayPal is the judge. Your job is to hand them a file so clear, organized, and packed with irrefutable proof that they have no choice but to rule in your favor. This is your one shot to tell your side, so let's make it count.

Gathering Your Evidence for Common Disputes

Most of the disputes you'll face will fall into two buckets: "Item Not Received" (INR) and "Significantly Not as Described" (SNAD). Each one needs a different game plan.

For an Item Not Received claim, your entire defense rests on proving one simple thing: you shipped the item, and it arrived at the right place.

- Tracking is King: You absolutely need a valid tracking number from a reputable carrier (think USPS, FedEx, UPS). This is non-negotiable and the most powerful tool in your arsenal.

- Proof of Delivery: Don't just show you shipped it; show it was delivered. A screenshot from the carrier's website confirming "Delivered" status is perfect.

- Address Verification: Make sure the delivery address on your proof of delivery matches the address on the PayPal transaction details page exactly. Even a small mismatch can cost you the case.

When it comes to a Significantly Not as Described claim, the tables turn. Now, you have to prove that what you sent is exactly what the customer ordered.

- Show, Don't Just Tell: High-quality photos from your original product listing are crucial. Let the pictures do the talking.

- The Original Listing: Provide the full product description from your website. If a customer claims a feature is missing, you can point directly to where it was (or wasn't) described.

- The Paper Trail: Any emails or messages between you and the customer can provide critical context. Did they ask questions beforehand? Did you offer help afterward? Include it.

To help you stay organized, here's a quick checklist of the evidence you should always have on hand for these common disputes.

Evidence Checklist for Common PayPal Disputes

| Dispute Reason | Required Evidence | Pro Tip |

|---|---|---|

| Item Not Received (INR) | • Valid tracking number • Proof of delivery to the buyer's address • Shipping receipt or label |

Screenshot the delivery confirmation page. Don't just provide the number; show the final status. |

| Significantly Not as Described (SNAD) | • Original product listing (photos & description) • Any pre-sale communication with the buyer • Proof of your return policy |

Highlight specific parts of your product description that directly counter the buyer's claim. |

Having this information ready to go means you can respond quickly and confidently, which makes a huge difference.

Crafting a Professional Rebuttal

With your evidence in hand, it's time to put it all together. The key here is to stay professional. No emotion, no angry rants—just the cold, hard facts. A short, to-the-point rebuttal letter is far more effective than a long, rambling one. To effectively build a winning dispute case, merchants can leverage a dedicated chargeback dispute form template to meticulously gather and present their evidence.

Your rebuttal letter should be concise and directly address the buyer's claim. Start by stating the order details, then present your evidence point-by-point. End by summarizing why the claim is invalid based on the proof you've provided.

Putting together a compelling case takes time, and that's especially true when you're swamped during the busy seasons. If you want to dive deeper and really sharpen your skills, check out our advanced guide on how to build a winning representment case for more pro-level strategies.

Ultimately, winning a PayPal dispute comes down to preparation and precision. When you treat every case with the seriousness it deserves—by being organized, factual, and thorough—you give yourself the best possible shot at protecting your hard-earned revenue.

Proactive Strategies to Prevent Payment Reversals

While reacting to disputes is a necessary skill, the best defense is always a good offense. If you shift your focus from fighting reversals to preventing them in the first place, you’ll protect your revenue, save countless hours, and build a much stronger business. It's always cheaper, faster, and far less stressful to prevent a problem than to fix one.

The whole game is about eliminating ambiguity. Think about it: most disputes pop up because of a simple misunderstanding or an unmet expectation. When you get ahead of these friction points, you take away the most common reasons a PayPal payment can be reversed before a customer even thinks about filing a claim.

Set Crystal-Clear Expectations

The classic "Significantly Not as Described" claim almost always comes down to one thing: a gap between what the customer thought they were buying and what showed up at their door. Your product listings are your first and best line of defense here.

- High-Quality Photos and Videos are Non-Negotiable: Show your products from every conceivable angle, in different lighting, and, if possible, in use. The more a customer can see, the less room there is for their imagination to fill in the blanks incorrectly.

- Write Descriptions That Leave Nothing to Guess: Don't just list specs. Explain the benefits and be upfront about any limitations. Give exact measurements, list all the materials, and include care instructions. Being honest builds more trust than you'd think.

- Make Your Policies Obvious and Fair: Your shipping, return, and refund policies shouldn't be buried in the footer. A clear, easy-to-find return policy often encourages a customer to work with you directly for a refund instead of jumping straight to a dispute.

When you set the stage properly from the very beginning, you help customers make truly informed decisions. That alone cuts down dramatically on buyer's remorse and the disputes that come with it.

Master Your Shipping and Communication

"Item Not Received" is another big one, but luckily, it's one of the easiest to prevent with solid operational habits. The golden rule? Always use a shipping service that gives you tracking information and delivery confirmation. This is the single most important piece of evidence you can have.

PayPal's Seller Protection hinges on proof of shipment and delivery to the buyer's confirmed address. If you can't provide a valid tracking number, your odds of winning an "Item Not Received" dispute are close to zero.

Shipping is just one piece of the puzzle, though. Proactive communication is just as vital. Set up automated emails that confirm the order, the shipment, and the final delivery. If there’s a delay, tell the customer immediately—don't wait for them to ask. Keeping buyers in the loop shows you're on top of things, which calms their nerves and makes them far less likely to escalate a simple question into a formal dispute.

On their end, PayPal is constantly working to block bogus reversals. Their systems stop hundreds of millions in fraud attempts every quarter. In fact, PayPal’s transaction loss rate was just 0.08% in 2023, which is well below the industry average. These built-in protections handle many of the "unauthorized transaction" claims for you, freeing you up to focus on preventing the service-related disputes you can control. You can learn more about how PayPal's security measures impact merchants and the protections they offer.

Automating Your Defense Against Chargebacks

Even if you do everything right, some disputes are simply going to happen. For businesses with a steady stream of orders, trying to manage every single one by hand is a quick way to burn out your team and drain your resources. This is where automation steps in as your best defense against lost revenue.

Think of it like an early-warning system for your revenue. Instead of being blindsided when a formal chargeback hits your account, you get an immediate heads-up the moment a customer contacts their bank. This is exactly what chargeback alert services from networks like Ethoca and Verifi deliver.

How Chargeback Alerts Work

When a cardholder has an issue and calls their bank, the bank can send out a real-time alert. This opens a critical window—usually just 24 to 72 hours—for you to take action before the problem officially becomes a damaging chargeback.

A platform like Disputely plugs into these alert networks and acts on your behalf based on rules you’ve already set. You can decide which types of transactions should be automatically refunded, stopping a potential chargeback dead in its tracks. This one simple move protects your dispute ratio, lets you sidestep expensive fees, and saves a massive amount of manual effort.

By intercepting a dispute before it becomes a formal chargeback, you stay in control. You’re not just reacting to a problem anymore; you’re getting ahead of it and preserving your good standing with payment processors.

This screenshot shows how an automated system gives you a clean, simple dashboard for tracking these critical alerts.

The magic here is seeing all your potential threats in one central hub, turning what used to be a chaotic scramble into an organized, manageable workflow.

The Strategic Advantage of Automation

For any business looking to grow, this isn't just a "nice-to-have" tool—it's an essential safety net. Handling disputes manually is slow, tedious, and filled with opportunities for human error, which gets expensive when you’re up against tight deadlines.

Automating your defense means every alert gets handled instantly, around the clock. This system stops a reversible PayPal payment from snowballing into a major financial and operational headache. It frees you up to focus on growing your business instead of constantly putting out fires. It’s simply the smarter way to protect your revenue and your merchant account’s health.

Frequently Asked Questions About PayPal Reversals

How Long Does a Customer Have to Reverse a PayPal Payment?

When it comes to PayPal’s own dispute system, your customer has a generous 180-day window from the date of the transaction to raise an issue. They do this right inside PayPal's Resolution Center.

But here’s the tricky part: if they bypass PayPal and go straight to their credit card company to file a chargeback, that timeline can stretch out even further. Most card networks allow 120 days or more, depending on their specific rules.

Does PayPal Seller Protection Cover All Reversals?

Not even close. This is a common misconception that catches a lot of sellers off guard. PayPal’s Seller Protection is very specific and only covers two types of complaints: "Unauthorized Transaction" and "Item Not Received."

It offers absolutely no coverage for "Significantly Not as Described" disputes, which are often the most subjective and frustrating to fight. To even have a chance at qualifying, you need to follow PayPal's rules to the letter, like shipping exclusively to the address listed on the transaction details page.

Can I Stop a Customer From Reversing a Payment?

In a word, no. You can't physically prevent a customer from initiating a dispute or chargeback; it’s a fundamental consumer right. Once a customer decides to start the process, the ball is in their court.

Your best defense is a great offense. This means focusing on prevention through excellent customer service, crystal-clear communication, and transparent policies. For a deeper dive into managing these kinds of payment challenges, the Disputely blog has a ton of great resources.