What Is Friendly Fraud and How Do You Stop It

Let's get one thing straight: friendly fraud isn't friendly at all. It’s when a customer buys something from you, receives it, and then calls their bank to dispute the charge. They claim it was unauthorized or wrong, even though they’re the ones who made the purchase.

This isn't a simple misunderstanding; it's a legitimate transaction turned into a costly headache for your business, thanks to a system designed to protect consumers that's now being misused.

The Merchant's Hidden Threat: Understanding Friendly Fraud

Think about it this way. A diner sits down at a restaurant, orders a three-course meal, polishes off every last bite, and then quietly slips out. A week later, they tell their credit card company the restaurant billed them fraudulently. In the physical world, that sounds ridiculous. But in ecommerce, it happens every single day.

That’s the essence of friendly fraud.

This isn't your typical criminal fraud where a thief steals credit card details. With friendly fraud, the perpetrator is the actual cardholder—your customer. They initiate a chargeback on a purchase they absolutely made, which puts you in a tough spot. You’re forced to prove a transaction was legitimate to the very person who knows it was.

Accidental vs. Intentional: The Two Faces of Friendly Fraud

It’s crucial to know that not all friendly fraud comes from a place of bad faith. Sometimes, it’s a genuine mistake. A customer might not recognize your store's billing descriptor on their bank statement, or they might have simply forgotten about a small purchase they made weeks ago. There’s no malice here, just confusion.

Then there's the other side of the coin: intentional friendly fraud, often called "cyber-shoplifting." This is where a customer knowingly games the system to get something for free. Maybe they have buyer's remorse, or perhaps they just don't want to deal with your standard return process. They've learned that hitting the "dispute charge" button is faster and easier, and they assume there are no consequences.

The chargeback system was built to shield consumers from actual theft. But for many, it's become a convenient, no-questions-asked refund button. This abuse of the system forces merchants to absorb the financial hit from both honest mistakes and outright deception.

To get a clearer picture, it's helpful to see how friendly fraud stacks up against traditional, criminal fraud.

Friendly Fraud vs Criminal Fraud At a Glance

This table breaks down the key differences at a high level.

| Characteristic | Friendly Fraud | Criminal Fraud |

|---|---|---|

| Perpetrator | The legitimate cardholder | A thief using stolen card details |

| Intent | Can be accidental or intentional (to get free goods) | Always malicious (to steal money or goods) |

| Detection Method | Hard to detect pre-transaction; often identified after a chargeback | Can be flagged by AVS, CVV mismatches, or velocity checks |

| Merchant's Challenge | Proving a legitimate customer made a legitimate purchase | Proving the transaction was unauthorized |

As you can see, the lines are quite clear once you know what to look for.

The Key Players in Every Dispute

When a friendly fraud chargeback lands on your desk, three parties are immediately pulled into the ring:

- The Customer (Cardholder): The person who made the purchase and is now disputing it.

- The Merchant (Your Business): You, who fulfilled the order in good faith and now have to defend the sale.

- The Banks (Issuing & Acquiring): The customer's bank (the issuer) starts the chargeback, and your bank (the acquirer) is supposed to help you fight it.

Getting a handle on these roles is the first step toward building a defense. This guide will show you exactly how to protect your business from this sneaky and damaging threat.

The True Financial Impact of a Single Chargeback

A chargeback feels like a simple refund, but it's not. It's a financial gut punch, and its real cost goes way beyond the original sale amount. When a customer commits friendly fraud, they’re weaponizing a system that was designed to protect them, and you're the one who pays the price. Every single dispute kicks off a chain reaction of hidden costs that can quickly turn a good sale into a bad loss.

The moment a chargeback is filed, the transaction funds are immediately yanked from your account. But that's just the tip of the iceberg. The real financial drain is just getting started.

Deconstructing the Hidden Costs

The true damage from friendly fraud comes from all the expenses that pile up after you’ve already lost the revenue. These are the non-recoverable costs that make every dispute so toxic to your bottom line.

So, what do you actually lose?

- Non-Refundable Processor Fees: Your payment processor hits you with a penalty fee for every single chargeback, usually between $20 to $100. You have to pay this whether you win the dispute or not. It’s gone.

- Lost Cost of Goods: If you sell physical products, you’ve already paid for the item that was shipped out. The customer keeps the product, so you've lost both the sale revenue and the money you spent on the inventory.

- Operational and Labor Costs: Time is money, right? Your team has to stop what they're doing to gather evidence, write rebuttals, and manage the whole back-and-forth. Those are valuable hours that could've been spent actually growing the business.

This financial reality is startling. Friendly fraud has exploded, now accounting for as much as 70% of all credit card fraud. The damage is so severe that a single chargeback can end up costing merchants two to four times the original transaction amount once you add up all the hidden costs. You can get more insights on this multi-billion dollar trend over on the Mastercard blog.

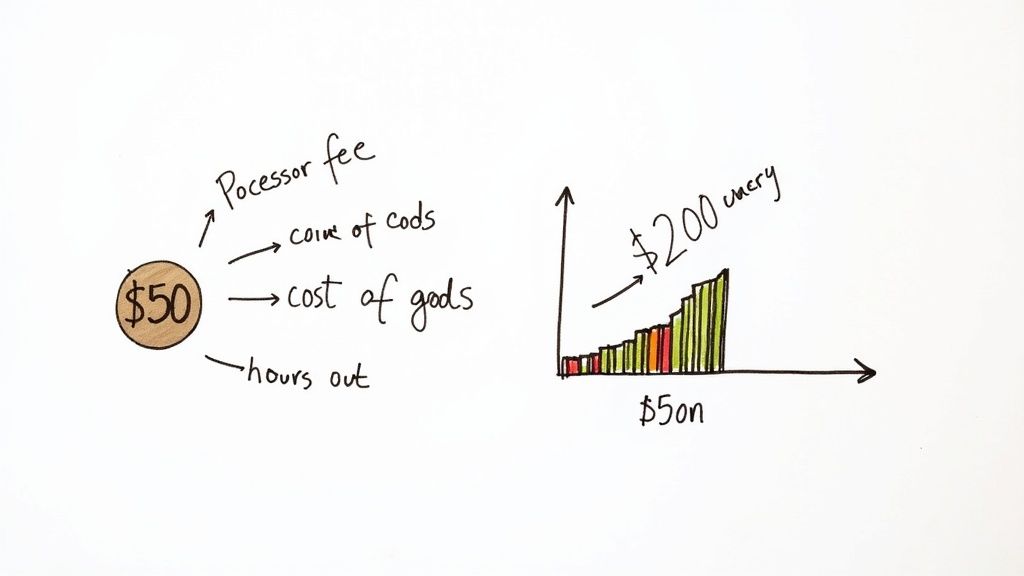

A Real-World Example of the Damage

Let’s break it down with a simple, everyday scenario. Say a customer disputes a $50 purchase.

- Original Sale Lost: -$50

- Chargeback Fee (average): -$35

- Cost of Goods Sold (let's say 50% margin): -$25

- Shipping & Handling Costs: -$10

- Operational Hours (1 hour at $30/hr): -$30

In this scenario, that single $50 chargeback has actually cost your business a staggering $150. You've effectively paid three times the product's value for what was initially a legitimate sale.

This is how quickly the costs spiral out of control. If you’re running on thin margins, just a few of these disputes can completely wipe out a day's worth of profits.

The Threat of the Chargeback Ratio

It gets worse. Beyond the cost of each transaction, every chargeback chips away at your relationship with payment processors. Card networks like Visa and Mastercard are constantly watching your chargeback ratio—that’s the number of chargebacks you get compared to your total number of transactions.

If that ratio creeps over the network's threshold (often around 0.9%), you’re in for a world of hurt. The penalties can be severe:

- Higher processing fees on all your transactions.

- Placement in a monitoring program, which comes with its own hefty monthly fines.

- Account termination, which means you can no longer accept credit card payments at all.

For an ecommerce business, losing your merchant account is a death sentence. This is why managing your chargeback ratio isn’t just about saving money on individual disputes; it's about making sure your business can survive long-term. Getting ahead of these risks with a proactive strategy, like conducting a Q4 audit of your dispute vulnerabilities, is essential. It makes fighting friendly fraud a non-negotiable part of doing business today.

Of course. Here is the rewritten section with a more natural, human-expert tone.

So, Why Does Friendly Fraud Actually Happen?

To get a handle on friendly fraud, you have to get inside the customer’s head. Why would a paying customer—someone who willingly bought from you—turn around and dispute a charge they actually made? It’s not always as sinister as it sounds. Often, it's a messy cocktail of confusion, convenience, and sometimes, a deliberate attempt to get something for nothing.

Figuring out the "why" is the first real step toward protecting your business. The reasons usually fall into one of two buckets: genuine customer mistakes or a calculated abuse of the chargeback system.

When Good Customers Go Wrong (By Accident)

Let's be clear: not every friendly fraud case involves a scammer. A lot of the time, it’s just an honest-to-goodness mistake that snowballs into a chargeback. Your customer isn't trying to rip you off; they're just confused, forgetful, or in the dark about a purchase.

These accidental disputes usually pop up from everyday mix-ups that create a gap between the moment of purchase and the line item on their bank statement.

- "What on earth is this charge?" The customer scrolls through their credit card statement and sees a cryptic charge from "GLB*WEBSERVICES" instead of "Pete's Premium Coffee Beans." They don't recognize it, panic, and hit the "dispute" button.

- The Family Card Sharer: A teenager grabs their parent's saved card info to buy a new skin in a video game, or a spouse orders something without mentioning it. When the primary cardholder sees the charge later, they assume it's fraudulent and report it.

- The "Oops, I Forgot" Subscription: Someone signs up for a free trial, loves it, but completely forgets it will auto-renew. A month later, a charge appears, and they dispute it, convinced they never authorized a payment.

In these cases, the customer isn't the villain. They're just reacting to information they don't understand. This is where crystal-clear communication from your end can make all the difference.

The Problem of Intentional 'Cyber-Shoplifting'

Then you have the other side of the coin: intentional friendly fraud. This is a much more calculated move where the customer knows perfectly well the charge is valid but disputes it anyway. It's a modern form of theft that many call "cyber-shoplifting," and unfortunately, it's on the rise.

It doesn't help that modern banking apps have made this incredibly easy. A customer can dispute a charge with a few taps on their phone, making it feel like a simple, no-fuss way to get their money back without ever having to talk to the merchant.

The reasons people do this on purpose can vary, but a few common themes emerge.

To help you spot potential trouble spots, let's break down the most common triggers for friendly fraud.

Common Triggers for Friendly Fraud

This table categorizes the common causes of friendly fraud to help merchants identify potential weak points in their customer experience and transaction processes.

| Cause Category | Specific Trigger Example | Primary Motivation |

|---|---|---|

| Customer Confusion | An unclear or generic billing descriptor appears on the bank statement. | Mistake |

| Unrecognized Purchase | A family member makes a purchase without the cardholder's knowledge. | Mistake |

| Service Cancellation Issues | The customer believes they canceled a subscription, but it auto-renews. | Frustration/Mistake |

| Buyer's Remorse | A customer regrets an expensive purchase but wants to avoid a return. | Convenience |

| Shipping Dissatisfaction | An order arrives a day later than the customer expected. | Impatience |

| Product Not as Expected | The item doesn't perfectly match the online photos or description. | Disappointment |

| Opportunistic Theft | The customer receives the item and disputes the charge to get it for free. | Intentional Fraud |

As you can see, the motivations range from genuine confusion to outright theft. This is why a one-size-fits-all approach to chargebacks simply doesn't work.

This behavior gets a boost from social media, where so-called "chargeback hacks" are shared as a clever way to get free stuff, making theft seem normal. As this mindset spreads, it's merchants like you who are left cleaning up the mess. Understanding both the accidental and the intentional reasons is your key to building a smart strategy—one that helps confused customers while shutting down those who are trying to abuse the system.

Building Your Case Against a Friendly Fraud Claim

https://www.youtube.com/embed/E9aecVGMwa4

Getting a chargeback notice can feel like a punch to the gut. It's easy to take it personally, but it's crucial to see it for what it is: a business process you can manage, not an automatic loss. While the system often seems to lean in the cardholder's favor, you absolutely have the right to fight for legitimate transactions.

This process is called representment. It’s your chance to lay out all the evidence and prove the charge was valid. But just firing back a response without a solid plan is a recipe for failure. You need a methodical approach to gather compelling proof and build a case that’s simply too strong for the issuing bank to ignore.

Identifying Red Flags Before a Dispute Occurs

Honestly, the best defense starts way before a chargeback ever lands on your desk. By learning to spot suspicious transaction patterns, you can often flag potential friendly fraud risks and step in to either verify the purchase or stop a dispute before it even happens.

Keep an eye out for these common warning signs:

- Mismatched Addresses: The billing address is in California, but the shipping address is in Florida. It's worth a closer look.

- Unusually Large Orders: You see a first-time customer drop a massive order, far bigger than your average sale.

- Rapid, Repeat Purchases: Someone makes several separate orders for high-ticket items in a very short amount of time.

- Expedited Shipping Requests: The buyer pays a premium for overnight shipping, a common tactic to get products fast before filing a dispute.

When you see these red flags, you don't always have to cancel the order. Sometimes, a simple verification email or a quick phone call is all it takes to confirm the purchase is legit and scare off a potential fraudster.

Gathering Compelling Evidence for Representment

Once that chargeback is filed, the clock is ticking. You usually have a very limited time to respond. Your representment case needs to be a clean, clear package of evidence that leaves no room for doubt. Think of yourself as a detective putting together a case file.

Your mission is to prove two simple things: the real cardholder authorized the purchase, and they received exactly what they paid for.

Key Takeaway: A strong representment case isn't just about showing a transaction happened. It's about telling the complete story of the purchase, from the moment the customer landed on your site to the second they received their order.

This is critical because a customer's motive can shift. What might start as a simple question can quickly turn into an intentional attempt to get something for free.

This image really drives home the point: whether the initial intent was accidental or not, the financial hit to your business is the same. That's why having your evidence in order is non-negotiable.

Your Essential Evidence Checklist

To build a case with a real chance of winning, you need to pull together as much of the following documentation as you can:

- Transaction Details: Get the basics down—date, time, and purchase amount. But also include the customer's IP address and the device information they used.

- AVS and CVV Results: Show that the Address Verification System (AVS) and Card Verification Value (CVV) checks passed. This is solid proof that the person making the purchase had the physical card in their hands.

- Customer Communications: Dig up every email, chat log, or support ticket you have with the customer. These can demonstrate they were happily engaging with you after the purchase.

- Proof of Delivery: This is your silver bullet. A shipping confirmation number with tracking that shows the package was delivered to the customer’s address is incredibly powerful evidence.

- Terms of Service: Provide a screenshot showing the customer had to check a box agreeing to your terms of service, especially your refund and return policies.

Friendly fraud is exploding. Global chargeback volume is on track to hit 337 million every year by 2026. What’s even more wild is that 43% of consumers openly admit to disputing a legitimate charge. With merchant win rates for these disputes often dipping below 20%, a rock-solid representment strategy is more important than ever.

As you build your defense, it’s helpful to look into general strategies for false claims removal to get a better handle on the principles of fighting back. For more direct help with your chargeback responses, a focused plan like this q4-representment guide can dramatically increase your chances of getting your money back.

Proactive Strategies to Prevent Friendly Fraud

The old saying "an ounce of prevention is worth a pound of cure" has never been more true than when it comes to chargebacks. While knowing how to fight a dispute is a crucial skill, the real win is stopping it from ever happening.

A smart, proactive strategy is your best defense. It's about building layers of protection that address everything from simple customer confusion to deliberate abuse, starting the moment a shopper visits your site.

Think of it like this: a robust fraud protection system, like the one Disputely illustrates here, acts as a shield for your entire business. By combining crystal-clear communication with the right technical tools, you can dramatically lower your risk of getting hit with friendly fraud.

Strengthen Your Communication and Customer Service

You'd be surprised how many friendly fraud cases start as a simple misunderstanding. A customer sees a weird charge on their statement, gets frustrated trying to make a return, or can't get a quick answer to a question.

By making your policies totally transparent and your support team easy to reach, you can solve these problems long before they escalate into a formal dispute. Your customer service should be your first line of defense. In fact, make it ridiculously easy for a customer to get a refund from you directly—so easy that filing a chargeback with their bank seems like too much work.

Here are a few high-impact communication practices to put in place:

- Use Clear Billing Descriptors: Make sure the name on your customer's credit card statement is one they’ll actually recognize. Instead of a generic "SP * WEB SVCS," use your brand name, like "SP * PETE'S COFFEE."

- Send Detailed Confirmations: Right after a purchase, fire off a comprehensive email receipt. It should include what they bought, the total cost, and your store's name. Follow that up with shipping and delivery notifications.

- Maintain a Hassle-Free Return Policy: A complicated or super-strict return policy is a recipe for chargebacks. If a customer has buyer's remorse, a difficult return process will push them straight to their bank. Make your policy clear, fair, and impossible to miss on your website.

The hard truth is that friendly fraud isn't a rare fluke anymore; it's a common threat. Today, a shocking 80% of chargebacks are considered abusive. This means they're disputes on legitimate transactions where no actual fraud took place. This shift makes prevention more critical than ever.

Implement Technical Fraud Prevention Tools

Great service is essential, but it won't stop everything. You also need a technical toolkit that can automatically verify transactions and flag sketchy activity. These tools work quietly in the background to confirm a buyer's identity and assess the risk of each order.

This creates a powerful barrier against both accidental and intentional friendly fraud.

Many of these tools are standard features on major payment processors and e-commerce platforms. If you're on Shopify, for example, just making sure these settings are turned on can be a huge step in securing your business and avoiding a painful https://disputely.com/shopify-hold.

Key Verification and Security Layers

Activating these security measures adds crucial checkpoints to every transaction. It makes it much harder for a customer to later claim a charge was unauthorized.

- Address Verification System (AVS): This tool is simple but effective. It checks the billing address the customer enters against the one their bank has on file. A mismatch is a classic red flag.

- Card Verification Value (CVV): Always require the three- or four-digit security code from the back of the card. It’s a basic way to prove the customer physically has the card in their possession.

- 3D Secure (e.g., Verified by Visa, Mastercard SecureCode): This adds an extra layer of authentication, requiring the cardholder to enter a password or a one-time code sent to their phone. The best part? It often shifts the liability for fraudulent chargebacks from you, the merchant, back to the issuing bank.

For an even stronger defense, you can explore things like biometric-first fraud prevention strategies, which add a nearly foolproof layer of identity confirmation. By combining these tools, you build a formidable defense that makes your business a much less appealing target for anyone looking to game the system.

Friendly Fraud FAQs

Even after getting a handle on the basics, you'll probably still have some lingering questions about friendly fraud. Let's tackle some of the most common ones we hear from merchants every day.

Is Friendly Fraud Actually Illegal?

The short answer is yes. When a customer knowingly disputes a legitimate charge just to get something for free, they're essentially committing theft or wire fraud.

But here's the reality: proving that criminal intent for a single customer is incredibly difficult and almost never worth the legal cost. Prosecutions are virtually unheard of. That’s why your energy is much better spent on preventing these disputes and fighting them through the credit card network’s civil process, rather than thinking about criminal charges. And of course, accidental friendly fraud isn't illegal at all, even though it costs you just as much.

Can I Ban a Customer Who Commits Friendly Fraud?

You absolutely can, and you probably should. If you have clear evidence that a customer has intentionally filed a fraudulent chargeback, you have every right to refuse to do business with them again.

Many smart merchants keep an internal blacklist to stop repeat offenders in their tracks. This means blocking their name, email, shipping address, and even their IP address from placing future orders. It’s a simple but powerful way to stop predictable losses from people who have already shown they're willing to take advantage of you.

Key takeaway: A chargeback is a painful, expensive payment dispute. A refund is a customer service gesture. Always, always try to guide unhappy customers toward a refund first. It's cheaper, keeps you in control, and protects your merchant account from getting flagged.

What’s the Real Difference Between a Chargeback and a Refund?

It all comes down to control and cost. A refund is a conversation between you and your customer. You agree to give their money back, and hopefully, the relationship stays intact. It's a clean, direct process.

A chargeback cuts you out of the conversation entirely. The customer goes over your head, straight to their bank, and the bank yanks the money from your account. This kicks off a formal, bureaucratic dispute process that hits you with non-refundable fees, forces you to gather and submit evidence, and dings your reputation with your payment processor.

How Long Do I Have to Respond to a Chargeback?

The clock starts ticking immediately, and it moves fast. This response window, officially called the representment timeframe, is set by the card networks and is non-negotiable. Generally, you’ll have somewhere between 20 to 45 days from the filing date.

But be careful—your own payment processor might give you an even shorter deadline to make sure they have time to process everything. If you miss that window, you automatically lose. You're out the money and the dispute fee, with no chance to even tell your side of the story. This is precisely why having an automated system in place is a game-changer.

Don't let friendly fraud quietly siphon away your hard-earned revenue. Disputely connects directly with the card networks, so you get an alert the instant a dispute is initiated. This gives you a critical window to simply refund the customer and stop a damaging chargeback before it ever officially hits your record. You can connect your processor in just a few minutes and see chargebacks drop by up to 99%. Protect your profits with Disputely today.