A Proactive Guide to Ecommerce Fraud Prevention

Ecommerce fraud prevention is simply the collection of tools and tactics you use to protect your business from getting ripped off. It's all about spotting and stopping bogus transactions before they turn into chargebacks, lost products, and a major headache. Think of it as the digital bouncer for your online store.

Why Ecommerce Fraud Prevention Is Non-Negotiable

Getting a chargeback notification feels like a punch to the gut. It’s not just the lost revenue from that one sale; it’s a direct hit to your store's stability, your reputation, and even your relationship with payment processors. The game has changed—modern ecommerce fraud is a sophisticated operation that goes way beyond a simple stolen credit card, and it can quietly bleed your profits dry.

Imagine your store's security is like a bank vault. Of course, you need a heavy-duty, reinforced door—that's your secure payment gateway. But a strong door isn't enough on its own. You also need a sharp security team watching the cameras, noticing who’s acting suspiciously, and stepping in before they ever get a hand on the cash. That’s what a good fraud prevention strategy does.

The True Cost of Ignoring Fraud

The financial hit from fraud is so much bigger than just the cost of the stolen item. Globally, ecommerce fraud is expected to drain a mind-boggling $343 billion from merchants between 2023 and 2027. That number makes one thing crystal clear: you can't afford to look the other way.

For every dollar a fraudster steals from you, the actual cost to your business is significantly higher. There's a painful multiplier effect from all the hidden costs, including:

- Chargeback Fees: Banks slap you with a fee for every single dispute, win or lose.

- Lost Inventory: The product you shipped out is gone forever. No getting that back.

- Operational Costs: Think of the hours your team wastes investigating claims and fighting disputes. That time is money.

- Increased Processing Fees: If your chargeback rate gets too high, payment processors will brand you as "high-risk" and hike up your transaction fees.

A proactive fraud strategy isn’t an expense; it’s an investment in your store's financial health and long-term viability. It flips the script, turning you from a reactive victim into a resilient defender of your revenue.

Moving from Reactive to Proactive

Trying to deal with fraud after a chargeback has already been filed is a losing game. You’re constantly playing catch-up, trying to put out fires and recover money that’s already gone. This guide is designed to completely change that mindset.

We're going to move past the vague anxieties and get into the nitty-gritty of protecting your business. We'll lay the groundwork here so you understand what you're up against. By the time you're done, you’ll know exactly how to safeguard your profits, keep your payment processors happy, and create a safer, more trustworthy store for all your real customers.

Decoding the Modern Fraudster's Playbook

If you want to build a rock-solid defense against ecommerce fraud, you have to get inside the criminal's head first. You need to understand their plays. Modern fraud isn't just one thing; it's a whole collection of different schemes, and each one leaves its own clues. Spotting these patterns is the first real step toward shutting them down for good.

Think of it like securing a house. Some burglars pick locks, others look for an open window, and some will try to trick you into letting them right through the front door. Your online store faces similar threats, and each one needs a different kind of defense.

Friendly Fraud vs. Chargeback Fraud

It's a strange thing to say, but not all fraud starts with bad intentions. Friendly fraud is the perfect example, as it often happens by mistake. A customer might see a charge on their credit card statement they don't recognize and immediately call their bank to dispute it, even though they actually bought and received your product. It could be as simple as a confusing billing descriptor. It’s not malicious, but it still costs you a chargeback.

Chargeback fraud, on the other hand, is the ugly twin of friendly fraud. This is where a customer makes a purchase with the deliberate plan to dispute the charge later, get their money back, and keep the product. It’s straight-up theft, just with extra steps.

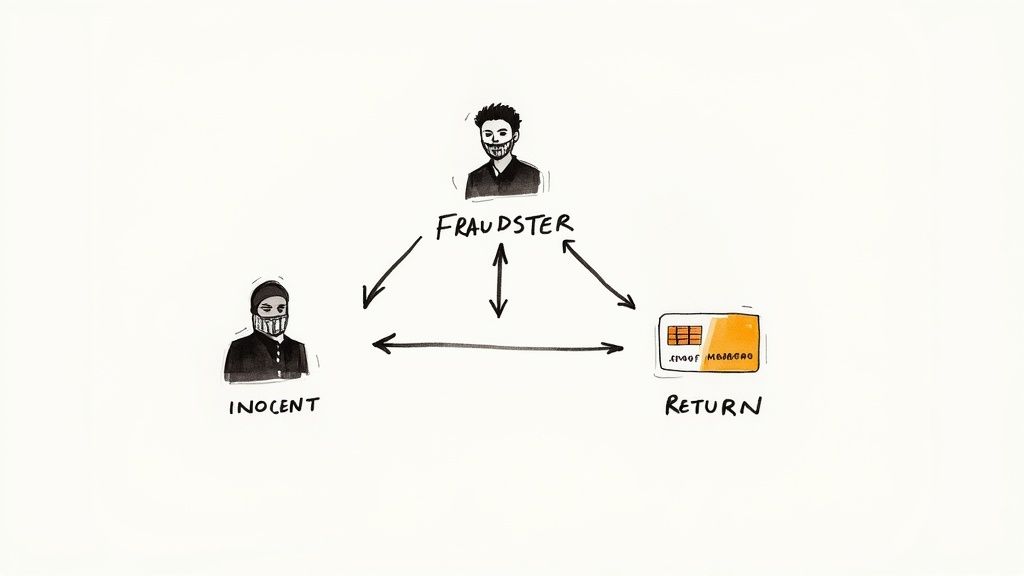

The Deception of Triangulation Fraud

This one is a sneaky, three-party shell game that leaves you holding the bag. It involves your store, an innocent buyer, and the fraudster pulling the strings.

- The Bait: The fraudster sets up a fake online storefront on a place like eBay or Facebook Marketplace, listing a hot product at a price that seems too good to pass up.

- The Hook: A genuine customer sees the deal and buys the item from the fraudster's fake listing.

- The Switch: Here’s the twist. The fraudster pockets the customer's money, then turns around and uses a stolen credit card to buy that same exact item from your store, shipping it directly to their customer.

Everyone is left confused. The innocent buyer gets their product and thinks everything is fine. You get an order paid for with a stolen card. And eventually, the real owner of that stolen card sees the charge and files a chargeback against you. The fraudster is long gone with the original payment, leaving you to clean up the mess and absorb the loss.

Ecommerce merchants are losing a staggering amount of money to this stuff—globally, it's estimated to be around $48 billion US dollars a year. And it gets worse. For every $100 you lose to a fraudulent order, the actual cost to your business is closer to $207 once you factor in fees, operational costs, and lost inventory. Interestingly, what we call friendly fraud is a big piece of this puzzle, accounting for 18% of all disputes.

Account Takeover and Card Testing

An Account Takeover (ATO) attack is exactly what it sounds like: a digital hijacking. Fraudsters get their hands on legitimate customer login details—usually from massive data breaches sold on the dark web—and simply walk into their account on your site. Once they're in, they can go on a shopping spree with saved credit cards, change the shipping address to their own drop-off point, or just steal personal data. Staying on top of specific methods, like a sophisticated MFA Fatigue Attack, is critical to protecting your customers.

Before they go big, criminals often start small with card testing. They use bots to hit your site with thousands of stolen card numbers, making tiny purchases—think $0.50 or $1.00. They don't care about the items. They're just "pinging" the cards to see which ones are still active. A successful micro-transaction tells them they've got a live one, ready for a much bigger shopping spree somewhere else.

Sophisticated Return Fraud

Finally, there’s return fraud, where criminals turn your own customer-friendly policies against you. This isn't just one tactic; it's a whole category. It can be as simple as "wardrobing"—where someone buys an outfit, wears it out for a night, and returns it for a full refund.

But it gets much more elaborate. Scammers might return stolen goods for store credit, send back a cheap knock-off in place of the real thing, or even ship back an empty box, banking on your busy warehouse team not noticing until it's too late.

Building Your Proactive Fraud Detection System

If you’re only dealing with fraud after it happens, you’re already behind. It's a losing game of whack-a-mole that costs you revenue, products, and a whole lot of time. The real secret to winning is to stop playing defense and start playing offense. You need to hunt for threats before they hit your bottom line by building a smart, multi-layered security system for your store.

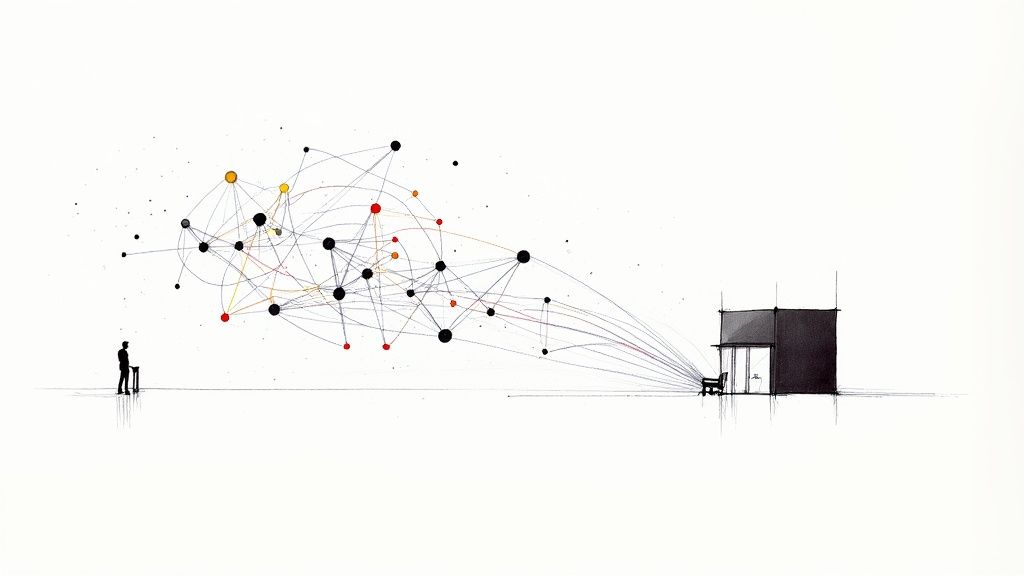

Think of it like securing your house. You wouldn't just rely on a strong lock on the front door, right? You’d have sensors on the windows, motion detectors inside, and maybe a camera watching the perimeter. Each piece looks for a different kind of trouble, and together they create a powerful defense. Your fraud detection system needs to work the same way, using a combination of tools to spot suspicious activity from every possible angle.

Identifying Critical Fraud Red Flags

Fraudsters are crafty, but they almost always leave a trail of digital breadcrumbs. The first step is learning to spot them. Certain transaction details are huge giveaways, and recognizing these patterns is your first line of defense.

For instance, a massive order from a brand-new customer should set off immediate alarm bells. So should a string of rapid-fire orders coming from the same IP address. These aren't just random quirks; they are classic fraud patterns that demand a closer look.

Here are some of the most common red flags to watch for:

- Mismatched Addresses: The billing address is in rural Ohio, but the shipping address is a known freight forwarder in Miami. This is a classic move to obscure the fraudster's real location.

- Atypical Order Values: You get an order that’s 10x larger than your average sale. Why would a first-time customer suddenly go on such a huge spending spree?

- Suspicious Email Addresses: An email like

j.doe88@gmail.comfeels a lot more legitimate thanghkruy78234@freemail.biz. Gibberish usernames and disposable email domains are a fraudster's best friend. - Multiple Cards, Single Address: A single user tries five different credit cards in two minutes, all shipping to the same address. They’re burning through a list of stolen card numbers, hoping one will work.

This table breaks down some of the most common red flags we see and gives you a clear, actionable plan for each one. Keep it handy as you review orders.

Common Fraud Red Flags and Recommended Actions

| Red Flag Indicator | What It Means | Recommended Action |

|---|---|---|

| Shipping/Billing Mismatch | The product is going to an address different from the cardholder's. This could be a gift, but it's also a primary tactic for fraudsters. | Manual Review: Check if the addresses are in the same general region. A cross-country shipment is much riskier than one to a neighboring town. |

| Unusually High Order Value | A fraudster is trying to maximize their payout from a stolen card before it's shut down. | Manual Review/Customer Contact: For very large first-time orders, a quick phone call to the customer can often verify legitimacy. |

| Multiple Transactions in a Short Time | This could be "card testing," where criminals make small purchases to see if a stolen card is active before making a large one. | Automated Block: Set rules to temporarily block an IP or customer account after a set number of failed attempts (e.g., 3-5 declines). |

| Proxy or High-Risk IP Address | The user is actively hiding their true location, a common practice for organized fraud rings. | High-Risk Flag/Automated Decline: Use a tool to check the IP risk. Orders from known proxies or anonymous networks should often be rejected outright. |

| Gibberish Email/Name | The fraudster is using fake or randomly generated information, indicating they have no intention of being a real customer. | High-Risk Flag/Manual Review: Look at the order in combination with other risk signals. This alone might not be a deal-breaker, but it's highly suspicious. |

By familiarizing yourself and your team with these indicators, you can start catching obvious fraud attempts before they ever become a chargeback.

Introducing Transaction Risk Scoring

As your store grows, manually checking every single order for these red flags becomes completely unsustainable. This is where risk scoring becomes a game-changer. Think of it like a credit score, but one that’s generated instantly for every transaction.

Your system looks at dozens of data points in real-time—from the IP address to the time of day—and spits out a simple score that tells you how likely the order is to be fraudulent. A low score means it’s good to go and gets approved automatically. A high score flags it for a closer look or an automatic rejection.

Risk scoring empowers you to make instant, data-driven decisions. Instead of treating every order with the same level of suspicion, you can focus your valuable time and attention only on the transactions that pose a genuine threat.

This automated triage is the key to scaling your fraud prevention without slowing things down for your legitimate, high-value customers. It finds the needles in the haystack so you don’t have to.

Your Essential Fraud Detection Toolkit

To make risk scoring work, you need the right tools feeding data into the system. Each one examines a different piece of the puzzle, and when you put their insights together, you get a crystal-clear picture of who you're dealing with.

Foundational Verification Tools

These are the absolute basics. If you don't have these enabled, you’re leaving your front door wide open.

- Address Verification Service (AVS): This is a simple check that compares the numbers in the customer's billing address to the address the bank has on file. An AVS mismatch is a major red flag.

- Card Verification Value (CVV): That little 3 or 4-digit code on the back of the card is a powerful tool. Requiring it proves the customer most likely has the physical card in their hand, which stops fraudsters who only have a stolen card number.

Advanced Detection Methods

As fraudsters get more sophisticated, your defenses have to keep up. These methods dig deeper, analyzing behavior and identity signals, not just payment data.

Device Fingerprinting is a fascinating technology that creates a unique ID for a customer’s computer or phone based on hundreds of attributes like their operating system, browser version, language settings, and IP address. If that same device is suddenly used for ten different orders with ten different credit cards, you’ve just caught a fraudster red-handed.

Behavioral Analytics takes it a step further by watching how a user interacts with your site. Did they copy and paste the customer name and address instead of typing? Did they complete the entire checkout process in under 15 seconds—faster than any human could? These subtle behavioral cues are incredibly strong indicators of a bot or a criminal in a hurry.

Pulling these tools together creates a resilient system that can spot trouble from a mile away. This becomes absolutely critical as you scale, especially during the chaos of Q4. To get your defenses in order, running a seasonal security audit is one of the smartest things you can do. You can learn more by checking out a complete ecommerce fraud prevention guide built for the holiday rush.

How to Create a Resilient Fraud Prevention Strategy

Having a solid detection system is one thing, but turning those insights into a coherent, repeatable strategy is how you actually win the fight against fraud. Think of your fraud prevention strategy as a living blueprint for action. It’s a smart blend of automated muscle and sharp human oversight, designed to stop criminals without giving your legitimate customers a headache.

This isn’t about building an impenetrable fortress that no one can get into. That just frustrates good customers. Instead, you're creating a smart, flexible security checkpoint. The goal is to wave honest buyers through with a smile while politely pulling the suspicious ones aside for a closer look.

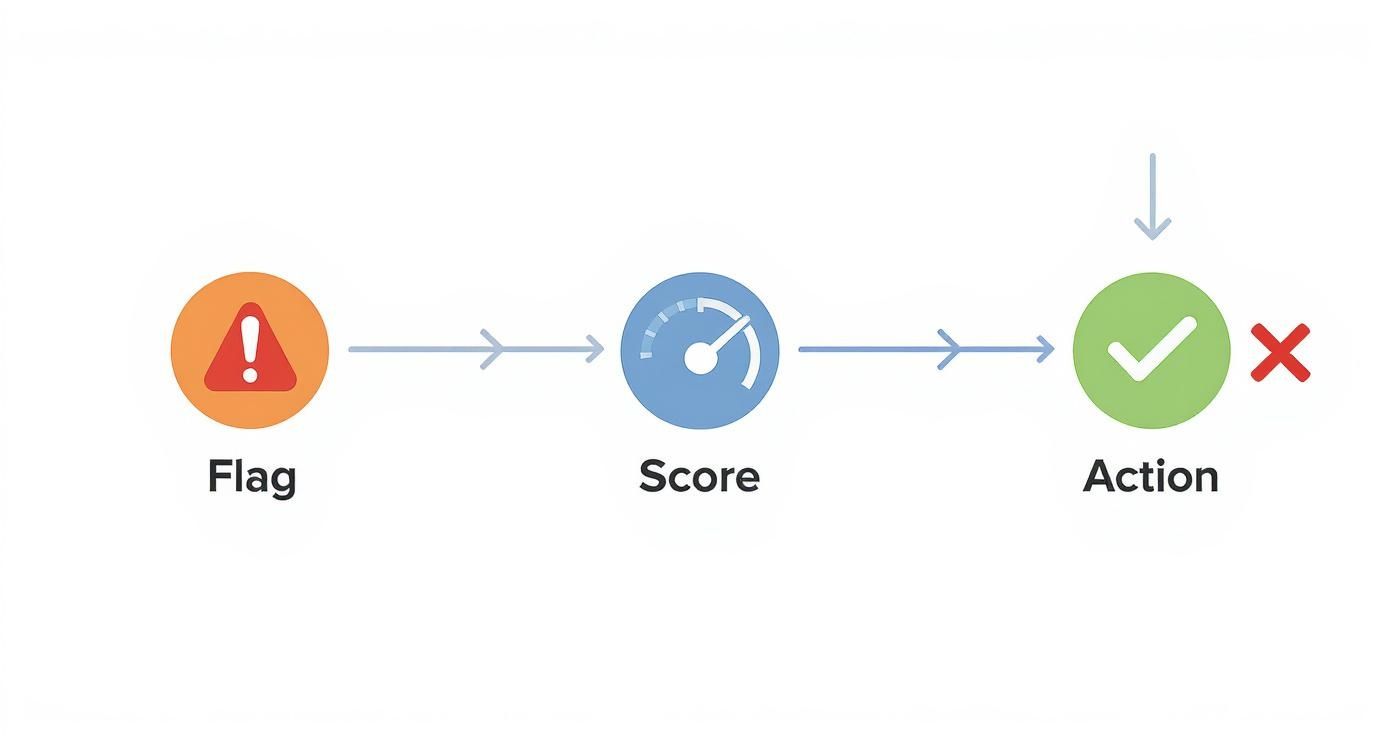

This simple flow shows how an automated system can flag, score, and then guide you to take decisive action on every single order.

As you can see, the core of a great strategy is sorting transactions quickly and cleanly. Is it an approve, review, or reject? Nailing this keeps your business secure and your checkout process smooth.

Setting Up Your Foundational Rules

Whether you’re on Shopify, WooCommerce, or another platform, your first move is to set up your foundational rules. These are the non-negotiable checks that catch the most obvious fraud attempts right out of the gate. They're your first line of defense.

Enable AVS and CVV Checks: This is the absolute bare minimum. Make sure your payment processor is set to reject transactions where the AVS (Address Verification Service) or CVV (Card Verification Value) fails. It’s a simple flip of a switch that filters out a huge amount of lazy fraud.

Implement Velocity Rules: You need to set limits on how many times a user can do something in a short period. For example, you might automatically block an IP address that tries more than five transactions in an hour. This is a killer tactic for shutting down card-testing bots.

Flag High-Risk Geographies: If you keep seeing fraudulent orders from a specific country where you have zero real customers, it's time to act. Create a rule to automatically flag or even block all orders coming from that region.

The Manual Review Playbook

Automation is great for the black-and-white cases, but what about the gray areas? A high-risk score doesn't always equal fraud. It could just be a loyal customer shipping a birthday gift to their daughter across the country. This is where your manual review process is absolutely critical.

A clear, documented workflow empowers your team to make confident, quick decisions on flagged orders. It should look something like this:

- Isolate Flagged Orders: First, create a dedicated queue for any transaction your system flags as medium-to-high risk. Don't let them get lost in the shuffle.

- Cross-Reference Red Flags: The reviewer needs to dig into why the order was flagged. Is it a shipping/billing address mismatch? An unusually high order value? A sketchy-looking email address? Look for a cluster of red flags, not just one.

- Gather External Clues: A little digital detective work goes a long way. Use free online tools to see if the shipping address is a real house or a known freight forwarder. Look up the customer on social media—does their profile seem like a real person?

- Make the Call: With all the evidence in hand, the reviewer makes a final decision. They can either approve the order, cancel and refund it, or reach out to the customer for a bit more verification.

This blend of automated scoring and human intuition creates the perfect balance. The machine filters out the noise, allowing your team to focus their expertise on the handful of transactions that truly need a second look.

Building a Bulletproof Chargeback Response Workflow

Even with the best prevention in place, some disputes are going to slip through. How you respond is the difference between losing revenue and winning it back. A last-minute scramble to find evidence is a guaranteed loss. You need a systematic workflow.

The moment a dispute notification hits your inbox, the clock starts ticking. Here’s a step-by-step process for fighting back effectively:

- Immediate Triage: As soon as a dispute alert arrives, categorize it. Is it clear fraud, a "product not received" claim, or something else? Knowing the reason code is the first step to building your case.

- Evidence Compilation: This is where you go to battle. Gather every single piece of documentation tied to that order. Your evidence checklist must include:

- Order Details: A screenshot of the order confirmation page, showing the items, billing, and shipping info.

- Customer Communications: Any emails, support tickets, or chat logs you have with the customer.

- AVS and CVV Results: Proof that you did your due diligence with these basic checks.

- Delivery Confirmation: This is non-negotiable. You need a tracking number and proof of delivery showing the package arrived at the address the customer provided.

- IP Address Logs: Data showing the geographic location where the order was placed can help disprove claims of an unauthorized transaction.

- Submission and Tracking: Submit your complete evidence package to your payment processor well before the deadline. Keep a simple spreadsheet to track the outcomes so you can spot patterns in your wins and losses. For a deeper dive into building a strong defense, check out these ecommerce fraud prevention best practices.

Managing this process is critical, especially during high-volume seasons like Q4. To really level up, you should consider how to optimize your https://disputely.com/campaign/q4-representment to maximize your win rate.

The New Frontier of AI-Powered Fraud Attacks

The game has completely changed. Ecommerce fraud isn’t about stopping a lone criminal anymore; it’s about defending your store against industrialized attacks run by artificial intelligence and automation. The solo fraudster has been replaced by an army of bots, and the battlefield looks nothing like it did a few years ago.

Trying to stop this new wave of fraud with old, rule-based systems is like trying to stop a tidal wave with a bucket. Those systems were designed to flag one shady transaction at a time. They simply can't keep up with the sheer volume and speed of modern AI-driven attacks.

The Rise of Industrialized Fraud

Today’s fraudsters deploy sophisticated bots that can perfectly imitate real shoppers. These scripts can browse your product pages, add items to a cart, and move through checkout, looking exactly like a legitimate customer. Their primary goal is often large-scale card testing, where they hammer your site with thousands of stolen credit card numbers in a matter of minutes.

The numbers back this up. In 2025 alone, the monetary value of fraud pressure on e-commerce merchants shot up by a staggering 13%. This spike is a direct result of fraud becoming an industrialized operation, with automated bot attacks exploiting security gaps at an unprecedented scale. You can dig into more of the numbers behind these emerging fraud trends and their financial impact.

It's not just card testing, either. AI is also powering hyper-realistic phishing schemes. These attacks generate emails and landing pages so convincing that they trick even your sharpest customers into giving up their passwords or payment details. Once an account is compromised, fraudsters can drain its value before the real owner has any idea what happened.

Fighting an AI-powered attack with a manual, rules-based system is like bringing a knife to a robot fight. To effectively combat automated threats, you need an automated defense that thinks and adapts just as quickly.

Fighting Fire with Fire Using Machine Learning

The only way to realistically counter AI-powered fraud is to use the same technology in your defense. Modern ecommerce fraud prevention platforms rely on machine learning algorithms that analyze thousands of data points in real-time, catching subtle patterns that are completely invisible to a human review team.

These systems don't just look at a single transaction in isolation—they see the entire context. They build a complete picture of a user's behavior, their device, their network, and their history to make a smart, instantaneous decision.

- Behavioral Analysis: Is the customer’s mouse moving naturally, or is it snapping from one field to the next like a bot?

- Device Fingerprinting: Has this exact same device been used with hundreds of different credit cards in the last hour?

- Network Intelligence: Is the IP address coming from a known proxy network commonly used by fraud rings?

This is the new standard for security. Machine learning models can spot a coordinated bot attack the moment it starts and block it, adapting to new tactics without anyone needing to write a new rule. It’s a proactive, intelligent defense built for the threats we're facing now, not the ones from five years ago. Consider this your briefing for the future of keeping your business secure.

Securing Your Store for Long-Term Growth

Think of ecommerce fraud prevention less like a one-time fix and more like an ongoing commitment. It's about staying vigilant and adapting as you grow. Every strategy and tool we've discussed points to one core idea: a proactive, layered defense is the best way to keep your business safe from constantly changing threats.

This isn’t just about stopping fraudsters. It's about creating a secure and trustworthy environment where your real customers feel confident buying from you, time and time again.

Ultimately, you're aiming for that sweet spot between tight security and a smooth, frustration-free customer journey. If your rules are too aggressive, you risk blocking legitimate customers and losing out on sales. But if they're too loose, you open the door to a flood of expensive chargebacks. The trick is to use smart automation for the obvious cases and give your team the right insights to handle the tricky, in-between orders.

Take Your First Step Today

It’s easy to feel overwhelmed by all this, but you don't have to boil the ocean. Real progress starts with a single, manageable step. Focus on tackling your biggest vulnerability first.

A resilient business isn't one that never faces threats, but one that continuously strengthens its defenses. Your long-term growth depends on the small, consistent security improvements you make every day.

Start by taking a hard look at your current chargeback process or reviewing your store’s fraud filter settings. For Shopify merchants, sudden payment holds are often the first red flag that something is wrong. Knowing why this happens is a critical first step. You can learn more about how to resolve a Shopify payment hold and start protecting your cash flow today.

Common Questions on Fraud Prevention

Getting started with fraud prevention can feel overwhelming, and it's natural to have questions. Let's walk through some of the most common ones I hear from merchants, with practical answers to help you secure your store right away.

What’s the Very First Thing I Should Do to Prevent Fraud?

Before you do anything else, go into your payment processor's settings and turn on the two most basic security checks: the Address Verification Service (AVS) and the Card Verification Value (CVV). Make them mandatory for every single transaction.

Think of it this way: these are the deadbolts on your digital storefront. They're a simple, free way to immediately stop a huge chunk of amateur fraud. Most low-level criminals only have a list of stolen card numbers, not the billing address or the three-digit code on the back of the physical card. This one move filters them out instantly.

How Do I Fight Chargebacks Without Angering Good Customers?

This is a delicate balance, but the key is to treat fraud prevention and customer service as separate motions. When you spot a high-risk order, don't just block it. A quick, friendly verification email can make all the difference. Frame it as a routine check to protect their account, not as an accusation. Most honest customers will appreciate the extra security.

When a dispute has already been filed, winning comes down to organized, compelling evidence. As we covered in the chargeback response workflow, your best defense is providing clear proof—things like delivery confirmations, AVS/CVV match logs, and any emails you exchanged with the customer. A professional, fact-based response protects your revenue without making things personal.

The goal isn't to build an impenetrable fortress that keeps everyone out. It’s to create a smart security system that welcomes legitimate customers while gently but firmly stopping suspicious actors at the gate. A balanced approach protects both your bottom line and your customer relationships.

Are the Basic Fraud Apps Enough to Protect My Store?

A basic, rule-based app is a solid starting point, but you'll likely outgrow it. These tools are fantastic for catching the most obvious red flags, but their rigidity is often their downfall. They tend to generate a high number of false positives, which means they end up blocking legitimate orders from perfectly good customers.

As we saw when looking at AI-powered attacks, modern fraud is often too subtle for simple rules. To stay protected long-term, you need a system that can understand behavior and connect the dots between complex patterns, not just check boxes.

How Do I Know if My Business Is a Target for Fraud?

Here’s the hard truth: if you sell anything online, you’re a target. Fraudsters are opportunistic and look for weaknesses, not specific types of businesses. That said, some stores are definitely more attractive targets than others. You might be at higher risk if you:

- Sell popular, easy-to-resell items like electronics, designer sneakers, or luxury goods.

- Offer digital products or gift cards with instant delivery.

- Have an especially generous return policy.

The most direct way to gauge your risk is to watch your chargeback rate like a hawk. If that number starts to climb, it’s the clearest signal you can get that fraudsters have found a crack in your defenses.

Ready to stop chargebacks before they happen? Disputely integrates directly with card networks to alert you the moment a dispute is initiated, giving you time to refund the transaction and protect your merchant account. See how much you can save and connect your store in under 5 minutes.