The Ultimate Guide to Time Limit for Credit Card Chargeback

That chargeback notification just hit your inbox, and a clock has officially started ticking. Here’s the single most important thing to understand: while your customer has months to file a dispute, the time limit for a credit card chargeback response from you is brutally short—often just a handful of weeks. Every day you wait to act costs you money.

Why Every Second Counts in Chargeback Timelines

It helps to think of the chargeback process as a game with two very different clocks. The customer gets a slow, leisurely countdown, while the merchant's clock is a frantic sprint. This isn't just another operational headache; it's a direct threat to your revenue.

Once a chargeback is filed, you’ve entered a formal, time-sensitive process run by card networks like Visa and Mastercard. Grasping this two-clock reality is the first step toward preventing losses you can actually control.

The Financial Stakes of Missed Deadlines

Let’s be blunt: missing a response deadline isn't a simple mistake. It's an automatic loss. You don't just lose the sale; you're also dinged with a non-refundable chargeback fee and your dispute ratio goes up. That ratio is a vital sign that payment processors watch like a hawk.

If your ratio gets too high, the consequences can be severe and escalate quickly, threatening your very ability to accept card payments.

- Increased Scrutiny: Your payment processor might put your account under review, demanding more paperwork for everything.

- Account Reserves: They could start holding back a percentage of your daily sales as a reserve, tying up your cash flow.

- Termination: The worst-case scenario? Your merchant account gets shut down, and you're forced to find a new, more expensive high-risk processor.

This isn't a small-scale issue. Mastercard tallied up 238 million chargebacks globally in 2023 and predicts that number will climb to 324 million annually by 2028. Because merchants often miss their short response windows, they automatically lose, which is why issuing banks win around 75% of all disputes. You can find more data on this growing problem for merchants on ClearSale’s blog.

A Game You Must Play to Win

You can't afford to sit on the sidelines. Dealing with the time limit for a credit card chargeback demands speed and a solid plan. Every single notification needs your immediate attention and a well-documented response.

Ignoring a dispute or putting it off until the last minute is the same as handing the money back. By treating every deadline with the urgency it requires, you can stop playing defense and start protecting your hard-earned revenue. This guide will walk you through the exact timelines you need to know so you’re ready to fight for every dollar.

The Customer's Clock vs. The Merchant's Sprint

Think of the chargeback process like a relay race, but with one major catch: one runner gets a long, leisurely jog, while their teammate has to run a frantic, all-out sprint. This is the reality of the time limit for a credit card chargeback. Every single dispute is governed by two completely different clocks, and knowing how they work is critical to protecting your revenue.

The first clock belongs to your customer. It moves slowly and gives them a wide window to file a dispute. The second clock is yours, and it’s more like a stopwatch with a very short fuse. This is your response window, and if you miss it, you automatically lose the dispute.

The Cardholder’s Extended Timeline

From the moment a customer makes a purchase, they have a generous amount of time to change their mind and take action. This filing window is designed to protect consumers who might not spot an incorrect charge right away, only discover a product is defective after a few weeks, or realize a promised service never happened.

The clock officially starts ticking for the bank when the customer contacts their card issuer to question the charge. The bank then looks into the claim, assigns a reason code, and files the chargeback against your business. All of this happens behind the scenes before you're even aware there’s a problem.

The system is built on a foundation of consumer protection. It’s designed to give customers plenty of time to find and report legitimate issues, which is why their timeline can stretch out for months. But that protection creates a ton of urgency on your end.

The Merchant’s Compressed Sprint

Once the customer's bank files the chargeback, it makes its way through the card network (like Visa or Mastercard) to your processor, or acquiring bank. Only then does the notification finally hit your desk. The moment it does, your response clock starts its countdown.

While the customer may have had months to get the ball rolling, you're typically looking at just a few short weeks to respond. This is your one and only shot to fight the chargeback through a process called representment.

This tight deadline exists to keep the payment system moving efficiently. Disputes have to be resolved quickly to maintain stability. The system places the burden on you, the merchant, to have your evidence organized and ready to go at a moment's notice. You can learn more about getting ready for busy seasons with our guide to Q4 representment strategies.

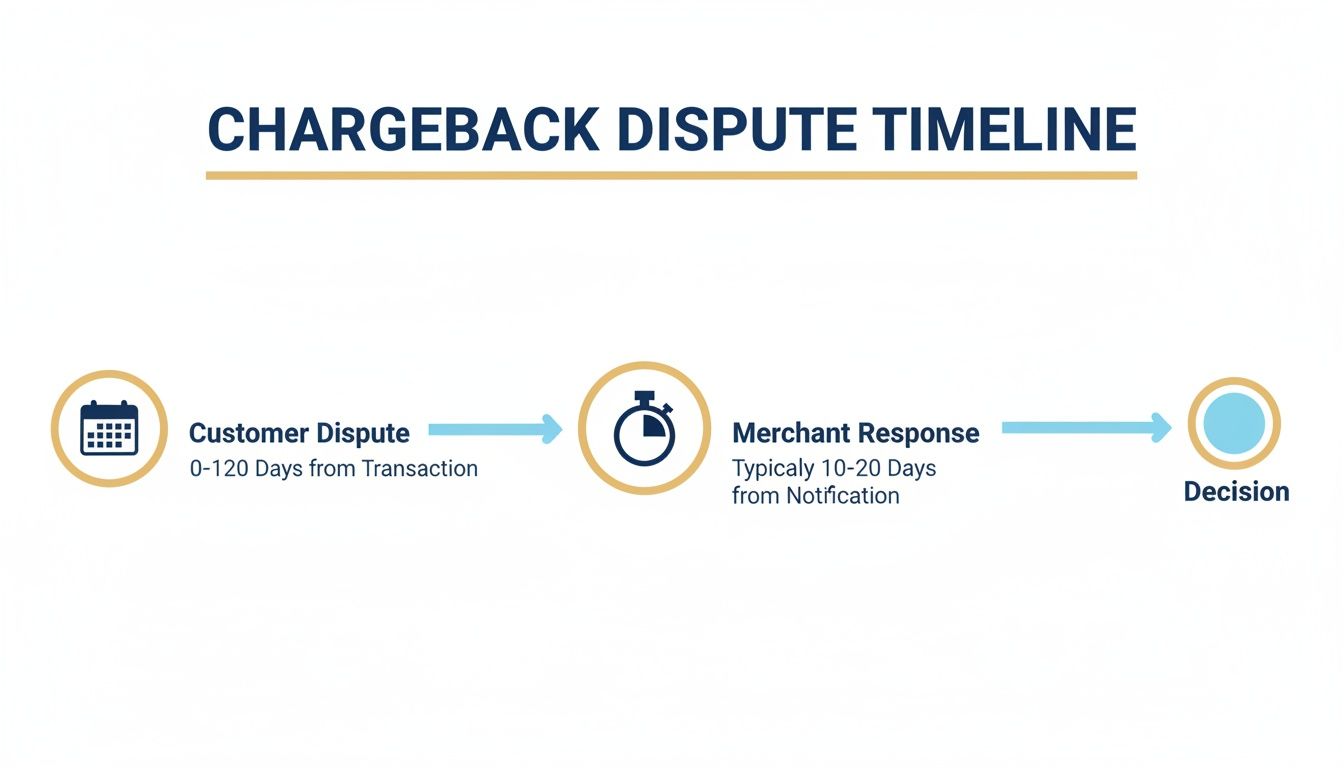

Let’s walk through how these two timelines play out in a real dispute:

- Transaction: A customer buys a product from your online store.

- Cardholder Action (The Long Walk): Up to 120 days later, the customer decides the product wasn't what they expected and calls their bank.

- Issuing Bank Review: The bank investigates the claim and officially initiates the chargeback.

- Merchant Notification: You finally receive the chargeback notice from your payment processor.

- Merchant Response (The Sprint): Your clock is now ticking. You have as little as 20-30 days to pull together all your compelling evidence—shipping confirmations, customer service emails, product descriptions—and submit your representment case.

This massive difference between the two clocks is the central challenge of chargeback management. The system lets the customer run a marathon while forcing you into a sprint.

Decoding Visa, Mastercard, and Amex Time Limits

When that chargeback notification lands in your inbox, the clock starts ticking. But here's the catch: not all clocks are the same. Each major card network—Visa, Mastercard, American Express, and Discover—plays by its own set of rules when it comes to the time limit for credit card chargeback filings. Getting a handle on these differences is the first step to building a solid response strategy.

Think of it like different sports leagues. They all play a similar game, but the rulebooks have key variations. A play that’s totally fine in one league might get you a penalty in another. It's the same with chargebacks; what's standard practice for a Visa dispute won't necessarily fly with Amex.

And it’s not just about memorizing a number of days. The specific reason code attached to the chargeback can completely change the game, sometimes shortening the timeline or extending it based on things like when a service was supposed to be delivered.

Let's break down the rules for each of the major players.

Visa Chargeback Time Limits

As one of the most common networks, Visa's timelines are a good baseline to know. For most disputes, Visa gives cardholders up to 120 calendar days to file a chargeback. The tricky part is figuring out when that 120-day clock actually starts.

For a typical e-commerce sale where you ship a product, the clock usually begins ticking from the date the customer actually gets the item or from the expected delivery date. This is a built-in protection for customers who run into shipping delays.

Once you get that chargeback notification from Visa, your window to act is much, much smaller. You generally have just 20-30 days to pull together all your compelling evidence and submit your case. If you miss that deadline, it's an automatic loss. No second chances.

Mastercard Chargeback Time Limits

Mastercard's system feels similar to Visa's on the surface, but the devil is in the details. Like Visa, Mastercard generally gives cardholders a 120-day window to kick off a dispute. That clock often starts from the transaction date or the day the cardholder first realized there was a problem.

Where Mastercard really differs is how much the reason code impacts the timeline. For instance:

- Authorization-related issues: These often come with a shorter fuse, sometimes around 75-90 days, because the problem is something that should have been spotted sooner.

- Goods/services not received: This usually follows the more standard 120-day rule, which starts from the expected delivery or service date.

The key takeaway here is that while the networks set the maximum windows, your acquiring bank often imposes its own, shorter internal deadlines to ensure they have enough time to process your evidence and meet the network’s final cutoff. Never assume you have the full network-allotted time.

When it's your turn to respond, Mastercard is a bit more generous than Visa. Merchants typically get up to 45 days to submit their representment package. That extra time can be a lifesaver for gathering thorough documentation, but it’s still a sprint compared to the marathon the cardholder gets.

American Express and Discover Time Limits

American Express and Discover run their own "closed-loop" networks, which essentially means they have more direct control over the entire dispute process.

American Express (Amex) is famous for being laser-focused on its cardholders, and its time limits reflect that. There isn't a hard-and-fast, publicly stated day count like Visa's 120 days. Instead, Amex allows cardholders to dispute charges for what they deem a "reasonable" amount of time. In practice, this can sometimes stretch well beyond the typical four-month window, especially for complaints about service quality. For merchants, the Amex response window is a tight 20 days.

Discover also makes its own rules. Cardholders usually have 120 days from the transaction date to file, but just like the other networks, this can change depending on the reason for the chargeback. For merchants responding to a Discover dispute, the window is also around 20 days.

The bottom line is that while card networks give customers a generous window to file a dispute, merchants are on a much tighter leash. It's a fundamental part of the system you have to master.

Card Network Chargeback Timelines At a Glance

Here’s a quick comparison of the typical time limits you can expect from each major card network. Remember, these are general guidelines—the specific reason code on a chargeback can always change the timeline.

| Card Network | Typical Cardholder Filing Window | Typical Merchant Response Window |

|---|---|---|

| Visa | Up to 120 days from transaction or expected delivery date | 20-30 days |

| Mastercard | Up to 120 days; can be shorter (e.g., 90 days) by reason code | Up to 45 days |

| American Express | "Reasonable" time, often beyond 120 days | Around 20 days |

| Discover | Up to 120 days from transaction date | Around 20 days |

Seeing the timelines side-by-side really highlights the pressure merchants are under. While your customer might have months to consider a dispute, you have only a few weeks to build a winning case.

This overview is a great starting point, but always, always check the specific reason code for every dispute you receive. For a deeper dive into managing disputes and protecting your business, explore the resources on the Disputely blog.

Navigating Timeline Exceptions and Special Cases

Just when you think you’ve memorized the standard time limit for credit card chargeback rules, a strange case lands on your desk. The dates don't line up, and the dispute seems to have arrived months too late.

Before you write it off as invalid, it's critical to know that these timelines aren't set in stone. The card networks build in flexibility to protect consumers in specific situations, and what looks like an old transaction might be a perfectly valid dispute.

Think of these exceptions as special clauses in the rulebook. They exist because not every sale is a simple, immediate exchange. Many business models, especially in e-commerce and services, have a natural delay between payment and fulfillment. The card networks get this, which is why they’ve created scenarios where the chargeback clock starts much later than you’d expect.

For any merchant, understanding these special cases is non-negotiable. It keeps you from wasting time fighting a valid dispute you can't win and protects you from being blindsided by a chargeback that seems to come out of nowhere.

When the Clock Starts Ticking Later

The most common reason for a timeline exception is a delay between when the customer pays and when they actually get what they paid for. The guiding principle is simple: the consumer protection clock shouldn’t start running until the merchant has held up their end of the deal.

Imagine buying a concert ticket. You pay in January for a show in August. It wouldn't be fair if your 120-day dispute window closed in May, especially if the band cancels in July. The card networks agree. That’s why the timeline often starts on the date the service was supposed to happen.

Here are the most common triggers for these delayed timelines:

- Future Delivery of Goods: For pre-orders or items with long shipping times, the chargeback clock usually starts on the expected delivery date or the day the item actually shows up—whichever is later.

- Services Rendered Over Time: This is for things like annual gym memberships, yearly software subscriptions, or ongoing consulting work. The clock might not even start until the end of the service contract if the customer argues the service wasn't delivered as promised.

- Tickets and Events: For flights, concerts, or conferences, the filing window opens on the date of the event, not the date the ticket was purchased.

Reason Codes With Their Own Rules

Beyond delivery dates, the reason for the dispute can also reset the timeline. Some chargeback reason codes are specifically designed for problems that aren't obvious right away, giving the cardholder more time to spot the issue and file a claim.

For instance, a chargeback for a defective product might have a longer effective timeline than one for a simple authorization error. The system recognizes that a product's flaw might only show up after a few uses.

A critical point to remember is that the "transaction date" is often just a starting suggestion. The effective start date for the time limit for a credit card chargeback is frequently tied to the date of service delivery or product discovery, giving the cardholder a fair window to act.

This timeline shows the two very different clocks in the chargeback process: the customer's often long dispute window versus the merchant's short sprint to respond.

The biggest takeaway here is the sharp contrast in urgency. It highlights why you, the merchant, have to act the moment a dispute notification comes in.

Handling these exceptions comes down to good documentation. Always keep clear records of expected delivery dates, service periods, and event schedules. This evidence is your best defense when a chargeback arrives with a timeline that seems strange but is perfectly valid under these special rules.

Building Your Deadline-Proof Chargeback Workflow

Knowing the rules of the game is one thing, but having a winning strategy is something else entirely. Understanding the time limit for credit card chargeback responses is only half the battle. If you really want to protect your revenue, you have to turn that knowledge into a fast, repeatable, and organized process.

Without a solid workflow, even the clearest deadlines can fly by, leading to automatic losses.

Think of it like an emergency response team. They don't start drawing up a plan when the alarm sounds—they have a pre-defined procedure drilled into them that everyone follows instantly. Your chargeback response should be no different. This is about building a system that turns chaos into a controlled, deadline-driven process, every single time.

Step 1: Activate Immediate Notifications

You can't fight a battle you don't know is happening. The very first step is making sure you're notified the instant a dispute hits your account. If you’re just waiting for monthly statements or casually checking your processor dashboard, you’re setting yourself up to miss deadlines.

Every hour counts. You need a system that flags new disputes in real-time, whether that's a dedicated email alias alerting multiple team members or an automated service that plugs directly into your payment processor. The goal is zero delay between the chargeback and your team knowing about it.

One of the most effective ways to build a deadline-proof system is through workflow automation, which can handle these alerts and start gathering data without anyone lifting a finger.

Step 2: Organize Compelling Evidence Swiftly

With the clock ticking, there's no time to go on a scavenger hunt for evidence. A winning representment case is built on clear, compelling proof that you held up your end of the deal. Your workflow has to make grabbing this data quick and painless.

Create a standardized "evidence checklist" for your team. This makes sure nothing critical gets missed and keeps your responses consistent and strong.

Your Evidence Gathering Checklist Should Include:

- Proof of Authorization: AVS and CVV match results, IP address logs, and device information.

- Order and Customer Communication: Every email, chat log, or support ticket tied to the order.

- Proof of Delivery: Shipping confirmations with tracking numbers and delivery signatures. For digital goods, this means server logs showing a download or account login.

- Terms and Conditions: A screenshot or record showing the customer agreed to your return and refund policy at checkout.

This structured approach turns evidence collection from a frantic scramble into a methodical process.

Step 3: Make the Strategic Fight-or-Fold Decision

Let's be honest: not every chargeback is worth fighting. Sometimes, the cost of putting together the evidence and the low chance of winning mean accepting the loss is the smarter financial move. Your workflow needs a clear checkpoint for making this call.

Establish a simple threshold for this decision. For instance, you might decide to automatically accept disputes below a certain dollar amount (say, $25) or those where you know your evidence is weak, like a transaction missing a delivery confirmation.

This isn't about giving up; it's about smart resource allocation. Focusing your energy on the high-value, winnable disputes delivers a far better return than fighting every single chargeback that comes your way.

This strategic filter saves invaluable time and keeps your team from getting bogged down in cases they can't win.

By putting this three-step workflow in place—immediate alerts, organized evidence, and a strategic decision point—you can stop reacting to deadlines and start proactively managing them. This is how you shift from being a victim of the chargeback system to a master of it, safeguarding your revenue one well-managed dispute at a time.

Common Questions About Chargeback Time Limits

Even when you think you've got the rules down, the real-world specifics of credit card chargeback time limits can still trip you up. Let’s clear up some of the most common questions we hear from merchants so you can handle disputes with more confidence.

What Happens If I Miss the Chargeback Response Deadline?

Put simply: you lose. Automatically.

If you miss that deadline, the case is closed, the funds are gone for good, and you have no path to appeal. On top of losing the sale, you're still on the hook for the non-refundable chargeback fee.

This is probably the most unforgiving rule in the entire chargeback process. It’s also one of the most common—and completely avoidable—reasons merchants lose money. It's why having a tight, efficient system for managing disputes isn't just a good idea; it's essential.

Can a Merchant Get an Extension on a Response Deadline?

In a word, no. The response window for merchants is notoriously strict.

While the card networks build in some flexibility for customers to file a dispute—especially for things like a future delivery date or a recurring subscription—that same courtesy just doesn't extend to merchants.

Once you get that chargeback notification, the clock is ticking on a hard deadline. It’s set by the card network and your processor, and it waits for no one. This is why you have to act fast. Pushing it to the last minute is a recipe for disaster, leaving zero margin for error.

Think of it this way: The system gives the customer a flexible timeline to ensure fairness, but it demands strict efficiency from merchants to keep the global payment system moving. Your deadline is firm because the entire dispute resolution chain depends on it.

How Do Reason Codes Affect the Time Limit?

Reason codes are a massive factor. While you often hear 120 days as the standard time limit for a customer to file, the actual window can be much shorter or start on a different date, all depending on the reason code. The logic is that some problems should be spotted and reported much faster than others.

Here are a few examples:

- Authorization Issues: These technical errors usually have a shorter filing window, sometimes just 75-90 days. The network expects these to be caught pretty quickly after the transaction.

- Defective Merchandise: For a faulty product, the clock might start ticking from the day the customer discovers the defect, not the day they bought it.

- Services Not Rendered: This is a big one. The timer for this dispute starts on the expected date of service, not the transaction date.

Knowing the reason codes that pop up most often in your industry is the key to understanding your real-world timelines and gathering the right proof. If you're ever stuck on a specific case, you can always ask our team for help by visiting the Disputely support page.

Do Timelines Change if a Dispute Escalates?

Yes, they absolutely do. A chargeback isn't always a single-stage event. If you fight a chargeback and win the first round, the customer's bank can push the case to the next level. Mastercard calls this a "second chargeback," while Visa refers to it as "pre-arbitration."

When this happens, a new clock starts, and it's usually much shorter. You might only have 10 days to provide more evidence or argue against the bank's latest claims. To protect your initial win, you have to respond all over again within this new, tighter window.

This means you can't relax until the case is officially closed for good. Winning round one is great, but the fight might not be over.

Are you tired of losing revenue to missed deadlines and complex chargeback rules? Disputely stops disputes before they ever become chargebacks. Our platform provides real-time alerts, giving you a chance to refund a customer and avoid the fees, penalties, and ratio damage altogether. Protect your business with Disputely today.