Dispute Charge Meaning and How to Stop It From Hurting Your Business

Think of a disputed charge as the first sign of trouble—a customer has a problem with a transaction and has gone to their bank to question it. This isn't a full-blown chargeback just yet. Instead, it's the customer formally challenging a payment, which kicks off a process that can escalate if you don't handle it right.

This initial inquiry is a critical heads-up, opening a small window for you to step in and fix the problem directly.

What Happens When a Customer Disputes a Charge

When a customer disputes a charge, they're not necessarily accusing you of wrongdoing. They're telling their bank, "Hey, I don't recognize this," or "Something's not right here." This action sends an alert through the card networks (like Visa or Mastercard) before an official, damaging chargeback gets filed.

This pre-dispute phase is your golden opportunity to get ahead of things. You typically have a very brief period—often just 24 to 72 hours—to investigate the customer's claim, communicate with them, and hopefully resolve the issue before it hurts your merchant account.

Common Triggers for a Disputed Charge

So, what pushes a customer to dispute a charge in the first place? It's not always about fraud. In fact, many disputes come from simple, fixable misunderstandings.

- Unclear Billing Descriptors: This is a classic. The customer sees a charge from "XYZ Holdings Inc." on their statement instead of "Your Awesome Sock Store" and panics, thinking it's fraud.

- Dissatisfaction with Product or Service: Maybe the item arrived broken, wasn't what they expected, or the service just didn't deliver on its promise.

- Accidental or Forgotten Purchases: This happens all the time with subscriptions. A customer signs up, forgets about the recurring payment, and disputes it when it shows up months later.

- True Fraudulent Transactions: Of course, sometimes it really is fraud. A criminal gets ahold of a stolen credit card and makes a purchase from your store.

A disputed charge is a formal challenge to a transaction that kicks off the chargeback process. This is a growing threat, with global chargeback volumes projected to hit 337 million cases by 2025—a 27% jump from 2022.

Handling these initial disputes effectively isn't just good practice; it's essential for survival in ecommerce. If you drop the ball, you're looking at lost revenue, steep fees, and potentially having your payment processor place a dreaded Shopify payment hold on your funds. For any modern business, nailing this first step is key to protecting your bottom line and your ability to operate.

Understanding Why Customers Dispute Charges

To really get a handle on disputes, you have to get inside the customer’s head and understand the "why." A customer dispute isn't just a single problem; it’s a symptom that can point to a few different underlying issues. Think of it like a doctor trying to figure out what’s wrong—you can't just treat the cough without knowing if it's a cold, allergies, or something else entirely.

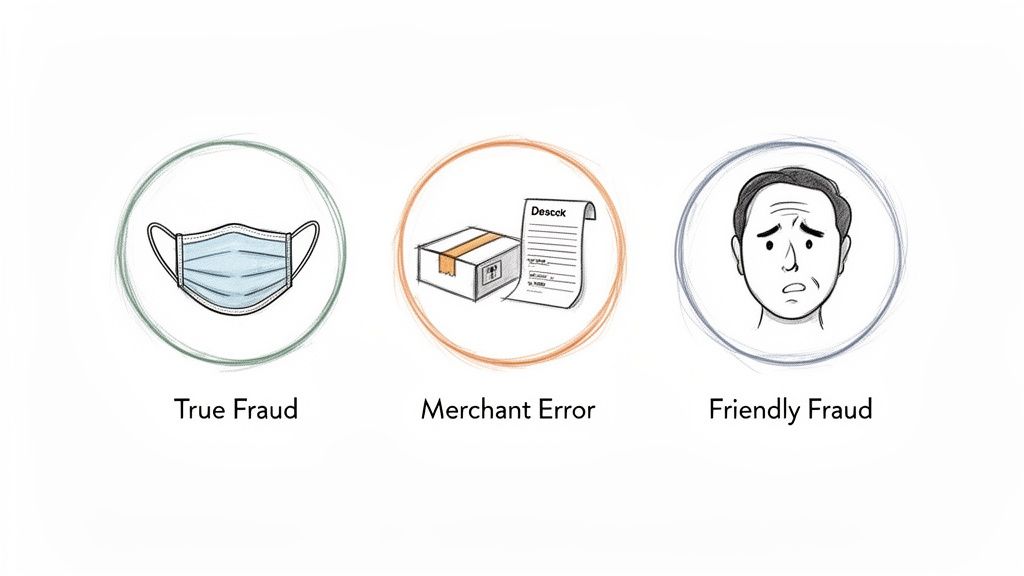

Disputes generally boil down to one of three main reasons. Pinpointing which category a dispute falls into is the critical first step in building a strategy that actually works for your business.

True Fraud: The Clear-Cut Theft

This is the one most people think of first. True fraud, or criminal fraud, is exactly what it sounds like: a thief gets ahold of someone's payment info and goes on a shopping spree. The real cardholder had no idea it was happening.

- Classic Example: A fraudster buys a list of stolen credit card numbers on the dark web and uses one to purchase a new laptop from your store. The actual cardholder eventually spots the charge on their statement and, rightly so, tells their bank they never made the purchase.

In these situations, the transaction was completely unauthorized. As a merchant, you have virtually no chance of winning this kind of dispute. Your best defense isn't fighting it after the fact, but preventing it from happening in the first place with solid fraud detection.

Merchant Error: The Preventable Mistakes

Let's be honest—sometimes, the problem starts on our end. A merchant error dispute is triggered by a mistake made by the business. The good news is these are often the easiest disputes to prevent.

Common slip-ups include:

- Shipping Mishaps: The wrong size shirt gets sent out, a package is delayed by weeks with no communication, or an item arrives broken.

- Billing Mistakes: A customer gets charged twice for one order, or a recurring subscription is processed on the wrong date.

- Poor Communication: Refund policies are buried in fine print, or it’s impossible for a frustrated customer to find a contact number and speak to a real person.

A customer dispute signals the start of a high-stakes battle over a transaction's legitimacy. While true fraud is a concern, friendly fraud has become the top culprit, now accounting for 61% of cases where valid purchases are reversed due to issues like buyer's remorse or simple billing confusion. You can learn more about chargeback statistics and how they impact merchants.

Friendly Fraud: The Most Complex Threat

This is where things get tricky, and the dispute charge meaning becomes much less clear. Friendly fraud happens when a customer files a dispute on a purchase they, or someone in their household, actually made. It can be a genuine mistake or completely intentional.

- Accidental (Chargeback Amnesia): The customer simply forgets making the purchase. This is super common with recurring subscriptions or when they don't recognize the business name on their bank statement (e.g., your official business name is "Global Commerce Inc." but your storefront is "Cool Tees").

- Intentional (Cyber-Shoplifting): This is when a customer knows the charge is valid but disputes it to get their money back while keeping the item. They might have buyer’s remorse or just don’t want to go through the hassle of a proper return.

Knowing the difference is everything. You’d handle a customer who forgot about their monthly subscription much differently than someone who is deliberately trying to get a free product.

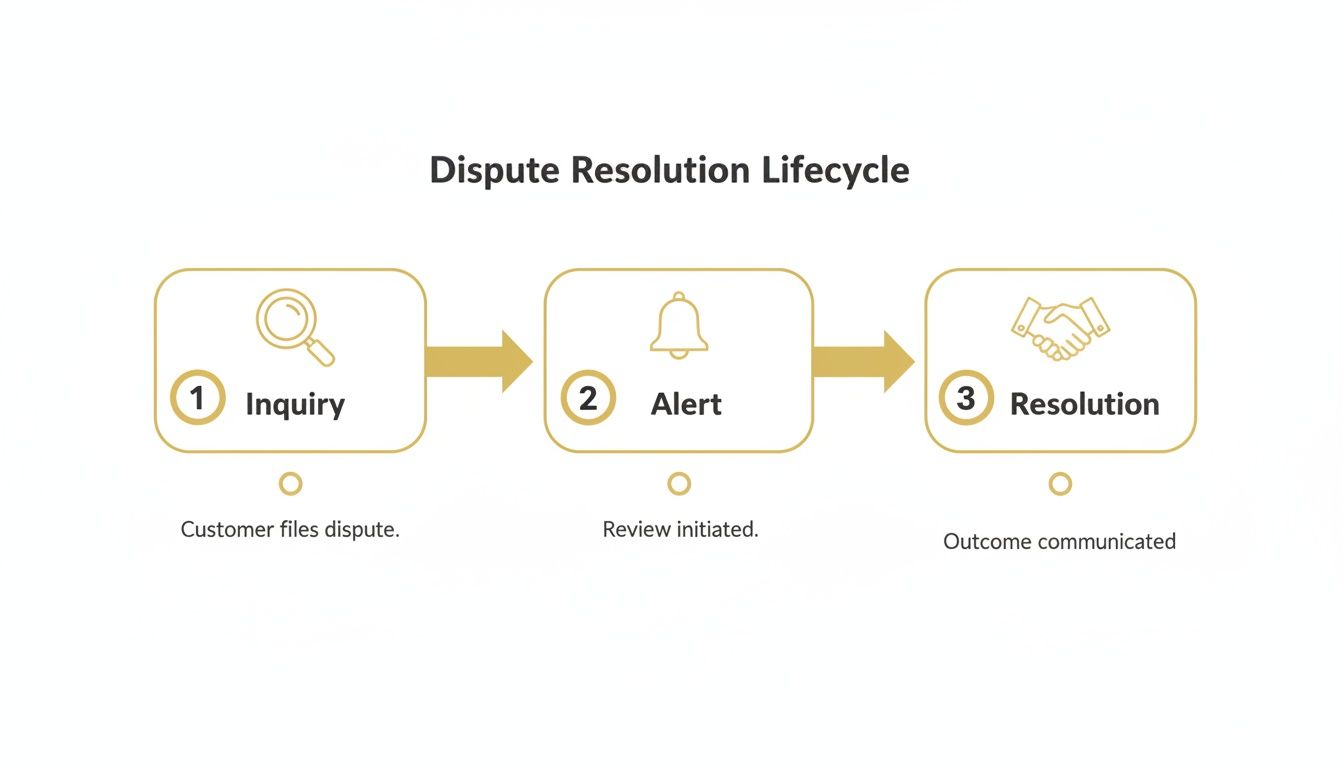

The Lifecycle of a Disputed Charge

A disputed charge doesn't just materialize out of thin air. It follows a distinct, predictable path. Understanding this journey is your key to getting ahead of the problem, because it reveals critical moments where you can step in and stop a customer's question from turning into a costly chargeback.

The whole thing kicks off the moment a cardholder calls their bank—the one that issued their credit card—to question a charge on their statement. Maybe they don't recognize your company's name, or perhaps they're just not happy with their purchase. That initial phone call triggers the first, and most important, stage of the dispute lifecycle.

The Pre-Dispute or Inquiry Phase

Instead of jumping straight to a formal chargeback, the bank usually starts with an inquiry. You can think of this as a preliminary fact-finding mission. The term 'dispute charge' really describes this initial customer complaint phase before it hardens into an official chargeback, giving you a golden opportunity to make things right.

This is where pre-dispute alert systems like Visa's RDR and Ethoca (from Mastercard) can be a real lifesaver. These networks fire off an immediate notification—an alert—giving you a tight 24- to 72-hour window to act. Unfortunately, many merchants let this chance slip by. According to Mastercard's State of Chargebacks report, a staggering 8% of potential disputes are actually resolved at this stage using alerts. You can find more details by reading more chargeback insights here.

From here, the path splits, leading to two very different outcomes.

Key Takeaway: The inquiry phase is your best and, frankly, your last chance to resolve a customer issue behind the scenes. Acting on an alert within this brief window lets you issue a refund, keep the customer happy, and completely sidestep a chargeback.

Resolution or Escalation

How you respond to that initial alert determines everything that comes next. You have two choices.

- Proactive Resolution: You can jump on the alert, check into the customer's claim, and decide to issue a refund. This solves the problem on the spot. The inquiry is closed, the process stops, and a chargeback never hits your merchant account.

- Escalation to Chargeback: Or, you can ignore the alert or decide not to refund. If that happens, the customer's bank will move forward with filing a formal chargeback. This is where the real fight starts, complete with evidence submissions, bank reviews, and potentially expensive fees.

Successfully managing the dispute lifecycle really boils down to focusing your energy on that inquiry stage. By using alerts to issue strategic refunds, you can save yourself a ton of headaches and protect your business from penalties. Of course, some chargebacks are worth fighting, which is why having a solid Q4 representment strategy is essential for those that do escalate.

The True Cost of Unresolved Disputes to Your Business

It’s one thing to know the definition of a disputed charge, but it’s another thing entirely to see the damage it can inflict on your business. When a customer's simple question snowballs into a full-blown chargeback, you don't just lose the money from that one sale. Think of it as a small leak that, if ignored, can cause some serious financial and operational flooding.

The most immediate pain point is the direct financial hit. First, the revenue from the original sale is clawed back. Then, your payment processor tacks on a non-refundable chargeback fee, which typically runs anywhere from $20 to $100 per incident. Suddenly, what looked like a profitable transaction is now a definite loss.

Beyond the Initial Financial Hit

But the damage doesn’t stop there. Each chargeback chews up your operational resources. Your team has to drop what they’re doing to dig up evidence, craft compelling rebuttal letters, and navigate the whole representment process. That’s precious time they could have spent acquiring new customers or improving your product.

This is why catching a dispute early is so critical. The ideal path is a short one, moving from a customer inquiry straight to a quick, painless resolution.

When you get an alert during that initial inquiry stage, you have the power to steer the conversation toward a positive outcome and completely sidestep the headache of a formal chargeback.

The Long-Term Consequences of a High Dispute Rate

The most dangerous costs are the ones that creep up on you. Every single chargeback nudges your chargeback-to-transaction ratio a little higher. This is a critical metric that card networks like Visa and Mastercard watch like a hawk. If that ratio creeps over their threshold—usually around 1%—you can be flagged and placed into a high-risk monitoring program.

Once you're on their radar, you’re looking at hefty monthly fines and intense scrutiny. If things don’t improve, you could face the ultimate business nightmare: your payment processor terminates your merchant account, effectively shutting down your ability to accept credit card payments.

For any online seller, getting a handle on the challenges of an Amazon suspension, chargeback dispute, or brand protection issues is a matter of survival. Beyond the numbers, a reputation for poor service can poison customer trust and loyalty for good. Managing disputes isn't just about dodging fees; it's about protecting the very heart of your business.

Proactive Strategies to Prevent Customer Disputes

The old saying that the best defense is a good offense holds true for payment disputes. Instead of waiting to react when a dispute hits your account, the smartest merchants get ahead of the problem. It all comes down to building a proactive strategy that stops disputes before they ever start, focusing on clarity, solid communication, and a great customer experience from day one.

Think of it like building a fortress around your revenue. Every preventative measure you take is another stone in the wall, making it that much harder for misunderstandings or frustrations to escalate into a full-blown chargeback.

Foundational Best Practices

You'd be surprised how many disputes arise from simple confusion or minor service hiccups. Getting the fundamentals right can wipe out a huge chunk of these. The goal is to make every single transaction so transparent and smooth that the customer never even thinks about questioning it.

Start with these core tactics:

- Use Crystal-Clear Billing Descriptors: Make sure the name on your customer's credit card statement is one they'll recognize instantly. "CoolTees" is a world away from your legal entity "Global Commerce LLC," which sounds generic and could easily make someone think their card was stolen.

- Offer Hyper-Responsive Customer Service: Don't make customers hunt for a way to contact you. Plaster your phone number, email address, and live chat options everywhere. When it's easy to reach you, they'll come to you with a problem, not their bank.

- Send Transparent Confirmations: Your order confirmation email is your first line of defense. It should clearly list what they bought, the total cost, and have an unmissable link to your return and refund policies. This creates a clear paper trail and manages expectations right away.

- Maintain a Fair Refund Policy: A straightforward, easy-to-find refund policy builds immense trust. If a customer feels confident they can get their money back without a hassle, they're far less likely to jump straight to a chargeback.

The best way to handle a disputed charge is to prevent it from ever becoming one. By making your business easy and fair to deal with, you encourage customers to talk to you directly, stopping small issues from turning into big problems.

Your Ultimate Safety Net: Pre-Dispute Alerts

Even if you do everything right, some disputes are simply going to happen. This is where a pre-dispute alert system acts as your ultimate safety net—a final line of defense against damaging chargebacks. While having effective ecommerce fraud prevention is essential, alerts tackle those issues that aren't outright fraud.

Platforms like Disputely plug directly into the major card networks, giving you a heads-up the second a customer initiates a dispute.

This opens up a critical 24-72 hour window where you can step in, issue a refund, and solve the customer's problem before it ever escalates into a formal chargeback on your record. This automated intervention stops the dispute dead in its tracks, protecting your merchant account from a rising chargeback ratio. For more deep dives on building out a powerful prevention strategy, check out the resources over on the https://disputely.com/blog.

Got Questions? We've Got Answers

Even with the best game plan, specific questions about disputed charges always pop up. Let's tackle a few of the most common ones that merchants run into.

I Just Got an Alert. What's My First Move?

Time to play detective, and you need to act fast. Your first step is to pull up everything you can find on that specific transaction. Look at the customer’s order history, check for any emails or phone calls, and verify the shipping information. You've only got a 24- to 72-hour window to make a call.

Your goal is to figure out if the customer's claim has merit. If it looks legitimate, or if it seems like a case of friendly fraud you probably can't win, your best bet is to issue a refund directly through the alert system. This stops a chargeback in its tracks.

Should I Fight Every Single Disputed Charge?

You can, but you really shouldn't. While the process of fighting a chargeback (known as representment) is always an option, it's a strategic mistake to fight every single one. It drains your time and money, and frankly, you have almost no chance of winning cases involving true fraud or a clear mistake on your end.

The smart approach is to pick your battles. Use your data and the information from the alert to quickly refund the disputes you know you'll lose. This frees you up to pour your resources into fighting the chargebacks where you have strong, compelling evidence that the transaction was legitimate.

How Does a Platform Like Disputely Actually Stop a Chargeback?

It’s all about getting a heads-up. A chargeback alert platform like Disputely plugs into networks run by the card brands themselves, like Visa's RDR and Mastercard's Ethoca. When a cardholder calls their bank to question a charge, the bank sends out a "pre-dispute" alert before a formal chargeback is ever filed.

Disputely catches that alert in real time. Based on rules you set, the platform can automatically refund the customer on your behalf. Since the customer got their money back, the bank's inquiry is satisfied, and the chargeback process is stopped cold. It never officially starts, which keeps your merchant account safe and your dispute ratio low.

Stop letting preventable chargebacks chip away at your revenue. Disputely connects to your payment processor in minutes to handle dispute alerts automatically, protecting your business around the clock. See how much you can save and get started today.