How to Fight Chargebacks With a Complete Merchant Playbook

Quick Overview Of How To Fight Chargebacks

A strong chargeback defense leans on three core pillars: proactive prevention, real-time detection, and structured representment. Tackle issues before they escalate, and when disputes hit your inbox, you’ll be ready to respond without breaking a sweat. This roadmap lays out the essentials for taking control of your chargeback flow.

Pillar Breakdown

Proactive Prevention stops confusion at the source. Clear billing descriptors, transparent refund policies, and concise order confirmations go a long way toward keeping disputes at bay.

Real-Time Detection acts like a security camera for your transactions. By layering data-driven alerts with targeted manual reviews, you flag the riskiest orders before they spiral into formal chargebacks.

Structured Representment turns scattered evidence into a winning narrative. Collate shipping receipts, customer communications, and product photos to build a case that wins back lost revenue.

Real-World Scenario

One apparel merchant noticed a spike in disputes tied to unclear billing descriptors. They swapped out a generic company name for a more detailed descriptor on customer statements—and saw their dispute rate drop by 30% within weeks.

At the same time, automated alerts for mismatched addresses kicked off manual reviews. That second line of defense caught potential fraud before refunds were issued, trimming chargebacks by an additional 15% in just one quarter.

Key Takeaway

Combining proactive tweaks with instant alerts and airtight evidence packages can cut your disputes almost in half—without overhauling your entire operation.

Summary Of Key Chargeback Defense Strategies

Below is a quick reference that lays out each strategy’s core purpose and the impact you can expect:

| Strategy | Purpose | Impact |

|---|---|---|

| Proactive Prevention | Stop misunderstandings early | 20–30% fewer disputes |

| Real-Time Detection | Flag at-risk orders fast | 15% faster response |

| Structured Representment | Submit compelling evidence | Up to 70% win rate |

Use this breakdown to prioritize investments and assign responsibilities within your team.

Armed with this framework, you’ll see how each pillar reinforces the others—driving down your overall chargeback ratio and freeing up time for growth initiatives.

This dashboard view highlights a 28% drop in chargeback rates once automated alerts go live, giving you clear proof that the system works.

Benefits Of A Three-Pillar Defense

- Early Clarity: Clear invoices and policy pages build trust, cutting down on friendly fraud.

- Instant Alerts: Catch disputes in the pre-dispute window, saving hours of follow-up.

- Efficient Representment: Well-organized evidence makes merchant representment painless and boosts win rates.

Whether you’re on Shopify, Stripe, or PayPal, this approach plugs right into your stack.

Next Steps

First, audit your current billing descriptors and customer-facing templates. Make sure every line item on a statement reads clearly.

Then, set up data-driven alerts for transactions with high refund or decline rates:

- Connect Disputely for real-time notifications and automated workflows.

- Monitor chargeback ratio, reason codes, and average resolution time.

- Compare platform fees and track ROI to choose the right tools.

- Report monthly savings to leadership and refine thresholds as you go.

Get started today and turn chargebacks from a headache into a metric you control.

Understanding Chargeback Trends

Over 60% of all chargebacks in ecommerce and subscription businesses now come from card-not-present transactions.

Friendly fraud has spiked across North America, Europe and APAC, forcing merchants to rethink old assumptions.

A surprising number of disputes stem from simple confusion. Refining product descriptions and billing descriptors is often your first line of defense.

- Update item names with clear titles and precise specs

- Align the statement descriptor with the brand name your customer knows

- Flag ambiguous SKUs or generic labels in internal notes

- Test descriptor tweaks on a subset of orders before rolling out broadly

Market Specific Hotspots

In the EU, a cosmetics retailer trimmed disputes by 28% after swapping out English descriptors for local language versions.

Stateside, subscription services routinely see friendly fraud peaks around annual renewals when customers don’t recognize charges.

We’ve put together a Q4 Audit Guide for Dispute Prevention that walks you through every step.

- North America: renewal disputes on digital subscriptions

- Europe: confusing descriptors in multilingual markets

- APAC: first-party disputes on cross-border orders

Consistency in billing information reduces confusion and slashes unnecessary disputes by up to 30%.

Choosing Real Time Alert Partners

To make the most of your team’s energy, pick alert partners that slot right into your payments stack.

Merchants who turn on Ethoca or Visa’s Rapid Dispute Resolution get notifications in 24–48 hours, giving a narrow window to issue refunds and stop chargebacks.

Fine-tune your filters to cut out noise and zero in on alerts that really matter.

| Provider | Notification Delay | Key Benefit |

|---|---|---|

| Ethoca Alerts | 24–48 hours | Pre-dispute resolution |

| RDR | Within 24 hours | Direct issuer feed |

| Disputely | Real-time | Automated workflows and auto-refunds |

This early-warning setup catches many disputes before they ever reach the issuing bank.

Testing Descriptor Changes

Never push a new billing descriptor sitewide without testing it first.

Run A/B experiments over two to four weeks and watch how each variant affects chargeback ratios, support tickets and email receipt click-through rates.

| Variant | Chargeback Rate | Support Tickets | CTR on Receipts |

|---|---|---|---|

| A | 0.49% | 12 | 18% |

| B | 0.32% | 8 | 24% |

Once you identify the winning descriptor, roll it out across checkout flows, emails and card statements in every locale.

This kind of data-driven tweak can lower friendly fraud without denting genuine sales.

Global chargeback volumes hit 238 million disputes in 2023.

Analysts predict 24–41% growth over the next three years, driven by card-not-present transactions and first-party fraud.

Read the full research on dispute trends in the Sift Q4 2025 Report.

Keep a close eye on your monthly chargeback rate, refine descriptor rules quarterly and stay nimble as new fraud patterns emerge.

That ongoing cycle is your best defense.

Prevention Tactics That Work

Stopping risky orders before they slip through is the cornerstone of fraud prevention. With the right mix of tools, you can protect revenue without turning away loyal customers.

Device fingerprinting and behavioral scoring catch odd patterns instantly. When applied properly, these checks can cut fraud by up to 20 percent while keeping checkout smooth.

High ROI Fraud Screening

Profiling devices by IP, browser and operating system stops bots and proxy networks early. We’ve found that pairing fingerprinting with real-time alerts drives the best returns.

- Device Fingerprinting

Logs hardware signals—like screen resolution and installed fonts—to spot repeat offenders. - Behavioral Scoring

Monitors mouse movements and typing cadence, flagging anything that looks robotic. - Velocity Rules

Blocks cards or accounts that try too many transactions in a short span.

In one case, a subscription box merchant layered these tactics with 24-hour alerting and saw disputes drop by 18%. They caught the same stolen card attempting checkout three times in under an hour.

Optimize Billing Descriptor Clarity

Vague charges lead to “friendly fraud” when cardholders don’t recognize the statement. Swap the cryptic codes for your brand name and you’ll see fewer calls to banks.

A fashion retailer switched from “FSHNCO” to “StyleHub” and watched disputes plummet. Combine clear descriptors with pre-dispute alerts, and you can resolve 8–18 percent of potential chargebacks before they blow up into formal disputes. Learn more from Chargeback Insights.

Key Takeaway Clear billing descriptors and fast alerts often stop disputes before banks get involved.

Enforce AVS And CVV Checks

Adding address verification (AVS) and dynamic CVV validation creates quick checkpoints that rarely affect genuine shoppers. Flag any transaction where the AVS or CVV mismatch happens more than twice.

| Rule | Requirement | Impact |

|---|---|---|

| AVS Exact Match | Billing address must match cardholder info | Fewer misrouted orders |

| Dynamic CVV | Require CVV entry on suspicious orders | Blocks leaked cards |

One marketplace cut chip-fraud losses by 12% simply by rejecting high-ticket orders with repeated CVV mismatches.

Build Refund Policies And Support

A clear, visible refund policy gives customers an easy out before they file a dispute. Keep your window straightforward and weave support links into every confirmation email.

- Define a 30-day refund period that matches your shipping and fulfillment timelines.

- Offer instant chat support for quick resolution—many disputes vanish once you answer a simple question.

- Automate a reminder two days before the refund window closes to prompt last-minute returns.

An online course provider added live chat to their FAQ and saw a 14% drop in friendly-fraud claims. A human reply at the right moment can make all the difference.

Real customer support speeds can cut disputes by up to 20 percent according to merchant studies.

Integrate these tactics with minimal friction using APIs from Disputely, Stripe or PayPal. Track metrics like chargeback rate, dispute resolution time and refund volume—and refine rules every month.

Next Steps For Prevention

Begin by mapping your current fraud stack against these methods. Spot any gaps in device screening, descriptor clarity or checkout validation.

- Run device-fingerprint trials on 10% of your traffic for a month.

- Update billing descriptors in your payment-gateway sandbox first.

- Activate AVS and CVV rules alongside existing filters.

- Roll out refund-policy changes with targeted email reminders.

Keep an eye on dispute trends and alert volumes through dashboards. Adjust thresholds to maintain a smooth checkout for real shoppers. Gather your team for monthly reviews and celebrate every win.

Fighting chargebacks is a continuous cycle of clarity, verification and fast response. Regularly revisit your prevention plan and adapt as card-network rules evolve. Testing and iteration will keep you ahead of new fraud tactics—so you stay protected and profitable.

Detecting Early Warning Signs

Spotting trouble before it turns into a chargeback can save you hours of headaches and thousands in fees. Tweak your order dashboard so it lights up whenever something unusual pops up.

Watch for:

- Sudden jumps in chargeback ratios compared to your daily norm

- Transactions hitting multiple declines or heavy refund requests

- Shipping address mismatches triggering AVS failures

- A burst of negative reviews or refund inquiries

- Rapid-fire purchases from the same account

Dashboard Tuning Basics

Kick things off by setting thresholds that make sense for your volume and risk appetite. For instance, trigger an alert if your chargeback ratio climbs above 0.5% within any two-hour window.

Then wire those alerts into email or Slack to rally your team at once. A simple rule could flag orders with more than 2 declines in 30 minutes.

| Metric | Threshold | Action |

|---|---|---|

| Chargeback Ratio | 0.5% over 2 hours | Manual Review |

| Decline Count | 2 in 30 minutes | Fraud Check |

| Refund Request Rate | 10% of daily sales | Customer Follow Up |

Integrating Fraud Signals

Most gateways feed you session-risk scores—tap into those. Plug in Ethoca alerts or Visa RDR to enrich your signals.

One merchant slashed their representment workload by 30% just by auto-ticketing on these feeds.

Quick action on rich fraud signals can slash your workload and stop disputes cold.

Combine those alerts with your own rules to build a real safety net.

Quick Manual Review Triggers

AVS mismatches and odd shipping addresses often point to fraud attempts. Build a manual pause into any order that fails those checks.

Try this workflow:

- Identify orders where the billing and shipping addresses don’t align

- Reach out via a quick call or email to confirm details

- Hold fulfillment until the customer verifies their address

This simple gate can block bogus orders before they turn into chargebacks.

Monitoring Customer Signals

Your customers are your early warning system. When someone flags a problem, you want to catch it before it escalates.

Set up quick surveys or chat prompts tied to shipping delays or refund requests. Then:

- Link each survey to the order number for fast resolution

- Escalate low ratings to your dispute team immediately

- Offer partial refunds automatically to calm upset buyers

These steps keep small problems from ballooning into formal disputes.

Refining Thresholds Over Time

As your business grows or runs promotions, order patterns shift. Make it a habit to review your alerts every month.

Look for spikes in false positives and adjust:

- Chargeback ratio limits

- Decline and refund triggers

Run A/B tests whenever you tweak a rule, so you know whether disputes actually drop. Smaller teams might lean on tools like Disputely to auto-tune settings based on what’s working.

Early detection is your first line of defense. With sharp dashboards, smart fraud feeds, and clear review rules, you’ll catch most disputes before they ever see a bank.

A monitoring rule that catches one disputed order per thousand can save thousands monthly.

- Flag 5 or more disputes within a month for targeted reviews.

Action matters now.

Building Automated And Manual Response Workflows

When a new dispute pops up, you need a clear system that moves swiftly without sacrificing detail. Organizing all cases in a single hub keeps everyone on the same page. That way, nobody duplicates efforts or wastes time digging through scattered emails.

Assembling Evidence Packages

Start by pulling together every document that proves you fulfilled the order exactly as promised.

- Include the customer’s receipt or invoice PDF with line items and timestamps

- Attach AVS and CVV logs that confirm address and code matches

- Export shipping data showing delivery dates and tracking status

- Compile chat, call, and email transcripts in a clean, legible format

Well-structured evidence can make or break your case. In fact, about 74 percent of disputes turn into chargebacks—and having receipts, AVS, CVV records, and fulfillment proofs ready to go is crucial for timely representment. Discover more insights about the true cost of chargebacks in 2025

You can also centralize disputes through our platform for consistency and faster resolution. Check out our Fourth Quarter Representment playbook for advanced tips.

Deciding When To Automate Vs Manual Review

Automation shines when you need speed—imagine evidence packages firing off the moment a dispute triggers.

Manual checks matter too, especially if an order has mismatched AVS data or unusually large refunds. From my experience, it’s best to:

- Push evidence via API once your error rate dips below 2% and you see more than 10 disputes a day

- Flag any orders where AVS and shipping details conflict for in-depth human review

- Route high-value claims to a specialist who can gather extra context

This hybrid approach keeps the wheels turning while giving tricky cases the personal attention they deserve.

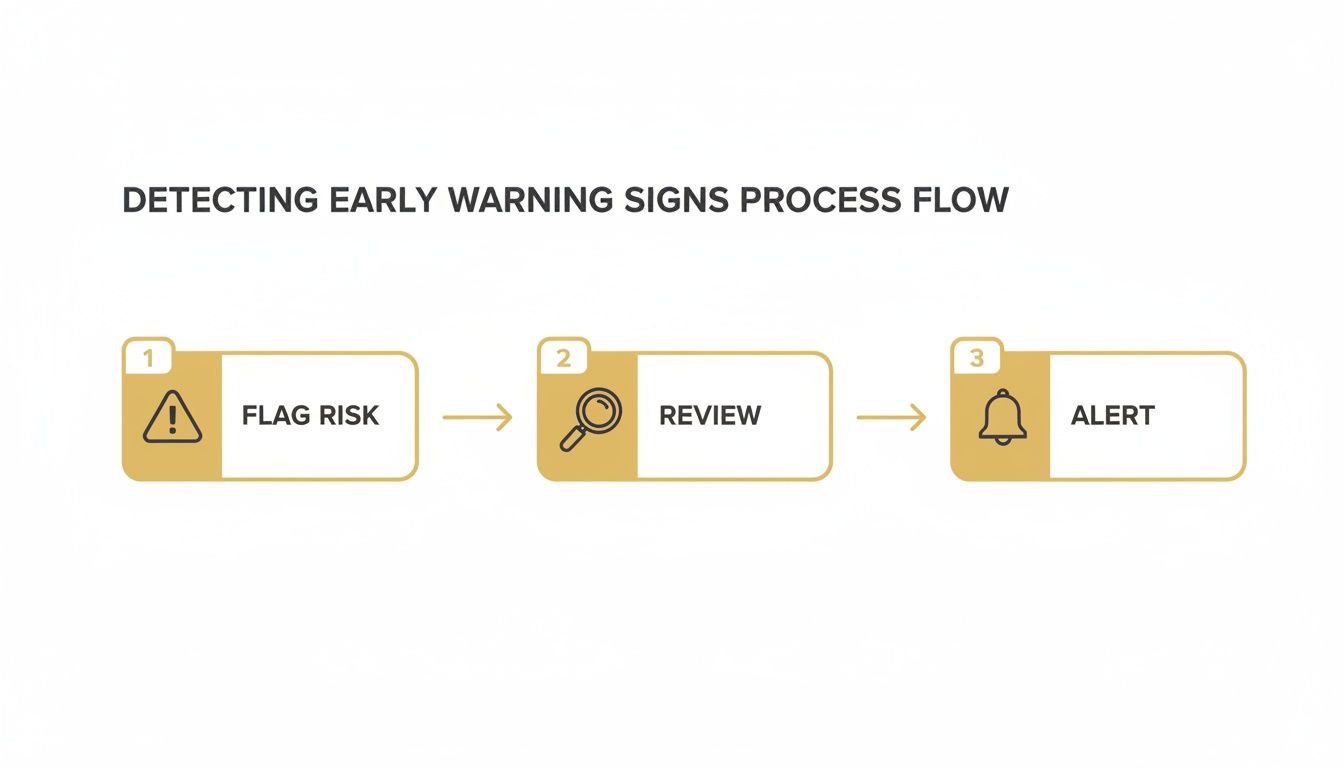

Infographic Insights

This graphic breaks down how you can spot early warning signs right in your dispute dashboard. By flagging, reviewing, and alerting, you could intercept 30 percent more disputed transactions before they snowball into chargebacks.

Timing Submission Practices

Getting your package in on time—and thorough—can bump your win rate by up to 15 percent. It’s all about finding the sweet spot between speed and detail.

| Approach | Speed | Detail Level | Typical Win Rate |

|---|---|---|---|

| Fast Submit | 1–3 Days | Low | 60% |

| Full Package | 5–7 Days | High | 75% |

Expert Insight

Timing representment within the first five days can lift success by 25 percent.

Use automated reminders for looming deadlines and log each submission date in a shared dashboard. Building a library of templates lets your team crank out compliant packages under pressure.

After every batch of cases, review wins and losses to refine your evidence checklist. It might feel like extra work, but those insights fuel continuous improvement.

Practical Templates And Formatting

Issuer requirements shift by brand and region, so format every document to spec. Clear headings, bolded dates, and well‐labeled sections speed up review.

- Open with a cover page listing transaction ID, date, cardholder name, and dispute reason

- Order logs and receipts chronologically, and number each page

- Save everything as a PDF under 5MB to meet upload limits

| Section | Details Included |

|---|---|

| Cover Page | Transaction ID, Date, Cardholder Info |

| Evidence Summary | Receipts, Logs, Shipping Confirmation |

| Communication Logs | Date, Time, and Channels of All Interactions |

| Conclusion Statement | Brief Recap of Why the Chargeback Lacks Merit |

Personalize each template with your logo, case number, and contact details so issuers can verify authenticity in seconds. Storing these in a shared drive guarantees consistency no matter who’s handling the dispute.

Metrics To Track Savings

Keeping score on your workflow reveals where you’re winning—and where you can tighten up.

- Track average submission time to confirm you’re beating issuer deadlines

- Monitor win/loss ratios over monthly and quarterly cycles

- Calculate full cost per dispute, including fees, staffing, and tools

- Compare dispute volumes before and after workflow tweaks

Charts or scorecards make these stats impossible to ignore. A real-time dashboard will even flag performance dips so you can course-correct on the fly.

Continuous Refinement

Chargeback defense is a cycle of testing, reviewing, and adapting. It’s never “set it and forget it.”

- Gather feedback from reviewers on evidence packets

- Update your templates based on what’s winning or falling short

- Run quarterly audits to catch new patterns and edge cases

Over time, these small tweaks add up—transforming a reactive process into a proactive advantage.

Taking Action With Stripe PayPal and Shopify

Managing disputes across Stripe, PayPal, and Shopify doesn’t have to feel like a juggling act. Each dashboard hides powerful tools for evidence uploads, notifications, and custom risk rules.

Harmonizing those settings means you never scramble to match order IDs or hunt down receipts. Mirror the same order number in Stripe and Shopify, and every case stays traceable from start to finish.

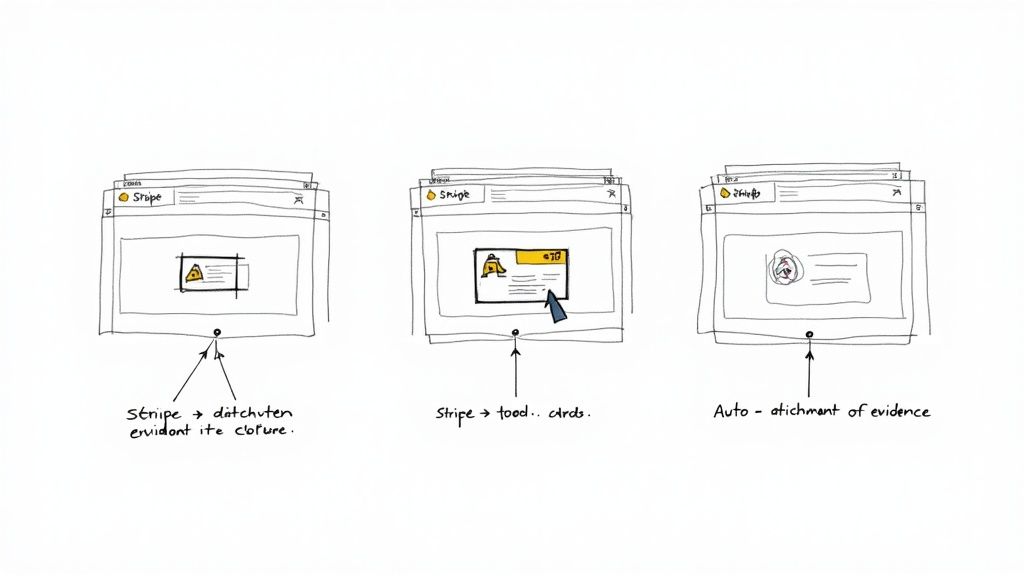

Here’s a screenshot showing Stripe’s dispute settings in action.

That view highlights auto-submit toggles, shaving off 40% of manual copy/paste work and speeding up each representment.

Stripe Dispute Dashboard

Open the Disputes section under Settings and flip on real-time evidence uploads. Receipts, fulfillment logs, and risk signals then flow straight into your case files—no extra clicks required.

Refine those submissions with:

- Mapped dispute reason codes aligned to your ticket statuses

- Session metadata like IP addresses, device fingerprints, and geolocation

- Automated PDFs for invoices, tracking details, and chat transcripts

You can also hook into Stripe events to:

- Trigger a support ticket for every new dispute

- Push notifications to Slack or your helpdesk

- Log a timestamp for each evidence upload

A simple tip: embed customer support screenshots within the evidence portal. It often bumps your win rate by 5–7%. In one apparel store’s case, they slashed first-response time by 50% after enabling these rules.

Optimizing PayPal Disputes

The Resolution Center in PayPal groups disputes and chargebacks into a single view. From there, you choose which evidence types upload automatically.

Try these settings:

- Auto-upload Transaction Details for orders under $100

- Send daily Email Summaries on dispute statuses to finance

- Activate Fraud Filters to block risky orders before they escalate

“Our team shaved off two hours per day by automating receipt uploads,” says a DTC merchant.

Maximize PayPal’s workflow by:

- Reviewing Dispute Settings under Account Access

- Linking your CRM to pull support logs automatically

- Appending custom order fields via the PayPal API

Thread-level comments let you reply directly to issuers—an extra clarity boost that can lift win rates by 10%. Archive each thread in your CRM right away to spot repeat disputers faster.

Configuring Shopify Workflows

Shopify Payments includes a native dispute hub, but adding an app like Disputely brings in extra fraud signals. You decide whether to auto-submit evidence or route cases through Disputely’s alerts.

Focus on three core tweaks:

- Turning on Email Alerts for every dispute

- Crafting Fraud Rules to auto-suspend flagged orders

- Using Order Tags to set dispute priority levels

Learn more about Shopify hold practices in our guide to refine your dispute holds (https://disputely.com/shopify-hold).

Below is a quick comparison of automation features:

| Platform | Auto Evidence Submission | Notification Methods |

|---|---|---|

| Stripe | API-powered uploads | Email, Webhooks, SMS |

| PayPal | Selective auto-upload | Email, Dashboard alert |

| Shopify | Manual or app-driven | Email, Dashboard, App |

For example, a subscription box service turned on address verification rules in Shopify and cut mismatched AVS disputes by 25%. They eliminated manual uploads and now rely on Disputely’s early flags.

Fine-tuning these settings frees your team from repetitive tasks. Typically, merchants reduce full resolution cycles by 35–45%.

Key Insight

Integrating session data and mapping reason codes across platforms ensures no detail falls through the cracks.

Next Steps: Audit each platform monthly and share findings across teams. Refine these actions in small batches to stay ahead of fraudulent and friendly disputes for maximum impact.

Frequently Asked Questions

Merchants often look for quick wins when it comes to chargebacks. Here are the essentials to kickstart your dispute-reduction playbook.

What Are The Fastest Steps To Implement For Fighting Chargebacks?

In our experience, six targeted tweaks can deliver impact within weeks:

- Update Merchant Descriptors for better customer recognition

- Tighten AVS and CVV checks at checkout

- Clarify Product Descriptions to match expectations

- Enable Proactive Dispute Alerts for real-time notifications

- Fine-tune Refund Policies to reduce friction

- Elevate Customer Support with faster, informed responses

How Can I Track Dispute Reduction Over Time?

Keep an eye on these four metrics:

- Chargeback Rate Trends

- Reason Code Breakdown

- Dispute Volumes and Timelines

- ROI of Your Prevention Workflows

What Evidence Most Impacts Representment Success?

A well-assembled evidence packet often wins:

- Receipts and invoices detailing each purchase

- Proof of delivery logs with dates and times

- AVS/CVV verification records

- Customer communication transcripts

When Should I Use External Dispute Specialists?

Once your in-house team hits capacity, bringing in specialists pays off. They excel at deep evidence gathering and can lift your win rate significantly.

“Automating alerts and refining descriptors cut one merchant’s disputes by 30% in weeks.”

Additional Tips

Running small A/B tests on descriptor tweaks delivered 20–30% fewer disputes in days.

Check your analytics dashboard regularly to spot chargeback spikes before they escalate.

Hand off select cases to outside specialists so your team can focus on proactive prevention.

- Track monthly dispute trends to measure progress and refine your rules

Ready to stop chargebacks before they hit? Learn more about Disputely at Disputely