Chargeback Protection for Merchants: A Practical Guide to Safer Payments

Chargeback protection is a merchant's playbook for preventing and fighting payment disputes. It’s not just a single tool but a combination of smart technology, clear policies, and great customer service designed to shield your revenue. Think of it as a modern security system for your sales, one that stops fraud in its tracks and heads off disputes before they turn into expensive chargebacks.

Why Proactive Chargeback Protection Is No Longer Optional

Back in the early days of e-commerce, a chargeback was a rare headache. Now, it's a constant threat that eats into your profits and can destabilize your entire business. The game has changed. Simply waiting for disputes to happen and then reacting is a surefire way to lose. A reactive approach burns through time and money, sours your relationship with payment processors, and directly hits your bottom line.

It's like trying to bail water out of a boat that has a hole in it. You can spend all day tossing water overboard, but you're not actually fixing the problem. Proactive chargeback protection for merchants is about patching that hole for good—and reinforcing the hull to make sure new ones don't appear.

The Rising Tide of Digital Disputes

As online shopping continues to boom, so do payment disputes. It's simple math: more online transactions mean more opportunities for things to go wrong, whether it's genuine fraud, a package that never arrived, or the all-too-common "friendly fraud." On top of that, many customers have realized it’s often easier to call their bank and start a chargeback than it is to contact the merchant for a refund. What was once a consumer safety net has become a go-to move.

And this isn't a trend that's going away. Global chargeback volumes are set to jump from an estimated 261 million in 2025 to roughly 324 million by 2028. That's a massive 24% spike in just three years, with the total value projected to hit $41.7 billion. This explosion is almost entirely driven by digital commerce, which is where the vast majority of transactions now happen.

Moving Beyond Simple Prevention

A solid chargeback strategy is much more than a basic fraud filter. It's a complete defense system built on three core pillars:

- Advanced Prevention: Using sophisticated tools to spot and block high-risk transactions before your payment gateway even processes them.

- Dispute Deflection: Intercepting a customer's complaint at the bank level, allowing you to offer a direct refund and prevent an official chargeback from ever being filed.

- Intelligent Representment: When an illegitimate chargeback does get through, you need to be ready to fight it with compelling, evidence-backed responses to win back that lost revenue.

Ignoring this and sticking to a reactive approach is just asking for trouble. High chargeback rates can land you in costly monitoring programs, get your funds frozen, or even get your merchant account shut down entirely. For anyone selling on a major platform, that could mean facing a dreaded Shopify Payments hold, which can bring your business to a grinding halt. A robust protection plan is your best defense against these kinds of operational nightmares.

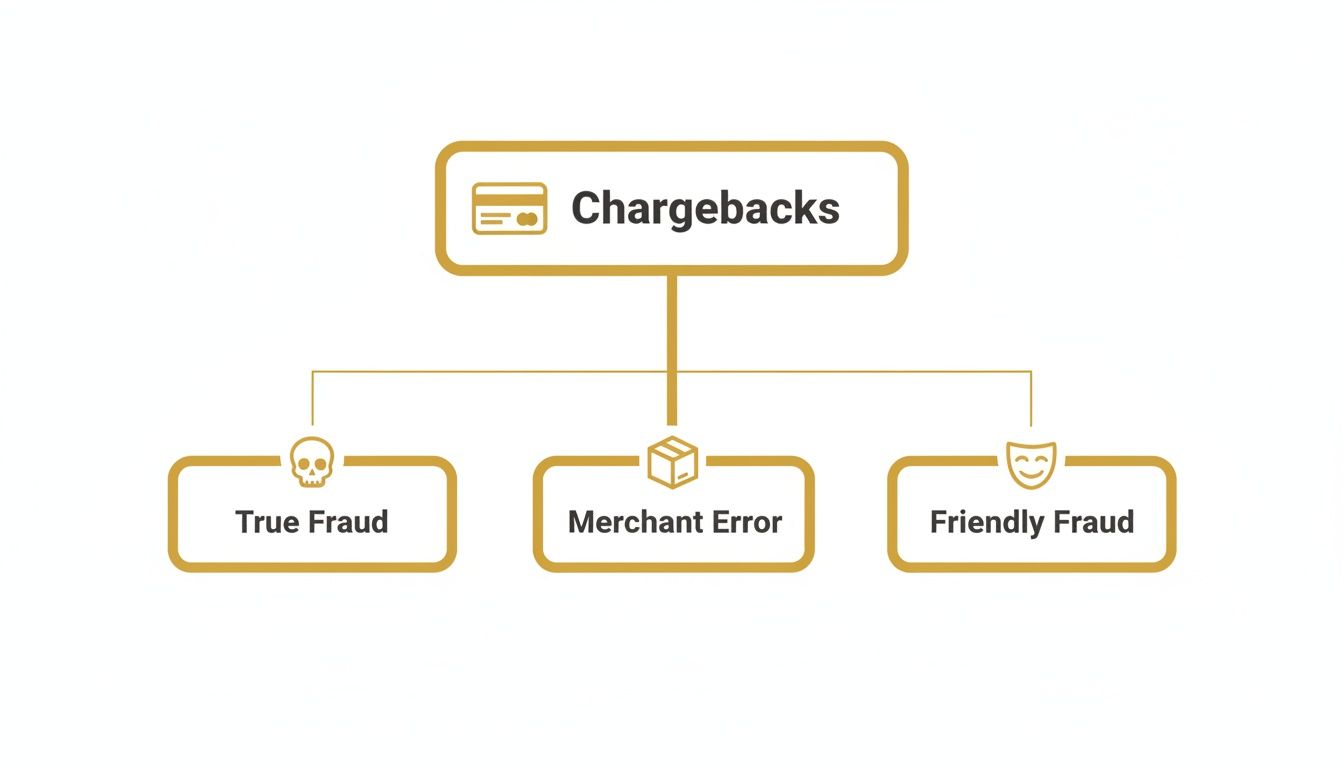

Diagnosing Your Disputes: The Three Faces of Chargebacks

If you want to build an effective defense against chargebacks, you first have to understand what you're up against. The truth is, not all chargebacks are the same. They actually fall into three very different categories. Treating them all as one big problem is like using the same medicine for every illness—it just doesn't work.

Think of yourself as a detective. When you show up at a crime scene, your first job is to figure out what happened. Was it a random break-in? An inside job? Or something else entirely? Each scenario demands a completely different approach, and the same goes for your chargebacks. Getting clear on where your disputes are coming from is the first step toward building a winning chargeback protection strategy.

True Criminal Fraud

This is the classic case of theft everyone thinks of first. True fraud happens when a criminal gets their hands on stolen credit card information and uses it to buy something from your store. The real cardholder eventually spots the unauthorized charge, calls their bank, and correctly reports it as fraud.

In this scenario, the cardholder is the victim, and you have almost no chance of winning the dispute. The responsibility really falls on you, the merchant, to have security measures in place that can sniff out and block these kinds of transactions before they even go through.

- Example Scenario: A fraudster buys a list of stolen credit card numbers on the dark web. They use one to purchase a new laptop from your e-commerce site, having it shipped to a temporary address. When the actual card owner gets their monthly statement, they immediately flag the purchase they never made.

Unintentional Merchant Error

The second type of chargeback comes from honest mistakes—usually operational hiccups on your end. These disputes pop up when a customer feels they have no other choice. Maybe they received the wrong item, their order showed up damaged, or they got tangled up in a confusing return policy.

While frustrating, these chargebacks are actually a gift. They’re a bright, flashing sign that something in your fulfillment or customer service process is broken. To really dig in and understand the "why" behind the problem, using diagnostic analytics can be incredibly helpful for finding the weak spots in your operations.

A merchant error chargeback is basically a customer saying, "I tried to solve this the normal way, but I couldn't." By making your policies crystal clear and your support team easy to reach, you can stop many of these disputes before they ever start.

Deceptive Friendly Fraud

This is easily the trickiest and fastest-growing category. Friendly fraud—sometimes called first-party misuse—occurs when a legitimate customer makes a purchase but disputes the charge later. They might do it on purpose to get something for free (think of it as digital shoplifting), but often it's out of confusion. Maybe they forgot they made the purchase or didn't recognize your store's name on their bank statement.

This type of dispute is so tough because, on the surface, the transaction looks perfect. All the usual fraud checks, like AVS and CVV matching, come back clean because it’s the actual cardholder making the purchase.

The rise in this behavior is staggering. Industry reports now point to friendly fraud as a major driver of disputes. One survey found that a whopping 84% of consumers think it's easier to file a chargeback than to ask for a refund. That same research shows that simple buyer's remorse is behind roughly 65% of friendly fraud cases, which tells you a lot about the shift in consumer habits. You can dig into more of these chargeback statistics on Chargebacks911.com.

To figure out where your revenue is leaking, you have to be able to tell these three chargeback types apart. This table breaks down the key differences to help you quickly identify the source of your disputes.

Comparing the Three Types of Chargebacks

| Chargeback Type | Primary Cause | Example Scenario | Initial Prevention Tactic |

|---|---|---|---|

| True Fraud | Stolen payment information used by a criminal. | A fraudster uses a stolen credit card to buy high-value goods online. | Implement robust fraud detection tools (e.g., AVS, CVV, 3D Secure). |

| Merchant Error | A mistake in fulfillment, billing, or customer service. | A customer is shipped the wrong product and can't easily contact support. | Provide clear communication, accurate product descriptions, and accessible customer service. |

| Friendly Fraud | A legitimate customer disputes a valid charge. | A customer forgets about a recurring subscription and disputes the charge. | Use clear billing descriptors and send order confirmation and shipping update emails. |

Understanding these distinctions is the foundation of any solid chargeback management plan. Once you know what you’re dealing with, you can start applying the right tools and strategies to protect your business.

Building Your First Line of Defense With Prevention Tools

To get a real handle on chargebacks, you have to start at the very beginning: the point of sale. Think of your checkout page as the front door to your store. You want a smooth, welcoming entry for good customers, but you also need a bouncer to spot trouble before it walks in. That’s exactly what prevention tools do—they’re your digital security team, checking IDs and flagging suspicious behavior in real-time.

The aim isn't to build an impenetrable fortress that accidentally locks out legitimate buyers. It's about creating a smart, layered defense that weeds out the obvious fraudsters before they can make a mess. Each tool you use looks at a different part of the transaction, and when they work together, they form a pretty formidable shield.

Foundational Security Checks

These are the absolute, non-negotiable basics. Every single online merchant should have these active on their payment gateway. If you don't, you're leaving the front door wide open.

- Address Verification Service (AVS): This is a simple but effective check. It confirms whether the billing address the customer typed in matches the one their bank has on file. A mismatch is a classic red flag for a stolen card.

- Card Verification Value (CVV): That little three or four-digit code on the back of the card? That's the CVV. Asking for it proves the customer actually has the physical card in their hand, which stops a huge number of fraudsters who've only managed to get their hands on a list of card numbers.

While they're essential, AVS and CVV alone won't stop a dedicated criminal. They are simply your first and most basic checkpoint.

A layered approach is always the best defense against chargebacks. By combining simple checks like AVS and CVV with more advanced tools, you create a much tougher barrier. Most fraudsters will just give up and look for an easier target.

The Power of 3D Secure Authentication

Ready for the next layer? Enter 3D Secure. You’ve probably seen it yourself when buying something online; it has brand names like Visa Secure or Mastercard Identity Check. It adds one extra step to the checkout process where the cardholder has to prove who they are directly to their bank, usually by entering a code sent to their phone or approving the purchase in their banking app.

That simple step does something incredible: it shifts the liability for fraudulent chargebacks from you, the merchant, straight to the card-issuing bank. If a transaction that went through 3D Secure is later disputed as fraud, the bank is usually the one that has to eat the cost. This makes it one of the most powerful tools available for shutting down true fraud.

To get a clearer picture of what you're up against, it helps to know that all disputes fall into one of three main buckets.

When you know if you're dealing with true fraud, a mistake on your end (merchant error), or so-called "friendly" fraud, you can deploy the right tools to tackle the problem at its source.

Advanced Fraud Scoring and Analytics

Beyond these standard checks, today's best chargeback protection for merchants uses some seriously sophisticated tech to analyze hundreds of data points in the blink of an eye. These systems go way beyond just checking an address or a security code.

Here's a peek under the hood at what they're looking for:

- Device Fingerprinting: This technology assigns a unique ID to the customer's device, whether it's a laptop, phone, or tablet. It can instantly tell if the same device is being used to try multiple stolen credit cards or if a fraudster is trying to mask their location with a proxy server.

- Geolocation Tracking: A quick comparison of the customer's IP address location against their billing and shipping addresses can reveal some major inconsistencies. An order placed from an IP in Eastern Europe but shipping to Ohio? That’s a huge red flag that needs a closer look.

- AI-Powered Fraud Scoring: This is the real brains of the operation. Modern AI algorithms look at things like transaction velocity (how many purchases are attempted in a short period), the order value, the customer's past behavior, and dozens of other signals to assign a simple risk score to every single transaction.

Platforms like Stripe Radar take all this complex data and boil it down into a clear risk assessment. This allows merchants to set up custom rules, like automatically blocking any payment that scores above a certain risk level or flagging mid-range scores for a quick manual review.

By combining these foundational and advanced tools, you build a resilient first line of defense that stops fraud in its tracks—long before it has a chance to become a costly chargeback.

Using Chargeback Alerts To Deflect Disputes

Even if you’ve done everything right to prevent fraud, some disputes are simply going to happen. It's a fact of doing business. A customer might not recognize your billing descriptor on their credit card statement, or maybe they just find it easier to call their bank than to contact your support team.

This is where your second line of defense kicks in: chargeback alerts.

Think of chargeback alerts as an early warning system. Instead of getting blindsided by a formal chargeback weeks after the fact, these services ping you the moment a customer starts the dispute process with their bank. That notification gives you a small, but incredibly valuable, window of time to step in and fix the problem.

This entire system runs on powerful networks, mainly operated by Verifi (owned by Visa) and Ethoca (owned by Mastercard). They’ve built direct communication lines to thousands of banks all over the world, creating a bridge between you and the issuer that just didn't exist before.

How Chargeback Alerts Work

The process itself is surprisingly straightforward but has a huge impact.

When one of your customers calls their bank to question a charge, the bank's internal system flags it. But instead of immediately initiating a formal chargeback, the bank sends out an alert through the Verifi or Ethoca network.

That alert shows up in your dashboard almost instantly, complete with all the key transaction details. It’s a clear signal: a customer is unhappy, and a chargeback is on the horizon. This is your chance to act before things escalate.

You’re given a critical window of 24 to 72 hours to make a decision. By issuing a full refund directly to the customer, you effectively "deflect" the dispute. The network notifies the bank, the customer gets their money back, and the inquiry is closed. Most importantly, an official chargeback is never filed against your merchant account.

The Benefits of Dispute Deflection

Choosing to deflect a dispute rather than letting it turn into a chargeback brings some massive advantages, especially for businesses processing a high volume of transactions. This proactive strategy is a core part of modern chargeback protection for merchants.

The payoff is immediate and directly impacts your bottom line:

- Avoid Expensive Fees: You get to sidestep the painful, non-refundable chargeback fee (usually $15 to $100) that your payment processor charges for every single dispute—whether you win or lose.

- Protect Your Chargeback Ratio: Every dispute you deflect is one less chargeback counting against your merchant account. This is crucial for staying in good standing with processors and avoiding high-risk programs.

- Preserve Customer Relationships: A fast, no-questions-asked refund can turn a frustrated customer into a loyal one. It shows you value their business and can salvage the relationship for the future.

- Prevent Frozen Funds: A high chargeback rate is a red flag for processors, often leading them to hold your funds in a reserve. Keeping your ratio low means your revenue keeps flowing.

This approach fundamentally changes the game from reactive damage control to proactive problem-solving. By heading off the dispute at the source, you stay in control of the outcome and protect the financial health of your business.

Integrating Alerts and Sharing Information

The system works so well because of the deep collaboration between the card networks and the banks. Programs like Visa’s Consumer Clarity and Mastercard’s Order Insight take this even further by sharing more detailed transaction information with banks in real time. This added context often helps customers recognize a purchase, stopping a dispute before it even begins.

The results speak for themselves. Some data shows that merchants using Order Insight have prevented disputes at rates as high as 64–70%. Similarly, the rollout of Consumer Clarity led to a 23% reduction in chargebacks for North American issuers. These numbers prove how powerful real-time data and alerts can be. You can dive deeper into how these chargeback statistics impact merchants on Chargeback.io.

For any merchant, this means integrating an alert service like Disputely isn't just another expense—it's a strategic investment. It plugs you directly into these powerful networks, automating the refund process based on your own rules and ensuring you never miss that critical window to deflect a costly chargeback.

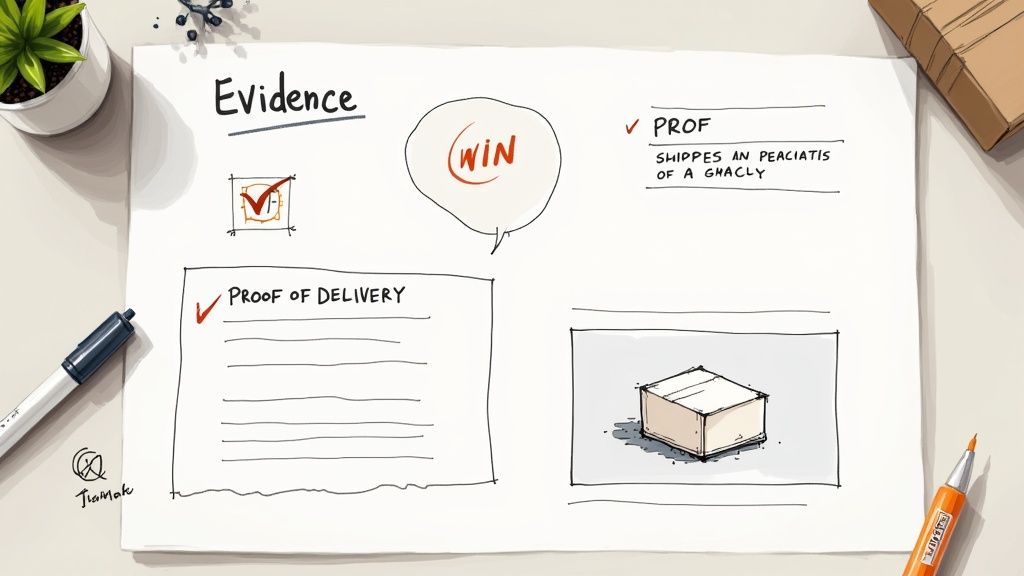

How to Win Disputes With Effective Representment

Even with the best prevention and alert systems, some illegitimate chargebacks will inevitably get through. But that doesn't mean it's game over. This is where representment comes in—it's the official process of fighting the dispute by showing hard evidence that the sale was legit. Think of it as your day in court, where you build a case to get your money back.

While stopping chargebacks before they happen is always the goal, getting good at representment is a critical part of any solid chargeback protection for merchants strategy. It’s your last line of defense against friendly fraud and your only chance to recover revenue that’s rightfully yours. Ignoring this step is like watching a shoplifter walk out the door and just shrugging your shoulders.

The secret to winning is being methodical. A well-organized, evidence-based response can make a massive difference, flipping a potential loss back into a recovered sale.

Decoding the Reason Code

Every single chargeback comes with a reason code from the cardholder's bank. This little code is your most important clue. It tells you exactly why the customer disputed the charge, and it's the starting point for your entire investigation.

For example, a "Product Not Received" claim needs a completely different set of evidence than a "Transaction Not Recognized" claim. Trying to fight a dispute without first understanding its reason code is like trying to solve a puzzle with your eyes closed. You're just taking a wild guess.

Your rebuttal letter and all the evidence you submit must directly tackle the specific reason code. Sending a generic, one-size-fits-all response is a surefire way to lose.

Assembling Your Evidence Package

Once you know why the chargeback was filed, it's time to gather your proof. Your mission is to provide compelling, undeniable evidence that proves the customer's claim is invalid. The stronger your evidence, the better your shot at winning.

A powerful evidence package is always tailored to the reason code, but it often includes a mix of these key items:

- Proof of Delivery: For "I never got it" claims, this is your silver bullet. You need tracking numbers, delivery confirmation from the carrier (showing the correct address), and a signature if you have one.

- Customer Communications: Got emails, support chats, or help desk tickets? These are gold, especially in "friendly fraud" cases where a customer might have admitted to receiving the item before they filed the dispute.

- Transaction Details: Show the AVS and CVV match results, the customer's IP address, and what device they used. This all helps prove the real cardholder made the purchase.

- Clear Policies: A screenshot of your terms of service or return policy—the one the customer had to agree to at checkout—can shut down disputes rooted in buyer's remorse.

Crafting a Winning Rebuttal

Your rebuttal letter is the cover sheet for your evidence. It's a short, professional summary that guides the bank's reviewer through your case. Keep it factual and easy to follow. Ditch the emotional language and just stick to the cold, hard facts you've gathered.

A good rebuttal letter follows a simple structure:

- Introduce the Transaction: State the purchase date, amount, and other key details right up front.

- State Your Case: Directly challenge the customer's claim with a clear, logical argument.

- Reference Your Evidence: Walk the reviewer through each document you've attached, explaining how it proves your point.

- Conclude: Finish with a firm, polite request to reverse the chargeback based on the compelling evidence provided.

The representment process can feel like a lot, but having a structured game plan makes all the difference. For merchants trying to get their strategy dialed in, especially during busy times, focusing on a dedicated Q4 representment campaign can help maximize revenue recovery. Ultimately, a strong representment game ensures you aren't leaving your hard-earned money on the table.

Is Your Chargeback Protection Actually Saving You Money? Let's Do the Math.

Pouring money into a chargeback protection strategy without knowing if it's working is like running an ad campaign with your eyes closed. You hope it's bringing in customers, but you have no real proof. This isn't just an operational expense; it's an investment meant to protect your bottom line.

So, how do you know if you're getting a solid return? The key is to stop guessing and start measuring. By tracking the right numbers, you can see exactly how much revenue you’re saving and recovering, making it easy to justify the cost and prove the value of your efforts.

The Numbers That Matter Most

To get a true sense of your ROI, you need to keep a close eye on a few specific metrics. Think of these as the vital signs of your chargeback health.

Chargeback-to-Sales Ratio: This is your North Star metric. Simply divide the number of chargebacks you get in a given month by your total number of sales. If that percentage is dropping, you know your prevention tools are doing their job.

Dispute Win Rate: How often are you winning the disputes you fight? A rising win rate is a fantastic sign that your representment efforts are paying off, clawing back revenue you would have otherwise lost.

Revenue Saved Through Alerts: This is a direct measure of your deflection success. Just add up the dollar value of every dispute you avoided by refunding the customer through a chargeback alert network.

Reduced Chargeback Fees: Don't forget this one! Every chargeback you deflect also means you've dodged a nasty, non-refundable bank fee. These can stack up quickly, often costing $15 to $100 a pop.

A Real-World ROI Example

Let's break this down with a hypothetical online store, "Urban Apparel."

Before they had any real protection in place, Urban Apparel was processing 5,000 orders a month with an average sale of $100. They were hit with 50 chargebacks every month (a 1% ratio) and, like many merchants, they were losing every single one.

The Monthly Damage:

- Lost Revenue: 50 chargebacks x $100 = $5,000

- Bank Fees: 50 chargebacks x $25 fee = $1,250

- Total Monthly Loss: $6,250

Then, they decided to get proactive and signed up for a chargeback alert service. The results were immediate and impressive. They managed to deflect 40 of the 50 disputes with refunds and won 5 of the 10 that slipped through.

The New Monthly Reality:

- Revenue Lost (unwon disputes): 5 chargebacks x $100 = $500

- Cost of Refunds (deflected disputes): 40 refunds x $100 = $4,000

- Bank Fees: 5 chargebacks x $25 fee = $125

- Total Monthly Cost: $4,625

By subtracting their new, lower costs from their old losses ($6,250 - $4,625), Urban Apparel came out ahead with a net savings of $1,625 every single month.

This figure doesn't even factor in the monthly cost of the alert service, but it clearly shows how the strategy pays for itself and then some. To get a better idea of how this might look for your own business, you can explore various chargeback protection pricing models.

This simple math proves the point: a smart chargeback strategy doesn't just reduce headaches—it delivers a tangible, positive return that makes the investment a no-brainer.

Your Top Questions About Chargeback Protection, Answered

Diving into chargeback protection can feel a bit overwhelming, and it's natural to have questions. Let's tackle some of the most common ones we hear from merchants, giving you the clear, straightforward answers you need to protect your business.

What Is a Good Chargeback Rate for an Online Business?

The magic number you'll hear from major card networks like Visa and Mastercard is 0.9%. Anything below that is generally considered acceptable. But let’s be real—the real goal is to get that number as close to zero as humanly possible.

Creeping over that 0.9% threshold is where the trouble starts. You could find yourself in a high-risk monitoring program, staring down higher fees and the very real risk of losing your merchant account entirely. Solid chargeback protection for merchants is all about staying safely under that danger line.

Can I Stop Friendly Fraud Completely?

Honestly, stopping friendly fraud completely is probably impossible. But you can absolutely make a huge dent in it. This type of chargeback often happens because a customer is confused, forgot about a purchase, or finds it easier to call their bank than to call you.

Your best defense is being proactive and crystal clear. Here’s how:

- Clear Billing Descriptors: Make sure the name on their credit card statement is instantly recognizable as your business. No cryptic abbreviations!

- A Fair and Obvious Return Policy: Don’t hide your return policy. Make it so easy to find that getting a refund is simpler than filing a dispute.

- Top-Notch Customer Service: A responsive, helpful support team can solve problems long before a customer even thinks about calling their bank.

- Timely Order Updates: Keep customers in the loop with order, shipping, and delivery confirmations. A well-informed customer is a happy customer.

The core idea is simple: if you make it easier for a customer to work with you, they'll be far less likely to go around you.

Is Chargeback Protection Expensive for a Small Business?

The cost can vary, but it's almost certainly more affordable than the alternative. The foundational tools, like AVS and CVV checks, are usually baked right into your payment processor's service at no extra charge.

When you start looking at more advanced services like chargeback alert networks or fraud scoring, there will be some additional costs. But you have to weigh that against the money you're losing to chargebacks—lost revenue, bank penalties, and the time your team spends fighting disputes. Think of it as an investment. A good protection service often pays for itself by preventing just a few chargebacks a month.

Stop losing revenue to preventable disputes. Disputely integrates directly with major card networks to alert you to chargebacks in real-time, giving you the power to refund and deflect them automatically. Protect your business and your bottom line today.