Understanding Provisional Credit Reversal and Protecting Your Revenue

So, you won a chargeback dispute. That’s great news, but what happens next? You'll likely see a provisional credit reversal, which is just the banking world's way of saying they’re returning the money to you.

Essentially, it's the final step in a successful dispute defense. The bank takes back the temporary refund they gave the customer and puts the funds back into your account where they belong. While it’s a win, the whole process can leave your cash flow in a serious state of limbo.

Unpacking the Real Cost of Provisional Credit

Let's walk through a typical scenario. A customer disputes a charge. Almost instantly, their bank issues them a temporary refund called a provisional credit while they look into the matter. At that same moment, those funds are yanked from your merchant account.

You've already shipped the product or provided the service, but the revenue has vanished. It’s a frustrating position to be in.

The provisional credit reversal is the light at the end of the tunnel. It means you’ve successfully proven the charge was legitimate. The bank then reverses that temporary credit, officially closing the loop and returning your money. Think of it as a financial boomerang—it went out, but thankfully, it came back.

Why Winning Still Feels Like Losing

Even when the money is back in your account, the victory can feel a bit hollow. Why? Because the entire cycle creates a period of financial whiplash that can be incredibly disruptive.

During the investigation—which can drag on for weeks or even months—your revenue is held hostage. This uncertainty makes it tough to manage inventory, pay suppliers, or even accurately forecast your earnings.

A provisional credit reversal is more than just a transaction; it's the end of a temporary seizure of your earned revenue. The real problem is the cash flow chaos that erupts between the initial dispute and the final resolution, no matter the outcome.

And the costs don't stop there. You have to sink time and resources into gathering evidence and building a solid case. On top of that, most payment processors slap you with a non-refundable chargeback fee, usually $15 to $25, the second a dispute is filed. You have to eat that cost even when you win.

The Scale of the Problem

For a small business, this is an annoyance. For high-volume businesses, it's a major financial headache.

Picture a company processing 10,000 transactions a month with a $100 average ticket size. Based on the average US chargeback rate of 0.47%, that business could have a staggering $47,000 tied up in provisional credits over the course of a year. You can dive deeper into the impact of provisional credits on business operations on gettrx.com.

This really drives home a critical point: The best strategy isn’t just getting good at winning reversals. It’s stopping disputes before they ever happen.

Provisional Credit vs Reversal at a Glance

To make this crystal clear, let's break down the key differences between the initial credit and the final reversal.

| Action | Who Receives the Money | Reason | Impact on Merchant |

|---|---|---|---|

| Provisional Credit | The cardholder (your customer) | A dispute was filed, and the bank issues a temporary refund while investigating. | Immediate loss of funds from your account, causing cash flow disruption. |

| Provisional Credit Reversal | The merchant (you) | You won the dispute by providing compelling evidence that the charge was valid. | Funds are returned to your account, resolving the cash flow issue for that specific transaction. |

This table shows the two bookends of the dispute process—one where your money is taken and one where it's rightfully returned.

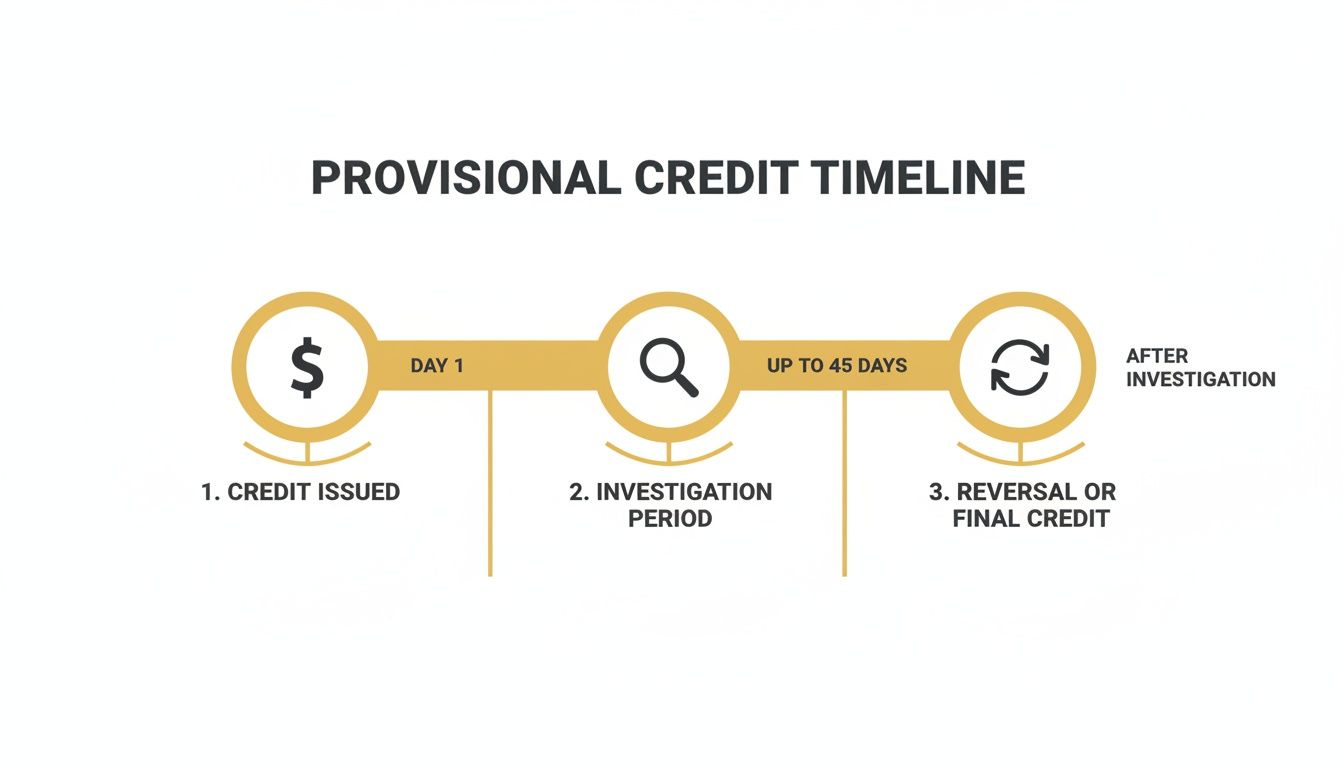

Mapping The Provisional credit Reversal Timeline

Dealing with a payment dispute can feel like you're lost in the woods without a map. But once you understand the timeline for a provisional credit reversal, the entire process becomes much clearer. It’s no longer a mysterious "black box" of bank investigations, but a predictable series of steps.

It all starts the moment a customer calls their bank to question a charge. That one phone call triggers a cascade of strict deadlines and required actions for everyone involved—the customer, their bank, and your business.

This visual timeline breaks down the journey, from the bank handing out the initial credit to the final decision on whether it gets reversed.

As you can see, the path moves from the initial credit, through an investigation, and ends with either a permanent chargeback or a reversal that puts the money back in your pocket.

Stage 1: The Initial Dispute and Provisional Credit

The second a cardholder files a dispute, the clock starts ticking. Thanks to Regulation E, the customer's bank usually has to give them a provisional credit within 10 business days (or 20 days for newer accounts). For merchants, this is the part that stings the most—the money is pulled directly from your account.

You'll get a formal notice about the dispute, which will include a reason code like "Item Not Received" or "Fraudulent Transaction." Think of this as your official signal to spring into action.

Stage 2: The Representment and Investigation Window

This is your shot to defend the sale. The "representment" window is the time you're given to submit compelling evidence proving the charge was valid. The deadlines are non-negotiable and vary by card network, but you typically have between 20 to 45 days. If you miss this window, you lose automatically.

During this phase, you need to act like a detective and gather all the critical evidence you can find:

- Proof of Delivery: Think shipping confirmations, tracking numbers, and especially delivery signatures.

- Transaction Records: AVS and CVV match results are great, as are IP logs that place the order at the cardholder's known location.

- Customer Communication: Any emails, support tickets, or chat logs where the customer acknowledges the purchase can be incredibly powerful.

After you’ve sent in your evidence packet, the issuing bank takes over and starts its investigation. This part can drag on for up to 90 days as they sift through the information from both you and the cardholder. The whole process can feel painfully slow, especially during peak seasons. That's why having a solid game plan is so important for high-volume times—you can get more tips by checking out this guide to optimize your Q4 representment strategy.

Stage 3: The Final Decision and Reversal

Finally, the bank makes a ruling. If they decide in your favor, they’ll process the provisional credit reversal. This is the moment you've been waiting for. The temporary credit gets clawed back from the cardholder’s account, and the funds are returned to you.

The reversal itself happens fairly quickly, with the money typically showing up in your account within 3-7 business days of the bank's decision. But don't mistake that for a fast process overall—the total time from the initial dispute to getting your money back can easily stretch from 30 to 120 days.

This lengthy timeline really drives home why preventing disputes in the first place is so crucial. Winning a reversal feels great, but the long stretch where your cash flow is tied up shows just how costly a reactive approach to chargebacks can be.

The Evidence That Wins Provisional Credit Reversals

When an issuing bank reverses a provisional credit, it’s not because you got lucky. It’s because you presented an airtight case backed by solid proof. Banks don’t operate on good faith or assumptions; they need cold, hard evidence showing the transaction was legitimate and you held up your end of the deal.

Think of it like you're building a case file for a trial. The more compelling and relevant your evidence, the higher your chances of winning. A simple transaction record just doesn't cut it anymore. Your job is to paint a complete picture that leaves absolutely no room for doubt.

This means you have to stop scrambling for proof after a dispute hits. Instead, you need a proactive, strategic process for collecting evidence from the moment an order is placed. Knowing what to gather for different dispute types is how you turn the tables.

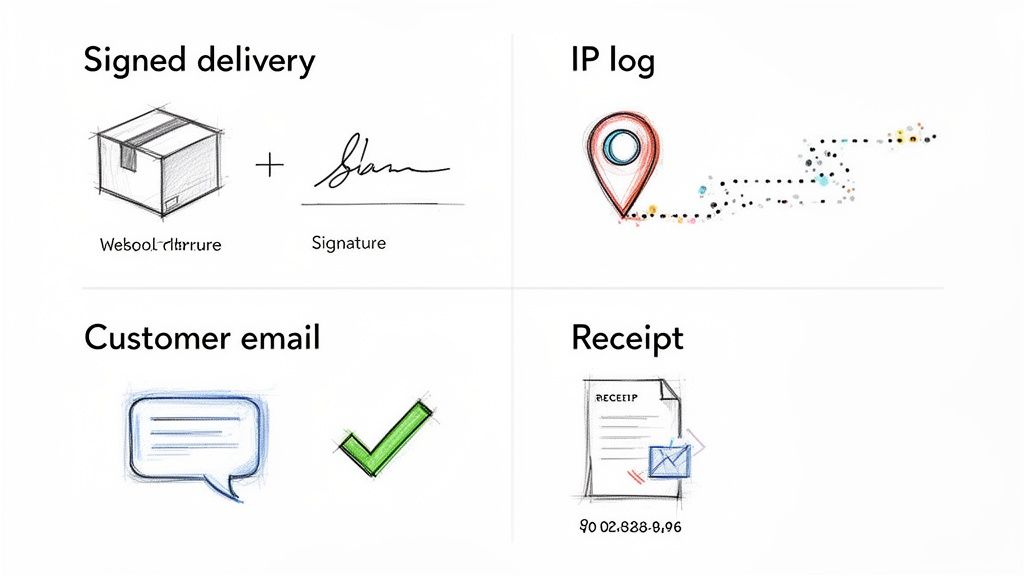

Building Your Evidence Arsenal

For a bank to take back a provisional credit, your proof has to directly demolish the customer's claim. Different claims require different evidence, and your biggest advantage is knowing what you'll need ahead of time.

If a customer claims "Product Not Received," your best weapon is obviously proof of delivery. A tracking number is a good start, but a delivery confirmation with the customer's signature? That's a knockout punch.

The quality of your evidence is everything. A single, high-impact piece of proof, like a customer's signature on a delivery receipt, can be more persuasive than ten weaker pieces of supplementary data.

Get ahead of the game by documenting the entire customer journey. This approach ensures you have exactly what you need, ready to go, the moment a dispute lands in your queue.

Tailoring Evidence to Specific Disputes

Let's break down the most effective evidence for two of the most common disputes that spark these provisional credit battles. Your goal is to match your proof directly to the cardholder's claim, leaving no wiggle room.

1. For "Item Not Received" Disputes:

- Proof of Delivery: Don’t just send a tracking number. Provide the full shipping confirmation showing the item was delivered to the verified address on file.

- Signature Confirmation: This is the gold standard. It proves someone at the address physically accepted the package, making it very hard to dispute.

- Customer Communication: Did the customer email you about their order? Or message you on chat? Any communication where they acknowledge the shipment is powerful evidence.

2. For "Fraudulent Transaction" Disputes:

- AVS and CVV Results: Show the bank that the address verification system (AVS) and card verification value (CVV) provided during checkout were a match. This is your first line of defense.

- IP Address Geolocation: Present data showing the order was placed from an IP address in the same city as the cardholder’s billing or shipping address.

- Previous Order History: If you have records of past, undisputed transactions from the same customer or IP address, it strongly suggests they are a legitimate buyer and not a victim of fraud.

When you’re putting your case together, detailed receipts act as crucial proof of purchase. It can be helpful to review examples of grocery store receipts to see what a comprehensive document looks like. Winning a dispute often comes down to preparation, and a strong representment strategy starts with meticulous documentation. For a deeper dive, consider a comprehensive audit of your dispute processes to find and fix any gaps in how you collect evidence.

Deciding When to Refund vs. When to Fight a Dispute

When a dispute notification hits your inbox, you’re at a crossroads. Do you issue a quick refund and move on, or do you dig in your heels and fight to get that provisional credit reversed? This isn't just about one transaction; it’s a strategic choice that affects your revenue, your chargeback ratio, and ultimately, the stability of your merchant account.

The right answer isn't always obvious. Fighting a dispute takes time and energy, and even if you win, you're still out the non-refundable chargeback fee. But on the flip side, refunding every claim is like putting up a sign that says "free money," encouraging friendly fraud and telling bad actors you're an easy mark. Making the smart call requires a solid framework, not a gut reaction.

A Practical Framework for Your Decision

Your decision should really come down to weighing the potential reward against the risk and the effort you'll have to put in. It often makes sense to let the small stuff go, especially if your evidence is a bit shaky. For example, if a $15 order gets disputed and you don't have rock-solid proof like a delivery signature, the time and effort spent fighting probably isn't worth the cash you might recover.

On the other hand, a high-value transaction backed by ironclad evidence is a clear-cut case for representment. If you have a signed delivery confirmation for a $500 order, you have an excellent shot at winning and getting that provisional credit reversed.

The core question to ask is: Do I have a high probability of winning, and is the order value high enough to justify the effort? If the answer to either is "no," issuing a refund is often the smarter move to protect your resources and keep your chargeback ratio low.

But here's the thing: this whole debate—to refund or to fight—is reactive. You're already on the back foot. Modern alert systems let you get ahead of the problem and prevent the dispute from ever being filed in the first place.

Here's a quick cheat sheet to help you make the right call in the heat of the moment.

Decision Matrix: When to Refund vs. When to Defend

Making a snap judgment can be tough. This table breaks down common scenarios to help you quickly assess a dispute and decide on the best course of action for your business.

| Scenario | Recommended Action | Reasoning | Tool to Use |

|---|---|---|---|

| Low-Value Order ($5-$25) with Weak Evidence | Refund Immediately | The cost of fighting (time + fees) outweighs the potential revenue recovered. Protects your chargeback ratio. | Chargeback Alert System (e.g., RDR) |

| High-Value Order ($250+) with Strong Evidence | Defend (Representment) | The revenue is significant and your compelling evidence (AOV, tracking, IP match) gives you a high chance of winning. | Your Payment Processor's Portal or a Dispute Management Platform |

| Repeat Customer with No History of Disputes | Refund (and contact customer) | Likely a genuine issue. A refund preserves a valuable customer relationship and prevents a chargeback. | Customer Service Outreach + Chargeback Alerts |

| Suspected "Friendly Fraud" (e.g., buyer's remorse) | Defend Vigorously | Fighting these cases discourages repeat fraudulent behavior and protects your business from being seen as an easy target. | Dispute Management Platform with detailed evidence gathering |

| Subscription Renewal Dispute | Refund via Alerts | Subscription disputes are common. Using alerts to refund avoids ratio hits and the high fees associated with these chargebacks. | Chargeback Alert System (e.g., Ethoca, CDRN) |

Ultimately, a structured approach helps you move from emotional reactions to data-driven decisions, saving you time, money, and a lot of headaches.

Changing the Game with Chargeback Alerts

This is where things get interesting. Systems like Visa's Rapid Dispute Resolution (RDR) and Mastercard's CDRN (via Ethoca) completely change the equation. These networks create a crucial window—usually 24-72 hours—for you to resolve a customer's complaint with a refund before it officially becomes a chargeback.

Taking this proactive step is a true game-changer. Here’s why:

- No Hit to Your Chargeback Ratio: The dispute is stopped in its tracks. Since it's never formally filed, it never counts against your critical chargeback threshold.

- No Chargeback Fees: You completely avoid that non-refundable $15-$25 fee your processor slaps on every single chargeback.

- No Provisional Credit Hassle: Because the customer is refunded before the dispute process kicks off, the funds are never yanked from your account. This means no cash flow disruptions.

This strategy is especially critical for merchants in high-risk industries or those running subscription-based models. These businesses often see 20-30% more disputes, making provisional credit reversals a constant threat. By integrating with alert platforms, merchants can intercept these issues and see up to a 99% reduction in chargebacks, steering clear of the strict monitoring programs that can freeze or even terminate their accounts. To see just how common these issues are, check out these insightful payment processing industry statistics on paycompass.com.

By automating refunds for certain disputes through alerts, you effectively sidestep the entire provisional credit cycle. You save money, protect your account, and keep your business running smoothly.

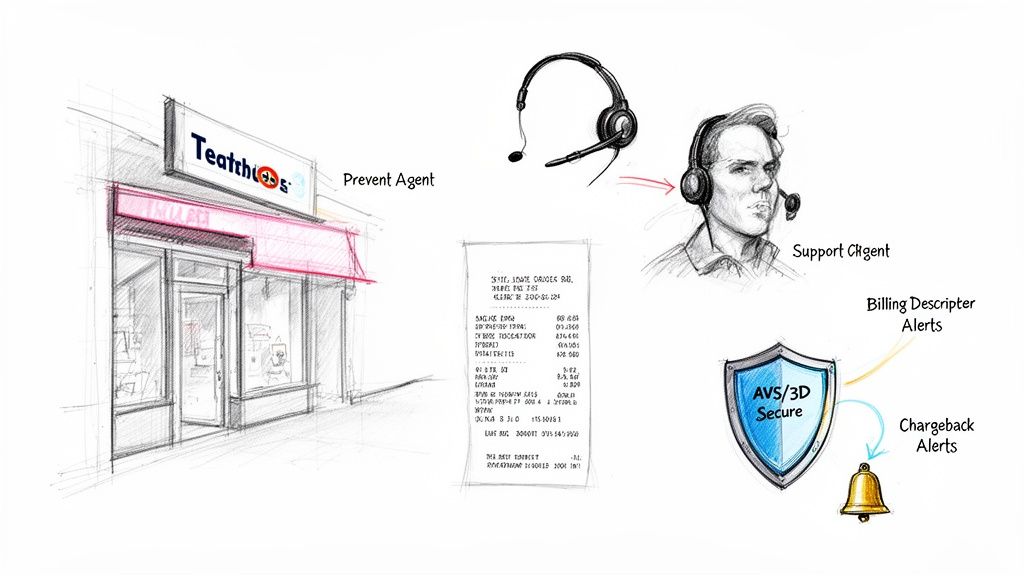

How to Stop Disputes Before They Even Start

Let's be honest, the best way to handle a provisional credit reversal is to never see one in the first place. Winning a dispute feels good, but it's a reactive game. You've already lost time, paid fees, and dealt with tied-up cash flow.

A proactive strategy is about protecting your revenue and, crucially, the health of your merchant account. This all starts with a better customer experience. You’d be surprised how many disputes are just a result of simple confusion—a customer sees a charge they don't recognize and calls their bank instead of you.

Strengthen Your First Line of Defense

The goal here is to slam the door on obvious fraud and clear up any potential customer confusion. A few smart operational tweaks can eliminate a huge chunk of disputes, making the whole song-and-dance of provisional credit reversals a non-issue for those sales.

Get these fundamentals right:

- Clear Billing Descriptors: Make sure the name on your customer's bank statement is one they'll actually recognize. "WEB PURCHASE" is a surefire way to get a dispute.

- Accessible Support: Your contact info should be everywhere—your website, confirmation emails, even on the packaging. A fast refund from you beats a painful chargeback any day.

- Fraud Prevention Tools: Using Address Verification Service (AVS) and CVV checks is the bare minimum. For an extra wall of security, turn on 3D Secure (like Verified by Visa) to add another authentication step at checkout.

Beyond the technical stuff, building good relationships with your customers is huge. Understanding the role of empathy in customer service can help you tackle the root causes of frustration long before they bubble up into a dispute.

Deploy Your Ultimate Defense With Chargeback Alerts

Even with perfect practices, some disputes are going to slip through. This is where chargeback alert services become your secret weapon. Think of them as an early-warning system that gives you a chance to fix a problem before it officially becomes a chargeback.

When a customer starts to dispute a charge, services like RDR and CDRN open up a short window—usually just 24-72 hours—for you to issue a refund and solve the problem directly. This stops the dispute from ever being formally filed.

This is a complete game-changer.

By issuing a refund through an alert, you avoid the entire chargeback process. No hit to your chargeback ratio, no pesky non-refundable fees from your processor, and no provisional credit ever gets issued. This is especially important for businesses on platforms like Shopify, where a high dispute rate can get your funds frozen. If you're in that situation, our guide on navigating a https://disputely.com/shopify-hold can help.

When you combine a great customer experience with solid fraud filters and a powerful alert system, you're building a layered defense that makes most disputes—and the provisional credit reversals that come with them—a problem you no longer have to worry about.

Common Questions About Provisional Credit Reversals

Provisional credit reversals can seem like a murky corner of the payments world, but getting a handle on the details is the best way to tackle these situations confidently. Let's clear things up by answering the questions we hear most often from merchants.

How Long Does a Provisional Credit Reversal Take to Appear In My Account?

Once the bank sides with you, the final step is pretty fast. You'll typically see the funds back in your merchant account within 3-7 business days.

The real waiting game, however, is the entire process leading up to that moment. From the day the dispute is filed to the final decision, you could be looking at anywhere from 30 to 120 days. The exact timeframe really boils down to the card network involved and how complicated the case is. All the while, that revenue is tied up, which is a powerful reminder of why stopping the dispute before it starts is so crucial for your cash flow.

Do I Still Pay Chargeback Fees If a Provisional Credit Is Reversed?

Yes, unfortunately, you’re almost always on the hook for that fee. The moment a dispute is filed, your payment processor dings you with a non-refundable administrative fee, which usually runs between $15 and $25.

Even when you win the dispute and get your money back, that fee is gone for good. This is one of the clearest financial arguments for using a chargeback alert service—it's much cheaper to prevent the dispute altogether than to win it later.

Think of the initial chargeback fee as a sunk cost. Winning the dispute gets your revenue back, but it won't refund the administrative fee you paid just to enter the fight.

Can a Customer Re-Dispute a Charge After a Provisional Credit Reversal?

They can, although it’s not an everyday occurrence. If a cardholder is convinced the bank made the wrong call, they can push the issue again. This next phase is usually called arbitration or a second chargeback.

At this stage, the stakes get higher for everyone. It becomes more complex, more expensive, and eats up a lot more time. This is precisely why keeping detailed, organized records from the very first transaction is non-negotiable. The evidence you submitted the first time around becomes the bedrock of your defense if the customer comes back for round two.

Does a Provisional Credit Reversal Negatively Affect My Chargeback Ratio?

This is probably the single most important thing to grasp: the initial dispute is what hits your chargeback ratio, not the final outcome.

It doesn't matter if you win and get the money back, lose the case, or just refund the customer to make it go away. The moment that dispute was filed, it was tallied against your monthly count by the card networks. Winning the case feels good, but it doesn't magically erase the mark against your record.

This reality exposes the core weakness of only reacting to chargebacks. The only surefire way to protect your merchant account's health and keep your chargeback ratio safely in the green is to stop disputes from ever being filed in the first place. That’s exactly what alert systems like RDR and CDRN are designed to do—they give you a chance to solve the problem before it does any real damage.

Stop wasting time and money fighting disputes you could have prevented. With Disputely, you can automatically intercept and resolve customer issues before they become costly chargebacks. Connect your payment processor in minutes and protect your revenue, your chargeback ratio, and your peace of mind. Learn how Disputely can save your business.