Chargebacks on Debit Cards: Your Essential Guide to Resolving Disputes

A debit card chargeback is a forced refund. It’s when a customer’s bank yanks money directly out of your business account to settle a dispute. Unlike credit card disputes that tap into a line of credit, this process removes actual cash from your bank balance. That immediate hit to your cash flow makes understanding—and managing—debit card chargebacks a crucial skill for any merchant.

What Are Debit Card Chargebacks and How Do They Affect Your Business?

Picture this: a customer buys something from your online store. The money hits your account, and you ship their order. Then, a few days later, those funds simply disappear. That’s not a system error; it’s a debit card chargeback.

Think of it as the banking version of a customer marching back into your shop, forcing open the cash register, and taking their money back—with their bank’s full blessing.

This system was created to protect consumers, giving them a way to fight fraudulent charges or get their money back from uncooperative merchants. But for an ecommerce business, it’s a direct and immediate financial threat. The money isn't just put on hold; it's gone.

The Growing Threat to Merchants

The explosion of online shopping has put this risk into overdrive. With more and more transactions happening without a physical card present, the opportunity for disputes—both legitimate and fraudulent—has skyrocketed.

Global chargeback volumes are on track to hit a staggering 337 million by 2025, which is a 27% jump from 2022. This surge is fueled by card-not-present (CNP) transactions, which are a prime target for fraud and now make up 63% of merchants' total sales. You can dig into more chargeback statistics to see the full picture.

For any business, but especially those in the direct-to-consumer (DTC) world, the fallout is painful. A single chargeback isn't just a lost sale; it’s a financial punch with multiple impacts:

- Lost Revenue: The full transaction amount is immediately clawed back.

- Lost Product: You've already shipped the goods, and you’re probably never seeing them again.

- Chargeback Fees: Your payment processor hits you with a penalty, usually between $15 and $100.

- Operational Costs: Your team has to drop what they're doing to spend time and energy gathering evidence to fight the dispute.

It’s a common myth that chargebacks are a credit card problem. The truth is, chargebacks on debit cards are just as common and, because they pull real cash from your bank account instantly, they're often far more damaging.

Why Every Merchant Needs a Strategy

You can't afford to ignore debit card chargebacks. The problem is made even worse by "friendly fraud," which happens when a legitimate customer disputes a charge—often out of confusion, forgetfulness, or even buyer's remorse. This alone accounts for up to 75% of all chargeback cases.

This trend makes one thing crystal clear: every transaction you process carries a risk that lasts long after the sale is complete.

Without a solid grasp of the process and a proactive plan to prevent and fight these disputes, you’re risking more than just immediate financial losses. You could seriously damage your relationship with your payment processor. This guide will give you the knowledge and tools you need to protect your business.

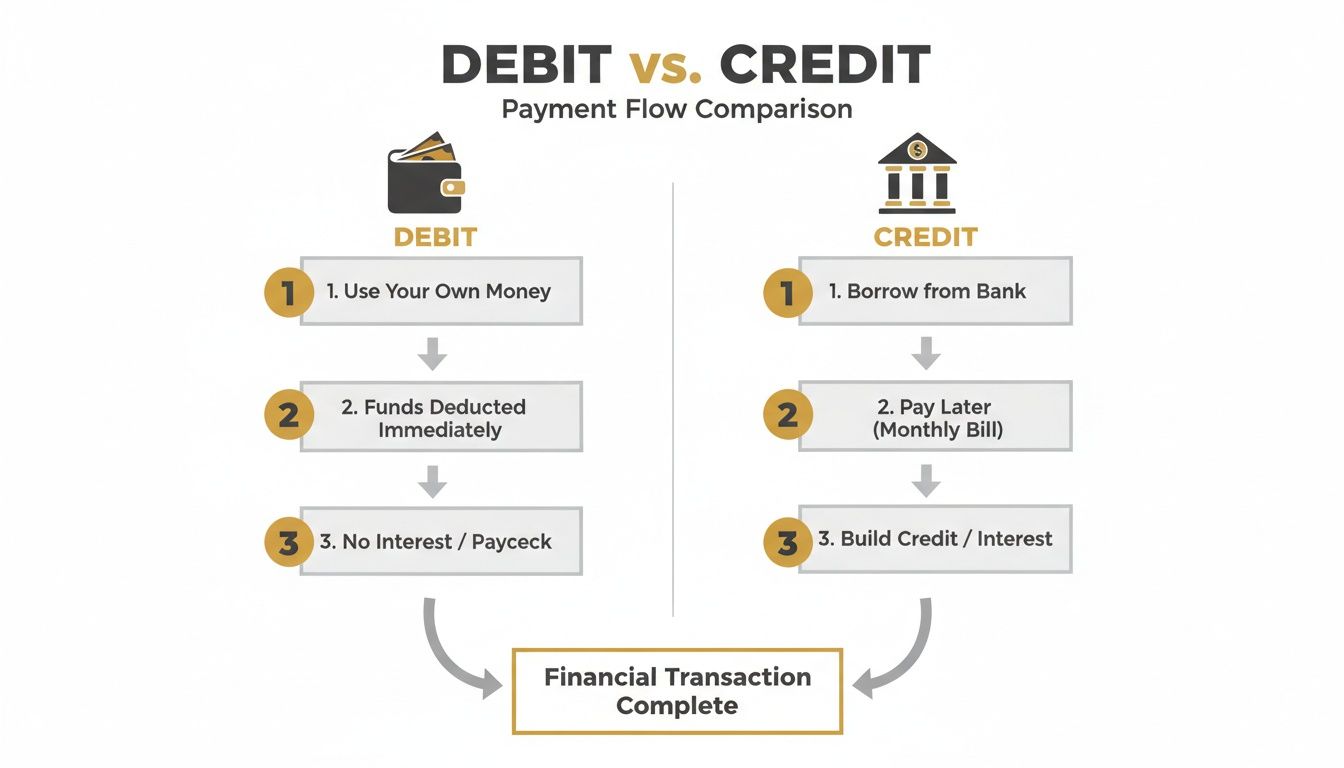

How Debit and Credit Card Chargebacks Differ

On the surface, debit and credit card chargebacks can look like the same problem. A customer disputes a charge, and suddenly you're out the money. But for a merchant, they are fundamentally different animals, and knowing how to handle each one is key to protecting your business.

The real difference isn't just a technicality; it’s all about whose money is actually in play.

When a customer disputes a credit card purchase, they're essentially questioning a charge against their line of credit. The bank temporarily foots the bill, crediting the cardholder's account while they sort things out. It's a dispute over the bank's money.

But with chargebacks on debit cards, the stakes are much higher and far more personal. The dispute is over the customer's own cash—money that was pulled directly from their personal checking account. This simple fact changes everything, making the process feel more urgent and often more emotionally charged for the customer.

The Immediate Financial Hit

The most jarring difference for a merchant is how quickly a debit card dispute hurts your cash flow.

- Debit Card Chargebacks: The second a dispute is filed, the money is yanked directly from your merchant account. It’s gone. This creates an instant, real-time hole in your finances.

- Credit Card Chargebacks: The disputed amount is usually just held back from a future payout. It’s still a loss, of course, but it feels more like a pending IOU than someone reaching into your cash register.

That immediate withdrawal makes debit card chargebacks incredibly disruptive. It's the difference between getting a bill in the mail and having cash snatched right out of your wallet.

Key Differences at a Glance

To really get a handle on the operational nuances, let's put them side-by-side. Everything from the laws that govern them to the customer's state of mind will shape how you should respond.

Debit Card Chargebacks vs. Credit Card Chargebacks

This table breaks down the crucial differences you need to be aware of when a dispute lands on your desk.

| Feature | Debit Card Chargeback | Credit Card Chargeback |

|---|---|---|

| Source of Funds | Customer's real cash from their bank account. | Bank's line of credit extended to the customer. |

| Financial Impact | Instant withdrawal of funds from your merchant account. | Funds are held or deducted from future settlements. |

| Governing Law | Primarily governed by the Electronic Funds Transfer Act (EFTA). | Primarily governed by the Fair Credit Billing Act (FCBA). |

| Filing Window | Often a shorter window for customers to file, sometimes as little as 60 days. | Typically a longer window, often up to 120 days or more. |

| Customer Mindset | Highly personal; "It's my money." Disputes can feel more urgent. | Less personal; "It's the bank's money." The process is more detached. |

These distinctions aren't just trivia; they're the foundation of a solid defense strategy. While this guide is focused on debit cards, understanding the whole payment dispute landscape, including scenarios like receiving a refund to a cancelled credit card, gives you a much richer context for handling any situation that comes your way.

Because a debit card dispute involves a customer’s own funds, banks often scrutinize the evidence more rigorously. They are essentially mediating a direct financial conflict, which can make winning a representment case more challenging for the merchant.

In the end, any chargeback is bad news. But the direct cash impact of a debit card dispute makes it a more immediate threat to your business. It demands an even higher level of diligence in your record-keeping, customer communication, and evidence gathering. Now, let's dive into the step-by-step process for fighting back.

So, What Happens When You Get a Debit Card Chargeback?

When a customer disputes a debit card purchase, it kicks off a formal, step-by-step process that can easily make a merchant's head spin. The best way to protect your revenue is to first understand exactly what you're up against. This isn't just a simple refund request; it's a structured journey with its own rules, deadlines, and key players.

Think of it as a mini-court case. The customer is the plaintiff, their bank is the judge, and you're the defendant. You have to show up and present a solid case proving the transaction was legitimate. If you ignore the summons—the dispute notification—you automatically lose.

This flowchart lays out the core difference between how money moves in a debit versus a credit card transaction. Pay close attention to when the cash actually leaves your account.

The big takeaway here? With debit cards, the money is pulled from your account right at the start of the dispute. This creates an immediate hit to your cash flow, which is a major pain point for any business.

The First Move: The Dispute and Provisional Credit

It all starts when a cardholder calls their bank to question a charge on their account. They'll state their case, and the bank will slap a reason code on it, which is just a category for the claim—think "Item Not Received" or "Fraudulent Transaction."

As soon as the bank decides the customer's claim has merit, two things happen almost at the same time:

- The Money Vanishes: The disputed amount is yanked directly out of your merchant account. This is the first, and often most painful, part of the process.

- The Customer Gets a Temporary Credit: The bank gives the customer a provisional credit for the same amount. This is to keep them happy while the bank sorts things out behind the scenes.

At this point, you haven't even been officially notified, but your money is already gone. It's a tough pill to swallow.

The Clock Starts Ticking: The Retrieval Request

Next, the customer's bank pings your acquiring bank or payment processor through the card network (like Visa or Mastercard). Your processor then passes that message along to you. This notification is often called a retrieval request or a dispute alert, and it's your official call to action.

The moment that notification hits your inbox, a very important clock starts ticking.

You generally have a window of 15 to 45 days to respond with your side of the story and evidence. This is a hard deadline. If you miss it, you forfeit the dispute. The funds are gone for good.

This is where so many merchants lose by default. They either don't see the email, don't grasp the urgency, or just can't pull together the necessary proof in time.

Fighting Back: The Representment Phase

If you decide to challenge the chargeback, you've officially entered the representment phase. This is your chance to fight back. You’ll need to submit a compelling rebuttal package filled with evidence that proves the original transaction was totally legitimate and you delivered on your promise.

What kind of evidence do you need? It really depends on the reason code, but you'll almost always want to include:

- Proof of Authorization: AVS and CVV match results, the customer's IP address.

- Proof of Delivery: Shipping confirmation and tracking numbers that show a successful delivery to the customer's address.

- Customer Communication: Any emails, support tickets, or chat logs where the customer talks about the purchase or the product.

- Your Policies: Crystal-clear screenshots of your return, refund, and shipping policies that the customer had to agree to before checking out.

Building a winning representment case is part art, part science, and it’s especially crucial during busy shopping seasons. For businesses looking to sharpen their strategy, learning how to prepare for Q4 representment can make a huge difference in recovering lost sales.

Once you submit your evidence, it's back in the issuing bank's hands. They review everything and make a call. They might rule in your favor and return the funds, or they'll side with their customer, making the provisional credit permanent. While it’s rare, a dispute can sometimes escalate to arbitration. Every single stage is a checkpoint where one wrong move can cost you the sale.

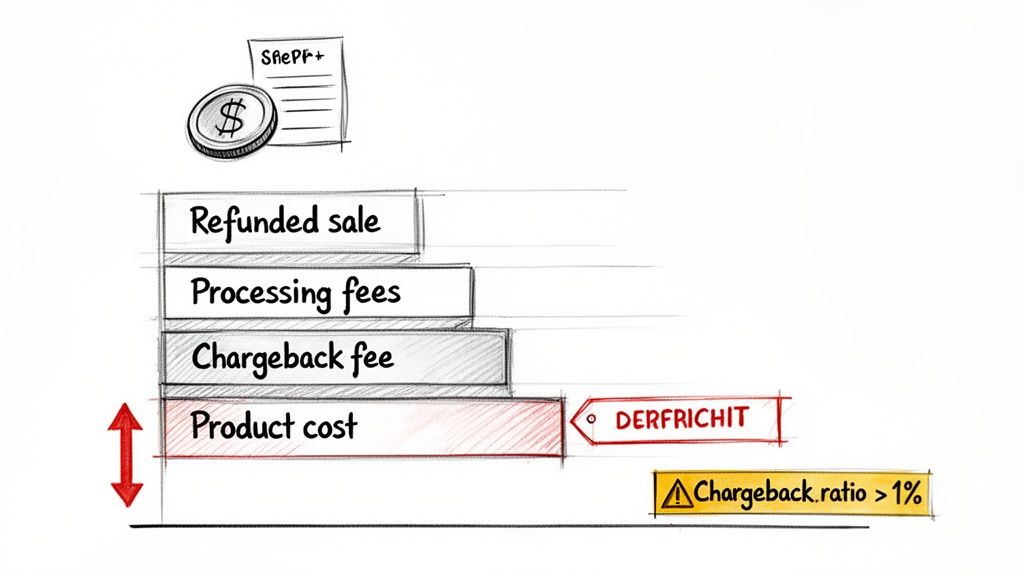

The True Cost of a Single Chargeback

Think a chargeback is just a refund? Think again. A chargeback is more like a financial grenade tossed into your profit margins. The money you lose from the original sale is just the shrapnel—the real damage is a cascade of hidden costs that makes the initial loss look tiny.

Once a customer files a dispute, the money from that sale is gone in a flash. But your expenses are just getting started. You're getting hit from all sides, and that once-profitable sale quickly turns into a painful net loss.

The numbers paint a pretty grim picture. The true cost of chargebacks is staggering, with forecasts projecting global losses to hit $33.79 billion by 2025. For U.S. merchants, it gets even worse: for every dollar lost to fraud, you actually lose an average of $4.61. That’s a 37% jump since 2020. This multiplier effect comes from a nasty mix of direct costs and operational headaches that chew through your bottom line. You can dig deeper into the true cost of chargebacks from Mastercard.

Breaking Down the Financial Damage

So, what does this actually look like for a real transaction? Let's say a customer disputes a $100 order they paid for with a debit card. Here’s a quick rundown of what that single incident really costs you.

- Forfeited Revenue ($100): This is the obvious one. The full $100 is yanked from your merchant account right away.

- Non-Refundable Processing Fees (~$3): Remember that fee you paid your processor to handle the sale? It’s gone. You don't get that back, even though the sale was reversed.

- Punitive Chargeback Fee ($15 - $100): On top of everything else, your processor slaps you with a separate penalty fee just for the hassle of dealing with the dispute. These can range from annoying to downright painful.

- Lost Product Cost (~$30): You've already shipped the item, and you paid for that inventory. In most disputes, especially fraud-related ones, you can kiss that product goodbye.

In this simple $100 sale, you're looking at a total loss of at least $148. You've lost nearly 1.5 times the value of the original order, and that's before you even factor in the time and resources spent trying to fight it.

The Most Dangerous Number: Your Chargeback Ratio

As painful as individual disputes are, there's a much bigger threat lurking in the background: your chargeback ratio. This is the metric that keeps payment processors up at night. It’s calculated by dividing the number of chargebacks you get in a month by your total number of transactions in that same month.

Card networks like Visa and Mastercard watch this number like hawks. They have strict thresholds, and if you cross them, you’re in trouble.

The magic number to stay under is 1%. If your chargeback ratio consistently creeps above this line, card networks will brand your business as high-risk, and a world of pain is about to follow.

Going over this threshold isn't just a slap on the wrist. It’s a direct threat to your ability to do business.

The Consequences of a High Dispute Rate

Once you cross that 1% line, you can be placed into a monitoring program, like the Visa Dispute Monitoring Program (VDMP). This kicks off a series of escalating penalties designed to force you to get your chargebacks under control, or else.

Here’s what you can expect:

- Steep Monthly Fines: The card networks will start hitting you with heavy fines that get bigger the longer you stay in the program.

- Higher Processing Fees: Your payment processor will see you as a bigger risk and will likely hike up your transaction fees to cover their exposure.

- Account Termination: This is the nightmare scenario. If you can't get your ratio down, your processor can shut down your merchant account completely. No more card payments. Game over.

This is the ultimate cost of letting chargebacks run wild. It stops being about losing a bit of money on individual sales and starts being about losing your entire business. It makes managing "chargebacks on debit cards" less of a nuisance and more of an essential survival skill.

Proven Strategies to Prevent and Fight Chargebacks

Let's get real about chargebacks. Defending your revenue isn't just about fighting disputes after they happen; it's about building a defense so strong that most of them never get started. You need a two-part playbook: one for stopping chargebacks cold, and one for winning the fights you can't avoid.

A proactive defense is always going to be cheaper and more effective. While the average chargeback rate across all industries is about 0.65%, online stores often see that number jump to between 0.6% and 1%. If you're in a high-risk space like supplements or travel, it can climb even higher. And here’s the kicker: for every dollar you lose to fraud, it actually costs you a whopping $4.61 in total. That number alone should make prevention your top priority. For a deeper look at the numbers, check out the full Sift report on dispute trends.

Proactive Prevention: Your First and Best Line of Defense

The absolute best way to handle chargebacks on debit cards is to prevent them from happening in the first place. Think about it—most disputes come from one of three places: confusion, customer frustration, or straight-up fraud. If you can tackle these head-on, you’re already halfway there.

Start with something simple: your billing descriptor. That’s the little line of text that shows up on a customer's bank statement. If it says "SP*WEBSERVICES" instead of "SP*YourBrandName," you’re inviting a chargeback. The customer won't recognize the charge and will immediately assume it's fraudulent. Make sure your descriptor clearly states your business name and, if space allows, a phone number.

Next, make it incredibly easy for customers to talk to you. When someone has a problem, you want their first instinct to be "I'll call the company," not "I'll call my bank." Offer support through phone, email, and live chat, and make sure your response times are quick. A fast, helpful answer can defuse a situation that would have otherwise turned into a costly dispute.

Here are a few other essential tactics to add to your arsenal:

- Make Your Policies Crystal Clear: Your refund, return, and shipping policies should be impossible to miss. Put them right there at checkout and have customers tick a box saying they agree before they can pay.

- Use the Basic Fraud Tools: Always, always use the Address Verification Service (AVS) and check the Card Verification Value (CVV). These are simple, powerful tools that catch a surprising amount of fraud from stolen cards.

- Send Detailed Confirmation Emails: Your order confirmation email is a key piece of evidence. It should include an itemized list of what they bought, the total amount charged, your business name, and how to contact customer service.

Think of prevention as building a fortress around your revenue. Every clear policy, every fraud check, and every helpful customer interaction is another stone in the wall, making it harder for disputes to breach your defenses.

How to Fight Back—and Actually Win

Even with the best prevention strategy, some chargebacks are simply going to happen. When a dispute lands in your lap, you need to be ready to fight back with a strong, evidence-based response. This process is called representment, and it's your one shot to prove the transaction was legitimate and get your money back.

Success all comes down to the evidence you provide. You have to submit compelling proof that directly shuts down the customer’s specific claim, which the bank will have labeled with a reason code.

Crafting a Winning Representment Case

For every single chargeback, your mission is to tell a clear story backed by undeniable proof. Here’s a quick guide on what evidence to pull together for the most common disputes.

Reason Code: Product Not Received

The customer is claiming they never got their order. Your job is to prove they did.

- Shipping Confirmation: Start with the tracking number from a major carrier like UPS, FedEx, or USPS.

- Proof of Delivery: Include a screenshot from the carrier’s website that clearly shows the item was delivered to the exact address the customer provided.

- Customer Communications: If you have any emails or chat logs where you confirmed the shipping address with the customer, include those too.

Reason Code: Fraudulent Transaction

Here, the cardholder is saying they didn't authorize the purchase. You need to prove it was them.

- AVS and CVV Results: Show the bank that the address and security code entered at checkout matched what they have on file. A match is strong evidence.

- IP Address Geolocation: Provide data showing the IP address used to make the purchase is in the same city or region as the customer's billing or shipping address.

- Past Order History: Has this customer ordered from you before without any issues? Show that! A history of successful purchases helps establish a pattern of legitimate buying behavior.

Modern Tools to Stop Disputes Instantly

Beyond fighting chargebacks one by one, you can bring in modern tools to automate your defense. This is where services offering chargeback alerts and deflection really shine.

Platforms like Disputely plug directly into the card networks. The moment a customer calls their bank to start a dispute, you get an alert. This opens up a crucial 24-72 hour window for you to step in and solve the problem directly—usually by issuing a refund—before it ever becomes an official chargeback. This simple move can stop disputes from ever hitting your merchant account, protecting your all-important chargeback ratio from taking a hit.

Automating Your Chargeback Defense with Disputely

Let's be honest: fighting chargebacks by hand is a soul-crushing, time-sucking ordeal. The endless cycle of gathering evidence, writing rebuttals, and chasing deadlines is a massive operational headache. It pulls you and your team away from what you should be doing—growing your business. This constant fire-fighting mode means you’re always playing defense. It’s time to get ahead of the game with smart automation.

Disputely changes the entire dynamic. Instead of just reacting to chargebacks, our platform helps you stop them before they even happen. We plug directly into the chargeback alert networks from Visa and Mastercard, giving you a powerful heads-up. The second a customer starts a dispute with their bank, you get an instant notification.

This alert is your golden opportunity. It opens up a crucial 24- to 72-hour window for you to take control of the situation. Rather than waiting weeks for a formal chargeback to slam your merchant account, you can resolve the issue right away, often with a simple refund. That one move prevents the dispute from ever being officially filed, which protects your chargeback ratio and saves you from those painful fees.

Seamless Integration and Intelligent Rules

We designed the setup process to be incredibly fast and straightforward. Disputely connects to major payment processors like Stripe, Shopify Payments, and PayPal in just a couple of minutes. Once you're linked up, you can build automated rules to manage incoming alerts based on what makes sense for your business.

For example, you can set a rule to automatically refund any dispute under a certain dollar amount. Or maybe you want to flag transactions for a specific product for a manual review. This flexibility means you’re making smart, strategic calls that balance keeping customers happy with protecting your bottom line—not just blindly refunding everything.

The Disputely dashboard gives you a crystal-clear, real-time snapshot of every dispute.

This single screen provides detailed analytics, helping you quickly spot patterns and get to the bottom of why disputes are happening in the first place.

By automating the response to these early alerts, businesses can slash their chargeback volume by up to 99%. This is huge. It's not just about saving money on lost sales and fees; it's about protecting your vital relationships with payment processors and staying off their radar.

A Smarter Way to Handle Debit Card Disputes

This proactive approach is an absolute game-changer for merchants who see a lot of chargebacks on debit cards. Remember, debit card disputes pull actual cash out of your account immediately. Preventing them isn't just nice—it's essential for maintaining healthy cash flow. Automation through Disputely turns this unpredictable threat into a manageable, data-driven part of your operations.

The platform keeps an eye on your transactions 24/7, using smart filters to catch potential problems without you having to constantly watch over it. This frees up your team to focus on what they do best: serving your customers and building your brand. To see how this could work for your business, check out the transparent pricing plans available from Disputely to find the right fit for your sales volume.

Frequently Asked Questions

Even with the best game plan, you're bound to run into some specific questions about debit card chargebacks. Let's tackle a few of the most common ones we hear from merchants.

Can a Customer Dispute a Debit Card PIN Transaction?

Yes, but it's tough. A customer can technically dispute a PIN transaction, but only under very specific circumstances, like a proven bank error or a system glitch that double-charged them.

For the cardholder, the burden of proof is incredibly high. As an ecommerce merchant, this isn't something you'll likely ever run into. The disputes you'll face are almost exclusively for card-not-present (CNP) sales, where PINs aren't part of the equation.

How Long Does a Customer Have to File a Debit Card Chargeback?

Generally, the clock is ticking for about 120 days from the transaction date or when the customer expected to receive their item.

But that’s not a hard and fast rule. The exact deadline can change based on the reason for the dispute and the card network's policies (Visa, Mastercard, etc.). For instance, a claim for "goods not received" might have a different timeframe than one for a simple billing mistake.

Do I Get My Chargeback Fees Back if I Win a Dispute?

Almost never. This is a tough pill to swallow, but even when you win a dispute and get the transaction funds back, that initial chargeback fee your processor hit you with is gone for good.

It's a frustrating part of the process and it really underscores a core truth for any business: preventing chargebacks is always more profitable than fighting them. Winning feels good, but avoiding the fight in the first place is what truly protects your bottom line. If you need more help navigating a tricky dispute, you can find tons of info in our customer support documentation.

Stop wasting time and losing revenue to endless disputes. Disputely gives you the power to stop chargebacks before they ever happen with real-time alerts. See how much you can save and protect your business today.