Disputed Charges Meaning A Guide to Protecting Your Business

A disputed charge is what happens when a customer asks their bank to reverse a transaction they see on their statement. It’s a formal request, but the key thing to remember is that they're raising a red flag with their financial institution, not with you directly. This single action kicks off a formal investigation to figure out if the charge was legitimate.

What Does a Disputed Charge Actually Mean?

Getting that first notification about a dispute can feel like a gut punch. It’s easy to think you've just lost a sale, plain and simple. But a disputed charge is really just the start of an inquiry.

Think of it this way: instead of calling your support line, the customer filed a formal complaint through an official channel—their bank. The bank then temporarily credits the customer's account while it looks into the claim, and your payment processor will likely hold those funds from you. But at this point, nothing is set in stone.

To help you get a quick handle on this, here's a simple breakdown of what's involved.

Disputed Charge At a Glance

| Component | Description |

|---|---|

| Initiator | The cardholder (your customer). |

| Recipient | The issuing bank (the bank that gave the customer their card). |

| Nature | A formal inquiry or complaint about a specific transaction. |

| Initial Outcome | A temporary credit for the customer and a hold on the merchant's funds. |

| Status | Investigation pending. No final decision has been made yet. |

This table shows that a dispute is just the first step, not the final word. It's your opportunity to respond and present your side of the story.

The Spark Behind the Dispute

So, why would a customer go straight to their bank instead of just reaching out to you? The reasons can be all over the map, but they usually boil down to a few common situations:

- Unrecognized Transaction: The customer simply doesn't recognize your business name on their statement.

- Product/Service Issues: They feel the item they got was damaged, completely different from what they ordered, or never even showed up.

- Suspected Fraud: They believe their card details were stolen and used without their permission.

- Billing Errors: They were charged the wrong amount, accidentally billed twice, or have a problem with a recurring subscription.

This initial phase is your window of opportunity. Once you understand that a dispute is a process, not a verdict, you can build a methodical response instead of just reacting. For a deeper dive into managing these issues, explore the resources on the Disputely blog.

And make no mistake, this is a massive issue. Globally, the average cardholder filed 5.7 chargebacks, contributing to over $65.2 billion in disputes in a single year. Projections even show that number could grow by another 41%. This isn't just a minor cost of doing business; it's a growing financial threat.

Disputed Charges vs. Chargebacks: What's the Real Difference?

In the world of e-commerce, you’ll often hear the terms "disputed charge" and "chargeback" used interchangeably. While they’re closely related, they aren’t the same thing at all. Getting the distinction right isn't just about terminology; it's about understanding the small window you have to defend a sale and protect your bottom line.

A disputed charge is the starting pistol. It's the initial flag a customer raises with their bank, saying, "Hey, I have a problem with this transaction." At this stage, nothing is set in stone—it's just a formal inquiry.

A chargeback, however, is the final, painful outcome. It’s the actual reversal of funds—the money being pulled from your merchant account and returned to the customer after the bank has investigated and sided with them.

Think of It Like This: An Accusation vs. a Verdict

To make sense of the disputed charges meaning, let's use a simple courtroom analogy. When a customer files a dispute, they are pointing a finger and making an accusation against your business.

The disputed charge is the accusation. The chargeback is the final judgment.

This difference is everything. The period between the dispute and the chargeback is your chance to go to court, so to speak. The bank plays the role of the judge, and both you and your customer get to present evidence. If you ignore the initial dispute or fail to build a strong case, the verdict—the chargeback—is almost guaranteed to go against you.

The Path from a Simple Dispute to a Costly Chargeback

The process isn't a single event but a sequence of steps. Knowing where you are on this path tells you exactly what you need to do next.

Here’s a breakdown of how a disputed charge escalates:

- Step 1: The Dispute (The Claim): It all begins when a customer calls their bank to question a charge. The bank then opens an official inquiry into the transaction.

- Step 2: The Investigation (The Trial): You get a notification from the bank requesting compelling evidence that the charge was legitimate. You have a very tight deadline to respond.

- Step 3: The Chargeback (The Verdict): If you don't respond in time, or if your evidence isn't convincing enough, the bank rules in the customer's favor. The chargeback is finalized, the funds are gone for good, and you're hit with a penalty fee.

This flow makes it crystal clear why you have to jump on a disputed charge notification immediately. It’s your one and only opportunity to tell your side of the story and stop a simple customer complaint from turning into a direct hit to your revenue.

Why Do Customers Dispute Charges in the First Place?

To get a handle on disputes, you have to know what's really driving them. Think of yourself as a detective. Every dispute has a backstory, and while the details differ, they almost always trace back to one of three main scenarios. Figuring out which one you're dealing with is the key, because your strategy for responding—and preventing it from happening again—changes completely depending on the cause.

The reasons can be anything from straightforward criminal fraud to an honest mistake on your end. Let's break down the usual suspects.

1. True Fraud: The Obvious Culprit

This is the one everyone thinks of first. True fraud, or criminal fraud, is exactly what it sounds like: a thief gets their hands on stolen credit card information and goes on a shopping spree. The real cardholder spots the charge on their statement, knows they didn't make it, and immediately calls their bank.

There’s no grey area here. The purchase was illegal, and fighting this kind of dispute is a losing battle. Your energy is much better spent tightening up your defenses with tools like Address Verification Service (AVS) and CVV checks to stop these transactions before they ever get approved.

2. Merchant Error: The Avoidable Mistakes

Sometimes, the call is coming from inside the house. Merchant errors are disputes that happen because of a slip-up in your own operations. They’re usually accidental, but for a customer, they’re incredibly frustrating and often lead them straight to their bank for a quick fix.

We've all seen these happen:

- Accidental double billing for a single purchase.

- Charging the wrong amount due to a typo or a system glitch.

- Shipping something to the wrong address or the item arriving broken.

- Using a confusing billing descriptor that makes a customer think, "What on earth is 'Global Biz Inc.'?" and assume it's fraud.

The good news? These are almost entirely within your control. A little more attention to detail in your fulfillment process and making sure your business name is crystal clear on bank statements can practically wipe this category off the map.

3. Friendly Fraud: The Most Common—and Complicated—Threat

Here’s where things get tricky. Friendly fraud is the fastest-growing and most common reason for a dispute, and it happens when a legitimate customer disputes a charge they actually made.

It’s not always malicious. Sometimes it’s an honest mistake—they forgot about a subscription renewal or don’t recognize a purchase a family member made on their card. Other times, it's a case of buyer's remorse, or worse, someone trying to get something for free.

Friendly fraud accounts for a staggering 75% of all chargebacks. As commerce has shifted online, this problem has exploded. With 63% of all merchant transactions now happening digitally, the "one-click-to-buy" convenience has made it just as easy for customers to dispute a charge, whether they mean to or not. You can dive deeper into these chargeback statistics and trends to see just how big this issue has become.

Because the person making the purchase is the real cardholder, your typical fraud prevention tools are completely useless. Stopping friendly fraud is all about clear communication, transparent policies, and making it incredibly easy for customers to reach you before they feel the need to call their bank.

To give you a clearer picture, here’s a breakdown of the most common reasons disputed charges pop up.

Top Reasons for Disputed Charges

Understanding the "why" behind a dispute is the first step toward building a solid defense. This table breaks down the most frequent causes, showing how they fit into the three main categories.

| Dispute Category | Common Examples | Primary Cause |

|---|---|---|

| True Fraud | Stolen credit card used for purchase; Account takeover. | Criminal Intent: A third party illegally uses the cardholder's information without their knowledge. |

| Merchant Error | Double billing; Incorrect charge amount; Item not received. | Operational Mistake: A breakdown in the merchant's process, from billing to fulfillment. |

| Friendly Fraud | Buyer's remorse; Family member made the purchase; Forgot about a subscription. | Cardholder Action: The legitimate cardholder disputes a valid charge, either intentionally or by mistake. |

As you can see, only one of these categories involves actual criminals. The other two stem from operational gaps or customer confusion—both of which you have the power to influence.

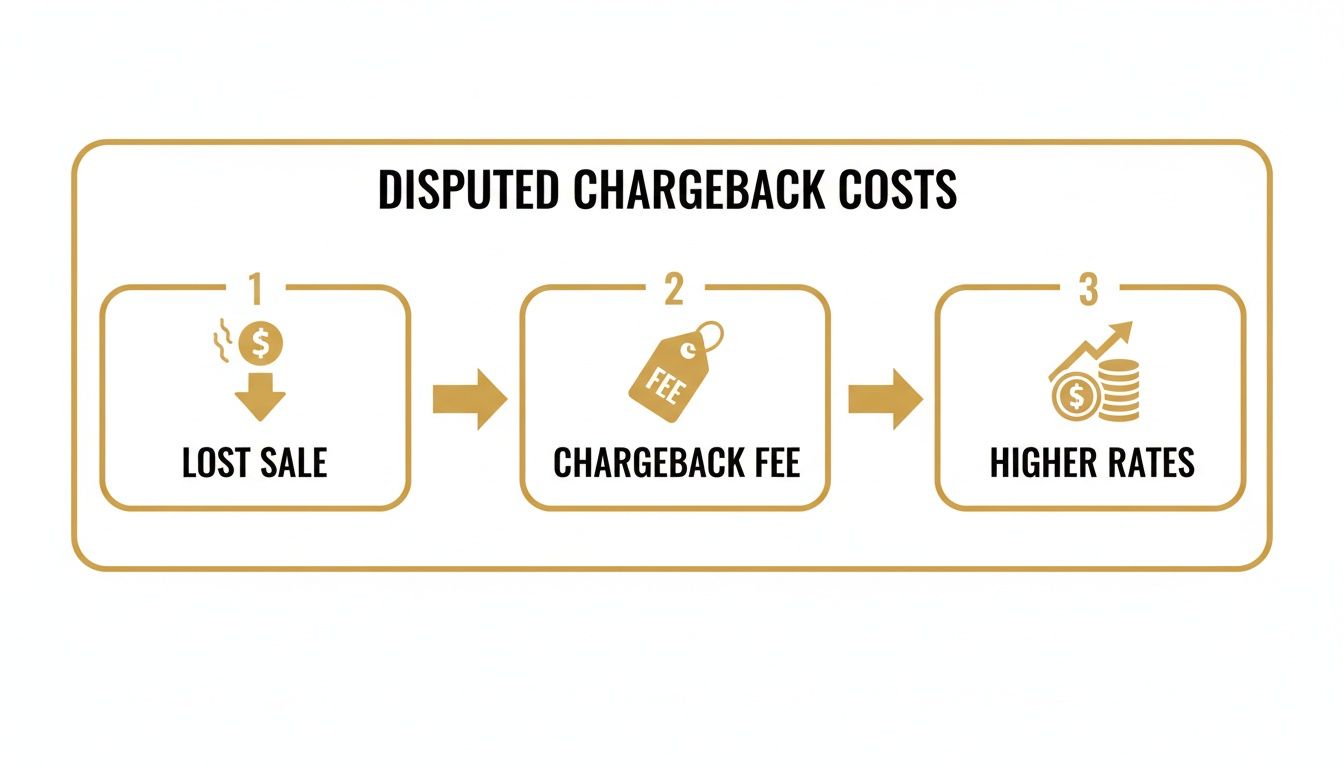

The True Cost of Disputed Charges to Your Business

When a disputed charge notification lands in your inbox, it's easy to just see the dollar amount of that one lost sale. But that's a classic case of seeing only the tip of the iceberg. The real cost of a dispute is a whole mess of hidden expenses that silently chips away at your profits.

You might be tempted to ignore the small ones, thinking it's not worth the time. Honestly, that’s a costly mistake. Each dispute, big or small, comes loaded with extra penalties and operational headaches that can do some serious damage to your bottom line.

More Than Just the Lost Sale

First, let's get the obvious out of the way. You lose the money from the sale itself—it's yanked from your account and sent back to the customer. But the bleeding doesn't stop there. Your payment processor immediately hits you with a separate, non-negotiable chargeback fee.

Think of this fee as the bank's administrative penalty. It typically runs anywhere from $15 to $100 per dispute, and you pay it whether you win or lose the case. It’s their fee for having to get involved, and it comes straight out of your pocket.

So, if a customer disputes a $50 purchase, you’re not just out $50. You lose the $50 sale, plus the chargeback fee, plus the cost of whatever product you already shipped. Don't forget the marketing and shipping costs you spent to get that sale in the first place. All of a sudden, that "small" dispute has snowballed into a much bigger loss.

The Hidden Operational and Financial Damage

Beyond the immediate hit to your wallet, disputes create a ton of operational drag and put your business at long-term risk. These costs aren't as easy to see on a spreadsheet, but over time, they can be even more destructive.

And this isn't a minor issue—it's getting worse. Global chargeback volume is on track to hit 324 million transactions a year, with eCommerce businesses expected to lose a staggering $33.79 billion. For U.S. merchants, the pain is particularly sharp, with an estimated loss of $4.61 for every single dollar of fraud. You can dig deeper into these trends with chargeback insights from Mastercard's report.

Here’s a breakdown of how these costs pile up:

- Wasted Labor: Instead of focusing on growing the business, your team gets bogged down in administrative trench warfare. They have to spend hours digging up evidence, writing rebuttal letters, and communicating with banks. That’s precious time stolen from marketing, product development, or actually helping happy customers.

- Higher Processing Fees: Payment processors are always watching your dispute ratio—the percentage of your transactions that turn into disputes. If that number creeps up, they start seeing you as a "high-risk" merchant. The result? They'll often hike up your credit card processing fees for all your transactions.

- Frozen Funds and Account Termination: If your dispute ratio gets seriously out of hand, things can get ugly. Your processor might put a hold or a "reserve" on your funds to cover their own risk. And if the problem doesn't get fixed, they can shut down your merchant account completely. That means you can no longer accept card payments, which for most online businesses, is a death sentence.

Your Step-by-Step Guide to Responding to a Disputed Charge

Getting that "disputed charge" notification can make your stomach drop. But the absolute worst thing you can do is panic. The key is to have a calm, methodical process ready to go. Think of yourself as a detective building a case—every piece of evidence and every deadline is critical to winning back your revenue.

From the moment you're notified, the clock is ticking. Most payment processors give you a very tight window, often just 7 to 21 days, to get your response in. There are no extensions. You have to act fast, but more importantly, you have to act smart.

Step 1: Analyze the Claim and Reason Code

First things first: you need to know exactly what you're dealing with. Every single dispute comes with a reason code. This is a short, standardized code that tells you why the customer is disputing the charge. For example, one code might mean the customer claims the "Product Was Not Received," while another might point to a "Fraudulent Transaction."

This code is your entire game plan. It dictates the kind of evidence the bank needs to see and shapes your entire response strategy. Don't just glance at it. Look up the specific code for the card network (like Visa or Mastercard) to understand the nitty-gritty requirements for fighting it successfully.

Step 2: Gather Compelling Evidence

Once you understand the reason code, it's time to gather your proof. Your mission is to find every piece of documentation you have that proves the transaction was legitimate and directly counters the customer’s claim.

Your evidence file needs to be tailored to the specific dispute, but here are some of the most common things you'll want to pull together:

- Order and Payment Confirmation: This includes screenshots of receipts, invoices, or any confirmation emails you sent to the customer.

- Proof of Shipping and Delivery: Tracking numbers are good, but delivery confirmations with a signature are even better. Don't forget shipping labels.

- Customer Communications: Pull copies of any emails, support tickets, or live chat logs that show your interactions. Did they contact you before the dispute? That's important!

- Terms of Service and Policies: You need to show that the customer saw and agreed to your terms, refund policy, or service agreement when they checked out.

Losing a dispute isn't just about the lost sale. The costs pile up quickly, as this flowchart shows.

As you can see, a single lost dispute creates a painful domino effect that goes far beyond the original transaction amount.

Step 3: Craft a Professional Rebuttal Letter

All that great evidence you collected needs a cover letter to tie it all together for the bank reviewer. This is your rebuttal letter, and it should be a clear, professional summary of your case. Keep it concise, easy to scan, and focused on directly refuting the reason code.

Start with the basic transaction details. Then, walk the reviewer through your evidence piece by piece, explaining how each document proves the charge was valid. Stick to the facts. Avoid emotional or accusatory language. Your goal is to make it incredibly easy for the reviewer to see that the dispute should be reversed in your favor.

It's also smart to prepare for high-volume seasons when disputes tend to spike. You can learn more about getting your business ready with our expert representment strategies.

Key Takeaway: A winning rebuttal letter doesn't just throw a pile of documents at the bank. It tells a clear, factual story that logically guides the reviewer to the only possible conclusion: your business did everything right.

Finally, package your rebuttal letter and all your supporting documents into a single file (a PDF is usually best) and submit it through your payment processor’s online portal. Make sure you get it in well before the deadline. In the world of disputes, being thorough and on time are your two biggest advantages.

How to Proactively Prevent Disputed Charges

While knowing how to fight a disputed charge is important, the best defense is a good offense. Preventing disputes from happening in the first place is always the smarter strategy. When you build a transparent and secure experience for your customers, you can stop most issues before they ever escalate, protecting your revenue and your hard-earned reputation.

It all starts with crystal-clear communication. Take a look at your billing descriptor—that’s the name that shows up on a customer's credit card statement. If it’s something vague like "ACME Services," you're practically asking for a confused customer to file a dispute. Make sure it's instantly recognizable as your business name.

Beyond that, simple things make a huge difference. Always send an order confirmation email the second a purchase is made, and follow it up with a shipping notification that includes a tracking number. This kind of transparency builds trust and reassures customers that everything is on track.

Strengthen Your Customer Service Channels

Here's a simple rule of thumb: make it easier for a customer to contact you than their bank. Think of your support team as your front line against disputes. When a customer is frustrated or confused, a quick and helpful response can be the difference between a resolved issue and a costly chargeback.

Your goal should be to resolve issues so quickly and easily that a customer never even considers calling their bank. Proactive support is a direct investment in dispute prevention.

Modern tools can really help here. For example, using AI chatbots for your business offers customers instant, 24/7 support for common questions, which can stop small problems from snowballing. If you're on Shopify, it's also worth getting familiar with their processes; we break down how to handle a Shopify payment hold in our detailed guide.

Embrace Smart Fraud Prevention

Finally, don't neglect the security tools at your disposal. Basic checks like the Address Verification Service (AVS) and Card Verification Value (CVV) are non-negotiable first steps in weeding out obvious criminal fraud.

But technology is giving us even more powerful tools. AI-driven solutions are making a real impact, with some merchants seeing an 80% improvement in their win rates and saving around $315 per dispute. As total losses to payment fraud creep toward an estimated $49.32 billion, these advanced systems are becoming less of a luxury and more of a necessity.

Frequently Asked Questions About Disputed Charges

Even when you've got a handle on the basics, a few specific questions always seem to pop up. Let's tackle some of the most common ones we hear from merchants trying to get a grip on the dispute process.

How Long Do I Have to Respond to a Dispute?

The clock starts ticking the second you're notified. You generally have a very tight window to respond to a dispute, often somewhere between 7 and 21 days.

This isn't a soft deadline—it's set in stone. If you miss it, you almost always lose the dispute by default, and the money is gone for good. Acting fast is non-negotiable.

Can a Disputed Charge Affect My Business Credit?

A single, isolated dispute won't ding your business credit score directly. The real danger lies in the bigger picture.

If you rack up too many disputes, your payment processor will start seeing you as a "high-risk" merchant. That can lead to a whole host of problems: higher processing fees, held funds, and in the worst-case scenario, they could shut down your merchant account entirely. That kind of reputational and financial damage can be hard to recover from.

The world of disputes is only getting more complex. In key industries like information and media, almost half of all businesses expect to spend more on dispute resolution in the near future. This really drives home how crucial it is to get a handle on this now. Learn more about the global disputes forecast.

Is It Possible to Prevent Disputes Entirely?

Getting your dispute rate to zero is probably unrealistic, but you can absolutely get it close. Think of it as playing defense.

Your best preventative measures are great business practices: clear billing descriptors so customers recognize the charge, top-notch customer service that’s easy to reach, and straightforward return policies. The goal is to make it much easier for a customer to call you than to call their bank.

Investing in developing robust fintech software solutions also plays a huge role here. A solid payment system can squash a lot of the errors and potential fraud that lead to disputes in the first place.

Stop losing revenue to preventable chargebacks. Disputely uses chargeback alerts from Visa and Mastercard to notify you of disputes in real-time, giving you the power to refund and prevent a costly chargeback. See how much you can save with Disputely.