What is a return item chargeback - what is a return item chargeback

A return item chargeback is what happens when a customer believes they returned something but never saw the refund hit their account. Instead of getting in touch with you, they go straight to their bank to dispute the charge.

This simple action completely sidesteps your normal return process. It kicks off a formal, expensive dispute through the credit card network rather than a straightforward refund handled by your team.

What a Return Item Chargeback Really Is

Think about it from the customer's point of view. They sent a product back and are now waiting for their money. If a week goes by and they don't see the credit, they might get impatient. Instead of emailing your support desk, they just open their banking app, tap a few buttons to dispute the transaction, and type, "I returned this but never got my money back."

And just like that, a return item chargeback is born.

A standard refund is a simple conversation between you and your customer. A chargeback, on the other hand, is a messy, multi-party affair. It pulls in the customer’s bank (the issuer), your bank (the acquirer), and the card network (like Visa or Mastercard). The key difference is that a chargeback is essentially an accusation that you failed to deliver on your promise to refund them.

The Real Cost of Customer Impatience

The fallout from a chargeback is much worse than just giving back the original sale amount. The moment a return item chargeback is filed, your payment processor yanks the disputed funds from your account. Then, they tack on a hefty penalty fee, usually anywhere from $20 to $100 per dispute. This all happens automatically, often before you even get a chance to tell your side of the story.

This isn't just a small operational headache; it's a growing threat for businesses, especially online. The ecommerce world has seen a staggering 222% jump in chargebacks, often fueled by shipping delays and what's known as "friendly fraud." The travel industry got hit even harder, with an unbelievable 816% surge in disputes in a single year. These numbers, detailed in recent chargeback trend reports, show just how fast a little customer frustration can spiral into a big financial problem.

A standard refund is a customer service interaction. A return item chargeback is a forced fund reversal accompanied by penalties and a black mark against your business.

To really understand the damage, it helps to see the two processes side-by-side.

Standard Refund vs. Return Item Chargeback At a Glance

Here’s a quick breakdown that shows just how different a simple refund request is from a full-blown chargeback.

| Attribute | Standard Refund Process | Return Item Chargeback Process |

|---|---|---|

| Initiator | Customer contacts the merchant directly. | Customer contacts their bank, bypassing the merchant. |

| Resolution | Merchant processes a refund through their payment system. | The bank forcibly reverses the funds from the merchant's account. |

| Associated Costs | Only the cost of the returned product. | The original transaction amount, plus a penalty fee ($20-$100). |

| Business Impact | A positive customer service opportunity. | Damages merchant reputation and increases chargeback ratio. |

As you can see, the path a customer chooses has huge implications. While a standard refund is a manageable part of doing business, a chargeback introduces penalties, administrative work, and a direct hit to your reputation with payment processors.

So, Why Do Customers File a Chargeback Instead of Just Asking for a Refund?

When a customer files a return item chargeback, it’s almost never about malice. Let's get that out of the way. They aren't trying to pull a fast one on you. The reality is much simpler: they're just looking for the path of least resistance.

This is a classic case of what we call friendly fraud—when a legitimate cardholder disputes a valid charge. It’s a huge headache for merchants, now making up an estimated 61% of all chargebacks worldwide. A customer sees calling their bank as a guaranteed, one-step solution, which often feels much faster than navigating a company's return process. You can dig deeper into these numbers in this detailed chargeback statistics report.

Getting to the "why" is the key to stopping these chargebacks before they happen. It’s not a fraud problem; it's a customer experience problem.

Common Triggers That Push Customers Toward a Dispute

Think about it from the customer's perspective. When getting a simple refund feels like running an obstacle course, that one-click "dispute charge" button in their banking app starts to look pretty good.

Here are the most common things that push good customers over the edge:

- A Confusing Return Policy: Is your policy buried in the footer of your website? Is it loaded with legal jargon? If a customer has to work to understand how to return something, they'll just skip it and call their bank instead.

- A Glacially Slow Refund Process: We live in an on-demand world. If a customer sends an item back and doesn't see their money within a few business days, they get anxious. Waiting weeks for a credit to post is a guaranteed way to trigger a dispute.

- Radio Silence: Nothing frustrates a customer more than feeling ignored. Unanswered emails, endless hold music, or a total lack of updates on their return will make them feel like a chargeback is the only way to get someone's attention.

A return item chargeback is often just a symptom of a breakdown in your customer service. The customer isn't trying to hurt your business—they're just trying to solve their problem as painlessly as possible.

A Real-World Example

Let’s picture Sarah. She buys a pair of shoes from your online store, but they don't fit. No problem. She follows the instructions, prints the label, and drops the package off at the post office. A week later, the tracking number confirms it was delivered to your warehouse.

Then... crickets.

Another week goes by, and she still hasn't seen the refund hit her credit card. She shoots an email to your support team and gets nothing but an automated "we'll get back to you" response. After two more days of waiting, she’s had enough. She opens her banking app, finds the transaction, and taps "dispute."

For Sarah, this wasn't fraud. It was a perfectly logical solution to a problem your process created.

When you start seeing these disputes as feedback on your customer experience, you can stop fighting them and start fixing the root causes.

Let's be clear: a return chargeback isn't just a refund that takes a different route. It’s a financial gut punch that makes the original lost sale look like a paper cut. The second a customer files that dispute, a whole chain reaction of costs kicks off, and you're the one left paying for it.

First, the money from the sale is immediately yanked from your merchant account. On top of that, your payment processor slaps you with a non-refundable chargeback penalty fee, which can be anywhere from $20 to $100. And the product? You can probably kiss that goodbye, too. Suddenly, that one dispute has cost you two or three times what the sale was even worth.

More Than Just a Fee Problem

The immediate cash drain is bad enough, but the real danger lies in the long-term damage. Every single chargeback you get—no matter how small the amount—ticks your chargeback ratio upward. This is the magic number that card networks like Visa and Mastercard watch like a hawk to decide if you're a risky business.

When that ratio climbs, it’s like a giant red flag for payment processors. They start seeing you as a liability, and that's when the real trouble begins. You could be facing:

- Higher Processing Fees: Your processor might start taking a bigger cut from every single sale to protect themselves from what they see as a growing risk.

- Frozen Funds or Rolling Reserves: They could decide to hold onto a chunk of your money to cover any future chargebacks. This can cripple your cash flow and is a particularly nasty surprise for sellers on platforms like Shopify. If this sounds familiar, it’s crucial to know the steps for resolving a Shopify payment hold.

- Account Termination: This is the nightmare scenario. If your ratio crosses the card networks' threshold (usually around 1%), they can shut down your merchant account completely. Game over.

Each return chargeback is not just a lost sale; it's a vote against your business's stability in the eyes of the entire payment processing ecosystem.

A Growing Global Headache

This isn't a problem that's going away—it's getting bigger. The number of chargebacks filed worldwide is exploding, with forecasts predicting a staggering 324 million transactions by 2028. The financial fallout is climbing even faster. Losses are expected to jump from $33.79 billion in 2025 to a massive $41.69 billion by 2028.

For any business, that means one thing: without a solid plan, disputed returns are going to chew up more and more of your revenue and resources. A single return chargeback is a costly domino that can knock over your financial health and threaten the very stability of your business.

Tracing the Path of a Return Dispute

When a customer initiates a return item chargeback, it triggers a chain reaction that's often invisible to the merchant until it's too late. For many business owners, it feels like a sudden, out-of-the-blue penalty. But if you pull back the curtain and look at how the process actually works, you'll see why it can feel so stacked against you.

The whole thing starts when your customer decides to sidestep your customer service team. Instead of shooting you an email or picking up the phone, they go straight to their bank—the issuing bank—and tell them, "I sent the item back, but I never got my money."

That one complaint is all it takes to get the ball rolling. The customer's bank takes their word for it, files the claim under a "merchandise returned" reason code, and officially launches the chargeback.

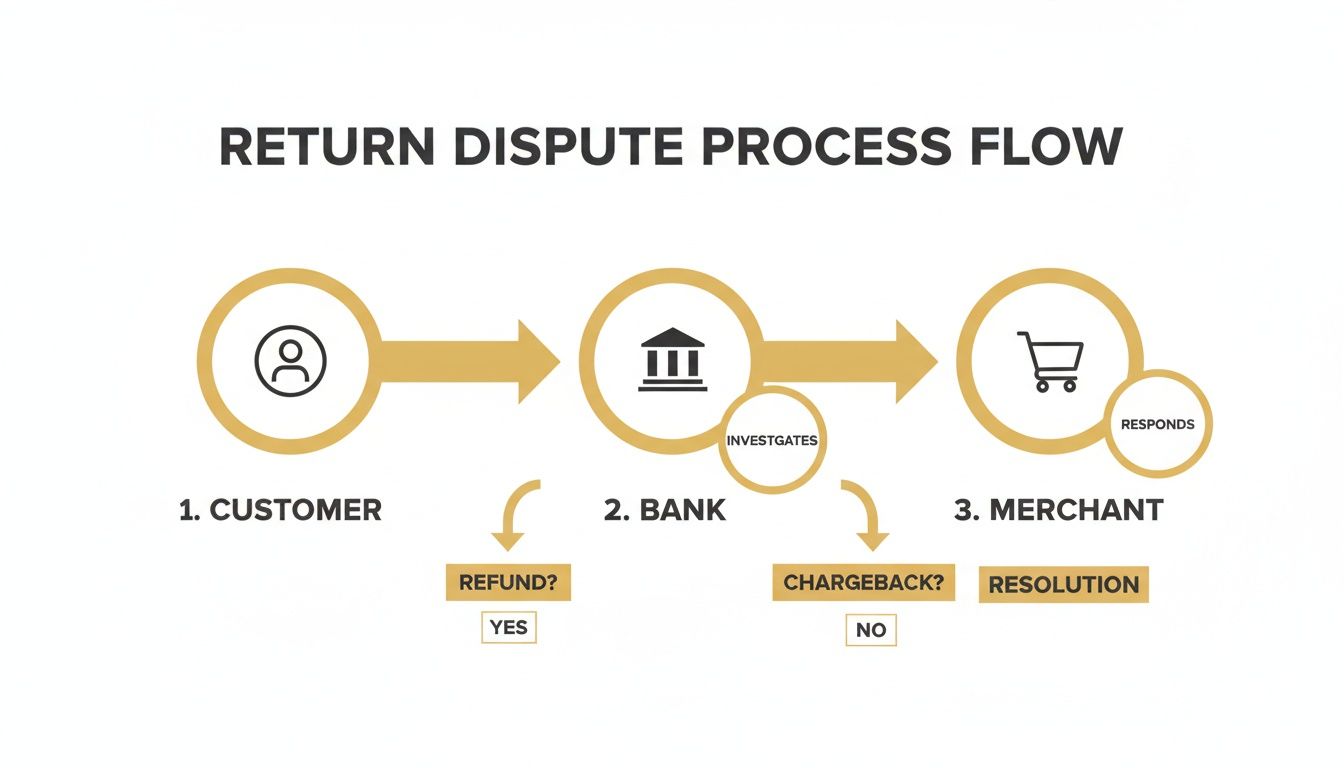

This flowchart breaks down the typical journey of a return dispute, from the moment the customer complains to the final debit from your merchant account.

As you can see, the merchant is the last one to find out, which explains why these disputes often feel like a blindside hit long after the money has been clawed back.

From the Customer's Bank to Your Bottom Line

Once the issuing bank kicks things off, they don't call you. They send the dispute up the chain to the card network, like Visa or Mastercard. The card network then acts as the middleman, passing the chargeback down to your bank or payment processor—what's known as the acquiring bank.

It’s only then, at the very end of this relay, that you finally get the bad news. Your acquirer pulls the full transaction amount from your account and tacks on a separate, non-refundable chargeback fee for the trouble.

By the time a return dispute shows up in your payment portal, the money is already gone. The system is built to favor the cardholder's claim first, placing the burden of proof squarely on the merchant to prove otherwise.

This whole sequence highlights a fundamental problem for businesses. The conversation happens between the customer, their bank, and the card network, leaving you completely in the dark until after you've already been penalized financially. Knowing this journey is the first step toward figuring out how to get in front of it.

Your Proactive Guide to Preventing Return Chargebacks

The best way to handle a return item chargeback is to stop it from ever happening. Instead of just reacting when a dispute hits, a proactive strategy protects your revenue, saves you time, and keeps your merchant account in good standing. This really comes down to strengthening two key areas: how you run your business day-to-day and the technology you use to back it up.

At the heart of good prevention is a smooth customer experience. Think about it: when customers find it easier to get help from you than to call their bank, disputes simply don't happen. The trick is to focus on those core moments where you can either build trust or create frustration.

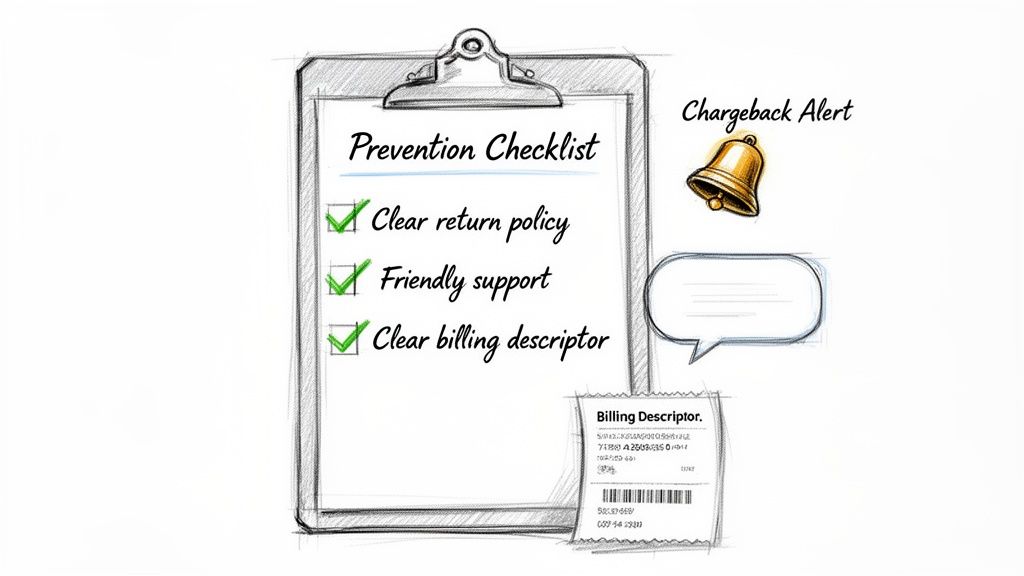

Fortify Your Operational Defenses

Your daily operations are your first line of defense. These are the practical, hands-on things you can do to clear up confusion and prevent service-related disputes before they start. Even small tweaks here can make a huge difference.

- Craft a Simple, Clear Return Policy: Your return policy needs to be incredibly easy to find, read, and understand. Ditch the legal jargon. It should be written in plain English and feel fair to the customer. Plaster it everywhere—product pages, your website footer, and order confirmation emails.

- Use Crystal-Clear Billing Descriptors: Nothing triggers a chargeback faster than a mysterious line item on a credit card statement. A generic descriptor like "ONLINE PAY SVCS" is practically an invitation for a dispute. Make sure yours clearly states your business name, like "YOURBRANDNAME.COM," so there's zero guesswork.

- Provide Fast, Friendly Support: When a customer has a problem, your response time is everything. Acknowledge their return request right away, give them simple instructions, and process their refund the second you get the item back. A little speed and empathy go a long way.

The goal is simple: make your customer service so accessible and efficient that disputing the charge with their bank never even crosses their mind. Every positive interaction is a chargeback you've successfully avoided.

Deploy a Technological Shield

Great service prevents a lot of headaches, but you can't control every customer's impulse. This is where technology becomes your most powerful ally. Chargeback alert services are basically an early-warning system, giving you a crucial heads-up to solve a problem before it blows up into a formal dispute.

Here’s a practical checklist to guide your efforts, covering both the operational and technical sides of prevention.

Your Return Chargeback Prevention Checklist

| Prevention Area | Key Action Items | Impact on Chargebacks |

|---|---|---|

| Customer Communication | Publish a clear, easy-to-find return policy. Ensure your billing descriptor is recognizable (e.g., YOURBRAND.COM). | Drastically reduces confusion and "friendly fraud" from customers who don't recognize the charge. |

| Support & Operations | Offer fast, multi-channel customer support (email, phone, chat). Process refunds immediately upon receiving returned goods. | Makes contacting you the path of least resistance, diverting customers from calling their bank. |

| Technology & Automation | Implement a chargeback alert service to get pre-dispute notifications from issuing banks. | Allows you to refund the customer and stop the chargeback before it officially files, protecting your dispute ratio. |

Putting these measures in place creates a robust defense system that addresses the root causes of return-related chargebacks.

Platforms like Disputely are a game-changer here. They plug directly into the card networks and issuing banks. When a frustrated customer calls their bank to complain, the bank sends out a pre-chargeback notification. Disputely catches that alert in real time and tells you about it instantly.

This opens up a critical 24-72 hour window for you to step in and issue a full refund. By doing that, you give the customer what they want, and the bank cancels the dispute before it's ever officially filed. What could have been a damaging chargeback—complete with fees and a hit to your ratio—becomes a simple customer service fix.

This isn't just a nice-to-have; it's an essential strategy for any merchant serious about maintaining a healthy business. If you want to see where your specific weaknesses might be, a great next step is to conduct a chargeback prevention audit.

How to Fight a Return Chargeback and When to Accept It

No matter how buttoned-up your processes are, some disputes will eventually find their way to you. When a return item chargeback hits your dashboard, your gut reaction might be to fight it immediately. But hold on—the first and most important question you need to ask is, "Is this battle even worth fighting?"

Making the right business call means sizing up the situation quickly. Not every dispute justifies the time and resources it takes to build a case.

Evaluating Your Position

Before you spend a single second digging through records, you need to do a quick cost-benefit analysis. A smart, strategic approach will save you from sinking resources into a case you can't win.

Here’s what you should be thinking about:

- Transaction Value: Is the disputed amount high enough to make the effort worthwhile? Fighting a $15 chargeback could easily cost you more in time and administrative overhead than just taking the hit.

- Evidence Quality: Can you actually prove your case? You need compelling evidence that directly counters the customer’s claim—things like a signed delivery confirmation, time-stamped emails, or clear proof that your return policy was visible and you followed it to the letter.

- Customer History: Is this a one-off issue with a loyal customer, or do you see a pattern of questionable disputes? Sometimes, the smartest long-term move is to accept a small loss to keep a great customer happy.

The decision to fight should be strategic, not emotional. If your evidence is flimsy or the transaction value is low, accepting the chargeback and focusing on preventing the next one is often the most profitable path forward.

Building Your Rebuttal Case

Okay, so you've decided to fight. Your response needs to be sharp, professional, and loaded with compelling evidence. Your mission is to give the issuing bank a simple, undeniable reason to side with you and reverse the chargeback.

Your rebuttal letter has to directly address the specific reason code for the dispute and be backed by solid documentation. Building a winning case means getting familiar with the entire chargeback representment process. If you want to really sharpen your skills, you can explore our complete guide to chargeback representment and master the art of winning these disputes.

Make sure you gather all the essentials: a screenshot of your clearly posted return policy, proof of delivery, and any conversations you had with the customer about their return or refund. And whatever you do, don't miss the response deadline. Missing it is an automatic loss, no matter how strong your evidence is.

Unpacking Return Item Chargebacks: Your Questions Answered

When it comes to return-related disputes, the details can get a little fuzzy. Let's clear up some of the most common questions merchants ask.

Is a Return Item Chargeback the Same as Friendly Fraud?

In many cases, yes. Think of friendly fraud as the broad category, and a return item chargeback is often a prime example that fits right in.

This happens when a real customer—not a scammer—disputes a charge because it’s easier or faster than following your official return process. Maybe they don’t want to pay for return shipping or simply find it more convenient to call their bank. While some of these disputes might stem from a genuine issue, most are just a path of least resistance for the customer, which is the very definition of friendly fraud.

Can My "No Refunds" Policy Stop a Chargeback?

Unfortunately, no. A "No Refunds" policy offers very little protection against a chargeback.

Card network rules are designed to protect consumers, and a customer can easily sidestep your policy by filing a dispute with their bank. They might claim the 'Product Was Not as Described' or 'Merchandise Was Defective.' From the bank's perspective, these claims often trump a store's internal policy, making it incredibly difficult for you to win the dispute. A fair and clearly communicated return policy is a much stronger defense than a rigid "no refunds" stance.

Chargeback alert services tap directly into the communication lines between card networks and issuing banks. The moment a customer calls their bank to complain, an alert is triggered before a formal chargeback is filed. A platform like Disputely catches that alert, giving you a crucial 24-72 hour window to issue a refund and prevent the dispute from ever becoming an official chargeback.

Don't let preventable disputes damage your bottom line and merchant accounts. Disputely helps you stop up to 99% of chargebacks before they happen. See how our real-time alerts can protect your revenue and learn more about our chargeback prevention tools.