What Are RDR Alerts and How Do They Work?

RDR alerts are automated notifications that come directly from Visa's Rapid Dispute Resolution system. Their entire purpose is to catch a customer dispute and resolve it with a refund before it has a chance to turn into a full-blown, damaging chargeback.

Unpacking Visa RDR Alerts

Think of an RDR alert as an early warning system for your business. When a cardholder calls their bank to question a Visa charge, the old way involved kicking off a formal, often lengthy, chargeback investigation. RDR changes the game by creating a shortcut. Instead, an alert can instantly trigger a pre-approved refund, solving the customer's problem on the spot.

For any merchant, this is a huge deal. The real win isn't just about refunding the money—it's about protecting your merchant account's health. Every single chargeback hits you with fees, eats up your team's time, and, most critically, drives up your chargeback-to-transaction ratio. If that ratio gets too high, you could find yourself in a costly monitoring program or even risk losing your ability to process payments altogether.

To give you a clearer picture, here’s a quick breakdown of what makes RDR so effective.

RDR Alerts at a Glance: Key Features and Benefits

| Feature | Description | Primary Benefit for Merchants |

|---|---|---|

| Automated Refunds | Merchants set predefined rules to automatically refund certain disputes. | Prevents chargebacks without any manual intervention, saving time and resources. |

| Real-Time Alerts | Notifications are sent the moment a cardholder initiates a dispute with their bank. | Gives merchants a chance to resolve the issue before it escalates. |

| Rule-Based System | Rules can be based on transaction amount, product type, currency, and more. | Provides flexible, customized control over which disputes get refunded automatically. |

| Chargeback Prevention | By refunding the transaction, the dispute is resolved and a chargeback is avoided. | Protects the merchant account's health and avoids costly chargeback fees. |

In short, RDR is a proactive defense mechanism that works around the clock to keep your chargeback ratio low and your payment processing secure.

How RDR Automation Works

The secret to RDR's effectiveness is its rules-based engine. You don't have to sit there and review every single alert that comes in. Instead, you work with an authorized provider to set up rules that tell the system exactly when to automatically process a refund on your behalf.

This hands-off approach is incredibly efficient. You can build a strategy around several factors:

- Transaction Amount: You might decide to automatically refund any dispute under $25, since fighting it would cost more than it's worth.

- Product Type: Set specific rules for digital goods or subscription renewals, which are common sources of disputes.

- Customer History: Tailor your rules based on a customer's purchase history or loyalty.

By setting these rules, you create a powerful, automated defense system. The system works 24/7 to resolve eligible disputes on your behalf, ensuring you prevent the maximum number of chargebacks without any manual effort.

Taking this proactive stance doesn't just save you money on fees; it helps preserve your customer relationships. A fast, no-questions-asked refund can turn a frustrated customer into a loyal one. It’s the same logic behind proactive customer churn prediction strategies—solving a problem early is always the best way to keep a customer.

The numbers really speak for themselves. Industry data suggests that a well-implemented RDR strategy can stop around 50–70% of Visa chargebacks. Merchants who get on board often see their chargeback numbers drop by an average of 34%. It's clear why RDR has quickly become an essential tool for any business looking to get ahead of disputes.

How the Visa Rdr Workflow Actually Works

To really get what RDR alerts are all about, let's walk through what happens when a customer has a problem with a charge. The whole system is built for speed, designed to resolve an issue in seconds, not the weeks or even months a traditional chargeback can drag on for. The real secret is how it catches the problem right at the very beginning.

It all starts when a cardholder calls their bank—the one that issued their Visa card—to ask about a charge they don't recognize or agree with. This is the moment that used to kick off the slow, expensive, and frustrating chargeback process.

The Automated Handshake

But now, things are different. Instead of launching a formal chargeback, the issuing bank’s first move is to ping Visa’s central system, a platform called Visa Resolve Online (VROL). VROL instantly checks to see if the merchant involved is part of the Rapid Dispute Resolution program.

If the merchant is enrolled, an automated RDR alert fires off immediately. Think of it as a digital flare, signaling that a customer dispute has just popped up and needs to be handled before it escalates into something bigger.

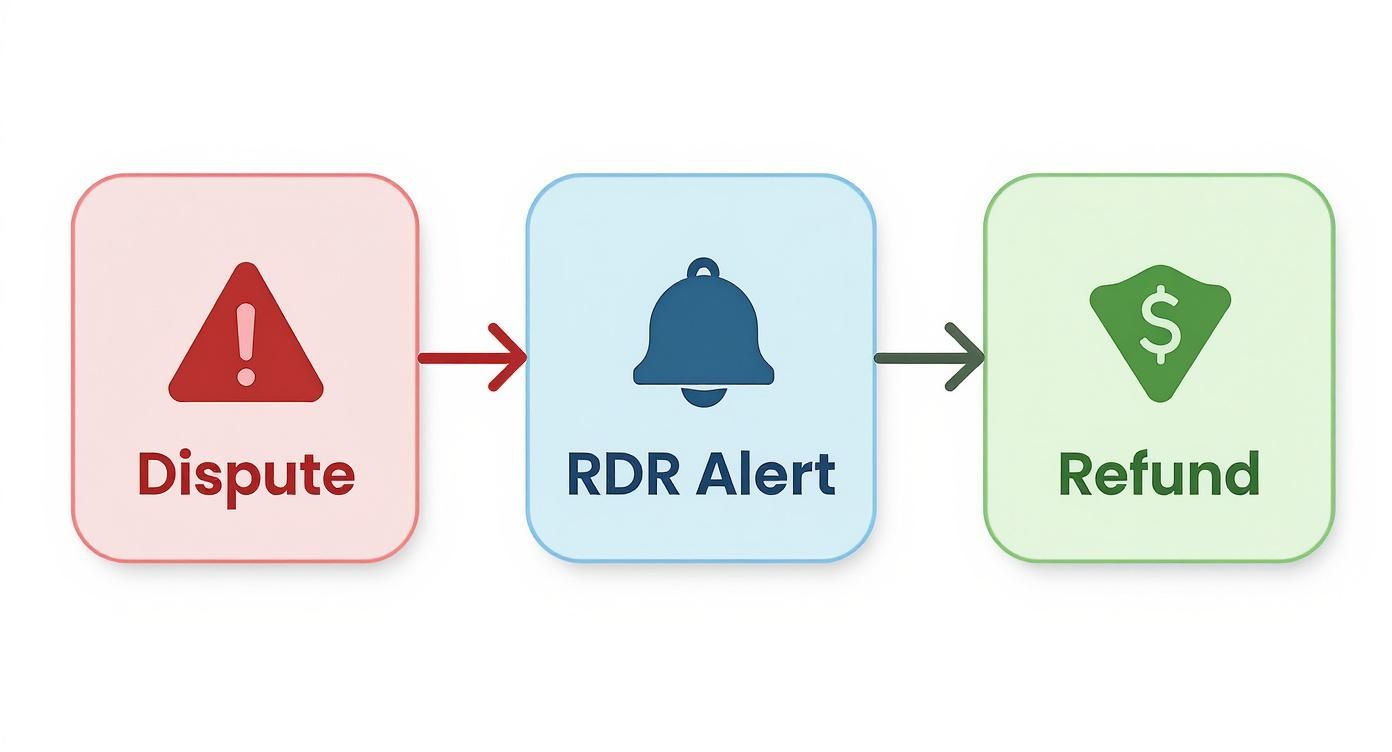

This simple flow chart shows just how elegantly RDR stops a dispute dead in its tracks.

As you can see, the dispute triggers an alert, which leads straight to a refund. The chargeback process is completely bypassed.

The Rules Engine Kicks In

This is where your strategy as a merchant comes alive. The RDR alert is instantly run against a "rules engine" you’ve set up beforehand. This is just a simple set of criteria that tells the system what to do automatically.

For instance, you might create rules like:

- Automatically refund any dispute for a transaction under $30.

- Always refund a dispute related to a first-time subscription renewal.

- Block refunds for physical products where delivery has been confirmed.

If the disputed transaction matches one of your refund rules, the system acts on it instantly. No human has to lift a finger. The decision is made in less than a second.

The core power of RDR is its automation. Once you set your rules, the system handles eligible disputes 24/7 without needing manual review. It stops a simple customer question from snowballing into a costly operational headache.

The final step is the resolution itself. If your rules engine gives the green light, the money is automatically credited back to the customer. Their bank is notified, their problem is solved, and the dispute is closed.

And here’s the most important part: no formal chargeback is ever filed. This single outcome protects your chargeback ratio from taking a hit and saves you from all the associated fees. You’ve just turned a potential conflict into a smooth customer service win.

RDR vs. Ethoca and Verifi CDRN: What's the Difference?

When you're trying to stop chargebacks, the jargon can get overwhelming. You’ve got RDR, Ethoca, and CDRN—all designed to prevent disputes, but they work in fundamentally different ways. To get the most out of them, you need to understand how they fit together.

The biggest distinction boils down to one simple idea: automation vs. manual review.

Visa's RDR is all about automated resolution. You set the rules, and it automatically refunds a customer dispute before it becomes a chargeback. Think of it as a "set it and forget it" tool.

On the other hand, Ethoca (from Mastercard) and Verifi CDRN (also from Visa) are pure alert systems. They send you a notification about a potential chargeback and give you a short window—usually 24 to 72 hours—to jump in, investigate the transaction, and decide whether to issue a refund yourself.

The Power of "Hands-Off" with RDR

RDR is your automated front line. It's an incredibly powerful tool for businesses with a high volume of small transactions, where manually investigating every single dispute just isn't worth the time or money.

Picture a company selling digital downloads for $15 a piece. If a customer disputes a charge, does it make sense to have a team member spend 15 minutes digging into it? Of course not. The labor cost would eclipse the transaction value.

This is exactly where RDR excels. You can create a simple rule like, "Automatically refund any dispute under $25." The system takes care of it instantly. No human effort required. Your team is freed up to handle bigger fish, and your chargeback ratio stays protected.

RDR is built for efficiency at scale. It acts as a smart filter, automatically resolving low-value, high-volume disputes that simply aren't economical to handle by hand, protecting your chargeback ratio with zero manual effort.

When You Need a "Hands-On" Approach: Ethoca and CDRN

While RDR is great for automation, some transactions demand a closer look. That’s where alert-based systems come in. Ethoca and CDRN essentially hit the "pause" button on a dispute, giving your team a crucial window to investigate.

This is your chance to figure out if the claim is legitimate or if it might be a case of friendly fraud. If you have compelling evidence that the transaction was valid, you might decide not to refund and prepare to fight the chargeback instead.

Here’s a quick look at each:

- Ethoca Alerts: This is Mastercard's network. It pings you almost immediately when a Mastercard cardholder initiates a dispute, giving you time to refund the transaction and avoid the chargeback.

- Verifi CDRN (Cardholder Dispute Resolution Network): Although it’s a Visa product, CDRN operates as a classic alert network. It gives you a heads-up on disputes from many participating issuers, adding another layer of protection.

RDR vs Ethoca vs Verifi CDRN: A Head-to-Head Comparison

Choosing the right tool—or combination of tools—is critical for an effective chargeback prevention strategy. This table breaks down the key differences between the three main players to help you decide what's best for your business.

| Feature | Visa RDR | Ethoca Alerts | Verifi CDRN |

|---|---|---|---|

| Primary Function | Automated Resolution | Manual Alert & Refund | Manual Alert & Refund |

| Card Network | Visa Only | Primarily Mastercard | Multi-Network (Visa & Others) |

| Process | Pre-set rules auto-refund a dispute. | Notifies merchant to manually review and refund. | Notifies merchant to manually review and refund. |

| Response Window | Instantaneous (based on rules) | 24-72 hours | 24-72 hours |

| Best For | High-volume, low-value transactions. | High-value transactions needing investigation. | Transactions requiring manual review across multiple card brands. |

| Human Effort | None (after setup) | Required for every alert | Required for every alert |

As you can see, these systems are more complementary than competitive. Each serves a distinct purpose in a well-rounded chargeback defense.

Ultimately, the smartest approach isn't about choosing RDR or Ethoca/CDRN. It's about using them together. You might set up RDR to automatically refund all Visa disputes under $50, while using Ethoca and CDRN alerts to manually review every Mastercard dispute and any higher-value Visa transactions. Successfully layering these tools is a game-changer; diving into effective strategies for chargeback representment can show you just how powerful a blended approach can be.

How to Integrate RDR and Set Up Your Rules

So, you understand what RDR alerts are. Now, how do you actually get them working for your business? The good news is, it's probably easier than you think. You don't need to build a direct connection to Visa's mainframe.

Instead, you'll work with an authorized RDR provider or a chargeback management company. They handle all the complicated technical stuff, connecting your business to the RDR network. Your main job is to tell the system what to do.

This is where the "rules engine" comes in. You’ll create a set of simple instructions that tell the RDR service when to automatically refund a customer's dispute. Getting these rules right is the key to making RDR work for you, helping you find that sweet spot between protecting your revenue and stopping chargebacks before they happen.

Building Your Automated Rules Engine

Think of your rules engine as your front-line defense against costly disputes. It’s a reflection of your business’s risk tolerance and what makes financial sense. The best place to start? Dive into your past chargeback data to spot the patterns.

Here are a few practical examples of rules merchants commonly set up:

- Transaction Amount Thresholds: This is the most popular rule, and for good reason. You might decide to auto-refund any dispute for a transaction under $25. Why? Because the bank fees alone for a full-blown chargeback can run anywhere from $20 to $100, not to mention the time your team spends fighting it. It just isn't worth it.

- Specific Product Types: Selling digital goods or monthly subscriptions? These are often hotspots for "friendly fraud." You could create a rule to automatically refund these disputes to sidestep the headache and protect your merchant account standing.

- Customer Purchase History: Your rules can get pretty smart. For instance, you might choose to refund a first-time customer to try and save the relationship. On the flip side, you could block automatic refunds for any customer who has a documented history of filing disputes.

The goal isn't to refund every dispute but to strategically resolve the ones that don't make financial sense to fight. A well-configured rules engine saves you money, protects your merchant account, and frees up your team's time.

Your RDR provider will give you a dashboard where you can easily set and tweak these parameters. If you’re not sure where to start or what rules make the most sense for your specific business model, don't guess. The experts at a provider like Disputely can help.

Feel free to reach out to our dedicated customer support team for personalized advice. By fine-tuning your rules, you can turn RDR into an intelligent and cost-effective shield for your business.

Best Practices for Maximizing RDR Effectiveness

Switching on Visa’s Rapid Dispute Resolution is a great first step, but getting the most out of it requires a smart, hands-on approach. If you just set up automated refunds and walk away, you're leaving money on the table. The real goal is to use RDR as an intelligent tool—one that not only stops chargebacks but also gives you crucial insights to fix problems at their source.

Thinking of RDR as a "set it and forget it" tool is a huge missed opportunity. The merchants who see the best results treat it like a dynamic shield that needs regular tuning to stay effective.

Audit and Optimize Your Rules Regularly

Your business is always changing, and your RDR rules need to change with it. The rules you first set up are a good starting point based on past data, but customer behavior, your product lineup, and fraud patterns are constantly evolving. That’s why you have to audit your RDR performance regularly.

Ask yourself: which rules are triggering refunds most often? Are you giving away too much money, or are you letting preventable disputes turn into full-blown chargebacks?

- Review Performance Data: At least once a quarter (monthly is even better), dive into your analytics. See what kinds of transactions are ending in RDR refunds.

- Adjust Thresholds: Maybe your average order value has gone up. If so, that $25 auto-refund threshold might need a bump to $30.

- Test New Rules: Don't be afraid to experiment. Try setting up new rules tied to a product launch or a holiday sale to see how they affect your dispute rate.

This kind of ongoing fine-tuning helps you find that sweet spot between stopping chargebacks and protecting your bottom line.

Layer RDR with Other Prevention Tools

RDR is an incredible last line of defense before a dispute officially becomes a chargeback, but it should never be your only defense. The smartest strategy is to layer multiple tools to catch bad transactions much earlier. Think of it like defending a castle—you wouldn't just rely on the main gate. You'd have a moat, high walls, and lookouts, too.

Combine RDR with other powerful solutions like:

- Upfront Fraud Filters: Use tools that can spot and block a suspicious order before the payment is even captured.

- Ethoca and CDRN Alerts: For disputes that fall outside your RDR rules (like high-value orders you don't want to auto-refund), these alerts give your team a chance to step in and handle them manually.

- Clear Customer Communication: Sometimes, the best prevention tool is just good communication. Simple things like clear order confirmations and shipping updates can stop a lot of confusion-based disputes before they start.

Use RDR Data as a Diagnostic Tool

Every single RDR alert is a data point telling you something about your business. Don't just look at it as a cost—see it as a clue. If you suddenly get a spike in RDR refunds for one specific product, that's a massive red flag.

RDR alerts do more than just prevent chargebacks—they are a feedback loop from your customers. Each refund is an opportunity to identify a root cause, whether it's an unclear billing descriptor, a confusing subscription policy, or a misleading product description.

By digging into these trends, you can fix the core issues causing disputes in the first place. Over the long run, this proactive approach has a huge financial upside. In fact, merchants who actively manage disputes with tools like RDR have seen an average ROI of 914%. The system’s power to resolve issues before they escalate is key to keeping your merchant account healthy and in good standing. You can find more details on these financial benefits from recent chargeback management reports.

What's Next for RDR? Brace for Visa's Big Policy Change

The payment world is always on the move, and if you're not keeping up with the rule changes, you're falling behind. Rapid Dispute Resolution has been a go-to tool for merchants looking to head off chargebacks, but a major shift from Visa is coming down the pipeline that will force everyone to rethink their strategy.

The change revolves around something called the Visa Acquirer Monitoring Program (VAMP). Think of VAMP as Visa's system for keeping score on merchant risk, tracking everything from fraud claims to disputes. Staying on the right side of this program is non-negotiable for a healthy merchant account.

The Game Is Changing for VAMP Calculations

Here’s the deal: up until now, if you got a fraud-coded dispute (a TC40 claim) and resolved it with an RDR refund, it was like it never happened. That dispute wouldn't count against your risk ratios, which was a huge relief for many businesses.

But that’s all about to change.

Starting April 1, 2025, Visa is going to count those fraud alerts resolved via RDR in its VAMP calculations. Yes, an RDR refund will still save you from the chargeback fees and operational headaches. But the key difference is that these resolved fraud disputes will now ding your merchant risk score. You can get a deeper dive into this VAMP policy update on PayCompass.

This isn't just a minor tweak; it fundamentally changes the game. Simply issuing a refund for every potential fraud claim is no longer a sustainable strategy. The focus has to pivot from just reacting to disputes to actively preventing them from ever happening.

The upcoming VAMP change makes one thing crystal clear: RDR is a great safety net, but you can't rely on it as your only line of defense. A robust, multi-layered fraud prevention strategy is now an absolute must-have to keep your risk metrics in a safe zone.

So, how do you prepare? It's time to double down on your upfront fraud detection. By catching and blocking bogus transactions before they're even processed, you cut off the problem at the source. This means fewer TC40 alerts firing off and fewer RDR refunds that could hurt your VAMP ratio. It's a proactive move that doesn't just protect your risk score—it strengthens your entire business.

RDR Alerts: Your Common Questions Answered

Diving into the world of RDR can bring up some practical questions. Let's clear up a few of the most common things merchants ask when they're getting started.

Does Using RDR Mean I Automatically Lose the Disputed Amount?

Yes, it does—and that’s by design. Think of an RDR alert as an opportunity to issue a strategic refund.

When your rules trigger a resolution, you're agreeing to refund the customer automatically. The whole point is to intercept the complaint before it becomes a full-blown, costly chargeback. You're essentially choosing the smaller cost of a refund to sidestep the much larger financial hit from chargeback fees and protect your merchant account health.

Can RDR Stop Every Single Chargeback?

Not quite. RDR is a powerful tool, but it's not a silver bullet for all chargebacks. It's a Visa-specific program, so it only works on Visa transactions before they escalate. It won't stop disputes from other card networks like Mastercard or American Express.

For that reason, RDR works best as a key piece of a broader chargeback prevention strategy. If you want to dive deeper into building a complete plan, you can find more tips on our chargeback prevention blog.

RDR really shines for businesses with high sales volume and lower-priced items, like companies selling digital downloads or monthly subscriptions. For them, the cost of an employee manually fighting a $15 dispute is far greater than just refunding it. Automation here is a clear financial win.

On the other hand, if you're selling high-ticket items, you'll likely want to stick with a manual review process for each dispute.

Ready to stop chargebacks before they start? Disputely integrates directly with RDR and other alert networks to protect your business 24/7. Connect your payment processor in minutes and see how you can reduce chargebacks by up to 99%. Learn more and get started at https://www.disputely.com.