Understanding the Credit Card Chargeback Time Limit

So, how long does a customer really have to file a chargeback? The number you'll hear thrown around most often is 120 days, but that's a huge oversimplification. It’s less of a hard deadline and more of a flexible window that shifts depending on the situation.

For merchants, this ambiguity can be a real headache. You might think a sale is settled and done, only to see a dispute pop up months later. Understanding what starts the clock is the key to getting a handle on your long-term risk.

The Myth of the 120-Day Rule

Think of the chargeback time limit less like a single countdown and more like a set of different stopwatches. Each one is triggered by a different event, and the 120-day clock doesn't always start on the day the card was swiped.

This flexibility is built in to protect cardholders from all sorts of issues, like a product that never ships or a service that wasn't what was promised. A simple in-store purchase has a pretty clear timeline. But what about a pre-order for a video game that ships six months later? The rules for that are completely different.

What Really Starts the Chargeback Clock?

The specific "start date" for a dispute window isn't one-size-fits-all. It changes based on the reason code for the chargeback and the specific card network's rules.

Here are the most common triggers that get the clock ticking:

- The Transaction Date: This is the most straightforward one. For most in-person sales or immediate digital downloads, the clock starts the day the transaction is processed.

- The Expected Delivery Date: If a customer orders something online, the window often doesn't open until the day they were supposed to receive it. This protects them if a merchant takes their money and never ships the goods.

- The Service Date: For things like concert tickets or hotel stays, the clock might start after the event or service was supposed to happen.

- The Discovery Date: In cases of fraud or a product with a hidden defect, the time limit might begin when the cardholder reasonably could have noticed the problem—which could be long after the original purchase.

To help you get a clearer picture, let's look at the standard windows for the big four card networks. Keep in mind, these are the typical limits for the cardholder to file a dispute with their bank.

Standard Chargeback Windows at a Glance

| Card Network | Standard Cardholder Time Limit | Clock Starts From |

|---|---|---|

| Visa | 120 days | Usually the transaction date, but can be the expected delivery or discovery date. |

| Mastercard | 120 days | Typically the transaction processing date or the date the cardholder was notified of the charge. |

| American Express | 120 days | Generally starts from the transaction date, but Amex is known for being flexible for its cardmembers. |

| Discover | 120 days | Starts from the transaction processing date or the date the cardholder becomes aware of the issue. |

As you can see, 120 days is the industry standard, but the starting point is what really matters. This system, while fair to consumers, creates a long tail of potential liability for businesses. You have to stay on your toes for months after a sale is finalized.

To learn more about the nuances of these windows and how they're applied in different scenarios, you can find a deeper dive into chargeback time limits here.

How Major Card Networks Define Their Timelines

That 120-day credit card chargeback time limit you often hear about? It’s a great starting point, but it's not the whole story. Think of it more like a rule of thumb than a hard-and-fast law.

Each card network—Visa, Mastercard, American Express, and Discover—plays by its own set of rules. They have their own deadlines, their own exceptions, and their own way of looking at things. If you treat a Visa dispute the same way you treat an Amex one, you're setting yourself up to lose fights you could have won. Getting these details right is crucial.

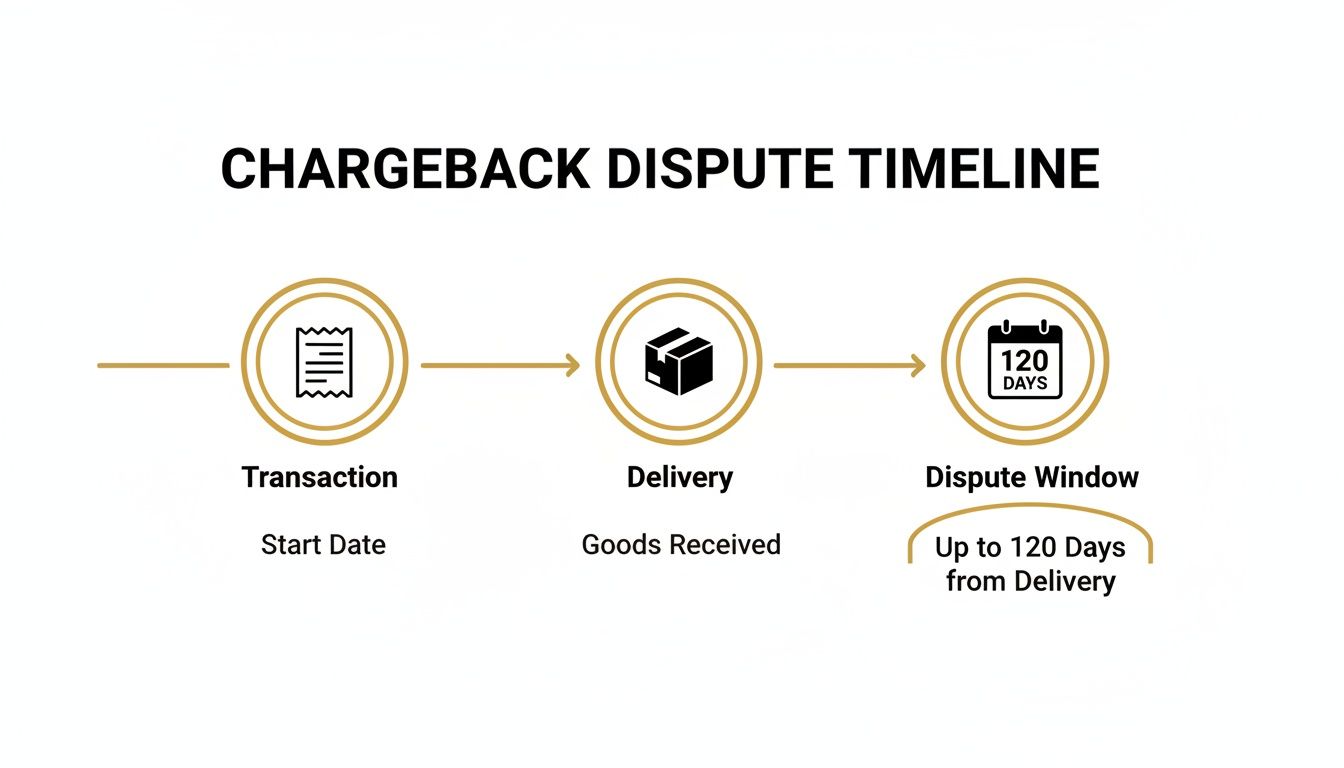

This infographic breaks down the typical journey from the initial sale to the point where that 120-day customer dispute window opens up.

Notice how the clock doesn't always start right when the purchase is made. Often, it begins on the delivery date or when the customer could have first noticed a problem, which means you could be on the hook for a sale long after you've considered it closed.

Visa Chargeback Time Limit Rules

Visa sets the tone for much of the industry, but its rules are anything but one-size-fits-all. The 120-day window is common, sure, but the reason for the chargeback changes everything, especially when the clock starts ticking.

- Fraud and Authorization Issues: For most fraud-related claims, the timer starts from the transaction processing date. But for certain authorization errors, the window can shrink to as little as 75 days.

- Processing Errors: If you accidentally double-bill a customer or charge the wrong amount, the 120-day window typically starts on the date of that incorrect transaction.

- Goods or Services Disputes: This is where things get tricky. If a customer claims a "product not received" or "not as described," the 120-day countdown begins from the expected delivery date or the date a service was supposed to happen. This is to protect customers from paying for something that never shows up.

Key Takeaway for Visa: The reason code is your road map. Never assume you have 120 days from the sale date. For some disputes, the clock might not even start for months.

Mastercard Chargeback Time Limit Nuances

Mastercard’s system looks a lot like Visa’s at first glance, but there are subtle and important differences. They also lean on the 120-day standard, but they often tie the start date to when the transaction officially posts to the cardholder's statement.

This provides a very clear, documented starting line, usually a day or two after the actual purchase. It takes some of the guesswork out of the equation.

Still, Mastercard has its own set of exceptions:

- For services not rendered: The time limit is often calculated from the date the services were supposed to be delivered, which could be long after you’ve collected payment.

- For recurring billing: The dispute window can apply to each individual charge. This means a subscriber could technically dispute a charge from months ago if it was part of an ongoing payment plan.

American Express Timelines: A Cardholder-Centric Approach

American Express has built its brand on phenomenal customer service, and that philosophy is baked right into their chargeback process. While they generally work within a 120-day window, they are known for being more flexible with their cardmembers.

Amex often starts its clock from the date the charge appears on the customer's billing statement, giving them plenty of time to spot any issues. More importantly, Amex isn’t afraid to bend the rules. If a cardholder has a good reason—like a product defect that only became apparent months later—they might extend the dispute window.

For you, the merchant, this means an Amex chargeback can pop up when you least expect it, long after you've closed the books on a sale. It’s a powerful reminder to keep meticulous records.

Discover Card Dispute Windows

Discover also uses a 120-day framework, but they are crystal clear about what pulls the trigger. The clock starts on either the transaction processing date or the date the cardmember becomes aware of a problem.

That "awareness" clause is the key detail. Let’s say a customer buys a seasonal item but doesn't open it for a few months, only to find it's defective. Discover’s policy might allow them to file a dispute well outside the normal window because that’s when they first discovered the issue.

At the end of the day, there's no substitute for digging into the details. The 120-day rule is just the headline. The real story is in the reason code and the specific card network’s rulebook.

Exceptions That Can Reset the Chargeback Clock

Just when you think you’ve got the standard 120-day chargeback time limit memorized, the rules change. Certain situations can hit the reset button on that clock, pausing or extending the window a customer has to file a dispute. This is where even seasoned merchants get tripped up, suddenly facing revenue loss from a sale they thought was long since closed.

Understanding these exceptions isn't just about knowing the fine print; it's about spotting risks hiding in plain sight. Ignoring them is like thinking a stopwatch only has a start and stop button, completely forgetting it can be paused and restarted.

How Reason Codes Change the Game

The reason code on a chargeback is the most critical piece of the puzzle for figuring out the timeline. It’s the customer’s official story, and card networks treat different problems on different clocks. A straightforward fraud claim is a world away from a complaint about product quality.

Let’s look at two common scenarios:

- Fraudulent Transaction: The clock usually starts ticking right on the transaction date. The cardholder is saying, "I didn't authorize this," and the timeline is fairly predictable.

- Product Not as Described: This is where it gets tricky. The clock might not start until the product is actually delivered. If a customer orders a custom sofa that takes three months to build and ship, their 120-day dispute window only begins when it finally arrives—not when they first paid.

That little detail means a sale you made in January could come back to haunt you as a chargeback in July or even later.

A recent study showed that nearly 25% of all chargebacks fall under "product not as described" or "services not rendered" reason codes. This really drives home how often these timeline-extending exceptions pop up.

The Recurring Billing Trap

If you run a subscription business, you’re dealing with a unique and potentially expensive exception. For recurring payments, the time limit doesn't just apply to the very first charge. In reality, each individual payment effectively resets the clock for itself.

Think about it: a customer signs up for a yearly software subscription billed monthly. After ten months, they become unhappy. They don't just have a window to dispute the latest payment; they could potentially file chargebacks for several of the previous monthly payments, as each one is still within its own 120-day window.

This creates a rolling liability that can be incredibly damaging. One unhappy customer can claw back months of revenue, and a sudden burst of disputes from a single account can easily trigger a payment processor hold. If that happens, knowing how to resolve a Shopify payments hold becomes absolutely critical.

International and Cross-Border Complexities

When a sale crosses international borders, you’re adding another layer of complexity to the chargeback clock. Different countries have their own consumer protection laws, and the card networks often give customers more time to file disputes to account for shipping delays, customs headaches, and language barriers.

For example, a transaction between a U.S.-based merchant and a customer in Australia might get an extended deadline to cover the 4-6 weeks it can take for a package to even show up. This means your risk period for international sales is automatically longer. You have to build this extended liability into your financial forecasts, because a sale isn't truly "final" until these longer international timelines have passed.

Why Your Response Deadline Is a Race Against Time

A customer can take their sweet time—often up to 120 days or even more—to dispute a charge. But the second that chargeback hits your dashboard, the tables turn completely. For you, the merchant, it’s no longer a leisurely marathon. It’s a flat-out sprint.

This lopsided timeline is one of the most frustrating parts of the entire dispute process. You’re often left scrambling to defend a sale that happened months ago, trying to recall details and dig up old records. If you’re too slow, forget a key piece of evidence, or miss the deadline, you lose automatically. It doesn't matter how legitimate the transaction was.

The Two Critical Merchant Timelines

Your response window isn't just one deadline; it's a couple of key stages where the clock ticks faster and faster. Getting a handle on these two phases is essential if you want to protect your revenue.

Initial Representment Window (Your First Shot): Once a chargeback is filed, your payment processor will let you know and give you a deadline to fight back. This first window is usually somewhere between 18 and 30 days. This is your best opportunity to present a rock-solid case with compelling evidence and shut the dispute down.

Pre-Arbitration Response (Your Last Stand): If the customer's bank isn't convinced by your initial evidence, the dispute can escalate to what's called pre-arbitration. The stakes get higher here, and the timeline shrinks dramatically. You might only have 7 to 10 days to respond. Miss this, and the money is almost certainly gone for good.

These shrinking timelines create a pressure-cooker situation for any business. With fraud losses projected to hit a staggering $12.5 billion in 2024, it's a tough environment. It's widely believed that 45% of all chargebacks are fraudulent, yet merchants get a tiny fraction of the time to actually prove their case.

Assembling Your Evidence Against the Clock

With such a tight turnaround, you simply can't afford to be digging for documents at the eleventh hour. Winning consistently comes down to having a system in place to gather and submit proof that validates the original sale—and doing it quickly.

Your job is to tell a story with your evidence, one that leaves no room for doubt in the issuing bank's mind. To pull this off, you need to collect specific evidence that directly addresses the reason the chargeback was filed in the first place.

Key Insight: Think of your evidence not as a random pile of files, but as a compelling narrative. Every document, from a tracking number to a customer service email, is a piece of the puzzle that proves you held up your end of the bargain.

To help you prepare, this table outlines the typical deadlines you'll face at each stage.

Typical Merchant Response Timelines

| Dispute Stage | Typical Merchant Deadline | Key Action Required |

|---|---|---|

| Initial Chargeback Notice | 18 - 30 days | Acknowledge the dispute and gather all initial evidence. |

| Representment | Same 18 - 30 day window | Submit a compelling rebuttal with evidence to the acquiring bank. |

| Pre-Arbitration | 7 - 10 days | If the dispute escalates, provide additional evidence or accept the loss. |

| Arbitration | ~10 days | Decide whether to proceed with the costly and final arbitration phase. |

Staying on top of these dates is crucial, as missing even one can result in an automatic loss.

Your Essential Evidence Checklist

Here’s the kind of compelling proof you should have ready to go at a moment's notice:

Proof of Delivery: For physical products, this is your number one defense. Tracking numbers and, even better, signed delivery confirmations are your best friends against "product not received" claims.

Customer Communications: Keep everything. Emails, live chat logs, social media DMs—all of it. A simple email from a customer saying they love the product is incredibly powerful when they later claim it was "not as described."

Terms of Service and Policies: Show that the customer saw and agreed to your terms, refund policy, and other rules when they made the purchase. A timestamped log of a checked "I agree" box is usually all you need.

Usage Logs and IP Data: For digital goods or services, this is gold. Show when the customer logged in, what IP address they used, and how they interacted with your platform. This is a direct counter to any "unauthorized use" claim.

Navigating this high-stakes process requires both speed and accuracy. For a closer look at fine-tuning your response strategy during peak seasons, check out our complete guide to Q4 chargeback representment. The only way to consistently win this race against time is to be prepared before the starting gun even fires.

The Financial Ticking Bomb of Growing Chargeback Volume

The chargeback time limit isn't just a rule in a handbook; it's a ticking clock with very real financial consequences. Consumers often get a generous window—sometimes 120 days or even longer—to dispute a charge, and this directly fuels a rising tide of disputes that can slowly but surely eat away at your profit margins.

Let’s be clear: a chargeback is so much more than a simple refund. It's a financial gut punch.

When a customer disputes a transaction, you don't just hand back the original sale amount. You also say goodbye to the non-refundable processing fees, absorb the loss of whatever product or service you delivered, and then get hit with a separate penalty fee from your bank. These fees can sting, ranging anywhere from $15 to $100 a pop. And that's just the start of the damage.

The True Cost of a Single Dispute

Think about the sheer operational headache. The moment a chargeback is filed, your team has to drop everything. They're now on the clock, scrambling to dig up evidence, piece together a compelling rebuttal, and submit it all before the deadline hits. That's time and energy stolen from what they should be doing—growing your business, talking to happy customers, or developing new products.

This financial squeeze is being felt by businesses all over the world, and the long time limits only make it worse. The stakes are getting higher with every single transaction. Just look at the travel and lodging industry, which was slammed with an 816% year-over-year surge in chargeback rates. When you stack up the lost revenue, the fees, and the operational slowdown, the total cost is staggering.

What’s more, that long dispute window is the perfect breeding ground for a particularly nasty problem: friendly fraud. This is when a legitimate customer files a chargeback, maybe because they forgot about the purchase, didn't recognize the name on their statement, or simply figured it was an easy way to get their money back. With months to reconsider a purchase, buyer's remorse can easily turn into a costly dispute long after your product has been used and enjoyed.

Global Trends and Alarming Numbers

The scale of this issue proves that getting a handle on chargeback timelines is no longer a "nice-to-have"—it's a must. In 2024, the average financial hit of just one chargeback climbed to $169.13 worldwide. While the U.S. is at the top with an average cost of $110, other countries like Brazil ($94) and the UK ($82) are feeling the pain, too. You can dig deeper into these chargeback time limit financial trends to see the full global picture.

This isn't just a small bump in the road. Experts predict the number of global chargeback cases will balloon to 337 million by 2025—that’s a massive 27% jump from 2022.

This trend puts merchants in a tough spot. You have to be ready to fight disputes, but more importantly, you have to get ahead of them. Every single day that ticks by on the chargeback clock adds to the financial risk hanging over your business, making a solid understanding of these timelines absolutely essential to survival.

How to Proactively Manage and Prevent Disputes

The best way to beat the chargeback clock is to make sure it never starts ticking. While winning a dispute through representment is possible, it’s a reactive, expensive, and time-consuming battle. A proactive strategy, on the other hand, is all about stopping disputes before they escalate into full-blown chargebacks.

This isn't about legal acrobatics or complex software. It all starts with solid, common-sense business practices. When customers feel valued and are kept in the loop, they’re far less likely to call their bank in the first place.

Fortify Your Foundational Defenses

Before you even think about fancy tools, get the basics right. A surprising number of chargebacks can be traced back to simple misunderstandings or frustrations. That’s why avoiding bad customer service is your first and most effective line of defense.

Here are the absolute must-haves for a strong prevention plan:

- Crystal-Clear Communication: Make sure your billing descriptor is instantly recognizable. Something like "YOURSTORENAME.COM" is far better than a vague corporate name. Confusing descriptors are a top reason for "I don't recognize this charge" disputes.

- Transparent Policies: Don't hide your refund, return, or cancellation policies. Plaster them everywhere—on product pages, in the website footer, and during checkout. Set clear expectations from the start.

- Exceptional Customer Service: Make it ridiculously easy for customers to contact you and respond to them fast. If a customer knows they can get a quick refund directly from you, they have zero incentive to file a chargeback.

Leverage Technology for Real-Time Prevention

Strong fundamentals are essential, but in today's fast-paced e-commerce world, you need another layer of protection. This is where technology steps in, giving you a chance to get ahead of the dispute before it hits your record. Instead of waiting weeks for that dreaded chargeback notice, you can intercept a customer's complaint almost as it happens.

Key Insight: The 24-72 hours after a customer contacts their bank—but before a formal chargeback is filed—is a golden window of opportunity. Acting within this timeframe can prevent the dispute from ever damaging your merchant account.

This is exactly what chargeback alert services were designed for. Platforms like Disputely tap directly into card network programs from Visa and Mastercard. The second a cardholder raises an issue with their bank, you get an alert.

This alert gives you the power to step in immediately. You can set up rules to automatically issue a refund, which resolves the customer's problem on the spot and stops the official chargeback dead in its tracks. This one move protects your chargeback ratio and saves you from those punishing fees.

By blending top-notch service with smart automation, you create a powerful defense that keeps your revenue right where it belongs: with you.

Frequently Asked Questions

Even when you think you've got the rules down, the fine print on chargeback time limits can still trip you up. Let's tackle some of the most common questions merchants have so you can get the full picture.

Can a Chargeback Be Filed After 120 Days?

Yes, and it happens more often than you'd think. While 120 days is the number everyone remembers, it's more of a guideline than a hard-and-fast rule. There are plenty of exceptions that can stretch that timeline out.

Think about a product with a defect that doesn't show up for months. The clock for the dispute might only start on the "discovery date," long after the original transaction. International sales often get longer windows to account for shipping delays, and recurring subscriptions are a whole other ballgame—each monthly charge gets its own dispute window. This means a payment from half a year ago could suddenly come back as a chargeback.

Do Debit Cards Have the Same Time Limits?

Nope, they're a different beast altogether. Debit card disputes fall under the Electronic Fund Transfer Act (EFTA), which has its own set of rules and timelines for consumer protection.

A customer generally has about 60 days from their statement date to flag an issue, but the process is nothing like the one for credit cards. It’s a classic mistake to assume the familiar 120-day credit card window applies to debit—don't get caught out.

Key Takeaway: The rules and time limits for debit cards are typically stricter and less forgiving for the consumer compared to credit cards. Understanding this difference is critical for managing your risk across all the ways you get paid.

How Does Friendly Fraud Relate to Time Limits?

Friendly fraud and long chargeback windows go hand-in-hand. When a customer has months to second-guess a purchase, it opens the door for "buyer's remorse" or simply forgetting they bought something in the first place.

Imagine this: a customer uses your service, loves it, and then 90 days later decides they want their money back. They file a chargeback, banking on the fact that you might struggle to pull up records from three months ago. This is how a consumer protection tool gets twisted into a weapon, contributing to the massive $125 billion friendly fraud problem. For a deeper look into dispute trends and prevention, you can find more insights on the Disputely chargeback prevention blog.

Ready to stop chargebacks before they ever hit your merchant account? Disputely integrates directly with card networks to alert you the moment a dispute is initiated, giving you a critical window to resolve the issue and prevent the chargeback. Protect your revenue and keep your merchant account safe today.