A Merchant's Guide to the Time Limit on Chargebacks

When you hear the phrase "time limit on chargebacks," you might think of a single, straightforward deadline. The most common number thrown around is 120 days, which is the window a cardholder usually has to dispute a charge. But that’s only half the story.

The reality is far more complex. That 120-day window can shift depending on the credit card network, the specific reason for the dispute, and even when the customer claims they first "discovered" the problem. And for you, the merchant, an entirely different clock starts ticking the second a dispute lands on your desk—and it’s a much, much faster one.

Understanding the Chargeback Ticking Clock

Think of the chargeback time limit as a statute of limitations for a transaction. Card networks like Visa and Mastercard created these rules to find a fair middle ground. On one hand, they need to protect customers from fraud or poor service. On the other, they have to give merchants some sense of finality on their sales.

Imagine the chaos if there were no deadlines. A customer could dispute a sale from years ago, leaving your business in a constant state of financial uncertainty. That’s why getting a handle on these timelines isn’t just good practice; it's essential for survival in ecommerce.

The Two Clocks That Matter Most

Every single chargeback runs on two distinct timelines. Getting them mixed up is an easy—and expensive—mistake to make. It’s a bit like a relay race: the first runner gets a long, relaxed lap, but the second runner has to sprint like mad the moment the baton is passed.

- The Cardholder's Clock: This is that longer, more flexible timeline, often stretching to 120 days or even more. It usually starts from the date of the transaction, but in some cases, it begins on the "date of discovery"—the day the cardholder first realized something was wrong.

- The Merchant's Clock: This is your response window. Once the bank officially files the chargeback, you have a very short period to fight back, typically just 20 to 45 days. Miss that deadline, and you lose by default. No questions asked.

Key Takeaway: The customer’s long grace period to file a dispute creates a very narrow, high-pressure window for you to respond. Once their clock runs out and yours begins, your speed and preparation are the only things standing between you and lost revenue.

Why Deadlines Are Not Always Simple

While the 120-day rule is a good general guideline, the actual "start date" can be tricky. For example, if a customer pre-ordered a product set to ship months later, their clock might not start ticking until the expected delivery date passes. With recurring subscriptions, a dispute could pop up months after the initial charge.

This is exactly why meticulous record-keeping is non-negotiable. Knowing the subtle differences in these timelines is your first line of defense. For more deep dives into managing and preventing disputes, you can find a wealth of information over on the Disputely blog. As we’ll see, mastering these deadlines is fundamental to protecting your hard-earned revenue.

Decoding Card Network Rules and Deadlines

If you think there's one simple answer to "how long does a customer have to file a chargeback?", you're not alone. But that belief can be a costly one. In reality, every card network—Visa, Mastercard, American Express—operates with its own unique rulebook, and the deadlines are anything but one-size-fits-all. A transaction you logged as a win months ago can suddenly come back as a dispute.

Think of it like a maze. The standard path is usually 120 days, but hidden passages and detours can stretch the journey out for much longer. Knowing how to navigate these variations is what separates merchants who control their revenue from those who are constantly surprised by old transactions coming back to haunt them.

The 120-Day Rule and Its Many Exceptions

For most common disputes, like an unrecognized charge or a product that wasn't as described, the go-to time limit is 120 days from the original transaction date. Both Visa and Mastercard use this as a general benchmark. It’s the number most people know.

The trouble starts when merchants treat that 120-day clock as a hard stop. It’s really just a starting point. Card networks have built-in flexibility to protect consumers in unique situations, which means certain transactions can remain "at-risk" for a surprisingly long time.

These rules are there to strike a balance between consumer protection (like the rights granted under the U.S. Fair Credit Billing Act) and a merchant’s need for finality. But this flexibility can push the time limit on chargebacks out significantly, sometimes as far as 540 days for specific fraud types or regulatory issues.

When the Clock Starts Ticking Later

Here's another critical detail: the clock doesn't always start on the day of the purchase. It often begins on the "date of discovery"—the day the cardholder could have reasonably known there was a problem.

Here are a few real-world examples of how this plays out:

- Delayed Delivery: A customer orders a custom sofa that takes four months to build and ship. The 120-day clock doesn't begin on the purchase date. It starts from the expected delivery date. If that sofa never shows, the customer can file a chargeback long after their card was charged.

- Recurring Subscriptions: Someone signs up for an annual service. They might not notice an incorrect renewal charge until their next statement arrives, well after the transaction itself. The clock usually starts when they spot the billing error.

- Seasonal Services: Imagine a customer prepays for a summer pool cleaning service in April. If the company is a no-show all summer, the dispute window would likely start from the date the service was supposed to happen, not the date they paid.

Why This Matters: Exceptions to the standard time limit on chargebacks mean that revenue you earned months ago isn't always safe. This is especially true for businesses with long fulfillment cycles or subscription models, where a single oversight can lead to an unexpected dispute down the road.

Comparing Major Card Network Timelines

While the rules are complex, getting a handle on the general guidelines for each major network gives you a much clearer view of your risk exposure. Even subtle differences can change how you should prepare and respond to disputes. For example, fighting a tough dispute during a high-volume season requires a deep understanding of these timelines, something we cover in our guide to Q4 chargeback representment strategies.

To help simplify this, we’ve put together a summary of the typical dispute windows and their common exceptions.

Standard Chargeback Time Limits by Card Network

| Card Network | Standard Time Limit (from transaction date) | Common Exceptions & Extended Limits |

|---|---|---|

| Visa | 120 calendar days | Can extend up to 540 days. The clock often starts from the date of discovery or expected service date. |

| Mastercard | 120 calendar days | Varies significantly by reason code, with some disputes allowed up to 540 days from the transaction date. |

| American Express | No fixed, published rule | Timelines are determined on a case-by-case basis and can sometimes exceed 12 months, making record-keeping crucial. |

| Discover | ~120 calendar days | Often flexible, with the clock starting from the transaction date or the expected date of service delivery. |

Ultimately, mastering these deadlines is about more than just memorizing numbers. It’s about understanding the why behind the rules and accepting that a transaction’s risk doesn't disappear when an order ships. When you start anticipating these extended timelines, you can build a far more resilient and prepared dispute management process.

The Merchant's Race Against the Clock: Your Response Window

Once a customer files a chargeback, their long, often flexible timeline is over. That’s when a new, much more aggressive clock starts ticking—yours. The focus instantly shifts from the cardholder's window to your critical response window. This is your one and only shot to fight the dispute.

Think of it like a shot clock in basketball. The other team had plenty of time to set up their play, but the second you get the ball, you have just moments to act. If that clock runs out, you lose possession. It’s the same deal here. Miss this deadline, and you automatically lose the dispute and the revenue.

This window is intentionally tight, usually somewhere between 20 and 45 days, though some processors are making it even shorter. We’re already seeing some move to just nine days for merchants in the US and Canada. The second you get that chargeback notification, the countdown is on.

Why Every Second Counts

The moment you're notified of a dispute, the funds from that sale are pulled from your account and held by the bank. The cardholder gets a provisional credit while everyone waits to see what happens. If you fail to respond in time, that provisional credit becomes permanent. The money is gone for good.

There are no appeals for a missed deadline. It doesn't matter if you were on vacation, the notification went to spam, or you just didn't see it. The card networks are incredibly strict about this rule.

A missed response deadline is essentially an admission of guilt. You're telling the bank that you agree with the customer's claim, which results in an automatic loss.

This unforgiving system means you absolutely must have a clear, immediate action plan for every dispute. Any delay in gathering evidence or writing your response will eat into your limited time and put your revenue on the line.

Your Four-Step Response Playbook

To beat the clock, you need a system. Acting quickly and efficiently is everything. Here’s a practical breakdown of what to do the moment a dispute notification lands.

- Catch the Notification Instantly: The clock starts ticking when the chargeback is filed, not when you open the email. You have to set up alerts or, even better, check your payment processor dashboard daily so a new dispute never slips through the cracks.

- Gather Evidence Immediately: Don't wait. Start pulling together every piece of documentation related to that transaction right away. This isn’t just about the receipt; it’s about telling the complete story of the purchase.

- Write a Clear Rebuttal Letter: Your evidence needs context. Draft a concise rebuttal that directly addresses the customer’s claim, using the proof you’ve gathered to back up your side of the story.

- Submit Before the Deadline: Don't push your luck. Always aim to submit your response several days early. This gives you a buffer against any last-minute technical glitches or submission errors that could cause you to miss the cutoff.

Building Your Evidence File

The strength of your response all comes down to the quality of your evidence. Your goal is to prove two things: the transaction was legitimate, and you held up your end of the bargain.

Your evidence file should contain things like:

- Proof of Authorization: Did the AVS and CVV match? What was the IP address? Do you have device fingerprints?

- Proof of Delivery: Include shipping confirmations with tracking numbers, signed delivery receipts, or logs for digital downloads.

- Customer Communications: Pull any emails, support tickets, or chat logs where you spoke with the customer about their order.

- Terms and Policies: Grab screenshots showing the customer checked the box agreeing to your terms of service, refund policy, or shipping timelines.

Failing to act decisively is one of the top reasons merchants lose disputes they could have won. By treating every notification with urgency and following a structured plan, you can meet this critical deadline and dramatically improve your chances of getting that money back.

Building Your Prootional Dispute Management Timeline

Winning a dispute isn’t about frantically digging for receipts after a chargeback notice lands in your inbox. The real secret is a proactive mindset that kicks in the second a customer clicks "buy." When you build a systematic timeline for every transaction, you stop playing defense and start building a powerful, evidence-backed case to protect your revenue from day one.

Think of it like building a fortress. You wouldn't wait for an attack to start looking for stones and mortar. You’d build your walls methodically, layer by layer, long before any threat ever appeared. That’s the kind of foresight you need to manage the long tail of chargeback risk.

Phase 1: The Point of Purchase

This is your first—and best—chance to collect the foundational evidence that proves a transaction is legitimate. Every bit of data you gather here tells a piece of the story, verifying the customer and documenting their consent right from the get-go.

Your immediate checklist should include:

- Authorization Data: Log the complete AVS and CVV match results. Even if a transaction is approved with a mismatch, this data is gold for showing you did your due diligence.

- IP Geolocation and Device Info: Record the customer's IP address, what kind of device they used, and their general location. This helps connect the actual cardholder to the purchase.

- Policy Agreement: Get proof that the customer actively agreed to your terms of service, refund policy, and shipping details. A simple, timestamped checkbox is incredibly powerful evidence.

Phase 2: Fulfillment and Delivery

Once the order is placed, the story shifts. Now, your job is to prove you delivered exactly what you promised. This phase is all about creating a clear, undeniable record that the customer received what they paid for. For disputes claiming "Merchandise Not Received," this documentation is your ultimate weapon.

Make sure these documents are organized and easy to pull for any order:

- Shipping Confirmation: Keep a copy of the email sent to the customer that includes their tracking number.

- Delivery Proof: Save the final delivery confirmation from the carrier, especially if it includes a photo or a signature. For digital goods, this means keeping access logs that show the customer downloaded or used the product.

- Customer Communications: Archive everything. This includes order updates, shipping notifications, and any conversations with your support team.

A well-documented fulfillment process does more than just prepare you for a dispute; it can stop one before it ever happens. Clear communication and transparent tracking go a long way in easing customer anxiety, which is a major driver of "friendly fraud."

Phase 3: The Long Game: Evidence Retention

The time limit on chargebacks means your responsibility doesn't end when a package hits the porch. With dispute windows stretching from 120 days to over a year for certain reason codes, your evidence needs to be ready for the long haul. A classic mistake is deleting records too soon, which leaves you completely exposed to a delayed dispute.

To stay prepared, you need a rock-solid evidence retention policy. The golden rule is to keep all transaction documents for at least 18 months. This timeframe provides a safe buffer that covers nearly all standard and extended chargeback deadlines, ensuring you’re never caught empty-handed. If you’re in a high-risk industry or run a subscription business, extending that to 24 months is an even safer bet.

Below is a simple checklist to help you stay organized. By following a chronological process, you can ensure no critical piece of evidence ever falls through the cracks.

Merchant Dispute Response Checklist

This timeline outlines the key actions and documents a merchant should prepare at each stage of the transaction lifecycle to build a strong defense against potential chargebacks.

| Stage | Action Item | Key Document to Retain |

|---|---|---|

| Point of Sale | Verify cardholder identity with AVS/CVV checks. | Full authorization log with AVS/CVV responses. |

| Point of Sale | Capture proof of agreement to terms and policies. | Timestamped checkbox log or digital signature. |

| Point of Sale | Record customer's device and location data. | IP address, device fingerprint, and geolocation data. |

| Order Fulfillment | Send immediate order and shipping confirmations. | Copies of all transactional emails sent to the customer. |

| Order Fulfillment | Track the package to the point of delivery. | Carrier-provided tracking number and delivery status link. |

| Post-Delivery | Secure and save the final proof of delivery. | Delivery confirmation with photo, signature, or GPS data. |

| Post-Delivery | Archive all customer service communications. | Email threads, chat logs, and call summaries. |

| Ongoing | Retain all transaction records for at least 18-24 months. | A complete, organized digital folder for each order. |

Systematically organizing your data this way is crucial, especially as you gear up for busy seasons. A seasonal review can help you spot any gaps in your process. Our comprehensive Q4 chargeback audit checklist is a great resource for guiding you through strengthening your defenses before a sales rush.

By adopting a proactive timeline—collecting proof at purchase, documenting fulfillment, and retaining evidence long-term—you’re building a powerful defense for every single sale. With a structured approach like this, when a dispute finally arrives, you won’t be starting from scratch. You’ll just be opening a case file that’s already complete.

Why Mastering Chargeback Timelines Matters Now

Chargebacks have evolved from a minor cost of doing business into a serious threat to your bottom line. Getting a handle on the time limit on chargebacks isn’t just about paperwork anymore—it's a critical financial strategy, especially as dispute volumes are climbing at an alarming rate.

This isn’t a small-scale issue; it's a global trend with massive financial implications. Projections show the annual number of disputes could jump from 261 million in 2025 to 324 million by 2028. That's a staggering 24% increase in just a few years.

The financial hit is projected to grow from $33.8 billion to $41.7 billion in that same timeframe. For merchants in North America, the costs could exceed $20 billion by 2028. For a deeper dive into these numbers, you can read the full report from Mastercard and Ethoca.

The Rising Tide of Disputes

So, what's driving this surge? A few clear trends are at play. Economic uncertainty, for one, often fuels a rise in "friendly fraud," where legitimate customers dispute charges for purchases they actually made. It’s a behavior that becomes more common when household budgets are tight.

On top of that, we see predictable seasonal spikes that add another layer of complexity. Retailers brace for a wave of disputes every January and February, right after the holiday shopping season when buyer's remorse kicks in. These periods are a real test of a merchant's ability to handle a high volume of disputes within very tight deadlines.

The sheer volume and cost of disputes mean that mastering chargeback timelines is no longer optional. It's a fundamental part of protecting your revenue from a problem that is getting more expensive and more common every single year.

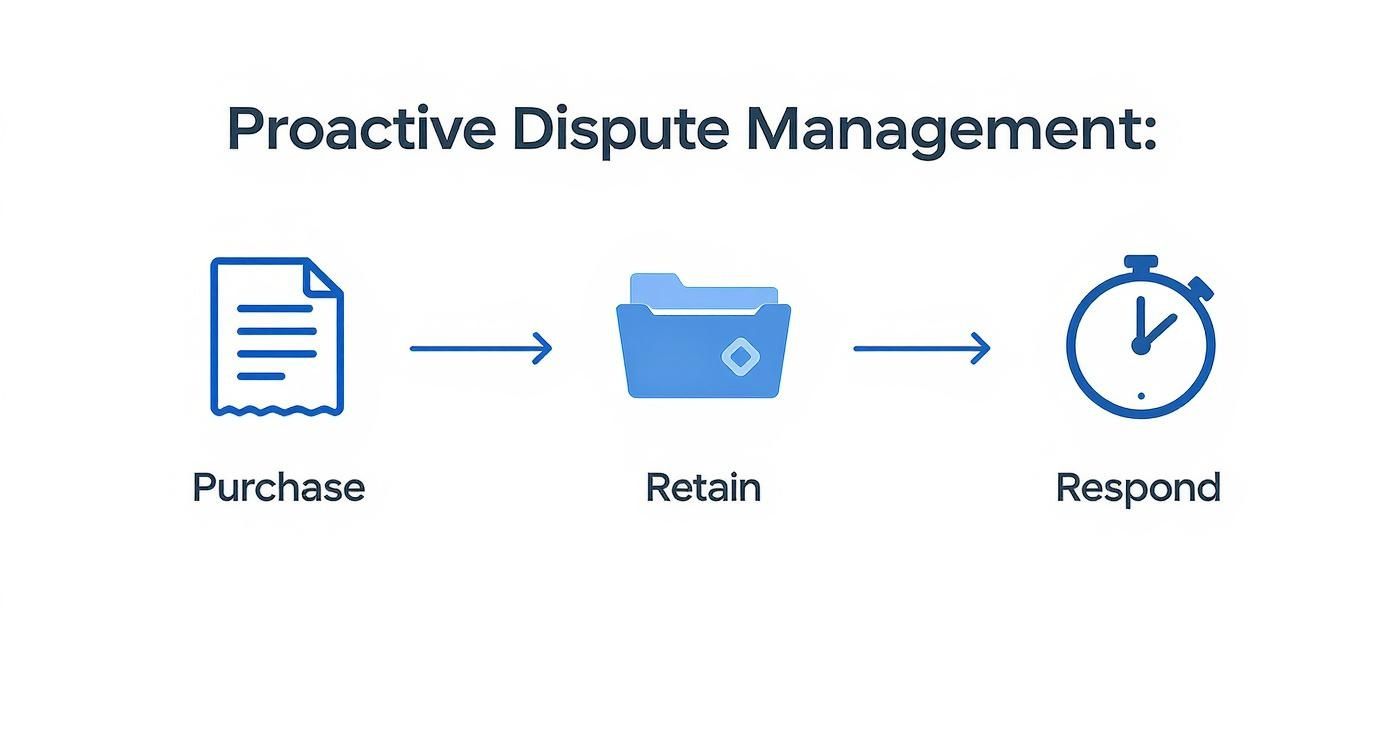

Shifting from Reactive to Proactive

If you’re not taking these trends seriously, your business is left exposed. A single missed deadline means you automatically lose that revenue, but the long-term impact of a rising dispute rate is far more damaging. It can trigger higher processing fees, frozen funds in account reserves, or even the termination of your merchant account.

The key is to move from a reactive stance to a proactive one. This simple timeline shows how to get ahead of the curve.

As the visual shows, smart dispute management starts the moment a customer makes a purchase and continues through careful evidence retention. It’s all about being prepared long before a dispute ever lands on your desk.

Ultimately, winning individual cases is just one part of the equation. The real win comes from building a strategic, timeline-focused approach to protect your business’s financial health. With automated tools like Disputely, merchants can stay ahead of deadlines by spotting risks early. By giving you a window to resolve issues before they become costly chargebacks, you can safeguard your bottom line against this growing threat.

Preventing Disputes Before the Clock Even Starts

The best way to handle the time limit on chargebacks? Never let the clock start ticking in the first place. While knowing how to fight a chargeback is important, a proactive approach that stops disputes from ever happening will always save you more money, time, and headaches.

It's about shifting your mindset from defense to offense. Fighting a chargeback is damage control—it’s like putting out a fire. Preventing one is like installing smoke detectors and fireproofing your business. By tackling the common issues that spark disputes, you can protect your bottom line and build much better relationships with your customers.

Start with Crystal-Clear Communication

So many disputes, especially cases of so-called "friendly fraud," boil down to a simple misunderstanding. When a customer is confused or frustrated, their first call is often to their bank, not to you. You can head this off with radical transparency at every stage of the sale.

It all begins with your billing descriptor. That’s the little line of text that shows up on a customer's credit card statement. It needs to be instantly recognizable. A generic descriptor like "ONLINE SVS" is practically an invitation for a chargeback. Something clear, like "DISPUTELY.COM 800-555-1234," leaves no room for doubt.

Your policies also need to be front and center.

- Transparent Return Policy: Don’t hide your refund and return terms. Spell them out clearly on product pages and during checkout. A fair, easy-to-find policy builds trust.

- Proactive Shipping Updates: The moment an order is placed or shipped, send a confirmation with tracking information. If there's a delay, let the customer know immediately. Managing expectations is everything.

A customer who feels informed and respected is a customer who will reach out to you with a problem, not their bank. Clear communication is your single most powerful tool for chargeback prevention.

Provide Exceptional Customer Service

When a customer does have a problem, the quality of your support is the deciding factor between a simple refund and a costly chargeback. Your goal should be to make it incredibly easy for customers to get in touch with you. Offer multiple contact options—email, phone, live chat—and make them obvious.

Speed matters. Try to answer every customer inquiry within 24 hours. A quick, genuinely helpful response can completely de-escalate a tense situation and turn a potential dispute into a moment of great service.

Remember, every chargeback you prevent saves you far more than just the transaction amount; it helps you avoid costly fees and protects your merchant account. With tools from Disputely, you can even get alerts about potential issues, giving you a chance to step in and offer a refund before a formal chargeback is ever filed. It’s the ultimate way to stop the clock for good.

Common Questions About Chargeback Time Limits

Wading through the rules and timelines for chargebacks can feel like a maze. Let’s clear things up with some straightforward answers to the questions we hear most often from merchants.

What Happens if a Chargeback Is Filed After the Time Limit?

It's rare, but sometimes a dispute pops up after the standard 120-day window has closed. This could be due to a simple bank error or a legitimate exception, like a service that was scheduled for a much later date.

If you get a chargeback that looks late, you have a solid angle for your defense. Your first move should be to challenge its validity on procedural grounds. In your response, clearly point out the transaction date and the date the dispute was filed to show that the deadline has passed.

Do Time Limits Differ for Debit and Credit Cards?

For the most part, the timelines for debit and credit card disputes are very similar because they all follow the rules set by the major card networks.

The main difference is that debit card transactions fall under additional consumer protection laws, like Regulation E in the United States. While the window for a customer to file a dispute is usually the same, these underlying regulations for electronic fund transfers can introduce some slight procedural variations.

It's a tough battle out there. Merchants only win about 45% of their disputed cases on average. That’s why mastering every detail, especially timing, is so important for protecting your bottom line. You can read more on chargeback trends and statistics to see the bigger picture.

Can I Set My Own Chargeback Time Limit for Customers?

Simply put, no. The time limits are dictated by the card networks—think Visa, Mastercard, and American Express—and they are not up for negotiation.

These network rules will always trump any policy you write into your own terms of service. Trying to enforce a shorter deadline you’ve created won't stand up when a dispute is filed.

How Does a Second Chargeback Affect Time Limits?

Let's say you win the first round and successfully reverse a chargeback. If the customer's bank isn't satisfied with that outcome, the dispute can escalate to a second stage, often called pre-arbitration or arbitration.

This new phase comes with its own set of much stricter—and shorter—deadlines. You'll need to act even faster this time around to gather your evidence and defend the sale all over again.

Don't let deadlines dictate your revenue. Disputely provides real-time alerts that give you a crucial window to resolve customer issues by issuing a refund, stopping chargebacks before they ever hit your account. Protect your business and maintain control over your finances.