fraud prevention for ecommerce: Essential Strategies to Protect Your Store

For any ecommerce business, fraud prevention isn't just a background task or another line item in the budget. It's an active, ongoing strategy that directly protects your revenue, your customers' trust, and the reputation you've worked so hard to build. Moving past basic security checks to proactively stop sophisticated threats is no longer optional—it's essential.

Understanding the Real Cost of Ecommerce Fraud

It's easy to think of ecommerce fraud as a simple numbers game—a lost product here, a chargeback fee there. But that view is dangerously narrow. Think of it more like organized retail theft in a brick-and-mortar store; it's a constant threat that eats away at your business from the inside out.

The obvious cost is the direct loss from a fraudulent sale. But the real damage goes much deeper, creating a ripple effect of hidden costs that can quietly hamstring your growth and tarnish your brand.

Beyond the Initial Transaction Loss

Once a fraudulent order is out the door, the financial bleeding has only just begun. The true impact is a cascade of operational and reputational damage that's harder to track but far more destructive in the long run. This is where the real fight against fraud happens.

Let's break down these hidden costs:

- Operational Strain: Your team’s time is your most valuable resource. Every minute they spend digging into suspicious orders, fighting chargeback disputes, or handling fraud-related support tickets is a minute they aren't spending on marketing, product development, or customer experience.

- Increased Fees and Penalties: Each chargeback slaps you with a non-refundable fee from your payment processor. If your chargeback ratio gets too high, you risk being dumped into a high-risk monitoring program, which means even higher fees or, in a worst-case scenario, losing your merchant account entirely.

- Customer Trust Erosion: Legitimate customers often get caught in the crossfire. Their accounts can be compromised, or worse, their perfectly valid orders get flagged and declined by overzealous fraud filters. Nothing sours a customer relationship faster than being treated like a criminal.

These issues show that the real cost of fraud bleeds into every part of your operation. It’s why mastering the ecommerce post-purchase experience is so critical; you have to manage everything from fraudulent returns to friendly fraud chargebacks.

Fraud prevention isn't just about blocking bad transactions. It’s about safeguarding customer trust, preserving your brand's integrity, and ensuring your long-term profitability. A proactive strategy is fundamental to survival and growth.

The Escalating Threat Landscape

This isn't a static problem. Fraudsters are getting more organized, their tools are more sophisticated, and they are constantly finding new weak spots to exploit. The numbers are frankly staggering. Global losses from ecommerce fraud are projected to skyrocket from $44.3 billion in 2024 to an incredible $107 billion by 2029.

That's a 141% increase. It shows just how quickly this threat is evolving, especially as criminals target newer payment methods.

The data makes it clear that fraudsters have preferred targets. High-value goods that are easy to resell—think electronics, designer apparel, and luxury items—are always at the top of their list. If you're selling in these categories, a strong fraud prevention strategy for your ecommerce store isn't just a good idea; it's your first line of defense.

1. Get to Know the Most Common Types of Online Fraud

Before you can build an effective defense, you have to understand what you're up against. Ecommerce fraud isn't a single beast; it’s a whole zoo of different schemes, each with its own motives and tell-tale signs. Getting a handle on these is the first real step toward building a smarter, more targeted fraud prevention strategy for your business.

Think of it like being a detective. Every type of fraud leaves behind a different trail of clues. Once you learn to spot them, you can stop reacting to losses and start proactively shutting down threats before they do any damage.

Classic Credit Card Fraud

This is the one everyone knows. It’s the bread and butter of online scams. A criminal gets their hands on stolen credit card numbers—usually from massive data breaches, phishing schemes, or the dark web—and uses them to buy things from your store. Their goal is simple: get high-value goods they can quickly flip for cash.

The classic story plays out like this: a surprisingly large order comes through for your most expensive items, with a request for expedited shipping. The dead giveaway? The shipping address is completely different from the card's billing address. Eventually, the real cardholder sees the bogus charge, reports it, and you're stuck with a chargeback, the loss of your product, and the shipping fees.

The heart of this fraud lies in using someone else's compromised payment details. While the cardholder is the initial victim, it's the merchant who ultimately foots the bill for the chargeback and the stolen inventory.

Friendly Fraud and Chargeback Abuse

This one stings because it often comes from a customer you thought was legitimate. Friendly fraud is what happens when a customer buys something, receives it, and then calls their bank to dispute the charge. They might claim they never got the item or that the transaction was unauthorized.

Sometimes, it’s an honest mistake. Maybe they forgot about the purchase or didn't recognize your store's name on their credit card statement. But more often than you'd think, it's intentional—a form of digital shoplifting where they get to keep the product for free. This is a huge headache for merchants, and it can lead to your payment processor freezing your funds. If that happens, knowing how to resolve a Shopify payment hold becomes critical.

Account Takeover Fraud

Think of an account takeover (or ATO) as a complete digital hijacking. A fraudster gets access to one of your real customer's accounts, usually by using login credentials stolen from a data breach on another, less secure website.

Once they're in, it's a goldmine. They can:

- Place orders using saved credit cards.

- Change the shipping address to a location they control.

- Drain the account of any loyalty points or store credit.

- Scrape the customer's personal data for other scams.

An ATO attack is a double-whammy. It hurts your bottom line and severely damages your relationship with the customer whose account was compromised. You're left dealing with the chargeback, and your customer is left feeling violated, making this a particularly nasty threat to deal with.

Triangulation Fraud

This is one of the more clever schemes out there because it involves three parties: the scammer, a completely innocent buyer, and your store. Triangulation fraud basically turns your business into an unwilling middleman in the con.

It unfolds in a few steps:

- The Bait: The fraudster sets up a fake listing on a marketplace like eBay or Facebook for a popular product, usually at a ridiculously low price.

- The Purchase: An unsuspecting shopper sees the "deal" and buys the item from the fraudster.

- The Switch: The fraudster takes that shopper's money, then turns around and uses a stolen credit card to buy the exact same item from your official store, shipping it directly to the innocent shopper's address.

- The Fallout: The shopper gets their product and leaves a great review, none the wiser. You got paid (for now). But eventually, the person whose credit card was stolen reports the fraud. You're hit with the chargeback, losing both the money and the product.

The scammer is long gone with the original customer's payment, having used you and a stolen card to fulfill their fake order. This is a tough one to spot without the right systems in place.

To help you get a clearer picture, let's break down how these common fraud types stack up against each other.

Common Ecommerce Fraud Types Compared

The table below outlines the most prevalent ecommerce fraud schemes, their core tactics, and the risk they pose to merchants.

| Fraud Type | Primary Tactic | Detection Difficulty | Typical Financial Impact |

|---|---|---|---|

| Classic Card Fraud | Using stolen credit card details for unauthorized purchases. | Medium | High (Chargeback + Lost Goods) |

| Friendly Fraud | A legitimate customer disputing a valid charge. | High | Medium to High (Chargeback + Possible Lost Goods) |

| Account Takeover (ATO) | Gaining unauthorized access to a real customer's account. | High | High (Chargeback + Customer Trust Damage) |

| Triangulation Fraud | Using a stolen card to fulfill an order for a third-party buyer. | Very High | High (Chargeback + Lost Goods) |

Understanding these distinctions is key. Each type requires a slightly different approach to detection and prevention, which is why a one-size-fits-all strategy rarely works.

Building Your Foundational Fraud Prevention Toolkit

Alright, let's move from theory to action. Building a solid fraud prevention toolkit doesn't mean you need a massive budget or a team of security experts right out of the gate. It all starts with a few foundational, surprisingly effective tools that serve as your first line of defense.

Think of these as the basic security for a brick-and-mortar shop: good locks on the doors, a camera at the entrance, and a decent alarm system. They won’t stop a master thief, but they will absolutely deter the vast majority of opportunistic crooks. Putting these basic checks in place is the fastest way to make your store a much less appealing target.

The sheer creativity of modern scams has forced nearly three-quarters of companies to bump up their fraud prevention budgets. They’re focusing on essentials like card verification and identity checks. You can discover more about these ecommerce fraud trends from Statista to see how the industry is shifting toward smarter, automated detection to stay ahead.

Address Verification Service (AVS)

One of the simplest yet most powerful tools you have is the Address Verification Service (AVS). When a customer types in their credit card details, AVS quickly checks the numbers in their billing address against what the card-issuing bank has on file.

It's basically like a bouncer checking an ID. They glance at the address on the license and compare it to what the person told them. If they don't line up, that's an immediate red flag.

The AVS check comes back with a simple code: full match, partial match (like just the zip code is right), or a total mismatch. It isn't foolproof—some international banks don't support it—but a clear mismatch is a huge signal of potential fraud, especially when you see it alongside other risky signs.

CVV and Card Security Codes

That three or four-digit number on the back of a credit card—the Card Verification Value (CVV), or CVC/CID—has one simple job: to prove the person making the purchase actually has the physical card in their hand.

Requiring a CVV for every single transaction is non-negotiable. It’s a best practice for a reason. Fraudsters working off stolen lists of card numbers often don't have the CVVs, making this a simple but incredibly effective roadblock.

This one check weeds out a ton of low-effort fraud. While a sophisticated phishing scam might capture a CVV, these codes are usually missing from the massive data breaches you hear about. That means this simple step can shut down a huge amount of automated card testing and bogus purchases.

Leveraging Geolocation and IP Checks

So, where is your customer really ordering from? IP geolocation helps you answer that by tracing the physical location of the device used to place an order. This piece of data becomes incredibly valuable when you start comparing it against everything else.

For example, if the customer's IP address is in Nigeria, but the billing address is in Ohio and they want to ship it to Florida... well, you've got a classic high-risk situation on your hands. These kinds of mismatches are one of the strongest indicators of a compromised account or stolen card.

IP data can also tell you about:

- Proxy Usage: Scammers love to use proxies or VPNs to hide where they are. Spotting one is a major red flag.

- High-Risk Countries: You can automatically flag or even block orders that come from countries known for high rates of fraud.

- Velocity Checks: Watching for a bunch of orders coming from a single IP address in a short amount of time is a great way to spot automated bot attacks.

To really nail your foundational fraud prevention, you need to grasp the key parts of online security. Learning the fundamentals provides the context for building your defenses, and you can explore some 6 cybersecurity essentials for e-commerce platforms to get a deeper understanding.

Remember, managing these tools is an ongoing job, especially during your busiest seasons. You can prepare for Q4 chargebacks by making sure your toolkit is fine-tuned and ready to go. These foundational layers all work together, creating a powerful defense that dramatically cuts down your risk from the most common fraud tactics.

Implementing Advanced Fraud Detection Strategies

As your business scales, you become a bigger, more attractive target for sophisticated fraudsters. The basic tools we've covered are great for catching low-hanging fruit and opportunistic attacks, but protecting your growth means adopting a more dynamic, multi-layered approach to fraud prevention for ecommerce. This is where you graduate from static defenses to an intelligent system that learns on the fly.

Think of it like this: your foundational tools are the locks on your doors and windows. They're essential. Advanced strategies are like installing a smart security system with motion sensors, real-time alerts, and an AI that can distinguish between the mail carrier and a burglar. You're adding layers of intelligence to your defense.

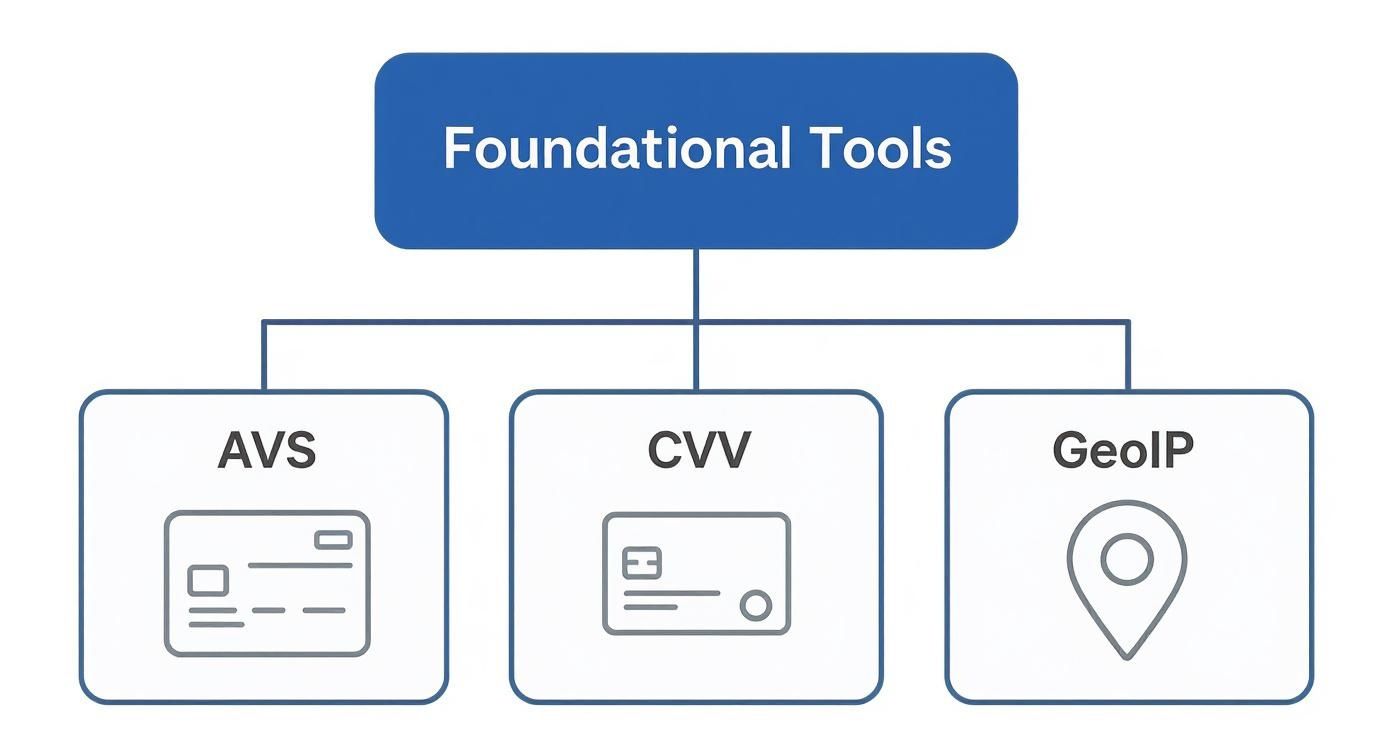

This diagram shows the basic building blocks that form the foundation for these more advanced techniques.

These core checks—AVS, CVV, and GeoIP—give you a first-pass validation on a transaction's legitimacy before it ever gets scrutinized by more complex systems.

The Power of Machine Learning and AI

At the heart of any modern fraud detection stack, you'll find Artificial Intelligence (AI) and Machine Learning (ML). These aren't just buzzwords; they're the engines that can analyze thousands of data points for every single transaction in the blink of an eye. A human reviewer might be able to check a dozen signals, but an AI can process thousands at once.

Machine learning models are trained on massive datasets of both legitimate and fraudulent transactions. Over time, they get incredibly good at recognizing the subtle, almost invisible patterns that separate a real customer from a crook. This allows the system to generate a risk score for each order, giving your team an instant, data-backed assessment of its potential threat.

An AI-driven system doesn't just follow a checklist. It uncovers new connections. It might flag an order that looks perfect on paper because it noticed the customer's mouse movements were erratic or they copy-pasted the credit card details in a way that perfectly matches known fraud ring behavior.

This level of analysis goes way beyond simple AVS or CVV checks. It’s weaving together behavioral biometrics, device fingerprinting, transaction history, and network analysis to paint a complete picture of who is behind the purchase.

Creating Dynamic Fraud Rules

While AI is brilliant at complex pattern recognition, you still need a set of clear, actionable rules. The key difference is that advanced strategies move beyond rigid "if-this-then-that" logic. Dynamic rules are adaptive and context-aware, leading to far more accurate outcomes.

Here’s what dynamic rules look like in the real world:

- Order Velocity: Instead of a blunt rule like "block more than three orders from one IP in an hour," a dynamic rule might adjust that threshold based on the IP's purchase history or the time of day. A known customer buying multiple items during a flash sale is different from a brand-new IP doing the same at 3 AM.

- Geolocation Mismatches: A simple rule flags any order where the billing, shipping, and IP locations are different. A dynamic rule might be more forgiving if the customer has a history of shipping gifts to that specific address.

- Transaction Value Thresholds: Rather than flagging every order over $500, a dynamic rule could lower that threshold to $200 if the order is also being shipped to a known high-risk country or uses a disposable email address.

This smarter approach dramatically cuts down on false positives—those frustrating moments when you block a legitimate customer. By fine-tuning your rules, you protect your business without ruining the shopping experience for your best customers.

Integrating Automated Systems for Efficiency

The whole point of an advanced fraud prevention system is to reduce your team's workload, not add to it. Automation is how you get there. A fully integrated system can automatically approve low-risk orders, flag medium-risk ones for a quick manual review, and flat-out block high-risk transactions before they can do any damage.

This frees up your fraud team to focus their expertise on the truly ambiguous cases that require human intuition.

Surprisingly, the adoption of these powerful technologies is still incredibly low. Despite the clear risks, only 3% of Canadian and 6% of U.S. ecommerce businesses have fully automated their fraud prevention. This leaves a staggering 41% of merchants in North America still relying on slower, less effective manual processes. You can discover more insights on ecommerce fraud management from LexisNexis Risk Solutions to see why experts are pushing for a multi-layered, AI-enabled approach.

By building out an advanced, layered strategy, you create a resilient defense that not only protects your revenue but also preserves the seamless shopping experience your real customers expect.

You can't just set up fraud prevention tools and hope for the best. That’s like navigating a ship without a compass—you're moving, but you have no idea if you're headed for open water or straight into a reef. To really protect your business, you have to measure, analyze, and constantly fine-tune your approach.

https://www.youtube.com/embed/Dryxo7i_u64

A smart fraud prevention strategy isn't about getting fraud down to absolute zero. It’s about striking a delicate balance: tight enough security to stop criminals, but a smooth enough experience for your legitimate customers. If you're too aggressive, you’ll end up blocking good orders, which kills your revenue and alienates the very people you want to keep. The only way to find that sweet spot is by using data to see what’s actually happening.

Moving Beyond the Chargeback Rate

Most merchants live and die by their chargeback rate. And while it’s definitely an important number, focusing on it alone gives you a dangerously narrow view. It tells you what fraud got through, but it says nothing about the fraud you blocked or, even worse, the good customers you mistakenly turned away.

Think of it like a bouncer at a nightclub who's so aggressive that the club is half-empty. Sure, there are no fights breaking out, but the business is bleeding money. A near-zero chargeback rate can be a huge red flag. It often means your fraud filters are way too tight and you're leaving a ton of revenue on the table from false declines.

The goal isn't just a low chargeback rate; it's a high approval rate for legitimate customers combined with a low rate of fraud. True success lies in maximizing revenue while minimizing risk.

To get the full picture, you need to look at a wider set of Key Performance Indicators (KPIs) that paint a complete story of your fraud management health.

Core Metrics for Your Fraud Prevention Dashboard

Tracking just a handful of the right metrics can give you powerful insights into how your fraud prevention program is performing. These numbers are what you'll use to make informed decisions, tweak your rules, and ultimately protect your bottom line.

Here are the essentials you should be monitoring:

- Approval Rate: This is simple: what percentage of all incoming orders get approved? If this number is low or starts trending down, it’s a sign your rules might be too strict and need a second look.

- Manual Review Rate: What percentage of orders get flagged for a human to review? A high rate here means your automated rules are probably casting too wide a net, creating a bottleneck for your team and delaying good orders.

- False Decline Rate (False Positive Rate): This is the percentage of declined orders that were actually legitimate. It's a critical, if sometimes difficult, metric for understanding exactly how much revenue and customer goodwill you're losing.

- Total Cost of Fraud: This calculation goes way beyond just chargebacks. It needs to include the value of lost inventory, all chargeback fees, the operational costs of your fraud team, and the estimated revenue lost from all those false declines.

The fallout from fraud isn't just financial. According to recent research, 63% of merchants report higher customer churn due to fraud-related friction, and 64% see lower conversion rates. It’s a stark reminder of that balancing act between strong security and a seamless experience. You can dig into more data on the true cost of fraud from LexisNexis Risk Solutions.

Interpreting the Data to Make Smarter Decisions

So, you've got the numbers. What now? This is where you put on your detective hat. A rising manual review rate might tell you it’s time to refine your automated rules or look into a smarter machine-learning tool. A high false decline rate is a fire alarm—it means you need to loosen specific filters that are blocking your best customers right now.

The table below breaks down the key metrics you should have on your dashboard.

Key Fraud Prevention Performance Metrics

A summary of essential metrics to track the health and effectiveness of your ecommerce fraud prevention program.

| Metric | How to Calculate | What It Tells You |

|---|---|---|

| Chargeback Rate | (Total Chargebacks / Total Transactions) x 100 | The percentage of transactions that resulted in a chargeback; a lagging indicator of fraud that slipped through. |

| Approval Rate | (Approved Orders / Total Orders) x 100 | The overall health of your checkout flow; a sudden drop can signal overly strict rules or a new fraud attack. |

| Manual Review Rate | (Orders Sent to Manual Review / Total Orders) x 100 | The efficiency of your automated rules; a high rate points to operational strain and potential delays for customers. |

| False Decline Rate | (Legitimate Orders Declined / Total Orders Declined) x 100 | The amount of revenue and customer goodwill you're losing; a critical indicator of customer friction. |

| Total Cost of Fraud | Chargeback Losses + Fees + Lost Goods + Operational Costs + Lost Revenue from False Declines | The complete financial impact of fraud on your business, far beyond just the chargeback numbers. |

By keeping a close eye on these KPIs, you can move from simply reacting to fraud to proactively managing it.

It’s crucial to make reviewing these numbers a regular habit. Set aside time at least once a quarter to do a deep dive, spot trends, and adjust your strategy accordingly. If you need a hand getting started, you can learn more about conducting a chargeback audit for your ecommerce store to uncover hidden vulnerabilities.

When you consistently measure and optimize, fraud prevention stops being a reactive cost center and becomes a strategic advantage that actually protects revenue and builds customer trust.

Common Questions About Ecommerce Fraud Prevention

Diving into ecommerce fraud prevention can feel like you're learning a whole new language. As you start putting new tools and strategies in place, you’re bound to have questions. Let's walk through some of the most common ones we hear from merchants to help you make smarter, more confident decisions for your store.

Getting a handle on these details is the key to building a strategy that actually works—one that protects your bottom line without turning legitimate customers away.

How Much Should I Spend on Fraud Prevention?

This is the big one, and the honest answer is: it depends. There’s no magic number or universal percentage that fits every business. The right amount to invest is a balancing act, and it comes down to a few factors unique to your store.

Think about these variables when setting your budget:

- Your Industry and Product Type: Are you selling high-end electronics or luxury handbags? If so, your risk is naturally higher because those items are easy to resell. You’ll need to invest more in protection than a store selling personalized, low-cost goods.

- Your Average Transaction Value (ATV): When your ATV is high, each fraudulent order stings a lot more. It becomes much easier to justify spending on prevention tools when you're protecting more revenue with every transaction you save.

- Your Chargeback Rate: If you see your chargeback rate inching closer to that dreaded 0.9% threshold set by Visa and Mastercard, it's time to invest more aggressively. Trust us, the cost of good prevention is almost always cheaper than the fees and penalties you'll face for exceeding those limits.

Instead of seeing it as a cost, try to frame fraud prevention as an investment in protecting the revenue you’ve worked so hard to earn. A great starting point is to add up the total cost of fraud—chargebacks, lost inventory, shipping costs, and your team's time—and use that number to justify a proportional spend on the right tools.

Will Tighter Fraud Rules Hurt My Sales?

This is a completely valid fear. The last thing you want is to block good, paying customers in your quest to stop criminals. This problem, known as a false decline, is a real risk if your system is poorly configured.

The trick is to stop thinking in terms of blunt, static rules and start thinking in terms of smart, dynamic analysis. A simple rule like "decline all orders with an AVS mismatch" is like using a sledgehammer to crack a nut; sure, you'll stop some fraud, but you'll also block a lot of good customers who just made a typo.

The goal isn’t to build an impenetrable fortress. It's to build a smart, flexible fence. An effective fraud prevention system should analyze dozens of data points in context, making nuanced decisions that separate real threats from your best customers.

When you use tools that look at the whole picture—things like transaction history, device reputation, and behavioral patterns—you can slash your false decline rate. The aim is to create a frictionless experience for the vast majority of your customers and only step in when an order is genuinely suspicious.

Can I Handle Fraud Prevention on My Own?

When you’re just starting out, manually reviewing orders might feel doable. You can personally check orders that seem a bit off, look up IP locations, and even call customers to verify their information. But this approach has a very short shelf life.

As your order volume picks up, manual review quickly becomes a massive operational bottleneck. Your team gets bogged down in tedious checks, legitimate orders get delayed, and the chance of human error goes way up. All it takes is one missed fraudulent order worth thousands of dollars to wipe out the profits from dozens of good sales.

Here’s how you know it’s time to automate:

- You can no longer review every flagged order within a few hours. Shipping delays create unhappy customers.

- Your chargeback rate starts to climb. This is the clearest sign that your manual process just isn't cutting it anymore.

- You’re spending more time investigating orders than growing your business. Your time is better spent on marketing, product development, and strategy.

Modern fraud prevention for ecommerce solutions are built to handle this work for you, freeing up your team to focus on growth while giving you a much higher level of protection.

At Disputely, we specialize in stopping chargebacks before they happen. Our platform integrates with major alert networks to notify you of a dispute the moment it's raised, giving you the chance to refund the customer and prevent a damaging chargeback from ever hitting your record. Protect your merchant account and reduce chargebacks by up to 99% with Disputely.