Fraud and Dispute: Complete Guide to Prevention and Resolution

On the surface, fraud and disputes look the same—they both hit your bottom line and cause revenue loss. But dig a little deeper, and you'll find they are two completely different beasts requiring entirely different strategies.

Getting this distinction right is the first step toward protecting your business.

Clarifying Fraud and Disputes

Let's break it down. True fraud is a crime. It’s when a bad actor uses stolen payment details to make a purchase. Think of it as a burglar using a stolen key to get into your house. The intent is malicious from the start.

A dispute, on the other hand, is a customer service problem. This happens when a legitimate cardholder contacts their bank to question a charge. They aren't a criminal; they're a customer with an issue.

The Critical Difference in Intent

The real dividing line here is intent. In a fraud scenario, the person making the purchase has no right to use the card. They're a fraudster, plain and simple, using stolen credentials to get something for free. It’s straight-up theft.

With a dispute, the person calling the bank is the actual cardholder. They legitimately own the card but have a problem with a specific transaction. Their reason could be anything from:

- Product Not Received: They swear the package never showed up.

- Not as Described: What they got wasn't what they thought they were buying.

- Unrecognized Charge: They see your business name on their statement and have no idea who you are.

- Canceled Subscription: They thought they canceled their membership but got billed again.

Sometimes the customer is right, sometimes it's a misunderstanding, and sometimes they're trying to get something for free (which we call "friendly fraud"). But in every case, it starts with your actual customer.

Why This Distinction Matters

If you treat a customer dispute like a criminal attack, you're going to have a bad time. Overly aggressive fraud tools can block legitimate customers, creating friction and killing sales. But if you treat a fraudster like a confused customer, you’ll leave the door wide open for financial losses. For merchants, particularly those in certain industries, understanding high-risk banking is a crucial first step in navigating these financial complexities.

To give you a quick reference, here's a simple breakdown of the core differences.

Fraud vs Dispute At a Glance

This table offers a quick summary highlighting the key differences between a fraudulent transaction and a customer dispute.

| Characteristic | Criminal Fraud | Customer Dispute (Chargeback) |

|---|---|---|

| Who is acting? | A criminal using stolen payment information. | The legitimate cardholder. |

| Core Intent | To steal goods or services with no intent to pay. | To resolve a problem with a transaction they believe is wrong. |

| Your Response | Block the transaction; security-focused prevention. | Resolve the issue; customer-service-focused communication. |

| Primary Goal | Prevent unauthorized access and financial theft. | Retain the customer and prevent the issue from escalating. |

| Example | A fraudster uses a stolen card number from the dark web to buy a laptop. | A customer is billed for a subscription they thought they canceled and calls their bank. |

By separating these two issues, you can deploy the right tools for the right job. You can use powerful filters for fraud and focus on clear communication for disputes.

This strategic separation is the foundation of a healthy payment ecosystem. It allows you to protect your revenue from genuine threats without alienating the loyal customers who are the lifeblood of your business.

Building a solid strategy for both is key. You can find more practical advice and deep dives into managing these challenges on the Disputely blog.

From Upset Customer to Costly Chargeback: The Old Way

For most merchants, the traditional chargeback process is a painful and often confusing ordeal. A sale looks good one day, but weeks later, the money is gone, and a stinging penalty fee takes its place. This entire mess doesn't start in your system; it begins the moment a customer decides to call their bank instead of you.

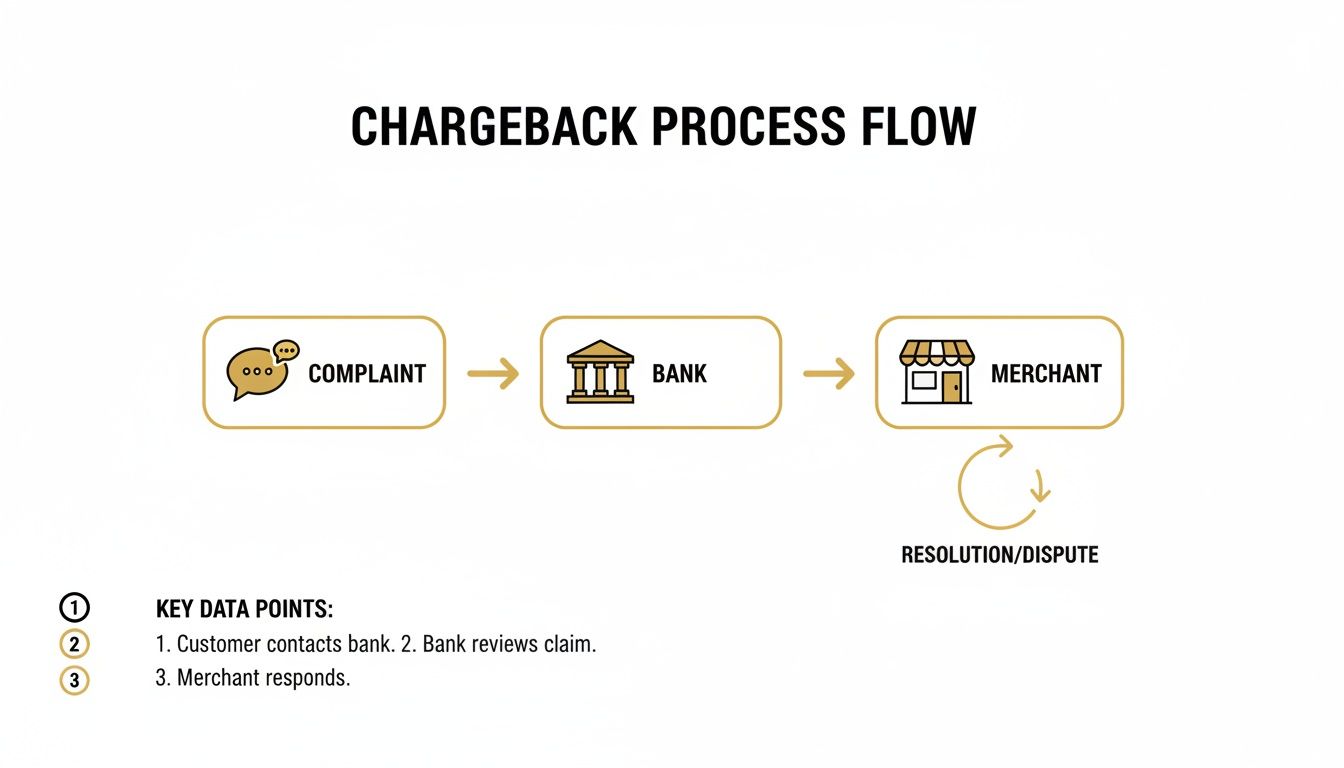

It all kicks off when a cardholder isn't happy with a purchase. Rather than reaching out to your customer service for a simple refund or to get their question answered, they dial the number on the back of their credit card. That one phone call sets off a slow, complicated chain reaction that almost always leaves the merchant holding the short end of the stick.

The Point of No Return

Once your customer is on the phone with their bank (the issuing bank), they state their case. The bank's agent listens, and if the complaint sounds legitimate—think "I never got the package" or "I don't recognize this charge"—they launch a formal dispute. Right then and there, the customer gets a provisional credit back on their card.

This is where the real trouble starts for you. Your customer has their money back, so they have zero reason to talk to you anymore. And the worst part? You have absolutely no idea any of this has happened.

The system was built to protect consumers, but it creates a massive communication gap. The one person who could actually fix the problem—the merchant—is the last one to hear about it.

This whole process is painfully slow. Information about the dispute has to travel from the customer's issuing bank, through the card network (like Visa or Mastercard), over to your bank (the acquiring bank), and then, finally, it lands in your lap. This game of telephone can take anywhere from a few days to several weeks.

When the Financial Hit Lands

By the time you get that formal chargeback notice, the damage is already done. A few things happen all at once, and none of them are good for your bottom line:

- Lost Revenue: The full amount of the original sale is yanked from your merchant account.

- Chargeback Fee: You get slapped with a penalty fee, usually between $20 and $100, that you don't get back even if you win the dispute.

- Wasted Time: Now your team has to drop what they're doing to dig up evidence and fight to get your money back.

This is the old, reactive way of doing things. You're constantly on the defensive, scrambling to recover revenue long after the customer’s issue first came up. This is just one of many financial headaches businesses face; for instance, understanding how to handle issues like managing bounced checks and restricted accounts is another critical skill for maintaining financial health.

The Damage to Your Merchant Account

Every single chargeback does more than just cost you money; it also adds to your chargeback ratio. This key metric is simple: it's the number of chargebacks you get in a month divided by your total number of transactions. Card networks like Visa and Mastercard are extremely strict about this, and they want to see it stay below 0.9%.

If your ratio creeps above that line, your business is in real jeopardy. Your payment processor could put you into a high-risk monitoring program, freeze a chunk of your revenue as a "reserve," or just shut down your merchant account completely. This perilous journey from a simple customer complaint to a formal chargeback shows exactly why a modern, proactive approach isn't just a nice-to-have—it's essential for survival. If you are struggling with a surge in disputes, getting expert help with your Q4 chargeback representment can make all the difference in protecting your revenue.

Navigating the Rise of Friendly Fraud

While most merchants are on high alert for criminal fraud, a trickier threat is quietly draining revenue from an unexpected source: your own customers. This is the world of friendly fraud, a term for when a legitimate customer disputes a perfectly valid charge.

It’s a tangled mess because you're not dealing with a hacker using a stolen credit card. You're dealing with someone who willingly bought from you.

Picture this: a customer signs up for a free trial that rolls into a paid subscription. A month later, a charge pops up on their credit card statement with a billing name they don't recognize. Instead of emailing your support team, they just call their bank and say, "I don't know what this is." The bank kicks off a dispute, and just like that, you’ve lost the sale and gained a costly chargeback.

This kind of scenario is incredibly common, blurring the line between a customer service hiccup and a full-blown financial dispute.

What Drives Friendly Fraud

So, what’s behind this growing problem? Sometimes, it’s an honest mistake. The customer genuinely forgot about that recurring subscription, didn’t connect your company’s legal name with your brand, or maybe a family member used their card without asking. In these cases, the "fraud" is truly accidental.

But there's a more calculated side to it, often called chargeback abuse. This is when a customer knowingly disputes a valid charge just to get something for free—it’s basically cyber-shoplifting. They get your product, use your service, then file a dispute claiming it never showed up or wasn't what they ordered. They keep the goods, and the bank yanks the money right back out of your account.

The real issue here is that the modern banking system has made it almost too easy for consumers to dispute a charge. It often takes just a few taps in a banking app, creating a path of least resistance that completely bypasses any conversation with you, the merchant.

This diagram breaks down the costly journey from a simple customer complaint to a chargeback hitting your books.

As you can see, the merchant is the last one to find out, long after the bank has already refunded the customer.

The New Social Media Influence

Making matters worse, "refund hacks" have gone viral on social media. Short videos on TikTok and Instagram walk people through the exact scripts to use with their banks to win a dispute, whether it's legitimate or not. This has turned what was once an obscure loophole into a shareable, almost gamified trend.

The numbers are pretty telling. Recent payment studies show that a staggering 61% of all chargebacks are initiated by the cardholders themselves, not by criminals. Economic pressure doesn't help either, with one in five shoppers admitting they could justify filing a false claim to save money. This trend has made friendly fraud a massive threat, with 10% of consumers admitting they've tried refund tricks they learned online. You can dive deeper into these numbers and what they mean in these chargeback statistics.

Whether it's intentional or not, the reasons a customer might commit friendly fraud usually fall into a few common buckets:

- Buyer's Remorse: They regret a purchase but find it easier to file a dispute than to follow your return policy.

- Unclear Billing Descriptors: Your charge shows up as "SP *WEBSERVICES" instead of your actual brand name, causing confusion.

- Forgotten Subscriptions: They subscribed months ago, forgot about it, and don't recognize the recurring charge.

- Desire for a Free Product: They know the system is easy to game and see a chance to get both the product and their money back.

At the end of the day, these disputes add up to a significant financial drain. Unlike criminal fraud, which you can fight with security tools, friendly fraud demands a more delicate approach. It takes a smart combination of clear communication, proactive customer service, and an intelligent dispute management strategy to protect your revenue.

How Real-Time Alerts Stop Chargebacks

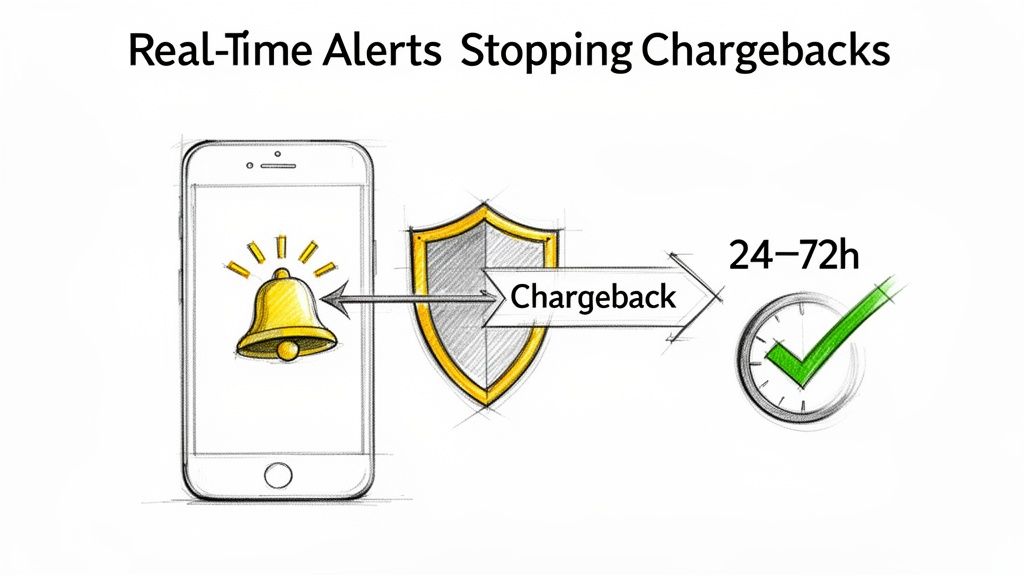

The old way of handling chargebacks is entirely reactive. You're left waiting, sometimes for weeks, to learn about a customer problem you could have solved in minutes. Real-time alerts completely flip that script. They shift your entire strategy from defense to offense.

Think of it this way: a traditional chargeback is like getting a letter that your house burned down last month. A real-time alert is the smoke detector going off. It gives you those precious few seconds to grab an extinguisher and put out the fire before it causes any real damage. It’s an early-warning system built for the speed of modern business.

So, how does it work? These systems tap directly into networks run by the major card brands and their partners, like Visa's Rapid Dispute Resolution (RDR), Mastercard's CDRN, and Ethoca alerts. These networks create a direct communication bridge between your customer’s bank and you.

When a cardholder calls their bank to question a charge, the bank first checks if you're part of one of these alert networks. If you are, the process changes dramatically. Instead of launching a formal chargeback, the bank sends an electronic alert through the network that lands in your system almost instantly.

The Golden Window of Opportunity

That alert opens up a critical 24- to 72-hour window for you to take action. This is your one chance to resolve the customer's issue directly before it ever becomes a damaging chargeback on your record. Forget the weeks-long, document-heavy battle; you get a short, clear timeframe to just make it right.

In this window, your objective is simple: solve the problem. For the vast majority of cases—especially those involving friendly fraud or a simple misunderstanding—the quickest and most effective solution is to issue a full refund.

Once you process the refund, that information travels back through the alert network to the customer's bank. The bank sees the issue is resolved, the customer is happy, and the dispute is stopped dead in its tracks. No chargeback is filed, no penalty fees are charged, and your all-important chargeback ratio is completely unaffected.

Automating Your Defense

Of course, you can't be expected to monitor alerts 24/7. That’s where automation platforms come in. By connecting your payment processor—whether it's Stripe, PayPal, or Shopify Payments—to an alert service, you can build an automated workflow that handles these issues for you.

A typical automated flow looks something like this:

- Alert Received: The platform gets the dispute alert from the network in real-time.

- Rules Applied: It instantly analyzes the alert based on rules you've already set. For instance, you might have a rule to automatically refund any dispute under $50.

- Action Taken: The system triggers the refund through your payment processor, no clicks required.

- Case Closed: The resolution is reported back, and the potential chargeback is successfully deflected.

This all happens quietly in the background, often without anyone on your team lifting a finger. It's a seamless way to deal with the high volume of small-dollar disputes that can otherwise bleed your profits and put your merchant accounts at risk.

The power of this system is that it prevents the problem, it doesn't just manage the aftermath. By resolving disputes at the earliest possible moment, merchants can reduce their chargeback volume by up to 99%.

Beyond Refunds: A Strategic Approach

While a refund is often the smartest play, an intelligent alert system also gives you the flexibility to fight when it actually makes sense. You can configure filters and rules to flag specific types of alerts for manual review instead of just auto-refunding everything.

Here are a few ways to apply this strategically:

- High-Value Transactions: Automatically flag any dispute over a certain threshold (say, $200) for your team to investigate personally.

- Known Abusers: If a customer has a history of filing disputes, you can create a rule that blocks them from getting an automatic refund.

- Strong Evidence: For disputes where you have rock-solid proof of delivery or service usage, you can choose to let it escalate to a formal chargeback, confident that you have the evidence to win.

This blend of smart automation and strategic oversight puts you back in the driver's seat. It transforms a chaotic, reactive process into a predictable, efficient system that protects your revenue, your time, and your crucial relationships with payment processors.

Building Your Automated Resolution Playbook

Alright, let's move from theory to action. This is where you actually start to regain control over the chaos of fraud and dispute management. An automated resolution playbook isn't just a defensive tactic; it's a game plan that saves you time, protects your revenue, and keeps your merchant accounts in good standing.

The whole system works by hooking your payment processor directly into an alert platform. This creates an automated workflow that intercepts disputes the moment they pop up, then resolves them based on smart rules that you create.

The goal here is simple: turn a manual, reactive headache into an efficient, hands-off operation that only needs your attention when a situation truly calls for it.

Step 1: Connect Your Payment Processor

First things first, you need to build the bridge. This means linking your payment processor (whether it's Stripe, PayPal, or Shopify Payments) to your chargeback alert service. This connection is the pipeline that lets real-time data flow between the two, which is what makes automated actions like refunds possible.

A modern alert platform makes this part easy. You can usually authorize the connection in just a few clicks, no coding or IT wizardry required. Once they’re talking to each other, the system can see incoming alerts and instantly trigger actions in your payment gateway.

Step 2: Define Your Smart Refund Rules

With your systems connected, it’s time to teach them what to do. This is where you set up "smart rules" that tell the platform how to handle different kinds of dispute alerts. You're looking for the sweet spot between what’s cost-effective and what needs a human eye.

A great place to start is with a simple value threshold. For example, you could create a rule to automatically refund any dispute valued at $30 or less.

Why do this? Think about it: the cost of fighting a low-value chargeback—factoring in staff time and potential fees—often adds up to more than the transaction itself. It’s smarter to take the small hit and automatically refund it, protecting your precious chargeback ratio from getting dinged.

Here are a few common rules you can set up:

- Value-Based Rules: Automatically refund disputes below a certain dollar amount. Anything higher gets flagged for your team to review manually.

- Currency-Specific Rules: Set different refund thresholds for different currencies, depending on your profit margins and risk in those markets.

- Product-Specific Rules: If you know certain digital products get a lot of "buyer's remorse" disputes, just set them to auto-refund and save yourself the headache.

- Blacklist Rules: Block automatic refunds for customers who have a history of filing disputes.

This rule-based approach puts the majority of your dispute management on autopilot. It frees up your team to focus their brainpower on the high-stakes cases where a manual review can actually recover significant revenue.

Step 3: Analyze Data to Fix the Root Causes

An automated system does more than just put out fires; it gives you the data you need to prevent them in the first place. Your alert platform’s analytics dashboard is your new command center for spotting the recurring issues that are causing disputes.

By digging into the reasons behind the alerts, you can find patterns that are surprisingly easy to fix. For instance, if you see a spike in disputes with the reason code "Unrecognized Transaction," that’s a huge clue that your billing descriptor is confusing people.

A simple fix, like changing "SP *WEBSERVICES" to your actual brand name, can wipe out that entire category of disputes. In the same way, a high number of "Subscription Canceled" alerts tells you your cancellation process is probably a pain. Make it clearer and easier for customers to cancel on their own, and watch those chargebacks disappear.

Regularly reviewing this data is crucial for the long-term health of your business. Performing a comprehensive Q4 dispute audit can uncover hidden trends and get you ready for the year ahead. This proactive feedback loop turns your dispute management from a cost center into a source of incredibly valuable business intelligence. When you listen to what your data is telling you, you can fix the real operational problems, improve the customer experience, and stop disputes before they even happen.

Key Metrics for Measuring Your Dispute Health

You can't fix what you can't see. When you're navigating the tricky world of fraud and disputes, Key Performance Indicators (KPIs) are your guiding lights. Think of them as the vital signs for your business's payment health—they tell you exactly where you're strong and, more importantly, where you're vulnerable.

Flying blind is a dangerous game. Without a clear view of your dispute metrics, you could be bleeding revenue or slowly inching your way into a high-risk category without even realizing it. Keeping a close eye on a few core numbers is the only way to build a sustainable, profitable business.

The One Metric That Matters Most: Your Chargeback Ratio

If you track only one thing, make it your Chargeback Ratio. This is the number that card networks like Visa and Mastercard obsess over. It's a simple calculation: the number of chargebacks you get in a month divided by your total transactions for that same month.

For instance, if you had 100 chargebacks last month and processed 20,000 transactions, your chargeback ratio would be 0.5%.

The magic number to keep in your head is 0.9%. If your chargeback ratio climbs above this threshold, you're in the danger zone. The card networks could place you in a monitoring program, which means higher fees and a lot of painful scrutiny. Let it go on for too long, and your payment processor might just shut down your account.

Keeping this number low isn’t just good practice; it's essential for survival. It’s the single biggest reason why preventing disputes from ever becoming formal chargebacks is so critical.

Other Vital Signs to Monitor

Beyond the big one, a few other KPIs can give you a much richer understanding of your dispute management performance. Tracking these helps you diagnose specific problems in your process before they get out of hand.

- Dispute Win Rate: This tells you how often you actually win the chargebacks you choose to fight. A low win rate might be a sign that you're fighting battles you can't win or that the evidence you're submitting isn't strong enough.

- Alert Resolution Rate: This is the percentage of chargeback alerts you successfully resolve (usually by refunding) before they escalate. A high rate here—ideally close to 100%—is a clear sign your prevention playbook is firing on all cylinders.

- Refund Rate: Keeping an eye on your overall refund rate helps you separate standard customer service refunds from those you issue to head off a chargeback. If you see a sudden spike, it could point to a deeper problem with a product or a recent marketing campaign.

Having a solid grasp of these core metrics is fundamental. Here's a quick breakdown of what to track and why it matters.

Essential Dispute Management KPIs

| Metric (KPI) | How to Calculate It | What It Tells You |

|---|---|---|

| Chargeback Ratio | (Number of Chargebacks / Total Transactions) x 100 | Your overall account health and your standing with the card networks. This is your primary risk indicator. |

| Dispute Win Rate | (Chargebacks Won / Total Chargebacks Fought) x 100 | The effectiveness of your evidence-gathering and representment process. Are your efforts paying off? |

| Alert Resolution Rate | (Alerts Refunded / Total Alerts Received) x 100 | The real-time efficiency of your chargeback prevention system. Is it catching disputes before they escalate? |

Building a simple dashboard to watch these numbers is a game-changer. It moves your team from guesswork to a data-backed strategy. You'll be able to see the direct impact of your prevention efforts, justify new tools, and confidently steer your business clear of costly payment processing headaches.

Common Questions About Fraud and Dispute Management

Diving into fraud and dispute management can feel like learning a new language. Let's clear up some of the most common questions merchants have when they start trying to protect their business and their bottom line.

What's the Real Difference Between Chargeback Alerts and Fraud Alerts?

This is a big one, and it’s easy to get them mixed up. The simplest way to think about it is that they tackle problems at completely different times.

- A fraud alert is your first line of defense. It happens before a transaction is ever approved, trying to spot and block a fraudster before they can even get through the door.

- A chargeback alert is a post-purchase tool. It kicks in after a sale is made, letting you know that a customer has contacted their bank to dispute the charge.

Essentially, fraud alerts stop theft before it happens. Chargeback alerts give you a crucial window to solve a customer service issue before it escalates into a full-blown, damaging chargeback.

Think of it like this: Fraud alerts are the bouncers at the door. Chargeback alerts are the customer service managers who can resolve a problem before a formal complaint is filed.

Do I Really Have to Refund Every Single Disputed Charge?

Not at all. A smart dispute strategy isn't about handing out refunds left and right—it's about making smart financial choices. This is where chargeback alerts become so powerful.

You can set up rules that work for your specific business. For example, you might decide to automatically refund any dispute under $25. It simply isn't worth your team's time to fight it, and refunding protects your chargeback ratio.

But for high-value orders or claims that look a bit fishy? You can have those alerts flagged for a human to review. This balanced approach lets you cut your losses on minor issues while focusing your energy on the fights that actually matter.

How Quickly Will I See a Drop in Chargebacks?

The results are surprisingly fast. Once you're set up with a chargeback alert system and have your rules in place, you'll start deflecting potential chargebacks almost instantly.

Since it can take weeks for a formal chargeback to wind its way through the banking system and hit your merchant statement, you'll see a noticeable drop in new chargebacks within your first 30-day payment cycle. Most merchants see their chargeback rates plummet within the first two months, offering immediate relief and helping to secure their payment processing accounts.

Stop letting preventable chargebacks eat into your profits. Disputely connects to your payment processor in minutes to automate your dispute response, slash your chargeback ratio by up to 99%, and keep your merchant account in great shape. Find out how much you could be saving at https://www.disputely.com.