What Is Chargeback Fraud and How Can You Stop It?

At its heart, chargeback fraud is what happens when a customer disputes a legitimate credit card charge, telling their bank it wasn't them or something was wrong, even when they got exactly what they paid for.

Think of it as digital shoplifting. The buyer gets to keep the product and gets their money back by gaming the system. This abuse of consumer protection policies is a silent killer for a merchant's revenue.

Understanding Chargeback Fraud: The Silent Revenue Killer

To really grasp what chargeback fraud is, you have to separate it from a valid dispute. The chargeback mechanism was created for a good reason—to protect people from genuine issues like credit card theft or a business that never shipped their order. Chargeback fraud is simply the intentional misuse of that safety net.

In a fraudulent scenario, the customer contacts their bank to start the dispute. The bank then yanks the funds from your account and provisionally returns them to the cardholder. Suddenly, the burden of proof is on you to show the transaction was legitimate. This isn't just a refund; it's a forced reversal that piles on extra fees and penalties, making it far more costly.

The Key Players and Their Roles

To get a clearer picture of how this all unfolds, it helps to understand who's involved. The table below breaks down the key players and their roles when a dispute is fraudulent.

Chargeback Fraud At A Glance

| Component | Description in a Fraudulent Scenario |

|---|---|

| The Customer | The person who made a valid purchase but later disputes the charge, often claiming it was unauthorized or the item never arrived. |

| The Merchant | Your business, which delivered the product or service as promised but now loses the revenue, the merchandise, and gets hit with fees. |

| The Issuing Bank | The customer's bank, which investigates the claim. They tend to side with their cardholder by default, initiating the chargeback process. |

This dynamic stacks the deck against merchants. The bank acts as the initial judge and jury, and their primary relationship is with their customer, not you. This setup makes it incredibly tough for businesses to win, even with solid evidence.

The problem is massive and growing. Fraudulent chargebacks are on track to cost businesses a staggering $15 billion worldwide in 2025. That number doesn't even include legitimate disputes, which highlights just how severe this intentional abuse has become. You can explore more data about this growing problem to see the full financial impact.

A fraudulent chargeback is not a victimless action. It directly pulls revenue from your account, costs you the shipped product, and adds operational strain as your team scrambles to fight a battle you've already lost financially.

Ultimately, chargeback fraud turns a system designed for consumer protection into a weapon against honest businesses. Understanding this is the first and most critical step in building a defense that actually works.

The Two Faces of Fraud: Friendly vs. Malicious Intent

Not all chargeback fraud is created equal. To build a solid defense, you first have to understand the critical difference between friendly fraud and true criminal fraud. It’s your first tactical step, because confusing the two will lead you down a path of ineffective strategies and wasted resources.

Think of it this way: criminal fraud is a deliberate break-in. Someone smashes the window with the clear intent to steal. Friendly fraud, on the other hand, is more like a houseguest who "forgets" to pay for their stay. Both hurt your bottom line, but they demand entirely different responses.

Understanding Friendly Fraud

Friendly fraud happens when a real customer disputes a charge they actually made. It’s often not done with malicious intent, but instead grows out of confusion, convenience, or a simple misunderstanding. Frankly, this is the type you’ll see most often.

So, what does this look like in the wild?

- Family Purchases: A teenager uses their parent’s saved card for an in-game purchase, and the parent has no idea what the charge is when it appears on their statement.

- Forgotten Transactions: A customer genuinely forgets about a recurring subscription or a small purchase they made weeks ago. Life gets busy.

- Unclear Billing Descriptors: Your company’s name on their bank statement is abbreviated or just plain confusing, leading them to think it’s a fraudulent charge.

- Buyer’s Remorse: The customer regrets their purchase and decides it’s easier to file a chargeback than to follow your official return process.

That last point is a huge one. Friendly fraud now makes up more than 70% of all chargebacks, which shows just how often a system designed to protect consumers gets misused. A big part of the problem is that 72% of shoppers don't get the difference between a chargeback and a regular refund. Over half of them just skip contacting the merchant altogether. You can read the full analysis on chargeback statistics to see just how much this trend hurts businesses like yours.

Friendly fraud is so tricky because it starts as a perfectly valid transaction with a real customer. They have your product or used your service, but they’ve decided—either by accident or on purpose—to get their money back through their bank instead of you.

Recognizing Malicious Criminal Fraud

On the complete other end of the spectrum is criminal fraud. This is a premeditated attack, plain and simple. It’s what most of us picture when we hear the word "fraud"—a criminal using stolen credit card information to make purchases they have no intention of paying for.

Here, the goal is pure financial gain for the fraudster. They’ll often use stolen card numbers bought on the dark web to purchase high-value items that are easy to resell, like electronics or designer goods. Unlike friendly fraud, there's no legitimate customer relationship to begin with. The real cardholder is a victim, just like your business.

Telling these two types of fraud apart is absolutely essential. A strategy designed to educate a confused customer will do nothing to stop a determined criminal, and a heavy-handed approach could alienate a good customer who just made a mistake. Knowing who you're up against dictates your entire defense.

The True Cost of Chargebacks on Your Business

Think a chargeback is just a refund? Think again. It’s more like a financial gut punch that sends damaging ripples through your entire business. The initial lost sale is just the tip of the iceberg; the real cost is a brutal multiplier effect that turns one bad transaction into a cascade of hidden fees and operational headaches.

When a chargeback hits, it’s not just the sale amount that vanishes from your account. You’re also out the cost of the merchandise you shipped, which is now gone for good. Then, your payment processor slaps you with a non-refundable chargeback fee, typically anywhere from $20 to $100 per dispute. All of a sudden, that $50 sale has morphed into a $150 loss.

The Financial Multiplier Effect

It’s shocking how fast the costs add up with every single dispute. Let's look at the direct financial hits you take:

- Lost Revenue: The original sale amount is clawed back from your merchant account.

- Product Loss: You’re out the cost of goods sold (COGS) for the item you sent.

- Chargeback Fees: You get hit with a penalty fee from your payment processor just for the dispute.

- Processing Fees: Those original credit card processing fees? You don’t get those back, either.

This nasty combination means you’re not just back to zero on the sale—you’re deep in the red. Now, imagine this happening dozens or even hundreds of times a month. The financial bleeding can become catastrophic.

Operational Drain and Long-Term Risks

Beyond the immediate financial sting, chargeback fraud is a massive time sink. Your team has to drop everything to go on an evidence hunt, digging through order details, shipping confirmations, and customer emails just to build a case to fight back. This administrative black hole kills productivity and pulls focus from what actually grows the business.

But the most dangerous threat is the long-term damage to your merchant account's health. Payment networks like Visa and Mastercard are always watching your chargeback-to-transaction ratio. If that number creeps too high, you get flagged as a "high-risk" merchant.

That "high-risk" label is a business killer. It can lead to your processor holding back a huge chunk of your revenue in a rolling reserve, or worse, they could just shut down your merchant account entirely. And without the ability to process payments, your business is dead in the water. This is why fighting chargeback fraud isn't just a good idea—it's a matter of survival.

How to Spot Fraud Before It Happens

The best way to fight chargeback fraud is to stop it before it even starts. Think of it as having a great security guard at the door of your store—you want to spot trouble before someone walks out with your merchandise, not chase them down the street afterward. Getting good at this means you can flag sketchy orders for a closer look and shut down fraudsters before they cost you real money.

Learning to spot fraud is all about pattern recognition. You start to see little red flags and inconsistencies that just don't line up with how a normal, happy customer behaves. These signals are your early warning system, telling you that a transaction might not be on the level.

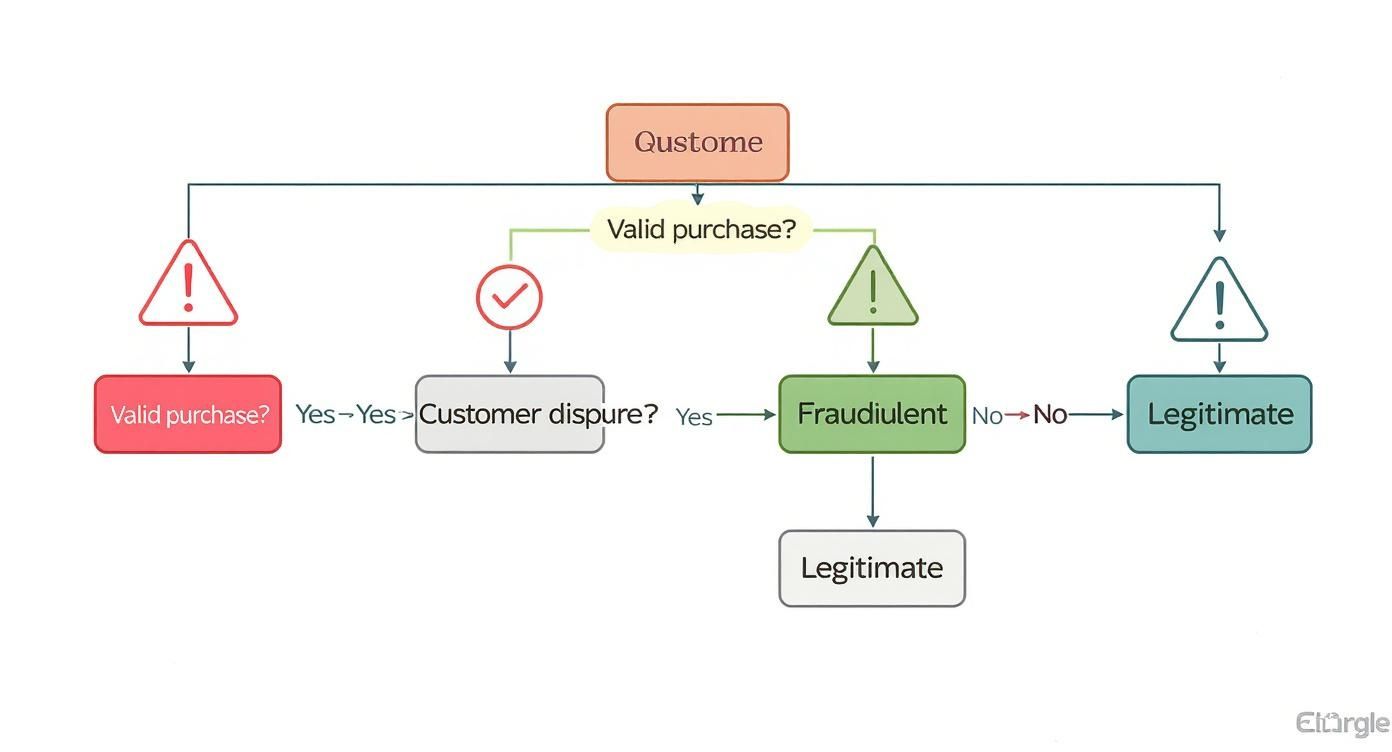

This simple flowchart gives you a good visual of how to think through a purchase and decide if it's legit or not.

As you can see, it all boils down to two key stages: first, figuring out if the purchase itself is valid, and second, determining if a dispute that comes in later is a genuine problem or a bogus claim.

Key Transactional Red Flags

Some orders just feel off from the moment they come in. While a single one of these signals might be a coincidence, when you see a few of them pop up in the same order, it's a huge indicator of potential fraud.

Mismatched Addresses: The billing address is in California, but the shipping address is in a different state or, even more suspiciously, a different country. This is a classic move where a thief uses a stolen card but has the goods sent to a location they can access.

Unusual Order Velocity: A customer you've never seen before suddenly places an enormous order or a bunch of high-value orders in a few minutes. Real first-time customers usually test the waters with a smaller purchase.

Expedited Shipping Urgency: The buyer selects the most expensive, overnight shipping without a second thought. Criminals aren't trying to save a buck; they want to get their stolen goods as fast as possible before the legitimate cardholder spots the fraudulent charge and cancels the card.

A single suspicious transaction might seem small, but it’s often a test run. If it goes through, the fraudster knows your store is an easy target and will likely come back for a much bigger score, multiplying your losses.

Behavioral and Payment Signals

It's not just what they buy, but how they buy it. The way someone behaves during checkout can tell you a lot about their intentions. Fraudsters just don't act like regular customers.

Multiple Failed Attempts: You see a string of declined payments with different card numbers, expiration dates, or CVV codes, and then suddenly, one goes through. This is a huge red flag that someone is running through a list of stolen card details, hoping one will eventually work.

Proxy or VPN Usage: The IP address placing the order traces back to a known VPN or proxy service. While some people use VPNs for privacy, fraudsters rely on them to hide their real location and make themselves harder to track.

Common Red Flags for Potential Chargeback Fraud

It's helpful to know which red flags point toward criminal fraud versus friendly fraud. While there can be overlap, certain behaviors are more common to one type than the other. This table breaks down some common indicators to watch for.

| Red Flag Indicator | Potential Criminal Fraud Signal | Potential Friendly Fraud Signal |

|---|---|---|

| Address Mismatch | Billing and shipping addresses are in different countries or high-risk areas. | Minor discrepancies, like a typo or an old address on file. |

| Order Size/Velocity | Unusually large first-time order or multiple rapid-fire orders. | A sudden, uncharacteristic splurge from an existing customer. |

| Shipping Method | Demands for the fastest, most expensive shipping, regardless of cost. | A normal shipping choice, with no sense of urgency. |

| Contact Information | Uses a disposable email address (e.g., mailinator.com) or a fake phone number. | Uses a legitimate, long-standing email address and valid phone number. |

| IP Address Origin | IP address is from a high-risk country or a known proxy/VPN service. | IP address matches the customer's billing location. |

| Payment Attempts | Multiple failed payments with different card details before a successful transaction. | A single failed attempt due to an incorrect CVV or expired card, then corrected. |

Recognizing these signals in real-time is your first line of defense. By flagging these transactions for manual review, you can often stop a fraudulent chargeback before the product even leaves your warehouse.

Building Your Proactive Defense Strategy

Just spotting a sketchy order is one thing, but if you really want to shut down chargeback fraud, you need to get proactive. This isn't about just playing defense; it's about going on the offensive.

A solid strategy blends smart tech with even smarter, customer-focused policies. The idea is to build a fortress around your revenue—making your store a terrible target for criminals while creating a smooth, trustworthy experience for your actual customers.

Hardening Your Technical Defenses

Your first line of defense is the automated tools that come with your payment processor. Think of these as your digital bouncers, checking IDs at the door to validate a transaction's authenticity right at the point of sale.

Each of these adds another hurdle for anyone trying to use stolen card details.

- Address Verification System (AVS): This is a basic but crucial check. AVS confirms that the billing address the customer typed in matches what the credit card company has on file. A mismatch is a classic red flag.

- Card Verification Value (CVV): You know that little three- or four-digit code on the back of the card? Requiring it proves the person making the purchase physically has the card. It’s a simple step that stops a huge amount of fraud from breached card number lists.

- 3D Secure (e.g., Verified by Visa, Mastercard SecureCode): This one is a game-changer. It adds an extra pop-up where the cardholder has to enter a password or a one-time code sent to their phone. This directly confirms their identity with their bank, shifting liability away from you.

No single tool is a silver bullet, but layering them together creates a seriously tough barrier. They quietly filter out the most blatant fraud attempts before they ever hit your dashboard.

Strengthening Your Operational Practices

Tech can't stop everything, especially when it comes to "friendly" fraud. This is where your own business practices come into play—your policies, your communication, and your customer service are just as critical.

A confused or frustrated customer is far more likely to file a chargeback than one who feels heard and respected. Excellent service isn't just a best practice—it's a core component of your fraud defense.

Start with the basics. Your product descriptions need to be brutally honest and detailed, with great photos from every angle. This heads off any "item not as described" claims before they can even start.

Next, look at your return and refund policies. Are they buried in fine print? Make them easy to find, easy to understand, and fair. A customer who sees a clear path to a return is much less likely to take the chargeback shortcut.

Finally, make your customer service top-notch and easy to reach. When someone has a problem, they need to know they can contact you and get a fast, helpful answer. This builds trust and gives them a reason to work with you, not against you. This is especially important as platforms crack down on high-risk merchants; managing disputes well can help you avoid a painful Shopify Payments account hold. A proactive approach here isn't just a good idea—it's essential.

How to Respond When a Chargeback Occurs

So, despite your best efforts, a chargeback notice has landed in your inbox. It’s a frustrating moment, but it’s not the end of the road. Don't panic—it's time to act.

Think of the representment process as your chance to state your case. It’s your opportunity to assemble a rock-solid file of evidence showing the transaction was completely legitimate and that you held up your end of the deal.

This is exactly why diligent record-keeping is so crucial. The moment a dispute is filed, a timer starts, and you often have a very narrow window to respond. Speed is everything here. If you miss that deadline, it's an automatic loss, no matter how compelling your evidence might be.

Gathering Your Compelling Evidence

To win a chargeback dispute, you need to clearly demonstrate two things: the customer authorized the purchase, and they received what they paid for. Your response should be a clean, organized package of proof that makes your case for you.

Start pulling together every bit of relevant information you can find.

- Proof of Delivery: This is your heavyweight evidence. A shipping confirmation with a tracking number showing the package was delivered to the customer’s address is incredibly powerful.

- Order Communications: Dig up all the emails, support tickets, or chat logs you exchanged with the customer about their order.

- Transaction Details: Include the digital fingerprints of the purchase—things like AVS and CVV match results, the customer's IP address, and any device information you collected at checkout.

- Usage Logs: If you sell digital goods or services, this is your gold. Provide logs showing the customer downloaded, logged into, or used what they bought.

Your evidence file needs to tell a clear, simple story that leaves no room for interpretation. The more detailed and organized it is, the higher your chances of getting that chargeback reversed and your money back.

Building Your Rebuttal Letter

With all your proof in hand, the next step is to write a professional rebuttal letter. This is a concise summary of your case for the issuing bank. It explains why the charge is valid and points directly to the specific evidence you’ve attached to back up your claims. Think of it as your closing argument.

You won't win every single time, but a meticulously documented response drastically shifts the odds in your favor. It also sends a clear signal to banks that you take fraudulent claims seriously and are prepared to fight them.

For a deeper dive into crafting winning responses, check out our guides on mastering the chargeback representment process to protect your revenue.

Answering Your Top Questions About Chargeback Fraud

As a merchant, you're bound to have some nagging questions about chargeback fraud. Let's tackle some of the most common ones head-on so you can build a smarter defense for your business.

What Is an Acceptable Chargeback Ratio?

This is a big one. Generally, card networks like Visa and Mastercard want to see your chargeback ratio stay below 1%. Once you start creeping over that line, you're heading into high-risk territory.

What does that mean for you? It can trigger higher processing fees, force you to keep a cash reserve with your processor, or, in a worst-case scenario, get your merchant account shut down entirely. It's a simple calculation: the number of chargebacks you get in a month divided by your total transactions for that same month.

Can I Prevent All Chargeback Fraud?

Let's be realistic: stopping 100% of chargeback fraud isn't going to happen. The real goal is to make your business a less appealing and much more difficult target for fraudsters.

Think of it like home security. You can't guarantee a burglar will never try, but strong locks, an alarm system, and good lighting make them far more likely to just move on to an easier house. A proactive approach using fraud detection tools (like AVS and CVV checks), clear and upfront store policies, and genuinely helpful customer service is your best defense. Most of the time, this combination nips potential disputes in the bud.

Is It Worth Fighting Small-Dollar Chargebacks?

Absolutely. It might feel like a waste of time to fight over a small amount, but the principle is what matters here. Consistently fighting every illegitimate dispute sends a clear signal.

You're showing issuing banks and would-be fraudsters that you're paying attention and won't be an easy mark. Over time, this builds a reputation that helps protect your all-important chargeback ratio and discourages people from attempting friendly fraud in the first place. If you're looking for more strategies on this, check out the resources on the Disputely blog.

Ready to stop chargeback fraud before it happens? Disputely integrates directly with card networks to provide real-time alerts, giving you the power to refund a dispute and prevent up to 99% of chargebacks from ever hitting your account.

Protect your business and your revenue now at https://www.disputely.com