What is a chargeback fee? Key insights to prevent costly disputes

A chargeback fee is the penalty your payment processor hits you with when a customer disputes a transaction. Think of it as an administrative fee the bank charges for the hassle of reversing a payment.

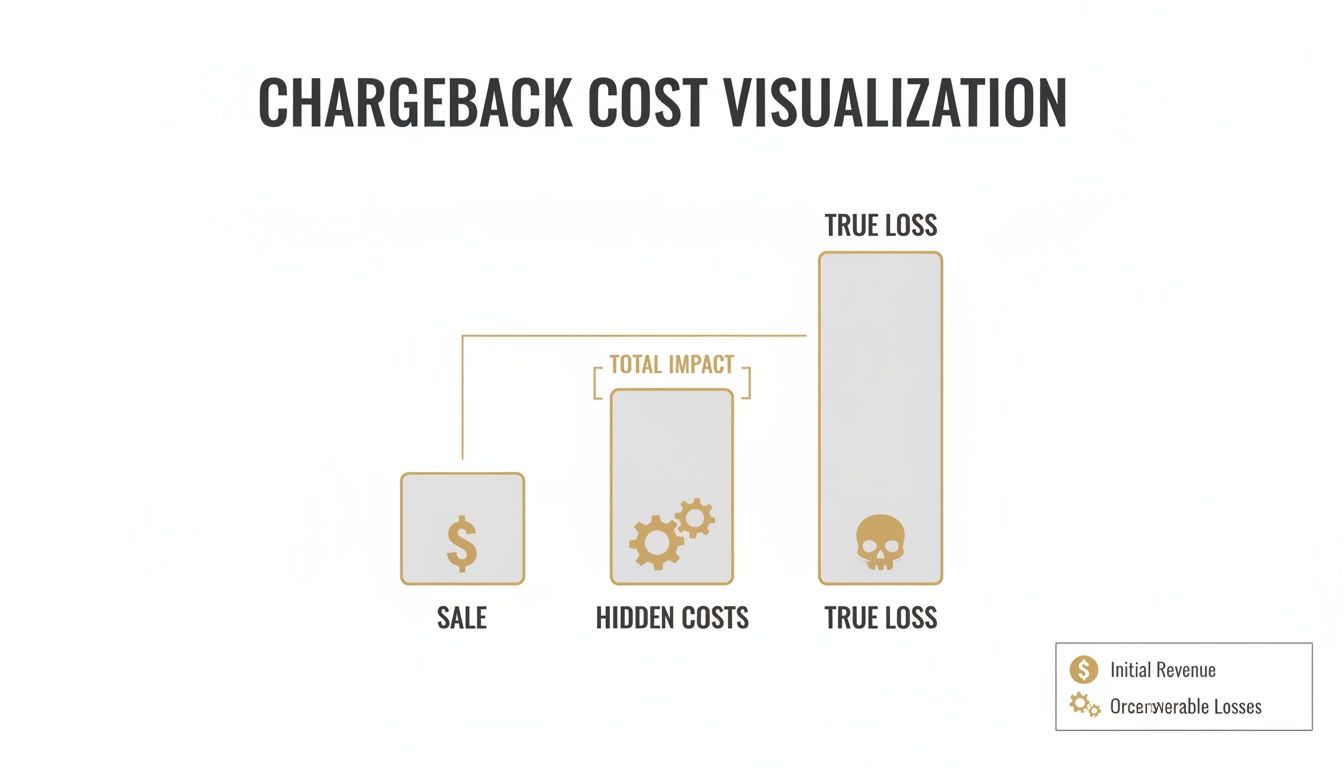

But here’s what most people miss: the true cost of a chargeback is so much more than just that single fee. The disputed sale is just the tip of the iceberg; underneath, you've got a mountain of hidden operational costs and lost inventory.

Unpacking the True Cost of a Chargeback

When a customer files a chargeback, you don't just lose the money from that one sale. That single dispute sets off a chain reaction of financial hits that can seriously eat into your profits. It's a costly one-two punch of lost revenue and a major drain on your team's time.

A lot of merchants think a chargeback is just another word for a refund. It's not. A refund is between you and your customer. A chargeback is a forced reversal kicked off by the customer's bank, and it comes with non-negotiable fees and can do real damage to your merchant account over time.

The financial fallout has several painful layers:

- Lost Revenue: The full amount of the original sale is pulled right out of your account.

- Processor Penalty: Your payment processor tacks on a chargeback fee, which can be anywhere from $15 to $100, just for their trouble.

- Operational Expenses: Your team has to stop what they're doing to dig up evidence and fight the dispute. That's time and money you're not spending on growing the business.

- Cost of Goods: You're out the product you shipped or the service you already delivered.

This infographic does a great job of showing how all these different costs pile up.

It’s clear the final loss is way bigger than the price tag on the original sale. In fact, research shows that U.S. merchants lose an estimated $4.61 for every $1 lost to chargebacks once you factor in all the associated costs.

Let's break that down with a real-world example.

Anatomy of a $100 Chargeback's True Cost

| Cost Component | Description | Estimated Cost for a $100 Sale |

|---|---|---|

| Original Transaction | The revenue from the sale that is immediately reversed. | $100.00 |

| Wholesale Product Cost | Your cost to acquire or produce the item sold. | $50.00 |

| Chargeback Fee | The penalty fee charged by your payment processor. | $25.00 |

| Operational Costs | Labor hours spent investigating and responding to the dispute. | $20.00 |

| Shipping & Handling | The non-recoverable cost to ship the item to the customer. | $15.00 |

| Marketing Costs | The prorated cost of acquiring that customer (e.g., ads). | $30.00 |

| TOTAL LOSS | The combined financial impact from this single chargeback. | $240.00 |

Suddenly, that $100 dispute has cost your business $240.00, and that doesn't even account for the potential long-term damage to your processing relationship.

The expenses can be staggering, but seeing them laid out like this is the first step toward getting them under control. The good news is there are tools and solutions built to help you fight back. You can explore options like Disputely's transparent pricing plans to see how you can start reducing these costs today.

Why Do Merchants Get Stuck With the Bill?

It's one of the first questions every business owner asks: "If the customer is the one complaining, why am I paying for it?" It’s a totally fair question. The answer goes back to the very reason chargebacks were invented in the first place—to give people the confidence to use credit cards.

Think about it. Without that safety net, would you feel comfortable buying from a new online store? Probably not. The whole system was designed to protect shoppers from shady dealings or honest mistakes. Because you, the merchant, are the one who accepted the payment and provided the product or service, the banks place the responsibility squarely on your shoulders. From their perspective, you're in the best position to prevent a dispute from ever happening through good service, clear descriptions, and on-time fulfillment.

Following the Money in a Dispute

So what actually happens when a customer files a chargeback? Let's say someone buys a pair of shoes from your store but claims they never arrived. The process kicks off immediately:

- The Customer Calls Their Bank: The cardholder contacts their bank (the issuing bank) to dispute the charge.

- The Bank Issues a Credit: The issuing bank gives the customer a provisional credit for the purchase amount. This is the official start of the chargeback.

- The Money Gets Pulled Back: The customer's bank then yanks the funds from your bank (the acquiring bank). Your bank, in turn, pulls the transaction amount plus a separate chargeback fee right out of your merchant account.

That fee isn't just a penalty; it’s the bank's way of charging for the administrative headache of investigating the claim.

At its core, the chargeback system operates on the assumption that the merchant is responsible for proving the transaction was legitimate. This puts the burden of proof on the business, not the consumer.

This is why that chargeback fee lands on your statement. The system is designed to incentivize good business practices, holding you accountable for every transaction you process to keep the entire payment network safe and reliable for everyone.

The Growing Threat of Global Chargebacks

A single chargeback fee might seem like a small hit, but don't be fooled. These individual costs are adding up to a massive, and frankly alarming, global problem for anyone selling online. For e-commerce businesses, chargebacks have moved beyond an operational headache into a serious financial threat.

The main culprit? The explosion of card-not-present (CNP) transactions. Think about it: every single time a customer buys something from your online store without physically swiping their card, it's a CNP sale. While incredibly convenient for everyone, this opens the door to more disputes—whether from actual fraud or simple customer confusion. The sheer volume of these higher-risk transactions has created a perfect storm for merchants.

A Worldwide Financial Drain

Let's put some numbers to this to see just how big the problem is. Projections show global chargebacks are set to cost e-commerce merchants $33.79 billion. If that's not bad enough, the forecast jumps to an eye-watering $41.69 billion by 2028. This incredible growth is happening because CNP payments now make up a whopping 63% of all merchant transactions. You can dive deeper into these figures in this in-depth analysis of chargeback statistics.

The total number of global chargeback cases is expected to reach 337 million. That's a massive 27% leap from the estimated 265 million cases just a few years ago. This isn’t a slow drip; it's a floodgate.

The data tells a clear story: you simply can't afford to ignore chargebacks anymore. What feels like a minor fee on one order is really just a single drop in a vast, costly ocean. For any modern merchant, building a solid defense against disputes and their fees isn't just a good idea—it's essential for staying profitable and competitive.

Proactive Strategies to Prevent Chargebacks

The best way to handle a chargeback fee is to make sure you never have to. It's about shifting your mindset from putting out fires to fireproofing your business. Building a solid defense starts with crystal-clear communication, top-notch customer service, and smart fraud prevention.

Think about it—most chargebacks aren't started by criminal masterminds. They usually come from simple confusion or frustration. Maybe a customer doesn't recognize your business name on their credit card statement, or they feel like their complaint fell on deaf ears. Getting ahead of these common issues is your best defense against those painful fees.

Strengthen Your Communication and Service

Your number one job is to make every step of the customer experience as transparent as possible. When customers are left guessing, disputes are sure to follow.

It all starts with your product listings. Are your descriptions honest and detailed? Do the photos show exactly what the customer is getting? If what shows up at their door doesn't match what they saw online, you're practically inviting a "product not as described" chargeback.

Then, nail your post-purchase communication. Sending order confirmations, shipping updates, and tracking numbers right away keeps customers in the loop and builds trust. It’s a simple action that can almost completely wipe out disputes from people who think their order has gone missing.

One of the most powerful ways to stop chargebacks, especially those related to service issues, is by implementing robust customer service solutions. Great support can turn a bad situation around, creating a loyal customer instead of a costly dispute.

The goal is to make it easier for a customer to contact you than it is for them to contact their bank. A visible phone number, responsive email support, and a clear return policy can defuse a potential dispute before it escalates.

Implement Smart Fraud Detection

While service slip-ups cause a lot of chargebacks, you can't ignore straight-up fraud. Having basic security checks in place is non-negotiable for any ecommerce business. These tools act as a bouncer at the door, turning away shady transactions before they can cause trouble.

Here are a few must-haves for your checkout process:

- Address Verification Service (AVS): This tool confirms that the billing address the customer typed in matches what the bank has on file.

- Card Verification Value (CVV): Always require that three or four-digit security code. It's a simple way to prove the customer physically has the card.

- 3D Secure: This adds an extra step where the cardholder has to verify their identity, often with a password or a one-time code sent to their phone.

When you blend clear communication with solid fraud prevention, you build a much safer environment for your business and cut down on unnecessary fees. If you want a closer look at your own defenses, a professional Q4 chargeback audit can often spot weak points you didn’t even know you had.

Automating Your Defense Against Chargeback Fees

As your business scales, trying to manually fight every single chargeback just isn't sustainable. It quickly becomes a massive time-suck, pulling you and your team away from actually growing the company. This is where technology becomes your best friend.

Modern chargeback management software works like having an expert team on call 24/7, turning a reactive, frustrating task into a well-oiled part of your operations.

These systems plug right into your payment processor and keep an eye on transactions as they happen. The second a dispute is filed, the platform gets to work, automatically pulling together all the crucial evidence—things like AVS/CVV match codes, shipping confirmations, and any customer emails or chats—to build a solid, data-backed case for you.

How Automation Can Seriously Boost Your Win Rate

Think about it: instead of you spending hours digging through order histories and shipping logs, the software does all that heavy lifting in seconds. This frees you up to contest far more disputes than you ever could manually, which means you recover more revenue. It’s all about protecting your bottom line so you can stay focused on the big picture.

Take a look at the hand-drawn flowchart below. It illustrates the kind of complex logistics and documentation process that automation can simplify, giving you a clear view of your defense.

Having this kind of real-time visibility is a game-changer for spotting dispute patterns and tweaking your prevention strategy before problems get out of hand.

Automation isn't just about fighting disputes faster; it's about fighting them smarter. When you use data to build a rock-solid evidence package, you dramatically increase your odds of winning the dispute and getting your money back.

If you’re looking to sharpen your approach, diving into the latest chargeback representment strategies can give you a real advantage. And for a deeper look at what's coming next, check out this piece on how AI is transforming e-commerce strategy in 2025.

Putting these tools in place helps take the operational headache out of chargeback management, letting you keep more of your hard-earned revenue and protect your merchant account.

Common Questions About Chargeback Fees

Diving into the world of chargebacks can feel a bit like navigating a maze. Lots of questions pop up, and getting straight answers isn't always easy. Let's cut through the jargon and tackle some of the most common things merchants ask about these frustrating fees.

Can I Get a Chargeback Fee Refunded If I Win?

The short answer is: usually, yes. When you fight a chargeback and win, the bank returns the original transaction amount to your account. In most cases, your payment processor will also refund the chargeback fee they initially charged you.

But don't take that for granted. It’s absolutely crucial to read the fine print in your merchant agreement, as some processors have different policies. Remember, even when you get the fee back, you've still lost the time and money spent fighting the dispute in the first place. This is exactly why preventing chargebacks is always a better strategy than fighting them.

What Is a Chargeback Threshold and Why Does It Matter?

Think of a chargeback threshold as a "speed limit" for disputes, set by card networks like Visa and Mastercard. It’s the maximum number of chargebacks you can receive, calculated as a percentage of your total monthly sales. For instance, Visa's standard program keeps a close eye on merchants who exceed a 0.9% chargeback-to-transaction ratio.

Going over this limit is a huge red flag for payment processors. It can lead to serious consequences, from much higher fees and forced enrollment in monitoring programs to the worst-case scenario: having your merchant account shut down entirely.

Staying under your threshold isn't just a good idea—it's essential for keeping your business running smoothly. It’s how you maintain a healthy relationship with your payment partners and avoid devastating account problems.

Is a Chargeback Fee Different From a Retrieval Request Fee?

Yes, they are completely different things, and it pays to know the distinction. A retrieval request is the first step, an inquiry from the cardholder's bank asking for more details about a transaction. It’s a precursor to a chargeback, not the chargeback itself.

You’ll be charged a small retrieval request fee, typically just $5 to $15, for the bank to pull this information. If you respond quickly with clear proof of the purchase, you can often clear up the customer's confusion and stop the dispute from escalating into a full chargeback. This simple action can save you from the much higher $20 to $100+ chargeback fee and the bigger financial headache that comes with it.

Stop disputes before they become costly chargebacks. With Disputely, you can get real-time alerts and automatically resolve issues, protecting your revenue and keeping your merchant account safe.