visa dispute monitoring program: Key thresholds & compliance

Think of the Visa Dispute Monitoring Program (VDMP) as a kind of early-warning system for your business. It’s Visa’s way of keeping an eye on merchants who are getting an unusually high number of chargebacks.

If your dispute rate starts to creep up, Visa flags your account as a potential risk. This isn't just about protecting shoppers; it's about maintaining the health and trust of the entire payment network, which includes card-issuing banks and your business.

So, What Exactly is Visa’s Monitoring Program?

At its heart, the program isn't meant to be punitive. It’s a mechanism to identify merchants whose dispute levels are way out of line with the norm. These high rates can signal deeper problems—maybe with the products you sell, your customer service, or even your fraud prevention measures.

Ignoring a flag from this program is a bad idea. It can quickly escalate to stiff fines, and in a worst-case scenario, you could lose the ability to accept Visa payments altogether.

For a long time, Visa ran two separate but related programs:

- The Visa Dispute Monitoring Program (VDMP), which zeroed in on chargebacks.

- The Visa Fraud Monitoring Program (VFMP), which tracked transactions confirmed as fraudulent.

But as e-commerce has grown more complex, that separation started to make less sense. So, Visa is rolling them both into a single, streamlined framework: the Visa Acquirer Monitoring Program (VAMP).

Why the Shift to One Unified System?

This move is all about getting a clearer picture of what’s really happening. Fraud and disputes are two sides of the same coin. A customer might file a dispute claiming they never received a product, but the root cause could be that a fraudster used a stolen card for the purchase.

By combining fraud and dispute data, Visa can see the whole story. This holistic view of a merchant's risk profile helps them spot troublesome patterns much faster, which is better for everyone involved.

This change means you can't afford to treat your fraud filters and your dispute management as separate tasks anymore. You need a unified strategy. And the first step is understanding what this new program looks for. For more tips on building that strategy, check out the in-depth articles on the Disputely blog.

The new VAMP framework brings with it updated metrics and new thresholds that you absolutely need to know. It’s a fundamental shift in how Visa polices its network, placing more emphasis than ever on preventing fraud and disputes before they happen. Let’s dive into what those new rules are and how you can make sure you stay on the right side of them.

How the New VAMP Framework Actually Works

With the shift to the Visa Acquirer Monitoring Program (VAMP), Visa did more than just slap a new name on an old system. They fundamentally changed the math they use to measure merchant risk. Getting a handle on this new framework is the first, most crucial step to staying off Visa’s radar and keeping your payment processing secure.

The heart of VAMP is a single, powerful metric: the VAMP ratio. It’s best to think of this as your new financial health score. Visa has stopped looking at fraud and disputes in separate buckets and now combines them into one unified measurement. This gives them a much clearer, holistic picture of your transaction integrity.

Calculating Your VAMP Ratio

The formula is pretty simple on the surface, but its implications are huge. It’s calculated by taking the total number of your fraud and dispute transactions and dividing that by your total number of settled sales for the month.

Here’s what goes into that calculation:

- Fraud Count: These are transactions Visa has flagged as confirmed fraud (TC40).

- Dispute Count: This covers all non-fraud disputes, like claims for "item not received" or "product not as described" (TC15).

- Total Settled Transactions: This is the denominator in the equation—the total count of successful transactions you processed in that month (TC05).

By merging these two data points, Visa can now catch merchants who might have very low traditional fraud but are racking up a ton of customer service-related chargebacks. Those disputes are just as costly to the ecosystem, which makes proactive management, including solid chargeback representment strategies, more important than ever.

The diagram below shows how merchants, consumers, and Visa all fit together within this monitoring ecosystem.

As you can see, the program acts as a central hub, keeping an eye on every interaction to protect the integrity of the whole network.

Understanding the Key Thresholds

What really gives VAMP its teeth are the strict, region-specific thresholds. The program consolidates the old VDMP and VFMP to better police card-not-present transactions. It's not a one-size-fits-all system, and that's a key detail many merchants miss. The requirements shift based on regional risk profiles and transaction volumes.

The table below breaks down the thresholds for different regions, so you can see exactly what rules apply to your business.

VAMP Regional Thresholds and Key Metrics

| Region | VAMP Ratio Threshold (bps) | Minimum Monthly Fraud/Dispute Count |

|---|---|---|

| U.S., Canada, Europe | 220 bps (2.2%) | 1,500 |

| Latin America, Caribbean | 150 bps (1.5%) | 1,500 |

| Asia Pacific | 220 bps (2.2%) | 1,500 |

| CEMEA | 220 bps (2.2%) | 150 |

As you can see, for major markets like the U.S. and Europe, you get flagged if your VAMP ratio hits 220 basis points (2.2%) and you have over 1,500 combined fraud and dispute transactions in a single month.

The crucial takeaway is that Visa’s thresholds aren't arbitrary. They are designed to identify merchants whose performance is significantly worse—often several times higher—than the industry average, posing a direct risk to the ecosystem.

For instance, Latin America and the Caribbean have a lower ratio threshold at 150 basis points (1.5%), reflecting different market dynamics. Meanwhile, the CEMEA region (Central Europe, Middle East, and Africa) keeps the 220 bps ratio but drops the transaction count to just 150, which allows Visa to target high-risk activity even at lower volumes. Knowing which rules you’re playing by is essential for benchmarking your performance and avoiding a nasty surprise.

What Happens When You Cross the Line?

Landing in the Visa Dispute Monitoring Program isn't an instant disaster; it's more like a slow slide into deep trouble. The consequences build over time, starting with a warning shot and escalating to heavy financial penalties that can seriously jeopardize your ability to process card payments. Understanding how this process unfolds is non-negotiable for any merchant.

It all starts when your dispute ratio and transaction counts break through Visa's set thresholds. The good news? Visa doesn't just drop the hammer on you immediately. Instead, they place your acquiring bank—and by extension, your business—into a multi-stage monitoring process. This gives you a chance to fix things before they get out of hand.

This whole system is very structured, and it’s designed to give you a window to get your house in order. But make no mistake, doing nothing will cost you dearly.

The Initial Advisory Period

The first sign of trouble is a notification that you've crossed the line. This kicks off what's called an advisory period. For VAMP, this is a six-month, penalty-free grace period where Visa officially alerts your acquirer about your high-risk activity. Think of it as a formal warning shot across the bow—a clear signal to act now.

During this time, you're expected to work hand-in-hand with your acquirer to build a solid remediation plan. This isn't just a suggestion; it's a requirement. Your plan needs to detail the specific actions you're taking to get your dispute and fraud numbers down.

The Two Tiers of Risk

If you're still over the limits after the advisory period ends, you're officially in the program. At this point, you'll be sorted into one of two risk levels, each with its own set of consequences.

- Above Standard: This is the first formal monitoring level. While Visa technically targets the acquirer, you can be sure those costs and pressures are passed straight down to you, the merchant causing the problem.

- Excessive: This is the deep end. Landing here means you’re facing much steeper fines and intense scrutiny from both Visa and your acquirer. If you stay in this category for too long, your entire merchant account is at risk.

This tiered system is a key part of how Visa tackles the estimated $2.5 billion in global card fraud each year. By zeroing in on merchants with risk levels five to ten times higher than average, Visa can focus its efforts where they matter most. It’s also smart about it—the program excludes disputes resolved through tools like RDR, which incentivizes merchants to use proactive solutions.

Escalating Fines and Financial Penalties

If you can't get your dispute rates under control and exit the program, the financial penalties start to climb. These fines are charged on a per-dispute basis, which means every single chargeback you get digs you into a deeper financial hole. For a business with decent volume, these fees can easily snowball into tens of thousands of dollars a month.

These fines aren't just another business expense. They are a direct attack on your profitability, designed to be painful enough to force you to take immediate, effective action.

To get the full picture, you have to understand how chargebacks affect merchants beyond just the fines—they drain revenue and create a huge operational headache. These penalties just pile on top of the money you already lost from the original disputes. A great first step is digging into your own data. A comprehensive Q4 audit of your dispute performance can help you spot the patterns and root causes you need to address.

The Ultimate Consequence: The MATCH List

The end of the road for merchants who don't comply is a spot on the MATCH list (Member Alert to Control High-Risk). This is the payment industry’s blacklist, and getting on it is a catastrophic event for any business.

Being MATCH-listed doesn't just end your relationship with Visa; it effectively cuts you off from processing payments with almost every major card network. It makes opening a new merchant account nearly impossible for years. For most businesses, this is a death sentence. The risk is so severe that preventing disputes isn't just a best practice—it's a fundamental survival strategy.

Why Visa Merged Its Fraud and Dispute Programs

To really get why Visa created the new Visa Dispute Monitoring Program, you have to look at how much e-commerce has changed the game. For years, Visa treated fraud monitoring and dispute monitoring as two completely separate things. That system made sense when most sales happened face-to-face, but the explosion of online, card-not-present (CNP) transactions turned everything on its head.

Online, the line between a legitimate customer dispute and outright fraud gets incredibly fuzzy. Think about it: is an "item not received" claim a genuine shipping mistake, or is it a fraudster who used a stolen card and couldn't care less if the package ever shows up? The old, siloed programs had a tough time connecting these dots.

By rolling them into a single, unified system—the Visa Acquirer Monitoring Program (VAMP)—Visa suddenly gained a much clearer, more powerful view of risk. This move lets them see the whole story behind a transaction, catch patterns that were invisible before, and shut down organized fraud rings much faster.

A Single, Unified View of Risk

Imagine a detective trying to solve a case with only half the clues. That's pretty much what Visa was doing by keeping fraud data (TC40) and dispute data (TC15) separate. A merchant could have a low fraud rate but a sky-high dispute rate, signaling major problems with their operations that still created risk for everyone.

Combining the data allows Visa to build a single, far more accurate risk profile for every merchant and acquirer. This holistic approach means you can no longer treat fraud prevention as a separate job from customer service or dispute management. In Visa's eyes, they're two sides of the same coin, and you need to see them that way, too.

This unified strategy is a direct response to how fraud is changing worldwide and the massive growth in online payments. As the leader in digital payments, processing billions of transactions, Visa needed to step up its security. The new VAMP framework doesn't just track fraud and disputes; it also keeps a close eye on enumeration activity, where criminals rapidly test stolen card details. Formal enforcement of the new program kicks off on October 1, 2025, following a six-month advisory period. You can learn more about how the new Visa chargeback rules and time limits are reshaping the landscape.

Targeting High-Risk Activity

Another huge reason for the merger was to get better at targeting high-risk behavior like card testing, also known as enumeration. This is a go-to tactic for fraudsters, who use bots to hit a merchant's site with thousands of tiny transactions to see which stolen card numbers are still live.

Under the old systems, these small, often-declined transactions might have flown under the radar. With VAMP, this kind of activity is watched like a hawk, with a specific threshold in place to identify and penalize it.

This shift shows Visa moving from a reactive to a proactive security stance. They're not just cleaning up the mess after fraud and disputes happen anymore; they're actively looking for the warning signs that come first. For merchants, this means that having solid, real-time fraud detection isn't just a nice-to-have—it's absolutely essential to stay on the right side of the Visa Dispute Monitoring Program.

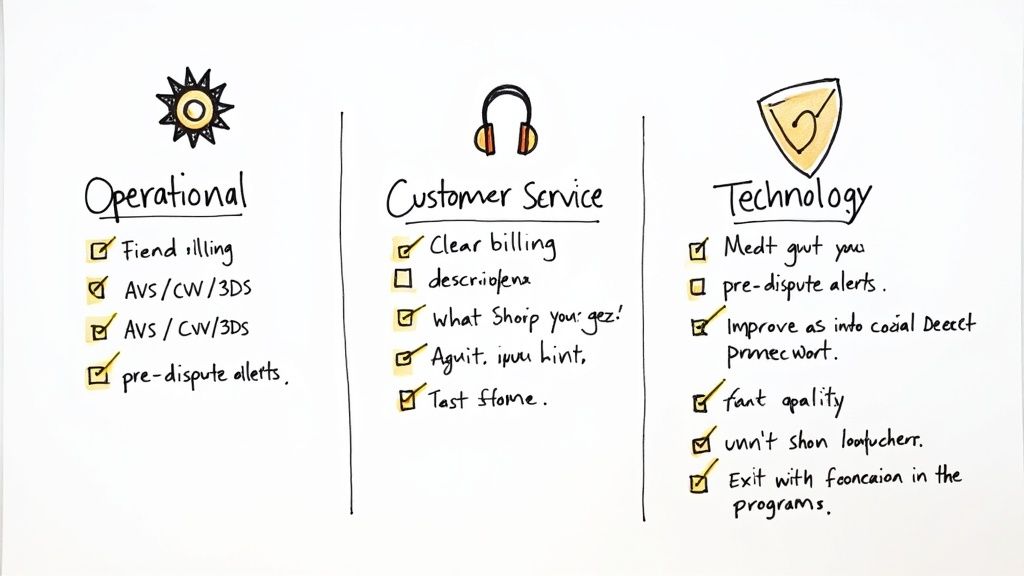

Your Checklist to Avoid or Exit the Program

Knowing how the Visa Dispute Monitoring Program works is one thing, but actively staying out of it is a different ballgame. It's time to move from theory to action with a clear, practical plan. Let's break down the essential strategies into three core areas: fine-tuning your operations, beefing up your customer service, and adopting the right tech.

Think of this as your roadmap to staying in the clear. By following these steps, you can either dodge the program entirely or, if you're already in it, build an effective exit strategy.

Fine-Tune Your Operations

More often than not, disputes spring from small operational oversights that are surprisingly simple to fix. Making these foundational changes can have a massive, positive impact on your dispute numbers.

- Clarify Your Billing Descriptor: Make sure the name that shows up on a customer's credit card statement is instantly recognizable. A vague descriptor like "ECOM SERVICES" is practically an invitation for a "transaction not recognized" dispute. Use your brand name and maybe even a phone number or URL.

- Set Clear Expectations: Your product descriptions, shipping timelines, and return policies need to be crystal clear and impossible to miss. Any ambiguity is a breeding ground for "product not as described" or "item not received" claims.

- Communicate Proactively: Keep your customers in the loop. Send order confirmations, shipping notifications with tracking numbers, and delivery updates. This constant communication builds trust and stops a simple "Where's my order?" question from escalating into a chargeback.

These operational tweaks are your first line of defense. They create a transparent and trustworthy customer experience right from the get-go.

Enhance Your Customer Service

Excellent, easy-to-reach customer service is one of the most powerful dispute prevention tools you have. When customers can solve a problem by talking to you, they have no reason to call their bank.

Your entire goal is to make contacting your support team the path of least resistance.

- Be Accessible: Plaster your contact info everywhere. Your phone number, email, and live chat link should be highly visible in your website's header, footer, and on order confirmation pages.

- Respond Quickly: Speed is everything. A customer left waiting for days for a simple answer is far more likely to file a chargeback out of pure frustration.

- Empower Your Team: Give your support agents the authority to solve problems on the first try. That means letting them issue a refund, send a replacement, or offer store credit without needing to jump through hoops.

The core principle is simple: be the easiest and fastest solution to your customer's problem. A chargeback should always feel like more work for the customer than simply contacting your support team.

Adopt the Right Technology

While better operations and service are crucial, technology is the force multiplier that protects you at scale. In the VAMP era, having robust fraud prevention and dispute management tools isn't just a good idea—it's essential.

Start with the basics. Every e-commerce business should have these foundational fraud filters switched on.

- Address Verification Service (AVS): This tool simply checks if the billing address entered by the customer matches the one on file with their bank.

- Card Verification Value (CVV): Requiring that three- or four-digit security code on the card confirms the customer physically has it, shutting down a common type of fraud.

- 3D Secure (3DS): This adds an extra authentication step, like a one-time code sent to the customer's phone. Crucially, it shifts the liability for many fraudulent chargebacks away from you and back to the issuing bank.

Beyond these fundamentals, the most powerful technology you can implement is one that stops disputes before they even officially exist. This is where chargeback alerts come into play.

Services like Disputely plug you directly into alert networks from Visa (RDR) and Mastercard (Ethoca). Here’s how it works: when a cardholder calls their bank to start a dispute, you get an instant alert. This opens up a 24-72 hour window for you to issue a full refund, which automatically stops the dispute from ever becoming a formal chargeback.

And here’s the key part: a transaction you resolve this way does not count against your VAMP ratio.

This proactive strategy is the single most effective way to manage and slash your dispute numbers, giving you direct control over your standing with Visa. It lets you sidestep the VAMP metrics entirely by preventing the problem in the first place.

Proactive vs Reactive Dispute Management

Switching to a proactive mindset completely changes how you handle disputes and, more importantly, how they affect your VAMP metrics. Instead of just fighting chargebacks after they happen, you're preventing them from being counted at all.

| Strategy | Reactive Approach (Representment) | Proactive Approach (Alerts & Prevention) |

|---|---|---|

| When It Happens | After a chargeback is filed and hits your account. | Before a dispute becomes a formal chargeback. |

| VAMP Impact | The dispute always counts against your ratio, even if you win the case. | The dispute is deflected and never counts against your ratio. |

| Cost | You lose the revenue, the product, and pay chargeback fees (often $25-$100+). | You refund the transaction and pay a smaller alert fee. |

| Effort | Requires time-consuming evidence gathering and representment case building. | Requires a simple, automated refund. |

| Outcome | Win rates are low (typically 20-30%), and the VAMP metric damage is already done. | 100% success rate in preventing the dispute from counting toward VAMP. |

Ultimately, relying on reactive representment is a losing battle when it comes to VAMP. While fighting legitimate fraud is important, the only guaranteed way to control your dispute count and stay out of the program is to prevent disputes from being filed in the first place with a proactive alert system.

VAMP Questions Answered

If you’re trying to get your head around the Visa Dispute Monitoring Program, you're not alone. Let's clear up some of the most common questions merchants have about how VAMP actually works and what it means for your business.

What Kind of Transactions Count Towards My VAMP Ratio?

VAMP is all about card-not-present (CNP) transactions. Think online checkouts, phone orders, and subscription payments. Face-to-face transactions where a customer uses their chip and PIN don't factor into these calculations at all.

What's really important to grasp is that Visa lumps both fraud and non-fraud disputes together. This includes:

- Fraud Disputes: These are the straightforward cases flagged as confirmed fraud (TC40).

- Non-Fraud Disputes: This bucket covers everything else—from authorization issues and processing errors to customer service disputes like "product not as described" (TC15, codes 11-13).

Don't panic just yet. To even land on Visa's radar, you need to hit a minimum of 1,500 total disputes in one month (or 150 if you're in the CEMEA region). This threshold is designed to focus on merchants with a genuine dispute problem, not smaller businesses that just had a bad month.

I Just Got a VAMP Notification—What’s My First Move?

First thing's first: take a deep breath, but don't ignore it. A VAMP notification means Visa has flagged your acquiring bank because of your dispute numbers. Your absolute first step is to get on the phone with your acquirer. They are your main point of contact and partner in getting this sorted out.

Think of this notification as an official warning shot. It triggers a six-month, penalty-free advisory period. This is your window to get aggressive, figure out what's causing the disputes, and create a solid plan to bring your numbers down.

You'll need to work with your acquirer to create a formal remediation plan. This isn't just a vague promise to do better; it's a document outlining the specific changes you're making. You might need to tweak your billing descriptors, send clearer shipping updates, or, most importantly, start using a chargeback alert service.

How Do Tools Like Chargeback Alerts Help With VAMP?

This is the most important piece of the puzzle. Using pre-dispute resolution tools—like Visa's own Rapid Dispute Resolution (RDR) or third-party alert networks—is your single best defense against VAMP.

Here’s how they work: When a customer calls their bank to complain, these systems intercept the inquiry and send you an immediate alert. This gives you a short window, usually 24 to 72 hours, to just refund the customer directly.

If you process the refund in time, the dispute is stopped in its tracks. It never officially becomes a chargeback. And here’s the crucial part: any dispute you resolve this way is completely excluded from your VAMP calculation. From Visa’s point of view, it never even happened. That’s why an alert system is an absolute must-have for any merchant who wants to avoid—or escape—this program.

Tired of walking the tightrope of VAMP compliance? Disputely offers the safety net you need. We automate the refund process for incoming alerts, stopping disputes before they ever hit your record and guaranteeing you stay below Visa’s thresholds. Protect your merchant account and eliminate VAMP-related stress with Disputely.

Article created using Outrank