Format for rebuttal letter: Winning Chargeback Disputes With the Right Approach

The best way to think about your rebuttal letter format is as a one-page cover letter for all your evidence. It needs to be sharp and to the point. Your goal is to clearly state the dispute details, summarize why the chargeback is invalid, and then neatly itemize every piece of proof you’ve attached to back it up.

Why Your Rebuttal Letter Format Is Your First Line of Defense

Let's be blunt: generic, copy-paste templates won't cut it. The way you structure your rebuttal letter is arguably the most critical piece of the puzzle when you're fighting a chargeback. You have to remember that dispute analysts at the major card networks are wading through hundreds of these cases every single day.

When they see a clear, well-structured response, it makes their job easier and immediately frames your case as credible and professional. This isn't just about looking good—it's a core strategy.

A logical format acts like a roadmap, guiding the analyst straight through your evidence. From my experience, this translates directly into higher win rates. On the flip side, if your response is a jumbled mess, you're forcing the analyst to solve a puzzle they simply don't have the time or patience for. That almost always results in a swift denial, even if your evidence is rock-solid.

The Unwritten Rules of Dispute Resolution

Card networks like Visa and Mastercard are built on efficiency. They have very specific, prescriptive guidelines for dispute responses because they need to process an immense volume of claims quickly and consistently. Your rebuttal letter is your first—and often only—shot to make a compelling impression.

Here’s what a solid format really does for you:

- Establishes Professionalism: It proves you take this process seriously.

- Creates Clarity: It builds a logical argument that’s easy to follow.

- Highlights Key Evidence: It shines a spotlight on your most compelling proof.

- Reduces Review Time: It helps the analyst get to a "yes" faster.

A disorganized rebuttal is a massive red flag for any dispute analyst. By presenting a clean, logical format for your rebuttal letter, you’re not just sending over a pile of documents; you’re building a case that’s easy to understand and tough to argue against.

The Numbers Tell the Story

Let's face it, the odds in the chargeback process are often stacked against merchants. This is why the content and structure of your rebuttal are your most powerful weapons. Data from Mastercard’s 2025 State of Chargebacks report shows that while merchants fight back against 54% of disputes, they only manage to win about 20% of those cases.

Think about that. For every 100 disputes, merchants only successfully reverse 10 or 11 of them. Success almost always hinges on how clearly the evidence was presented in that initial rebuttal package. You can dig deeper into these chargeback statistics and trends to see the full picture.

This reality makes a precise, strategic approach non-negotiable. A well-crafted rebuttal can be the one thing that separates recovering your revenue from writing it off as a loss. It's also worth noting that pre-dispute resolution tools, like alerts from Visa RDR and Mastercard CDRN, can help you sidestep this process entirely. They give you a chance to refund the customer before a formal chargeback is filed, protecting your merchant account from the get-go.

How to Structure a Winning Rebuttal Letter

Think of your rebuttal letter as the cover letter for your entire evidence package. Its job is to make a powerful first impression on a busy dispute analyst who has a stack of cases to get through. It needs to clearly summarize your position and guide them, step-by-step, through your proof.

A winning format isn't just a checklist; it's a strategic blueprint designed for clarity and persuasion. Each component plays a crucial role in building an argument that is impossible to ignore. From a subject line that gets straight to the point to a conclusion that demands action, every element has to work together.

Start with a Powerful, Direct Opening

Your opening needs to be concise and hit hard. Immediately state the purpose of the letter and summarize your core argument in one or two sentences. This isn't the place for a long story; it's the thesis statement for your entire case.

For example, a strong opening looks like this:

"This letter is in response to chargeback [Case #12345] for [$99.99]. We are contesting this dispute as the transaction was legitimate, and the digital product was successfully delivered and accessed by the cardholder on [Date]."

That simple statement tells the analyst everything they need to know right away: the case number, the amount, and exactly why you believe the chargeback is invalid.

Build a Factual, Chronological Narrative

After your opening, provide a brief, step-by-step account of what happened. This narrative should be a factual, emotionless timeline that walks the analyst through the customer's journey from purchase to delivery. Keep it objective and rooted in the evidence you're about to present.

For a physical product dispute, a good narrative might look like this:

- Order Placed: The customer placed an order for one 'Deluxe Coffee Grinder' on our website on March 5, 2024.

- Payment Authorized: The payment of $75.50 was successfully authorized with AVS and CVV codes matching the cardholder's address.

- Product Shipped: The item was shipped via UPS on March 6, 2024, with tracking number 1Z987XYZ.

- Delivery Confirmed: UPS tracking confirms the package was delivered and signed for at the cardholder's verified address on March 9, 2024.

This chronological flow makes the sequence of events incredibly easy to follow and directly connects to the evidence you'll present next.

Itemize Your Compelling Evidence

This is the heart of your rebuttal. Don't just dump a folder of attachments on the analyst. Instead, create a clean, itemized list inside your letter that explains what each piece of evidence is and what it proves. This acts as a table of contents for your supporting documents, making their job infinitely easier.

An analyst is far more likely to review your evidence thoroughly if you tell them exactly what they are looking at and why it matters. A well-organized evidence list is the most persuasive part of your entire rebuttal.

Let's break down the essential sections that make up a powerful rebuttal letter. Each piece has a specific job to do, and when they all work together, your case becomes much stronger.

Key Components of a Rebuttal Letter

| Component | Purpose | Example |

|---|---|---|

| Clear Subject Line | To immediately identify the dispute so it gets to the right person. | Rebuttal for Chargeback Case #123456 - Order #78910 |

| Opening Statement | To state your position and the reason for the letter in one clear sentence. | We are contesting this dispute; the transaction was legitimate and service was rendered. |

| Chronological Narrative | To provide a factual, easy-to-follow timeline of the transaction. | Customer purchased on Jan 1, service was activated Jan 2, usage confirmed Jan 5. |

| Evidence List | To itemize and explain all supporting documents you've attached. | See "Attachment C: Usage logs showing customer activity." |

| Concluding Request | To clearly state the desired outcome, leaving no room for confusion. | We request the reversal of this chargeback and the return of the funds. |

Putting these pieces together in a logical order creates a document that's not just informative, but persuasive. It guides the analyst through your argument from start to finish.

Close with a Clear Call to Action

Finally, your conclusion should be firm and unambiguous. Restate your position one last time and explicitly request the desired outcome. The analyst should have absolutely no doubt about what you're asking for.

A simple and effective closing would be:

"Based on the compelling evidence provided, we have demonstrated that this was a valid transaction. We respectfully request that you reverse this chargeback and return the disputed funds to our account."

Include your business name and contact information, and you're done. This professional closing reinforces your confidence and brings your argument to a powerful conclusion.

Telling Your Side of the Story: The Narrative

Think of your rebuttal as telling a story. You need to walk the dispute analyst through the entire transaction, from the moment the customer placed the order to the point of delivery. A simple list of facts is okay, but a clear, chronological narrative gives those facts context and makes your case much easier to understand.

Keep it professional and stick to the facts. This isn't the place for emotion or guessing why the customer filed a dispute. Just lay out what happened, step by step. This narrative acts as the framework for all the proof you're about to provide, turning a pile of documents into a cohesive argument.

Back It Up: Assembling Your Evidence

With your story straight, it's time to bring in the proof. This is where you really build your case. Don't just dump a bunch of attachments and hope for the best. You need to strategically select evidence that directly counters the customer's specific claim.

The goal is to present such a clear and well-supported case that the analyst has no choice but to see the transaction was legitimate. List each piece of evidence in your letter so they know exactly what they're looking at.

One of the biggest mistakes I see is merchants submitting a messy pile of evidence with no explanation. Be explicit. Don't just label an attachment "IP Log." Instead, write: "Attachment B: IP Log confirming the order was placed from an IP address that geolocates to the cardholder's billing city."

Matching the Evidence to the Dispute

The proof you need depends entirely on what you sell and why the customer is disputing the charge. A "product not received" claim requires a completely different set of evidence than an "unauthorized transaction" claim.

- Selling Digital Goods? You'll want to show things like IP logs proving the customer accessed the product, timestamps of downloads, or even chat logs where they asked for help using it.

- Shipping Physical Products? The gold standard here is a combination of AVS and CVV match confirmations, photos from the carrier showing the package at the correct address, and detailed tracking information.

- Running a Subscription Service? Your best evidence includes usage logs showing the customer accessed their account, the original welcome email, and a history of previous successful payments.

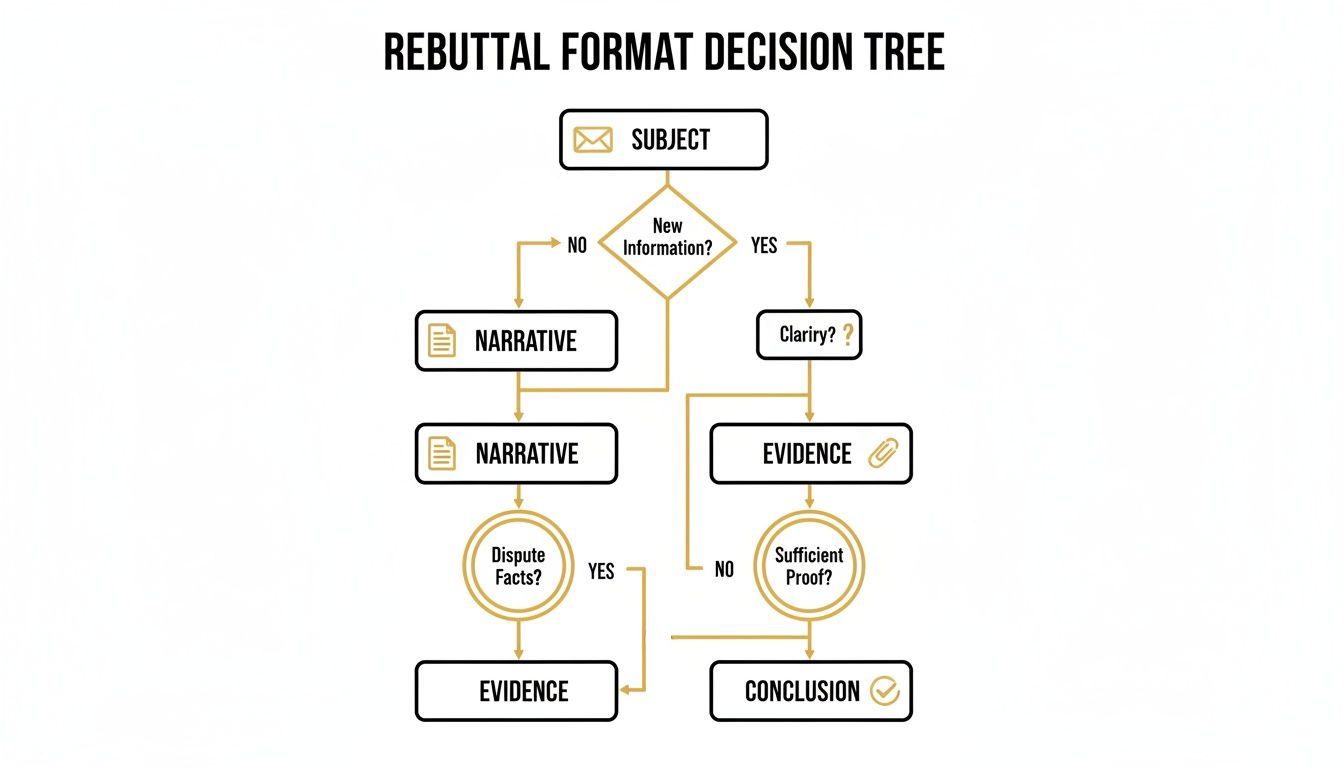

This flowchart gives you a great visual of how a strong rebuttal letter flows, from the subject line all the way to your closing.

Following this kind of logical structure is key. The story sets the scene, and the hard evidence proves your point.

Let's See It In Action

Let's say you run a subscription box service and get hit with a "product not received" chargeback.

Your narrative would simply state the date the order was processed and when it was shipped. Then, you'd present your evidence, piece by piece:

- Order Confirmation Email: This proves you notified the customer that their box was on its way.

- UPS Tracking Information: A screenshot showing the package was marked as "delivered" to their verified address.

- Carrier Delivery Photo: An image with a timestamp showing the box sitting right on their front porch.

- Customer's Order History: Showing a pattern of previous successful deliveries to that exact same address.

This layered approach systematically shuts down the customer's claim with undeniable proof. Each piece of evidence directly supports your story, creating a tight, compelling case.

For any business dealing with a high volume of disputes, especially around the holidays, having a solid representment process is non-negotiable. If you want to get ahead of the busiest season, it's smart to start building your Q4 representment strategy now.

How to Adapt Your Rebuttal for the Most Common Disputes

You can't treat every chargeback the same. A generic, one-size-fits-all rebuttal letter just doesn't work. The core elements of your letter will stay the same, but the story you tell and the proof you provide have to be laser-focused on the specific reason the customer filed the dispute.

Let's dig into the two biggest headaches for most online sellers: claims of fraud and claims that the product never showed up. For each, you’ll need to adjust your strategy to build the strongest possible case.

Countering "Fraudulent Transaction" Claims

When a customer claims they never authorized a purchase, your entire goal is to prove they did. Think of it like being a detective—you need to piece together all the digital footprints that connect the legitimate cardholder to that specific order. Your rebuttal should tell this story clearly.

Here’s the kind of hard evidence that shuts down fraud claims:

- AVS and CVV Results: Don't just mention them; spell it out. Clearly state that the Address Verification System (AVS) and Card Verification Value (CVV) checks were successful. This is your first and most powerful piece of evidence.

- IP Geolocation Data: Pinpoint where the order was placed. Include the IP address and its location. If that city matches the customer's billing address, that’s a massive point in your favor.

- Customer's Order History: Is this a repeat customer? Highlight their past orders, especially if they were shipped to the same address without any problems. This paints a picture of a familiar, legitimate buyer.

- Device & Session Info: If you can, show that the device ID or browser fingerprint matches previous, undisputed orders.

Pro Tip: Don't just attach the raw AVS code and expect the bank to decipher it. Be explicit in your letter. For example, write: "The AVS check returned a full match on both the street address and 5-digit zip code, confirming the cardholder's information was entered correctly."

Addressing "Product Not Received" Disputes

With a "product not received" claim, the tables are turned. The pressure is entirely on you to prove the item made it to the customer's doorstep. Your rebuttal needs to be a straightforward, chronological account of the journey, from your warehouse to their front porch. Your shipping documentation is everything here.

Make sure your letter includes this crucial proof:

- Shipping Confirmation: Include a copy of the email you sent the customer with their tracking number.

- Tracking Details: Provide a screenshot from the carrier's website that clearly shows the package's journey and, most importantly, the "Delivered" status.

- Proof of Delivery: This is the gold standard. If you have a delivery photo showing the package at their door, or a signature confirmation, it's nearly impossible for the bank to ignore.

- Customer Communications: Did the customer email you asking where their package was before filing the dispute? Include that conversation. It shows they were aware the shipment was on its way.

These types of disputes can be incredibly frustrating and damaging, sometimes even leading to a painful https://disputely.com/shopify-hold on your funds. Having a locked-in process for gathering this evidence and presenting it clearly is the best way to fight back, protect your revenue, and get these issues resolved fast.

Knowing When to Fight and When to Fold

Look, trying to fight every single chargeback that comes your way is a guaranteed recipe for burnout and wasted money. You can have the perfect rebuttal letter format, but the smartest move you'll make happens before you ever write a single word. It’s all about learning to tell the difference between a dispute you can win and one that’s better to just let go.

At its core, this decision comes down to a quick cost-benefit analysis. How many hours will your team sink into digging up evidence, crafting a compelling story, and putting the whole package together? If the cost of that time and effort is more than the transaction amount itself, fighting it means you're losing money even if you win the case.

A Quick Cost-Benefit Gut Check

Before you dive in and commit resources, you need to ask a few tough questions:

- What’s the dollar amount? This one’s obvious. A $500 dispute is worth a lot more of your time than a $15 one.

- How solid is my evidence? Do you have a signed delivery confirmation or server logs showing a digital download? If your proof is shaky, your odds of winning are, too.

- What’s the reason code? Some dispute reasons are just notoriously hard to beat. Knowing which ones are an uphill battle helps you pick your fights wisely.

This kind of strategic thinking is a huge part of modern dispute management. We see it in the data all the time—merchants are getting smarter about which disputes they contest based on the value and their industry. For example, with average chargebacks hovering around $88 for e-commerce and $65 for digital goods, a surprising 11–19% of those smaller disputes are just written off. The math simply doesn't work out. You can see more on this in an in-depth 2025 chargeback report.

The smartest merchants don't fight every battle. They win the war by strategically choosing which disputes to contest, preserving resources for high-value cases where they have a clear path to victory.

Changing the Game with Pre-Dispute Alerts

Now, this whole calculation gets turned on its head when you bring pre-dispute alerts into the picture. Systems from Visa (Rapid Dispute Resolution) and Mastercard (CDRN) give you a heads-up before a formal chargeback is even filed. You get an alert about the customer's complaint, giving you a chance to issue a refund and stop the dispute dead in its tracks.

This tech lets you automate refunds for those low-value or high-risk transactions, meaning you never have to think about writing a rebuttal letter for them. Your team can then focus all their energy on the high-value, winnable disputes where it really counts. This doesn't just protect your revenue; it keeps your merchant account in good standing.

If you're curious about your own risk profile, getting a professional chargeback audit can pinpoint exactly where you're most exposed.

Your Rebuttal Letter Questions, Answered

When you're staring down a chargeback, a lot of questions pop up. Getting the right answers can mean the difference between winning back your revenue and taking an unnecessary loss. Let’s tackle some of the most common things merchants ask about putting together a solid rebuttal letter.

How Long Should a Rebuttal Letter Be?

Keep it short. Seriously. Your letter should be a one-page summary, max.

The real power of your case isn't in a long, drawn-out story; it's in the organized evidence you attach. A dispute analyst has to review countless cases. They're far more likely to appreciate a brief, clear letter that gets straight to the point than a five-page novel that buries the essential facts. Think of your letter as the cover sheet for your evidence—its only job is to introduce and summarize.

Can I Use the Same Format for Every Chargeback?

Absolutely. The basic skeleton of a strong rebuttal letter is universal, and you should have a template ready to go.

Every single one should include these core elements:

- A clear subject line with the case or reference number.

- A brief opening stating your purpose.

- A chronological, fact-based summary of the transaction.

- A numbered or bulleted list of the evidence you’ve included.

- A direct closing statement asking for the chargeback to be reversed.

The structure stays the same, but the content must change every time. You have to customize the story and the evidence to directly refute the specific reason code for that dispute. Sending a generic, one-size-fits-all response is just as bad as sending nothing at all.

What Are the Biggest Mistakes to Avoid?

It's funny, but the most damaging mistakes are often the easiest to sidestep. First, never let emotion creep into your writing. Getting angry or unprofessional immediately tanks your credibility. Another big one is sending a messy pile of disorganized evidence. You're just making the analyst's job harder, and they aren't going to thank you for it.

But the absolute, number-one mistake is missing the deadline. It doesn't matter how perfect your letter is or how airtight your evidence is. If you submit it even one day late, you automatically lose. Period.

Stop disputes before they even start. Disputely integrates directly with Visa and Mastercard alert systems to notify you the moment a customer files a complaint, giving you time to issue a refund and prevent a chargeback. Protect your merchant account and eliminate chargeback fees by visiting https://www.disputely.com.