Fraud Prevention e commerce: A Practical Guide to Securing Online Sales

Think of your fraud prevention for e commerce less like a line-item expense and more like an insurance policy for your entire business. It's not just a technical back-office task anymore; it’s a core strategy that directly protects your revenue, customer trust, and even your ability to process payments. Without a solid plan, you're leaving the door wide open to some pretty serious financial and operational headaches.

Why Proactive Fraud Prevention Is Non-Negotiable

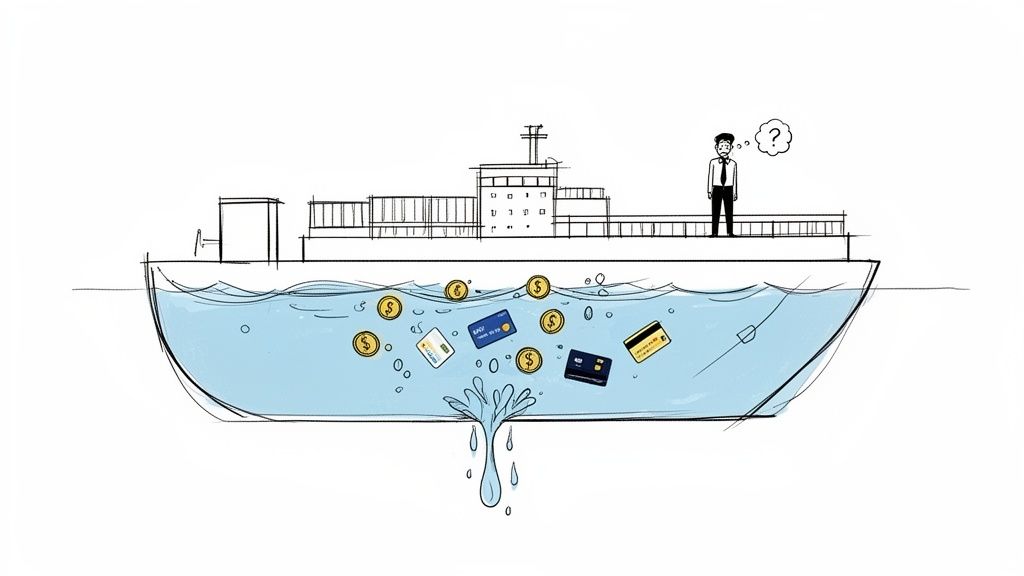

Letting a few "small" fraudulent orders slip through is like noticing a tiny leak in the hull of a ship and deciding it’s not a big deal. At first, it seems manageable. But over time, that tiny drip becomes a steady flow, and before you know it, the cumulative damage can sink your whole operation. Every bad transaction eats into your profits, but the real damage goes much deeper than just the cost of a lost product.

Unchecked fraud puts a huge strain on your relationship with payment processors like Stripe, Shopify Payments, or PayPal. When your chargeback rates start creeping up, they see your business as a higher risk. That’s when a whole domino effect of painful consequences can kick in:

- Frozen Funds and Payout Holds: A processor might lock up your merchant account to cover their potential losses, which instantly chokes your cash flow.

- Increased Processing Fees: As your risk profile gets worse, you’ll start paying more for every single transaction.

- Account Termination: If things get bad enough, your processor could shut down your account entirely, leaving you scrambling to find a way to accept payments online.

The Escalating Financial Threat

This isn't a small problem—it's growing at a genuinely alarming rate. Research from Juniper shows the total value of ecommerce fraud is on track to explode from $56.1 billion in 2025 to $131 billion by 2030. That’s a staggering 133% increase in just five years.

For you, the merchant on the front lines, this rising tide of fraud means higher dispute ratios and more intense scrutiny from the card networks. As Visa and Mastercard clamp down, a lot of this fraud shows up as chargebacks and so-called "friendly fraud," making a proactive defense absolutely essential to stay in business.

This shift means that old-school, single-layer defenses—like just relying on CVV checks—are completely outdated. A modern fraud prevention strategy has to be multi-layered. It needs to block clear-cut criminal fraud in real-time while also intelligently managing customer disputes after the sale.

A Modern Approach to Protection

A truly effective strategy protects you from both sides. It’s about spotting and stopping suspicious orders before you approve them, while also having a system in place to catch customer disputes before they turn into damaging chargebacks.

This guide will walk you through how to build that system, one layer at a time. For more tips on keeping your merchant account in good standing, you can explore our in-depth articles on the Disputely blog. By mastering both prevention and resolution, you can safeguard your revenue and keep your business secure and profitable for the long haul.

Know Your Enemy: The Different Faces of E-Commerce Fraud

To build a smart fraud prevention e commerce strategy, you first have to know who you’re up against. Think of it like a detective’s office with a wall full of suspect profiles—each type of fraud has a unique signature, motive, and method of attack. Getting a handle on these differences is the only way to pick the right tools for the job.

Broadly speaking, e-commerce fraud isn't a single entity. It falls into three main buckets, and each one demands a totally different defensive playbook. After all, the tactics that stop a professional fraudster are useless against a legitimate customer who’s just trying to game your return policy.

- Criminal Fraud: This is the most obvious type, where bad actors use stolen credit cards or hacked accounts. Their goal is simple: get their hands on goods they can flip for a quick profit.

- Friendly Fraud: This one is trickier because it starts with a real customer making what looks like a perfectly normal purchase. They receive the product, then call their bank to dispute the charge, claiming they never got it or don't recognize the transaction.

- Policy Abuse: This is the gray area. It’s not outright theft, but it’s when customers bend—or break—your store policies like returns, refunds, or promo codes to their advantage.

Let's dig into the details of each of these adversaries so you can start spotting their tells in your own order data.

Before we dive deeper, it's helpful to see how these fraud types compare and what kind of damage they can do.

Common E-Commerce Fraud Types and Their Business Impact

This table breaks down the most prevalent types of e-commerce fraud, outlining their core characteristics and the direct impact they have on a merchant's operations and bottom line.

| Fraud Type | Description | Primary Impact on Merchants |

|---|---|---|

| Criminal Fraud | Bad actors use stolen payment credentials (credit cards, account logins) to make unauthorized purchases, often for high-value goods that are easy to resell. | Immediate loss of product and revenue, plus chargeback fees and penalties from payment processors. |

| Friendly Fraud | A legitimate customer makes a purchase but later disputes the charge with their bank, claiming the item never arrived, was defective, or the charge was unauthorized. | Leads to chargebacks, which include lost revenue, lost product, and hefty fees. Too many can jeopardize a merchant's payment processing accounts. |

| Policy Abuse | Customers exploit store policies for personal gain. This includes abusing return policies ("wardrobing"), promo codes (creating fake accounts), or refund rules. | Drains resources through excessive returns, lost shipping costs, and devalued inventory. It erodes profit margins without triggering traditional fraud alerts. |

| Account Takeover (ATO) | A fraudster gains unauthorized access to a legitimate customer's account to make purchases, steal loyalty points, or access stored payment information. | Damages customer trust and brand reputation. Results in chargebacks and the potential loss of a loyal customer for good. |

Understanding these distinctions is crucial because your response to each one has to be different. Now, let’s get a closer look at the culprits themselves.

The Classic Fraudster: Straight-Up Criminal Intent

This is the villain everyone pictures when they hear the term "e-commerce fraud." These are organized criminals or solo operators using stolen payment information—often bought in bulk from dark web forums—to place orders. Their goal is almost always to acquire valuable items they can quickly fence for untraceable cash.

Because they’re using someone else’s data, their attempts often leave a trail of digital breadcrumbs that don't quite add up.

Key Indicators of Criminal Fraud:

- Mismatched billing and shipping addresses that trigger AVS failures.

- IP addresses from unusual locations, often masked by proxies or VPNs to hide their real whereabouts.

- A flurry of orders placed from the same IP address but with different credit cards.

- A sudden rush for expedited shipping on high-ticket items—they want the goods in hand before the real cardholder gets a bank alert.

The Deceptive Customer: When Good Customers Go Bad (Friendly Fraud)

Friendly fraud is so frustrating because it comes from a real customer using their own card. They place an order, you ship it, and everything seems fine. Then, days or weeks later, they bypass you entirely and go straight to their bank to dispute the charge. Their excuse could be anything: "the product never arrived," "it wasn't what I expected," or the classic "I don't recognize this charge."

This is a silent killer for profit margins. Since the initial transaction looks totally legitimate, your standard fraud filters won't catch it. It only pops up after the fact as a chargeback, slapping you with fees, reversing the sale, and damaging your standing with payment processors.

Believe it or not, friendly fraud—where customers dispute legitimate charges—is behind roughly 18% of all disputes. For DTC and subscription brands, this is a massive drain on profitability and a direct driver of high chargeback ratios. Because these disputes surface long after the sale, merchants are increasingly turning to alert systems to get an early warning. These platforms can intercept disputes within 24–72 hours, giving you a chance to issue a refund and prevent a formal chargeback from ever being filed.

The System Gamer: The Policy Abuser

Policy abuse is less about a single illegal transaction and more about chronically exploiting your store's rules. This behavior isn't technically fraud in the criminal sense, but it absolutely costs you real money. Think of the serial returner who sends back heavily used items for a full refund, or the customer who repeatedly claims their package was "lost in transit" to score a free replacement.

Here are a few classic examples:

- Refund Abuse: Lying about a product being defective or not received to get their money back without ever returning the item.

- Promotion Abuse: Creating dozens of different email accounts to repeatedly cash in on a "new customer" discount code.

- Return Fraud: The most common form is "wardrobing"—buying an outfit, wearing it out for a night, and then returning it. Another version is returning a cheap knockoff or an old item in place of the one they actually bought.

Building Your Layered Fraud Prevention Strategy

Relying on a single tool for fraud prevention is like trying to guard a castle with just one lock on the front gate. Eventually, a savvy intruder will find another way in. To build a defense that actually works, you need multiple layers working in concert, each designed to catch a different kind of threat.

Think of it like that medieval fortress. Each layer—the moat, the high walls, the watchtowers, the guards—makes it progressively harder for invaders to breach your defenses. In e-commerce, this multi-layered approach means that if one check fails to stop a fraudster, another one is waiting right behind it.

Before you start building, it's crucial to understand what fraud protection is and how it functions at a fundamental level. This knowledge is the bedrock you'll build your entire strategy on.

Layer 1: The Moat and Gatekeeper

Your first line of defense is all about pre-authorization checks. These are your moat and gatekeeper—the most basic, yet absolutely essential, tools that scrutinize an order before the payment is ever processed.

These initial checks are designed to be fast, filtering out the most obvious and clumsy fraud attempts without adding friction for your legitimate customers. Every merchant should have these active, no exceptions.

- Address Verification Service (AVS): This service simply checks if the billing address entered by the customer matches the one on file with their bank. A mismatch is a classic red flag that you're dealing with a stolen card.

- Card Verification Value (CVV): That little three- or four-digit code on the back of the card is a powerful tool. Requiring it confirms that the buyer most likely has the physical card in their hands, stopping fraudsters who only managed to get their hands on a list of card numbers.

Layer 2: The High Walls and Watchtowers

Once a transaction makes it past the gatekeeper, the next layers start analyzing more subtle clues. This is where behavioral analytics and device intelligence come in, acting as your castle’s high walls and ever-watchful lookouts. They quietly observe how a user interacts with your site, spotting suspicious patterns a human would never catch.

These systems work in the background, building a real-time risk profile for every single transaction. For example, a fraudster frantically copying and pasting stolen card details behaves very differently from a real customer carefully typing in their information. The machines can spot that difference instantly.

Key Takeaway: Device intelligence can tell you if someone is trying to hide their location with a VPN or proxy. It can also spot if the same device is being used to place dozens of orders with different credit cards—a dead giveaway for criminal fraud.

This is a great breakdown of the main fraud categories your layered strategy needs to address.

As you can see, the threats are coming from all sides, from outright criminal attacks to friendly fraud and policy abuse.

Layer 3: The Guards on Patrol

Your final, active layer of defense is a set of custom payment rules and transaction scoring. These are your guards on patrol, empowered to make judgment calls based on a specific set of orders you’ve given them.

This is where you get to tailor your defense to your store’s unique risks. You can create rules that automatically flag, block, or hold transactions based on a combination of risk factors that are most relevant to you.

Examples of Custom Fraud Rules:

- Flag for Review: Any international order over $500 where the shipping and billing addresses don't match.

- Automatically Block: Any transaction where a customer tries more than three different credit cards in under five minutes.

- Hold for Verification: A brand-new customer account places a high-value order with next-day shipping.

If you often find your funds tied up, understanding how to navigate a https://disputely.com/shopify-hold can be a game-changer for protecting your cash flow.

This kind of layered approach isn't just a nice-to-have anymore; it's the industry standard. The Merchant Risk Council found that e-commerce businesses now use an average of five different fraud detection tools. For anyone in a high-risk industry, the game has shifted from just blocking bad orders to integrating all these tools with chargeback alerts to keep dispute rates low and merchant accounts in good standing. By weaving these layers together, you create a dynamic, powerful defense system that protects your revenue and secures your business.

Stopping Chargebacks Before They Happen

Even with the best pre-transaction filters in place, some fraudulent orders are going to slip through. It’s inevitable. This is especially true with friendly fraud and policy abuse, which often come from legitimate customers long after a payment has cleared. At this point, your fraud prevention e commerce strategy has to pivot from blocking attacks to managing post-sale disputes.

This post-transaction phase demands a totally different toolkit. We're no longer focused on declining sketchy orders. Instead, the goal is to catch customer disputes before they escalate into full-blown chargebacks that can poison your merchant account.

The Fire Alarm Analogy for Chargeback Alerts

Think of a chargeback as a fire raging through your business. The damage is immediate and costly. You lose the revenue from the sale, the product is already gone, and you get slapped with a non-refundable chargeback fee that can be anywhere from $15 to over $100. Worst of all, every chargeback is a black mark against your merchant account, inching you closer to high-risk monitoring programs.

A chargeback alert, on the other hand, is the fire alarm. It’s an early warning that goes off when it detects the first sign of smoke—the customer calling their bank to complain. This alarm gives you a critical window, usually 24 to 72 hours, to put out the smoldering issue by simply issuing a refund. By doing that, you prevent the chargeback from ever happening in the first place.

This distinction is vital. An alert system doesn't fight chargebacks after they’ve been filed; it stops them from being filed at all. This proactive approach is the single most effective way to protect your merchant account health and avoid crippling penalties from card networks.

How Chargeback Alert Networks Function

Chargeback alert systems aren't a single piece of software. They're a network of connected platforms run by the major card brands and third-party companies. Their whole purpose is to create a direct line of communication between the customer’s bank (the issuer) and you, the merchant.

Here's how it works: when a cardholder calls their bank to dispute a charge, the bank can first route that inquiry through one of these networks instead of immediately triggering a chargeback. This sends an alert directly to you.

The main players in this space are:

- Visa RDR (Rapid Dispute Resolution): This is an automated system baked right into Visa’s own infrastructure. It lets merchants create rules to automatically refund specific disputes before they ever become chargebacks.

- Mastercard CDRN (Consumer Dispute Resolution Network): Run by Verifi, this network sends merchants detailed alerts about customer complaints, giving them the chance to resolve the problem directly.

- Ethoca Alerts: This is another major network that works with thousands of issuing banks around the world to give merchants near real-time notifications when a customer initiates a dispute.

Together, these networks cover a huge percentage of global card transactions, providing a powerful safety net for ecommerce businesses.

The Strategic Value of Proactive Refunds

I get it—the idea of automatically refunding customers can feel like giving up. It might seem like you're admitting defeat or just throwing revenue away. But when you look at it through the lens of your business's long-term health, a strategic refund is almost always the smarter, more profitable move.

Let’s just do the math. A chargeback costs you the transaction amount, a big fee, and a hit to your dispute ratio. Refunding a transaction through an alert system, however, only costs you the transaction amount. You dodge the penalty fee and, more importantly, you protect your relationship with your payment processor.

A high dispute ratio can lead to some serious headaches:

- Placement in Monitoring Programs: Visa and Mastercard will put merchants with high chargeback rates into special programs that come with punishing monthly fines.

- Increased Processor Scrutiny: Your payment processor might start holding your payouts or create a rolling reserve, which ties up your cash flow.

- Account Termination: In a worst-case scenario, you could lose your ability to process card payments entirely.

By using an alert system, you're trading the small, controlled cost of a refund for protection against these massive, business-threatening risks. It's a calculated decision to sacrifice one tree to save the entire forest. This is what modern, intelligent fraud prevention e commerce is all about—balancing immediate revenue with long-term stability and growth.

Building Your Fraud and Dispute Management Playbook

Knowing the theory behind fraud prevention is one thing, but putting a practical, step-by-step plan into action is what actually protects your business. A good playbook turns those abstract concepts into a concrete operational strategy. This is your guide to building that system from the ground up, from plugging in the right tools to keeping a sharp eye on your performance.

The whole process kicks off by connecting your core systems. First, you'll want to integrate a chargeback alert service that plugs into networks like Visa RDR, Mastercard CDRN, and Ethoca. This creates that all-important early warning system we talked about.

Next, you need to link that service directly to your payment processor, whether you’re using Stripe, Shopify Payments, or another gateway. This connection is vital—it lets the alert platform see transaction data and, when needed, trigger refunds automatically. It’s the key to a seamless, automated defense against chargebacks.

Step 1: Define Your Automatic Refund Rules

Once everything is connected, it's time to get smart about your refund rules. This isn't about refunding every single alert that comes through. It’s about strategically deciding which disputes are worth fighting and which are cheaper to resolve right away. Your playbook needs to spell these rules out based on your risk tolerance and product margins.

Here are a few common scenarios to get you started:

- Low-Value Transactions: Automatically refund any alert for an order under a certain amount, say $50. The chargeback fee alone often costs more than the revenue you'd save by fighting and winning.

- New vs. Repeat Customers: You might set a rule to auto-refund alerts from first-time buyers to avoid a terrible first impression, but flag alerts from loyal customers for a manual review.

- Specific Product Types: If you sell digital goods with virtually no fulfillment cost, you might decide to refund all related alerts. But for high-ticket physical items, you'll probably want a human to review every single one.

These rules become the brain of your automated fraud prevention e commerce defense, making sure your system makes smart, consistent decisions around the clock.

Step 2: Configure Your Alert Filtering Logic

Not all disputes are created equal. Some alerts point to clear-cut friendly fraud you have no chance of winning, while others could just be simple misunderstandings you can clear up. Your playbook should include criteria for filtering these alerts to avoid pointless refunds and to gather better data.

For example, you can tell your system to ignore alerts with certain reason codes where you know you have solid evidence to win. Think disputes claiming "product not received" when you have a signed proof of delivery. This stops you from refunding a dispute you are almost certain to win through representment.

This kind of intelligent filtering ensures your automation is working for you, not against you, by striking a balance between preventing chargebacks and protecting revenue. If you need a refresher on building a strong case, understanding the fundamentals of chargeback representment during peak seasons can give you some great insights for crafting winning responses.

Step 3: Monitor Key Performance Indicators

Your playbook isn't a "set it and forget it" document. It's a living strategy that needs to be measured and refined over time. Tracking the right Key Performance Indicators (KPIs) is the only way to know if your system is actually working and where you can make improvements.

Your analytics dashboard should be your single source of truth, zeroing in on these critical metrics:

- Dispute Rate: This is your north star. It’s the percentage of your total transactions that turn into a chargeback. The goal is to keep this number comfortably below the card network thresholds (like Visa's 0.9% limit).

- Alert Resolution Rate: What percentage of incoming alerts are you successfully stopping with a refund? A high rate here—ideally over 95%—proves your system is doing its job.

- Financial Savings: Track the cold, hard cash you've saved by avoiding chargeback fees. This metric is perfect for demonstrating the ROI of your entire dispute management setup.

By keeping a close eye on these KPIs, you can fine-tune your refund rules, spot emerging fraud patterns, and constantly reinforce your defenses. This data-driven approach shifts you from just reacting to fraud to proactively managing and minimizing its hit to your bottom line.

Common Questions About E-Commerce Fraud Prevention

Even with a solid plan, the world of fraud prevention can be tricky. Let's tackle some of the most common questions merchants ask, clarifying the key ideas you need to build a tough defense for your business.

How Much Does E-Commerce Fraud Really Cost a Business?

The price tag on a bad order is just the beginning. The real cost goes way beyond the lost product. For every $1 you lose to a fraudulent transaction, the actual damage to your business is closer to $3.75. That number accounts for the chargeback fees, the time your team spends dealing with it, and the cost of shipping a product you'll never get paid for.

But here’s the most critical part: too many chargebacks can destroy your relationship with your payment processor. If your dispute rate climbs above the network limits (like Visa's 0.9% threshold), you'll get hit with heavy monthly fines. If it continues, you could lose your merchant account entirely. Proactive fraud prevention for e-commerce isn't just about saving a few bucks on individual orders; it's about protecting your ability to do business online at all.

Can I Manage Fraud Prevention Without a Dedicated Team?

You absolutely can. While giant retailers have entire risk departments, modern tools are built to automate most of the heavy lifting for small and medium-sized businesses. The secret is a layered system that works for you, even when you're not watching.

By combining the built-in filters from your payment processor (think Stripe Radar or Shopify Protect) with an automated chargeback alert service, you can stop the overwhelming majority of threats. The goal is to set up smart, automated rules that run 24/7, giving you a powerful defense without needing a person to manually review every single transaction.

This kind of automated setup means even a one-person shop can have a sophisticated defense that was once only available to the biggest players. It really levels the playing field, making strong security accessible to everyone.

What Is the Difference Between Blocking Fraud and Managing Disputes?

This is a really important distinction, and it's at the heart of any modern fraud strategy. Knowing the difference helps you use the right tool for the right job.

Fraud Blocking is your frontline defense. It happens before a payment is even approved. This is where tools like AVS, CVV checks, and risk scoring come in, declining obviously suspicious orders in real-time before they can do any damage.

Dispute Management kicks in after a payment has already been processed. It's for those situations where a legitimate-looking customer later disputes the charge. This is often "friendly fraud" or simple buyer's remorse, so you can't really block it upfront because the transaction looks perfectly fine at the time.

Instead of blocking them, you manage these post-sale problems with alert systems from platforms like Ethoca and CDRN. They notify you the moment a customer complains to their bank, giving you a chance to issue a refund and completely avoid the chargeback. It’s a safety net for the disputes you can’t see coming.

Will I Lose Too Much Money by Automatically Refunding Alerts?

That's a fair question, but when you look at the numbers, a strategic refund almost always saves you money compared to taking a chargeback hit. The math is simple and powerful.

When you get a chargeback, you lose on multiple fronts:

- The original transaction amount (the revenue is gone)

- The cost of the product (your inventory is gone)

- A hefty, non-refundable chargeback fee (typically $15-$100+)

- A negative mark against your dispute ratio

On the other hand, a proactive refund issued through an alert only costs you the transaction amount. You completely sidestep the penalty fee and, crucially, you protect your merchant account's good standing.

By setting smart rules—for example, automatically refunding all alerts for orders under $100—you can neutralize the most common and costly chargebacks without breaking the bank. The return on investment is a no-brainer. You're saving your business from thousands in potential fines and protecting your ability to process payments, which is worth far more than the cost of a few refunds.

Ready to stop chargebacks before they happen? Disputely integrates directly with Visa RDR, Mastercard CDRN, and Ethoca to alert you to customer disputes in real-time, giving you the power to refund and prevent up to 99% of chargebacks. Connect your payment processor in minutes and see how our automated system can protect your merchant account and save you from costly fees. Learn more and get started at https://www.disputely.com.