What Are Chargeback Fees and How Can You Stop Them?

When a customer disputes a transaction, your payment processor hits you with a chargeback fee. This isn't a refund—it's a separate, non-refundable penalty meant to cover the processor's administrative costs for dealing with the whole mess.

These fees can sting, usually falling somewhere between $15 and $100 per incident. The worst part? This fee gets tacked on top of the original sale amount you already have to give back.

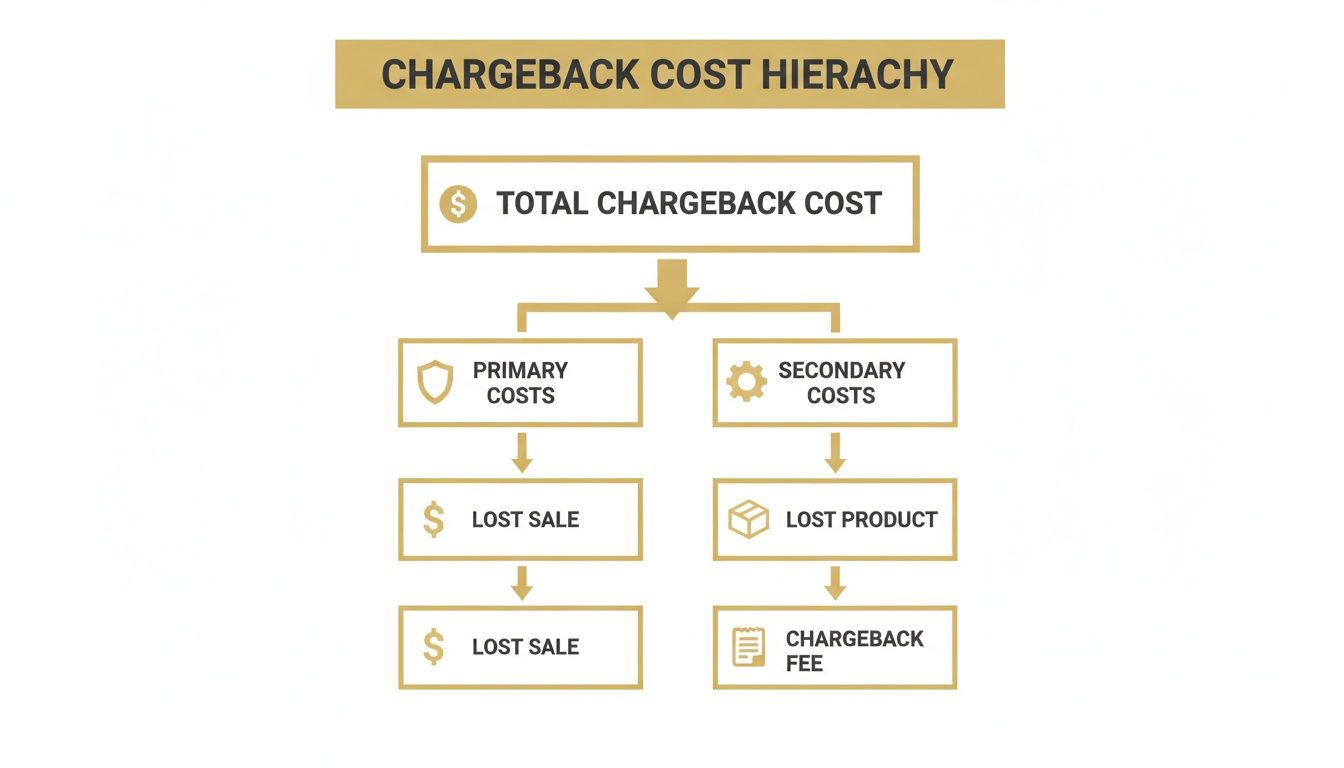

The True Cost of a Single Chargeback

A chargeback fee isn't just a simple line item on your statement. It's a painful financial penalty that attacks your bottom line from multiple angles. Think of it less like an administrative charge and more like a punishment for a transaction gone wrong.

When a customer files a dispute, you're not just out the sale amount. You also lose the product you shipped, the money you spent on postage, and then you get slapped with this extra fee. It’s a triple-whammy that can seriously hurt, especially for smaller businesses.

Imagine you run an online shop and sell a product for $50. A customer disputes the charge. Suddenly, you've lost the $50 from the sale, you're out the product itself (which you can't resell), and your processor charges you a $20 chargeback fee. Your immediate loss is $70, not even counting what the product originally cost you to acquire.

To see how these costs stack up, let's break down the financial hit from just one chargeback incident.

Quick Breakdown of a Chargeback's Financial Impact

| Cost Component | Description | Typical Amount (Example) |

|---|---|---|

| Lost Revenue | The full amount of the original transaction that is refunded to the customer. | $50.00 |

| Chargeback Fee | The penalty fee charged by your payment processor for handling the dispute. | $20.00 |

| Cost of Goods Sold | The wholesale cost of the product you shipped, which is now lost. | $15.00 |

| Operational Costs | Expenses like shipping, packaging, and labor associated with the original order. | $10.00 |

| Total Loss | The combined financial damage from a single disputed transaction. | $95.00 |

As you can see, a simple $50 sale can quickly turn into a nearly $100 loss. And that's before we even get into the bigger picture.

The Snowball Effect of Fees

This financial pain multiplies fast. It’s not just about one bad transaction. Research shows that merchants can lose a staggering $4.61 for every single dollar disputed due to fraud. That number accounts for the refunded money, the cost of goods, and the processing fees from card networks like Visa or Mastercard. You can dig deeper into chargeback statistics and their impact on merchants to see the full scope of the problem.

The real danger of a chargeback isn't the one-off incident. It’s the cumulative damage to your financial health and your standing with payment processors.

Processors use these fees to encourage merchants to keep their transactions secure and their customers happy. But let's be honest, they feel punitive. Every fee is a signal that something broke down in the process, creating a financial leak that, if ignored, can easily turn into a flood. Grasping this true cost is the first step toward building a solid defense for your business.

So, Who Actually Takes Your Money and Why?

When a chargeback fee hits your account, it's natural to blame your payment processor. But that single line item on your statement is hiding a more complicated story. It’s not just one penalty; it's a bundle of different costs charged by several players along the transaction chain, each taking a cut for their role in the dispute process.

Think of it as a domino effect. A customer complaint tips the first domino, triggering a chain reaction of administrative work for everyone involved. And at each step, someone adds a handling fee. To really understand the financial sting of a chargeback, you have to know who's taking a piece of the pie and why.

The Key Players in the Fee Chain

The journey of a chargeback involves three main parties, and each one has a reason to charge you. These fees aren't just punitive; they're meant to cover the labor and systems required to investigate the claim. They also act as a financial nudge for merchants to keep their operations secure and their customers happy.

Here's a breakdown of how the costs stack up, showing that the fee itself is just the tip of the iceberg.

As you can see, the penalty fee is just one more loss piled on top of the revenue and product you've already lost.

Your Payment Processor

Your payment processor—think Stripe, PayPal, or Shopify Payments—is your direct line to the dispute. They’re the ones who break the bad news, notify you of the chargeback, and pull the disputed funds from your account.

For their part in this, they charge an administrative fee, which usually lands somewhere between $15 and $35. This covers their cost of shuffling digital paperwork, managing the evidence you send over, and communicating with the banks. For most merchants, this is the most immediate and obvious part of the chargeback fee.

The Customer's Issuing Bank

It all starts here, with the customer's bank (the issuing bank). When a cardholder disputes a charge, their bank is the one that kicks off the investigation and formally files the chargeback.

To cover the costs of their own internal review, they pass a fee down the chain, which ultimately gets rolled into the total you end up paying. Their primary job is to protect their cardholders, and these fees help fund that effort.

A chargeback fee isn't a single punitive charge. It's a combination of service costs from the banks and processors involved in mediating the dispute between you and the customer.

And finally, you have the big players overseeing the entire system.

The Major Card Networks

Card networks like Visa and Mastercard are the rule-makers of the payment world, and they have their own ways of penalizing excessive chargebacks. While they might not bill you for every single dispute, they absolutely levy hefty fines against the acquiring banks that work with merchants who cross certain chargeback thresholds.

Those fines don't just disappear; they get passed right down to you. This can show up as higher processing rates or, even worse, getting flagged for a costly monitoring program. The networks do this to protect the integrity of their entire system, making high chargeback rates a very expensive problem for everyone involved.

Putting a Price Tag on Chargebacks

It’s one thing to talk about chargeback fees in theory, but seeing the actual numbers is where the real wake-up call happens. These aren't just minor administrative costs; they’re a direct hit to your bottom line, and the final price tag depends on your processor, the card network, and even what you sell. For most businesses, a single chargeback fee from a processor like Stripe or PayPal lands somewhere between $15 and $35.

But that’s just the beginning. The card networks (think Visa, Mastercard) can tack on their own penalties, creating a painful stack of fees that adds up incredibly fast. This is where the simple math starts to get scary for merchants.

How One Dispute Can Cost You Dearly

Let’s walk through a real-world scenario. Say you sell a product for $50. A customer files a dispute, and the chargeback process kicks in. Here's a quick look at how your finances take a hit:

- You lose the original $50 sale. That money is immediately pulled back and returned to the customer.

- Your processor hits you with a $20 fee. This covers their time and effort to handle the dispute.

- The card network might add a $15 penalty. This gets passed right down to you.

All of a sudden, that $50 sale didn't just disappear. It’s now an $85 loss, and that's before you even factor in what you paid for the product you shipped out. On top of that, losing a customer adds to your overall churn, a hidden expense you can estimate with a churn cost calculator.

To get a clearer picture of who charges what, let's break down the typical fee ranges from each party involved in the dispute process.

Estimated Chargeback Fee Ranges By Payment Entity

The table below gives you a comparative look at the typical fees merchants can expect from the different players who handle a chargeback.

| Charging Entity | Typical Fee Range (per dispute) | Purpose of Fee |

|---|---|---|

| Payment Processor | $15 - $35 | Covers administrative costs of managing the dispute |

| Card Network | $10 - $75+ | A penalty fee passed down to high-risk merchants |

| Issuing Bank | $5 - $25 | Fee for investigating and processing the customer's claim |

As you can see, the costs are layered. A single dispute triggers a financial chain reaction where each entity takes a piece, leaving the merchant to foot the final, inflated bill.

Why Your Industry Matters

The fees you’re charged aren't a one-size-fits-all penalty. They are heavily influenced by how risky your business is perceived to be. Processors and card networks group businesses into risk categories based on their industry's historical chargeback data. If you’re in a "high-risk" industry, you can bet you'll be paying more.

For example, a business selling digital subscriptions or a travel agency is naturally seen as higher risk than a local coffee shop. As a result, they get hit with higher chargeback fees simply because disputes are a more common part of their business landscape.

This risk profiling directly impacts your profitability. Some industries also deal with higher transaction values, which just makes the problem worse. In 2024, data revealed that the travel and hospitality sectors had the highest average chargeback value at a whopping $120 per incident. The U.S. led the pack globally with a $110 average, with Brazil ($94) and the UK ($82) following behind.

Understanding these real-world figures is essential for any business owner. It also highlights the value of proactive defense. This is where a service like Disputely can make a huge difference, offering a pay-per-alert model that helps you intercept disputes before they ever become full-blown, expensive chargebacks. You can check out the https://disputely.com/pricing for a clearer idea of how it works.

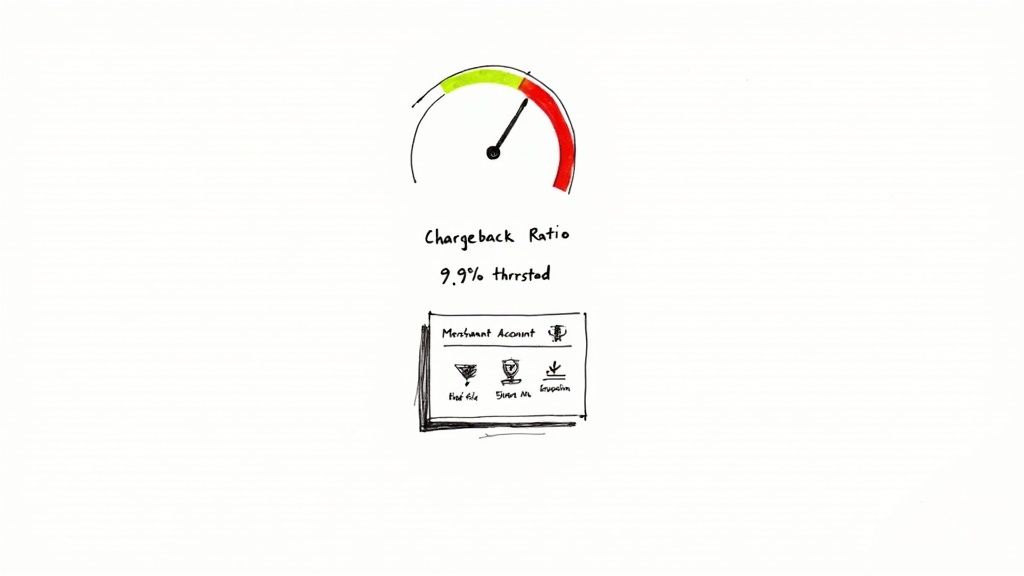

The Hidden Risks That Cost More Than Fees

The sting of a single chargeback fee is bad enough, but the real danger to your business runs much deeper. That initial financial hit is just the tip of the iceberg. The far more serious threat is a metric that payment processors and card networks watch like a hawk: your chargeback ratio.

Think of your merchant account as having its own credit score. Every successful sale builds your reputation. But every chargeback? That's a big, ugly red mark against you. Your chargeback ratio is simply the percentage of your transactions that get disputed.

Why Your Chargeback Ratio Matters

Card networks like Visa and Mastercard have very clear rules. They expect merchants to keep their chargeback levels below a certain threshold, which is typically around 0.9% of total transactions. Once you cross that line, your business is immediately flagged as "high-risk."

And that "high-risk" label isn't just a name. It’s a trigger for a cascade of painful penalties that can make it incredibly difficult to operate. To a processor, a high ratio signals that your business might be unstable, fraudulent, or just bad at customer service. They’ll take drastic, and expensive, measures to protect their own bottom line.

Those measures often look like this:

- Higher Processing Fees: Your standard transaction rates will jump to cover the new, higher perceived risk you represent.

- Rolling Reserves: The processor might start holding back a percentage of your daily revenue to build a safety net for future disputes, which can absolutely crush your cash flow.

- Account Holds: A sudden spike in chargebacks can get your funds frozen while the processor investigates. We cover this in our guide on how to handle a Shopify payment hold.

The biggest threat isn't one fee; it's the domino effect. A high chargeback ratio is the first domino to fall, leading to crippling monitoring programs and, in the worst-case scenario, total account termination.

Crossing the Threshold Into Monitoring Programs

Let your chargeback ratio stay elevated for too long, and you'll find yourself forced into a costly monitoring program. Visa’s Dispute Monitoring Program (VDMP) and Mastercard’s Excessive Chargeback Program (ECP) are two of the most common, and they come with hefty monthly fines that can easily run into thousands of dollars.

These programs are the last warning shot. They are designed to force you to get your disputes under control—or else. If you can't bring your ratio back down while enrolled, the next step is almost always the termination of your merchant account. At that point, you're effectively cut off from accepting credit cards.

While the average chargeback ratio across most industries is a manageable 0.60%, it doesn't take much for that number to spiral. For example, international merchants often see their ratios climb toward 2%. Certain regions are even riskier; Brazil currently leads the world with a staggering ratio as high as 3.48%, with Mexico not far behind at 2.81%.

Proactive Strategies to Prevent Chargebacks

When it comes to chargeback fees, the best offense is a good defense. The most effective way to eliminate those fees is to stop the dispute before it ever has a chance to start. A proactive approach is always far less expensive than a reactive one, saving you money, time, and your hard-earned reputation with payment processors.

It all comes down to focusing on the root causes of most disputes: fuzzy communication and weak security. This starts from the very moment a customer glances at their bank statement. If they see a charge they don't recognize, their first instinct is often to call the bank, not you.

Enhance Communication and Clarity

One of the simplest, yet most powerful, prevention strategies is making your business easy to identify and contact. When a customer knows exactly who charged them and how to get help, they are far less likely to escalate a simple question into a formal dispute.

Here are a few high-impact tactics you can implement right away:

- Use Crystal-Clear Billing Descriptors: Your billing descriptor needs to be instantly recognizable. Ditch generic codes like "SP-1234" and use something clear like "YOURBRANDNAME.COM" or "YOURBRAND*PRODUCT." This one small change can stop countless "unrecognized transaction" disputes in their tracks.

- Provide Accessible Customer Support: Don't hide your contact information. Plaster your phone number, email, and live chat links on your website, receipts, and order confirmation emails. A quick resolution directly with you is always better than a chargeback.

- Send Detailed Order Confirmations: As soon as a purchase is made, send an email receipt. Make sure it includes the product purchased, the total cost, your business name, and, once again, your customer service contact info. This creates a clear paper trail and reminds the customer of their legitimate purchase.

Your goal is to make getting a direct refund so simple that filing a dispute feels like too much work. A five-minute support chat is infinitely cheaper than a $25 chargeback fee and a lost customer.

Implement Robust Fraud Prevention

Clear communication helps with legitimate customer issues, but you still need strong security measures to block criminal fraud at the source. Automated tools can help verify a cardholder’s identity before a transaction is approved, effectively filtering out many fraudulent attempts.

This is also your best weapon against friendly fraud, which shockingly accounts for around 75% of all chargebacks. This is when a customer recognizes a charge but disputes it anyway, hoping to get their money back for free.

Key security checks to have in place include:

- Address Verification Service (AVS): This tool cross-references the billing address the customer enters with the one the card issuer has on file. A mismatch is a major red flag.

- Card Verification Value (CVV): Always require the three- or four-digit code from the back of the card. This helps prove that the customer physically has the card in their possession.

- 3D Secure (3DS): This adds an extra authentication step, often requiring a password or a one-time code sent to the cardholder's phone. It's a powerful way to confirm the buyer is who they say they are.

Beyond these direct tactics, a truly proactive strategy includes broader efforts, like implementing proven strategies to reduce customer churn and improve customer retention. By combining crystal-clear communication with powerful security, you build a comprehensive defense that protects your revenue and keeps your payment processing relationships healthy.

How to Fight Chargebacks and Win Your Money Back

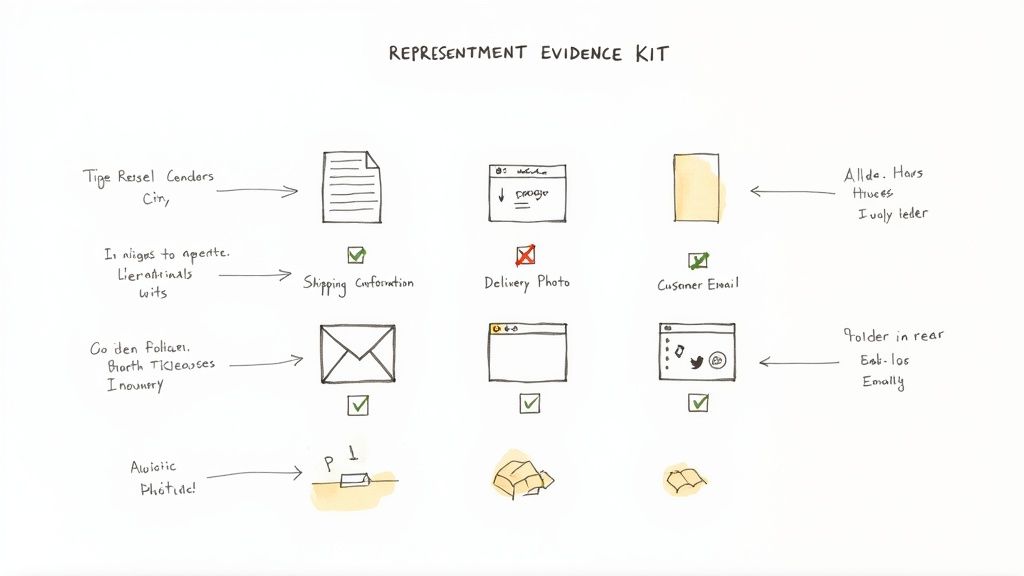

Even with the best prevention strategies in place, some disputes are just going to happen. It's an unfortunate part of doing business. When a chargeback lands on your doorstep, your next move is to fight it through a process called representment.

This isn't about getting into an argument. It's about building a solid, evidence-based case to prove the transaction was completely legitimate. Just letting it go and absorbing the cost is a huge—and expensive—mistake.

Fighting back is absolutely worth the effort. Merchants who don't bother with representment are literally leaving money on the table. With the right evidence and a smart approach, win rates can climb as high as 40-60%.

Building Your Winning Case

Your success in this process boils down to one thing: the quality of your evidence. The whole point is to provide irrefutable proof that you held up your end of the deal. Think of yourself as a detective building a case file, and tailor it specifically to the reason code of the dispute.

So, what does a winning evidence kit look like? It often includes:

- Proof of Delivery: This is your best friend for "product not received" claims. Think shipping confirmations, tracking numbers, and especially photos showing the package delivered to the right address.

- Customer Communications: Dig up every email, support ticket, or live chat log. Any message where the customer acknowledges the purchase, asks a question about the product, or confirms they received it is pure gold.

- Transaction Data: To shut down fraud claims, you need the technical details. Include the AVS and CVV match results, the IP address the order came from, and any device information you captured.

- Service Records: If you sell digital goods or services, your proof is in the usage logs. Show that the customer logged in, downloaded the file, or used the service they paid for.

Your rebuttal letter is like your closing argument to a jury. Keep it professional, concise, and focused. It should directly counter the cardholder's claim by pointing to the specific evidence you've attached. No emotion, just facts.

Deadlines Are Non-Negotiable

Here's the single biggest mistake you can make: missing the response deadline. It’s a killer.

Card networks give you a very strict window to submit your evidence—sometimes as short as 20 days, and rarely more than 45. Miss that deadline by even a minute, and you automatically lose. You lose the sale, you lose the product, and you're stuck with the chargeback fee. No appeals.

This tight turnaround is precisely why so many businesses rely on automated platforms to manage the process. To get ahead of the curve, check out our guide on how to prepare for Q4 representment. It shows how the right tools can make sure you never miss a deadline or a chance to get your money back. When you actively defend your sales, you can reclaim revenue that is rightfully yours.

Got Questions About Chargeback Fees? We Have Answers.

Let's be honest: chargebacks can be a headache. But getting a handle on the fees and the process behind them can make a huge difference. Here are straightforward answers to some of the most common questions we hear from merchants.

Can You Get a Chargeback Fee Refunded?

Yes, in most cases. If you fight a chargeback and win, your payment processor will usually refund the administrative fee they hit you with. On top of that, you'll also get the original transaction amount back in your account.

Of course, the exact policy can vary from one processor to the next. It’s always a good idea to dust off your merchant agreement and confirm the specifics. But generally, a successful dispute makes you whole again—recovering both the sale and the pesky fee.

The takeaway here is simple: winning a dispute doesn’t just get your money back; it erases the penalty fee, too. This is exactly why fighting invalid claims is a non-negotiable part of managing your payments.

What's the Difference Between a Chargeback and a Refund?

The main distinction comes down to who’s in control and what it costs you.

- A refund is a collaborative process. You, the merchant, agree to return the customer's money. It’s a customer service gesture that can actually help preserve the relationship.

- A chargeback is a forced reversal. The customer's bank initiates it, pulling the funds directly from your account without your consent. It always comes with a penalty fee and a black mark on your record.

Think of it this way: a refund is a handshake, while a chargeback is a penalty flag thrown by the bank.

Do All Payment Processors Charge the Same Fees?

Definitely not. Chargeback fees are all over the map. Every payment processor sets its own rates, and what you pay depends on a few things: your industry, how much you sell each month, and your past chargeback history.

For example, a business that’s considered high-risk, like a subscription service, will almost always pay a steeper fee per chargeback than a low-risk business like a local coffee shop. When you're shopping for a payment processor, the chargeback fee should be a major point of comparison.

Tired of watching your profits disappear one dispute at a time? Disputely connects directly with the card networks, giving you real-time alerts. This lets you issue a refund and stop up to 99% of chargebacks before they even happen. Protect your business and your bottom line with Disputely.