What is Payment Reversal: A Quick Guide to Preventing Chargebacks

A payment reversal is essentially the banking world's "undo" button for a transaction. It's a broad term for when funds are sent back to the customer's account, but unlike a typical refund, this process is usually kicked off by a bank or card network, not by you, the merchant.

Think of it as an early warning system—a critical heads-up before a minor issue blows up into a full-blown, and far more damaging, chargeback.

Understanding Payment Reversals and Why They Matter

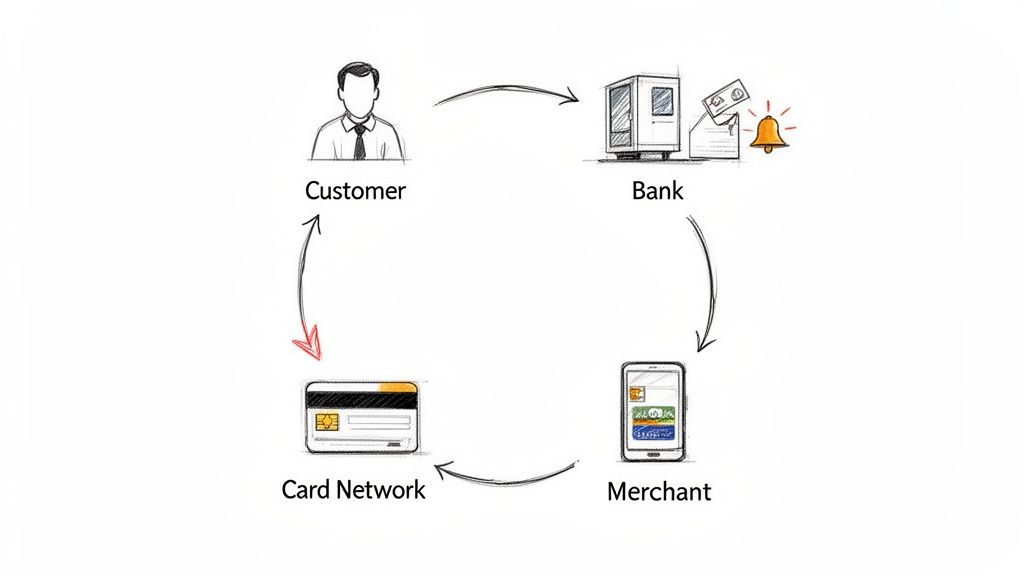

When a customer buys something from your online store, it feels simple. They click "buy," and the money appears in your account. But behind the scenes, it's a four-way conversation between the customer, their bank (the issuer), you, and your bank (the acquirer).

A payment reversal is what happens when that conversation breaks down and the money flow suddenly stops or reverses course.

It's not just a simple refund. A customer asking for their money back is a routine part of doing business. A reversal initiated by a bank, however, is a financial fire alarm. It signals a more serious problem that demands your immediate attention, especially if you're running a subscription or ecommerce business.

To help you get a quick handle on the key differences, here's a simple comparison.

Payment Reversal vs Traditional Refund At a Glance

| Attribute | Payment Reversal (Bank-Initiated) | Standard Refund (Customer-Initiated) |

|---|---|---|

| Who Starts It? | Customer's bank, card network, or acquiring bank | Customer contacts the merchant directly |

| Why It Happens | Potential fraud, authorization error, customer dispute | Dissatisfaction, wrong item, returns policy |

| Urgency | High: Precursor to a chargeback, immediate action needed | Low to Medium: Routine customer service request |

| Merchant Impact | Risk of fees, chargeback, and higher processing costs | Lost sale, but no penalties or bank involvement |

Essentially, one is a routine business interaction, while the other is a formal warning from the financial system that something is wrong.

The Key Players in a Reversal

Getting a handle on payment reversals means knowing who’s involved. Each player has a different role and motivation:

- The Customer (Cardholder): The person who made the purchase and is now questioning the charge for some reason.

- The Issuing Bank: This is the customer’s bank. Their primary job is to protect their cardholder from what they see as fraudulent or incorrect charges.

- The Merchant (You): Your business accepted the payment and now faces losing that revenue, plus potential fees.

- The Acquiring Bank: This is your business bank. It manages your payment processing and is the intermediary between you and the card networks.

Why This Matters for Your Business

A payment reversal is much more than just a lost sale. It’s a bright red flag pointing to a problem somewhere in your process—maybe a confusing billing descriptor on your customer's statement, a simple misunderstanding, or even a targeted fraud attack.

These reversals often come in the form of chargeback alerts, giving you one last chance to resolve the issue before it escalates. The stakes are massive. Chargebacks are projected to cost the global eCommerce industry a staggering $33.79 billion. And for merchants in the U.S., every dollar of fraud actually costs them $4.61 in related expenses. You can dive deeper into these eCommerce trends and their financial impact on chargeflow.io.

A payment reversal acts as a critical signal. It tells you there’s a breakdown somewhere in your sales, fulfillment, or customer service process. Addressing it proactively is essential for protecting your revenue stream and maintaining a healthy merchant account.

The Three Main Types of Payment Reversals Explained

A payment reversal isn't a single, straightforward event. It's more of an umbrella term covering a few different actions. Think of it like this: "precipitation" is the general term, but a light drizzle is a world away from a hailstorm. Each has a very different impact.

It’s the same with payment reversals. They aren’t all created equal, and knowing the difference is key because each one signals a different kind of problem and requires a completely different response from you. They can range from a simple operational correction to a serious threat to your business’s financial health.

Let's unpack the three main types you'll come across.

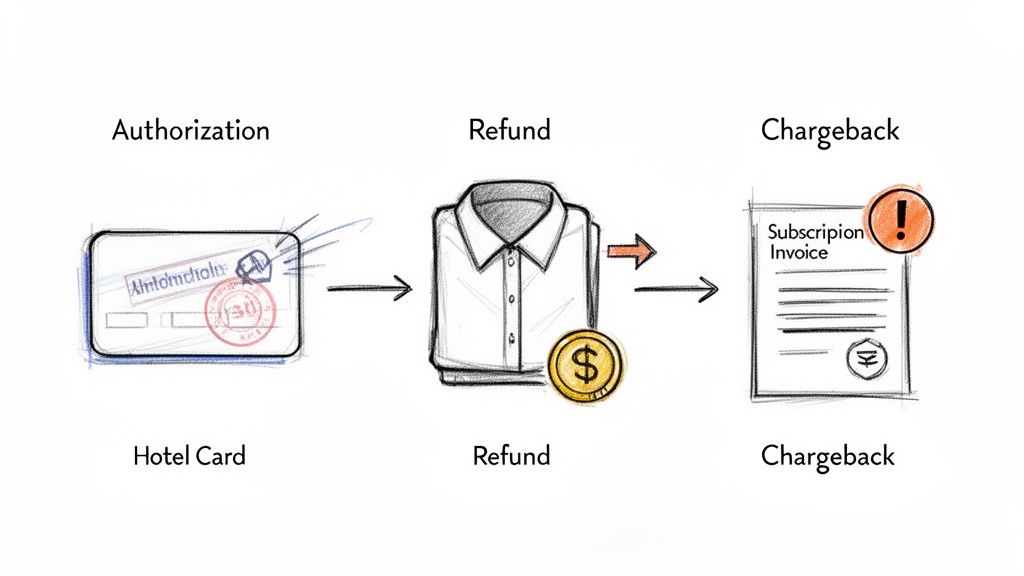

1. Authorization Reversals

An authorization reversal is the mildest type you'll ever see. It’s basically catching and stopping a transaction before any money actually changes hands. It's like calling a restaurant to cancel your takeout order before the chef has even started cooking. No harm done.

This happens in that small window of time after the customer's bank approves the sale (placing a temporary hold on the funds) but before you officially "capture" that money.

- Common Scenario: A customer accidentally clicks "buy" twice on the same item. You spot the duplicate order and cancel one before you process the payment. The temporary hold on their card simply vanishes.

- Business Impact: Practically zero. There are no fees, no penalties, and no black marks on your merchant account. It's a clean slate.

2. Refunds

A refund is the one we’re all familiar with. This is a reversal you, the merchant, initiate yourself. It happens after the transaction has been fully settled and the money is sitting in your account. You're simply sending the funds back to the customer, usually because they've asked you to.

Maybe a customer returns a sweater that didn't fit, or a subscriber wasn't happy with their first box and you agree to give them their money back. This is just part of doing business. With nearly 40% of consumers returning an online purchase at least once a month, refunds are an everyday occurrence.

While refunds certainly mean lost revenue and maybe some shipping costs, they're often a sign of good customer service. Handling an issue with a refund can stop it from blowing up into something much, much worse.

3. Chargebacks

The chargeback is the most serious and painful type of reversal by a long shot. Unlike a refund where you're in control, a chargeback is started by the customer going directly to their bank. The bank then forcefully yanks the money out of your account and gives it back to the cardholder while an investigation gets underway.

Think of it as the customer's nuclear option. They might trigger one if they don't recognize a charge, think their card was stolen, or feel like they couldn't get a resolution from you directly.

- Common Scenario: A customer forgets about a recurring subscription payment, sees your company's name on their statement but doesn't recognize it, and immediately calls their bank to report an unauthorized charge.

- Business Impact: Severe. You don't just lose the original sale revenue—you also lose the product or service you delivered. On top of that, you get slammed with a non-refundable chargeback fee that can be anywhere from $20 to $100.

Worse yet, every chargeback you get pushes up your chargeback-to-sales ratio. If that ratio climbs too high (the industry red line is usually around 0.9%), payment processors will flag you as "high-risk." This can lead to frozen funds or even getting your entire merchant account shut down. This is precisely why stopping a customer dispute before it becomes a chargeback is so critical.

Why Do Payment Reversals Happen? The Top Causes

Payment reversals don't just happen out of the blue. Each one is a direct response to a specific trigger, and getting to the bottom of these root causes is the first step toward building a real defense for your business. Think of a reversal as a symptom—a red flag pointing to an underlying issue in your sales, fulfillment, or customer communication process.

By digging into the "why," you can pinpoint exactly where things are going sideways. The reasons generally fall into three buckets, each with its own set of challenges and solutions.

Simple Merchant Errors

Let's start with the most straightforward cause: simple mistakes on the merchant's side. These are usually unintentional slip-ups that can frustrate a customer enough to dispute a charge if you don't catch and fix them fast. The good news? These are often the easiest problems to solve once you know what to look for.

Common merchant errors include:

- Duplicate Billing: A customer gets charged twice for the same thing because of a system glitch or a simple manual error.

- Incorrect Amount Charged: Hitting a customer with a $250 charge for a $25 item is a surefire way to trigger a dispute.

- Shipping the Wrong Item: Someone orders a blue shirt but gets a red one. If your return process is a pain, they're far more likely to just reverse the charge.

- Unclear Billing Descriptors: Your company is "Sunshine Supplements," but the charge shows up as "SS LLC." A confused customer is going to assume it's fraud.

These kinds of errors are almost always preventable with tighter operational controls and clearer communication.

Criminal Fraudulent Activity

This category is what most people think of when they hear about payment fraud—a criminal using stolen financial information to make unauthorized purchases. This is true, malicious fraud. In this case, the actual cardholder is the victim, and the payment reversal is a necessary security measure.

Criminal fraud is a clear-cut case where a chargeback is justified. The cardholder's bank is obligated to reverse the transaction to protect its customer from theft. While you lose the revenue, this isn't a reflection of your service.

The driver here is almost always stolen credit card numbers, which criminals get through data breaches, phishing scams, or even just physical theft. The real cardholder eventually spots the unfamiliar transaction on their statement, reports it, and their bank immediately initiates a reversal to get their money back.

The Challenge of Friendly Fraud

Now we're wading into the gray area of payment reversals. Friendly fraud is, by a long shot, the most common, complex, and infuriating cause for merchants. It happens when a legitimate customer makes a purchase but later disputes the charge, essentially taking their money back for reasons that aren't tied to criminal intent or an obvious merchant error.

This behavior accounts for up to 75% of all chargebacks, making it a massive drain on resources for ecommerce and subscription businesses.

A few key scenarios fall under this umbrella:

- Buyer's Remorse: The customer regrets their purchase but doesn't want to deal with the official return process. Filing a chargeback just seems like an easier shortcut.

- Family Member Purchase: A teenager uses their parent's card to buy a new video game without asking. The parent sees the charge, doesn't recognize it, and disputes it.

- Forgotten Subscriptions: A customer signs up for a free trial, forgets to cancel, and gets billed. Instead of contacting support, they go straight to their bank.

- Service Dissatisfaction: The customer got the product but felt it didn't live up to their expectations. They bypass your customer service team and head directly to their bank for a reversal.

These situations are a huge headache. You don't just lose the revenue and the product; you also get slapped with damaging chargeback fees. For high-volume sellers, a spike in friendly fraud can even lead to a Shopify payment hold or other processor penalties that freeze your cash flow. Pinpointing and tackling the drivers behind friendly fraud is absolutely critical for the long-term health of your business.

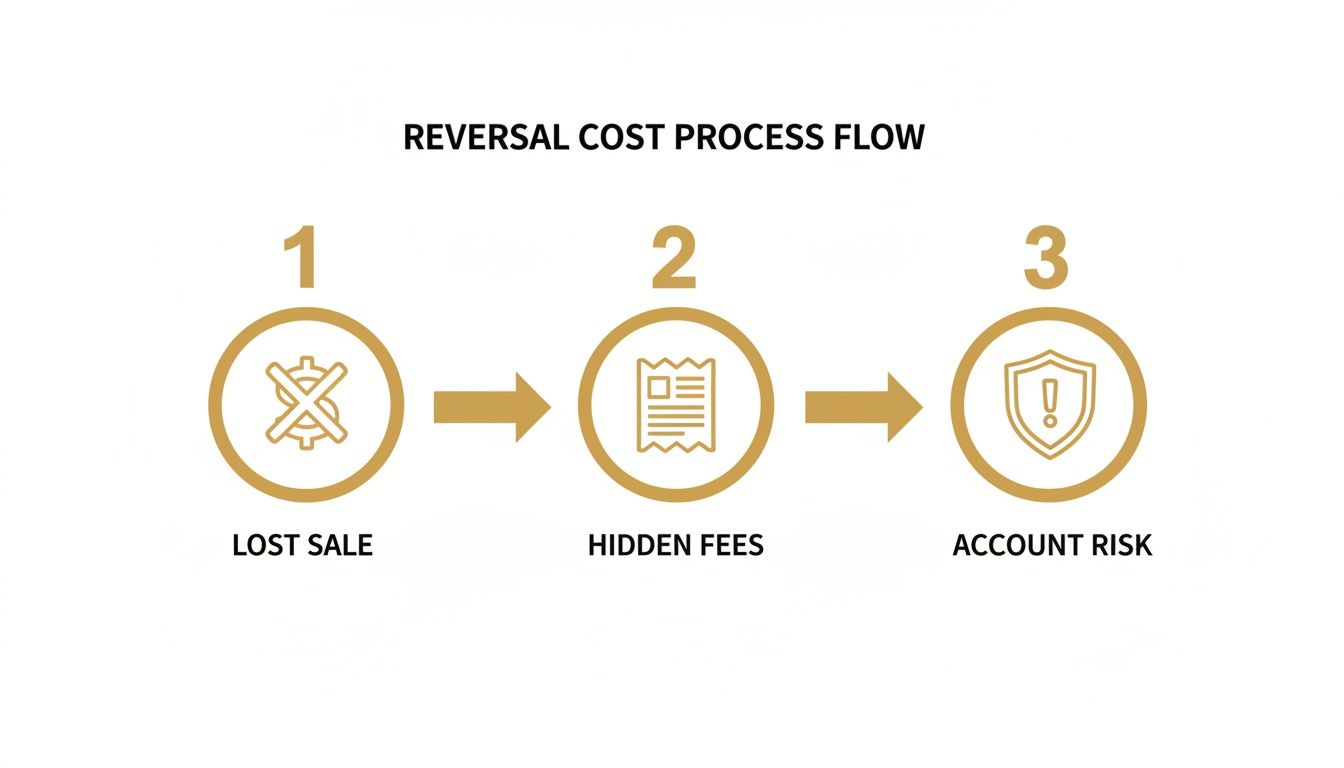

The True Cost of a Reversal on Your Business

It’s easy to look at a payment reversal as just one lost sale—a minor hiccup. But that thinking is a trap. For anyone running a subscription service, a DTC brand, or any high-volume online store, a reversal isn't just a lost transaction; it's a financial and operational gut punch with effects that ripple out much further than you'd think.

When a customer initiates a reversal, especially a chargeback, the most obvious loss is the revenue from that sale. But you're also out the cost of the goods you already sent and the shipping fees you paid to get it to them. For businesses running on thin margins, that double-whammy can flip a good day into a bad one in an instant.

But the bleeding doesn't stop there.

The Hidden Financial Penalties

On top of losing the sale and the product, your payment processor and the customer's bank are going to hit you with their own penalties. The most common one is the chargeback fee, a nasty, non-refundable penalty they charge just for the trouble of handling the dispute. These fees typically run anywhere from $20 to $100 per incident, and you pay it whether you win the dispute or not.

Think about that. A few chargebacks a month can quickly stack up to thousands of dollars in pure, unrecoverable loss.

A single chargeback isn't just a refund. It's the original sale amount, plus the cost of your product, plus shipping, plus a hefty penalty fee—all gone. It’s a financial setback that can easily be 150% or more of the original transaction value.

This is exactly why getting ahead of disputes is so important. We've come a long way from the old days of simple bank refunds. Now, networks like Ethoca and Visa RDR offer digital chargeback alerts, giving merchants a fighting chance. With real-time payments (RTP) fraud hitting 45% of merchants globally, you can't afford to be reactive. The average disputed chargeback in the U.S. is $110, but an early alert can stop it cold, helping you sidestep the 75% of chargebacks that are actually friendly fraud. You can find more details in this report on the global impact of payments fraud on catalystpay.com.

Long-Term Damage to Your Merchant Account

The immediate financial hit is painful, but the long-term damage from a high reversal rate is what can really kill your business. Payment processors like Stripe and PayPal are watching your chargeback-to-transaction ratio like a hawk. To them, this number is a direct measure of how risky your business is.

If that ratio starts creeping over the industry threshold—usually around 0.9%—you're going to set off some serious alarms. That triggers a domino effect of consequences that can completely hobble your operations.

High-Risk Monitoring Programs: Get on the wrong side of Visa or Mastercard, and they'll place you in a monitoring program. This means higher fees, constant scrutiny, and living under the threat of having your account shut down.

Frozen Funds and Rolling Reserves: To cover their own risk, processors might start holding back your money. They could implement a rolling reserve, where they keep a percentage of your daily sales for 90 or even 180 days. This can absolutely suffocate your cash flow.

Merchant Account Termination: This is the nightmare scenario. If you can't get your chargeback rate down, your processor will eventually pull the plug on your account. For most online businesses, losing the ability to accept credit cards is game over.

These risks are even bigger for companies built on recurring revenue, like a SaaS tool or a subscription box service. A high chargeback rate doesn't just eat into this month's profits; it threatens the very foundation of your business. That’s why you have to stop thinking of dispute management as an expense. It's an essential investment in your company's survival.

A Proactive Strategy to Manage and Prevent Reversals

When it comes to handling payment reversals, the best defense is a good offense. Instead of sitting back and waiting for the financial hit of a chargeback, the smart move is to get ahead of the problem. This means stopping disputes before they even start and quickly shutting down the ones that do slip through. This approach doesn't just protect your revenue; it safeguards your relationship with your payment processor.

The whole strategy really boils down to two things: clarity and communication. You’d be surprised how many major disputes can be avoided with a few small, deliberate actions that stop a confused customer from escalating an issue.

Building Your First Line of Defense

Your main goal should be to make every transaction crystal clear and every customer interaction a positive one. This all starts with the basics.

Craft Unmistakable Billing Descriptors: A top driver of "friendly fraud" is simply a customer not recognizing a charge on their statement. Don't use a vague legal name like "SS LLC." Instead, use something they’ll immediately recognize, like "SUNSHINE SUPPLEMENTS."

Offer Stellar Customer Service: You want to make it way easier for a customer to contact you than their bank. Plaster your contact info everywhere, offer support through chat and phone, and respond fast. Digging into an AI customer service automation guide can show you how to build a support system that significantly cuts down on disputes.

Implement Smart Fraud Detection: Use tools that can spot suspicious activity before a fraudulent transaction goes through. Things like CVV checks, address verification (AVS), and 3D Secure are essential layers of protection against criminal fraud, stopping a guaranteed chargeback in its tracks.

The Power of Real-Time Dispute Alerts

Prevention is key, but you can't stop every single dispute. That's where modern technology becomes your secret weapon. Real-time dispute alert platforms are built to intercept a problem the moment a customer complains to their bank—well before it becomes an official chargeback.

These platforms plug directly into card network programs like Visa's Rapid Dispute Resolution (RDR) and Mastercard's CDRN. When a customer tries to initiate a dispute, you get an alert instead of a chargeback.

This alert is your golden ticket. It opens a critical 24-72 hour window to resolve the issue yourself. By simply issuing a refund, you stop the chargeback process cold. Yes, you lose the sale, but you completely dodge the damaging fee and the black mark on your merchant account.

This completely changes the game. With a platform like Disputely, you can connect your processor, set up automated refund rules, and let the system handle these alerts 24/7. Merchants who take this proactive approach have seen up to a 99% reduction in chargebacks.

This infographic breaks down the cascading costs a single payment reversal can trigger if you don't manage it proactively.

As you can see, what starts as a lost sale can quickly spiral into hidden fees and, ultimately, put your entire merchant account at risk.

From Reactive to Proactive: A New Way Forward

The old way of dealing with disputes is costly and stressful. The new, proactive approach using real-time alerts turns a potential crisis into a manageable, automated process. Let's compare the two side-by-side.

Proactive vs Reactive Dispute Management

| Process Step | Reactive Approach (Traditional Chargeback) | Proactive Approach (Using Real-Time Alerts) |

|---|---|---|

| Initial Trigger | Customer files a dispute with their bank. | Customer initiates a dispute; an alert is sent to the merchant. |

| Merchant Notification | You receive a formal chargeback notification days or weeks later. | You receive an instant alert, often within seconds. |

| Your Window to Act | You have weeks to gather evidence and fight the chargeback. | You have 24-72 hours to issue a refund and stop the process. |

| Associated Costs | Lost sale + chargeback fee ($20-$100) + administrative costs. | Lost sale only. No chargeback fee. |

| Impact on Account | Negative mark against your chargeback ratio. | No impact on your chargeback ratio. The dispute is deflected. |

| Outcome | Win or lose the representment battle; significant time and money spent regardless. | The dispute is resolved before it becomes a chargeback. You save time, money, and your reputation. |

As the table shows, there’s really no contest. Shifting to a proactive model is one of the smartest financial decisions a modern ecommerce business can make.

Turning a Cost Center Into a Strategy

Embracing a chargeback alert system is a game-changer. In the U.S., where the average chargeback is $110, every dollar of fraud actually costs merchants $4.61 in lost goods, fees, and operational expenses. By automatically refunding disputes during that alert window, you turn a huge, unpredictable cost into a manageable one.

For subscription and high-volume ecommerce businesses, this isn't just about saving a few bucks on fees. It's about protecting your chargeback ratio to avoid getting slapped with high-risk monitoring programs or having your funds frozen. Turning a potential chargeback into a simple refund keeps you in good standing with payment processors.

If you're already dealing with a pile of disputes, our guide on chargeback representment strategies can help you recover some of that lost revenue. But going forward, this proactive framework is what allows you to stop constantly fighting fires and start building a more resilient business.

Your Payment Reversal Questions, Answered

Let's be honest, payment reversals can be a confusing part of running a business. To help clear things up, here are some straight-to-the-point answers to the questions we hear most often from merchants.

What's the Real Difference Between a Reversal and a Chargeback?

It helps to think of a payment reversal as the big-picture category for any time money goes back to a customer. A chargeback is just one specific type of reversal—and it's the one you really need to worry about.

Other reversals, like an authorization reversal or a simple refund, are pretty standard and don't cause much harm. A chargeback, on the other hand, is a formal dispute started by the customer's bank. It always comes with painful fees and can seriously damage your standing with payment processors.

Can You Actually Fight a Payment Reversal?

That depends entirely on what kind of reversal it is. You can't really "fight" an authorization hold that expired or a refund you already agreed to. But when it comes to illegitimate chargebacks? Absolutely. You not only can fight them, you should.

This process is called representment. It’s your chance to submit solid proof—like delivery confirmations or customer communications—to show the bank that the original charge was completely valid. One thing to remember, though: even if you win the dispute, you're usually still out the chargeback fee. Prevention is always the cheaper, smarter move.

How Long Does a Payment Reversal Take?

The timeline is all over the place and hinges on the type of reversal.

- Authorization Reversals: These are lightning-fast. Since the money was only held and never truly captured, the hold just disappears, typically within 1-3 business days.

- Refunds: These take a bit more time. You can expect the funds to show up back in your customer's account within 5-7 business days.

- Chargebacks: Get ready for a long wait. The chargeback process can drag on for weeks or even months as it winds its way through the bank's investigation and formal dispute cycles.

The drawn-out, unpredictable nature of a chargeback really highlights why catching disputes early is so crucial. A quick refund is always a better outcome than a months-long battle you might not even win.

What’s the Single Best Way to Lower My Chargeback Ratio?

Hands down, the most effective strategy is to use a real-time dispute alert service. These platforms plug directly into the card networks and notify you the second a customer complains to their bank. This opens up a critical 24-72 hour window for you to issue a refund before it escalates into a formal chargeback. The dispute simply goes away and never hits your record.

Beyond that, the fundamentals still matter. Make sure your billing descriptors on customer statements are crystal clear—no one should have to guess who charged them. And make your customer service easy to find and use.

If you have technical questions or need help getting set up, our team is here for you at the Disputely support portal. For a deeper dive into payment industry trends and security, you can also check out these additional industry insights.

Ready to stop chargebacks before they start? Disputely integrates directly with Visa, Mastercard, and your payment processor to give you real-time alerts on customer disputes. Automatically refund alerts, protect your merchant account, and say goodbye to surprise chargeback fees. See how much you can save with Disputely in under five minutes.