How to Avoid Chargebacks: A Practical Guide on how to avoid chargebacks

Preventing chargebacks isn't about finding one secret weapon. It’s about building a smart, layered defense system that combines sharp order validation, clear customer communication, and meticulous record-keeping. The whole game is about getting ahead of disputes before they even have a chance to start.

Your Blueprint for a Proactive Chargeback Prevention Plan

Let's be honest, chargebacks are a massive headache for any ecommerce business. They don't just eat into your profits; they drive up processing fees and, in a worst-case scenario, can even threaten your merchant account itself. Think of a chargeback as more than just a lost sale—it’s a signal that something, somewhere in your process, broke down.

This guide is your blueprint for building a solid prevention framework from the ground up. We'll walk through the core pillars of a winning strategy, helping you understand the landscape and build a defense that works for the long haul.

First, Know Your Enemy: The 3 Types of Chargebacks

You can't fight what you don't understand. To effectively shut down chargebacks, you have to know where they come from. They typically fall into one of three buckets:

- True Fraud: This is the classic scenario—a fraudster gets their hands on stolen credit card details and makes a purchase they have no intention of paying for.

- Merchant Error: These are the "oops" moments that happen on your end. Maybe you shipped the wrong size, accidentally billed a customer twice, or your refund policy was buried and impossible to find.

- Friendly Fraud: This is when a legitimate customer disputes a legitimate charge. Sometimes it's an honest mistake—they forgot about a subscription renewal or don't recognize your business name on their statement. Other times, it’s intentional, a form of "cyber shoplifting."

Friendly fraud is the elephant in the room, making up a staggering 60-80% of all chargebacks. This is exactly why crystal-clear communication and bulletproof record-keeping are non-negotiable. Winning these disputes comes down to proving the customer knew what they were buying and that you delivered on your promise.

Building Your Defense: The Core Pillars of Prevention

Your strategy needs to be solid from every angle, tackling each type of dispute at different stages of the customer's journey. It's all about creating a system that’s both tough on fraud and easy on your team. To keep everything running smoothly, it's always a good idea to improve workflow efficiency across your prevention and response efforts.

Thinking about your chargeback strategy through these core pillars will help you organize your efforts and plug any holes in your defense.

Core Pillars of Chargeback Prevention

| Strategy Pillar | Primary Goal | Key Actions |

|---|---|---|

| Pre-Transaction Screening | Stop fraudulent orders before they are processed. | Use AVS, CVV checks, fraud scoring tools, and IP geolocation. |

| Transactional Clarity | Eliminate customer confusion about charges. | Set a clear, recognizable billing descriptor; send detailed order confirmations. |

| Post-Transaction Support | Make it easier to get a refund than to file a dispute. | Offer 24/7 support, have a clear refund policy, and respond to inquiries quickly. |

| Evidence Collection | Be ready to fight and win illegitimate disputes. | Log all customer interactions, save delivery confirmations, and capture IP data. |

Focusing on these key areas helps you move from a reactive position—just putting out fires—to a proactive one. This mindset shift doesn't just save you money on lost revenue and fees; it protects the health and longevity of your merchant account.

Especially as you head into busy seasons, taking a hard look at your setup is crucial. A complete Q4 audit of your chargeback processes can get you ready for the rush and shore up any weak spots before they become a real problem.

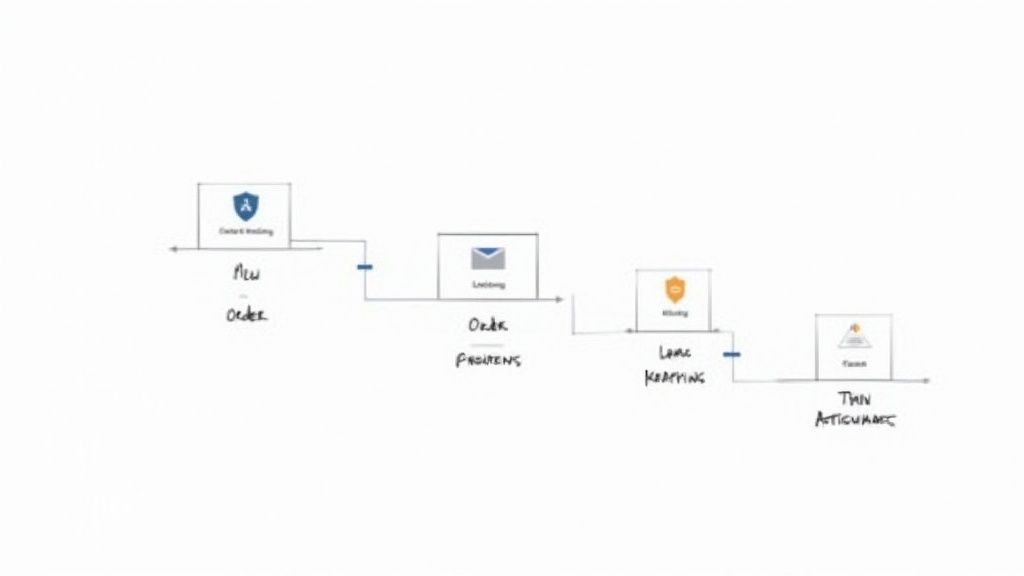

1. Fortify Your First Line of Defense with Order Validation

Your best shot at stopping a chargeback is before you even capture the payment. Think of your checkout process as a gatekeeper. A smart pre-authorization and screening workflow can separate legitimate customers from fraudsters without getting in the way of good sales. This is about more than just ticking security boxes; it's about learning to read the story the data tells you.

Every piece of information you gather during checkout—from the CVV code to the customer's IP address—is a clue. Your job is to assemble these clues to get a clear picture of the risk involved before you approve the sale.

Go Beyond Basic AVS and CVV Checks

The Address Verification Service (AVS) and Card Verification Value (CVV) are your foundational tools, but they’re far from foolproof. Simply seeing a "pass" isn't enough. You need to understand what the different response codes actually mean and have a plan for how to react.

A full AVS match is obviously a great sign. But what about a partial match, where the street is right but the zip code is off? It could be an honest typo from a good customer, or it could be a fraudster working with incomplete stolen information. This is where context is everything.

My Two Cents: Don't just auto-decline every transaction with a partial AVS mismatch. Instead, treat it as a trigger for a closer look, especially on larger orders. Check that mismatch against other signals, like the IP location or the customer's order history.

Implement Smarter Fraud Screening Tools

To really build a solid defense, you need to layer in more sophisticated checks that analyze behavior and patterns. These tools can run quietly in the background, flagging sketchy activity without slowing things down for your legitimate customers.

Here are a few checks I've seen work wonders:

- Velocity Checks: This is a must. These tools track how many times a single credit card, IP address, or email is used on your site in a short period. If you suddenly see 10 orders from the same IP in five minutes, that’s a massive red flag for an automated bot attack.

- IP Geolocation: Does the customer’s location match their billing address? An order from a New York IP address using a card with a California billing address should get your attention. It's not always fraud—people travel or use VPNs—but it definitely adds to the risk profile.

- Email Verification: You can tell a lot from an email address. Is it established and normal-looking, like

firstname.lastname@gmail.com? Or does it look like a burner, likefgr654h@domain.com? Tools can analyze an email's age and reputation, helping you spot the throwaway accounts that fraudsters love to use.

The checkout flow itself is a surprisingly big factor. I've seen merchants reduce chargebacks by 15% just by streamlining their process to a single page. For mobile shoppers, an optimized design can cut disputes by a whopping 30%. With global chargeback volumes always on the rise, every little bit of friction you remove for good customers helps protect your bottom line. If you want to dive deeper into the numbers, you can explore detailed chargeback rate statistics.

Connecting the Dots: A Real-World Scenario

Let's walk through how this looks in practice. Imagine a $1,500 order for a new laptop comes in. Your system flags it for review, and here's what you see:

- Billing Address: Los Angeles, CA

- Shipping Address: An address in Miami, FL that you recognize as a freight forwarder.

- IP Address Location: A server in Eastern Europe.

- AVS Result: Partial match (The zip code matches, but the street address doesn't).

- Customer Email: A brand-new, unverified Gmail account.

Taken one by one, a few of these might have a reasonable explanation. But when you put them all together? That's a high-risk order screaming "fraud." A real customer is almost never going to have this combination of mismatched data.

This is a textbook example of a transaction you should decline immediately or, at the very least, subject to serious manual verification. By building a system that connects these dots, you turn your checkout from a simple payment form into an intelligent fraud filter.

Using Clear Communication to Eliminate Confusion

A surprising number of chargebacks aren't malicious—they're just the result of simple confusion. A customer glances at their bank statement, sees a charge from a name they don't recognize, and immediately thinks "fraud." This is often the starting point for "friendly fraud," and it's a battle you can absolutely win with crystal-clear, proactive communication.

Think of your communication strategy as your best defense. Every touchpoint, from the moment a customer buys to the weeks after delivery, is a chance to build trust and get rid of the guesswork that leads to disputes.

Nail Your Billing Descriptor

Let's start with one of the most common, and easily fixable, mistakes: the billing descriptor. This is the short line of text that shows up next to a charge on a customer's credit card statement. If it’s your vague legal entity name like "XYZ Holdings LLC" instead of your well-known brand "Glow Skincare," you’re essentially inviting a dispute.

Your descriptor has to be instantly recognizable. The best ones usually combine your brand name with a contact number or website, making it dead simple for the customer to connect the dots.

- Bad Descriptor:

ACMEWEBSERVICES - Good Descriptor:

GLOWSKINCARE*glowskin.com - Great Descriptor:

GLOW*800-555-SKIN

This tiny detail can be the difference between a happy customer and a "transaction not recognized" chargeback.

Automate Informative Transactional Emails

Once a customer clicks "buy," your communication job is really just getting started. A solid series of automated emails keeps them in the loop and reassures them that their order is being handled by professionals.

- Instant Order Confirmation: Send this the second the purchase goes through. It needs to include the order number, a detailed list of what they bought, the total cost, and both billing and shipping addresses. This email is your first piece of evidence if a dispute arises.

- Shipping Notification: As soon as you have a label, send this update. The most important part? A direct link to the tracking information. This lets the customer watch their package's journey, heading off most "item not received" claims before they even start.

- Delivery Confirmation: This final email closes the loop, confirming the package has arrived. It proves you've held up your end of the deal and gives you a great excuse to ask for a review or offer a discount on their next purchase.

For subscription merchants, this is non-negotiable. You should be sending renewal reminders 3-5 days before you charge the card. That simple heads-up prevents the shock of an unexpected charge, which is a massive trigger for subscription-related chargebacks.

A proactive communication workflow does more than just inform the customer; it builds a paper trail of compelling evidence. Every email confirmation, shipping update, and delivery notice becomes a document you can use to successfully fight an illegitimate dispute.

Make Your Refund Policy Impossible to Miss

Finally, one of your most powerful tools is a clear and ridiculously easy-to-find refund policy. When a customer is unhappy, you want them to contact you for a refund, not their bank for a chargeback.

Make your policy a core part of your site. Put it in the footer, link to it from product pages, and even include a summary in your order confirmation emails. Don't make them hunt for it.

This simple transparency works. In fact, one of the most effective ways to avoid chargebacks is by implementing clear refund policies, which can slash chargeback rates by 20-30%. Displaying your terms right on the checkout page is a proven tactic that puts customers at ease and protects your business. You can discover more powerful chargeback statistics that show just how much of an impact clear policies can have.

By making yourself the easiest path to a resolution, you redirect potential disputes back into your customer service channels, where you can solve the problem and maybe even save the customer relationship.

Building an Evidence Locker to Win Disputes

Let's be realistic: you can’t prevent every single chargeback. No matter how good your fraud filters are, some disputes will inevitably slip through. That’s where your second line of defense comes in—a meticulously organized “evidence locker.”

When a dispute notice lands in your inbox, the last thing you want is a frantic scramble for proof. The goal is to have a digital file for every single transaction, packed with compelling evidence and ready to go. Think of it as building a case file before a crime is even reported. This proactive approach is how you shut down friendly fraud and protect the revenue you’ve earned.

What “Compelling Evidence” Actually Means

Card networks like Visa and Mastercard have very specific rules about what they consider “compelling evidence.” Just showing a receipt isn’t going to cut it. You have to prove three things: the legitimate cardholder authorized the transaction, they received what they paid for, and they actually used or benefited from it.

For every single order, you should be automatically capturing and storing this data:

- Order & Customer Details: Basic stuff, but essential. The customer’s name, email, and both the billing and shipping addresses.

- Transaction Vitals: This is where it gets interesting. You need the AVS and CVV response codes, the customer's IP address, and its associated geolocation. A mismatch here is a potential red flag.

- Device Fingerprinting: Log the device details—operating system, browser, language settings. This helps you build a profile of a customer’s normal buying behavior.

When you log these details for every transaction, you’re not just collecting data; you’re building a story that can be pulled up in seconds when a dispute hits.

A Pro Tip From the Trenches: Don't just use your evidence locker for fighting disputes. Look for patterns. Are you seeing a lot of chargebacks from orders where the IP geolocation is in one country and the shipping address is in another? That’s a signal to tighten up your fraud rules.

Tailoring Your Evidence to Your Products

The proof you need for a shipped sweater is worlds away from what you need for a software download. You can’t use a one-size-fits-all approach. Your evidence checklist needs to be specific to what you sell.

The Checklist for Physical Products

Here, it's all about proving the item made it to the right person at the right address.

- Proof of Delivery: This is the big one. Always, always use a shipping carrier that provides tracking and delivery confirmation. For high-value orders, that extra few dollars for signature confirmation is the best investment you can make.

- Address Matching: Keep crystal-clear records showing the shipping address the customer entered at checkout is the exact same address on the delivery confirmation slip.

- Customer Communications: Save everything. Every email, every live chat, every support ticket. If a customer emails you asking, "When will my blue sweater arrive?", it's pretty hard for them to later claim they never ordered it.

The Checklist for Digital Products & Services

With intangible goods, you have to prove access and use. You’re showing they got the keys to the kingdom and walked through the door.

- Access Logs: This is your silver bullet. Log every single time a customer signs into their account, complete with the IP address and timestamp.

- Usage Records: Show that they took action. Did they download the PDF? Did they watch the video course? If you sell a SaaS tool, can you show that they created and saved a new project?

- Terms of Service Agreement: Make sure you have a timestamped record of the customer checking the box to agree to your terms and refund policy. This is crucial.

For digital goods, you can also add another powerful layer of security and proof with tools like DRM encryption for digital assets, which helps verify that the content was delivered securely and accessed by the intended user.

Keep a Master Log of All Communications

Every single interaction you have with a customer is a potential piece of evidence. These golden nuggets can get lost in scattered email inboxes, social media DMs, or different support platforms. You need one central, unified log of all communications for each customer, tied directly to their order history.

This log should include everything from pre-sale questions and order confirmations to shipping updates and post-sale support chats.

When a customer files a "product not received" dispute, and you can instantly pull up an email chain of them asking for tips on how to use that very product, you've just turned a potential loss into an open-and-shut win.

Mastering Your Dispute Response Process

Getting a chargeback notice is always a gut punch. But your response needs to be strategic, not emotional. While stopping chargebacks before they happen is the real goal, having a rock-solid dispute response process is your essential safety net. It’s how you get your money back from bogus claims and show processors you're a serious, diligent merchant.

This is where all that evidence you've been collecting really pays off. A fast, factual, and evidence-packed response can flip a potential loss into a recovered sale, protecting both your revenue and your merchant account.

Deconstruct The Chargeback Reason Code

First things first: you have to know why the chargeback was filed. Every single dispute comes with a specific reason code from the cardholder's bank. Think of this code as your roadmap for building a winning rebuttal. It tells you the customer's exact claim, which in turn tells you exactly what you need to disprove.

Don't make the mistake of treating all disputes the same. Your response for a "Transaction Not Recognized" claim will be completely different from an "Item Not Received" claim. The first needs proof of authorization; the second demands proof of delivery.

A fraud code, for instance, means you should immediately pull up evidence like AVS/CVV matches, IP address logs, and device fingerprints. But if the dispute is about fulfillment, that signed delivery confirmation is the most powerful weapon in your arsenal.

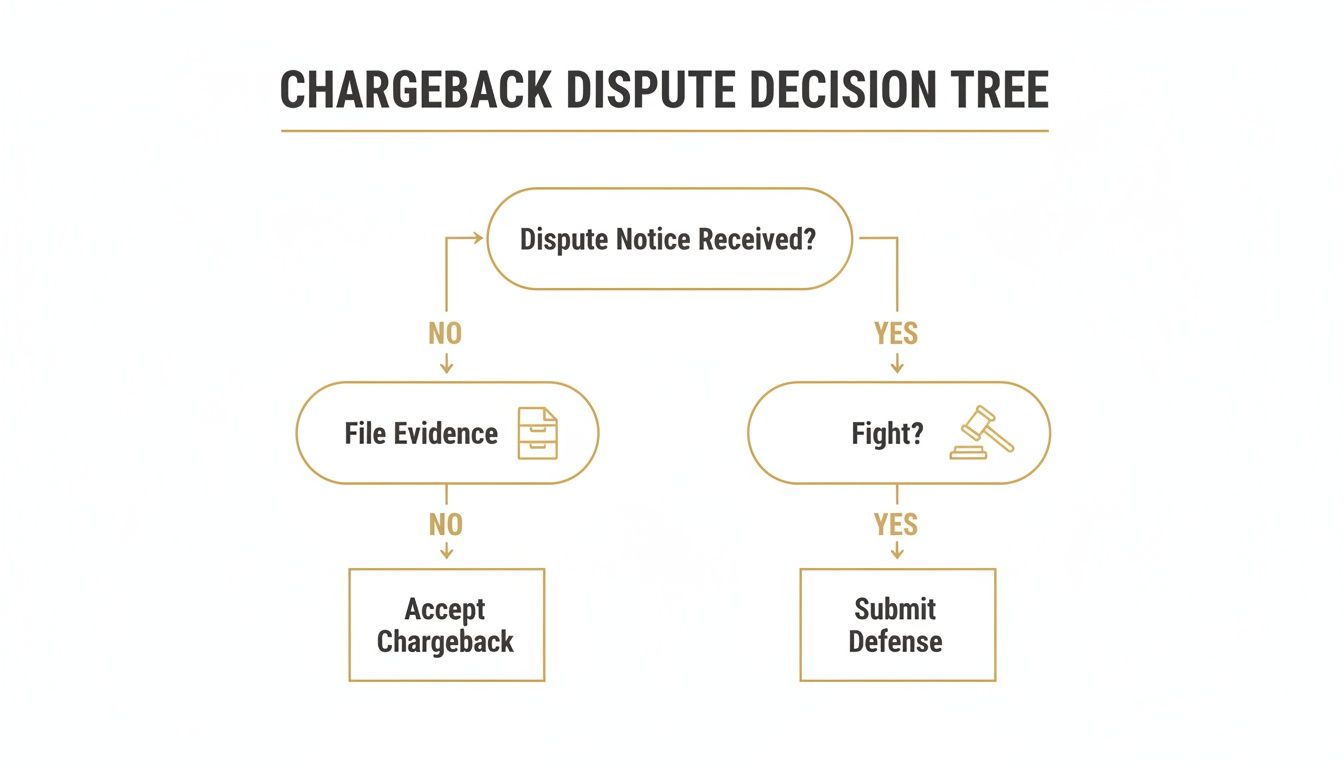

To Fight Or Not To Fight: The Strategic Decision

Believe it or not, you shouldn't fight every chargeback. It’s tempting, I know, but sometimes taking the loss is the smarter business move. This has to be a quick, calculated analysis, not an emotional reaction.

Before jumping into the ring, ask yourself these questions:

- What’s the transaction value? Is the amount in dispute worth the time and effort it will take to fight? Contesting a $10 chargeback could easily cost you more in operational hours than the chargeback itself.

- How strong is my evidence? Be brutally honest. Do you have undeniable proof of delivery? Crystal-clear evidence the service was used? If your evidence is flimsy, your odds of winning are low, and that time is better spent elsewhere.

- What's the customer's history? Is this a brand-new customer or someone who has ordered from you a dozen times? For a valuable, long-term customer, it might be better to issue a refund and save the relationship, even if you think the claim is unfair.

This decision tree gives you a great visual for that critical moment when a dispute notice lands. Should you invest the resources to fight it?

As the flowchart shows, it all starts with your evidence. The decision to fight is a strategic fork in the road, and the strength of that evidence tells you which path to take.

Crafting A Winning Rebuttal Letter

Once you've decided to fight, your rebuttal letter is your one shot to plead your case to the issuing bank. It has to be concise, factual, and incredibly easy for a bank employee to scan and understand. These folks look at hundreds of these a day, so clarity and brevity are your best friends.

Forget long, emotional paragraphs. Use bullet points and clean headings to lay out your case. Your letter should act as a cover sheet that quickly summarizes the transaction and points the reviewer directly to the evidence you've attached.

A powerful rebuttal letter always includes:

- A quick summary of the original order.

- A direct takedown of the customer's claim, referencing their specific chargeback reason code.

- An itemized list of all the compelling evidence you’re providing.

This formal process is called representment—it's your official chance to tell your side of the story. For merchants who see a spike in disputes during busy seasons, getting this workflow down is absolutely crucial. To get your team ready, it's worth exploring specialized guides on building a powerful Q4 representment strategy to handle the holiday rush.

Selecting The Right Evidence For The Claim

Your rebuttal letter is only as good as the evidence you back it up with. You need to pull the most relevant documents from your evidence locker based on that specific reason code. Don't just dump a folder of files on the bank; overwhelming them with irrelevant documents will only hurt your chances.

Here's a quick guide to matching your evidence to the most common claims.

Common Chargeback Reason Codes and Required Evidence

| Reason Code Category | Example Scenario | Crucial Evidence to Provide |

|---|---|---|

| Fraud/No Authorization | A customer claims they never made the purchase. | AVS/CVV match results, IP address logs showing a match to the billing location, and any past order history from the same customer or IP address. |

| Product/Service Not Received | The customer insists the item never arrived or the service wasn't provided. | Dated shipping confirmation with a tracking number, proof of delivery from the carrier (signature confirmation is gold), or server logs showing the customer logged in and used your digital service. |

| Product Not as Described | The customer alleges the item was defective, damaged, or different from your website's description. | High-quality product photos from your website, a copy of the product description at the time of purchase, and any communication (emails, chats) where the customer acknowledged receipt or seemed happy with the item before the dispute. |

When you tailor your evidence package to directly counter the customer's specific claim, you make it simple for the bank to see the truth and rule in your favor. This systematic, evidence-first approach is exactly how you protect your revenue and keep your payment processors happy.

Your Top Chargeback Questions, Answered

Even with the best prevention plan in place, you're bound to run into tricky situations and have questions. Getting a handle on the nuances of chargeback management is what separates the merchants who get by from the ones who thrive. It's about making smart calls that protect your bottom line and keep your business on solid ground.

This section tackles some of the most common questions we hear from merchants in the trenches. Think of it as your field guide for those "what do I do now?" moments.

What’s Actually Considered a "High" Chargeback Rate?

The magic number here is 1%. Once your chargeback-to-transaction ratio climbs above that 1% mark, you’re on the radar of payment processors like Visa and Mastercard. Crossing this line often lands you in a high-risk monitoring program, which is a world of expensive monthly fines and constant scrutiny.

Don't underestimate how quickly things can escalate. If you can't get that rate back down, you're looking at the very real possibility of having your merchant account shut down. Losing your ability to process credit cards is a devastating blow, and it's incredibly tough to recover from. This is why being proactive isn't just a good idea—it's essential.

How Does 3D Secure Actually Help?

You've probably seen it at checkout—Visa Secure, Mastercard Identity Check, etc. That's 3D Secure. It’s an extra authentication step that forces the customer to prove they are who they say they are, usually by plugging in a password or a one-time code sent to their phone from their bank.

This little step is a huge deal when it comes to "unauthorized transaction" claims. Why? Because when a purchase is successfully authenticated with 3D Secure, the liability for that specific type of fraud-related chargeback shifts from you to the bank that issued the card. It's a powerful piece of evidence proving the real cardholder was in on the transaction.

It's important to remember that 3D Secure is a scalpel, not a sledgehammer. It’s fantastic for fighting fraud claims but won't do a thing to stop chargebacks for things like "item not as described" or "product not received." It’s just one critical layer in your defense.

For a deeper dive into other chargeback topics and strategies, you can explore more articles on the Disputely blog.

Should I Really Fight Every Single Chargeback?

No, and trying to is a classic rookie mistake. Deciding whether to fight a chargeback is all about a quick, smart cost-benefit analysis. Your time is money, so you have to be strategic about where you invest it.

Pick your battles. You should absolutely fight when:

- The order value is high. It makes a lot more sense to spend an hour fighting a $500 chargeback than a $10 one.

- Your evidence is rock-solid. If you have a signed proof of delivery or server logs showing a customer used your software, your chances of winning are great. Go for it.

- You spot a pattern of friendly fraud. Pushing back against serial disputers sends a clear signal that you won't be an easy target.

On the other hand, for a tiny transaction with shaky evidence, it's often cheaper to just take the L and move on. The real win is figuring out what went wrong in your process to cause the dispute in the first place and fixing it.

At Disputely, we stop chargebacks before they even hit your merchant account. By integrating with Visa RDR, Mastercard CDRN, and Ethoca alerts, we notify you instantly when a dispute is initiated, giving you time to issue a refund and avoid the chargeback entirely. Protect your business and see how much you can save with Disputely.