10 Ecommerce Fraud Prevention Best Practices for 2025

The digital marketplace is expanding at an unprecedented rate, but so are the threats that come with it. For ecommerce merchants, staying ahead of sophisticated fraudsters isn't just a technical challenge; it's a critical business imperative. A single vulnerability can lead to devastating financial losses, damage customer trust, and jeopardize relationships with payment processors. The difference between thriving and surviving often comes down to a robust, multi-layered security strategy.

A foundational aspect of fortifying any digital storefront against fraud involves understanding and implementing robust security protocols. As detailed in guides on how to ensure data security and compliance, a comprehensive approach protects both your business and your customers. This listicle moves beyond generic advice to provide a definitive roundup of the top ecommerce fraud prevention best practices for today's market. We'll dissect each tactic, from foundational verification systems like AVS and CVV checks to advanced behavioral analytics and device fingerprinting.

This guide is designed for action. For each of the ten strategies covered, you'll find specific implementation details, real-world examples of how they stop fraud in its tracks, and the key metrics you need to monitor. We will explore everything from real-time fraud rules to effective chargeback mitigation, providing a clear roadmap for payment teams and merchants on platforms like Shopify, WooCommerce, or custom carts. By implementing these strategies, you can build a resilient defense that not only stops fraud but also protects your revenue and reputation in an increasingly complex landscape.

1. Implement Foundational Checks: AVS and CVV Verification

The first and most crucial line of defense in any ecommerce fraud prevention strategy involves two fundamental verification tools provided by payment processors: the Address Verification System (AVS) and Card Verification Value (CVV). These checks are your non-negotiable building blocks, acting as an initial security gate that filters out a significant volume of unsophisticated fraud.

AVS cross-references the billing address entered by the customer with the address on file at their card-issuing bank. CVV verification requires the customer to provide the 3-4 digit security code from the physical card. Together, they create a powerful barrier against criminals using lists of stolen card numbers, which often lack this associated data.

Why This is a Foundational Practice

Ignoring these checks is equivalent to leaving your front door unlocked. They are highly effective at stopping low-effort fraud attempts, forcing criminals to either abandon the transaction or seek out less-protected merchants. For businesses processing over 5,000 transactions a month, enabling these automatic checks can prevent hundreds of fraudulent orders without manual intervention.

How to Implement AVS and CVV Checks

Most payment gateways like Stripe, Shopify Payments, and Authorize.net have AVS and CVV checks enabled by default, but their response handling is often customizable.

- Configure Your Rules: Decide how to handle AVS mismatches. You can set rules to automatically decline transactions with a complete AVS mismatch (

Ncode for no match) while allowing partial matches (e.g., zip code matches but street address does not) to be flagged for manual review. - Enforce CVV Checks: Always require the CVV for new transactions. Platforms like Amazon often re-prompt for the CVV when a new shipping address is added, even for a saved card, which is an excellent security practice.

- Never Store CVV Data: Storing the CVV post-authorization is a major violation of Payment Card Industry Data Security Standard (PCI-DSS) compliance. Your payment gateway handles the check without you ever needing to store the data.

Key Insight: AVS and CVV checks are not foolproof on their own, but their true power lies in their integration with other data points. An AVS mismatch from a high-risk IP address is a much stronger fraud signal than a mismatch from a loyal customer's known device. This contextual analysis turns basic checks into a sophisticated defense mechanism.

2. Leverage Strong Customer Authentication (SCA) with 3D Secure

Beyond foundational checks, the next layer of an effective ecommerce fraud prevention strategy is Strong Customer Authentication (SCA), most commonly implemented through 3D Secure (3DS). This is a security protocol that provides an additional authentication step for online card payments, designed to confirm that the person making the purchase is the legitimate cardholder.

Where AVS and CVV verify data associated with a card, 3D Secure verifies the identity of the user themselves. The protocol redirects the customer to their bank's domain to complete a verification challenge, which could be a one-time password sent to their phone, a biometric scan via their banking app, or another method. This is the online equivalent of entering a PIN at a physical terminal.

Why This is a Foundational Practice

Implementing 3D Secure is one of the most powerful moves a merchant can make to combat fraudulent chargebacks. Its primary benefit is the liability shift. When a transaction is successfully authenticated with 3DS, the liability for any subsequent fraud-related chargebacks shifts from you, the merchant, to the card-issuing bank. For businesses in high-risk industries or those frequently targeted by "friendly fraud," this protection is invaluable.

How to Implement 3D Secure

Modern payment gateways have integrated the latest version, 3D Secure 2 (3DS2), which uses rich data to assess risk and only triggers the challenge for high-risk transactions, creating a frictionless flow for legitimate customers.

- Enable 3DS in Your Payment Gateway: In platforms like Stripe or Adyen, you can enable 3D Secure through your account settings. Many gateways allow you to create rules that request 3DS only when certain risk conditions are met, such as for unusually large orders or first-time customers.

- Understand Dynamic Triggering: Instead of forcing every customer through a 3DS challenge, use it strategically. The protocol can run silently in the background, sharing over 100 data points between your business and the cardholder's bank to assess risk. The challenge is only presented when the bank deems it necessary.

- Educate Yourself on the Benefits: The liability shift is a critical concept for any merchant to grasp. For a deeper dive into how this powerful authentication method works, refer to an article on understanding 3DS2 liability shift authentication.

Key Insight: The power of 3D Secure 2 is its intelligence. It minimizes friction by only challenging suspicious transactions, preserving the user experience for the vast majority of your customers. This selective approach allows you to secure transactions and benefit from the liability shift without creating unnecessary hurdles that could hurt conversion rates.

3. Employ 3D Secure (3DS) Authentication

While foundational checks filter out basic fraud, 3D Secure (3DS) adds a powerful, dynamic layer of authentication that shifts liability for fraudulent chargebacks away from you and back to the card-issuing bank. It acts as a digital version of a chip-and-PIN transaction, requiring customers to actively prove their identity directly with their bank during checkout.

3D Secure redirects the customer to their bank's authentication page, where they might enter a one-time password sent via SMS, use a biometric scan on their banking app, or answer a security question. This process confirms the legitimate cardholder is present and authorizing the purchase, making it an extremely effective tool in your ecommerce fraud prevention arsenal.

Why This is a Foundational Practice

3D Secure is no longer a "nice-to-have" security feature; for many businesses, it's a necessity. In regions covered by regulations like Europe's PSD2, Strong Customer Authentication (SCA) is mandatory, and 3DS is the primary method for compliance. For merchants in other regions, selectively applying 3DS to high-risk transactions provides a liability shift, meaning if a 3DS-authenticated transaction results in a fraud-related chargeback, the issuing bank absorbs the loss.

How to Implement 3D Secure

Modern payment gateways like Stripe, Adyen, and Square have made implementing the latest version, 3DS 2.0, much simpler. This version introduces "frictionless" authentication, using rich data to assess risk without always requiring customer interaction.

- Activate 3DS in Your Gateway: Most providers allow you to enable 3DS with a simple toggle in your dashboard. You can often create rules to trigger it only for specific scenarios, such as transactions over a certain value or those originating from high-risk countries.

- Leverage 3DS 2.0: Ensure you are using the latest version. 3DS 2.0 allows for a risk-based approach where low-risk transactions are approved without a challenge, preserving a smooth user experience and minimizing cart abandonment.

- Understand Exemptions: Be aware of SCA exemptions for low-value transactions or recurring subscriptions. Correctly flagging these transactions can help you bypass 3DS when it's not needed, further improving the checkout flow.

Key Insight: The strategic power of 3D Secure lies in its selective application. Instead of forcing every customer through an authentication hoop, use it as a surgical tool. Trigger 3DS authentication only when other risk signals-like a new customer placing an unusually large order with overnight shipping-are present. This balances robust security with a seamless experience for your trusted customers.

4. Leverage Machine Learning and Behavioral Analysis

As fraudsters become more sophisticated, static rules alone are not enough. This is where machine learning (ML) and behavioral analysis become essential components of a modern ecommerce fraud prevention best practices stack. These systems analyze thousands of data points in real-time to uncover hidden patterns and anomalies indicative of fraud, adapting continuously as new threats emerge.

Instead of just checking a single data point like an AVS mismatch, ML models assess the entire context of a transaction. They evaluate everything from device fingerprints and IP geolocation to mouse movements and typing speed, comparing this behavior against a vast dataset of both fraudulent and legitimate orders. This allows them to assign a dynamic risk score to each transaction with remarkable accuracy.

Why This is an Advanced Practice

Machine learning moves your fraud prevention from a reactive to a proactive state. It excels at identifying novel fraud tactics that haven't been seen before, something rule-based systems inherently struggle with. For high-volume merchants, platforms like Stripe and PayPal prevent billions in fraud annually by using complex ML models to identify high-risk transactions before they can become costly chargebacks.

How to Implement Machine Learning

Integrating machine learning doesn't necessarily mean building a data science team from scratch. Many third-party solutions and payment gateways have powerful models built-in.

- Start with Built-in Tools: Leverage the ML capabilities of your existing payment gateway (e.g., Stripe Radar, Shopify Fraud Protect). These are trained on massive networks and offer excellent protection out of the box.

- Ensure Data Quality: The performance of any ML model is directly tied to the quality of the data it's trained on. Ensure your transaction data is clean, consistent, and accurately labeled (e.g., correctly tagging chargebacks with fraud reason codes).

- Combine with Manual Review: Use ML to automate decisions for clearly low-risk and high-risk orders, but send transactions with moderate risk scores to a queue for manual review. This human-in-the-loop approach balances automation with accuracy.

- Monitor and Retrain: Fraud trends change. It's crucial to monitor your model's performance for "drift" where its accuracy declines over time. Periodically retrain the model with fresh data to keep it effective. To get a clear picture of your system's performance, you can get a comprehensive analysis with a Q4 operational audit.

Key Insight: The true power of machine learning is its ability to connect seemingly unrelated data points. It can flag an order that looks legitimate on the surface (e.g., matching AVS/CVV) because it detects subtle behavioral anomalies, like the customer pasting card details from a clipboard and rushing through checkout, which is common in automated bot attacks.

5. Utilize Velocity and Pattern Analysis

Beyond scrutinizing individual transactions, a sophisticated ecommerce fraud prevention strategy involves analyzing the rate and rhythm of user behavior over time. This is the core of velocity and pattern analysis, which monitors the frequency of actions from a single data point-like an IP address, device, email, or credit card-within a specific timeframe to detect suspicious acceleration.

This technique is incredibly effective at identifying automated bot attacks, such as card testing, where a fraudster rapidly checks the validity of a list of stolen card numbers with small transactions. It also flags manual fraud where a criminal makes multiple quick purchases before a stolen card is reported. By setting rules that track these patterns, you can stop coordinated attacks in their tracks.

Why This is a Foundational Practice

Velocity analysis acts as your system's tripwire. While a single fraudulent order might slip through basic checks, a high-velocity attack is a loud, clear signal that something is wrong. Platforms like Shopify automatically flag accounts with an unusual number of failed payment attempts, and payment processors use "impossible travel" velocity (e.g., a card used in New York and then Tokyo an hour later) as a hard decline rule. This automated monitoring is crucial for protecting your business from large-scale, rapid-fire fraud.

How to Implement Velocity Analysis

Your payment gateway, fraud prevention tool, or even your ecommerce platform may have built-in velocity rules that you can configure to match your business's typical customer behavior.

- Establish Smart Thresholds: Define rules that trigger a review or a block. For example, flag any IP address that attempts more than three transactions with different cards in an hour, or any customer account that tries more than five payment attempts in 15 minutes.

- Monitor Multiple Data Points: The most effective velocity rules correlate several data points. A rule that looks for a high number of transactions from a new device using a new email address in a short period is far more precise than one that only looks at the IP address.

- Create Whitelists for Trusted Users: Legitimate customers, like corporate buyers or resellers, may exhibit high-velocity behavior. Create whitelists or customer segments for these known good actors to bypass strict velocity rules and avoid creating unnecessary friction for your best customers.

Key Insight: Velocity rules are not "set it and forget it." Your baseline for normal customer behavior will change during sales events, holidays, or product launches. Your rules must be dynamic. Temporarily relax certain thresholds during a Black Friday sale to avoid flagging legitimate bulk buyers, but tighten them again once the promotion ends to maintain strong security.

6. Device Fingerprinting and Behavioral Biometrics

Beyond transaction data, some of the most powerful fraud signals come from the customer's device itself. Device fingerprinting creates a unique, persistent ID for a user’s computer or phone by analyzing a combination of hardware and software attributes, such as browser version, operating system, screen resolution, and installed plugins. This digital "fingerprint" helps you recognize legitimate returning customers, even if they clear their cookies.

When combined with behavioral biometrics which analyzes how a user interacts with your site (typing speed, mouse movements, scrolling patterns), this practice becomes an incredibly sophisticated tool. It helps distinguish between a genuine customer and a fraudster using stolen credentials by identifying anomalies in their digital behavior, a key tactic in modern ecommerce fraud prevention best practices.

Why This is a Foundational Practice

This approach excels at detecting complex fraud types like account takeover (ATO) and sophisticated bot attacks that basic checks miss. If a known customer suddenly logs in from a new device fingerprint in a high-risk country with jerky mouse movements, your system can flag it instantly. For businesses with a high lifetime value customer base, protecting user accounts is as critical as preventing fraudulent transactions.

How to Implement Device Fingerprinting and Biometrics

Integrating these advanced tools usually requires a specialized fraud prevention solution, as they are complex to build in-house. Providers like ThreatMetrix and BioCatch offer robust platforms for this.

- Integrate a Third-Party Solution: Choose a vendor that provides a simple SDK or API to embed on your site. This script will collect the necessary data points in the background during a user's session without impacting their experience.

- Establish a Baseline: Allow the system to collect data to build a baseline profile for legitimate user behavior and device usage. This "learning" period is crucial for accuracy.

- Create Risk-Based Rules: Configure rules based on the data. For example, you can trigger a multi-factor authentication (MFA) challenge for logins from an unrecognized device, or flag orders for manual review if the behavioral biometrics don't match the customer's known patterns.

- Ensure Transparency and Compliance: Clearly state in your privacy policy that you collect device and behavioral data for security purposes. This is essential for GDPR and CCPA compliance.

Key Insight: The power of device fingerprinting is its ability to link seemingly unrelated fraudulent activities. If multiple "new" accounts place orders using different stolen credit cards but all originate from the same unique device fingerprint, you've uncovered a fraud ring, not just individual bad transactions. This allows you to block the source, not just the symptoms.

7. Geolocation Verification

Analyzing a customer's physical location provides powerful, real-time context that can confirm a legitimate purchase or expose a fraudulent one. Geolocation verification leverages data like IP addresses, GPS, and Wi-Fi triangulation to pinpoint where a transaction is originating from. This allows you to cross-reference the customer’s digital footprint with their stated billing and shipping details, creating a crucial layer of security.

This practice is essential for spotting obvious red flags in card-not-present fraud scenarios. For example, an order placed using a credit card with a New York billing address that originates from an IP address in Eastern Europe should immediately trigger a high-risk alert. By flagging these geographical inconsistencies, you can stop fraudsters who are physically distant from their victims.

Why This is a Foundational Practice

Geolocation data answers the critical question: "Does this transaction make sense geographically?" A fraudster can steal credit card numbers, but they cannot easily hide their physical location from sophisticated tracking tools. This makes geolocation an effective method for identifying high-risk orders, especially for businesses that ship physical goods or have a defined regional customer base. For a brand that only ships within the United States, an order from an international IP is an immediate and clear fraud signal.

How to Implement Geolocation Verification

Most advanced fraud prevention tools and payment gateways offer built-in geolocation analysis, but you can refine how you use this data.

- Flag High-Risk Geographies: Create rules that automatically flag or decline orders originating from countries or regions known for high rates of fraudulent activity.

- Check for Impossible Travel: Modern fraud systems can detect "impossible travel" scenarios, such as a card being used in London and then, just 30 minutes later, in Los Angeles. This is a strong indicator of coordinated fraud.

- Integrate VPN and Proxy Detection: Fraudsters often use VPNs or proxies to mask their true location. Employ services that can identify these anonymizers, as their use significantly increases the risk profile of a transaction.

- Compare IP to Shipping/Billing: The most common check is to compare the IP address location to the shipping and billing addresses. A significant mismatch, like a transaction from a Nigerian IP shipping to a Florida address, warrants immediate manual review.

Key Insight: Geolocation is most powerful when combined with other data points, not as a standalone indicator. A legitimate customer might use a VPN for privacy or be traveling abroad. However, when a masked IP is combined with a new customer account, a high-value order, and a failed AVS check, the probability of fraud becomes extremely high. Context transforms location data from a simple signal into a decisive piece of evidence.

8. Establish Proactive Chargeback Monitoring and Prevention

While many fraud prevention efforts focus on stopping bad transactions upfront, a critical secondary strategy involves managing the chargebacks that inevitably occur. Chargeback monitoring is the process of tracking, analyzing, and responding to customer disputes. A robust approach not only helps you recover revenue but also reveals weaknesses in your customer experience and fraud detection systems.

Effectively managing chargebacks is essential for maintaining a healthy relationship with your payment processor. Exceeding the industry-standard 1% chargeback-to-transaction ratio can lead to higher processing fees, mandatory monitoring programs, or even account termination. This makes proactive monitoring a non-negotiable part of any comprehensive ecommerce fraud prevention best practices.

Why This is a Foundational Practice

A high chargeback rate is a symptom of deeper issues. It could signal friendly fraud, true fraud that slipped through your defenses, or operational failures like unclear product descriptions or delayed shipping. By analyzing chargeback reason codes, you can identify these root causes and address them directly, preventing future disputes and protecting your bottom line. Companies like Amazon use this data to refine everything from product listings to their customer service protocols, turning a negative event into a valuable learning opportunity.

How to Implement Chargeback Monitoring and Prevention

Your payment gateway (like Stripe or PayPal) is the starting point, but a dedicated strategy is necessary to keep rates low and win disputes.

- Implement Chargeback Alerts: Services like Ethoca and Verifi provide alerts that notify you of a pending dispute before it becomes a formal chargeback. This gives you a window to issue a refund and avoid the dispute altogether, protecting your chargeback ratio.

- Maintain Meticulous Records: For every transaction, keep detailed documentation including the customer’s IP address, device fingerprint, AVS/CVV responses, and all communications like order and shipping confirmations. This evidence is crucial for fighting illegitimate chargebacks. For more advanced strategies, you can learn more about chargeback representment.

- Analyze Reason Codes: Regularly review your chargeback data. Are you seeing a lot of "Product Not as Described" codes? Revisit your product pages. A spike in "Transaction Not Recognized" could point to a need for clearer billing descriptors.

- Make Customer Service Accessible: Ensure customers can easily contact you with issues. A prominent "Contact Us" page with a phone number or live chat can divert many potential disputes before a customer calls their bank.

Key Insight: Treat every chargeback as a data point. A single dispute might be an anomaly, but a pattern reveals a systemic vulnerability. By categorizing chargebacks by reason, product, and customer segment, you can transform reactive dispute management into a proactive strategy that improves both security and customer satisfaction.

9. Email Verification and List Monitoring

An email address is more than just a contact point; it's a digital identity marker that provides valuable clues about a customer's legitimacy. Implementing robust email verification and list monitoring allows you to scrutinize this data point, identifying high-risk signals before a fraudulent transaction is even attempted. This proactive measure is a core component of modern ecommerce fraud prevention best practices.

This process involves two key actions. First, verifying that an email address is valid, deliverable, and not from a disposable or temporary service. Second, cross-referencing the email against internal blocklists and external databases of known fraudulent accounts. This combination helps prevent fraudsters from creating synthetic identities or reusing addresses linked to previous chargebacks.

Why This is a Foundational Practice

A fraudster's goal is to create as many accounts as possible with minimal effort. Disposable email services are their primary tool for achieving this at scale. By blocking these and monitoring email reputation, you create significant friction for bad actors, forcing them to use more established, traceable email accounts. For businesses seeing high rates of new account fraud or promo abuse, analyzing email characteristics can shut down entire fraud rings.

How to Implement Email Verification and Monitoring

Many fraud prevention tools offer email risk scoring as a feature, but you can also implement standalone checks at key customer touchpoints like registration and checkout.

- Integrate Real-Time Verification: Use an API-based service (like Emailable or ZeroBounce) at the point of entry. This instantly checks for syntax errors, domain validity, and whether the address is from a known disposable provider.

- Analyze Email Age and Reputation: Look beyond simple validity. An email address created just hours before a high-value purchase is a major red flag. Services that provide an email's "first seen" date are incredibly valuable for risk scoring.

- Maintain an Internal Blocklist: Automatically add the email addresses associated with confirmed chargebacks, refund abuse, or fraudulent activity to a permanent internal blocklist. This prevents repeat offenders from simply trying again with a new payment card.

Key Insight: The email address is often the most consistent data point a fraudster uses across different stolen identities. While they can cycle through stolen credit cards, they frequently reuse the same set of email addresses for convenience. By focusing on blocking and tracking these emails, you can neutralize a fraudster's entire operation, not just a single transaction.

10. Real-Time Fraud Rules and Decision Management

While machine learning models excel at finding hidden patterns, a robust fraud prevention strategy also needs the precision of human-defined logic. Real-time fraud rules provide this control, allowing you to create a customizable engine that automatically approves, flags, or declines transactions based on criteria you set. This acts as a powerful complement to other systems, giving you direct control over your risk tolerance.

A rules engine can combine multiple data points into a single decision. For example, a rule could be: "If the transaction amount is > $500 AND the shipping address is different from the billing address AND the IP address is from a high-risk country, THEN flag for manual review." This allows for a nuanced approach that static checks like AVS/CVV alone cannot provide.

Why This is a Foundational Practice

A rules engine transforms your fraud prevention from a passive to an active system. It empowers you to respond immediately to new fraud trends specific to your business without waiting for a model to retrain. If you notice a spike in fraud from a particular region using a specific payment method, you can deploy a rule in minutes to block or review those transactions, effectively shutting down the attack vector.

How to Implement Real-Time Fraud Rules

Most modern payment processors and dedicated fraud platforms offer sophisticated rule-building interfaces. Stripe Radar for Fraud Teams, for example, allows for extensive custom rule creation.

- Start Simple and Iterate: Begin with basic, high-confidence rules. A good starting point is to decline transactions where the shipping address is a known freight forwarder and the order value is unusually high.

- Segment Your Rules: Don't apply a one-size-fits-all approach. Create different rule sets for new customers versus loyal, high-LTV customers. You can be more lenient with trusted users to reduce friction.

- Test and Monitor: Before deploying a new rule, test it against historical data to understand its potential impact on both fraud rates and false declines. Once live, constantly monitor its performance and adjust thresholds. For instance, you might notice that a specific rule is putting a temporary hold on too many good Shopify orders and needs to be refined.

- Combine with ML Scores: Use rules to handle the output of machine learning models. For example, create a rule to automatically approve all transactions with a risk score below 10, manually review those between 10-60, and decline anything above 60.

Key Insight: The most effective fraud rules are not set-and-forget. They are dynamic, reflecting your business's real-time fraud patterns. Regularly review your fraud data and chargeback reason codes to identify new patterns that can be translated into precise, effective rules. This continuous feedback loop is what makes a rules engine a cornerstone of modern ecommerce fraud prevention best practices.

Ecommerce Fraud Prevention: 10-Point Comparison

| Solution | Implementation (🔄) | Resources (⚡) | Expected outcomes (⭐) | Ideal use cases (💡) | Key advantages (📊) |

|---|---|---|---|---|---|

| Address Verification System (AVS) | 🔄 Low — simple gateway address check | ⚡ Low — minimal dev & integration | ⭐ High — reduces CNP fraud & chargebacks | 💡 Retail checkout, US-focused transactions | 📊 Fast, low-cost, industry-standard; minimal UX impact |

| CVV/CVC Verification | 🔄 Low — standard checkout field | ⚡ Low — processor validates in real time | ⭐ Very High — strong possession proof; ≈80% fraud reduction | 💡 Card-not-present payments, standard checkouts | 📊 Simple, familiar, PCI-sensitive (do not store CVV) |

| 3D Secure (3DS) Authentication | 🔄 Medium–High — issuer redirect & flows | ⚡ Medium — auth flows, customer friction, vendor support | ⭐ Very High — strong authentication; liability shift to issuer | 💡 High-value txns, EU SCA compliance, chargeback-prone merchants | 📊 Reduces fraud and chargebacks; enables liability shift |

| Machine Learning & Behavioral Analysis | 🔄 High — models, pipelines, ML ops | ⚡ High — data, data scientists, compute, maintenance | ⭐ Very High — detects sophisticated/emerging patterns; fewer false positives | 💡 High-volume platforms, complex/adaptive fraud environments | 📊 Adaptive, scalable detection; improves over time |

| Velocity & Pattern Analysis | 🔄 Medium — rule thresholds & monitoring | ⚡ Medium — tracking, logs, tuning effort | ⭐ High — catches bulk testing and rapid fraud | 💡 Card testing, account takeover detection, high-traffic stores | 📊 Effective vs organized/bulk fraud; configurable thresholds |

| Device Fingerprinting & Behavioral Biometrics | 🔄 Medium — client-side collection + analysis | ⚡ Medium — vendor fees, analytics, privacy work | ⭐ High — detects returning fraudsters & ATOs invisibly | 💡 Login protection, account takeover prevention, high-risk checks | 📊 High accuracy when combined with other signals; low UX impact |

| Geolocation Verification | 🔄 Low–Medium — IP/GPS checks and comparisons | ⚡ Low — geolocation DBs; optional GPS integration | ⭐ Medium — flags cross-border, VPN, impossible-travel cases | 💡 International fraud detection, shipping vs transaction checks | 📊 Inexpensive; effective against geographically distant fraud |

| Chargeback Monitoring & Prevention | 🔄 Medium — tracking, workflows, representment | ⚡ Medium — ops time, documentation, integration | ⭐ Medium — reduces long-term chargebacks, protects processor standing | 💡 Merchants with rising disputes, subscription services | 📊 Identifies systemic issues; supports disputes and representment |

| Email Verification & List Monitoring | 🔄 Low — integration with validation APIs | ⚡ Low — third‑party services, light dev work | ⭐ Medium — reduces fake accounts and disposable email use | 💡 Account creation, marketplaces, gaming registrations | 📊 Low-cost; prevents bot signups and disposable-email abuse |

| Real-Time Fraud Rules & Decision Management | 🔄 Low–Medium — rules engine and workflows | ⚡ Medium — staff to maintain, integrate signals | ⭐ High — fast, transparent decisions; adjustable by business | 💡 Businesses needing granular control and segmentation | 📊 Flexible customization; easy testing and rapid iteration |

Building a Resilient, Multi-Layered Fraud Defense

Implementing a robust ecommerce fraud prevention strategy is not a "set it and forget it" task. It is a dynamic, continuous process of adaptation, learning, and reinforcement. As we have explored, there is no single solution or magic bullet that will eliminate all risk. Instead, true security comes from building a resilient, multi-layered defense where each practice works in concert to protect your revenue and your customers.

The journey from foundational checks like AVS and CVV to advanced systems like machine learning and device fingerprinting represents a maturation of your security posture. Each layer you add makes your business a harder, less profitable target for fraudsters. This strategic depth is the cornerstone of effective ecommerce fraud prevention best practices.

From Individual Tactics to a Unified Strategy

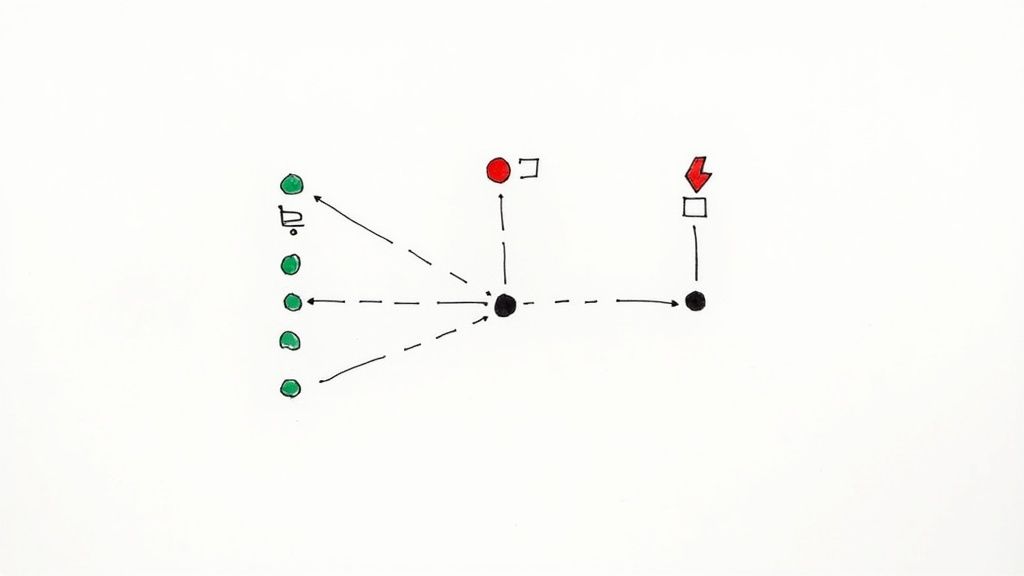

Thinking of these practices as isolated tools is a common mistake. Their real power is unlocked when they operate as a cohesive system. For example, AVS and CVV provide a baseline, while 3D Secure adds a critical authentication step for high-risk orders. Meanwhile, machine learning and velocity analysis work silently in the background, identifying subtle, suspicious patterns that individual rules might miss.

Your goal is to create a security ecosystem where:

- Data from one tool informs another: Geolocation data can be combined with device fingerprinting to flag a transaction where a customer’s IP address is in one country, their shipping address is in another, and their device has a history of fraudulent activity.

- Friction is applied intelligently: Instead of challenging every customer, you can reserve strong authentication measures like 3D Secure for transactions that exhibit multiple risk signals, preserving a seamless experience for legitimate buyers.

- Your team is empowered, not overwhelmed: Automated rules and machine learning should handle the bulk of clear-cut cases (both approvals and denials), freeing up your team to manually review the complex, grey-area transactions that require human intuition.

Key Takeaway: The most effective fraud prevention is not about building an impenetrable wall, which can block good customers. It's about creating an intelligent, flexible filter that dynamically assesses risk and responds appropriately, moment by moment.

The Proactive Imperative: Beyond Prevention

While preventing fraud is the primary objective, a complete strategy must acknowledge that some fraudulent transactions and disputes are inevitable. This is where the final, crucial layer of your defense comes into play: proactive dispute management. Waiting for a dispute to escalate into a chargeback is a reactive posture that costs you revenue, incurs fees, and damages your relationship with payment processors.

Embracing a proactive approach means intercepting disputes at the earliest possible stage, resolving them before they impact your chargeback ratio. This not only protects your bottom line on a case-by-case basis but also safeguards your merchant accounts, which are the lifeblood of your ecommerce operation. By combining a strong, multi-layered prevention framework with an equally strong dispute resolution plan, you create a comprehensive shield around your business. You’re not just stopping fraud; you’re building a resilient operation that can absorb shocks and continue to thrive in an ever-evolving digital landscape.

Ready to complete your fraud defense with automated, expert-driven dispute resolution? Disputely integrates directly with your payment processors to intercept disputes before they become costly chargebacks, protecting your revenue and merchant health. Discover how our proactive approach complements your ecommerce fraud prevention best practices by visiting Disputely today.