Win More Disputes With Rebuttal Letter Templates

A rebuttal letter template is your secret weapon for fighting chargebacks. Think of it as a structured, pre-built framework that helps you quickly assemble a professional, evidence-backed response to reclaim revenue and defend your merchant account.

Why Chargebacks Are a Costly Threat to Your Business

Let's be clear: chargebacks are much more than a simple reversed transaction. They are a direct, escalating threat to your business's financial health. For any e-commerce or subscription company, every single dispute chips away at your profit margins and, worse, jeopardizes your relationship with your payment processor. You simply can't afford to ignore them anymore.

The immediate financial sting is obvious—you lose the sale revenue and the product. But the real damage runs much deeper. For every dispute a customer files, your payment processor hits you with a non-refundable chargeback fee, regardless of whether you win or lose. Those fees add up fast, easily turning a great month into a losing one.

Beyond the Initial Financial Loss

The true danger lies in your chargeback ratio—the percentage of your total transactions that end up in a dispute. Once this ratio creeps over the thresholds set by card networks like Visa and Mastercard (usually around 0.9%), your business gets flagged as high-risk.

That’s when a cascade of operational nightmares begins:

- Higher Processing Fees: Your rates will climb to offset the perceived risk you pose.

- Account Reserves: Your processor might start holding back a percentage of your daily sales as a "just in case" security deposit, squeezing your cash flow.

- Account Termination: In the worst-case scenario, they can shut down your merchant account entirely. Suddenly, you can't accept credit cards at all.

Since chargebacks can create such a significant financial hole, learning about effective cash flow management is crucial for helping your business absorb and recover from these unexpected hits. The stakes are incredibly high, which makes having a proactive defense strategy absolutely non-negotiable. This is where a well-crafted rebuttal letter, packed with compelling evidence, becomes your most critical tool for survival.

The Rising Tide of Disputes

This isn't a small problem, and it's growing at an alarming rate. In the high-stakes world of e-commerce, rebuttal letters are now an essential tool for fighting back. Global chargeback volumes are projected to hit a staggering 261 million in 2025 alone, then climb another 24% to 324 million by 2028.

This trend is especially punishing for DTC brands and subscription-based companies, where the average chargeback is around $88 for physical goods and $65 for digital products. The numbers don't lie, and you can see the full picture in this detailed 2025 report.

The game-changer is this: merchants who leverage structured rebuttal letters—often using templates for speed and consistency—can win back a huge portion of these losses.

Instead of just accepting lost revenue as a cost of doing business, you can build a rock-solid case that proves your transaction was legitimate. This not only recovers your money but also protects your good standing with payment processors.

If you're gearing up for a high-volume sales period, a strategic audit is key. Find out how to prepare with our free Q4 chargeback audit. Ultimately, an effective rebuttal process is the difference between letting disputes sink your business and successfully defending your hard-earned revenue.

Weaving Your Evidence into a Winning Story

When you fight a chargeback, you're not just sending over a pile of receipts. You're telling a story—a story backed by irrefutable proof. The goal is to build such a clear, logical case that the bank reviewer can't help but see things your way. You need to show them, step-by-step, that you held up your end of the deal.

Think about the person on the other end. They're sifting through dozens, maybe hundreds, of disputes every single day. A disorganized, emotional, or confusing response is an easy "no." But a professional, well-structured narrative? That makes their job simple, guiding them to the right conclusion: the charge was legitimate. This isn't the time to vent your frustration; it's the time to build a professional, fact-based argument that wins.

Keep a Professional Tone

First things first: your tone sets the stage. An angry or accusatory letter will sink your case before the reviewer even looks at your evidence. It immediately kills your credibility. Let the facts do the talking for you.

Instead of emotional claims like, "The customer is a liar," stick to objective statements. For example, rather than accusing someone of fraud, you'd state, "The AVS check confirmed a match for the billing address on file, and the CVV was verified during the transaction." This approach is professional, evidence-based, and far more powerful.

Your tone should be firm, but always respectful. You aren't arguing with the customer in your letter; you're presenting a clear-cut case to the bank to prove the charge was valid.

A professional approach signals to the reviewer that you're a serious merchant with solid processes. That alone can set you apart from the mountain of messy, unprofessional responses they see.

Build a Clear Timeline of Events

The heart of your rebuttal is a simple, chronological timeline. It's the easiest format for a reviewer to digest and leaves no room for confusion. You're essentially walking them through the entire transaction from beginning to end.

Kick things off by clearly stating the core details: the order number, date, transaction amount, and customer's name. This is the opening scene of your story.

From there, guide the reviewer through the entire customer journey, using your evidence as signposts. Each point in your timeline should be a verifiable fact.

- The Order: "On October 26th, Jane Doe placed order #5821 for a custom handbag." (Then, you’d reference the attached order confirmation).

- The Payment: "The $150 payment was successfully processed, with both AVS and CVV verification matching the cardholder's information." (Reference the screenshot from your payment processor).

- The Fulfillment: "The item shipped on October 27th via UPS, tracking number 1Z987XYZ." (Reference the shipping label and tracking history).

- The Delivery: "UPS tracking confirms the package was delivered to the verified address on October 29th at 2:15 PM." (Reference the delivery confirmation, especially if you have a photo).

This step-by-step account creates a chain of events that’s hard to argue with. You're not just dumping documents on them; you're connecting the dots and proving you did everything right.

Don't Get Tripped Up by Formatting

How your rebuttal looks can be just as important as what it says. Many processor portals, like those from Stripe or PayPal, have weird formatting quirks that can turn a well-written letter into an unreadable mess.

For starters, keep your paragraphs short and punchy. Use line breaks liberally to create white space. A huge wall of text is intimidating and practically guarantees the reviewer will just skim it, missing your key points.

You also need to understand the platform's technical limits. Some systems will strip out all formatting—no bold, no italics, not even bullet points. If you're not sure, it's safer to stick with plain text. Readability is everything. When you’re referencing multiple documents, label them clearly in your text (e.g., "See Exhibit A: Order Confirmation"). This simple bit of organization makes it easy for the reviewer to follow along and strengthens your case immensely.

Downloadable Templates for Common Dispute Scenarios

Staring at a blank page when you need to write a rebuttal is a sure-fire way to lose time and momentum. That’s where a solid set of rebuttal letter templates becomes your best friend. Instead of trying to guess what a bank reviewer wants to see, you can start with a proven framework designed to lay out your evidence clearly and professionally.

We've put together downloadable, ready-to-use templates for the four most common dispute reasons you'll run into. Each one is packed with tips on what specific evidence makes the strongest case, helping you build a compelling response in minutes, not hours.

Template for Fraudulent Transaction Claims

When a customer claims they never authorized a purchase, your job is to prove they did. This type of dispute lives and dies by the digital evidence you can provide to link the true cardholder to the transaction. Your rebuttal letter needs to be a logical, step-by-step presentation of data points that show the purchase was legit.

Our template for this scenario guides you through highlighting the most critical technical evidence:

- AVS (Address Verification System) and CVV Codes: Show that the billing address and security code they punched in at checkout were a perfect match with what the bank has on file.

- IP Address Geolocation: Include the IP address used to place the order and point out that it matches the customer's billing or shipping city. This is a powerful piece of the puzzle.

- Previous Order History: If this isn't a first-time buyer, showcase their history of successful, undisputed purchases. This helps establish a pattern of legitimate activity.

The rise of 'friendly fraud' has made these disputes a constant headache. In fact, 45% of all chargebacks are fraudulent, split evenly between first-party misuse and third-party criminal fraud. With global chargeback fraud losses projected to jump 40% to $28.1 billion by 2026, and total dispute volumes expected to hit 337 million cases by 2025, having an efficient response system is non-negotiable. You can find more insights about the global outlook on chargeback trends.

Template for Product Not Received Disputes

This is one of the most straightforward chargebacks to fight—if you have your documentation in order. The customer's claim is simple: "I never got my stuff." Your rebuttal needs to be just as simple: "Here is the proof that you did."

Our "Product Not Received" template is built to put your shipping and delivery evidence front and center. It prompts you to include:

- Shipping Confirmation: A screenshot of the shipping label with the customer's address clearly visible.

- Tracking Information: The tracking number linked directly to the carrier's website, showing the package's complete journey.

- Proof of Delivery: This is the knockout punch. It could be a delivery confirmation with a timestamp, a photo of the package on their doorstep, or a signature.

A common mistake is just dropping a tracking number in the letter. Always go one step further and include a screenshot of the final delivery status. It makes the reviewer's job easier and your case that much stronger.

Template for Item Not as Described Claims

These disputes can be tricky because they often feel subjective. The customer isn’t saying they didn't get the product; they’re claiming it was damaged, looked different from the pictures, or just wasn't what they expected. Your rebuttal has to prove that the product they received was exactly what you advertised at the time they bought it.

Our template for this scenario helps you build a case based on transparency and clear communication:

- Product Page Evidence: Grab screenshots of the product page they ordered from. Be sure to highlight the description, materials, dimensions, and all the photos they would have seen.

- Customer Communication: If they reached out before filing the dispute, include those emails or chat logs. This is especially powerful if they never once mentioned any issues with the product.

- Return Policy: Attach a copy of your return policy. This shows you gave them a clear path to resolve the problem without needing to file a chargeback.

Winning these comes down to proving you set clear, honest expectations. This template walks you through presenting your evidence in a way that shows you were upfront from the start. For deeper strategies on handling different types of disputes, you might want to check out some other articles on the Disputely blog.

Template for Subscription Canceled Disputes

For any subscription business, this one is particularly frustrating. A customer claims they canceled their service, but you kept billing them. Your job is to prove they didn't cancel according to the terms of service they agreed to.

This template focuses on your terms and the customer's actions (or lack thereof):

- Terms of Service: Provide proof that the customer checked the box and agreed to your terms when they signed up. Make sure your cancellation policy is clearly stated (e.g., "cancellations must be made 24 hours before the renewal date").

- Cancellation Logs: Show your system records. If the customer never logged into their account to hit "cancel" or never sent that required cancellation email, you need to present this lack of activity as evidence.

- Service Usage Data: If you can show the customer continued to use or log into your service after the date they claim they canceled, you have incredibly compelling proof.

By using these targeted rebuttal letter templates, you can stop just reacting to disputes and start strategically dismantling them with the right evidence for each specific claim.

Your Essential Evidence Gathering Checklist

Your rebuttal is only as strong as the proof you provide. A claim without evidence is just an opinion, and opinions don’t win chargeback disputes. You have to build a rock-solid case, and that starts with systematically gathering compelling evidence the moment a dispute lands.

Think of it like being a detective. Your job is to assemble all the pieces that tell the undeniable story of a legitimate transaction, from the moment the customer clicked "buy" to the second they received their order. Let's walk through exactly what you need to collect for every single dispute.

Proof of Purchase and Authorization

This is your foundation. Right out of the gate, you have to prove the cardholder actually placed the order. This evidence directly torpedoes common claims of unauthorized or fraudulent transactions.

Your goal here is simple: connect the person who owns the credit card to the person who made the purchase. The more data points you can line up, the stronger your argument will be.

- Order Confirmation: Grab a screenshot of the order confirmation page or the email you sent. It needs to clearly show the items, the total amount, and the date.

- AVS and CVV Results: This is non-negotiable. Show the results from your payment processor confirming the Address Verification System (AVS) and CVV code matched what the bank had on file.

- IP Address Log: Pull the IP address used to place the order and its geolocation. If that IP address traces back to the same city as the billing or shipping address, you’ve got a powerful piece of evidence.

- Previous Purchase History: If this is a returning customer, show their history of successful, undisputed transactions using the same card and shipping details. It paints a picture of a normal buying pattern.

Proof of Delivery or Service Usage

Okay, so you've shown they placed the order. Now you have to prove you held up your end of the bargain by delivering the product or providing the service. This is your go-to defense against those frustrating "Product Not Received" or "Subscription Canceled" claims.

I've seen too many merchants lose a dispute because they just threw a tracking number in the rebuttal. That's not enough. You have to provide a direct link or a screenshot showing the final "Delivered" status. Make it impossible for the bank reviewer to miss it.

For digital goods or subscriptions, the principle is the same, but the evidence looks different. You need to show the customer actually used what they paid for.

- Shipping and Tracking Information: Provide the full tracking number that links directly to the carrier's website, showing the complete journey and the final delivery confirmation.

- Delivery Photos or Signatures: If you have it, this is gold. A photo of the package on the customer's doorstep or a signature confirmation is incredibly difficult to argue against.

- Digital Service Logs: For any SaaS or digital product, pull the server or application logs. You need to show that the customer logged in and used your service after the purchase date. Always include the specific dates and timestamps.

Proof of Customer Communication

The final piece of your evidence puzzle is all about communication. Any conversation you've had with the customer—emails, support tickets, chat logs, even social media DMs—can provide crucial context that completely undermines their dispute.

For example, if a customer files a "Not as Described" dispute but never once mentioned any issues in their support tickets, that silence speaks volumes. Or, if they confirmed in a chat that they received their item, you can use that to instantly shut down a "Product Not Received" claim. Gather every single relevant message to tell the complete story.

From Proactive Alerts to Winning Rebuttals

If you’re only dealing with chargebacks after they hit your account, you’re already behind. That reactive approach is a constant drain on revenue and can put your relationship with payment processors at risk. The smart play is to get on the offensive by using proactive alerts that tip you off to a customer dispute before it officially turns into a chargeback.

This shift in strategy gives you a critical 24- to 72-hour window. Think of it as a golden opportunity to take back control. Real-time notifications from alert networks, like Visa's Rapid Dispute Resolution (RDR) and Mastercard's CDRN, deliver the intel you need to make a strategic call right then and there. It’s no longer about scrambling to put out fires; it’s about preventing them in the first place.

The Strategic Choice Alerts Provide

When an alert lands in your inbox, you’re suddenly at a crossroads with two clear paths. You can either issue an immediate refund for a legitimate customer claim—protecting your all-important chargeback ratio—or you can use that precious time to start building an ironclad case for your rebuttal letter. This isn't just about saving one transaction; it’s about safeguarding the long-term health of your merchant account.

Let's say an alert comes in for a low-value subscription renewal from a long-time customer. A quick refund is probably the smartest move to keep them happy and your metrics clean. But what if the alert flags a high-value order where you have a perfect AVS/CVV match and definitive proof of delivery? That’s your green light to prepare for a fight. The alert gives you a valuable head start to gather shipping confirmations, delivery photos, and any customer emails.

This brief window is your single greatest advantage. It allows you to transform a chaotic, reactive process into a managed, strategic workflow, ensuring you only fight the disputes you know you can win.

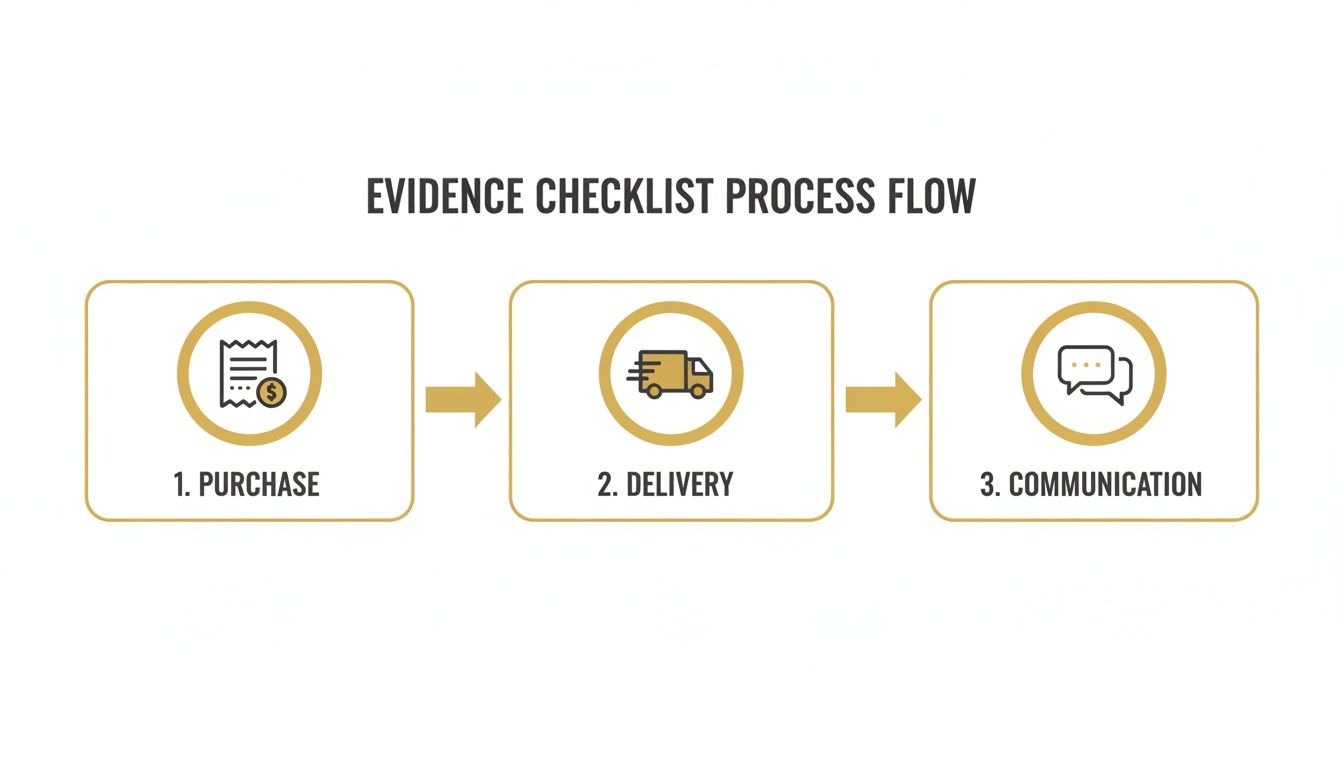

The evidence-gathering process really boils down to three key areas: purchase details, delivery confirmation, and your communication history with the customer.

As you can see, having your ducks in a row with solid evidence from these three categories makes your rebuttal incredibly difficult to beat.

Turning Data into a Winning Advantage

Proactive alerts are much more than just simple notifications; they're a stream of actionable data. By analyzing the kinds of alerts you’re getting, you can start to spot patterns. Maybe there’s a recurring issue with a specific product description, or perhaps your return policy isn't clear enough. This insight is gold, helping you fine-tune your operations to cut down on disputes before they even happen.

This rapid-response approach is changing the game in e-commerce, and rebuttal letter templates are a cornerstone for boosting win rates as dispute volumes climb. With global chargebacks projected to hit 324 million by 2028, the pressure is on. Here in the U.S., businesses lose an average of $4.61 for every $1 lost to a chargeback, and fraud is behind a staggering 45% of all disputes.

But fighting back works. A solid 54% of challenged disputes end in a merchant victory. While each dispute can cost around $190 in hidden fees and lost time, acting on real-time alerts gives you the power to respond effectively. You can learn more about the current landscape of chargeback disputes from Sift.

Platforms like Disputely tie directly into these alert systems, helping to automate the decision-making. You can set up rules to automatically refund certain types of disputes while flagging others that need a human eye. This ensures you never miss that crucial 24-72 hour window, turning raw alert data into a powerful tool for protecting your revenue. Our guide on building a Q4 representment strategy can help you gear up for the busiest shopping seasons. By combining proactive alerts with well-crafted rebuttal letter templates, you build a complete system that not only wins more disputes but helps stop them from ever hurting your business.

A Few Common Questions About Rebuttal Letters

Even with great templates in hand, you're bound to have questions when you're in the trenches fighting a chargeback. Let's clear up some of the most common uncertainties merchants face so you can build your case with confidence.

How Long Should My Rebuttal Letter Be?

Keep it short. Seriously. Aim for a single page.

The person reviewing your case at the bank is looking at hundreds of these a day. They don't have time to read a novel. A rebuttal that is clear, concise, and easy to scan will always be more effective than a five-page essay.

Use formatting to make their job easier. Think of it like an executive summary, not a legal brief. Use bullet points for key data, short paragraphs, and bold text to highlight things like order numbers, AVS confirmations, or tracking details. This helps the reviewer quickly find the exact proof they need.

What's the Single Biggest Mistake I Can Make?

Submitting a rebuttal without compelling evidence. Hands down.

Your opinion means nothing in this process. You need cold, hard facts. Simply stating, "the customer got the item," is just your word against theirs. A screenshot of the FedEx delivery confirmation showing the package on their doorstep? That's proof.

Think of your rebuttal as a mini-legal case. Your letter makes the argument, but your evidence is what wins it. Without solid documentation, your argument has no legs to stand on and will get tossed out almost immediately.

Before you hit send, look at your evidence with fresh eyes. Would it convince a total stranger who has zero context? If not, you need to dig deeper and find more proof.

Can I Just Use the Same Template for Every Dispute?

You can start with a similar structure, but absolutely do not send the same letter for every chargeback. The evidence needed to fight a "Product Not Received" claim is completely different from what's required for a "Fraudulent Transaction" dispute.

Your templates should be starting points, not finished products. You have to customize your response based on the specific reason code given for the chargeback.

- Fraud Claims: Your letter needs to highlight AVS/CVV matches, IP address logs, and any previous order history from that customer.

- Delivery Disputes: Here, it's all about shipping labels, tracking history from the carrier, and definitive proof of delivery (like a signature or photo).

- "Not as Described" Claims: You'll need to pull up screenshots of your product page, detailed descriptions, and any emails or chats with the customer.

Using a generic, one-size-fits-all rebuttal tells the bank you're not taking the dispute seriously. It's a quick way to lose.

Is It Even Worth Fighting a Chargeback for $20?

Yes, almost always. I know it feels like a waste of time for a $15 or $20 order, but you have to look at the bigger picture.

First, consistently fighting every bogus chargeback sends a message to opportunistic "friendly fraudsters" that you're not an easy target. But more importantly, every single chargeback you get—no matter the amount—counts against your chargeback ratio.

This is the number that payment processors like Stripe and PayPal watch like a hawk. If that ratio gets close to the industry threshold of 0.9%, you're in trouble. You could face higher processing fees, a frozen portion of your funds, or even lose your merchant account entirely.

So, fighting those small-dollar disputes isn't just about getting $20 back. It’s about protecting the long-term health and reputation of your business.

Fighting chargebacks manually is a constant drain on your time and resources. Disputely stops disputes before they become costly chargebacks by providing real-time alerts that give you a 24-72 hour window to act. Protect your revenue and your merchant account by automating your chargeback defense. Learn how Disputely can safeguard your business today.