A Merchant's Guide to Winning Debit Card Chargebacks

When a customer disputes a debit card purchase, the bank initiates a debit card chargeback—a transaction reversal that yanks real money straight out of your business bank account. This isn't like a credit card dispute, which deals with a line of credit. A debit chargeback is an immediate withdrawal of funds your business has already counted as settled.

Understanding the Stakes of Debit Card Chargebacks

Think of a debit card transaction like a cash payment. The money moves directly from your customer's bank account into yours. A debit card chargeback is the equivalent of that same customer walking back into your store days or weeks later, reaching into your till, and taking that cash back. It happens suddenly, and often without any prior warning.

This is a critical distinction. With a credit card dispute, the funds are part of a credit line from a bank. With a debit card dispute, it’s your actual cash—money from your operating account that is now gone.

Key Differences Debit vs Credit Card Chargebacks

While they might seem similar on the surface, the mechanics behind debit and credit card chargebacks have important differences that affect your business's cash flow and response strategy. Here's a quick breakdown of what sets them apart.

| Feature | Debit Card Chargeback | Credit Card Chargeback |

|---|---|---|

| Source of Funds | Direct withdrawal from the cardholder's bank account. | Charged against the cardholder's line of credit. |

| Financial Impact on You | Immediate loss of real, settled cash from your merchant account. | Funds are held from a line of credit; impact is on future payouts. |

| Governing Regulation | Governed by the Electronic Fund Transfer Act (Regulation E). | Governed by the Fair Credit Billing Act (FCBA). |

| Dispute Timeframe | Cardholders typically have 60 days from the statement date to file a dispute. | Cardholders have 60 days from the statement date, but often up to 120 days from the transaction date. |

| Provisional Credit | Issuing banks almost always give immediate provisional credit to the cardholder. | Provisional credit is common but can take longer for the bank to issue. |

Understanding these nuances is the first step. Debit card chargebacks hit your cash flow harder and faster, making a proactive defense even more essential.

Why Debit Chargebacks Demand Your Attention

The financial sting of a debit chargeback goes well beyond the lost sale. Every single dispute hits your business with a triple threat:

- Lost Revenue: The full amount of the original transaction is gone.

- Chargeback Fees: Your bank will slap you with a non-refundable fee, usually between $20 and $100, for each dispute—win or lose.

- Merchant Account Risk: Payment processors track your chargeback-to-transaction ratio very carefully. If it climbs too high, you could face higher processing fees, a hold on your funds, or even have your account shut down completely.

A debit card chargeback isn’t just a refund. It's a forced reversal initiated by the customer's bank that comes with punitive fees, operational headaches, and direct risk to your merchant account's health.

Ultimately, every debit chargeback is a direct assault on your cash flow. The money vanishes from your account instantly, and the burden falls entirely on you to prove the transaction was legitimate and claw it back. That’s why learning to fight them effectively isn't just a good idea; it's an essential survival skill.

The Debit Card Chargeback Lifecycle: A Step-by-Step Breakdown

A debit card chargeback isn't just a simple refund. It's a formal, multi-stage process with tight deadlines and specific rules, almost like a mini-trial for a single transaction. Once a customer files a dispute, the clock starts ticking, and you have a very limited window to build your case. Knowing what happens at each step is absolutely critical to protecting your revenue.

It all kicks off the moment a customer calls their bank—the issuing bank—to question a charge. Maybe they suspect fraud, claim a product never showed up, or just don't recognize the business name on their statement.

That single phone call sets the entire chargeback machine in motion.

Stage 1: The Initial Dispute and Provisional Credit

As soon as the customer lodges their complaint, their bank takes a quick look at the claim. For debit card disputes, which fall under the rules of Regulation E, the bank almost always issues a provisional credit to the customer.

What does this mean for you? It means the disputed money is put right back into the cardholder's account, often within a few days. At the same time, your payment processor pulls that exact amount, plus a nasty, non-refundable chargeback fee, straight out of your merchant account. So, right from the get-go, you're out the money, and the responsibility to prove the transaction was valid now rests squarely on your shoulders.

Stage 2: The Chargeback Notification

With the funds already reversed, the customer's bank sends the dispute details through the card network (like Visa or Mastercard) over to your bank, which is called the acquiring bank. From there, your bank sends you an official chargeback notification.

This notice is your call to action, and it contains two pieces of information you can't ignore:

- The Reason Code: This is a short code that tells you exactly why the customer disputed the charge.

- The Response Deadline: You'll have a strict timeframe, usually somewhere between 20 and 45 days, to submit all your evidence.

If you miss that deadline, you automatically lose. No second chances, no appeals.

Stage 3: Your Response Window (Representment)

This is your shot to fight back. The official term for this stage is representment, and it's where you gather every piece of compelling evidence you have to prove the charge was legitimate. You then package it all up and send it back to your acquiring bank before the deadline.

The evidence you submit has to directly counter the reason code. For example, if the customer claims "Product Not Received," your best defense is proof of delivery—a shipping confirmation showing the tracking number and the customer's verified address. Your response needs to be clear, professional, and straight to the point.

For merchants using platforms like Stripe, juggling these disputes can quickly become a major headache. This is where having a streamlined process makes all the difference. You can discover how to connect your payment processor with automated dispute management tools to make this whole stage much simpler.

Stage 4: The Final Verdict and (Maybe) Arbitration

Once you've submitted your evidence, your bank forwards it to the issuing bank for a final review. The issuing bank holds all the cards here and makes the final call.

If your evidence is solid and convincing, the chargeback gets reversed. The funds are returned to your account, and the provisional credit is taken back from the customer. Congratulations, you've won.

But if the bank sides with their customer, the chargeback stands, and the money is gone for good. In very rare situations, you can escalate the fight to arbitration with the card network itself. However, this is an expensive and lengthy process, usually only considered for extremely high-value disputes.

The sheer volume of these disputes is a growing problem for businesses everywhere. In fact, global chargeback volumes are projected to rocket to 337 million cases by 2025—that's a 27% jump from 2022. This trend makes it clearer than ever that you need a rock-solid strategy to defend your business.

Decoding Common Chargeback Reason Codes

When a debit card chargeback hits your account, it always comes with a reason code. Think of this two-to-four-digit code as a direct message from the bank, telling you exactly why your customer is disputing the charge. It’s your first clue in solving the puzzle and building a solid case to get your money back.

Rather than memorizing dozens of hyper-specific codes from Visa and Mastercard, it's much more effective to think of them in terms of four main categories. Knowing which bucket a dispute falls into immediately tells you the story behind the chargeback and what kind of proof you'll need to fight it.

The entire chargeback process, from the initial dispute to your chance to respond, hinges on this initial reason code.

As you can see, your representment—your opportunity to fight back—is all about providing evidence that directly refutes the claim outlined by that reason code.

Fraud and Unauthorized Transactions

This is the one that gives every merchant a sinking feeling. These chargebacks pop up when a purchase was made using a stolen debit card or someone's account details were compromised. The real cardholder spots the fraudulent activity, reports it to their bank, and the bank claws the money back from you.

The most common reasons in this group are:

- True Fraud: This is clear-cut theft. A criminal got their hands on a physical card or phished the account info and went on a shopping spree. Unless you used 3D Secure authentication (like Verified by Visa), you have almost no chance of winning this kind of dispute.

- Transaction Not Recognized: This one is murkier. It could be genuine fraud, but it’s often a case of simple confusion or even "friendly fraud." The customer might just not recognize your business name on their bank statement.

For example, imagine your company is registered as "Global Wellness Innovations LLC," but your customer-facing website is "VitaBoost." When the customer sees that unfamiliar corporate name on their statement, their first instinct might be to panic and report fraud. This is why having a clear, recognizable merchant descriptor is so incredibly important.

Customer Disputes and Service Issues

This category is all about a breakdown in the customer experience. The customer isn't claiming they didn't make the purchase; they're claiming you didn't hold up your end of the bargain.

These reason codes usually point to an operational snag:

- Product Not Received: The customer says the item they paid for never showed up. Your go-to evidence here is proof of delivery—a tracking number showing the package was delivered to the correct, verified address.

- Product Not as Described or Defective: The item arrived, but it’s the wrong size, it’s broken, or it just doesn't match what you promised on your website. To fight this, you'll need product page screenshots, photos, and any communication you had with the customer.

- Canceled Recurring Billing: A classic subscription issue. The customer swears they canceled, but you kept charging them. Your defense rests on showing your cancellation policy and proving they never followed the proper steps to end their subscription.

Watch out for friendly fraud hiding in this category. A customer might get their product, love it, and then claim it "never arrived" just to get their money back. Solid evidence is your only defense against this.

Authorization and Processing Errors

The last group covers technical glitches that happened somewhere in the payment pipeline. These aren't your fault or the customer's fault; they're system errors.

You might see reason codes for things like:

- Invalid Transaction: The transaction somehow violated the card network's rules.

- Late Presentment: Your payment processor took too long to submit the transaction for settlement.

While these are less frequent, they highlight why choosing a reliable payment processor matters. When you see one of these codes, your first call should be to your processor to figure out what went wrong on their end.

To make this easier to digest, here’s a quick-reference table that connects common reason codes to the evidence you’ll need.

Common Chargeback Reason Codes and Required Evidence

| Reason Code Category | Example Code | Meaning | Key Evidence to Provide |

|---|---|---|---|

| Fraud | Visa 10.4, Mastercard 4837 | Unauthorized Transaction (Fraud) | 3D Secure authentication (e.g., AVS, CVV match, Verified by Visa), IP address logs, previous undisputed transaction history from the same customer. |

| Customer Dispute | Visa 13.1, Mastercard 4853 | Merchandise/Services Not Received | Proof of delivery (tracking number, signature confirmation), delivery address matching the order, customer communications confirming receipt. |

| Customer Dispute | Visa 13.3, Mastercard 4853 | Not as Described or Defective | Product descriptions, images from your website, photos of the actual item, customer service emails, proof you offered a return/refund per your policy. |

| Customer Dispute | Visa 13.7, Mastercard 4841 | Canceled Recurring Transaction | Signed contract/terms of service, clear cancellation policy, proof the customer did not follow the cancellation procedure, communication logs. |

| Processing Error | Visa 12.5, Mastercard 4834 | Incorrect Transaction Amount | Signed receipt or digital order confirmation showing the customer agreed to the correct amount. |

By translating these codes, you can quickly move from confusion to action, armed with the knowledge of what you need to prove to win your debit card chargebacks.

How to Build a Winning Chargeback Response

Getting a debit card chargeback notification stings, but it’s not the final word. Think of it as an accusation, not a guilty verdict. You have a short window to fight back—a process we call representment—and a solid, evidence-backed response is your only shot at getting your money back.

The trick is to treat every response like you’re building a case for court. It needs to be clear, logical, and packed with proof that leaves the issuing bank with no other choice but to side with you. If you just slap something together and fire it off, you’re almost guaranteed to lose.

And the stakes are getting higher every year. The total global cost of chargebacks is on track to hit $41.69 billion by 2028. It's even worse for merchants in the U.S., who now lose an estimated $4.61 for every $1 in chargebacks. That's a massive 37% jump from 2020. You can't afford to ignore this.

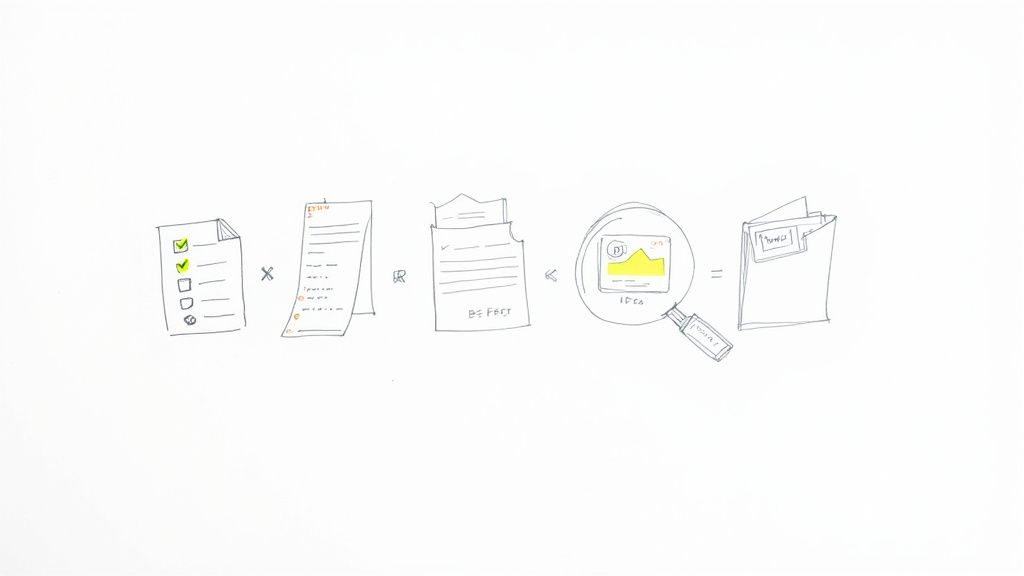

Step 1: Analyze the Reason Code

First things first: dig into the reason code that came with the chargeback. This little piece of data is your roadmap. It tells you exactly what the customer is claiming went wrong, and your entire defense has to be built around dismantling that specific claim.

For example, if the code is for "Product Not Received," you need to focus entirely on proving delivery. Don't waste time and muddy the waters by including evidence of your product's great quality or a positive customer review. Stick to the point. Match your evidence directly to the accusation.

Step 2: Gather Compelling Evidence

With the reason code as your North Star, it’s time to start gathering your evidence. And I don’t just mean a copy of the invoice. "Compelling evidence" is a whole collection of documents that, together, paint an undeniable picture of a legitimate transaction.

Here’s what should be on your evidence checklist:

- Proof of Delivery: For a physical item, this is a tracking number with delivery confirmation. Even better? A signature confirmation showing it arrived at the address on the order.

- Digital Goods Confirmation: If you sell digital products, you need server or activity logs. Show that the customer downloaded the file or used the service. IP address and timestamp matches are golden here.

- Customer Communications: Hunt down any emails, chat logs, or support tickets. Anything where the customer talks about the purchase or even just acknowledges receiving it can completely shut down a friendly fraud claim.

- Terms of Service and Policies: Always include a copy of the policies (refund, shipping, etc.) the customer agreed to at checkout. Make sure you also have proof they actually agreed, like a timestamped log of the checkbox click.

The more data you can provide that links the actual cardholder to this specific transaction, the better your odds. For more ideas on putting together a bulletproof response, check out our guide on winning chargeback representment at https://disputely.com/campaign/q4-representment.

Step 3: Write a Professional Rebuttal Letter

All that great evidence needs a cover letter to tie it all together. This rebuttal letter is your chance to give a quick, professional summary of your case. This is not the place to vent about the customer or the unfairness of it all. Just stick to the facts and walk the bank reviewer through your proof, step-by-step.

A winning rebuttal letter does four things:

- Starts with the basics: Clearly state the transaction details—date, amount, customer name.

- Addresses the reason code head-on: Name the reason code and immediately explain why the claim is wrong.

- Summarizes your evidence: Briefly explain what each piece of evidence proves. For instance, "Attached is the FedEx tracking confirmation showing delivery to the cardholder's verified address on May 15th."

- Keeps it professional: Use a neutral, factual tone. No emotion, no blame. Just the facts.

Think of this letter as your closing argument. It organizes all your proof into a story that makes it easy for the bank to rule in your favor.

A strong response is methodical, not emotional. It systematically dismantles the customer’s claim with indisputable facts, making it clear that the original transaction was valid and should be upheld.

Remember, the best defense is a good offense. Many chargebacks start as simple customer service issues that spiral out of control. Understanding effective service recovery strategies is a key part of preventing disputes before they ever happen.

Finally, pay close attention to the deadline. Submitting the world's most perfect representment package one day late is the same as not submitting it at all. Be organized, be thorough, and be on time. It's the only way to protect your hard-earned revenue.

Proactive Strategies to Prevent Chargebacks

While knowing how to fight a chargeback is important, the real win is stopping them before they even start. Shifting your mindset from reactive defense to proactive prevention will save you a ton of time, protect your revenue, and keep your merchant account in good standing.

It all boils down to tackling the root causes of disputes, whether it's simple customer confusion or blatant fraud. By putting a few smart strategies in place, you can build a formidable shield around your business and drastically cut down on the number of disputes you have to deal with.

Enhance the Customer Experience

You'd be surprised how many chargebacks aren't malicious at all. They often start with a simple communication breakdown. When a customer feels confused, ignored, or frustrated, their first instinct is often to call their bank, not your support team.

You can head off these service-related disputes by making things as clear and accessible as possible:

- Crystal-Clear Communication: Make sure your product descriptions are spot-on, your shipping estimates are realistic, and your billing terms are written in plain English. No surprises.

- Transparent Policies: Don't hide your refund and cancellation policies. A customer who knows they can easily get a refund is far less likely to file a chargeback out of frustration.

- Recognizable Billing Descriptors: Use a clear, obvious name for your business on a customer's bank statement. If your company is "Global Innovations Inc." but you sell under the brand "VitaBoost," your descriptor should absolutely say "VitaBoost."

- Responsive Support: Offer top-notch customer service that's easy to find and quick to respond. A fast, helpful email can solve a problem long before it ever becomes a formal dispute.

Deploy Essential Fraud Prevention Tools

Your next layer of defense involves the fundamental security tools that verify the person making the purchase is actually the cardholder. Think of these as the locks on your front door—they are non-negotiable for any online business.

Here are the must-haves:

- Address Verification Service (AVS): This tool simply checks if the billing address entered by the customer matches the one the bank has on file. A mismatch is a huge red flag.

- Card Verification Value (CVV): Requiring that three- or four-digit code from the back of the card is a basic but effective way to prove the customer has the physical card.

- 3D Secure (e.g., Visa Secure): This adds an extra layer of security, forcing the cardholder to enter a password or a one-time code sent to their phone. The best part? It often shifts the liability for fraudulent chargebacks away from you and back to the bank.

Beyond these foundational tools, you can also bring in more advanced systems like AI Fraud Detection to proactively spot and block sketchy transactions before they can turn into chargebacks.

Automate Your First Line of Defense with Chargeback Alerts

Even with perfect service and solid fraud tools, some disputes will still slip through. This is particularly true for "friendly fraud," where a legitimate customer files a chargeback out of convenience or misunderstanding. Believe it or not, friendly fraud is estimated to account for around 75% of all chargeback cases.

This is where technology gives you a massive advantage: chargeback alerts.

Chargeback alerts are a game-changer. They work by intercepting a customer's complaint before it becomes an official chargeback, giving you a 24-72 hour window to simply refund the transaction. This lets you dodge the chargeback, the fee, and the hit to your merchant account health.

Platforms like Disputely tie directly into alert networks from Visa (Rapid Dispute Resolution or RDR) and Mastercard (CDRN). So, when a customer calls their bank to complain about a charge, the bank pings the network. Disputely catches that alert instantly and, based on rules you set, can automatically issue a refund.

Here is an example of a platform that provides these automated solutions.

This automated workflow is your instant first line of defense, preventing disputes from ever registering on your record.

This is especially critical if you're on a platform like Shopify, where a high dispute rate can trigger a Shopify Payments hold and freeze your cash flow. An automated alert system is one of the best ways to keep your dispute rate low and your money flowing.

By combining great customer service, powerful fraud tools, and an automated alert system, you create a multi-layered defense that dramatically lowers your chargeback risk. It’s a proactive approach that doesn’t just save you money today—it secures your ability to process payments for the long haul.

Your Top Debit Card Chargeback Questions, Answered

Even with a solid game plan, debit card chargebacks can feel like a curveball. Let's tackle some of the most common questions and myths we hear from merchants. Think of this as your quick-reference guide to clearing up the confusion and protecting your revenue.

Can I Just Stop Accepting Debit Cards to Avoid Chargebacks?

You could, but it would be a classic case of cutting off your nose to spite your face. For starters, your merchant agreement with your payment processor likely requires you to accept all card types from the networks you’re part of, like Visa and Mastercard. Picking and choosing could land you in hot water.

Even more importantly, you’d be turning away a huge chunk of your customers. A lot of people prefer using debit cards or only use debit cards for their day-to-day spending. Saying "no" to their card means saying "no" to their business, and those lost sales will cost you far more than the occasional chargeback.

Are Debit Card Chargeback Timelines Different from Credit Cards?

Yes, and this difference is a big deal. Debit card disputes fall under the Electronic Fund Transfer Act (Regulation E), which gives cardholders up to 60 days from their statement date to file a claim. This window is often much shorter and more rigid than for credit cards, where a customer might have up to 120 days.

What does this mean for you? It means the clock starts ticking fast. The deadlines for you to respond are just as tight, so you have to jump on a notification the moment it comes in.

When it comes to debit card chargebacks, the tight timelines leave zero room for delay. A swift, organized response isn't just a good idea—it's the only way you stand a chance of winning the dispute and getting your money back.

What Happens if I Ignore a Chargeback Notification?

Ignoring a chargeback is the business equivalent of throwing in the towel. If you miss the response deadline set by your payment processor, you automatically lose the dispute. The funds are gone for good, and the chargeback still dings your merchant account's dispute ratio.

There’s no appeal process for a missed deadline. The money is gone, you’re still out the non-refundable chargeback fee, and you’re left with a negative mark on your record. No matter how swamped you are, ignoring that notification is the absolute worst thing you can do.

What’s the Difference Between a Refund and a Chargeback?

This is a fundamental distinction every business owner needs to get. They might seem similar, but they're worlds apart.

- A Refund: This is a friendly, two-way street. A customer contacts you with an issue, you agree to a solution, and you return their money. It's a customer service interaction between you and them.

- A Debit Card Chargeback: This is a forced, multi-party battle. The customer bypasses you and goes straight to their bank, which yanks the money from your account. It involves you, your bank, the customer, and their bank, and it comes with penalty fees and a black mark on your reputation.

A refund is a tool for building goodwill. A chargeback is a costly, formal process that signals something went wrong. Your goal should always be to encourage customers to talk to you first.

What if I Fight a Debit Card Chargeback and Still Lose?

If you submit your evidence but the bank sides with the cardholder, the provisional credit they received becomes permanent. The funds won't be returned to you, and that chargeback fee you paid is also non-refundable.

At that point, your options are pretty limited. You could technically take the customer to small claims court, but the legal fees and time involved usually outweigh the value of the original transaction. For most businesses, a lost chargeback is just a cost of doing business—one that you can minimize with smart prevention and a rock-solid response strategy.

Don't let disputes drain your revenue. Disputely uses automated alerts to stop debit card chargebacks before they happen, giving you a chance to refund and protect your merchant account. See how much you can save and connect your payment processor in minutes at https://www.disputely.com.