Time Limit on Credit Card Chargebacks: A Merchant's Guide

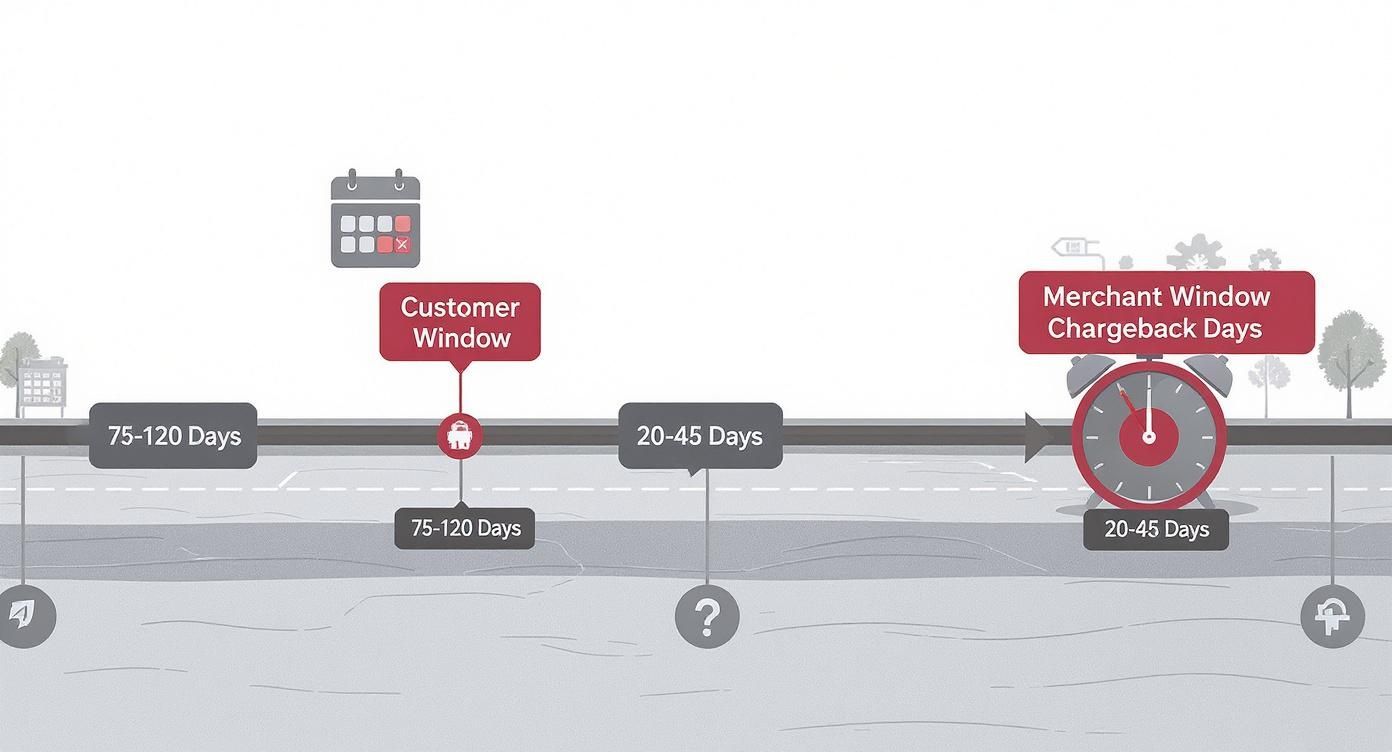

The time limit on a credit card chargeback isn't a single, straightforward number. It's a complex timeline with different rules for different people. While your customer might have 75 to 120 days to dispute a charge, you as the merchant get a much shorter window—typically just 20 to 45 days—to respond. Getting a handle on this imbalance is the first step to protecting your business from lost revenue.

Why Chargeback Time Limits Are a Merchant's Biggest Blind Spot

You know that sinking feeling when a chargeback notification hits your inbox. But what’s even worse is realizing you’ve already lost the dispute simply because you missed a deadline you didn't even know existed. The "time limit on credit card chargebacks" isn't one simple countdown; it's a whole system of interlocking clocks, and each one starts ticking at a different time.

If you miss your deadline, you forfeit the dispute. It's that simple.

Think of it like a legal case. The customer (the plaintiff) gets a generous amount of time to file their claim. But you, the merchant (the defendant), are put on the spot with a tight, high-pressure deadline to build your defense. This fundamental imbalance is a massive blind spot for many businesses, and it's a direct cause of automatic losses and revenue bleed.

The Two Clocks You Must Watch

Every single chargeback runs on two main timelines. Getting them mixed up is a mistake your bottom line can't afford.

- The Customer's Filing Window: This is the big one. Cardholders generally have between 75 and 120 days to file a dispute, but this can stretch out much longer depending on the situation. It gives them plenty of time to notice a problem on their statement and call their bank.

- The Merchant's Response Window: This is your clock. From the moment the chargeback is initiated, you have a brief 20 to 45 days to gather your evidence and submit a compelling rebuttal. This deadline is set in stone. If you don't respond, you're essentially admitting fault and accepting the loss.

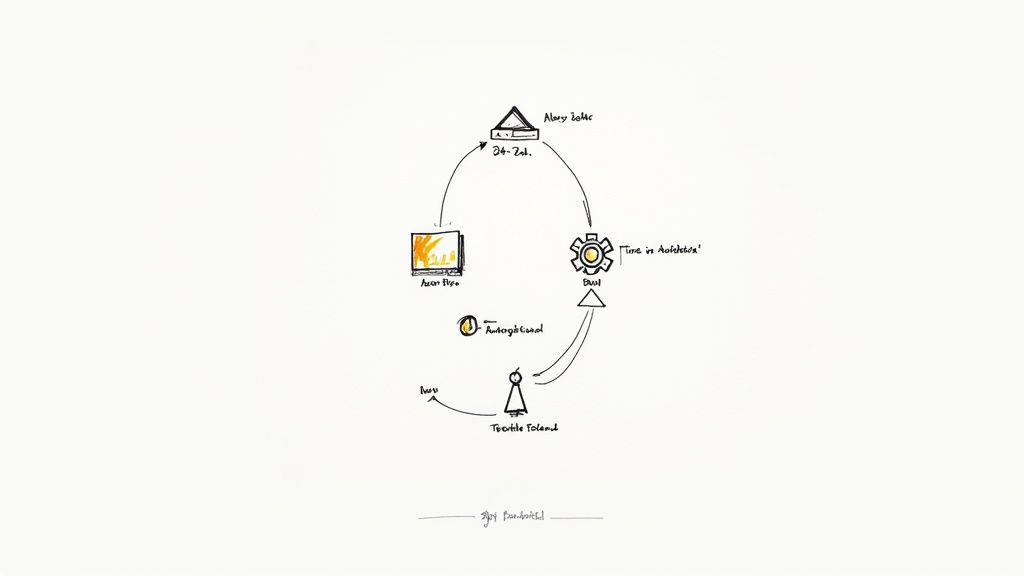

This timeline gives you a clear visual of just how different these two windows are.

The image really drives the point home: the customer gets a calendar, while you get a stopwatch. This is precisely why having a system for a fast, organized response is non-negotiable.

The Growing Urgency for Merchants

Getting these timelines right has never been more important. The number of chargebacks filed globally is exploding, with projections hitting 337 million by 2026—that’s a staggering 42% jump from 2023 levels. This isn't just random; it's a direct result of more e-commerce, sophisticated fraud, and customers who are more aware of their dispute rights than ever before. You can find more details on the factors behind this chargeback surge and what it means for your business.

The real challenge isn't just that deadlines exist—it's that they're so maddeningly inconsistent. The customer's clock might not start on the transaction date. Instead, it could be triggered by the delivery date, the service cancellation date, or even the date the customer claims they first discovered the problem.

This means a chargeback can pop up months after you’ve closed the books on a sale. Without a solid grasp of these rules and a system to track them, you're always going to be playing defense. Let's break down these rules so you can get ahead of the game.

Key Players and Their Deadlines in a Chargeback

To really understand the flow, it helps to know who does what and when. This table breaks down the main actors in a typical dispute.

| Key Player | Typical Timeframe | Primary Role |

|---|---|---|

| Cardholder | 75-120 days (or more) from transaction/discovery | Initiates the dispute with their bank after identifying a problem with a charge. |

| Issuing Bank | Immediate | Investigates the cardholder's claim, assigns a reason code, and officially files the chargeback. |

| Card Network | 1-2 days | Facilitates the transfer of the chargeback from the issuing bank to the merchant's acquiring bank. |

| Acquiring Bank | 1-2 days | Receives the chargeback and forwards the notification and all relevant details to the merchant. |

| Merchant | 20-45 days from notification | Gathers and submits compelling evidence to the acquiring bank to fight the chargeback. This is the crucial response window. |

As you can see, the ball moves quickly once a dispute is filed. The only player with a long, flexible timeline is the customer. For everyone else, especially the merchant, the process is a race against time.

Navigating Visa and Mastercard's Rules of the Road

If you want to protect your revenue, you have to get one thing straight: Visa and Mastercard are not the same. Each card network plays by its own rulebook, especially when it comes to the time limits for filing a chargeback. The details might seem small, but they can be the difference between winning and losing a dispute.

For a lot of common e-commerce disputes, the clock starts ticking as soon as a cardholder files a claim. The number you’ll hear most often is 120 days. But the real question is, 120 days from what? This is where the rules get complicated and where a lot of merchants trip up.

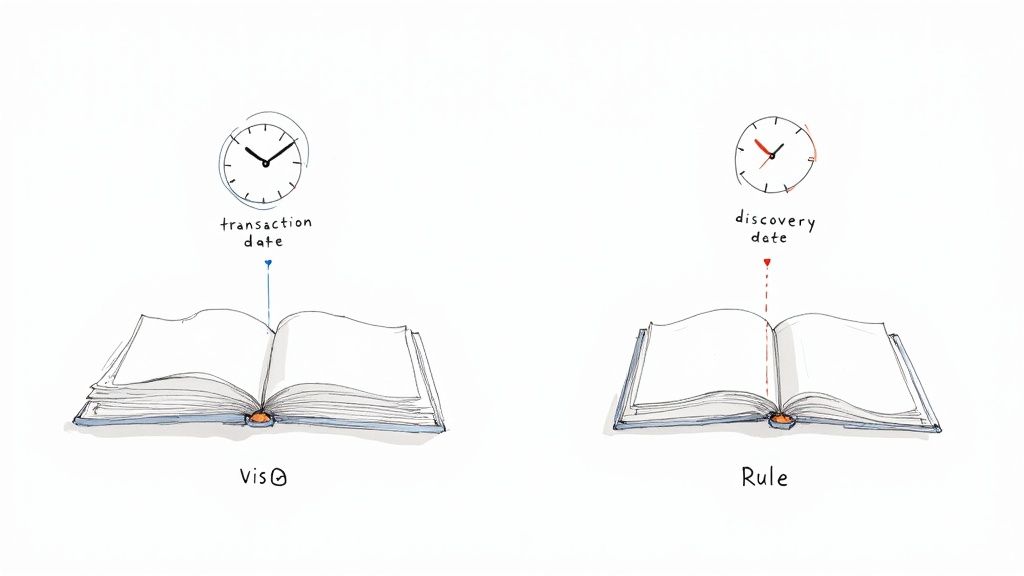

Transaction Date Versus Discovery Date

The starting point for that 120-day countdown isn't always the day the customer clicked "buy." Card networks use two very different concepts to decide when the clock begins, and knowing which is which is your first line of defense.

Transaction Date: This one is simple. It's the exact day the customer made the purchase. Visa tends to lean on this as the primary starting point for many of its dispute categories.

Discovery Date: This is where it gets messy. The discovery date is the day the cardholder says they first noticed the problem. This could be weeks, or even months, after the actual transaction.

Mastercard, for instance, often uses the discovery date for disputes over things like "goods not received" or "services not as described." A customer could buy a product, let it sit in the box for two months, and then file a chargeback based on the day they finally opened it and found a defect. Their 120-day window would start from that "discovery," not from the day you shipped it.

A common myth is that all chargebacks just disappear 120 days after the sale. The truth is, the "discovery date" rule can keep you on the hook for months longer than you'd expect. This makes keeping detailed records and communicating clearly with customers more important than ever.

How Card Networks Apply These Timelines

Let’s walk through a real-world scenario. A customer buys a software subscription from you on January 1st. Three months later, on April 1st, they look at their statement and realize they were billed for an add-on they didn’t want.

- Under a strict transaction date rule: The 120-day clock is almost up, and they're running out of time.

- Under a discovery date rule: The clock might just be starting on April 1st. This would give them until the end of July to file a dispute—almost seven months after you processed the original payment.

This is exactly why just looking at the purchase date isn't good enough. You have to pay attention to the reason code that comes with the chargeback, because that’s what tells you which timeline is in play. Visa and Mastercard each have dozens of reason codes, and every single one has its own set of rules. Disputes over fraud, for example, often have totally different (and sometimes longer) time limits than disputes over product quality.

Once you get a handle on these network-specific rules, you can start to accurately predict your risk and build a much stronger defense when that dispute notification lands in your inbox.

Just when you think you’ve got the 120-day rule down, a dispute lands in your lap that completely resets the clock. It happens all the time. The standard timelines for credit card chargebacks often bend—or even break—in certain situations, leaving merchants exposed long after they thought a sale was final.

If your business model is anything more complex than a simple one-time purchase, you need to know these exceptions inside and out.

Recurring Billing and Subscription Models

For anyone running a subscription business, the chargeback clock is a different beast altogether. A customer might not even notice an incorrect recurring charge for months. When they finally do, their "discovery date" becomes the starting point for the dispute, not the day they first signed up.

This means a customer could dispute a charge from six months ago if they just spotted the billing error on their latest statement. Essentially, every single recurring payment can create its own new dispute window, which dramatically extends how long you're on the hook.

The main thing to remember is this: for subscriptions, your risk doesn't just end 120 days after the first payment. It potentially renews with every single billing cycle. This makes crystal-clear communication and a dead-simple cancellation process your best defense.

Future-Dated Services and Deliveries

Another common curveball comes from services or goods that are paid for upfront but delivered much later. We see this all the time with things like concert tickets, custom-made furniture, or enrollment in a future workshop. For these sales, the time limit on a credit card chargeback doesn't start on the transaction date.

Instead, the clock usually begins on the date the service was scheduled to happen or the goods were supposed to arrive.

Here are a couple of real-world examples:

- Event Tickets: A customer buys tickets in March for a concert in September. If the event gets canceled, their 120-day window to file a dispute starts in September, not way back in March.

- Custom Orders: A client pays for a custom sofa in January with a promised delivery in June. If the sofa is a no-show, the chargeback clock starts ticking in June.

This delayed start means you could be fighting a dispute more than a year after you processed the initial payment. Keeping meticulous records of expected delivery or service dates isn't just a good idea—it's absolutely essential for winning your case.

The Complexity of International Transactions

Selling to customers overseas can stretch dispute timelines far beyond what you might expect. Chargeback time limits aren't the same everywhere, and international sales can sometimes extend the dispute window to over 500 days in certain scenarios. You can find more details about how cross-border sales impact chargeback limits on paycompass.com.

This is usually because of different consumer protection laws, issues with currency conversion, or just plain longer shipping cycles. Building these extended timelines into your risk management is a must for any global e-commerce business. A good first step is to run a chargeback risk audit to identify vulnerabilities in your international sales flow.

The Merchant's Race Against the Representment Clock

Once a customer files a dispute, the clock starts ticking, but this time it's on your wall. The generous timeline the cardholder had to initiate the chargeback is gone. Now, it's your turn to act, and the window is a whole lot smaller.

This is your representment window—the make-or-break period you have to fight for your revenue. Typically, you’re looking at just 20 to 45 days to gather your evidence and submit a compelling response.

Miss this deadline, and it's an automatic loss. It doesn't matter how solid your proof is. Think of it like a default judgment in court; if you don't show up to defend yourself, you forfeit the case.

The Anatomy of a Winning Response

Winning a dispute in such a tight timeframe isn’t about speed; it’s about preparation. You need a systematic way to build an airtight case that directly dismantles the cardholder's claim, leaving the issuing bank no other option but to side with you.

Your response needs to tell a story backed by hard facts. Simply saying, "the customer is wrong," won't cut it. You have to prove it.

The single biggest mistake merchants make is treating representment as a low-priority task. Every day you delay gathering evidence is a day you give away your advantage. A rushed, incomplete submission is almost as bad as no submission at all.

To avoid that last-minute scramble, you need a clear internal process. As soon as a chargeback notice hits your inbox, your team should know exactly what evidence to pull and where to find it. This turns a high-pressure fire drill into a manageable, predictable workflow. For a deeper dive into organizing your response, our guide on a successful Q4 representment strategy offers some great, actionable checklists.

Building Your Evidence File

While your evidence package should always be tailored to the specific reason code of the dispute, some pieces of proof are universally powerful. You should have a system to collect these for every transaction.

- Proof of Authorization: Show the purchase was legitimate. This includes things like Address Verification Service (AVS) and Card Verification Value (CVV) matches, which prove the cardholder had the physical card details.

- Customer Communications: Pull together all emails, support tickets, and chat logs. This can prove a customer received their item, understood your policies, or never tried to contact you for a refund first.

- Delivery and Service Confirmations: For physical goods, a signed delivery confirmation to the right address is pure gold. For digital products, server logs showing a download or account login can be just as strong.

- Terms of Service and Policies: Always have a timestamped record showing the customer checked the box agreeing to your terms of service, refund policy, and cancellation rules at checkout.

Ignoring a chargeback doesn't just cost you the sale—it also hurts your merchant account health. By having a clear battle plan ready to go, you can turn this frantic race against the clock into a strategic defense of your bottom line.

Stop Chargebacks Before They Even Happen

The best way to deal with the time limit on credit card chargebacks is to make sure the clock never starts. Sure, a solid representment game is essential, but a truly smart strategy is to stop disputes from ever making it into the system. It’s about shifting from defense to offense.

Think about it: what if you got a notification the moment a customer felt unhappy enough to call their bank? Instead of getting hit with a formal dispute weeks down the line, you get a chance to fix the problem right now. That’s precisely what pre-dispute alert services offer.

These services are essentially an early-warning system. When a customer calls their bank to question a charge, the bank doesn't immediately file a chargeback. Instead, they ping you with an alert, giving you a precious 24 to 72-hour window to resolve the issue directly with the customer—usually by issuing a refund.

The Magic of Pre-Dispute Alerts

Solving a problem at this early stage is a game-changer. It completely sidesteps the formal chargeback process. That means no dispute fee, no negative mark against your chargeback ratio, and no time wasted digging up evidence to fight the claim. You turn a potential battle into a simple, positive customer service moment.

The two giants in this space are:

- Verifi CDRN (Cardholder Dispute Resolution Network): Now part of Visa, CDRN works with a massive network of issuing banks to flag potential disputes before they become official.

- Ethoca Alerts: Owned by Mastercard, Ethoca does the same thing, giving merchants a heads-up when a customer has an issue, so they can step in and prevent the escalation.

When you catch a dispute at the inquiry stage, you’re still in the driver’s seat. You get to decide whether a refund is the right move, stopping the costly, time-sucking chargeback machine before it even starts. This is hands-down the most effective way to protect your merchant account.

Putting Your Defense on Autopilot

For any business dealing with a decent volume of transactions, manually tracking these alerts is a recipe for disaster. This is where modern dispute management platforms become your best friend. They plug directly into networks like CDRN and Ethoca to build an automated, intelligent shield for your business.

This creates a seamless workflow that protects you around the clock.

As you can see, a platform like Disputely acts as the central hub. It connects your payment processor to the alert networks and automatically handles issues based on rules you set.

Instead of a frantic, manual scramble every time an alert comes in, you have a predictable, automated system. You can create rules to automatically refund all transactions under $25, for instance, or flag high-value alerts for a team member to review personally. This approach not only saves a ton of time but also guarantees you never miss that critical 24-72 hour window. Broadening your payment options, including looking into things like crypto payment processors to prevent chargebacks, can add another powerful layer to your defense.

Ultimately, this proactive mindset transforms your entire dispute process. It goes from being a stressful, reactive fire-drill to a strategic, automated system that protects your revenue and your crucial relationships with payment processors.

Your Questions on Chargeback Time Limits Answered

https://www.youtube.com/embed/oes9UkcNOvY

Trying to make sense of all the chargeback rules can feel like you're untangling a giant knot. To help you out, we’ve put together some straight answers to the questions we hear most often from merchants about credit card chargeback deadlines.

Can a Customer File a Chargeback After 120 Days?

Yes, they absolutely can. While the 120-day mark is a common rule of thumb, it’s not a concrete cutoff. The real key is often the "date of discovery," not the date of the transaction itself.

Think about it this way: a customer buys a product that seems fine at first but then breaks four months later. The clock on their dispute might start ticking the day they realized it was defective, not the day they clicked "buy." This little detail is a huge factor in disputes over product quality or subscription billing errors, and it can push the filing window out much further than you'd expect.

Does the Time Limit Apply to Debit Cards Too?

For the most part, yes. When a debit card purchase runs through a major network like Visa or Mastercard, it's covered by nearly identical chargeback rules and timelines as a credit card.

Just be careful not to mix these up with direct bank transfers, like ACH payments. Those operate under a completely different set of banking regulations, which have their own, often stricter, dispute processes.

A common point of confusion is the difference between a simple inquiry and a full-blown chargeback. Think of a retrieval request, or inquiry, as a warning shot from the customer's bank. They aren't taking your money yet—they're just asking for more information about the sale.

You usually have a very short window, often just 7-10 days, to reply to these requests. If you miss that deadline or your response is weak, it’s almost guaranteed to escalate into a formal chargeback. That’s when the funds are pulled from your account, and the real fight begins. Keeping solid records is your best defense to shut down these inquiries early. If you need a hand figuring it all out, our team is always ready to help through the Disputely support page.

Ready to stop worrying about deadlines and prevent disputes before they start? Disputely integrates directly with pre-dispute alert networks to give you a crucial heads-up, letting you resolve customer issues before they ever become costly chargebacks. See how Disputely can protect your business.