What Is a Chargeback Fee? what is chargeback fee and How Merchants Avoid It

A chargeback fee is what your payment processor hits you with when a customer disputes a charge and wins. It’s a penalty, plain and simple. This fee has nothing to do with the original sale amount—it’s purely to cover the processor's administrative headache of investigating and reversing the payment. For you, it’s a direct financial hit on top of the revenue you just lost.

Understanding the True Cost of a Chargeback Fee

When a chargeback lands on your desk, that fee is just the tip of the iceberg. The financial damage goes much deeper.

It's less like a simple refund and more like a surprise car repair. You don't just pay for the new alternator; you're also on the hook for labor, shop fees, and the hassle of being without your car. A chargeback fee is the processor’s administrative charge, but the real cost to your business is a painful chain reaction of losses.

The Three Layers of Financial Damage

Every single chargeback delivers a triple-blow to your bottom line, and the damage goes way beyond the disputed amount. Getting a handle on these three components is crucial to understanding the full financial impact.

These costs compound quickly, turning what was once a profitable sale into a significant financial drain. Once you add it all up, the average dispute can cost a merchant more than $120. This is a major contributor to the projected global cost of chargebacks, which is set to hit $33.79 billion in 2025 and is expected to climb to $41.69 billion by 2028. You can dig into these chargeback trends and statistics to see just how big the problem is.

Key Takeaway: A chargeback isn't just a refund. It's a refund plus a penalty fee, plus the loss of your product and any shipping costs. It’s a profoundly damaging event for your business's financial health.

To really see how the costs pile up, let’s break down what a single chargeback actually costs you. The table below illustrates how different fees and losses come together to create a much bigger financial problem than most merchants realize.

Breaking Down the Total Cost of a Single Chargeback

| Cost Component | Description | Example Impact |

|---|---|---|

| Processor Penalty Fee | The non-refundable fee your payment processor (e.g., Stripe, PayPal) charges you just for handling the dispute. | -$15 to -$100 |

| Lost Sale Revenue | The original transaction amount that gets yanked from your account and sent back to the customer's bank. | -$100 (for a $100 sale) |

| Sunk Product Costs | The money you already spent on the goods or services, including your inventory cost and any shipping expenses. | -$50 (cost of goods) |

As you can see, a simple $100 sale can easily result in a total loss of $165 or more ($15 fee + $100 revenue + $50 product cost). It’s a brutal equation that highlights why preventing chargebacks is so critical.

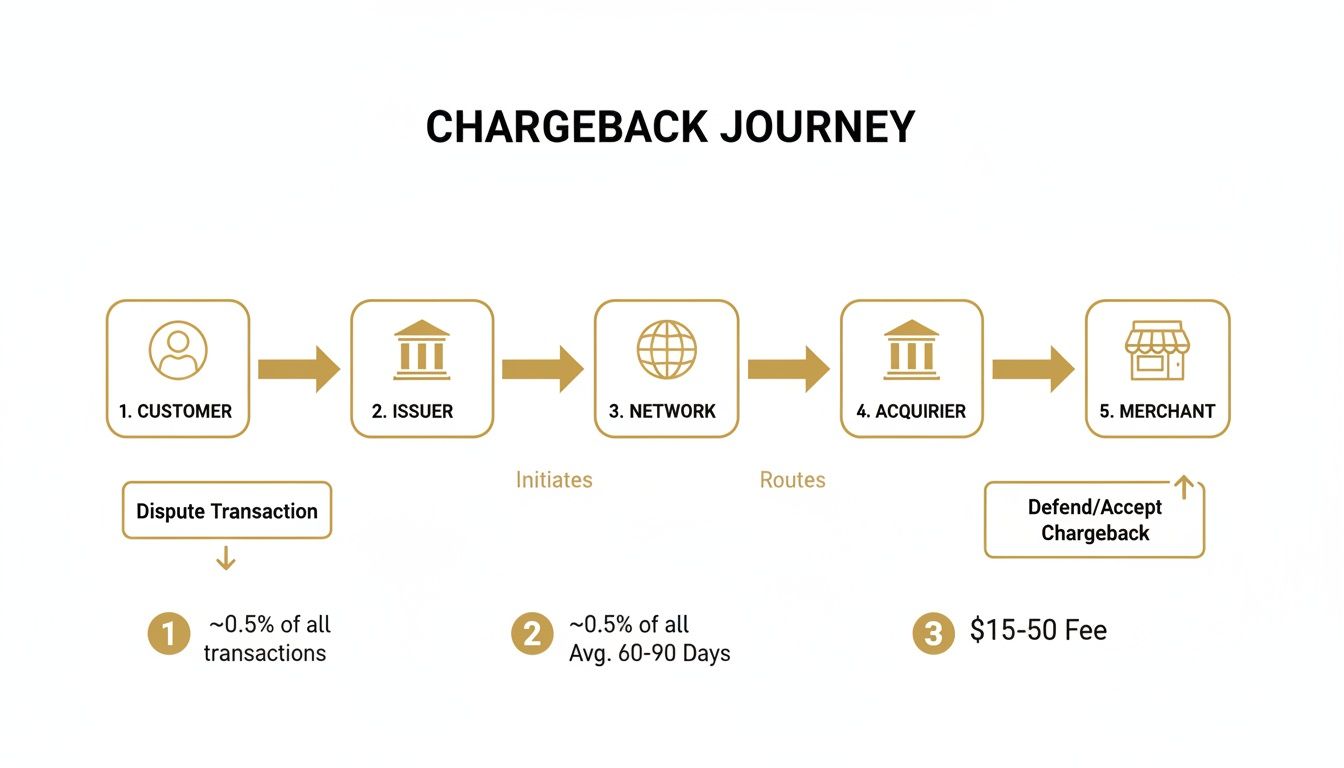

How the Chargeback Process Actually Works

To really get why you're hit with a chargeback fee, you have to look at the messy, winding road a single dispute travels. This isn't just a simple refund. It’s a formal, multi-stage investigation that pulls in some of the biggest players in finance. That fee you see? It's the cost of admission for this whole ordeal.

Think of it as a "dispute administration fee." Your payment processor is charging you for the time and resources they spend playing traffic cop—managing the back-and-forth, shuffling money around, and handling the digital paperwork between giant banking systems.

The Cast of Characters in Every Dispute

Before a dispute even lands on your desk, it helps to know who's involved. Every single credit card transaction has four main parties, and when a chargeback kicks off, they all get a seat at the table.

- The Cardholder: This is your customer, the person who made the original purchase.

- The Issuing Bank: This is the cardholder's bank (think Chase, Bank of America, etc.). They're the ones who "issued" the credit or debit card.

- The Acquiring Bank: This is your bank, or your processor's partner bank. They "acquire" the money from the sale on your behalf.

- The Card Network: These are the big names—Visa, Mastercard, American Express—that act as the referees, setting the rules and connecting the two banks.

Each one has a job to do, and the chargeback process is just the formal, rule-bound system they use to hash out the customer's complaint.

The Journey of a Single Disputed Transaction

The whole thing unfolds in a very specific order. Picture a game of financial hot potato, where the disputed funds and a folder of evidence get passed from one institution to the next.

Here’s how it typically plays out, step by step:

- The Customer Kicks Things Off: It all starts when a cardholder calls their bank to complain about a charge. They might say they never got the package, the item was a knock-off, or they don't recognize the transaction at all.

- The Issuer Reviews the Claim: The customer's bank takes a look. If the claim seems legitimate based on the card network's rules, they grant the cardholder a provisional credit. In plain English, they give the customer their money back for the time being.

- The Chargeback Is Officially Filed: Now it's official. The issuer files the chargeback through the card network's system, which sends it over to your acquiring bank. At this moment, the disputed amount is yanked from your merchant account. This is almost always when your processor tacks on the chargeback fee.

- You Get the Bad News: Your processor or acquirer notifies you about the chargeback, giving you a reason code that explains why the customer is disputing it. The clock is now ticking—you typically have between 20 to 45 days to respond.

- You Decide to Fight or Fold: You have two choices. You can accept the chargeback and let the customer keep the money, or you can fight it. To fight, you’ll need to submit compelling evidence—like shipping confirmations, AVS/CVV results, customer emails, or service usage logs—that proves the transaction was valid.

- The Final Verdict: The customer's bank reviews all your evidence and makes the final call. If you win, the provisional credit is taken back from the cardholder, and the money is returned to you. If you lose, the chargeback is final, the customer keeps the money, and you're out the funds and the chargeback fee.

Comparing Chargeback Fees From Major Payment Processors

Not all chargeback fees are created equal. You'll find that while most payment processors charge you a penalty for a dispute, the exact amounts, rules, and—most importantly—refund policies can be surprisingly different. Getting a handle on these differences is key, because they hit your bottom line every single time a customer files a chargeback.

A processor’s chargeback fee isn't just a simple line item; it's part of a larger policy. The single most important detail to check is whether that fee is refunded if you win the dispute. Many merchants learn this the hard way—they put in the work to fight a fraudulent chargeback and win, only to discover they're still out the initial penalty fee.

The whole process is a long journey. A dispute has to travel from the customer's bank all the way to yours, and every step costs someone time and money. That's what the fee is supposed to cover.

This journey from customer complaint to final decision involves a lot of administrative legwork, which is the justification processors use for charging these fees in the first place.

The Growing Challenge of E-Commerce Transactions

This financial pinch is getting worse as online shopping continues to boom. A huge driver of the modern chargeback problem is the explosion in card-not-present (CNP) sales—basically, any transaction where a physical card isn't swiped or dipped.

The numbers are pretty staggering. Global chargeback volume is expected to jump from 261 million disputes in 2025 to nearly 324 million by 2028. That's a 24% increase in just a few years. You can read more about these chargeback statistics and trends. This reality makes understanding your processor’s policies more critical than ever.

Chargeback Fee Comparison for Top Payment Processors

Let's take a look at how some of the biggest names in payment processing handle their chargeback fees. The table below gives you a quick, side-by-side comparison, but remember to always double-check the latest terms with your specific provider, as these figures can and do change.

| Payment Processor | Standard Chargeback Fee | Is Fee Refundable if You Win? |

|---|---|---|

| Stripe | $15 | No |

| PayPal | $15 | No |

| Shopify Payments | $15 | Yes |

| Authorize.net | $25 | No |

As you can see, there's a clear split. Some processors, like Shopify Payments, reward you for successfully defending a dispute by refunding the fee. Others, like Stripe and PayPal, keep the fee regardless of the outcome, treating it as a pure cost of doing business for their administrative efforts.

Here’s how that plays out: You make a $100 sale using Stripe. The customer files a chargeback. Stripe immediately pulls the $100 from your account and tacks on their $15 fee, so you're instantly down $115. You spend time gathering evidence, submit a compelling case, and win. Great! Stripe returns the $100... but that $15 fee is gone for good.

This is why a proactive strategy is so important. For businesses dealing with a steady stream of disputes, services that offer automated prevention are a lifesaver. Tools like chargeback alerts focus on intercepting and refunding a customer inquiry before it becomes a formal, fee-inducing chargeback. You can see how these systems work by exploring Disputely's pricing and features. This approach doesn't just save you from the fees; it protects the overall health of your merchant account.

The Hidden Dangers of a High Chargeback Rate

A single chargeback fee is frustrating, but the real trouble starts when those disputes pile up. To payment networks like Visa and Mastercard, this isn't about one or two unhappy customers—it’s a pattern. If your business is racking up too many chargebacks, you'll get flagged as a high-risk merchant, and that’s when a whole new world of problems begins.

We're not just talking about losing the money from a few sales anymore. A high chargeback rate puts your entire ability to accept credit cards on the line. Once you cross a certain threshold, which is often a chargeback-to-transaction ratio of just 1%, you’ll land in a monitoring program.

Think of these programs as the card network's penalty box. They’re designed to make life painful for merchants with too many disputes, and they come with hefty monthly fines that can easily run into the thousands of dollars. It's their way of saying, "Fix this, and fix it now."

The Snowball Effect of Penalties

Getting into a monitoring program is like starting a snowball rolling downhill. It gets bigger and faster, and the initial fines are just the start. Your payment processor, now viewing you as a serious financial liability, will almost certainly start taking steps to protect themselves—steps that can throw a wrench into your daily operations and cash flow.

This is where the consequences hit home. Your processor might jack up your rates, enforce stricter rules, or even start holding back a chunk of your daily sales.

Key Insight: A high chargeback rate isn't just a line item on your P&L; it's an operational crisis. It tells the entire payments ecosystem that your business might be unstable, forcing them to take drastic measures that can hamstring your company.

From Account Holds to Termination

The most common defense a processor uses is putting a reserve on your account. A reserve is simply a percentage of your money that they hold back to cover any future chargebacks. It could be a rolling reserve, where they keep a piece of every sale for a few months, or a fixed reserve, which is a lump sum they hold onto indefinitely.

This can absolutely suffocate your cash flow, making it tough to pay for inventory, run ad campaigns, or even make payroll. We see this all the time with merchants on platforms like Shopify, who suddenly face an unexpected Shopify payment hold and find themselves locked out of their own money.

It’s crucial to know what's causing these disputes. Industry data shows about 45% of chargebacks are tied to fraud. That bucket is split pretty evenly between true third-party fraud and so-called "friendly fraud," where the legitimate cardholder files the dispute. You can dig into these dispute trends and their causes to learn more.

If you don't get a handle on these issues, you face the ultimate penalty: account termination. Once your processor shuts you down, finding another one willing to take on a high-risk business is nearly impossible. For many merchants, this is game over.

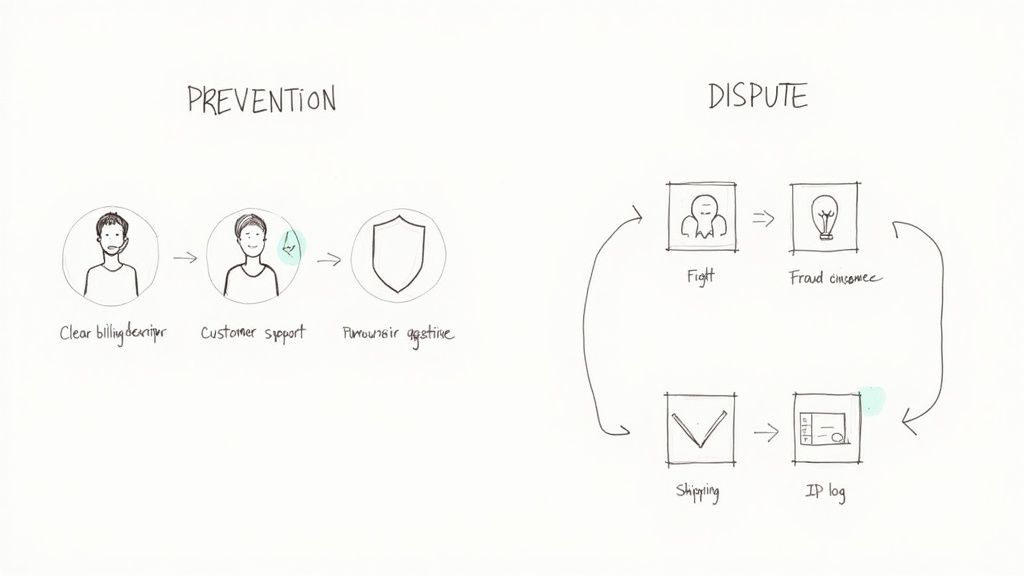

A Practical Guide to Preventing and Fighting Chargebacks

Knowing what a chargeback fee is and why it hurts is one thing. Actually defending your business against them is a whole different ballgame. To get a handle on chargebacks, you need a solid two-part strategy: first, get aggressive with prevention to stop disputes before they even happen. Second, have a methodical plan for fighting the ones that inevitably slip through.

Your best defense is a good offense. This means getting out ahead of the problem by tackling the root causes of disputes, especially the kind that come from customer confusion or frustration—what we often call "friendly fraud."

The flowchart above really lays it out. The ideal path starts with prevention and clear communication, which are your strongest shields against costly disputes.

Proactive Prevention Tactics

You'd be surprised how much of a difference a few simple operational tweaks can make. These tactics are your first line of defense, and they’re often the easiest to implement.

Use Clear Billing Descriptors: Make sure the name that shows up on your customer’s credit card statement is one they’ll actually recognize. Instead of a vague legal name like "XYZ Holdings," it should be something obvious like "BRANDNAME*RunningShoes." This one change alone can eliminate a huge number of "I don't recognize this charge" disputes.

Offer Exceptional Customer Service: Don't make customers hunt for a way to contact you. If they have a problem, they should be able to reach a real person—fast. Prominent contact info and a responsive support team can turn a potential chargeback into a simple refund request, saving you that nasty penalty fee.

Implement Fraud Detection Tools: At a bare minimum, you need to be using basic fraud filters like the Address Verification Service (AVS) and Card Verification Value (CVV) checks. These are simple but effective tools that confirm the person making the purchase likely has the physical card in their hand, weeding out a lot of straightforward fraud.

Building Your Case to Fight a Chargeback

Even with the best prevention plan, you’re still going to get hit with some illegitimate chargebacks. It just happens. When a customer disputes a perfectly valid charge, you need to be ready to fight back with a strong, evidence-based case. Your goal is to prove to the issuing bank that you held up your end of the deal.

Your response, which is often called a rebuttal, needs to be clear, concise, and absolutely packed with compelling evidence. Think of yourself as a detective putting together a case file for a judge.

Key Takeaway: A common mistake is to overwhelm the bank with a messy pile of information. A well-organized rebuttal with specific, relevant evidence will always be more effective than a long, emotional letter.

To build a case that can win, you need to gather as much of the following documentation as you can:

- Proof of Delivery: This is non-negotiable for physical products. You need shipping confirmations with tracking numbers and, most importantly, a delivery confirmation showing the package arrived at the customer's address.

- Customer Communications: Dig up any emails, support tickets, or chat logs where the customer acknowledges the purchase, asks about the product, or discusses delivery.

- Transaction Data: This is your digital proof. Submit details like the customer's IP address when they made the purchase, the AVS and CVV match results, and any device information you captured.

- Service Usage Logs: If you sell digital goods or subscriptions, show records of when the customer logged in, downloaded files, or used your service. It proves they received the value they paid for.

For any merchant dealing with more than a handful of disputes, pulling all this together manually for every single case just isn't realistic. It's a massive time-sink. This is where automation becomes your best friend. Modern tools can save you countless hours and significantly boost your win rate. You can learn more by exploring how to build a winning chargeback representment strategy that uses technology to make evidence gathering and submission a breeze.

Here’s the rewritten section, designed to sound natural and human-written:

How to Properly Account for Chargeback Fees

Chargebacks aren't just an operational headache—they can wreak havoc on your financial records if you don't stay on top of them. Getting the accounting right is crucial for seeing the real-world cost of disputes and catching worrying trends before they spiral out of control.

First things first: give these fees their own line item. It’s a common mistake to just lump a chargeback fee in with your normal credit card processing costs, but that buries the problem. You need to pull it out and put it under a microscope in your accounting software, whether you use QuickBooks, Xero, or something else.

Tracking and Categorization

To do this, you'll want to create a dedicated expense account. This gives you a crystal-clear view of exactly how much money is walking out the door due to dispute penalties alone.

- Create an Expense Account: Simply label an account "Chargeback Fees" or "Dispute Fees." It’s straightforward and effective.

- Consider Cost of Goods Sold (COGS): Alternatively, some businesses roll these fees into COGS. The logic here is that a chargeback fee is a direct cost of a sale that went wrong.

The goal is to isolate these fees so you can run reports that show the true cost of disputes. Your accounting data stops being a simple historical record and becomes a powerful diagnostic tool for your business's health.

Think about it this way: running a monthly report on your "Chargeback Fees" account can instantly flag a spike. Let's say you see fees triple right after launching a new product. That’s a massive red flag. It could point to anything from a quality control issue to a misleading product description on your website. This kind of financial clarity helps you connect the dots back to operational problems, so you can fix the root cause and protect your bottom line.

Got Questions? We’ve Got Answers.

Chargeback fees can feel like a punch to the gut, and the whole dispute process is often murky. Let's clear the air and tackle some of the most common questions merchants ask.

Do I Get the Chargeback Fee Back If I Win the Case?

This is the million-dollar question, isn't it? Unfortunately, the answer is a frustrating "it depends." Some payment processors, like Shopify Payments, will actually refund the fee if you win the dispute. They see it as a fair reversal for a claim that shouldn't have happened.

But don't get your hopes up too high. Most of the big players, including Stripe and PayPal, have a strict no-refund policy on these fees. From their perspective, they had to spend time and resources managing the dispute, and that fee is their compensation for the work, regardless of the outcome. So, even when you’re in the right, you still lose that money.

What’s the Real Difference Between a Chargeback and a Refund?

Think of it like this: a refund is a friendly conversation, while a chargeback is a lawsuit.

When a customer asks for a refund, it's a direct interaction between you two. You agree to return their money, you keep the relationship intact, and no banks or third parties get involved. It's a simple customer service gesture.

A chargeback, however, is a formal dispute process kicked off by the customer's bank. It completely bypasses you, forcefully yanks the money from your account, and slaps you with a chargeback fee. It's an aggressive action that hurts your business reputation with payment processors.

The Bottom Line: A refund is a customer service tool. A chargeback is a formal dispute that counts as a black mark against your merchant account. Always, always encourage unhappy customers to talk to you about a refund first.

How Long Am I Stuck Waiting for a Chargeback to Be Resolved?

Get ready to be patient, because the chargeback process moves at a snail's pace. You're typically looking at a timeline of 30 to 90 days, but it can easily drag on for much longer.

The whole thing is a slow back-and-forth between the customer’s bank (the issuer), the card network (like Visa or Mastercard), and your bank (the acquirer). Each stage has its own deadline, from the limited window you get to submit your evidence to the final decision from the card network. All the while, that disputed revenue is tied up, leaving a hole in your cash flow.

Can I At Least Write Off the Chargeback Fee on My Taxes?

Here’s a small silver lining: in most cases, yes. Chargeback fees are generally considered a cost of doing business, just like your other bank fees or payment processing costs. That means you can typically deduct them as a business expense on your taxes.

Just make sure you're tracking them properly in your accounting software. Categorize them clearly so you don't miss the deduction come tax season. Of course, it's always a good idea to chat with your accountant or a tax professional to make sure you're following the specific rules for your business and location.

Stop losing money to surprise disputes. Disputely integrates directly with card networks to provide real-time alerts, giving you the power to refund a transaction before it turns into a costly chargeback. Protect your revenue and your merchant account at https://www.disputely.com.