A Merchant's Guide to PayPal Chargeback Protection

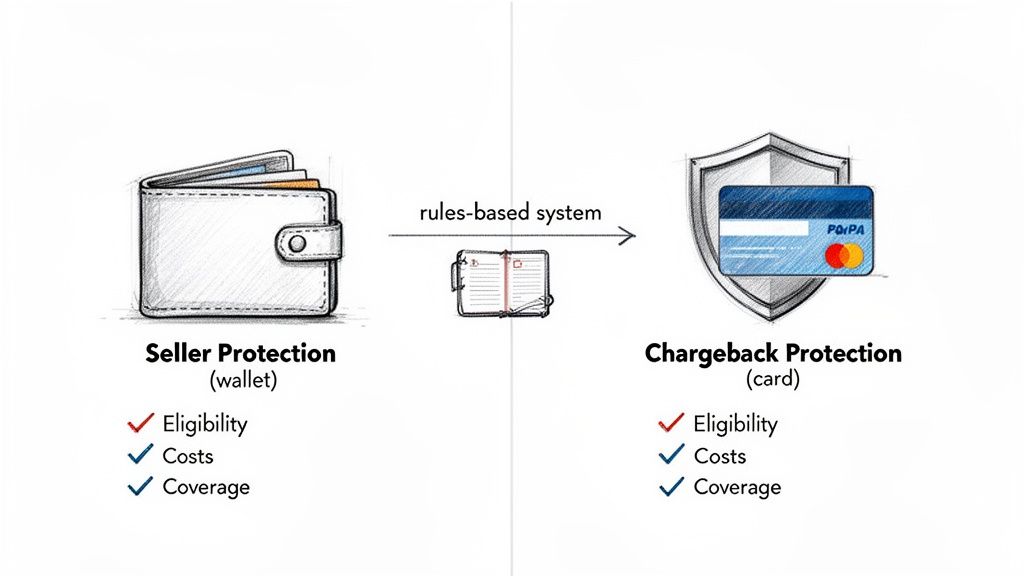

PayPal's approach to chargeback protection isn't a one-size-fits-all shield. It’s more like a conditional insurance policy with a very specific rulebook. You’re covered for certain, verifiable issues, but many common disputes fall outside its scope. The biggest point of confusion for merchants is understanding the difference between the free, standard Seller Protection and the paid Chargeback Protection add-on.

How PayPal Chargeback Protection Really Works

It's a common and costly mistake to assume that accepting PayPal automatically protects you from every dispute. The reality is, PayPal has two completely separate programs. Each has its own rules, costs, and limitations, and knowing which one applies to your transactions is the first step to managing your risk.

First, you have the standard Seller Protection. This is the free, built-in coverage that comes with most PayPal accounts. It applies to transactions where your customer pays you through their PayPal wallet, whether they use their balance, a linked bank account, or a card stored in their wallet. This basic protection is designed to shield you from two specific problems:

- Unauthorized Transactions: When a customer claims a purchase was made from their account without their permission, usually due to it being hacked.

- Item Not Received (INR): The classic "I never got it" claim from a buyer.

Then there’s the paid upgrade: Chargeback Protection. This is an add-on service for merchants using PayPal’s more advanced payment processing tools to accept direct credit and debit card payments—often called "guest checkout." In these cases, the customer isn't logging into a PayPal account. This service costs an extra fee on each transaction but offers a wider safety net for those direct card sales.

A Tale of Two Protections

The fundamental difference comes down to how the customer pays. Seller Protection is your default coverage for payments happening inside the PayPal ecosystem. Chargeback Protection is a specialized tool you pay for to cover card payments that bypass the PayPal wallet login.

At its core, PayPal's strategy is built on data. By analyzing billions of transactions, its systems can predict and absorb the financial risk for certain types of fraud—but only for merchants who provide the exact proof required by its rulebook.

This whole system is possible because of PayPal's massive scale. It handles around $1.53 trillion in payments and analyzes over 25 billion transactions every year. This firehose of data feeds the risk models for its Chargeback Protection service, allowing it to evaluate transactions instantly. When PayPal's system "approves" a transaction for this protection, it's essentially betting that it's legitimate. If a chargeback happens for a covered reason, PayPal agrees to waive the fee and eat the loss, as long as you've followed the rules and haven't hit your monthly coverage limit. You can learn more about PayPal's advanced fraud tools on their enterprise site.

This distinction is so important because it helps you set realistic expectations. Neither program is a magic button that makes disputes go away. For a broader look at how chargebacks work across the payments industry, you can explore the various guides on the Disputely blog.

Comparing PayPal's Merchant Protection Programs

To make it crystal clear, let's put the two programs side-by-side. The table below breaks down the most important differences so you can see at a glance which plan covers which sales and what to expect from each.

| Feature | Seller Protection (Standard) | Chargeback Protection (Paid Add-On) |

|---|---|---|

| Cost | Included with standard transaction fees | Additional fee per transaction (e.g., 0.40%) |

| Eligible Transactions | Payments made from a customer's PayPal wallet | Direct credit and debit card payments via PayPal's advanced processing |

| Covered Disputes | Unauthorized Transactions & Item Not Received | Unauthorized Transactions & Item Not Received |

| Major Exclusions | 'Significantly Not as Described' (SNAD), digital goods without proof | 'Significantly Not as Described' (SNAD), disputes outside of fraud or INR |

| Activation | Automatic for eligible transactions that meet all requirements | Must be enabled in your PayPal account and is subject to approval |

Ultimately, PayPal's protection isn't blanket insurance. Think of it as a conditional safety net. It’s built to catch predictable, data-supported types of fraud. If you play strictly by the rules—shipping to confirmed addresses, keeping detailed records, and providing proof of delivery—it works quite well for its intended purpose.

But the moment you step outside those very specific guidelines, that safety net disappears, and you're left completely exposed to the financial loss.

What PayPal Protection Actually Covers (and What It Doesn't)

Think of PayPal’s protection programs less like a safety net and more like highly specific insurance policies. They're designed to cover very particular types of risk, and knowing exactly where the boundaries lie can mean the difference between a successful claim and a painful loss.

At its heart, PayPal Seller Protection stands on two main pillars.

First, you have protection against "Unauthorized Transaction" claims. This is the classic fraud scenario: a customer's account gets hacked, and a bad actor makes a purchase without their permission. If you can show PayPal that you shipped the item to the exact address listed on the transaction details page, you're generally in the clear.

The second pillar is coverage for "Item Not Received" (INR) disputes. This is for when a buyer claims they paid for something, but it never showed up at their door. Just like with unauthorized transactions, your ticket to winning is providing valid, trackable proof of delivery to the buyer's confirmed address.

The Critical Exclusions That Can Cost You

While the covered claims seem straightforward, the real financial landmines for merchants are hidden in what’s not covered. This is where most businesses get tripped up, assuming they’re protected when they are, in fact, completely exposed.

The single biggest exclusion is for claims of "Significantly Not as Described" (SNAD).

If a buyer claims the product they received is the wrong color, defective, a different material, or just wasn't what they expected, you have zero coverage under PayPal Seller Protection. This is a massive gap, as SNAD is one of the most common dispute reasons and a favorite loophole for friendly fraud.

That means even if you did everything by the book—shipping a flawless product on time with tracking—you are still on the hook financially for a SNAD claim. PayPal’s stance is that you need to work these issues out directly with your customer.

Protection for intangible goods and services is also a much tougher game. While not impossible to get, selling digital downloads, event tickets, or services means you have to provide "compelling evidence" that the customer received what they paid for. A simple invoice won't cut it. You'll need things like server IP logs, download records, or customer support emails confirming they accessed the service.

This screenshot from PayPal's own User Agreement spells out the core requirements and exclusions pretty clearly.

As you can see, the text emphasizes that protection is entirely dependent on following strict shipping rules and explicitly states that it does not apply to SNAD claims. Understanding these limits is non-negotiable for sellers.

High-Risk Scenarios and Policy Violations

Beyond major exclusions like SNAD, a handful of other common seller mistakes will instantly void your PayPal chargeback protection. Failing to stick to these rules is why many merchants lose cases they should have won.

Here are some of the fastest ways to lose your eligibility:

- Shipping to a Different Address: A customer emails you asking to ship their order to a new address? Don't do it. If the address isn't the one on the PayPal "Transaction Details" page, your protection is gone. The only safe move is to refund the order and ask the customer to buy it again with the correct address.

- Transactions for Prohibited Items: Selling anything that violates PayPal's Acceptable Use Policy automatically disqualifies you from protection. This covers everything from certain types of digital content to regulated products.

- In-Person Delivery: You absolutely must have online, trackable proof of shipment from a third-party shipping company. If you hand-deliver an item or use a courier without online tracking, you have no way to prove delivery to PayPal's standards.

- Shipping Too Late: You have to ship within the timeframe you promised. Long delays can put your eligibility at risk, especially if the customer files a dispute before you’ve even sent the package.

At the end of the day, PayPal's protection is a rigid, rules-based system, not a flexible customer service gesture. It’s built to cover very specific, verifiable types of fraud for merchants who follow every single rule to the letter. If you bend those rules, even with the best intentions, you leave yourself wide open to financial loss.

Your Guide to Winning Claims and Proving Your Case

Winning a claim under PayPal’s protection program isn't about being right; it's about having the right paperwork. When a dispute pops up, think of PayPal as a referee who can only judge based on the official rulebook. Your job is to hand them a file so clear and complete that there's no other choice but to rule in your favor.

The best way to do this is to build your case file before a dispute ever happens. For the two main claim types covered—'Unauthorized Transaction' and 'Item Not Received'—the burden of proof is squarely on you.

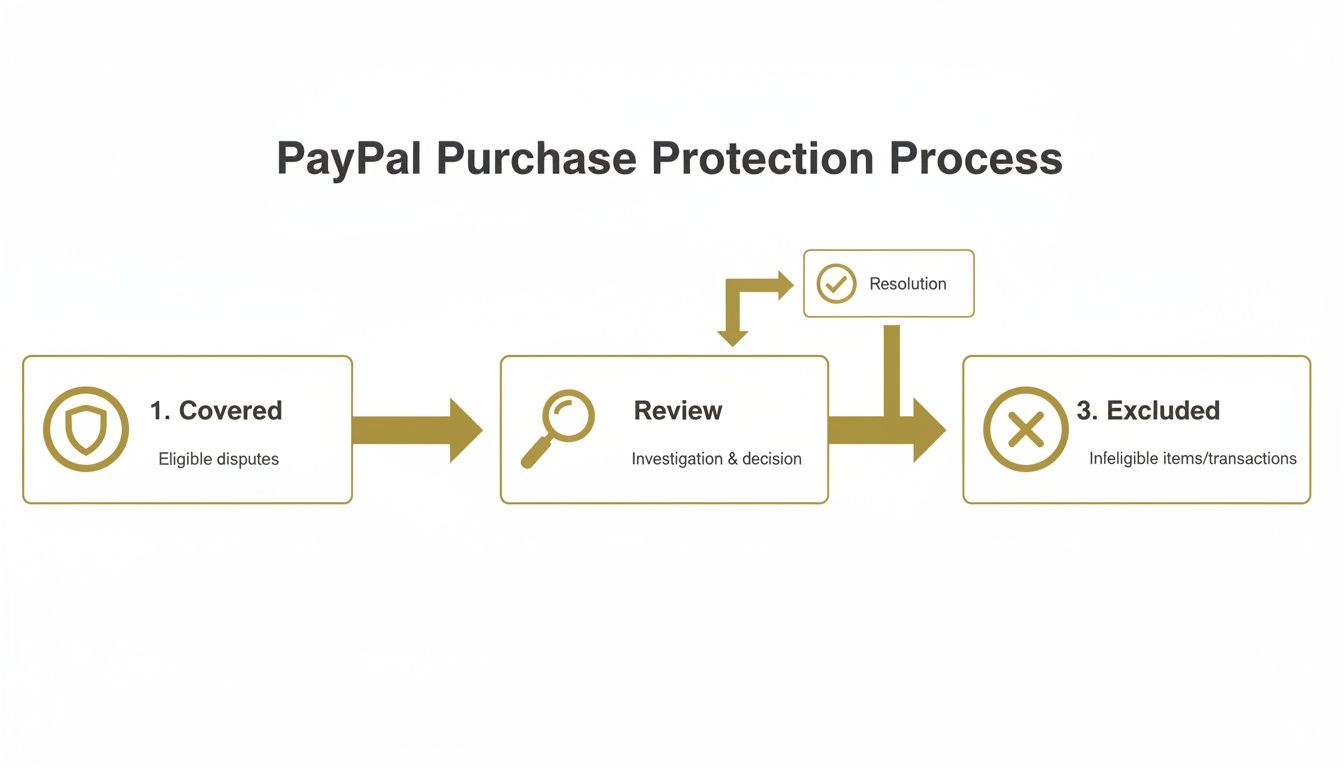

This flowchart lays out the typical path a claim takes, from the first eligibility check to the final outcome.

As you can see, PayPal first checks if you even qualify. If you don't meet their strict criteria right out of the gate, your claim is dead on arrival.

Winning "Item Not Received" Claims for Physical Goods

When you ship a physical product, your entire defense rests on two key documents: Proof of Shipment and Proof of Delivery. These aren't suggestions; they're absolute requirements.

Proof of Shipment is simply the initial record from your carrier (like UPS or FedEx) showing the package is on its way. It has to include:

- The date you shipped the item.

- The recipient's full address, which must match the address on the PayPal 'Transaction Details' page exactly.

Proof of Delivery is the final confirmation from the carrier's online tracking system. It's the digital handshake confirming the package arrived. It must show:

- The date of delivery.

- The recipient's address (again, matching the transaction details perfectly).

- For any sale over $750, you absolutely must have a signature confirmation. No exceptions.

One of the most common—and costly—mistakes merchants make is shipping to a different address at the customer's request after the payment has gone through. Even if you're trying to be helpful, this single action instantly voids your Seller Protection. The only safe play is to refund the transaction and have the customer buy again with the correct address.

Gathering Evidence for Digital Goods and Services

Proving you "delivered" a digital product or service is a bit trickier, but the principle is the same. You need to provide what PayPal calls "compelling evidence" that the customer got what they paid for and actually used it.

For digital goods, your evidence file should be packed with details like:

- IP Logs: Records showing the customer's IP address when they made the purchase and when they downloaded the file or accessed the service.

- Usage Data: Any system logs or screenshots that prove the customer logged in, used the software, or accessed your platform after the sale.

- Customer Communication: Any emails, support tickets, or chat logs where the buyer acknowledges they received the item or discusses using it.

Imagine you sold a piece of software. You’d want to submit the purchase confirmation, the IP address that initiated the download, and the exact timestamp of that download. This creates a digital trail that’s much harder for a scammer to deny. Without this kind of concrete proof, winning a claim for an intangible item is a real uphill battle.

Even with flawless records, some disputes, especially from friendly fraud, can sneak past your defenses. That's why many sellers start looking into more advanced dispute strategies, like sharpening their Q4 representment skills to fight and win more claim types. Ultimately, winning with PayPal is a game of details—follow their process meticulously and give them exactly what they ask for, every single time.

Why Solely Relying on PayPal Protection Is Risky

While PayPal’s protection programs offer a valuable safety net for certain kinds of fraud, thinking of them as a complete chargeback shield is a costly mistake. This mindset leaves your business wide open to financial hits and operational headaches that PayPal was never meant to handle.

Think of PayPal’s protection like a specialized wrench in a mechanic's toolbox. It’s perfect for one specific job—in this case, fighting clear-cut, unauthorized transactions. But it's the wrong tool for the countless other issues that can pop up, leaving you unprepared for the rest.

The modern payments world is getting tougher every day. One global estimate projects that sellers will lose over $100 billion to chargebacks in 2024 alone. The real kicker? So-called "friendly fraud" is expected to make up a staggering 61% of all those disputes.

Even PayPal sees the writing on the wall. In a 2023 survey, nearly 75% of retailers reported that friendly fraud had jumped by an average of 19% over the previous year. You can discover more insights about these alarming chargeback statistics to see just how widespread this problem has become.

The Gaps PayPal Doesn't Fill

The biggest hole in a PayPal-only strategy is its complete inability to cover "Significantly Not as Described" (SNAD) claims. As we’ve covered, these disputes are explicitly excluded from Seller Protection. This is a massive vulnerability because SNAD is the go-to reason for friendly fraud, where a customer who made a legitimate purchase simply changes their mind or wants something for free.

When a buyer files a SNAD claim, you’re on your own. PayPal won't cover the loss, but that dispute still gets added to your record.

On top of that, PayPal’s protection is, by its very nature, confined to its own platform. What about all the other ways you get paid?

- Stripe transactions on your website? Not covered.

- Shopify Payments for your storefront? Not covered.

- Authorize.net for subscription billing? Not covered.

Relying only on PayPal creates a fragmented, inconsistent defense. It’s like locking your front door but leaving every window and the back door wide open.

Your Dispute Ratio: A Processor-Agnostic Problem

This brings us to a critical metric that every merchant needs to live and breathe: your dispute ratio. This is the percentage of your total transactions that turn into a chargeback, and it’s a number that card networks like Visa and Mastercard watch like a hawk.

The most dangerous myth about chargebacks is that they only matter to the processor where they occurred. In reality, Visa and Mastercard see all your disputes, regardless of whether they happened on PayPal, Stripe, or any other platform.

Your overall dispute ratio is calculated across your entire business. If that number creeps too high—usually past a threshold of around 0.9%—you risk getting flagged and placed into a monitoring program, like the Visa Acquirer Monitoring Program (VAMP).

Once you're on their radar, the consequences are severe:

- Hefty monthly fines levied by the card networks.

- Intense scrutiny from all your payment processors.

- The very real threat of account termination, which can kill your ability to accept card payments anywhere.

Every single chargeback, no matter the reason or the platform it came through, pushes your dispute ratio higher. A SNAD dispute on PayPal that isn't covered still damages your merchant standing. A friendly fraud case on Stripe adds to the exact same total.

This is why a comprehensive strategy is non-negotiable. PayPal's protection, while helpful for its specific purpose, does absolutely nothing to shield your business from the cumulative damage all chargebacks inflict on your most vital asset: your ability to process payments.

Building a Complete Chargeback Defense Strategy

The first step to building a rock-solid defense is realizing PayPal's protection is a helpful tool, not a magic bullet. Savvy merchants know they can't rely on a single processor's policy. Instead, they build a multi-layered strategy that protects their entire business, not just one slice of their payments.

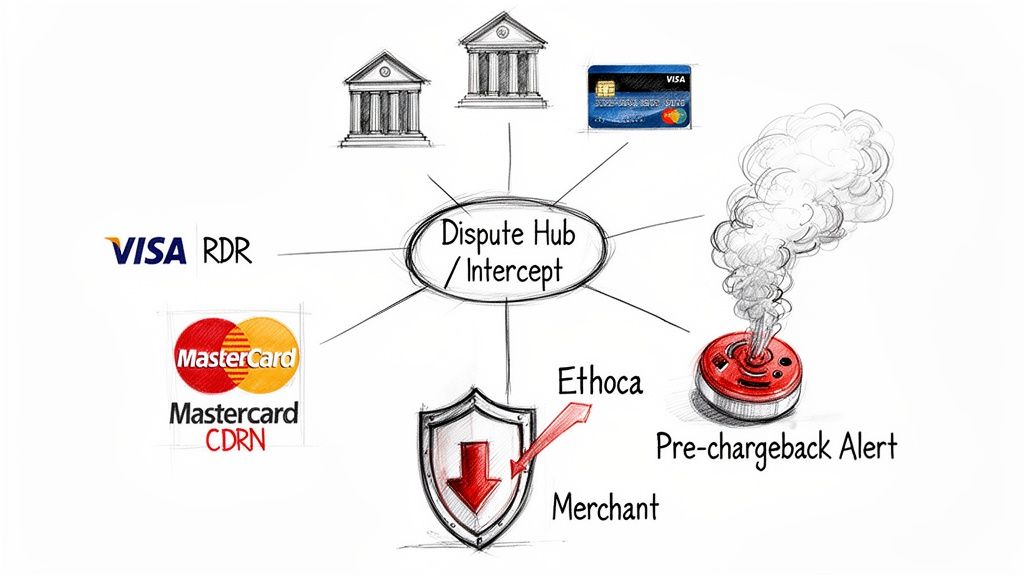

This modern approach is all about shifting from reactive defense to proactive prevention. Rather than waiting for a chargeback to hit your account and then scrambling to fight it, the goal is to stop it from ever being filed in the first place. This is exactly where pre-chargeback alert networks come in.

Think of these alerts as a smoke alarm for your merchant account. Systems from Visa (Rapid Dispute Resolution or RDR), Mastercard (CDRN), and Ethoca are designed to give you a heads-up the moment a customer contacts their bank to complain—before it escalates into a formal, damaging chargeback. This warning shot gives you a crucial window, often 24-72 hours, to simply issue a refund and neutralize the threat entirely.

Integrating Alerts for Full Coverage

These alert networks are game-changers, but they don’t talk to each other. A truly comprehensive PayPal chargeback protection strategy needs a central command center to pull all these warning systems together and automate the response. This is the exact role platforms like Disputely were built for.

Instead of just banking on PayPal to cover a narrow band of fraud, you can plug all your payment processors—PayPal, Stripe, Shopify Payments, you name it—into a single platform. This creates a unified shield that watches over every single transaction, no matter how the customer paid.

When a customer dispute pops up, the alert is intercepted by the platform, which can then automatically refund the transaction based on rules you’ve set. The chargeback never happens, your dispute ratio stays clean, and you sidestep the whole costly, time-consuming fight.

A Layered Defense for Modern Threats

This layered approach really gives you the best of both worlds. You can keep using PayPal’s Seller Protection for what it’s good at—covering clear-cut fraud on wallet payments—while deploying a much broader alert system to catch everything else.

This strategy directly addresses the biggest weakness of a PayPal-only approach. It protects you from the full spectrum of dispute reasons, including those tricky "Significantly Not as Described" claims that PayPal won't touch, and it covers all your revenue streams.

This method is quickly becoming the new industry standard. Recent data shows that 26.3% of merchants are now using pre-chargeback alerts, with 17.8% using Visa’s RDR specifically. Better yet, businesses that automated their dispute responses saw a 33% drop in chargeback cases.

This is a big deal, especially when you remember that PayPal's own Chargeback Protection only covers certain card transactions and costs an extra fee. A broader, automated strategy often ends up being far more effective and affordable.

The key to making this work at scale is using a platform that centralizes all the different alerts. For merchants looking into this model, it’s worth checking out the different pricing plans available for alert automation to compare the cost against what you’re currently losing to chargebacks.

Here’s a simple breakdown of how these strategies stack up:

Comparing Chargeback Management Strategies

| Strategy | Coverage | Cost Structure | Impact on Dispute Ratio | Best For |

|---|---|---|---|---|

| PayPal Protection Only | Limited to eligible unauthorized & INR claims on PayPal payments. Excludes many dispute types. | Included in transaction fees, but Chargeback Protection is an added fee. | No protection against SNAD or other disputes that harm your ratio. | Merchants with very low dispute volume, primarily processing PayPal wallet payments. |

| Layered Strategy (Alerts + Automation) | Comprehensive coverage across all payment processors and most dispute reasons. | Subscription-based for the platform, plus per-alert fees. Often cheaper than losing chargebacks. | Prevents chargebacks from being filed, keeping your dispute ratio low and healthy. | Growing businesses, high-risk industries, and any merchant seeking maximum protection. |

Ultimately, this integrated system is your best defense against both outright fraud and the growing headache of "friendly fraud." It allows you to protect your merchant health, steer clear of processor penalties, and keep your payment options open across your entire business. By combining the niche benefits of PayPal’s tools with the wide net of pre-chargeback alerts, you build a resilient defense that’s ready for the realities of modern e-commerce.

Frequently Asked Questions

Let's cut through the jargon. Getting your head around PayPal's protection policies can be a headache, so I've broken down the most common questions merchants ask. Here are the straight answers you need to protect your business.

Does PayPal Seller Protection Cover Item Not as Described Claims?

No, it doesn't. This is probably the single most important exclusion to burn into your brain. Neither the standard Seller Protection nor the paid Chargeback Protection will cover you if a buyer claims an item is "Significantly Not as Described" (SNAD).

This is a massive loophole.

Think about it: claims about the wrong color, a different material, a supposed defect, or even just plain old buyer's remorse disguised as a product problem all fall under the SNAD umbrella. These disputes are a favorite tool for friendly fraud. PayPal expects you to work it out with the buyer, but they won't cover your financial loss if it escalates to a chargeback.

This exclusion is exactly why relying only on PayPal chargeback protection is a dangerous game and why a more robust, multi-layered defense is a must for any serious business.

Am I Protected if I Ship to an Address Not on the PayPal Transaction?

Absolutely not. This is one rule where there is zero wiggle room. To have any chance of being covered for an "Item Not Received" claim, you must ship to the exact address shown on the PayPal 'Transaction Details' page.

If a customer pays and then shoots you an email asking to send the package to their office or a different house, you're walking into a trap. Comply with their request, and you instantly void your protection. Even if you have a delivery confirmation signature at the new address, you will automatically lose the dispute.

The only safe move here is to refund the original payment. Then, politely ask the customer to place the order again, making sure they enter the correct shipping address in their PayPal account before they pay. Any deviation from the official transaction address is an automatic loss.

How Does PayPal Protection Apply to Digital Goods and Services?

You can get protection for intangible goods and services, but the bar for proof is much, much higher than for physical products. PayPal requires what it calls "compelling evidence" that you delivered the digital item or performed the service.

A simple invoice or your word for it won't cut it. You need to build a solid digital paper trail.

- Digital Downloads: Have IP logs ready that show the download happened, complete with the timestamp and the customer's IP address.

- Services or Software Access: Keep screenshots of user activity logs. Can you show they logged in and used the platform? That's the kind of data you need.

- Any Intangible Sale: Save email exchanges or support tickets where the customer confirms they received the item or are using your service.

Because this kind of evidence is never as clear-cut as a tracking number, sellers of digital goods are at a much higher risk. This is why pre-chargeback alert systems are a game-changer for them, stopping these claims before they can even start.

What Happens if PayPal Denies My Protection Claim?

If PayPal denies your Seller Protection claim, it means they're stepping aside. They won't cover the financial loss for you. But, and this is important, the fight isn't necessarily over.

The chargeback case simply moves forward through the official card network channels (like Visa or Mastercard). The customer's bank will pull the disputed funds from your account while they investigate.

You still have the right to challenge the chargeback yourself by submitting your own evidence package. A denied claim just means PayPal's financial safety net is gone; it doesn't strip you of your ability to defend the sale through the standard chargeback representment process. Be warned, though—if you lose, you're on the hook for the chargeback fee, too.

A proactive defense is always better than a reactive one. With Disputely, you can stop chargebacks before they happen by integrating directly with Visa RDR, Mastercard CDRN, and Ethoca alerts. Protect your merchant account, keep your dispute ratio low, and secure your revenue. Learn more at https://www.disputely.com.