Your Guide to Merchant Protection From Chargeback

Let's be blunt: chargebacks are a silent killer for online businesses, and friendly fraud is leading the charge. If you’re still treating dispute management as a simple cost of doing business, you're falling behind. Protecting your business from chargebacks has gone from a back-office task to an essential survival strategy.

The Growing Threat of Chargebacks to Online Merchants

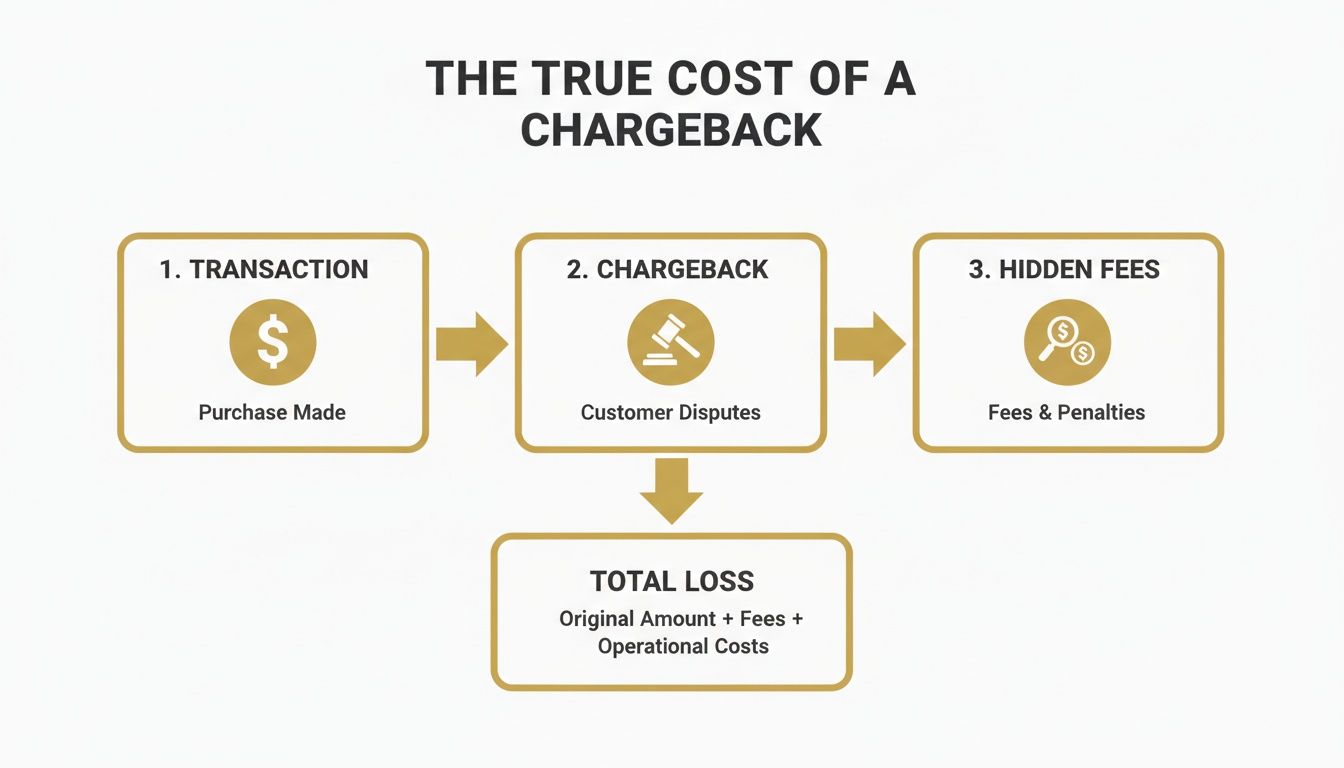

For anyone running a Shopify store, a SaaS platform, or a DTC brand, a chargeback is so much more than a reversed sale. It's a financial drain that gets worse over time. You don't just lose the sale; you get hit with a cascade of hidden costs that really start to sting.

Every single chargeback comes with a non-refundable fee from your payment processor, usually somewhere between $15 and $25. Now, add in what you spent to acquire that customer, the hours your team wastes fighting the dispute, and the cost of the actual product you shipped. Suddenly, that one reversed transaction looks a whole lot bigger.

The Hidden Costs You Cannot Ignore

It’s the costs lurking beneath the surface that do the most damage. Think about it:

- Operational Strain: Your team is tied up digging through order details and writing rebuttals when they could be focused on growing the business.

- Higher Processing Fees: A high chargeback ratio makes you look risky. Processors notice and often hike your transaction fees as a result.

- Account Holds and Termination: This is the big one. If your chargeback rate crosses the thresholds set by Visa or Mastercard, you risk having your funds frozen or, worst of all, losing your merchant account for good.

This isn't a small problem—it's getting worse, fast. In 2025, e-commerce chargebacks shot up by a jaw-dropping 233% between the first and third quarters. A huge chunk of that was driven by so-called "friendly fraud" and refund scams being passed around on social media.

Even what seems like a low chargeback rate can be devastating. At a rate of just 0.26%, a business can easily lose thousands. On average, U.S. merchants end up losing $4.61 for every $1 that gets charged back. You can dig into these findings in Sift's Q4 2025 Digital Trust Index.

The hard truth is this: for every $100 you lose to a chargeback, the real cost to your business is far greater once you factor in fees, labor, and the risk to your payment processing relationship. It's death by a thousand cuts.

Why Proactive Protection is Non-Negotiable

Waiting around to fight a chargeback after it's been filed is a losing game. By that point, the damage is done. Your dispute ratio has already taken a hit, and you're officially on the back foot.

The only way to win is to get ahead of the problem. A modern, proactive defense is all about intercepting customer issues before they ever escalate into a formal chargeback. This is where we start to see the different types of chargebacks and why a one-size-fits-all approach just doesn't work.

The True Cost of Different Chargeback Types

Here's a breakdown of common chargeback reasons—true fraud, merchant error, and the fast-growing 'friendly fraud'—and the actual costs they carry.

| Chargeback Type | Primary Cause | Typical Business Impact | Prevention Focus |

|---|---|---|---|

| True Fraud | A stolen credit card or identity is used to make an unauthorized purchase. | Direct revenue loss, lost product, and a hit to your chargeback ratio. | Strong fraud filters, AVS/CVV checks, and tools like 3D Secure. |

| Merchant Error | Mistakes like shipping the wrong item, unclear billing descriptors, or a confusing return policy. | Lost revenue and product, plus a poor customer experience that hurts repeat business. | Clear communication, accurate product descriptions, and an easy-to-find return policy. |

| Friendly Fraud | A legitimate customer disputes a valid charge, either by mistake or intentionally (cyber-shoplifting). | The most costly. You lose revenue, product, and pay fees, plus it's tough to win these disputes. | Pre-dispute alerts, clear billing, and excellent, accessible customer service. |

Understanding these distinctions is the first step toward building a defense that actually works. While you need to be prepared for all types, friendly fraud is often the leak that sinks the ship.

Beyond chargebacks, it's also critical to be aware of other significant threats to online merchants, like sudden account suspensions that can bring your entire operation to a halt. A truly resilient business is built to withstand all of it.

How the Chargeback Process Actually Works

If you want to build a solid defense, you first have to understand the playbook of the other team. A chargeback isn't just a simple refund request. It's a formal, complicated dispute that drags you into a mess involving your customer, their bank, and the card networks like Visa and Mastercard. Honestly, this is where most merchants lose—they don't grasp the full picture from the start.

It all kicks off when a cardholder calls their bank (the one that issued their credit card) to question a charge. Maybe they don't recognize your business name on their statement, or they claim the package never arrived, or perhaps they feel the service wasn't what they paid for.

The customer's bank takes a look at the claim. If it seems even remotely valid, they'll give the customer a provisional credit and then formally file a chargeback against your business. That’s when the clock starts ticking for you.

From Your Processor to Your Pocket

Once the card network gets the dispute, it trickles down the line to your acquiring bank or payment processor—think Stripe or Shopify Payments. At that moment, your processor yanks the disputed amount right out of your merchant account. To add insult to injury, they also hit you with a separate, non-refundable chargeback fee, which is usually somewhere between $15 and $25 a pop.

So, before you’ve even had a chance to defend yourself, you're out the original sale amount and a penalty fee. You then get a notification with a very tight deadline, often just a few days, to respond.

This flowchart really drives home how a single transaction can quickly snowball into a much bigger loss once a chargeback is filed.

As you can see, it’s not just about the lost revenue. The fees and hidden operational costs can really pile up.

The Critical Pre-Dispute Window

For years, the standard approach was to wait for the formal dispute notice and then react. That’s a slow, expensive way to do things. The real magic in modern merchant protection from chargeback happens in the tiny window of opportunity before a formal chargeback ever gets filed.

This is where pre-dispute alert networks come into play. You've probably heard of them:

- Ethoca: Now a Mastercard company, Ethoca works with a huge network of card issuers to give merchants a heads-up when a customer is about to file a dispute.

- Verifi: This is Visa's version, which also lets you resolve issues directly with the customer before they escalate into a full-blown, damaging chargeback.

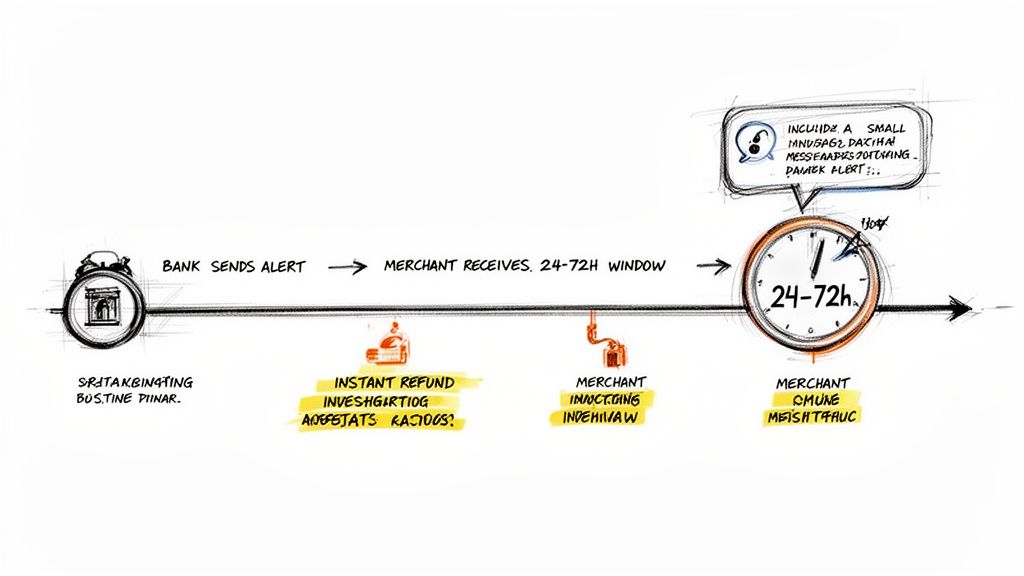

Here’s how it works: When a customer calls their bank, these alert systems can intercept the inquiry. Instead of the bank launching a chargeback, it sends an alert directly to you (or a service you use). This gives you a critical 24-72 hour window to take action.

By issuing a refund during this pre-dispute stage, you stop the chargeback cold. You still lose the sale, of course, but you completely avoid the chargeback fee and—most importantly—you protect your all-important dispute ratio.

Understanding Representment

What happens if you miss the alert or decide not to refund? The formal chargeback process moves forward, and your only recourse is representment. This is the official term for fighting back. You gather all your compelling evidence to prove the transaction was legitimate and submit it.

Your evidence packet might include things like:

- Shipping confirmation with tracking numbers or a signature

- Customer emails, support tickets, or chat logs

- Address Verification System (AVS) and CVV match results

- IP logs that show a customer logging in to access a digital product

This evidence gets sent back up the chain for the issuing bank to review. They get the final say. And here’s the hard truth: the odds are not in your favor. On average, merchants only win about 20-30% of the cases they fight. That’s why preventing the dispute in the first place is always the smarter strategy. If you’re waiting until the representment stage, you’re already playing from behind.

Using Real-Time Alerts for Proactive Defense

Trying to fight a chargeback after it’s already hit your account is a losing game. It's like damage control after the fire has already spread. The only winning move is to stop the fire before it even starts. That’s exactly what pre-dispute, real-time alerts are designed to do.

Think about what usually happens. A customer sees a charge they don't recognize and calls their bank. That single phone call kicks off a formal chargeback process, slapping you with a fee and dinging your dispute ratio.

But with a real-time alert system, that same phone call goes down a completely different path. Instead of a chargeback, an alert fires off directly to your system. This opens up a critical 24- to 72-hour window for you to step in and fix the problem before it ever escalates.

How Alert Networks Function

These alerts aren't magic—they're the product of sophisticated networks built by the card brands themselves to cut down on the costly, time-consuming dispute process for everyone involved. Three major players run the show:

- Ethoca Alerts: Owned by Mastercard, Ethoca works with thousands of card-issuing banks around the world. When their cardholder raises a question about a charge, the bank sends an alert through the Ethoca network, giving you a chance to issue a refund and stop the chargeback cold.

- Mastercard CDRN: The Consumer Dispute Resolution Network (CDRN) is another valuable tool from Mastercard. It functions similarly, creating an opportunity for you to resolve a customer's issue with a refund before it becomes an official dispute.

- Visa's Rapid Dispute Resolution (RDR): Visa's system, known as RDR, is all about automation. You set up rules ahead of time, and when a dispute inquiry comes in, RDR can automatically issue a credit to the cardholder in real-time. The chargeback process is completely bypassed.

Sure, issuing a refund means you lose the revenue from that one sale. But what you gain is far more valuable. You avoid the punishing chargeback fee and, most importantly, you protect your merchant account's health by keeping your dispute ratio in good standing.

An alert system isn't just about saving a few bucks on fees. It's about preserving your ability to process payments. A clean dispute ratio keeps your business off the high-risk list and ensures your payment processor sees you as a partner, not a liability.

A Real-World Scenario in Action

Let’s look at a classic example from a subscription business. A new customer signs up for a free trial but forgets to cancel. A month later, a $49 charge for their first month hits their card. The billing descriptor isn't familiar, so they call their bank.

Without alerts, this is an instant chargeback. The business is out the $49, gets hit with a $20 chargeback fee, and takes a hit to its dispute ratio.

Now, let's replay that with an alert system like Disputely in place. The bank's inquiry triggers an Ethoca alert. The system gets the alert and, based on a pre-set rule to auto-refund anything under $50, it immediately processes the refund. The chargeback is stopped dead. The business is still out the $49, but it saves the $20 fee and its merchant account is safe.

Why Alerts Are Crucial for Fighting Friendly Fraud

Today's chargeback problem is largely a friendly fraud problem. According to Ethoca's 2025 State of Chargebacks Report, merchants believe 45% of all their chargebacks are some type of fraud. This is split almost down the middle between first-party "friendly fraud" (23%) and actual criminal fraud (22%).

For merchants using platforms like Stripe or PayPal, this is a massive headache, with a staggering 72% reporting an increase in friendly fraud in 2024. Alert networks give you that vital window to resolve these issues before they turn into damaging disputes. By automating refunds based on smart rules, some merchants have seen 99% reductions in their chargeback volume—a critical step to avoid being placed in a costly monitoring program. You can get more insights when you explore the full chargeback report from Ethoca.

This proactive approach is your single best defense against customers who dispute charges out of confusion, forgetfulness, or simple convenience.

Comparing Pre-Dispute Alert Networks

A clear comparison of the leading alert systems helps you understand your options and how they provide comprehensive coverage. Each has a slightly different approach, but together they form a powerful shield.

| Alert Network | Card Network Affiliation | Typical Resolution Window | Primary Function |

|---|---|---|---|

| Ethoca Alerts | Mastercard | 24-72 hours | Provides a pre-dispute notification, allowing merchants to manually or automatically refund a transaction to stop a chargeback. |

| Mastercard CDRN | Mastercard | 24-72 hours | Facilitates direct resolution between merchants and issuers, enabling refunds to prevent disputes from being filed. |

| Visa RDR | Visa | Real-time | Uses merchant-defined rules to automatically process refunds the moment a dispute inquiry is made, guaranteeing chargeback prevention. |

Ultimately, the best strategy is a layered one. Using alerts from all the major networks gives you the most complete protection possible. It's about building an automated defense system that works around the clock, catching potential chargebacks before they can ever hurt your business.

Building an Automated Prevention Workflow

Alright, let's get into the nuts and bolts of actually stopping chargebacks before they happen. Theory is great, but putting an automated workflow in place is where you'll see a real difference. This is how you shift from scrambling to react to every dispute to proactively managing them, even while you sleep. We're essentially building a smart, 24/7 gatekeeper tailored to your business.

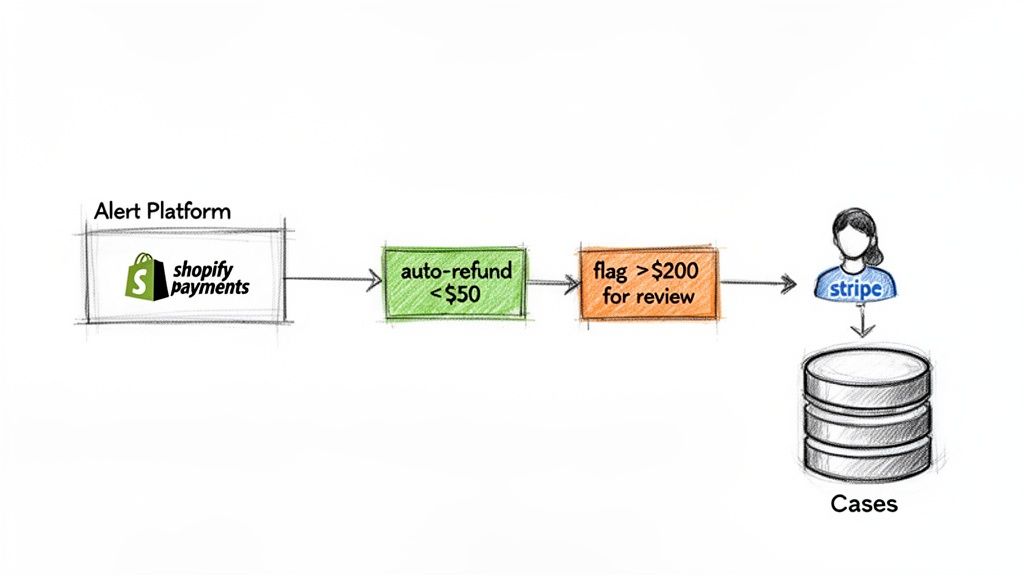

First things first, you need to connect your payment processor to a chargeback alert platform. If you’re using something like Stripe or Shopify Payments, this is surprisingly painless. Most modern alert services have a simple, secure API connection that takes less than five minutes to set up. Once that handshake is complete, your system is officially on the grid, ready to catch real-time alerts from networks like Visa RDR, Mastercard CDRN, and Ethoca.

Setting Up Smart Automation Rules

With the technical connection out of the way, the real strategy begins. This is where you create the "rules of engagement" that tell the system exactly how to handle incoming alerts. This isn't a one-size-fits-all situation; you're building a triage system that makes sense for your profit margins and your team's bandwidth. Think of these rules as the brain of your entire prevention strategy.

Here are a few practical rules I’ve seen merchants implement with great success:

- Auto-Refund the Small Stuff: Set up a rule to automatically refund any alert for a transaction under a specific dollar amount, like $50. The logic here is pure business sense—the time, effort, and potential fees involved in fighting a tiny dispute just aren't worth it.

- Flag Big Tickets for a Human Eye: For alerts on larger transactions, say anything over $200, have the system flag them for manual review. This simple step ensures you don’t accidentally refund a major sale, especially when you have solid evidence to win the dispute.

- Filter by Product or Service Type: Do you sell both physical goods and digital subscriptions? You can create rules for each. You'll likely want to be more aggressive in fighting a chargeback for a high-end product with a delivery confirmation than for a low-cost digital download with fuzzy usage logs.

The goal is to let automation handle the no-brainers. This frees up your team to focus their expertise on the high-stakes, nuanced cases where their judgment really matters. It’s all about working smarter, not harder, especially when you only have a 24-72 hour window to respond to an alert.

This is a great visual of a typical workflow. Alerts come in, and your rules automatically decide whether to refund small amounts or flag larger ones for review, keeping your formal dispute queue much cleaner.

Automating the initial response means fewer disputes ever make it to your processor’s dashboard. For merchants on Stripe, connecting your account to a prevention platform is a powerful move. You can see how easy it is to get going with a Stripe chargeback alerts integration and start deflecting disputes immediately.

Implementing Intelligent Filtering

I get it—the idea of auto-refunding can be nerve-wracking. Nobody wants to give money back on a sale they believe was legitimate. This is precisely why intelligent filtering is so crucial. A good alert platform does more than just push refunds; it helps you sift through the noise and decide which fights are worth fighting.

Intelligent filtering leverages key data points to inform your decision. For instance, an alert might pop up for a transaction that has all the green flags: matching AVS and CVV, a signed delivery confirmation, and a solid purchase history from that customer. In this case, the system can flag it as a prime candidate for representment.

Instead of refunding, you'd simply let the alert expire. Yes, the dispute will escalate to a formal chargeback, but you’ll be walking into that fight with a winning hand of evidence. This selective approach ensures you only invest your team's time and energy on cases you can actually win.

This hybrid model gives you the best of both worlds: the raw efficiency of automation and the sharp insight of human judgment. It lets you:

- Cut Your Losses on Unwinnable Disputes: Instantly resolve alerts from clear-cut fraud or service issues where fighting is a guaranteed waste of resources.

- Challenge Friendly Fraud: Isolate and prepare to fight back against "cyber-shoplifting" where you have compelling proof the transaction was valid.

- Safeguard Your Dispute Ratio: By resolving the majority of issues at the alert stage, you dramatically lower your chargeback volume and stay in good standing with your payment processor.

When you build out this layered workflow, you’re not just reacting—you’re creating a powerful, dynamic defense system. This is what true merchant protection from chargeback looks like in practice: an intelligent approach that safeguards your revenue and, just as importantly, your vital relationship with your payment processor.

Foundational Practices to Prevent Disputes

Real-time alerts are a fantastic safety net, but the best way to protect your business is to stop disputes before they even start. Think of it as your offense—shoring up the basic parts of your operation that, if ignored, can easily lead to customer frustration and costly chargebacks.

This all starts with the very first thing your customer sees on their bank statement after they buy from you.

Craft Crystal-Clear Billing Descriptors

A vague or confusing billing descriptor is a recipe for disaster and a leading cause of "friendly fraud." A customer glances at their credit card statement, sees a weird charge from "XYZ SERVICES LLC," and immediately hits the panic button. They don't recognize the name because they remember buying from "coolgadgetstore.com."

You can sidestep this common and expensive mistake with a few simple tweaks:

- Use Your Brand Name: Always make sure your descriptor shows the public name of your store. Don't use your legal entity name if it’s different and something your customers have never seen before.

- Add a URL or Phone Number: If you have the space, adding your website (like COOLGADGETSTORE.COM) or a customer service number gives a confused customer a way to contact you directly, instead of their bank.

This one small detail can stop a surprising number of disputes dead in their tracks. It connects the purchase they remember making with the charge on their statement.

Maintain Transparent and Accessible Policies

Nothing kills trust faster than ambiguity. When customers can't find or understand your refund and return policies, they’re much more likely to file a chargeback as their first move.

Make your policies impossible to miss. Link them in your website footer, on your product pages, and in your order confirmation emails. This level of transparency doesn't just help your customers; it gives you solid evidence if a dispute does arise. A clear policy proves you set fair and honest expectations right from the start.

Your customer service team is your first line of defense. Solving a customer's problem with a quick email or chat is infinitely cheaper and less damaging than fighting a formal chargeback.

Leverage Basic Fraud Prevention Tools

While alerts help you react to post-transaction issues, basic fraud prevention tools are your front-line defense, validating sales from the get-go. Most payment processors offer these as standard features, and they are absolutely essential.

- Address Verification Service (AVS): This confirms that the billing address the customer entered matches what the card issuer has on file.

- Card Verification Value (CVV): Requiring that three or four-digit security code is a simple way to prove the customer likely has the physical card.

- Delivery Confirmation: If you sell physical products, always use a shipping service that provides tracking and delivery confirmation. This is your best piece of evidence against "product not received" claims.

These checks make it harder for fraudsters to succeed and provide you with crucial data if a dispute slips through. With global chargeback volumes projected to hit 337 million by 2025, fueled by online shopping, these foundational practices have never been more critical. This surge puts many merchants at risk of landing in processor monitoring programs, which can lead to frozen funds and fines. This is a common issue if you're dealing with a Shopify Payments account hold.

You can get more insights on these trends at Chargeblast.com. And for those looking at alternative payment methods to reduce risk, you can even explore how to prevent chargebacks by utilizing crypto payment processors.

Your Top Questions About Chargeback Protection Answered

Diving into chargeback prevention brings up a lot of questions. If you're shifting your strategy from reactive to proactive, it’s completely normal to wonder about the costs, the real-world results, and what it actually takes to get started. Let’s tackle some of the most common things merchants ask.

What’s the Real Cost of a Chargeback Alert System?

This is usually the first thing people ask, and the answer is almost always a pleasant surprise. Most modern platforms, including ours, use a pay-per-alert model. It's a game-changer because you're not getting hit with a huge setup fee or a monthly subscription.

You simply pay a small fee when the service successfully stops a dispute from becoming a full-blown chargeback.

Think about it this way: that small fee is just a tiny fraction of what a chargeback actually costs you. A single dispute means you lose the sale amount, get slapped with a $15-$25 processor fee, and waste time and money on operational headaches. For most businesses, stopping even a handful of chargebacks a month means the system pays for itself—and then some. You can explore different chargeback protection pricing models to see what makes sense for your volume.

Am I Going to Lose Money by Issuing More Refunds?

That’s a fair question. The fear is that you’ll just be handing out refunds left and right. But a smart alert strategy isn't about refunding every single claim. It's about being surgical.

You can set up rules to automatically refund low-value disputes where the cost of fighting it would be more than the transaction itself. For bigger transactions or anything that looks a bit fishy, you can flag it for a human to review. The whole point is to strategically refund just enough to keep your dispute ratio in a healthy range. This keeps you off the "high-risk" list with your payment processor, which is worth its weight in gold.

A single chargeback can cost a merchant far more than the original transaction value. Strategically refunding a small percentage of disputes via alerts is an investment in the long-term health and stability of your payment processing relationship.

Can I Still Fight Chargebacks If I’m Using Alerts?

Of course. An alert system gives you more options, it doesn't take any away. It acts as a filter, letting you decide which disputes are worth an immediate refund and which ones you're ready to fight.

This is where true merchant protection from chargebacks really shines.

Let's say you get an alert for a dispute but you have iron-clad proof—like a delivery confirmation with a signature or IP logs showing the customer used your service. In that case, you just ignore the alert. It expires, and the dispute proceeds to the regular chargeback process where you can submit your evidence. This frees you up to put your energy into fighting the battles you know you can win.

How Long Does It Take to Get a Chargeback Alert System Running?

This is the best part. For merchants on major platforms like Stripe, Shopify Payments, or PayPal, you can be up and running in minutes. Seriously.

Setup is usually just a matter of connecting your processor account through a secure API. It’s a few clicks, and there's no coding or complicated integration project. You can start protecting your revenue and avoiding the stress of chargebacks almost immediately after you sign up.

Ready to stop chargebacks before they start? Disputely integrates directly with major alert networks to give you the power to resolve customer disputes in real-time. Connect your processor in minutes, set your rules, and see up to a 99% reduction in chargebacks. Protect your business with Disputely today.