recurring payment processing: automate billing and retention

Recurring payment processing is the automated system businesses use to charge customers on a set schedule. Think of it as putting your billing on autopilot—it's the engine running every subscription service you love, from your Netflix account to that weekly meal kit delivery. This approach gets rid of manual invoicing and gives businesses a much more predictable revenue stream.

The Foundation of the Subscription Economy

At its heart, recurring billing is a simple but powerful agreement. A customer gives you their payment details one time and gives you permission to charge them at regular intervals—weekly, monthly, annually, you name it. That single authorization kicks off an automated cycle that runs like clockwork until the customer decides to cancel, making life easier for everyone involved.

This model is what makes the modern subscription economy tick. It’s a game-changer because it turns unpredictable, one-off sales into stable, recurring revenue. For any business, that kind of predictability is gold. It makes financial forecasting simpler, smooths out cash flow, and helps build lasting relationships with customers.

Key Components of a Recurring Payment System

To really get how this all works, you need to know about two core pieces: the payment gateway and the merchant account.

Think of the payment gateway as a secure digital messenger. Its job is to encrypt the customer's payment information and shuttle it over to the payment network for approval. It’s the essential bridge between your website and the banks that actually process the transaction.

The merchant account, on the other hand, is a special kind of bank account. It’s where the money from all those approved transactions sits before it gets moved into your main business account. These two components work together seamlessly in the background, making automatic billing feel completely effortless.

This model has become a huge force in commerce. The global recurring payments market pulled in around USD 154.7 billion in revenue, and the United States alone accounted for USD 51.5 billion of that. This massive growth is fueled by everything from SaaS platforms and streaming services to e-commerce subscription boxes. You can dig into more insights on the recurring payments market over on Market.us.

Why It Matters for Your Business

Setting up a solid recurring payment system is about more than just convenience. It's a strategic move that has a direct impact on your bottom line and how efficiently you operate. The benefits go way beyond just putting billing on autopilot.

- Improved Customer Retention: When payments are frictionless and automatic, you eliminate common reasons for churn, like a customer forgetting an invoice or a card expiring without them noticing.

- Predictable Revenue Streams: Knowing exactly when and how much money is coming in provides a stable financial foundation. It makes it far easier to budget for growth, manage inventory, and invest in the future.

- Reduced Administrative Workload: Automating the billing cycle frees your team from the mind-numbing tasks of sending invoices, chasing down late payments, and manually keying in transactions.

In the end, this system lets you stop chasing individual transactions and start focusing on building long-term customer value. It’s the machinery that makes scalable, relationship-driven business models possible.

How Automated Recurring Payments Work

From the outside, automated recurring payments look like magic. Money just appears in your account on schedule. But behind the scenes, there's a sophisticated and highly secure dance of technology that makes every charge happen smoothly and safely. It all hinges on a few core components working together flawlessly.

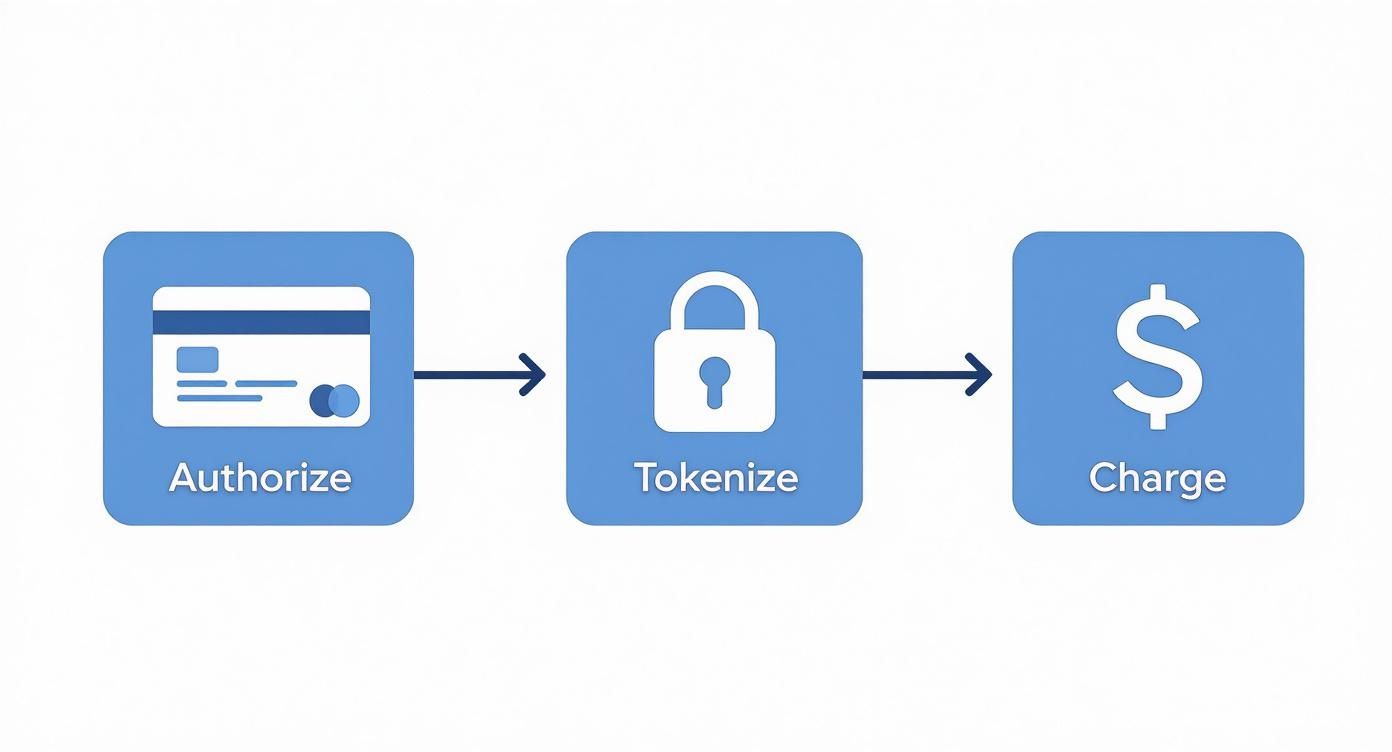

The whole thing kicks off with a single action from your customer: authorization. When someone signs up for your service, they enter their card details and agree to your billing terms. This is the critical moment they hand you permission to store their payment info and charge them automatically in the future.

This is often called a card-on-file or credential-on-file transaction. Your customer is essentially giving you a key to their account, trusting you to use it only as you've both agreed.

The Role of Tokenization in Securing Data

Once you have that authorization, the single most important security step takes place: tokenization. Storing a customer's actual credit card number on your servers would be a catastrophic security risk. Instead, your payment gateway intercepts that sensitive data and swaps it for a unique, meaningless string of characters called a "token."

Think of it like a coat check ticket. You hand over your valuable coat and get a simple ticket in return. That ticket is useless to anyone else, but the attendant knows it corresponds to your specific coat. The token works the same way; it's a stand-in that only your payment gateway can use to find the real card details inside its secure vault.

This is the bedrock of modern PCI DSS (Payment Card Industry Data Security Standard) compliance. By letting your processor handle the raw card data and only storing the token yourself, you drastically shrink your security and compliance footprint.

This token is what you link to the customer's account in your system, ready for the next billing cycle.

The Transaction Lifecycle Step by Step

With the token securely on file, your system is ready to run on autopilot. Here’s a quick look at what happens every time a payment is due:

Billing Trigger: Your subscription software sees that a customer's renewal date has arrived. It pings the payment gateway with a simple instruction: "Charge this token for X amount."

Gateway Action: The gateway receives the request. Inside its own secure environment, it looks up the token to find the actual card details it has stored.

Network Communication: The gateway then sends the charge request through the appropriate card network, like Visa or Mastercard, which routes it to the customer’s bank (the one that issued the card).

Bank Approval or Decline: The customer's bank takes a quick look. Does the account have enough funds? Is the card still active? Any red flags? It then sends back a simple "yes" or "no" response.

Settlement: On approval, the "yes" message travels back up the chain. The funds are then officially moved from the customer's bank to your merchant account, a process that usually takes a couple of business days to fully settle.

This entire round trip happens in seconds, without you or the customer lifting a finger. It's this automation that makes subscription models so powerful and scalable, letting you process thousands of payments without a massive manual effort and creating that predictable revenue stream businesses love.

Reducing Failed Payments and Involuntary Churn

No matter how smooth your recurring payment system is, you're going to hit an inevitable speed bump: failed payments. When a scheduled charge gets declined, it's not just a single missed payment. It's a direct route to involuntary churn, where a good customer loses access to your service simply because of a technical glitch. They didn't want to leave; their billing cycle just got interrupted.

Mastering how to handle these failures is a non-negotiable part of running a healthy subscription business. The automated process built for this is called dunning. Think of it as your digital accounts receivable clerk, working 24/7 to recover revenue you'd otherwise lose. The entire goal is to fix payment problems gracefully before they turn into a cancelled subscription.

Understanding Dunning Management

Dunning isn't just about firing off a "payment failed" email. A proper dunning strategy is a carefully choreographed sequence of messages and automated actions designed to get the customer's billing info updated and the payment pushed through. This is absolutely critical because a massive chunk of churn—often between 20% and 40% for subscription companies—is completely involuntary.

The first step is to figure out why payments fail. It's usually not a mystery:

- Expired Credit Cards: This is the big one. A card expires, and the customer simply forgets to update it.

- Insufficient Funds: A temporary cash flow issue or a maxed-out credit card can trigger a "soft decline," which can often be resolved later.

- Bank Declines: Sometimes the customer's bank flags a charge for fraud or blocks it due to a network error.

- Outdated Information: The customer might have moved or gotten a new card with a different security code, making your stored data useless.

The secret to good dunning is to start with the assumption that the customer wants to pay you. Your tone should always be helpful and proactive, never accusatory.

The diagram below shows how a successful recurring payment flows through the system, from the initial authorization to the final charge.

As you can see, a lot of things have to go right for the payment to succeed, which also means there are several points where things can go wrong.

Creating a Smart Retry Schedule

When a payment fails, your first instinct should never be to cancel the subscription. Instead, you need a smart retry schedule. This is just automated logic that tries to process the charge again at strategic times. Why? Because many declines are temporary. A retry in a few days might go through just fine after the customer gets paid.

A well-structured retry logic is one of the most powerful tools against involuntary churn. Simply retrying a failed payment can recover up to 70% of otherwise lost revenue without any customer interaction.

A common and highly effective retry schedule looks something like this:

- First Retry: Wait 3-5 days after the initial failure. This simple delay often clears up temporary issues like insufficient funds.

- Second Retry: Try again 5-7 days after the first retry. This attempt should be paired with an email notification to the customer.

- Final Retry: Make one last attempt about 7 days later, along with a final, clear warning that their account is about to be suspended.

This patient, automated approach claws back a ton of revenue while keeping customers happy. To truly build a resilient business, you need to go beyond just retries; it's worth exploring broader strategies to reduce churn rate and cultivate customer loyalty.

Choosing the Right Payment Processing Solution

Picking the right partner for your recurring payment processing is one of the most critical decisions you'll make. It’s a lot like choosing the engine for a car. The right one will run smoothly for years and give you the power you need to grow, but the wrong one will cause constant breakdowns and headaches down the road. This decision isn't just about the lowest transaction fees; it directly impacts your customer experience, your tech stack's flexibility, and your ability to scale.

This isn't a niche market, either. The global recurring payments space was valued at around $166.69 billion and is on a trajectory to hit an estimated $262.58 billion by 2029. That incredible growth shows just how foundational the subscription model has become for businesses of all shapes and sizes. If you want to dive deeper into the numbers, you can explore this detailed market overview of recurring payments and its future projections.

Evaluating Your Core Business Needs

Before you start comparing logos and pricing pages, you need to take a hard look in the mirror. There's no single "best" processor—only the one that’s best for your business model, your team's technical skills, and your long-term goals. A small e-commerce shop selling a monthly subscription box has completely different needs than a global SaaS platform that needs a rock-solid, developer-first API.

Start by asking yourself a few key questions:

- What's my business model? Are you a simple subscription service, a usage-based platform where billing changes each month, or a high-volume retailer?

- What are my technical resources? Do you have developers on hand who are comfortable working with a complex API? Or do you need a simple, out-of-the-box solution that plugs right into Shopify or WooCommerce?

- Who are my customers? Are they mostly in one country, or will you need to process payments in multiple currencies and offer local payment methods?

Your answers to these questions will instantly cut through the noise, helping you filter out the options that just aren't a good fit for your reality.

Comparing the Top Payment Processors

While there are dozens of options out there, a handful of major players tend to dominate the recurring payments landscape. Each has its own personality, and each was built with a specific kind of user in mind.

To make things clearer, let's break down some of the most popular choices and see where they shine. This isn't an exhaustive list, but it covers the processors you'll most likely encounter.

Comparing Popular Recurring Payment Processors

| Processor | Ideal For | Key Strength | Typical Fee Structure |

|---|---|---|---|

| Stripe | SaaS, platforms, tech-forward businesses | Powerful and flexible developer API | Flat-rate per transaction (e.g., 2.9% + $0.30) plus recurring billing fees. |

| PayPal | Small businesses, new e-commerce stores | Brand recognition and customer trust | Varies, but often a similar flat-rate model with international complexities. |

| Shopify Payments | E-commerce stores using the Shopify platform | Seamless integration with the Shopify ecosystem | Included with Shopify plans; fees vary by plan tier. No extra transaction fees. |

| Authorize.net | Large enterprises, high-risk merchants | Reliability and advanced fraud detection tools | More complex: monthly gateway fee, per-transaction fee, plus merchant account fees. |

Ultimately, this comparison shows there's no one-size-fits-all answer. The "best" choice is the one that aligns with your specific needs, not just the one with the most recognizable name or the lowest advertised rate.

Key Takeaway: Don't get distracted by brand names alone. Your goal is to match a platform's core strengths to your business's real-world needs. An API-first powerhouse is total overkill for a simple storefront, and a basic tool will only hold back a fast-growing SaaS company.

One final, crucial piece of the puzzle is how well a processor works with your dispute management strategy. Protecting your merchant account from chargebacks is non-negotiable, so you need a solution that easily connects with alert services. For example, our Disputely pricing plans are built to integrate with all the major processors, helping you catch and resolve disputes before they turn into expensive chargebacks.

When you're dealing with recurring payments, security isn't just a nice-to-have feature. It's the bedrock of your entire business. You're handling sensitive financial data, and that comes with a whole lot of responsibility. Getting a handle on the security and compliance rules isn't optional—it's essential for building a business that lasts.

Think of these standards as the rules of the road for the digital economy. They exist to protect everyone: your customers, your business, and the banks. Blow them off, and you're looking at potentially catastrophic fines, getting your payment processing privileges yanked, and doing permanent damage to your brand's reputation.

We're talking about a massive, growing industry here. The global digital payment world is projected to see transactions worth nearly $157 trillion by 2025. Payment processors themselves are expected to pull in about $64 billion in direct revenue from that activity. You can dig deeper into the expanding payment processing market to see just how big this space has become.

Understanding PCI DSS

The absolute cornerstone of payment security is the Payment Card Industry Data Security Standard (PCI DSS). At its heart, PCI DSS is a non-negotiable set of rules for any business that accepts, stores, or even just passes cardholder data through its systems. It was created by the big players—Visa, Mastercard, American Express—to clamp down on credit card fraud.

I like to think of it like the health code for a restaurant. A kitchen has to follow incredibly strict rules for handling food to keep diners safe. In the same way, your business has to follow PCI DSS to keep your customers' financial data safe.

The great news is that modern payment gateways do most of the heavy lifting for you. By using technologies like tokenization, which swaps out raw credit card numbers for a secure, meaningless token, your own PCI compliance burden gets a whole lot lighter.

Demystifying Strong Customer Authentication

If you do business in Europe or have European customers, you need to know about another key regulation: Strong Customer Authentication (SCA). It's part of a directive called PSD2 and was put in place to make online payments way more secure.

SCA is basically a beefed-up identity check. It forces customers to prove who they are using at least two of the following three methods:

- Knowledge: Something only they know, like a password or PIN.

- Possession: Something only they have, like a one-time code sent to their phone.

- Inherence: Something they are, like their fingerprint or face ID.

This two-factor system adds a critical layer of defense, making sure the person hitting "buy" is the actual cardholder. While it mostly affects transactions initiated by the customer, it’s a clear signal of where the entire world is heading with payment security.

Protecting customer data is an ongoing commitment, not a one-and-done task. Your security practices should be transparent and easy for your customers to understand, which builds trust. You can see how we approach this in our company privacy policy.

At the end of the day, compliance is more than just a box to check to avoid fines. It's about showing your customers you take their security seriously. When you commit to these standards, you're building a solid foundation that protects both your revenue and your reputation.

7. Key Metrics for Subscription Business Health

Running a subscription business isn't just about collecting payments each month. It's about building a predictable and scalable revenue engine. To really get a handle on how healthy that engine is, you need to look past top-line revenue and focus on a few key performance indicators (KPIs).

Think of these metrics as the gauges on your business's dashboard. They tell you what’s working, what's broken, and where you need to focus your attention. Without them, you’re flying blind.

Core Metrics Every Subscription Business Must Track

The first place to start is with Monthly Recurring Revenue (MRR). This is your lifeblood. It’s the predictable income you can count on every single month, calculated by multiplying your total active subscribers by your average revenue per user. MRR gives you a stable, forward-looking view of your finances, smoothing out the daily bumps.

Next up is your Churn Rate, which is the percentage of customers who cancel their subscriptions in a given period. High churn is a massive red flag. It’s a sign that something is off—maybe your product, your pricing, or the customer experience. Keeping churn low is absolutely critical for growth because it costs far more to get a new customer than to keep an existing one.

Key Insight: Your churn rate is the silent killer of growth. Even a tiny reduction in churn can have a huge compounding effect on your revenue and profitability over time.

Then there’s your Average Revenue Per User (ARPU). This simply tells you how much revenue you're generating from each customer, on average, every month. Tracking ARPU helps you see if your efforts to upsell, cross-sell, or adjust pricing are actually working. It answers the fundamental question: "How much is each customer worth to us right now?"

Finally, Customer Lifetime Value (LTV) brings it all together. This metric projects the total revenue you can expect from a single customer throughout their entire relationship with your company. A high LTV means you’re not just acquiring customers, you’re acquiring valuable customers who stick around. To really master this, it's worth learning how to calculate Customer Lifetime Value (LTV).

At-A-Glance: Your Subscription Health Dashboard

To keep things simple, here are the core metrics you should have on your dashboard. Monitoring these KPIs will give you a clear, ongoing picture of your business's performance and stability.

| KPI | What It Measures | Why It's Important |

|---|---|---|

| Monthly Recurring Revenue (MRR) | The predictable, normalized revenue you earn each month from subscriptions. | Provides a stable view of financial health and predictable growth trajectory. |

| Churn Rate | The percentage of subscribers who cancel their service within a specific time frame. | A direct indicator of customer satisfaction and product-market fit. High churn kills growth. |

| Average Revenue Per User (ARPU) | The average amount of monthly revenue generated per active customer. | Helps identify opportunities to increase value through upselling or pricing changes. |

| Customer Lifetime Value (LTV) | The total projected revenue a single customer will generate over their entire lifespan. | Puts acquisition costs into perspective and highlights the long-term value of retention. |

Ultimately, tracking these metrics turns raw payment data into strategic insights, allowing you to make smarter decisions about marketing spend, product development, and customer retention strategies.

Frequently Asked Questions

As you start putting recurring payments into practice, you're bound to run into a few specific questions. Let's tackle some of the most common ones that pop up when merchants move from theory to real-world implementation.

Can I Set Up Recurring Payments Without a Website?

Yes, absolutely. A website isn't a requirement at all. While an e-commerce store is a common place to handle subscriptions, modern payment processors give you plenty of other options.

You can use a virtual terminal to manually key in a customer's card details, send them a payable invoice straight to their email, or even share a secure payment link via text message or social media. It’s perfect for service businesses, coaches, or anyone who bills clients directly without a formal online checkout.

What Happens If a Customer's Card Is Declined?

A declined card is an everyday occurrence, not a crisis. This is where a good dunning management process kicks in. Instead of just giving up and canceling the subscription, the system will automatically try the card again according to a "smart retry" schedule over the next few days.

At the same time, it will send out friendly, automated emails asking the customer to update their payment info. This simple, proactive process saves a huge amount of revenue and stops customers from churning unintentionally over something as simple as an expired card.

How Do I Handle Chargebacks with Recurring Payments?

With subscriptions, the best way to handle chargebacks is to prevent them from ever happening. Start with a crystal-clear billing descriptor on your customer’s credit card statement (like "YOURBIZ*MonthlyBox") so they recognize the charge. Combine that with transparent terms and an easy-to-find cancellation option.

The real secret is catching disputes before they become full-blown chargebacks. Alert services are a game-changer here—they tell you the moment a customer has an issue, giving you a chance to issue a refund and sidestep the chargeback entirely.

If you do get hit with a chargeback, you'll need to fight it with solid proof. This means showing the bank the customer's original authorization, proof they used your service, and any emails or communication you have on file. If things get complicated, our team is here to help you build a strong case. You can find more details on our support page.

At Disputely, we stop chargebacks before they happen. Our platform connects directly with Visa and Mastercard alert networks, notifying you of disputes in real-time so you can refund and prevent costly chargebacks. Protect your revenue and merchant account with Disputely.