The Merchant's Guide to Chargeback Time Limit Rules

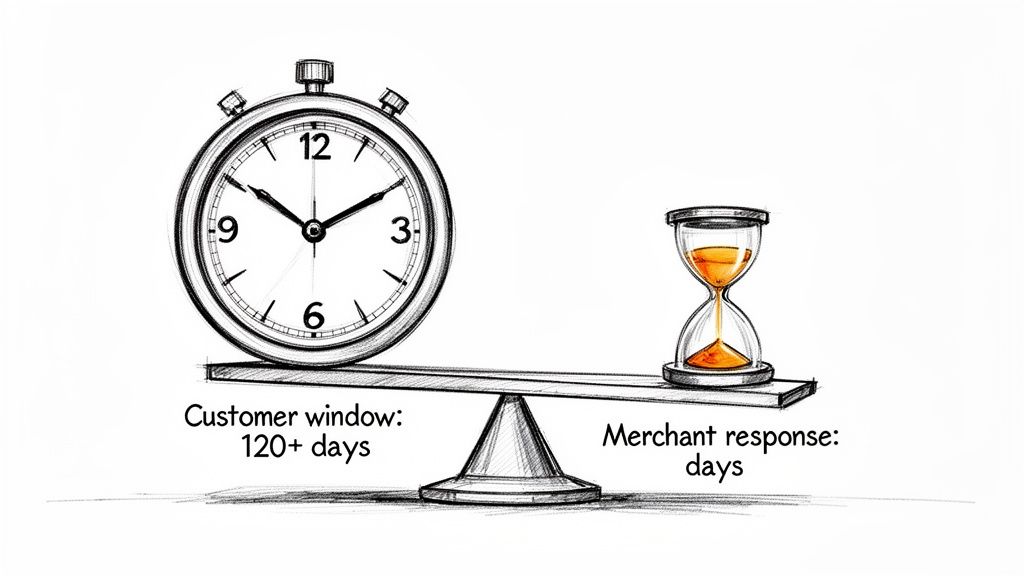

Think of the chargeback time limit as a ticking clock. It starts the second a customer disputes a charge, but this clock is anything but fair. Customers often have a massive window—frequently 120 days or more—to file a claim, while you, the merchant, are left with a tiny fraction of that time to react. Getting a handle on this imbalance is your first line of defense in protecting your revenue.

Why the Chargeback Clock Is a Merchant Challenge

The chargeback system was built to give consumers a safety net against fraud. That’s a good thing. But for merchants, it often feels like you’re running a race against an unforgiving deadline where the rules are stacked against you.

Imagine coaching a football team. The opposing team gets four months to study your plays and prepare their strategy, but you only find out you have a game a week beforehand. That’s what dealing with chargebacks feels like. A customer can wait months after a purchase to change their mind or claim an issue, forcing you to dig up evidence for a transaction that’s a distant memory.

The Key Players and Their Timelines

When a dispute lands, several parties get involved, and each operates on its own schedule. To beat the clock, you need to know who they are and how they affect your response time.

- The Cardholder: This is your customer, the one initiating the dispute. They have the most generous timeframe to take action.

- The Issuing Bank: The cardholder's bank (think Chase or Bank of America). They take the customer's complaint and formally file the chargeback.

- The Acquiring Bank: This is your bank or payment processor (like Stripe or Square). They’re the ones who tell you about the chargeback and handle your evidence submission.

- The Card Network: The big leagues—Visa, Mastercard, AmEx. They set the master rules and deadlines that everyone else must follow.

This chain of communication alone can eat into your valuable time. A 30-day deadline from the card network might shrink to just 20 days by the time the alert actually hits your dashboard. Every day counts.

To really see the difference, let's put the timelines side-by-side.

Cardholder vs Merchant Dispute Timelines at a Glance

This table breaks down the stark contrast between the time a cardholder has to start a dispute and the much tighter window a merchant has to defend it.

| Party | Typical Time Window | Key Consideration |

|---|---|---|

| Cardholder | 120+ Days | Can wait months after the transaction date, making evidence gathering harder. |

| Merchant | 7 - 30 Days | The clock starts ticking the moment the chargeback is filed, not when you see it. |

This imbalance is the core of the problem. Your customer has the luxury of time, while you're forced to act with urgency.

It's Not Just About Rules, It's About Revenue

Meeting these deadlines is more than just a compliance checkbox—it's about keeping your business healthy. A single missed deadline means an automatic loss. You’re out the sale amount, the product, and you get slapped with a chargeback fee.

The best way to fight back is to stop reacting and start preparing. By understanding the timeline imbalance and who's involved, you can build a system that helps you respond quickly and effectively. For a deeper dive into proactive strategies, we cover a ton of ground over on the Disputely blog.

Ultimately, mastering the chargeback time limit turns a major business threat into a manageable part of your operations. It’s about leveling the playing field to protect the revenue you worked so hard to earn.

Getting a Handle on Card Network Time Limits

You’ve probably heard of the “120-day rule” for chargebacks. While it’s a decent starting point, treating it as a hard and fast rule for every transaction is a recipe for losing money. The truth is, each card network—Visa, Mastercard, American Express, and Discover—has its own specific rulebook.

Think of it like this: they’re all playing the same sport, but each league has its own unique set of regulations. A move that’s perfectly legal in one might get you an immediate penalty in another. The same goes for chargebacks. Knowing the subtle differences in the chargeback time limit for each network is what separates a winning response from an automatic loss.

It’s not just about meeting a deadline. It’s about knowing precisely which rules are in play for the specific dispute sitting in your queue.

Visa Chargeback Time Limits

Visa is known for having one of the most structured and detailed dispute processes. Generally, a cardholder gets 120 days to file a dispute, but the real devil is in the details of when that 120-day clock actually starts ticking.

For straightforward fraud, the countdown usually begins on the transaction date. But for disputes over services not rendered or products not received, the clock might not start until the expected delivery date or even later. This is a critical detail for anyone in e-commerce or the subscription business.

On your end, as the merchant, the window to act is much, much smaller. Once a dispute lands, you’ll typically have just 20 to 30 days to pull together all your evidence and submit it through the Visa Resolve Online (VROL) portal. Miss that window, and it's game over—you lose by default.

This is exactly why tools like Visa's Rapid Dispute Resolution (RDR) are so valuable. They give you a chance to issue a refund before a formal dispute is ever filed, saving you from that stressful 30-day scramble.

Mastercard Chargeback Time Limits

Mastercard's rules run parallel to Visa's in many ways, often giving cardholders that same 120-day window to file a claim. However, a key difference is how they define the start date, which is frequently tied to something called the "Central Site Business Date."

The good news for merchants? Mastercard is usually a bit more generous with its response time, giving you up to 45 days to prepare your case. But don't let that extra time lull you into a false sense of security. Compiling compelling evidence can be a complex scavenger hunt, so every single day counts.

Mastercard also offers some fantastic tools to get ahead of disputes. Through its acquisition of Ethoca and its own Consumer Dispute Resolution Network (CDRN), it provides alert systems that can intercept a potential chargeback, letting you resolve it with a quick refund and sidestep the entire formal process.

American Express Chargeback Time Limits

American Express is a different beast entirely because it acts as both the card issuer and the network. This simplifies the process on their end but often makes life tougher for merchants. AmEx has a long-standing reputation for siding with its cardmembers, which means your evidence needs to be rock-solid.

The standard chargeback time limit for cardholders is around 120 days, but AmEx is known for being more flexible with that rule if they feel a customer's situation warrants it.

For merchants, the deadline is a rigid 20 days. No exceptions. With AmEx's cardholder-first approach, there is zero room for error. Your evidence must be airtight and speak directly to the customer's specific claim.

Discover Chargeback Time Limits

Discover keeps things pretty straightforward. Cardholders have up to 120 days from the transaction date to raise a dispute. The system isn't as layered with unique rules as Visa or Mastercard, but it demands the same level of attention to detail from you.

Once a dispute is on your plate, you get about 20 days to respond. Because Discover manages the entire process in-house, things tend to move quickly—that 20-day window can feel like it flies by. A fast, well-documented, and thorough response is your only path to winning.

To get a feel for how payment processors navigate these different rules in the real world, check out resources like Nyce Pay's Payment Processing Insights. A deep understanding of these network-specific timelines is the bedrock of any successful chargeback defense.

Chargeback Time Limit Comparison by Card Network

To make things a bit easier, here’s a quick-glance table comparing the time limits across the major card brands. Keep in mind that these are general guidelines, as specific chargeback reason codes can sometimes have their own unique clocks.

| Card Network | Typical Cardholder Time Limit | Common Merchant Response Deadline | Key Nuance for Merchants |

|---|---|---|---|

| Visa | 120 days | 20-30 days | The "start date" for the 120-day clock varies significantly based on the dispute type (e.g., delivery date vs. transaction date). |

| Mastercard | 120 days | Up to 45 days | Offers a slightly longer response window, but merchants should still act with urgency. |

| American Express | 120 days (flexible) | 20 days | Known for being very cardholder-friendly; requires exceptionally strong merchant evidence to win. |

| Discover | 120 days | 20 days | A straightforward process, but the short response time demands a quick and organized reaction. |

Ultimately, while the cardholder has months, you only have a few short weeks. This stark difference highlights just how crucial it is to have a fast and efficient system in place for managing disputes the moment they arise.

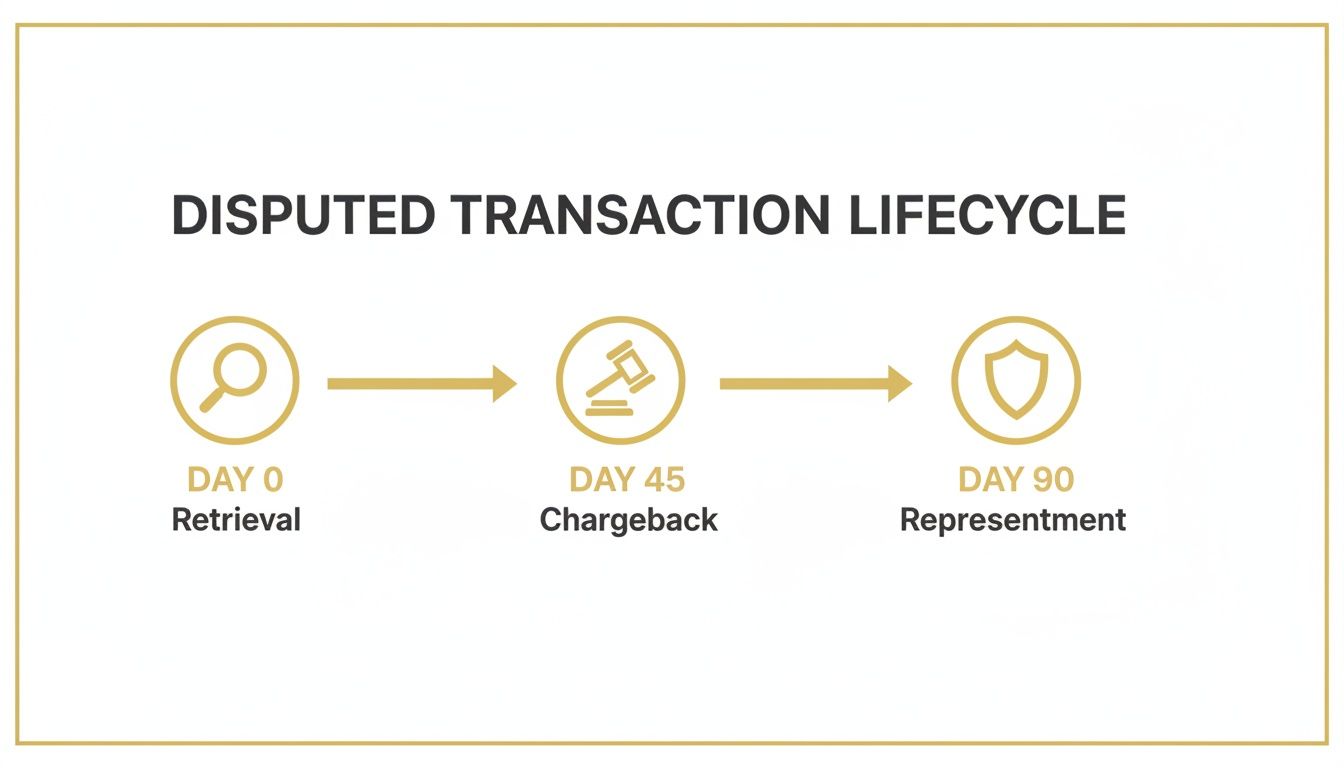

The Full Lifecycle of a Disputed Transaction

A chargeback isn't a single event. It's a whole process, a multi-stage journey with a series of unforgiving deadlines. If you miss just one of these deadlines, it's usually an automatic loss. Think of it less like a simple refund and more like a legal proceeding where every step has its own clock, and that clock is ticking.

To get a handle on it, let's break the dispute lifecycle down into three core phases. Each one has a specific job and a unique timeline.

- Retrieval Request (The "Hey, What's This?"): This is often the first, and thankfully optional, step. The customer's bank is just asking for more details about a charge. It's not a formal chargeback yet, but ignoring it is a guaranteed way to get one.

- Chargeback (The "We're Taking Our Money Back"): This is the main event. If the initial inquiry doesn't clear things up (or gets skipped entirely), a formal chargeback is filed. The disputed funds are immediately pulled from your account, and the countdown for your official response starts now.

- Representment (The "Here's Our Side of the Story"): This is your one and only shot to fight the chargeback. You'll need to submit compelling evidence that proves the transaction was legitimate and that you held up your end of the deal.

Each phase is governed by a strict chargeback time limit. Winning requires you to be organized and on top of your game from the very beginning.

Stage One: The Retrieval Request

A retrieval request—sometimes called a "soft" chargeback or an inquiry—is your early warning system. The cardholder's bank is essentially tapping you on the shoulder and saying, “We have a customer who doesn't recognize this charge. Can you help us out?”

You usually have a very short window, often just 7 to 10 days, to respond with the basics, like a sales receipt. A fast, thorough response here can stop the problem in its tracks and prevent it from ever becoming a full-blown chargeback. It’s your best chance to save yourself a ton of time, money, and headaches down the road.

Stage Two: The Chargeback Filing

If you miss the retrieval request window or the bank isn't satisfied, a formal chargeback gets filed. This is when things get serious. The money is immediately taken from your merchant account, and you get a formal notice with a reason code explaining the customer's complaint.

This is where the most famous deadline comes into play. While your customer might have up to 120 days to file a dispute, you don't get that luxury. For Visa disputes, for instance, merchants typically have about 20 days to respond, no matter the reason. The pressure is on. For a deeper dive into how these timelines stack the deck against businesses, you can read the full analysis of chargeback statistics.

A Critical Warning on Timelines: Don't get too comfortable with that 20-day number. Your payment processor has its own internal deadlines that are almost always shorter. They need time to review and package your evidence before sending it to the card network. That 20-day network deadline can easily shrink to a much tighter 7-10 day window for you and your team.

Stage Three: Representment and Arbitration

This is where you make your case. The representment phase is your formal defense. You need to gather every piece of relevant evidence you have—shipping confirmations, AVS/CVV match results, customer emails, service usage logs—and build an airtight response that directly debunks the customer's claim.

If your evidence is strong enough, the funds are returned. If it's not, the chargeback stands, and the money is gone for good. In rare situations where there's still a disagreement, the case can escalate to arbitration, where the card network steps in to make a final, binding decision. But be warned: arbitration is expensive and slow. Your best strategy is always to win with a powerful representment case from the get-go.

Looking back at past losses can be a goldmine for improving your defense. If you want to get proactive, you might be interested in our guide on how to run a Q4 chargeback audit to shore up your defenses.

Common Mistakes That Shrink Your Response Window

Knowing the official chargeback time limit is one thing. Actually getting to use all of that time is another entirely. I've seen countless merchants accidentally sabotage their own response windows, turning a manageable 20-day deadline into a chaotic 7-day sprint to the finish. These self-inflicted wounds are a direct path to missed deadlines and lost revenue.

Think of your response time like a finite resource. Every process delay, every disorganized step, every moment of confusion eats away at it. The merchants who win disputes consistently aren't just fast—they're ruthlessly efficient. They’ve systematically eliminated the internal friction that burns through precious days.

Disorganized Evidence Gathering

The most common pitfall I see is not having a central hub for transaction evidence. When a dispute hits your inbox, the clock starts ticking—loudly. If your team has to dig through three different systems for order details, shipping confirmations, customer emails, and server logs, you’re already losing the race.

This is what I call "The Weekend Scramble." A dispute notice lands at 4 PM on a Friday with a tight deadline. Because all the evidence is scattered, the task gets punted to Monday. Just like that, you've torched three valuable days and set yourself up for a rushed, sloppy response.

The fix? Make sure all your transaction data is accessible from one place. When everything is at your team's fingertips, they can pull together a rock-solid evidence packet in minutes, not days.

Failing to Centralize Dispute Management

Another critical mistake is letting different people or departments handle disputes their own way. Without a unified workflow, notifications get lost in the shuffle, response quality is all over the map, and nobody really owns the outcome. Who’s in charge of checking the Stripe dashboard? Who’s watching the PayPal alerts?

When there’s no single point of ownership, a dispute can sit idle for days before the right person even lays eyes on it. This simple operational gap is a huge reason why a 30-day network deadline shrinks to a much shorter internal reality for so many businesses.

By the time a dispute notice bounces through multiple inboxes and departments, a huge chunk of your response window has already vanished. Centralizing how you manage disputes means someone can triage and assign them immediately, saving every available hour.

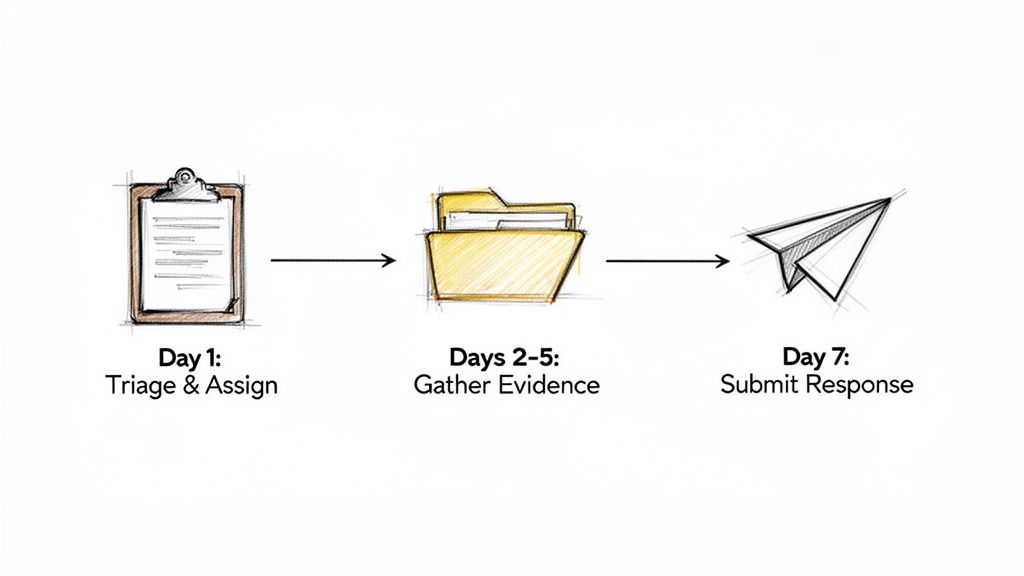

The infographic below breaks down the different stages of a dispute. Disorganized teams bleed time at every single step.

As you can see, from the initial retrieval request to the final representment, each phase demands quick, decisive action. There’s simply no time to waste.

Ignoring Initial Requests and Alerts

Finally, many merchants treat retrieval requests or pre-dispute alerts like they're no big deal. This is a massive strategic blunder. A retrieval request is your golden opportunity to shut down an issue with minimal fuss before it blows up into a full-blown, costly chargeback.

Ignoring these early warnings doesn't make them disappear. It just guarantees they’ll come back as a formal chargeback—with a tighter deadline and an immediate debit from your bank account. Here’s how you should be thinking about these stages:

- Retrieval Request: This is a simple request for information, usually with a 7-10 day window. A quick, clear response can stop the chargeback cold.

- Pre-Dispute Alert: You get 24-72 hours to simply refund the customer and avoid the dispute entirely. It's by far the cheapest way out.

- Formal Chargeback: This is the last stop. The money is already gone, and now you have to fight to claw it back.

Putting solid internal systems in place to avoid these common mistakes isn't optional for serious businesses. When you centralize your evidence, unify your workflow, and jump on early warnings, you take back control of your timeline and protect your bottom line.

A Step-by-Step Plan to Beat the Chargeback Clock

When a chargeback hits, it feels less like a business process and more like a fire alarm going off. Suddenly, you're in a mad dash against a ticking clock, with revenue hanging in the balance. The only way to turn that chaos into a controlled, effective response is to have a battle-tested plan ready to go—one that respects the tight chargeback time limit.

A structured timeline is your best defense. It ensures no crucial steps get missed and gives your team the best possible shot at winning the dispute. Think of it as your playbook for tackling every dispute head-on.

The Manual 7-Day Scramble

Here’s a sample weekly workflow your team can use the moment a new chargeback notification lands. This timeline is built for one thing: maximizing your chances within a painfully short response window.

Day 1: Triage and Assign

The second that dispute alert arrives, the clock officially starts ticking. Those first 24 hours are all about getting your bearings.

- Log the Dispute: Get the chargeback into your tracking system immediately. Record every key detail: case number, reason code, transaction amount, and, most importantly, the final due date.

- Make the First Call: Do a quick gut-check on the claim. Is this obvious fraud? A complaint about product quality? A classic case of subscription remorse? This initial read will shape your entire evidence-gathering strategy.

- Assign Ownership: Put one person in charge of the case from start to finish. This simple step prevents things from falling through the cracks and makes it clear who is responsible for seeing it through.

Days 2-5: Gather and Organize Evidence

This is where you build your case. The mission is to assemble a mountain of proof that directly torpedoes the cardholder's claim.

- Transaction Data: Pull up the original order details. You'll want the IP address, items purchased, and especially the AVS/CVV verification results.

- Customer Communications: Dig up every email, chat log, or support ticket you have with this customer. A single friendly email can sometimes win a case.

- Proof of Delivery: For physical products, this is your silver bullet. You need a tracking number and a delivery confirmation that shows the package landed at the right address.

- Service Usage Logs: If you sell digital goods or subscriptions, this is your proof of delivery. Show logs that prove the customer logged in, downloaded the file, or used the service after the purchase.

Days 6-7: Compile and Submit Your Response

With your evidence file ready, it's time to put it all together and ship it off. Whatever you do, don't wait until the last minute—your payment processor has its own internal cutoffs.

The deadline you see from the card network is the absolute final cutoff. But your payment processor’s internal deadline is almost always 2-3 days earlier. Always aim to submit your response with at least 48 hours to spare.

This manual process can work, but it locks you into a constant state of reaction. You're always on the defensive, fighting a clock that gives the cardholder a massive head start.

Shifting from Reactive to Proactive

The real pros know that fighting chargebacks is a losing game in the long run. The goal is to stop them from ever happening. This is where pre-dispute alerts come in and completely change the equation.

The timeline is already stacked against you. Cardholders often have around 120 days to file a dispute, and in some wild cases, that can stretch to over 500 days. Meanwhile, you, the merchant, get a measly 20–30 days to build a case and respond. You can see just how unbalanced this is in this 2023 Chargeback Outlook Report.

An automated alert system flips this dynamic on its head. Instead of a week-long scramble, you get a precious 24-72 hour window to act before a dispute becomes a formal chargeback.

Here’s how it works:

- A customer calls their bank to question a charge.

- Instead of filing a chargeback, the bank sends a "pre-dispute" alert through a network like Visa RDR or Ethoca.

- Your alert platform (like Disputely) catches it and can automatically issue a refund based on rules you set.

This proactive move completely sidesteps the dispute process. You avoid the nasty chargeback fee, protect your merchant account's health, and win back all those hours your team would've spent digging for evidence. It turns a week-long fire drill into a simple, automated refund, putting you back in control. To see how this can boost your bottom line, check out our guide on optimizing your representment strategy.

Frequently Asked Questions About Chargeback Time Limits

Diving into chargeback deadlines can feel like you're trying to hit a moving target, but getting a handle on the rules is the only way to protect your bottom line. Let's walk through the most common questions we hear from merchants to clear up the confusion and help you manage disputes like a pro.

Can a Chargeback Be Filed After 120 Days?

Yes, it happens more often than you'd think. This is a huge misconception for merchants. While you'll often hear the 120-day number thrown around, that isn't a hard-and-fast rule, because the clock doesn't always start on the day of the transaction.

For many disputes, the timer actually begins when the cardholder realizes there's a problem. For instance, if a customer files a chargeback because a product never showed up, the clock might not start until after the expected delivery date has come and gone. With recurring subscriptions, every new bill can potentially reset the timeline. In some very specific cases, like future-dated services or certain kinds of fraud, that window can stretch out as far as 540 days. Counting on a fixed calendar deadline is just not a reliable strategy.

Does the Reason Code Affect the Time Limit?

Absolutely. In fact, the reason code is probably the single most important piece of the puzzle. It tells you exactly when the dispute clock started ticking and what kind of proof you'll need to fight it.

Think about it this way:

- Unauthorized Transaction: The clock usually starts right when the transaction was processed.

- Product Not Received: Here, the timer might not begin until the day after the promised delivery date.

- Product Not as Described: The window often starts from the day the item was delivered, because that’s when the customer could first see it wasn’t what they expected.

Knowing the reason code gives you the context. It tells you how much time you have and whether you need to pull delivery confirmations, AVS data, or customer service emails to build your case.

How Do Chargeback Alerts Change the Time Limit?

Chargeback alerts completely flip the script, giving you a proactive timeline that works for you, not against you. Instead of waiting to react within the usual 20-30 day chargeback window, alerts from services like RDR and Ethoca/CDRN give you a much shorter, but incredibly valuable, 24-72 hour pre-dispute window.

This short timeframe is your golden opportunity. It happens after a customer has called their bank but before the bank officially files the chargeback. It’s a chance to issue a refund and completely sidestep the dispute, the fees, and the hit to your chargeback ratio.

What Is the Difference Between a Statute of Limitations and a Chargeback Time Limit?

This is a legal distinction that trips up a lot of people. A chargeback time limit is an internal rule created by private companies—the card networks like Visa and Mastercard. It’s part of their operational playbook, not a law.

A statute of limitations, on the other hand, is an actual law that sets a deadline for how long someone has to file a lawsuit in court. So, while a customer might be too late to file a chargeback, they could technically still be within the statute of limitations to sue. For virtually all e-commerce disputes you'll encounter, though, the card network's time limit is the one that really matters for your daily operations.

Stop chasing disputes and start preventing them. Disputely integrates directly with major card networks to give you a 24-72 hour window to refund a transaction before it becomes a costly chargeback. See how you can reduce your dispute rate by up to 99%.