Your Guide to Winning a Return Item Chargeback

A return item chargeback is a frustrating scenario every merchant dreads. It’s what happens when a customer sends something back, but instead of waiting for your refund to process, they call their bank and dispute the original charge.

This isn't just a simple return; it's a forced reversal of funds that pulls the money directly from your account, often before you even know there’s a problem. It completely bypasses your standard returns workflow and leaves you to clean up the mess.

What Is a Return Item Chargeback

With a normal return, you're in the driver's seat. You get the item back, check its condition, and issue a credit based on your policy. But a chargeback flips the script. The customer’s bank initiates the process, immediately yanking the funds from your merchant account and slapping you with a penalty fee, which can be anywhere from $20 to $100 per dispute.

From that point on, you’re on the defensive. You have to invest time and energy to prove the chargeback is invalid and fight to get your money back in a process called representment.

The Financial Stakes of Return Disputes

This isn't a minor issue—it's a massive financial drain on retailers. Industry reports project that retail returns will cost businesses a staggering $890 billion in 2024, which is nearly 17% of all sales. Worse, a huge slice of that pie—around $101 billion—is classified as return fraud, the very kind that often snowballs into chargebacks.

The numbers keep climbing. Global chargeback volume is expected to jump from 238 million in 2023 to over 320 million in the next few years. You can dig deeper into these figures with recent chargeback statistics.

Every single return item chargeback hits your bottom line in multiple ways:

- Lost Revenue: The full sale amount is clawed back.

- Non-Refundable Fees: Banks charge you a penalty for every dispute, win or lose.

- Operational Costs: Your team's time is wasted digging through records instead of growing the business.

- Increased Scrutiny: Too many chargebacks can flag your account and even lead to termination.

Common Reasons Behind These Chargebacks

So, why do these disputes happen in the first place? It usually boils down to a breakdown in communication or a hiccup in the customer experience. The card networks (like Visa and Mastercard) use specific "reason codes" to classify why a customer filed a dispute.

When it comes to return item chargebacks, the most common reason you'll see is “Credit Not Processed.” This is the customer’s way of saying, "I sent it back, but I never got my money."

A "Credit Not Processed" chargeback is essentially a customer's final, forceful attempt to get their money back after feeling their refund was delayed or ignored. This often happens due to slow processing on the merchant's end or a simple misunderstanding of the refund timeline.

This table breaks down some of the most frequent reason codes merchants see in these situations.

Common Return Item Chargeback Reason Codes Explained

| Reason Code Category | Example Reason Codes (Visa/Mastercard) | Customer's Claim | Merchant's Primary Defense Angle |

|---|---|---|---|

| Credit Not Processed | Visa 13.6, Mastercard 4855 | "I returned the item, but the merchant never refunded my money." | Provide proof of refund or show the return violated your policy (e.g., returned late, damaged). |

| Merchandise Not as Described | Visa 13.3, Mastercard 4853 | "The item I received was different from the description, so I sent it back for a refund." | Show the product matched the description or that the customer never attempted a return. |

| Cancelled Merchandise/Services | Visa 13.7, Mastercard 4841 | "I cancelled the order before it shipped, but I was still charged and never refunded." | Provide proof of shipment before cancellation or proof that a refund was issued. |

| Defective Merchandise | Visa 13.3, Mastercard 4853 | "The product was broken when it arrived, so I returned it." | Prove the item was shipped in good condition or that the refund was processed upon return. |

Understanding these codes is crucial. The customer's claim that they are owed money for a returned product puts the burden of proof squarely on your shoulders. It's up to you to show that you either processed the refund correctly or had a legitimate reason under your policy to deny it.

Building Your Airtight Case for Representment

When a "return item" chargeback lands, the clock starts ticking. I've seen too many merchants lose money because their response was rushed and disorganized. To win, you have to stop thinking about it as just sending a few documents. You're building a compelling, evidence-backed story for the bank reviewer, crafting a narrative so clear and logical that it leaves no room for doubt.

The second that dispute notification hits your inbox, your first move is to pull everything related to that transaction. Don't just grab the shipping confirmation. You need the full picture of the customer's journey, from the moment they clicked "buy" to the point they filed the dispute. Getting this done immediately is the bedrock of a strong representment case.

Gathering Essential Evidence

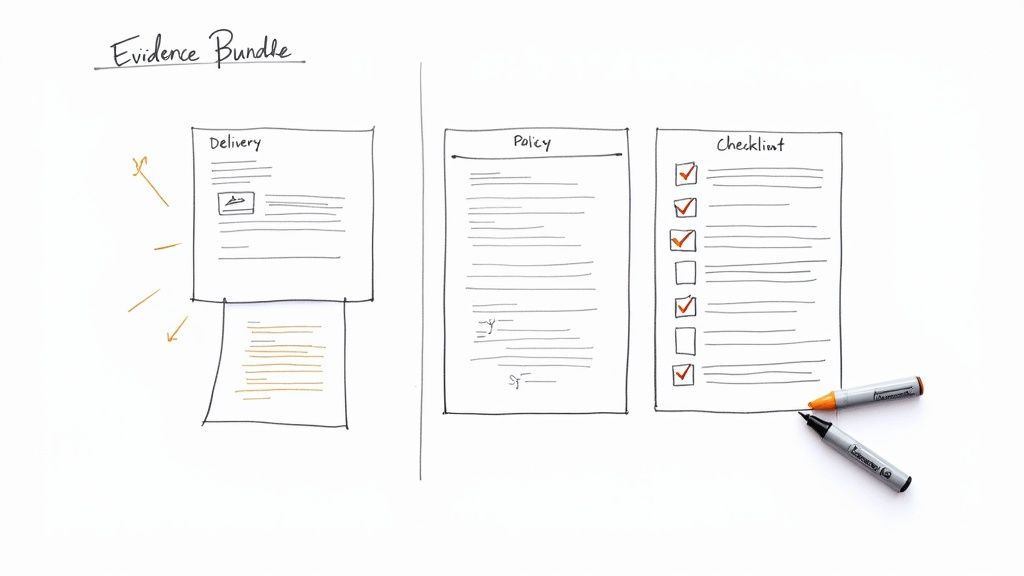

Time to put on your detective hat. Every piece of data you collect helps build your case and poke holes in the customer's claim that they were wronged. Your evidence bundle needs to be comprehensive, telling a story that the bank reviewer can follow without having to piece it all together themselves.

Here’s the essential checklist I use for every single return item chargeback dispute:

- Proof of Delivery: This is the absolute bare minimum. You need a delivery confirmation showing the customer's address, a clear "Delivered" status, and the exact date and time. If you have a signature, that's even better—it's incredibly hard to argue with.

- Return Policy Acknowledgment: You have to prove the customer saw and agreed to your policy. A screenshot showing the policy link clearly visible on the checkout page is good. A screenshot of a mandatory checkbox they had to tick to agree to your terms? That's your golden ticket.

- Customer Communications: Pull every single email, chat log, and support ticket. These are often a goldmine. You might find an email where they admit to receiving the item, acknowledge your policies, or even reveal an invalid reason for the return (like admitting they broke it themselves).

- Proof of Refund (or Denial): If you already issued a refund, include the transaction receipt showing the amount and date. If you denied the refund, you need to show why. Include proof that the return violated your policy, like photos of a damaged item they sent back or a timestamp showing the return was requested way past your deadline.

A quick pro-tip: organize all of this chronologically. Start with the order confirmation, then the shipping details, then any customer service chats, and finish with the return/refund evidence. A clear timeline makes your case a slam dunk for the bank reviewer to understand and approve.

Presenting Your Case Effectively

Simply dumping a folder of PDFs on the bank isn't going to cut it. You have to connect the dots for them. Think about it: a bank employee is sifting through hundreds of these cases a day. Make yours the easiest one to approve.

Highlighting the key information is a game-changer. For example, if you have an email where the customer says, "Thanks, I got the package!", use a simple editor to draw a box around that sentence. If the return tracking shows the package they sent back weighed 1 lb, but the original item you shipped weighed 10 lbs, call that out directly as evidence of an empty-box return.

This level of detail transforms your submission from a messy data dump into a persuasive argument. It shows you're an organized, fair merchant who's been wronged. Yes, building a solid case takes time, but the payoff in recovered revenue and lower dispute rates is absolutely worth it. For merchants staring down a high volume of disputes, especially during busy seasons, having a dialed-in Q4 representment strategy is critical for protecting your bottom line.

Ultimately, winning a "return item" chargeback comes down to proving you held up your end of the bargain. When you meticulously collect and clearly present your evidence, you're not just fighting a dispute—you're demonstrating to the bank that the customer's claim is baseless and that you followed your own policies to the letter.

Crafting a Winning Rebuttal Letter

So, you’ve gathered a folder full of evidence. That’s a fantastic start, but it’s only half the battle. Evidence without a narrative is just a collection of files. Your rebuttal letter is what brings it all together, connecting the dots for the bank reviewer and showing them exactly why the customer's claim doesn't hold up. This is where you put on your storyteller hat.

A solid rebuttal letter does more than just list facts. It needs to be professional, crystal clear, and persuasive. The goal is to make it incredibly easy for a busy reviewer to understand why this return item chargeback is invalid. Think of it as the cover letter for your evidence—it sets the tone and makes that crucial first impression.

Structuring Your Rebuttal for Maximum Impact

Organization is everything. A reviewer might only spend a few minutes on your case, so they need to grasp the situation almost instantly. Forget long, dense paragraphs. You need a structured format with clear headings that make your key points impossible to miss.

Every rebuttal letter you write should have these three core parts:

A Punchy Introduction: Get straight to the point. State the chargeback case number, the original transaction details (date, amount), and your clear intention to dispute the chargeback. Give them a one-sentence summary of why you're fighting it. For example, "This chargeback is invalid because a full refund was already processed on [Date]," or "The item was returned damaged, which violates our publicly stated return policy."

A Simple, Chronological Story: Walk the reviewer through the sequence of events from start to finish. A simple bulleted list is perfect for this. Outline the key moments: the order date, the delivery date, any important customer emails, the return request, and finally, the refund or the reason for denial. This timeline gives your evidence context and makes it much easier to follow.

A Direct Takedown of the Claim: This is where you address the customer's claim head-on. If the reason code is "Credit Not Processed," your entire argument should focus on proving that a credit was issued or was justifiably denied. Be sure to explicitly reference each piece of evidence you've attached. For instance, "See Exhibit A: Delivery Confirmation," or "As shown in Exhibit B, the customer acknowledged our return policy in their email."

This structured approach cuts through the noise and shows the bank you're organized and professional, which can genuinely swing the decision in your favor.

Rebuttal Letter Templates for Common Scenarios

While every chargeback has its own quirks, they often fall into a few familiar buckets. Having a couple of solid templates ready to go can save you a ton of time and prevent you from overlooking critical details.

Here are two battle-tested templates you can tweak for your own use.

Scenario 1: You Already Issued the Refund

This is a classic. The customer either missed the credit hitting their account or, unfortunately, is being less than honest. Your job is to simply prove the money went back to them.

Subject: Dispute for Chargeback Case # [Case Number] - [Customer Name]

Dear [Acquiring Bank Name],

We are writing to dispute the chargeback for transaction [Transaction ID], dated [Date] for the amount of [Amount]. The cardholder is claiming they did not receive a credit for a returned item.

This claim is incorrect. We successfully processed a full refund on [Date of Refund] for [Refund Amount].

Please see the attached documentation:

- Exhibit A: The original order receipt.

- Exhibit B: Proof of delivery to the customer.

- Exhibit C: The refund transaction receipt showing the credit issued to the cardholder’s original payment method.

The evidence clearly shows we fulfilled our refund obligation. We respectfully request that you reverse this chargeback.

Scenario 2: The Return Was Invalid

This happens all the time. The customer sent something back, but it didn't meet your policy's conditions—maybe it was damaged, way outside the return window, or not even the right product.

Subject: Dispute for Chargeback Case # [Case Number] - [Customer Name]

Dear [Acquiring Bank Name],

We are disputing the chargeback for transaction [Transaction ID], dated [Date] for the amount of [Amount]. The cardholder’s claim is invalid because their return did not comply with our policy, which they agreed to at checkout.

The item was returned to us in a damaged and unsaleable condition. As stated in our return policy, we cannot issue refunds for merchandise that has been damaged by the customer.

Please find the following evidence attached:

- Exhibit A: A screenshot of our return policy, which is clearly visible on our website and at checkout.

- Exhibit B: Our email correspondence with the customer explaining why the return was denied.

- Exhibit C: Photographs of the damaged item as we received it at our warehouse.

Because the customer violated the agreed-upon terms, this chargeback is baseless. We request its immediate reversal.

Nailing the Submission Process

Writing the perfect rebuttal is useless if you fumble the submission. Every payment processor has its own portal and its own set of rules. You have to pay close attention to things like file size limits, accepted formats (PDF is almost always your safest bet), and most critically, the deadline. Miss that deadline, and it’s an automatic loss.

This is where automation tools like Disputely can be a lifesaver. They centralize all your active disputes, track deadlines, and manage case statuses, which helps prevent those costly manual errors that can lose you a case you should have won.

Proactive Strategies to Prevent Return Chargebacks

Fighting a "return item" chargeback means you're already playing defense, sinking time and money into getting back what was already yours. Let’s be honest: real success isn't about winning disputes. It's about stopping them from happening in the first place.

Shifting your mindset from reactive to proactive is the single best thing you can do to protect your revenue and keep your merchant account in good standing. This is all about building a customer experience so clear and a returns process so smooth that calling the bank never even crosses your customer's mind. It's about getting ahead of the confusion and frustration before it can turn into a formal dispute.

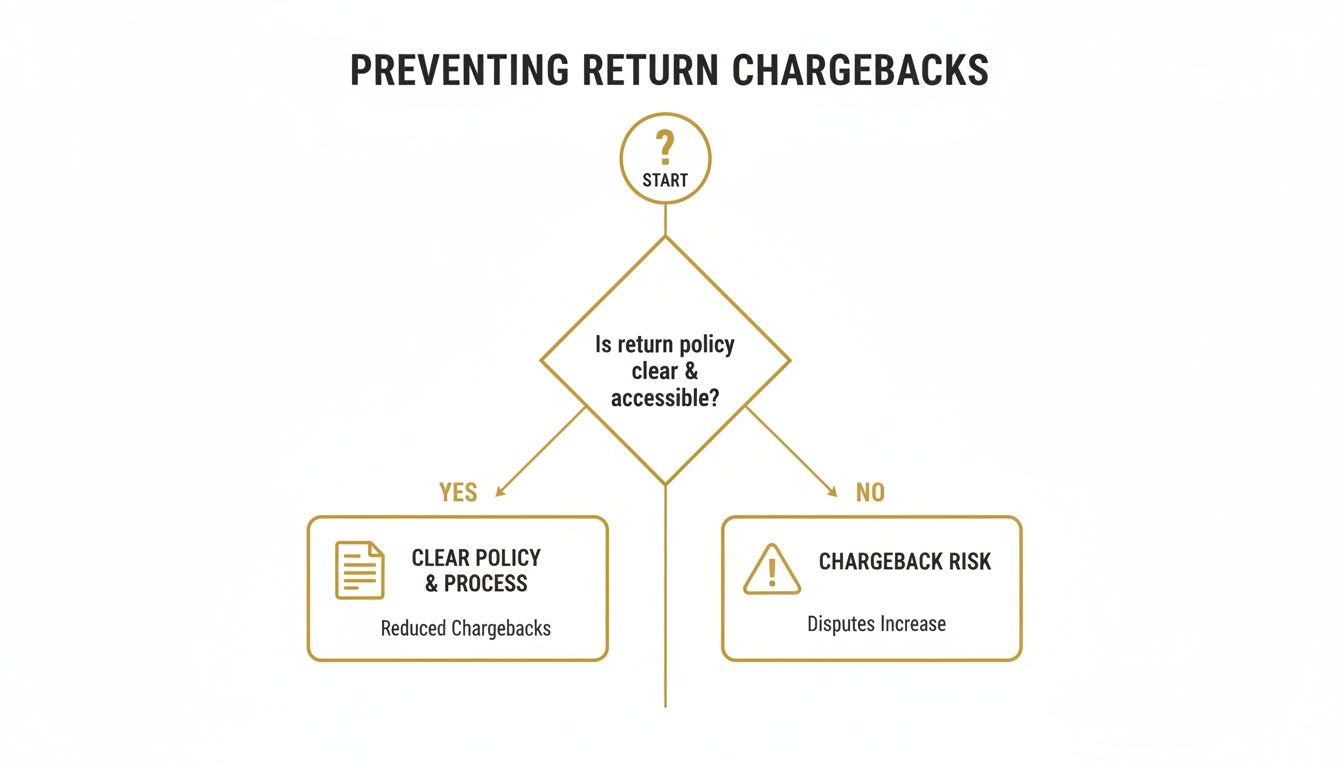

Solidify Your Return and Refund Policies

Think of your return policy as your first line of defense. If it’s vague, buried somewhere in your footer, or loaded with confusing legal jargon, you’re basically asking for disputes. Clarity is everything here.

Write your policy in simple, plain language. It absolutely must state:

- Return Windows: Be specific (e.g., "30 days from the delivery date").

- Item Condition: Spell out what's acceptable (e.g., "unworn, with original tags still attached").

- Refund Process and Timeline: Set clear expectations (e.g., "Refunds are issued to the original payment method within 5-7 business days after we've received and inspected the return.").

- Exceptions and Fees: Be upfront about non-returnable items (like final sale products) or any restocking fees.

Once the policy is solid, make it impossible to miss. Don't just stick a link in your footer and call it a day. Put it on product pages, in your FAQ, and most importantly, on the checkout page itself.

Pro Tip: Require customers to tick a box confirming they've read and agree to your return policy before they can complete a purchase. That simple click provides powerful evidence if a dispute ever comes up.

Enhance Customer Communication and Service

So many chargebacks are just born out of frustration. A customer feels ignored, their refund is taking too long, and they hit the "nuclear option" by calling their bank. A little proactive, responsive customer service can defuse these situations before they ever escalate.

This starts the second an order is placed. Following through and implementing transactional email best practices isn't just good marketing; it's a fantastic chargeback defense. Immediate order confirmations, shipping notifications with tracking, and delivery confirmations keep the customer in the loop and dial down the anxiety.

When someone requests a return, acknowledge it instantly. Give them clear instructions and a shipping label. Keep them updated as their package makes its way back to you, sending a quick note when it arrives and another when the refund is processed. That transparency builds a ton of trust and shows them you're on top of it.

Streamline Your Returns Workflow

A clunky, manual returns process is a recipe for delays and mistakes—the exact things that trigger "Credit Not Processed" chargebacks. Setting up an automated Return Merchandise Authorization (RMA) system can make the entire experience painless for both you and your customer.

A good RMA portal lets customers help themselves. They can generate their own return labels and track the progress without ever needing to email your support team. This isn't just better for them; it also creates a perfect digital paper trail for your records.

The financial hit from these disputes is staggering. Industry forecasts predict eCommerce chargeback costs will hit $33.79 billion in 2025, and keep climbing to $41.69 billion by 2028. With North America making up almost half of that, investing in prevention isn't just a good idea—it's essential for survival.

Optimize Billing Descriptors and Automate Alerts

Finally, some of the easiest chargebacks to prevent happen because the customer simply doesn't recognize the charge on their statement. Make sure your billing descriptor—the text that shows up on their credit card bill—is your recognizable brand name, not some obscure legal entity.

Beyond just being clear, automation is your best friend. Tools like Disputely can plug directly into card networks and give you real-time alerts the moment a customer initiates a dispute. This opens up a critical window where you can issue a refund and stop the chargeback before it's officially filed, protecting your dispute ratio and saving you from hefty fees.

Automation is also a lifesaver when your funds get frozen. We have a helpful guide on what to do if you're ever dealing with a Shopify Payments account hold that offers more detail. By combining crystal-clear policies with smart automation, you can turn a costly headache into a manageable part of doing business.

What Happens After You Submit Your Dispute

So, you’ve gathered all your evidence, crafted a compelling rebuttal, and hit 'submit'. While it feels like a big finish, it's really just kicking off the next phase of the chargeback process. From here, the case leaves your hands and enters the banking world, a journey that can feel a bit mysterious if you don't know the roadmap.

First, your evidence packet lands with your acquiring bank—that's the bank that processes your payments. They act as the first line of review, essentially checking your homework to make sure everything is complete and that your argument logically counters the customer's claim. If it all checks out, they forward it up the chain to the card network (think Visa, Mastercard, etc.), who then passes it to the customer’s issuing bank.

The Issuing Bank Makes the Call

Ultimately, the decision rests with the cardholder's issuing bank. A specialist there will lay out the evidence from both sides—yours and your customer's—and decide who has the stronger case. They're not just going on a gut feeling; they're meticulously comparing the facts against the specific chargeback reason code and the card network's rulebook.

This is exactly why your rebuttal letter needs to be sharp and to the point. These reviewers are sifting through countless cases every day. A clear, well-organized argument that’s easy to scan and backed by solid proof can make all the difference in the world.

It’s easy to think of the review process as a black box, but it's actually quite structured. The issuing bank isn't making an arbitrary call. They are weighing whether you, the merchant, held up your end of the bargain based on your own policies and the network's regulations.

The flowchart below really drives home how a clear, easy-to-find return policy is your first and best defense against these disputes ever happening.

As you can see, preventing chargebacks starts long before the dispute is filed. It begins with proactive communication, something the banks will be looking for in your evidence.

Navigating the Potential Outcomes

Now comes the waiting game. The entire review can take anywhere from 30 to 90 days, sometimes longer if the case is particularly tangled. During this time, keep an eye on the dispute status in your payment processor's portal.

When the dust settles, there are really only two ways your return item chargeback dispute can go:

- You Win the Dispute: The issuing bank agrees with you, and the chargeback is reversed. The money that was pulled from your account is returned. It’s a win that validates your processes.

- You Lose the Dispute: The bank sides with the cardholder. The chargeback is upheld, the customer keeps the funds, and you're out the money.

What to Do When the Verdict Is In

A win is a win. If the decision comes back in your favor, celebrate! The funds are typically returned to your merchant account within a few business days. Usually, there's nothing more you need to do.

But a loss doesn't always have to be the end of the road. You can escalate the case to pre-arbitration or even arbitration, where the card network steps in as the final referee. Be warned, though—this path is more formal, time-consuming, and expensive. You'll need to weigh the disputed amount against the additional fees, which can run into the hundreds of dollars. For smaller sales, it's rarely worth it.

If you find yourself losing these disputes more often than you'd like, it might be time to get some expert advice. You can find more resources and get help fine-tuning your strategy by reaching out to the Disputely support team. Knowing what to expect after you submit takes the anxiety out of the process and puts you back in control.

Common Questions About 'Return Item' Chargebacks

Diving into the weeds of chargebacks always brings up some tricky, "what-if" scenarios. Let's tackle some of the most common questions I hear from merchants who are in the thick of a dispute.

What Should I Do If a Customer Returns an Empty Box?

This one is infuriating, and unfortunately, it's a classic example of return fraud. The second you realize you've received an empty box or a package containing something other than your product, your priority is to document everything.

- Start by taking clear, well-lit photos. Capture the shipping box from all angles, get a close-up of the shipping label, and photograph the incorrect (or completely missing) contents.

- Next, weigh the returned package. Pull up the original shipment record for the order and compare the weight. A massive difference between the weight of the product you sent and the package you got back is compelling evidence.

- When you build your rebuttal, lead with this evidence. Your photos and the weight discrepancy tell a clear story: the customer failed to return the actual merchandise, which is a direct violation of your return policy and invalidates their claim.

How Long Do I Really Have to Respond to a Dispute?

The clock starts ticking immediately, and it moves fast. For most chargebacks, you'll have somewhere between 20 and 45 days to submit your evidence. The exact window depends on the card network (Visa, Mastercard, etc.) and your payment processor.

Let me be clear: missing this deadline means you automatically lose. There are no extensions or second chances. You have to treat every single chargeback notification with urgency. This is precisely why so many merchants rely on chargeback management software; getting automatic alerts and having deadlines tracked for you means you never lose a winnable dispute just because it got lost in an inbox. Always log in to your processor's portal and confirm the exact due date for every case.

Is It Ever a Good Idea to Just Accept the Chargeback?

It feels wrong, I know, but sometimes the smart business move is to strategically accept the loss. It all comes down to a simple cost-benefit analysis.

Fighting a dispute isn't free—it costs your team valuable time. If the order was for a low-value item, say under $20, the labor cost of gathering evidence, writing a rebuttal, and tracking the case can easily exceed what you'd recover. In those situations, it often makes more financial sense to take the hit and channel that energy into preventing the next dispute.

But don't make this your default strategy. If you get into the habit of accepting every chargeback, your dispute rate will climb, and you could be flagged by processors. That puts your entire merchant account in jeopardy.

The trick is to be selective. Fight the claims where you have solid evidence and a meaningful amount of money on the line. For the small, high-effort ones, it might be better to concede. A balanced approach protects both your resources and your relationship with your payment processor.

Can I Ban a Customer Who Files a Chargeback?

Yes, you absolutely can. If you've identified a customer who has filed a fraudulent chargeback, you are well within your rights to refuse to do business with them again. Protecting your store from repeat offenders is not just acceptable; it's a necessary part of risk management.

Make sure you document that customer’s details—name, email, shipping address—and add them to an internal blacklist. Most ecommerce platforms have features that allow you to automatically cancel and refund any future orders from that person. It's a simple but powerful way to stop friendly fraud in its tracks.

Stop wasting time and money fighting preventable disputes. Disputely integrates directly with card networks to alert you the moment a customer initiates a dispute, giving you the power to resolve it with a refund before it becomes a costly chargeback. Protect your merchant account and your revenue by visiting Disputely's official website to see how much you can save.