Protect Your Store: prevent ecommerce fraud with proven tactics

Fighting ecommerce fraud isn't about a single magic bullet. It's about building a smart defense with the right policies, technology, and a little bit of vigilance. By using tools like chargeback alert services and establishing clear ground rules for your operations, you can get ahead of fraudsters and protect your bottom line before a dispute even starts.

The Hidden Costs of Ecommerce Fraud

When a fraudulent order slips through, most merchants fixate on the lost product and the reversed sale. That’s painful enough, but the real financial damage goes much deeper, creating a ripple effect that can seriously hurt a growing business.

Think about it: every single chargeback that hits your account comes with a non-refundable fee from your payment processor. These fees can be anywhere from $15 to over $100 per dispute. For a store with any real volume, those penalties pile up fast, turning what seems like a small problem into a significant drain on your profits.

Beyond the Obvious Financial Hits

The bleeding doesn't stop with fees and lost revenue. If your chargeback rate climbs too high, your entire payment processing relationship is at risk. Processors like Stripe and PayPal, and the big card networks like Visa and Mastercard, are watching closely.

Cross their thresholds, and you’ll face some serious consequences:

- You could be flagged as "high-risk." This means more scrutiny from your processor and almost always leads to higher fees.

- Your processor might place a reserve on your account. They'll hold back a chunk of your own money to cover future chargebacks, which can wreck your cash flow.

- You could lose your merchant account entirely. This is the worst-case scenario. If you can't process payments, you're out of business overnight.

The real threat of ecommerce fraud isn’t just the individual losses; it’s the cumulative damage to your operational stability and financial health. A reactive approach is no longer enough—proactive prevention is the only sustainable path forward.

The scale of this issue is frankly enormous. To put some numbers on it, here's a quick look at the current landscape.

Ecommerce Fraud Snapshot Key Metrics

This table gives a high-level summary of the most critical statistics shaping the ecommerce fraud landscape today, providing a quick reference for merchants to grasp the scale of the problem.

| Metric | Projected Impact |

|---|---|

| Annual Global Ecommerce Fraud Losses | Projected to exceed $48 billion by 2025 |

| Average Chargeback Fee | $15 to over $100 per dispute |

| Account Monitoring Threshold | Often starts at a 0.9% chargeback ratio |

| Common Fraud Types | Friendly Fraud, Account Takeover, Triangulation Fraud |

These figures aren't just abstract numbers; they represent real threats to businesses trying to succeed online. From sophisticated scams using stolen credentials to AI-generated deepfakes, the battlefield is constantly evolving.

It's also worth remembering that direct fraud isn't the only source of preventable loss. Many businesses don't realize the hidden costs of non-compliance in regulated product shipping, which can lead to fines and forced returns that mirror fraud losses. It’s time to shift from constantly putting out fires to building a strong defense, and that's exactly what this guide will help you do.

Getting to Know Common Fraud Schemes and Their Red Flags

To really get a handle on ecommerce fraud, you have to think like the person on the other side of the screen. Fraudsters aren't just using one playbook; they have a whole arsenal of schemes, and each one leaves behind its own unique clues. Learning to spot these patterns is your single best defense against a chargeback hitting your account.

The tricky part? Fraud doesn't always come from a shadowy figure with a stolen credit card. Sometimes, it looks a lot like a regular customer, which is why a solid manual review process guided by clear red flags is non-negotiable for protecting your business.

The Rise of Friendly Fraud

This one is probably the most frustrating type of fraud you'll face. Friendly fraud, sometimes called first-party fraud, is when a legitimate customer buys something from you and then disputes the charge with their bank. They might falsely claim the package never arrived or the product wasn't what they expected.

The motivation can be anything from simple buyer's remorse to confusion over how the charge appeared on their statement. Of course, some are just trying to get a free product. This scheme costs merchants billions annually and is notoriously difficult to fight without ironclad proof of delivery and crystal-clear communication.

Think about it: a customer orders a high-end skincare set, uses it for a month, and then files a chargeback claiming the box was empty. If you don't have a signed delivery confirmation or photos of the packed order, that's a tough dispute to win.

Unraveling Triangulation Fraud

Triangulation fraud is a much more elaborate scam where your store is unknowingly used as the middleman. It's a sneaky tactic that’s tough to catch until you've already shipped the product and the money is long gone.

Here’s the breakdown:

- The Bait: A fraudster creates a fake storefront, often on a marketplace like eBay, advertising popular products at unbelievable prices.

- The Switch: A real customer sees the deal and buys the item from the fraudster’s fake shop.

- The Heist: The fraudster takes that customer's money, then uses a stolen credit card to buy the exact same item from your store. The key is they use the legitimate customer’s shipping address.

You ship the product to the unsuspecting buyer, who's thrilled with their purchase. Meanwhile, the fraudster vanishes with the cash, and you're stuck with a chargeback when the real owner of the stolen card spots the fraudulent transaction.

The dead giveaway for triangulation fraud is almost always a mismatch between the billing details (from the stolen card) and the shipping address (of the legitimate buyer). This single discrepancy should trigger an immediate manual review, no questions asked.

Spotting Account Takeover Attacks

Account takeover (ATO) is just what it sounds like: a fraudster gets into a real customer's account on your site. They usually get the login details from data breaches on other websites, banking on the fact that people reuse passwords everywhere.

Once they're in, they can go on a shopping spree with saved payment info, change the shipping address, or drain loyalty points. This doesn't just lead to chargebacks; it can permanently damage your relationship with a loyal customer. A sudden shipping address change on an established account, especially when it's paired with an unusually large order, is a classic sign of an ATO in progress.

Your Quick-Reference Red Flag Checklist

Get your team into a fraud-prevention mindset by keeping an eye out for these common warning signs. One flag on its own might be nothing, but when you see a few of them pop up on the same order, it's time to hit pause and investigate.

- Address Mismatches: The billing and shipping addresses are in totally different cities, states, or even countries.

- Atypical Order Velocity: A brand-new account suddenly places several high-value orders in a matter of minutes.

- Suspicious Email Addresses: The email looks like keyboard-smash (

jkls89a@mail.com) or comes from a known disposable email service. - PO Box Shipments for High-Value Goods: Scammers love using PO boxes to hide the final destination for expensive electronics or jewelry.

- Multiple Cards, Single Account: One account is suddenly cycling through several different credit cards for new orders.

By training your team to spot these signals, you move from just reacting to fraud to actively getting ahead of it. You’ll be stopping suspicious orders before they even make it out the door.

Building Your First Line of Defense with Smart Policies

Before you spend a dime on fancy software, let's talk about the single most powerful tool you have to fight fraud: your own business policies. Getting these right is your first—and strongest—line of defense. Think of them as the ground rules for your store, creating a secure environment that naturally weeds out fraudsters before they even think about clicking "buy."

A rock-solid set of policies does more than just block bad guys. It builds trust with your legitimate customers and gives you the evidence you need to win disputes when they inevitably pop up.

Make Your Return and Refund Policies Ironclad

If there's one place fraudsters love to strike, it's a weak or confusing return policy. This is especially true for "friendly fraud," where the customer is looking for any loophole they can find. Your goal is to eliminate all ambiguity. Leave zero room for interpretation.

Make sure your policy is easy to find and spells everything out in plain English:

- The exact timeframe for returns (e.g., "30 days from the date of delivery").

- The required condition of the item (e.g., "unopened, in original packaging, with all tags attached").

- Who pays for return shipping and whether you provide a prepaid label.

- The process for starting a return, including any required RMA numbers.

This level of detail is your shield. When a customer files a chargeback claiming they didn't know the rules, you can hit back with a timestamped copy of your policy and proof they accepted it. That kind of evidence is gold in a dispute.

Mandate CVV and AVS Checks for Every Transaction

This one is non-negotiable. The Card Verification Value (CVV)—that little three or four-digit code on the card—and the Address Verification Service (AVS) are your best friends. AVS checks that the billing address entered at checkout matches what the card-issuing bank has on file. You should require both for every single transaction.

Why? Because a fraudster with a stolen card number often won't have the CVV. An AVS mismatch is an even bigger red flag, signaling the billing address details don't line up. Most payment gateways give you the option to automatically decline any transaction that fails these checks. Turn it on.

Pro Tip: Setting your payment gateway to auto-reject any transaction with a failed CVV or a hard AVS mismatch is one of the simplest and most effective automated defenses you can put in place today.

Set Smart Transaction Velocity Limits

Fraudsters move fast. They’ll often test a stolen card with a tiny purchase to see if it works before going for a big-ticket item. Or they'll hit you with multiple orders from the same card in a very short window. This is where velocity limits save the day.

These are simple rules you can set up in your payment processor or a fraud app to catch suspicious patterns. For example:

- Flag any account placing more than three orders in one hour for manual review.

- Temporarily block an IP address with more than five declined transactions in 15 minutes.

- Limit brand-new customers to a maximum purchase of $500 on their very first order.

These rules act like a circuit breaker, stopping automated bot attacks cold. This is especially critical for Shopify merchants, where a sudden spike in fraud can trigger a payment hold and completely freeze your cash flow. If you're on that platform, understanding how to navigate a Shopify Payments hold is crucial knowledge.

By laying this foundation with clear policies and basic security checks, you make your store a much harder target for criminals and put yourself in a position of strength.

Leaning on Technology to Get Ahead of Fraud

Let's be honest, manually reviewing every single order is a recipe for burnout. It just doesn't scale. If you really want to get a handle on fraud, you have to embrace the technology built for the job. And the best place to start is with the tools you already have.

Your payment gateway, whether it's Stripe or PayPal, is more than just a way to get paid. These platforms have powerful, built-in fraud prevention filters. You can set up rules to automatically flag or even block orders based on clear red flags, like a mismatch between the AVS/CVV data or an order coming from a high-risk IP address. Getting these settings dialed in is your first line of automated defense.

For a deeper dive into making your payment stack work harder for you, exploring resources like this guide to Stripe integration for advanced fraud detection can show you how to centralize security and make everything more efficient. But even with these tools humming along, you're still mostly playing defense—catching fraud as it's happening. The real leap forward is shifting from reacting to proactively preventing chargebacks before they even start.

The Power of Chargeback Alert Networks

Imagine you had a direct line to a customer's bank, giving you a heads-up the moment they disputed a charge. That's precisely what chargeback alert networks offer. The two biggest players in this space are run by Visa and Mastercard.

- Visa’s Rapid Dispute Resolution (RDR): This system fires off an instant alert the second a Visa cardholder raises an issue with their bank.

- Mastercard’s Consumer Dispute Resolution Network (CDRN): This network does the exact same thing, but for Mastercard transactions.

These alerts are a game-changer. They give you a precious window—usually 24 to 72 hours—to act. If you issue a full refund within that timeframe, the chargeback is stopped in its tracks. The dispute never gets formally filed, you never get hit with a chargeback fee, and your merchant account health stays pristine.

This is what a proactive strategy looks like in the real world. You're not waiting weeks for a formal chargeback notice to land, only to fight a battle you'll probably lose. You're resolving the issue in hours, turning a potential fire into a puff of smoke.

For any business watching their dispute rate climb, this approach is monumental. You stop focusing on winning fights and start avoiding them entirely.

To see how these approaches stack up, here's a quick comparison.

Fraud Prevention Methods Comparison

| Method | How It Works | Best For | Limitation |

|---|---|---|---|

| Reactive (Fighting Chargebacks) | You receive a formal chargeback notice from the bank and then gather evidence to dispute it. | High-value, clear-cut cases of friendly fraud where you have compelling evidence. | Time-consuming, low win rates (often below 30%), and doesn't prevent chargeback fees or ratio hits. |

| Proactive (Chargeback Alerts) | You receive an early warning alert and issue a refund to prevent the chargeback from ever being filed. | Reducing overall chargeback volume, protecting merchant account health, and saving time. | Involves refunding the transaction, which is a calculated cost to avoid a larger loss. |

Ultimately, a proactive strategy using alerts is about damage control and resource management, letting you sidestep the entire chargeback process for a fraction of the cost and effort.

Turning Alerts into Action with Automation

Of course, getting hundreds of alerts a day is just noise if you can't act on them quickly. This is where a platform like Disputely becomes indispensable. It acts as the command center for your entire dispute process, integrating directly with your payment processor and the alert networks.

This integration lets you set up intelligent rules to automate your responses. You get to decide which alerts trigger an instant refund and which ones need a second look from a human.

For example, you could build rules like:

- Automatically refund any dispute for an order under $30. It's just not worth the time to fight.

- Flag all disputes over $200 for manual review.

- Always refund alerts from first-time customers to try and save the relationship.

This isn't about giving up; it's about being strategic. You concede the small, unwinnable disputes so you can pour your energy into the bigger ones you actually have a shot at winning. If you're curious about the ROI, you can see how this kind of pay-per-alert model works by checking out the https://disputely.com/pricing structure.

Why This Technology Is No Longer Optional

The ecommerce world is only getting tougher. In 2024, fraud attack rates consistently hovered around 3.3% across Sift's Global Network. Projections show fraud losses skyrocketing to $107 billion by 2029—that's a staggering 141% jump from $44.3 billion. These aren't just numbers; they're a clear signal that merchants have to adopt more sophisticated tools.

Yet, a staggering 80% of businesses admit they struggle to properly tune their fraud tools, leading to false positives that block and frustrate legitimate customers. You can read more about these trends and what they mean for your business over on Sift.com.

The risk is even higher for businesses with recurring revenue models, like subscription services and SaaS companies, where things like policy abuse can quickly spiral out of control.

By combining your payment gateway’s native filters with the early-warning system of chargeback alerts and the smart automation of a platform like Disputely, you're building a modern, multi-layered defense. This tech stack works around the clock to protect your revenue and your reputation, freeing up your team to focus on what actually matters: growing the business.

Automating Your Dispute Workflow with Intelligent Rules

Getting a dispute alert is only half the battle. How you respond—and more importantly, how quickly—is what separates a minor operational hiccup from a major threat to your merchant account. Manually reviewing every single alert isn't just slow; it's a surefire way to lose money and completely burn out your team. The key to getting this under control is to build an intelligent, automated workflow that handles the noise for you.

This approach means you can stop treating every dispute like a five-alarm fire. Instead, you create a system of smart rules that automatically resolves the low-stakes issues. This frees up your team to focus their expertise on the high-value disputes where a human touch actually makes a difference.

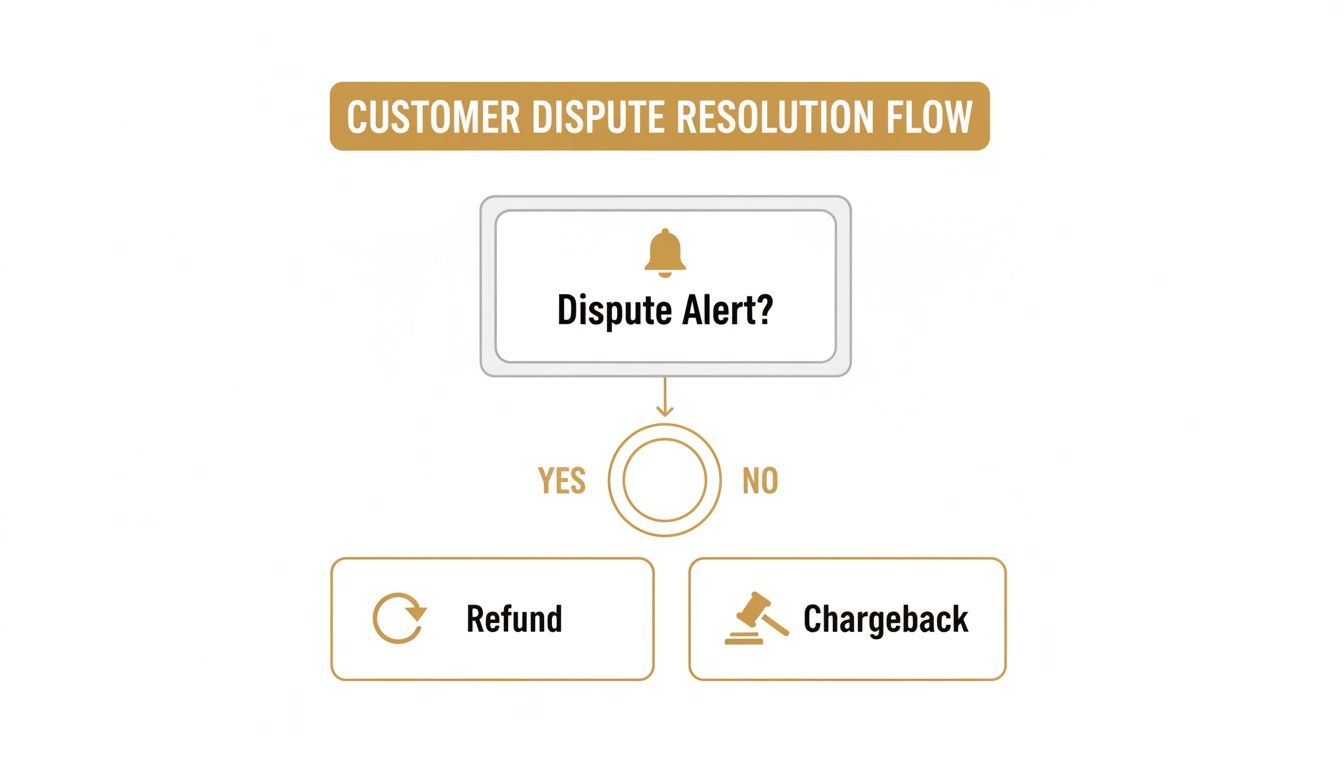

The flowchart below gives you a simple visual of this decision path. When a dispute alert comes in, you have a choice: refund or risk a chargeback.

This visual shows that critical crossroads you face with every alert. A strategic, early refund can help you sidestep the damaging consequences of a formal chargeback entirely.

Designing Your Custom Refund Rules

The heart of an automated workflow is a set of "if-this-then-that" rules designed specifically for your business. There’s no one-size-fits-all template here, because your risk tolerance, profit margins, and customer behavior are unique. Your goal is to define criteria that automatically sort incoming alerts into different buckets: Auto-Refund, Manual Review, or Auto-Ignore.

So, what variables should you be looking at? It usually comes down to a few key data points:

- Transaction Amount: The total value of the disputed order.

- Product Type: Was it a physical good, a digital download, or a subscription renewal?

- Customer History: Are we talking about a loyal repeat buyer or a brand-new customer?

- Dispute Reason Code: The initial reason provided by the bank (e.g., "Product Not Received").

By combining these data points, you can build a powerful logic engine. A platform like Disputely lets you configure these rules so the system can execute your strategy 24/7, no human input needed.

Practical Examples of Intelligent Rules

Let's move from theory to practice. Here are a few real-world examples of automation rules I've seen merchants use to effectively stop disputes from escalating into chargebacks:

1. The Small-Ticket Rule

- Rule: Automatically refund any dispute where the total transaction is under $25.

- Why it works: The cost of a chargeback fee (often $15-$100) plus the lost revenue and the time spent fighting it makes these small disputes impossible to win from an ROI perspective. It's just cheaper to refund and move on.

2. The New Customer Risk Rule

- Rule: Flag any dispute over $200 from a first-time customer for immediate manual review.

- Why it works: A large, disputed order from a brand-new account is a classic red flag. This rule ensures a human set of eyes investigates for signs of a sophisticated scam before any decision is made.

3. The Digital Goods Rule

- Rule: Automatically refund any dispute for a digital product where the customer hasn't logged in or downloaded the file.

- Why it works: If you have server logs showing the product was never accessed, a refund is a simple customer service win that avoids a messy, hard-to-prove dispute.

By setting these kinds of parameters, you're essentially pre-deciding how to handle 80% of your dispute alerts. This strategic automation is what allows lean teams to manage high volumes without getting overwhelmed.

The Growing Problem of Post-Purchase Abuse

Getting these rules in place is more critical now than ever. The entire landscape of returns and disputes is becoming increasingly hostile for merchants. In fact, one report from Signifyd found that abusive returns in ecommerce shot up by 64% in May 2025 compared to January 2024, contributing to a global problem worth $890 billion.

Post-purchase abuse, including bogus chargeback claims, is surging. And while nearly 90% of merchants are using compelling evidence strategies to fight back, it's often too late. Without the real-time alerts from services like Ethoca or CDRN, these disputes hit your merchant account unchecked, pushing your chargeback ratios into dangerous territory.

This tough reality shows why a proactive, automated refund strategy isn't just a convenience—it's a core business necessity. Fighting every single dispute is no longer a viable option. For merchants looking to fine-tune their evidence for the disputes they do choose to fight, our guide on preparing for Q4 representment offers valuable strategies. Your time and resources are finite; an intelligent workflow ensures they are spent wisely on the battles you can actually win.

A Few Common Questions We Hear About Fraud Prevention

When you're in the trenches, trying to get a handle on fraud, a lot of questions pop up. It’s one thing to read about a strategy, but it’s another to actually put it into practice. Let's tackle some of the most common questions I hear from merchants who are rolling up their sleeves and building a real defense against chargebacks.

Think of this as your field guide for those "what if" moments. The goal here is to give you clear, straightforward answers that you can actually use.

How Do I Stop Friendly Fraud Without Frustrating My Good Customers?

This is the tightrope every merchant walks. You want to lock down security, but you can't afford to treat your best customers like criminals. It all comes down to proactive communication and setting crystal-clear expectations from the get-go.

First, make sure your shipping, return, and refund policies are impossible to miss. Don't bury them. A customer who knows the return process is far less likely to jump straight to a chargeback.

For anything high-value, spring for delivery confirmation that requires a signature. I’ve seen that one piece of paper single-handedly win disputes. And if you sell digital goods, keep a log of IP addresses and download or access times. It’s your proof that the customer got what they paid for.

When a dispute pops up from a customer you know is legit, don't immediately go on the defensive. A chargeback alert is your chance to turn a problem into a customer service win. A quick, direct conversation and a refund can save the relationship and, more importantly, prevent a damaging chargeback from ever hitting your record.

Won't Chargeback Alerts Just Make Me Refund Everything?

I get this one a lot, and it's a total myth. The answer is a hard no. A good chargeback alert system isn't a sledgehammer; it's a scalpel. You are always in the driver's seat.

You’re not forced to refund every alert. Instead, you build smart rules based on what makes sense for your business. For instance, maybe you set a rule to auto-refund any dispute under $30. Why? Because the time and effort to fight it just isn't worth the money.

On the flip side, you can create a rule that flags any dispute over $200 for your immediate personal review. This way, you're not just giving away money on high-ticket items where you have a strong case. It's about being strategic—you stop the definite losses to protect your merchant account while focusing your energy on the fights you can actually win.

What's the Real Difference Between an Alert and a Chargeback?

Getting this straight is absolutely key. The difference is like hearing a smoke alarm versus seeing the fire truck pull up.

- A chargeback alert (from services like RDR or CDRN) is the early warning—the smoke alarm. It’s a heads-up that a customer has started the dispute process with their bank. This gives you a precious 24-72 hour window to do something about it.

- A formal chargeback is the fire truck. That window has closed, the dispute is officially filed, the bank has already clawed the money back from your account, and you've been slapped with a non-refundable fee, which can be anywhere from $15-$100.

An alert is your chance to prevent the fire. By issuing a refund when you get an alert, the chargeback itself is never officially filed. Your chargeback ratio stays clean, and you sidestep the penalty fee entirely.

How Long Does It Take to Get All This Set Up?

You'd be surprised. Getting a modern fraud and chargeback prevention system running is incredibly fast. This isn't a month-long IT project.

Connecting your payment processor—whether it's Stripe, Shopify Payments, or PayPal—to an alert platform like Disputely usually takes less than five minutes. It’s a simple, secure authentication process that just links the two accounts.

Once you're connected, you can start building your custom refund rules right away and begin seeing alerts almost instantly. Honestly, you can go from being completely reactive to proactively protecting your business in a single afternoon.

Ready to stop reacting to chargebacks and start preventing them? Disputely integrates directly with your payment processor to give you real-time alerts from Visa, Mastercard, and Ethoca. Set your own rules, automate your refunds, and protect your merchant account health. See how much you can save and get started with Disputely today.