A Modern Guide to Fraud Prevention Ecommerce Strategy

When we talk about "fraud prevention" in ecommerce, we're not just talking about a techy backend process. We're talking about the active defense of your online store—protecting it from financial hits and the kind of reputational damage that can sink a business. It’s a mix of smart technology, solid processes, and a savvy team working together to spot and stop bad actors before they can do harm, all without tripping up your real customers.

This isn't just an item on a technical to-do list; it’s a core business function that’s absolutely critical for survival and growth.

The Hidden Costs of Modern Ecommerce Fraud

Running an online store today means you're operating on a battlefield where the rules of engagement have completely changed. The old ways of stopping fraud, like simple filters and basic address checks, just don't cut it anymore. Think of it like putting a simple padlock on a bank vault; it might stop a clueless passerby, but it’s useless against a professional crew with modern tools.

That’s exactly what modern ecommerce fraud has become: a sophisticated, organized, and constantly adapting threat. Fraudsters now use complex tactics that perfectly mimic legitimate customer behavior, making them incredibly difficult to spot with outdated systems. And the consequences of not keeping up are steep, going way beyond the initial sting of a single lost sale.

The True Impact on Your Business

The costs of weak fraud prevention stack up fast and can easily cripple a growing business. Every fraudulent transaction is a direct hit to your bottom line, but the damage doesn't stop there. You’re also looking at:

- Chargeback Fees: Banks and payment processors slap you with a penalty for every dispute, adding insult to injury.

- Operational Strain: Your team gets bogged down manually reviewing suspicious orders, pulling them away from activities that actually grow the business.

- Damaged Customer Trust: When you accidentally block a real customer (a false positive) or their account gets taken over, their faith in your brand evaporates.

This isn't just theory; the numbers tell a stark story. The pressure from fraud in ecommerce jumped by 13% in value by 2025. A huge part of that is the explosion in abusive online returns, a global headache now worth a staggering $890 billion. In fact, from early 2024 to mid-2025, these shady returns shot up by 64%. If you want to dig deeper into these numbers, you can learn more about the impact of returns fraud from Signifyd.

This reality demands a new mindset. Solid fraud prevention isn’t a defensive cost center; it’s a strategic investment in your business’s stability, your customer relationships, and your long-term profitability. It’s the difference between that simple padlock and building a modern security facility with sensors, cameras, and an expert staff on watch.

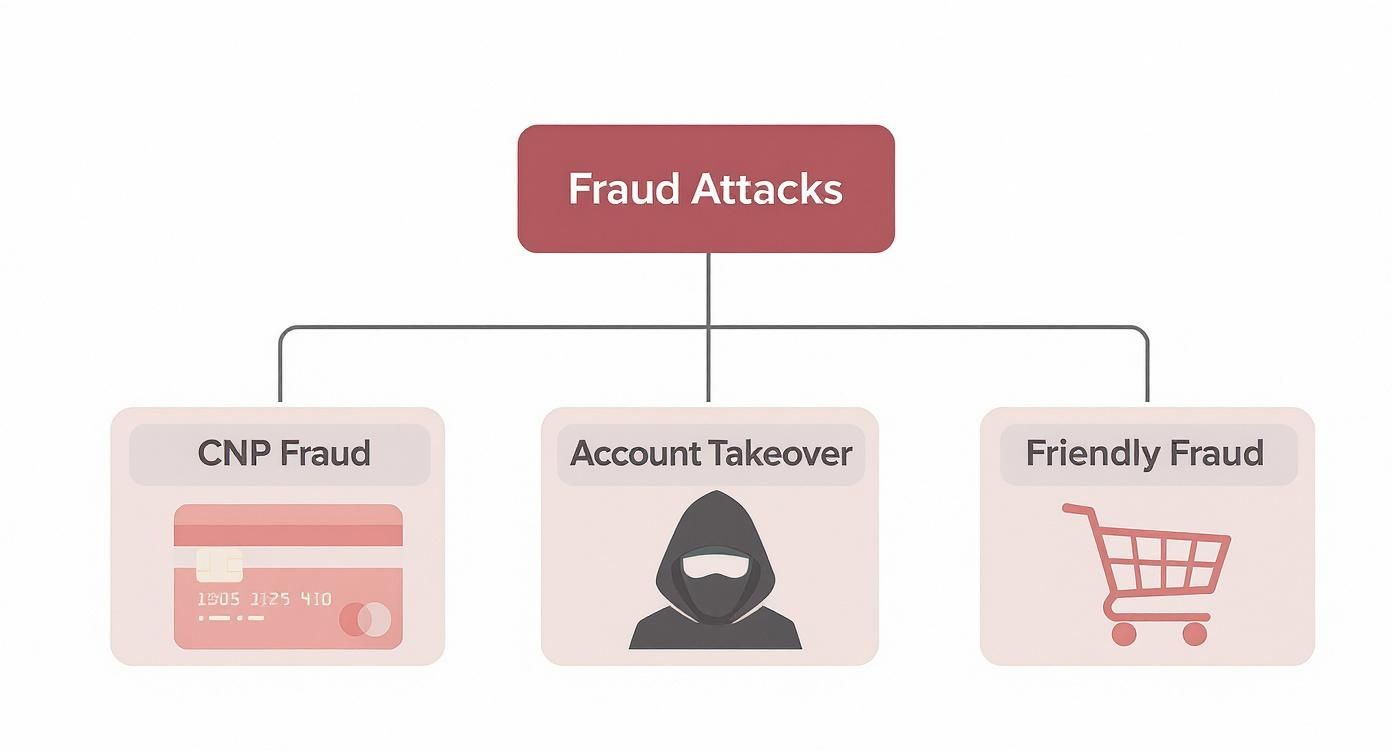

Identifying the Most Common Fraud Attacks

To build a solid defense, you first need to know what you’re up against. In the world of ecommerce fraud, that means getting familiar with the different playbooks fraudsters use. They aren't all the same; each attack has its own signature methods, motives, and, most importantly, its own set of red flags.

Think of it like being a home security expert. You wouldn't recommend the same system for someone worried about a simple break-in versus someone concerned about a sophisticated cat burglar. By learning to spot the most common types of fraud, you can fine-tune your defenses and shut down criminals before they ever touch your bottom line.

Here’s a quick overview of the most common schemes you’ll run into, what they look like in practice, and the tell-tale signs that should set off alarm bells.

Common Ecommerce Fraud Types and Key Indicators

| Fraud Type | How It Works | Common Red Flags |

|---|---|---|

| Card Not Present (CNP) | A fraudster uses stolen credit card details to make an online purchase without the physical card being present. | Mismatched billing/shipping addresses, multiple orders to the same address with different cards, unusually large first-time orders, rapid-fire purchase attempts. |

| Account Takeover (ATO) | A criminal gains unauthorized access to a real customer's account to make purchases or steal information. | Sudden changes to account details (password, email, shipping address) followed by a large purchase, login from an unusual location/device, orders placed at odd hours. |

| Friendly Fraud | A legitimate customer buys something, receives it, and then files a chargeback with their bank, falsely claiming the charge was unauthorized or the item never arrived. | Customers with a history of disputes, claims made right at the end of the chargeback window, vague or inconsistent reasons for the dispute. |

| Triangulation Fraud | A fraudster sets up a fake storefront, takes a real customer's order, then uses a stolen card to buy the item from your store and ship it to the customer. | A new "customer" places a high-value order with a shipping address that doesn't match the cardholder's name or billing location. The cardholder eventually files a chargeback. |

Now, let's dig a little deeper into how each of these attacks actually works.

Card Not Present Fraud: The Digital Pickpocket

The absolute bedrock of ecommerce crime is Card-Not-Present (CNP) fraud. It’s exactly what it sounds like: a crook uses stolen credit card info to buy something online, over the phone, or by mail—any time the physical card isn't actually swiped or dipped. It's the digital version of a pickpocket, but instead of nabbing a wallet, they’ve swiped card numbers from a massive data breach or a clever phishing email.

For fraudsters, CNP is a pure numbers game. They get their hands on huge lists of stolen card details and start "carding"—testing them with tiny purchases to see which ones are still active. Once they get a hit, they move fast to max it out before the real cardholder gets a notification and shuts it down.

Globally, losses from CNP fraud are staggering, running into the billions every single year. This isn't a niche problem; it's the most common and persistent threat every online merchant has to be ready for.

Account Takeover: The Customer Hijacking

A much deeper and more personal attack is Account Takeover (ATO). This is when a fraudster breaks into a legitimate customer's account on your store. They're not just stealing payment info here; they're stealing a whole identity within your business.

Once they're in, the damage can be massive. They can:

- Use saved credit cards to go on a shopping spree.

- Change the shipping address to their own drop point.

- Drain loyalty points or steal personal data.

- Fly under the radar by using the account's trusted purchase history.

ATO is especially nasty because it hurts you and your best customers, burning the trust you've worked so hard to build. A classic red flag is seeing a long-dormant account suddenly spring to life, change its shipping address, and immediately place a high-value order.

Friendly Fraud: The Insidious Insider Threat

Not every threat comes from a shadowy hacker. "Friendly fraud," which is anything but friendly, happens when a real customer makes a purchase and then disputes the charge with their bank to get a refund, even though they received the goods.

They might claim the package never showed up, that their kid made the purchase without permission, or that the product wasn't what they expected. While some of these are honest mistakes, a huge chunk is just people gaming the system. This type of fraud is infuriating for merchants. In fact, some reports show that chargeback abuse made up a shocking 34% of all ecommerce fraud in 2023. Fighting these disputes means keeping perfect records and knowing how to respond. For anyone hit hard by this, learning the chargeback representment process is non-negotiable.

Triangulation Fraud: The Deceptive Middleman

Finally, we have a more complex con known as triangulation fraud. This scheme is a three-way hustle involving the customer, the merchant (you), and the fraudster pulling the strings in the middle.

Here’s the step-by-step:

- A fraudster lists a popular product on a marketplace like eBay at a too-good-to-be-true price.

- An unsuspecting customer sees the deal and places an order.

- The fraudster takes the customer's money, then uses a stolen credit card to buy that exact item from your store, shipping it directly to the customer.

On the surface, everything looks fine. You got an order and shipped it, and the customer received their item. The problem shows up weeks later when the legitimate owner of the stolen credit card sees the fraudulent charge, files a chargeback, and the money gets pulled from your account. You're left with no product, no payment, and a painful chargeback fee.

Building a Multi-Layered Defense System

Relying on a single security tool for fraud prevention is like putting a single, simple lock on a bank vault. It’s a single point of failure. A determined fraudster will always find a way around it. They’ll look for the digital equivalent of an open window or a weak spot in the wall. To truly protect your business, you need to think like a fortress architect, not just a locksmith.

This is where a multi-layered defense system comes in. Think of it as building that digital fortress. You have the moat (basic compliance), the high walls (transaction screening), and the intelligent watchtowers (advanced analytics). Each layer is designed to stop a different kind of attack. If one layer fails, another is right there to catch the threat. It's a strategy that builds a resilient, adaptive defense capable of standing up to a huge range of attacks.

This approach is critical because, as the diagram shows, threats come from all angles.

You’ve got everything from classic card-not-present (CNP) fraud to more subtle "friendly fraud" and sophisticated account takeovers. A robust defense has to cover all these bases.

The Foundational Layer: Bedrock Security

Let's start with the foundation. This first layer isn't about actively hunting for fraud; it's about creating a secure environment that makes it much harder for basic attacks to even get off the ground. These are the absolute non-negotiables for any online business.

- SSL Certificates: This is the essential encryption that protects data as it moves between a customer's browser and your server. It's what keeps sensitive info like credit card numbers from being snatched out of the air.

- PCI DSS Compliance: The Payment Card Industry Data Security Standard is the rulebook for handling card information. Following it isn't optional—it's what prevents catastrophic data breaches and the massive fines that come with them.

Trying to build a fraud prevention strategy without these is like building a house on quicksand. It's the bare minimum, like locking the doors and windows before you even think about installing a security system.

The Transactional Layer: Active Screening

With a solid foundation in place, the next layer is all about actively scrutinizing every single transaction in real time. These tools are your front-line guards, checking the "ID" of everyone trying to make a purchase. They are fantastic at weeding out the most common, low-effort fraud attempts.

Here are the key players at this stage:

- Address Verification Service (AVS): This is a simple but effective check. It confirms whether the billing address provided by the customer matches what the card-issuing bank has on file. A mismatch is a classic red flag.

- Card Verification Value (CVV): That three- or four-digit code on the back of the card? Requiring it is a great way to prove the customer likely has the physical card, stopping fraudsters who only managed to steal the card number.

Most payment gateways have these features built-in, and you should absolutely have them turned on. They filter out a huge volume of opportunistic fraud. But they aren't foolproof. A determined criminal who has a full packet of stolen data can bypass them, which is why our next layer is so important.

The Advanced Layer: Intelligent Analysis

This is where modern ecommerce fraud prevention really flexes its muscles. The advanced layer uses powerful technology to spot the subtle, almost invisible patterns that scream "fraud." This is your high-tech watchtower, using AI and machine learning to analyze behavior, not just static data.

This layer is like an expert detective. It knows a fraudster might have the right AVS and CVV, but their behavior gives them away—like copy-pasting info with superhuman speed, hiding behind a proxy server, or moving a mouse in a distinctly non-human way.

This layer is powered by some impressive tech:

- Behavioral Analytics: AI models watch how users interact with your site. Things like hesitation on certain fields, odd navigation patterns, or filling out forms impossibly fast can signal a bot or a fraudster.

- Device Fingerprinting: This technology creates a unique ID for a user's device based on its specific setup (browser, OS, plugins). If that device has been tied to fraud before, it can be blocked instantly.

- Dynamic Risk Scoring: Instead of a simple pass/fail, these systems give each transaction a risk score based on hundreds of data points. Low-risk orders fly through, high-risk ones get flagged for a human to review, and the really bad ones are blocked outright.

With global ecommerce sales expected to hit $7.38 trillion by 2025, you can see why this kind of intelligent automation is no longer a luxury—it's a necessity. That massive market is a playground for criminals, pushing merchants to adopt stronger defenses to protect their customers and their revenue.

When a high-risk transaction gets flagged, it can sometimes trigger a hold on the payment. For merchants on certain platforms, knowing how to navigate this is crucial. That’s why we put together a guide on what to do when you face a Shopify payment hold.

By combining these three layers—Foundation, Transactional, and Advanced—you create a security system where each part makes the others stronger. It’s a comprehensive defense that protects your business from top to bottom.

How AI and Machine Learning Detect Modern Fraud

Let's be honest: manual reviews and simple, static rules just can't keep up with the creativity and speed of today's fraudsters. This is exactly where Artificial Intelligence (AI) and Machine Learning (ML) come in—not as some far-off concept, but as a must-have tool for any serious fraud prevention ecommerce strategy.

Imagine your fraud team as security guards at a massive mall. A human guard is great at spotting obvious trouble, like someone trying to jimmy a lock. But they can't be everywhere at once. They can’t track the subtle behaviors of thousands of shoppers simultaneously, much less cross-reference those actions with a global database of known offenders.

AI can. It's like having an infinitely scalable team of security experts, analyzing thousands of data points on every single transaction in the blink of an eye. It finds the tiny, almost invisible connections and deviations from normal behavior that even the most skilled human team would miss.

Looking Beyond Basic Transaction Data

The real magic of AI in fraud detection is its ability to see beyond surface-level details like billing addresses and IP locations. It digs into a much richer layer of user behavior and digital identity to build a complete picture of every interaction.

Modern AI systems evaluate a huge range of signals, grouping them into key categories that work together to profile a user and their transaction.

Here are a few key areas where AI analysis really shines:

- Behavioral Biometrics: This is all about how a user interacts with your website. Is their typing speed natural? Are their mouse movements fluid? How are they holding their phone? A real customer moves in a uniquely human way, while a fraudster using a script often looks robotic, with impossibly fast data entry or jerky movements.

- Device Fingerprinting: Every device has a unique digital "fingerprint" made up of its OS, browser, fonts, screen resolution, and more. AI can instantly recognize if a device has been linked to fraud anywhere in its network, even if it’s a brand-new visitor to your store.

- Network Intelligence: AI models are constantly learning from global data networks, absorbing fraud patterns from thousands of other online businesses. If a stolen credit card was just used for a fraudulent purchase on another site, the system flags it the second it shows up at your checkout.

This means AI isn't just asking, "Does this transaction look right?" It’s asking, "Does this transaction feel right?" It's the difference between a quick ID check and a full background check that happens in milliseconds.

The Power of Continuous Learning

Unlike a static rulebook that your team has to update constantly, machine learning models get smarter over time. Every single transaction—good, bad, or manually reviewed—becomes a new lesson that refines the algorithm.

Think about it. When a new type of account takeover attack emerges, the model quickly learns to recognize its signature patterns and automatically adjusts its defenses. This self-improving cycle is absolutely crucial in a world where fraudsters change their tactics daily. Of course, when implementing these systems, you have to consider the AI speed-accuracy trade-off to find the right balance between rapid decisions and deep analysis.

This adaptive power is more important than ever, especially as criminals start using their own AI to scale attacks. By 2030, fraudulent digital goods transactions are projected to hit $27 billion. The ecommerce fraud prevention market is growing fast to meet this challenge.

Ultimately, bringing AI into your fraud strategy is about moving from a reactive to a proactive defense—one that doesn't just block today's threats but is smart enough to anticipate tomorrow's.

An Actionable Framework for Fraud Prevention

https://www.youtube.com/embed/gFjBtWsXjvY

Moving from a high-level idea to real-world execution means you need a clear, structured plan. An effective fraud prevention ecommerce strategy doesn't just materialize out of thin air; it’s built on a solid foundation that aligns your people, processes, and technology toward a single, unified goal. This approach ensures there are no weak links in your chain of defense.

Think of it like running a professional kitchen. You need skilled chefs (People), standardized recipes and workflows (Process), and the right ovens and tools (Technology). If any one of those is off, the whole operation feels the heat. Let's break down how to build this framework for your business.

H3: Empowering Your People as the First Line of Defense

Your team is your most valuable asset in the fight against fraud, and honestly, they're often the most overlooked. Technology is great at flagging suspicious orders, but a well-trained human eye can often spot the subtle details an algorithm might miss. The key is to empower them with the right knowledge and clear guidelines.

Training needs to be an ongoing effort, not just a one-and-done meeting. Your customer service and order fulfillment teams should be genuine experts at recognizing common red flags.

- Suspicious Activity Recognition: Train them to spot odd patterns, like a sudden flood of orders from a brand-new account, multiple orders using different credit cards but shipping to the same address, or transactions coming from unusual IP locations.

- Clear Handling Protocols: What should an employee actually do when they spot a fishy order? Create a simple, step-by-step guide. It should clearly outline who to notify, what information to gather, and how to put an order on hold for review without ruining the customer experience.

By investing in your team's expertise, you turn a potential weak point into a proactive, intelligent layer of defense.

Refining Your Processes for Maximum Efficiency

Once your team is trained and ready, the next step is to build efficient processes that cut down on risk and keep things moving quickly. These are your "standardized recipes" that ensure consistency and prevent fraudulent orders from slipping through the cracks, especially when things get busy. A solid process is the backbone of any successful fraud prevention plan.

Start by optimizing your review and response workflows.

- Establish a Manual Review Queue: Create crystal-clear criteria for which orders get flagged for a manual review. This could be based on order value, the risk score from your tools, or specific red flags like AVS/CVV mismatches. This keeps your team from getting buried and lets them focus on the riskiest transactions.

- Set Intelligent Velocity Rules: Velocity rules are absolutely crucial for stopping automated bot attacks. These rules limit how many transactions an account, IP address, or device can attempt within a certain time. For instance, you could set a rule to block any IP address that tries to make more than three purchases in five minutes.

- Build a Chargeback Dispute Workflow: Don’t just accept chargebacks as a cost of doing business. Create a clear, documented process for gathering evidence—like shipping confirmations and customer communications—and responding to disputes. This is essential for clawing back revenue lost to friendly fraud.

A well-defined process removes the guesswork and panic from the equation. When a high-risk situation pops up, your team knows exactly what to do, how to do it, and who is responsible for each step. That means a swift and effective response, every single time.

To truly secure your ecommerce platform against ever-changing threats, think about adopting a comprehensive Trust & Safety strategy. This broader approach folds fraud prevention into a larger mission of creating a genuinely secure and reliable environment for your customers.

Integrating the Right Technology Stack

Technology is the force multiplier for your people and processes. The right tools can automate detection, give you deep insights, and empower your team to make smarter, faster decisions. Your tech stack should be layered, combining different tools that work together to give you complete coverage.

Your stack should include a mix of foundational and more advanced tools.

- Payment Gateway Filters: At the very least, turn on the built-in fraud filters from your payment gateway (like Stripe or Shopify Payments). This includes AVS and CVV checks, which are your first line of defense against basic card-not-present fraud.

- Dedicated Fraud Prevention Platforms: For more serious protection, a dedicated platform is a must. These tools use AI and machine learning to analyze hundreds of data points, including behavioral biometrics and device fingerprinting, to generate a real-time risk score for every single transaction.

- Chargeback Alert Services: Platforms like Disputely integrate directly with card networks to send you alerts before a dispute officially becomes a chargeback. This gives you a critical window to issue a refund and dodge the associated fees and penalties, which is vital for protecting your merchant account's health.

To tie this all together, here’s a straightforward checklist that breaks down the People, Process, and Technology framework into actionable steps.

People Process Technology Implementation Framework

| Pillar | Action Item | Benefit |

|---|---|---|

| People | Conduct regular fraud recognition training for customer-facing teams. | Empowers your team to spot nuanced fraud that automated systems might miss. |

| People | Define clear roles and responsibilities for fraud review and escalation. | Eliminates confusion and ensures rapid, consistent responses to threats. |

| Process | Document a step-by-step manual review and chargeback dispute workflow. | Creates a standardized, efficient system that reduces human error and revenue loss. |

| Process | Implement and fine-tune velocity rules based on your business patterns. | Proactively blocks automated bot attacks and high-frequency fraud attempts. |

| Technology | Enable all built-in fraud filters on your payment gateway (AVS, CVV). | Establishes a baseline layer of security against basic fraud at no extra cost. |

| Technology | Integrate a dedicated fraud detection platform to analyze transactions. | Provides advanced risk scoring and deeper insights to catch sophisticated fraudsters. |

| Technology | Implement a chargeback alert service to intercept disputes pre-chargeback. | Reduces chargeback ratios, saves on fees, and protects your merchant account health. |

By implementing this framework, you move from a reactive, chaotic approach to a proactive, organized, and powerful fraud prevention system. Each pillar supports the others, creating a resilient structure that can adapt to and overcome the challenges of a constantly shifting fraud landscape.

Measuring the Success of Your Strategy

So, how do you know if all your fraud prevention work is actually paying off? It's tempting to just look at fraud losses, but that's only one piece of the puzzle.

A successful strategy isn't about getting fraud down to zero. Honestly, that’s impossible, and trying to achieve it would mean turning away far too many good customers. The real win is finding that sweet spot—the perfect balance between tight security, a smooth customer experience, and costs you can actually manage.

To get a true picture, you need to be tracking the right Key Performance Indicators (KPIs). Think of these metrics as the dashboard for your fraud prevention engine. They give you a clear, data-driven view of what’s working, what’s not, and where your efforts might be accidentally hurting your bottom line.

Key Metrics for Fraud Prevention

Focusing on a handful of core metrics will tell you almost everything you need to know about the health of your strategy. I like to think of them as the vital signs of your business; if one is out of whack, it's often a symptom of a deeper problem that needs a closer look.

Here are the essential KPIs you should have on your radar:

- Chargeback Rate: This is the big one. It’s the percentage of your transactions that end up as a chargeback, giving you the most direct feedback on how much fraud is slipping through. If this number starts creeping up, it’s a major red flag.

- Manual Review Rate: This tells you what percentage of your orders get flagged for a human to look at. A high rate can mean your automated rules are too tight, creating a bottleneck that slows down legitimate orders and frustrates good customers.

- Approval Rate: This is simply the percentage of incoming orders you approve. A high approval rate feels great, but you have to look at it next to your chargeback rate. If both are high, you might be letting too much risk through the door.

The name of the game is keeping your approval rate high for good customers while pushing your chargeback rate as low as possible. It’s a constant balancing act between bringing in revenue and managing risk.

Understanding Your False Positive Rate

Now for what I consider the most critical—and most overlooked—metric of all: your False Positive Rate. This is the rate at which you decline good, legitimate orders because your system wrongly flagged them as fraudulent.

Every false positive is a double whammy. You lose the immediate sale, and more importantly, you risk losing that customer forever. Studies have shown that a huge chunk of customers who are wrongly declined will never come back.

If your false positive rate is too high, your security is actually costing you more in lost sales than fraud ever could. It means your defenses are too aggressive. Getting this balance right is everything. If you're looking to dial this in, a periodic chargeback and fraud audit can pinpoint exactly where you're blocking good customers.

By keeping a close eye on these KPIs together, you can stop guessing. You’ll have the insights you need to tweak your rules, adjust your tools, and build a fraud prevention strategy that actually protects your business without punishing your best customers.

Common Questions About Ecommerce Fraud Prevention

Jumping into fraud prevention can feel overwhelming, and it's natural to have questions. Getting a handle on the fundamentals is the best way to build a strategy that actually works—protecting your store without frustrating your real customers. Let's tackle some of the most common questions we hear from merchants.

What's the First Step for a Small Business?

The absolute first thing you should do is switch on the security tools that are already built into your ecommerce platform and payment processor. Specifically, make sure Address Verification Service (AVS) and Card Verification Value (CVV) checks are active. These are your first line of defense, and they’ll catch a surprising amount of low-effort fraud without costing you a penny extra.

Once that's done, set up a simple process for manually reviewing any order that just feels a bit off. Think mismatched billing and shipping addresses or orders that are way larger than your average sale.

You don't need a complex, enterprise-level system from day one. The key is to use the powerful, free tools you already have to make a big security impact right away.

How Do I Cut Down on False Positives?

Reducing false positives—those frustrating moments when you block a legitimate customer—is all about being smarter with your rules, not just getting rid of them. A single, blunt rule like "block all international orders" is a recipe for lost revenue. Instead, you need to think in layers.

Modern fraud prevention tools don't just give a simple "yes" or "no." They analyze hundreds of data points for every single transaction to generate a risk score. This allows you to green-light the obviously safe orders, automatically decline the clearly fraudulent ones, and only spend your time manually reviewing the small fraction that are genuinely uncertain. Good customers get a seamless experience, and your revenue is protected.

Should I Try to Build My Own System?

Honestly, for nearly every online business, building a fraud prevention system from scratch is a bad idea. It's far more practical and cost-effective to partner with a specialized service. Fighting fraud is a full-time, high-stakes game of cat-and-mouse, with criminals constantly changing their tactics.

Third-party providers have huge teams of experts and, more importantly, a massive network of data from thousands of other merchants. Their systems can spot emerging fraud patterns in real-time and adapt in ways an in-house solution just can't. This frees you up to focus on what you do best: growing your business.

Ready to stop chargebacks before they happen? Disputely integrates directly with card networks to alert you to disputes in real-time, giving you the power to refund and prevent up to 99% of chargebacks. Protect your merchant account and secure your revenue at https://www.disputely.com.