What Is Transaction Monitoring And How Does It Work?

Think of transaction monitoring as a silent, digital security guard watching over every single financial interaction your business has. It's the critical process of reviewing and analyzing customer payments to spot and stop fraud, money laundering, and other sketchy activities before they can do any real harm. For any merchant selling online, this is your first and best line of defense against painful chargebacks and surprise account freezes.

Understanding The Core Process

At its heart, transaction monitoring is all about separating your genuine customers from the fraudsters trying to blend in. It’s a lot like a home security system. Your front door lock—let's call that basic identity verification—keeps most strangers out. But the cameras inside your house are what spot unusual behavior after someone is already in. That's transaction monitoring.

This isn't a one-and-done check. Fraudsters are persistent, so your defense has to be too. A good system is constantly watching all financial movements—payments, refund requests, even login attempts—and checking them against established rules and known patterns of risky behavior. This continuous vigilance is what keeps you on the right side of ever-changing global regulations from payment networks and financial authorities.

Breaking Down The Process

The whole monitoring process really boils down to four key stages. Each one builds on the last, creating a solid safety net that protects your revenue and reputation. Getting a handle on these components is the first step toward building a defense that actually works. For more deep dives into managing these kinds of business risks, you can find a ton of great info on the Disputely blog.

To make this crystal clear, let's break down how these pieces fit together in the real world.

The Four Core Components of Transaction Monitoring

This table shows the journey of a single transaction as it passes through the monitoring system, from initial data capture to the final decision.

| Component | Description | Example For An Ecommerce Store |

|---|---|---|

| Data Collection | The system pulls transaction data from all your sources—payment processors, banking systems, customer databases—the moment an order is placed. | A customer in Brazil buys five high-end laptops at 3 AM using a credit card issued in the US. The system grabs all of these details instantly. |

| Rule-Based Screening | Every transaction is immediately measured against a set of predefined rules designed to flag behavior that looks suspicious or high-risk. | The system's rules are triggered for: an IP address in a different country than the card, an unusual purchase time, and a large bulk order of expensive items. |

| Risk Scoring & Analysis | The system then assigns a risk score by weighing all the different factors, including the customer's past behavior and current transaction patterns. | This combination of red flags adds up to a very high-risk score, strongly suggesting the transaction is a fraudulent one. |

| Action & Reporting | Based on that risk score, the system takes immediate action—either automatically blocking the payment or flagging it for a human to review. | The system automatically declines the payment to prevent an almost certain chargeback. It also logs the entire event for your team to review later. |

This table shows how quickly a potentially disastrous transaction can be identified and neutralized, protecting your business from loss.

Key Takeaway: Transaction monitoring isn't just a blunt tool for blocking bad payments. It’s about building a smart, dynamic risk profile for every customer. This lets you apply tight security where it's needed most while keeping things fast and frictionless for your legitimate buyers.

Why Transaction Monitoring Is No Longer Optional

Thinking of transaction monitoring as just another business expense is a huge mistake. It's like calling a fire alarm system a "nice-to-have." The reality is, it's a core defense system for your company's financial health. Without it, you're leaving the door wide open to financial and reputational hits that can stop your growth in its tracks.

Fraud and disputes aren't just about losing the money from one bad sale. Every single chargeback slaps you with a fee, usually between $20 to $100, and you pay it whether you win or lose. Those fees stack up fast, turning what should have been a great month into a losing one.

The Payment Networks Are Watching

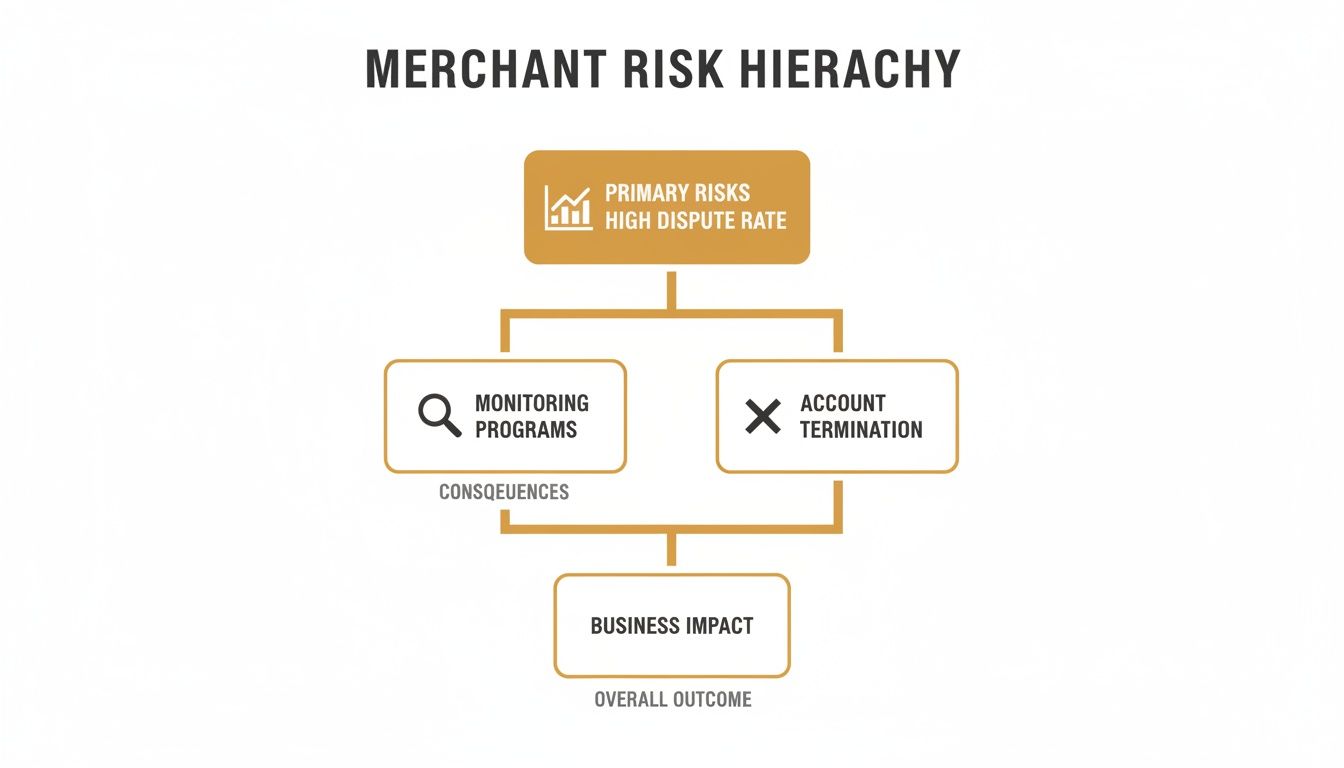

Beyond the direct costs, there's a much bigger threat lurking: the payment networks themselves. Visa and Mastercard have very strict limits on chargeback ratios, and they don't mess around when merchants cross the line. Breaking their rules can seriously damage your ability to take payments, period.

For example, if your chargeback numbers get too high, you could find yourself in one of their monitoring programs:

- Visa Dispute Monitoring Program (VDMP): You'll land here if your dispute count and ratio go over their monthly thresholds.

- Mastercard Dispute Monitoring Program (MDMP): Similar to Visa's, this program flags merchants with too much chargeback activity.

Once you’re on their radar, the penalties get steep, with monthly fines that can run into the thousands. And getting out isn’t easy—it takes months of consistently low dispute rates to prove you’ve fixed the problem.

“Ignoring high dispute rates is like ignoring a warning light on your car’s dashboard. At first, it’s an annoyance, but if you don’t address it, you’re heading for a complete breakdown.”

Your Merchant Account Is on the Line

A high chargeback ratio directly threatens your relationship with your payment processor. From their perspective, a merchant with lots of disputes is a high-risk partner, and they'll move quickly to protect themselves.

Often, the first step is a rolling reserve. This is where they hold back a percentage of your daily sales to cover any future chargebacks. This can be a killer for your cash flow, making it tough to cover inventory, run marketing campaigns, or even make payroll.

If things don't get better, they might freeze your account entirely, shutting off your ability to accept payments. The worst-case scenario is merchant account termination. That doesn't just put you out of business today; it makes it nearly impossible to get a new merchant account with another processor.

This critical need for better monitoring systems is causing the market to explode. Researchers valued the transaction monitoring market at around USD 18–21 billion and expect it to skyrocket to between USD 42 billion and USD 65 billion by the early 2030s. This isn't just a trend; it's a fundamental shift as businesses realize monitoring is a must-have for survival. You can learn more about the growth of the transaction monitoring market and what it signals for businesses.

At the end of the day, investing in solid transaction monitoring is an investment in your company’s stability. It protects your revenue, safeguards your relationship with your payment processor, and ensures you can keep growing without the constant fear of fines or account closure. It's worth exploring what this protection costs—you can see a breakdown of Disputely's pricing structure to understand just how affordable it can be.

How Monitoring Systems Spot Suspicious Activity

Think of a transaction monitoring system as an experienced security guard for your online store. It's not just looking for one obvious sign of trouble; it's trained to notice a combination of subtle clues that separate a genuine customer from someone trying to commit fraud. This whole process is less about catching a single smoking gun and more about spotting a pattern that just doesn't feel right.

The entire system's strength starts with a solid foundation, which means having a seamless payment provider integration for financial services. By pulling in data from every possible source, the system can connect the dots and flag inconsistencies that would otherwise fly under the radar.

This flowchart shows exactly what’s at stake. When dispute rates get out of hand, merchants face a slippery slope that can end in serious trouble.

As you can see, unchecked disputes aren't just a nuisance—they trigger expensive monitoring programs and can ultimately lead to account termination. This is precisely why catching suspicious activity early is so important.

The Key Signals That Trigger Alerts

Monitoring platforms are always on the lookout for specific red flags that fall into three main buckets. Each flag adds a bit more context to a transaction’s overall risk profile.

Behavioral Signals: This is all about how and when someone is buying. Your real customers usually have somewhat predictable habits. Fraudsters? Not so much. A classic example is a purchase made at 3 AM from a computer located thousands of miles away from the card's billing address. That’s a major behavioral red flag.

Identity Signals: These signals are tied to the raw verification data entered at checkout. Any mismatch here is a strong clue that something is wrong. Common examples include a failed Address Verification System (AVS) check, where the street or ZIP code doesn’t match what the bank has on file, or an incorrect Card Verification Value (CVV).

Order Signals: This one focuses on what's actually in the shopping cart. A fraudster wants to get the most value as quickly as possible, which leads to some strange shopping carts. If a brand-new customer suddenly places an unusually large order for popular, easy-to-resell items like electronics or gift cards, the system takes notice.

Here's the key: A single red flag, like a failed AVS check, might just be a simple typo. But when you combine that with a mismatched IP address and a strangely large order, the system sees a story unfolding—one that looks a lot like a fraud attempt.

From Signals to Scores: A Risk-Based Approach

Modern systems have moved beyond a simple "yes" or "no" decision. They use a much smarter method called risk scoring. Every suspicious signal adds points to a transaction's total risk score. A small inconsistency might add 10 points, while a huge red flag could add 50.

Once all the points are tallied up, the system checks the total against set thresholds to decide what to do next. This lets you handle potential threats with precision instead of a sledgehammer.

For instance, a low-risk score means the transaction is approved instantly, keeping your legitimate customers happy. A high-risk score could trigger an automatic block, stopping a guaranteed loss in its tracks. And for those in the middle? A medium score can flag the order for a quick manual review by a real person, adding a valuable human touch.

This scoring system is the heart of effective transaction monitoring; it’s how raw data becomes a clear, actionable plan.

Comparing Transaction Risk Profiles

To give you a better idea of how this works in practice, this table breaks down the typical characteristics of low, medium, and high-risk transactions. It helps clarify why some orders get flagged for a closer look while most sail through without a problem.

| Characteristic | Low-Risk Profile | Medium-Risk Profile | High-Risk Profile |

|---|---|---|---|

| Customer History | Returning customer with a positive purchase history. | New customer or infrequent buyer. | First-time customer with no history. |

| IP & Billing Match | IP address location matches the billing address. | IP address is in a different city or state. | IP address is in a high-risk country, far from the billing address. |

| AVS/CVV Check | Both AVS and CVV checks pass successfully. | AVS mismatch (e.g., wrong ZIP) but CVV passes. | Both AVS and CVV checks fail. |

| Order Value | Consistent with the customer's average order size. | Slightly higher than the site's average order value. | Unusually high value, often the largest order of the day. |

| Purchase Time | Occurs during normal local business hours. | Late at night or during off-peak hours. | Occurs between 1 AM and 5 AM local time. |

Ultimately, understanding these profiles is the first step in seeing your transactions the way a monitoring system does—not as isolated events, but as collections of data points that tell a story.

Understanding Fraud Prevention vs. AML Compliance

Transaction monitoring is a powerful security system, but it's really serving two very different masters: fraud prevention and Anti-Money Laundering (AML) compliance. They might use similar tools, but their core missions are worlds apart. Think of them as two sides of the same protective coin—each defending a different part of the financial world.

A great way to picture it is to think of fraud prevention as a security guard hired to protect a single store. Their one and only job is to stop shoplifters and prevent theft, protecting that specific business from losing money. The focus is immediate and personal to the merchant's bottom line.

AML compliance, on the other hand, is more like a federal law enforcement agency tasked with protecting the entire financial system. Its goal isn't just about one store; it's about stopping organized crime, terrorist financing, and other massive illegal operations from using the banking system to "clean" dirty money. The focus here is much, much broader and is driven by legal and regulatory duties.

The Merchant’s Focus: Protecting Your Bottom Line

For any e-commerce business, the day-to-day battle is almost always against fraud. The mission is simple: stop bad guys from making unauthorized purchases that turn into chargebacks, lost products, and shrinking revenue. Every single fraudulent order you block is a direct win for your business.

The signals a merchant's system looks for are fine-tuned for this specific goal:

- Identity Mismatches: Why is the shipping address in New York but the billing address is in Brazil?

- Behavioral Red Flags: Who places a rush order for ten high-end laptops at 3 AM?

- Verification Failures: Did the AVS or CVV checks come back with a hard "no" during checkout?

These clues are all about shielding the merchant from immediate financial damage. The motivation is pure economic survival.

The Regulator’s Mandate: Following The Law

AML compliance operates under a completely different set of rules, driven entirely by government regulation. Banks, payment processors, and other financial institutions are legally required to monitor transactions for signs of money laundering and report anything suspicious. If they don't, they face staggering fines and serious legal trouble.

In fact, regulatory pressure is a huge reason transaction monitoring has become so sophisticated. Regulators globally are cracking down hard, with penalties for weak AML controls climbing into the billions. It’s a zero-tolerance environment. You can learn more about the major enforcement actions driving AML adoption to see just how serious it is.

The core difference is the "victim." In fraud, the victim is the merchant. In money laundering, the victim is the integrity of the financial system itself.

This top-down pressure from regulators on banks and payment processors eventually trickles down to you, the merchant. While you probably aren’t filing Suspicious Activity Reports (SARs) yourself, your payment processor definitely is. They're watching your transaction patterns not just for fraud, but also for anything that smells like money laundering, all to ensure they're meeting their own legal obligations.

That's why a solid grasp of both disciplines is so important for everyone in the payments industry. For a closer look at the tools and strategies used to stop these illicit activities, you can explore detailed insights on modern Anti-Money Laundering solutions. By understanding both sides of the coin, we help keep the entire system safe and secure for everyone involved.

How AI Is Transforming Transaction Monitoring

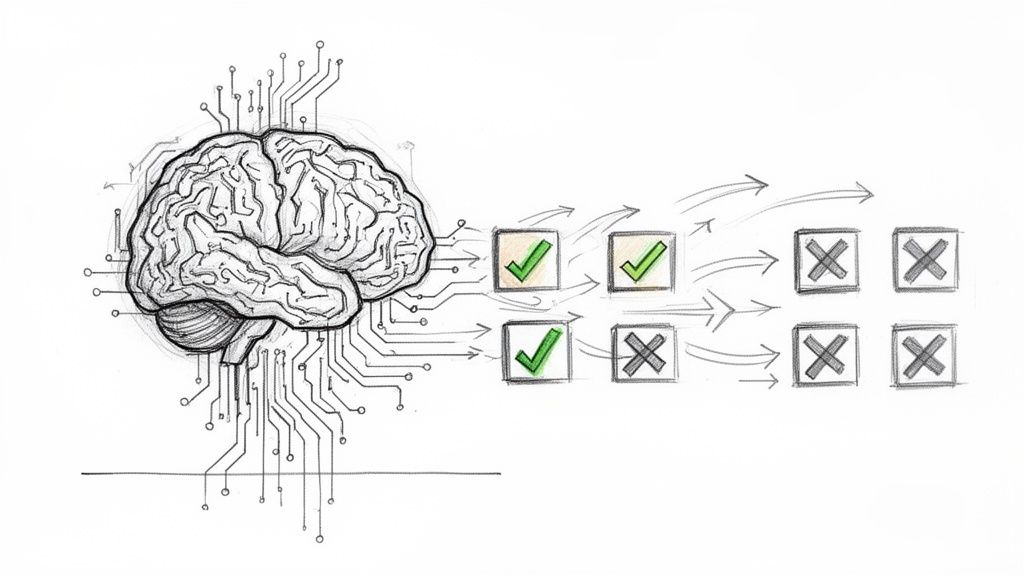

For years, transaction monitoring was a pretty rigid affair. It was built on rule-based systems, which worked a bit like a nightclub bouncer with a very strict, unchangeable guest list. If a transaction met a specific condition on that list—say, an order over $1,000 or a shipping address that didn't match the billing address—it got flagged. Simple, but not very smart.

This old-school approach had some major drawbacks. Scammers are clever; they quickly figured out the rules and learned how to sneak past them. On the flip side, these rigid rules created a tidal wave of false positives. Legitimate customers were constantly getting their orders flagged, which meant analysts had to waste countless hours manually reviewing perfectly good transactions. It was inefficient and incredibly frustrating for everyone involved.

The Shift to Intelligent Detection

This is where Artificial Intelligence (AI) and machine learning completely rewrite the playbook. An AI-powered system isn't a bouncer with a checklist; it's more like a seasoned detective. It doesn't just look for one or two obvious clues. Instead, it analyzes hundreds of data points at once, connecting the dots to find subtle patterns that a simple set of rules would never catch.

An AI model learns what "normal" looks like for your business and your customers. It can understand that a $500 purchase from a loyal customer who's been shopping with you for years is probably fine. But it also knows that a $150 order from a new account using a proxy server to hide their location is a huge red flag. It sees the context that a human might miss.

This ability to adapt and understand context is what makes AI so effective. It learns from new fraud tactics as they happen, spotting emerging threats before they can do any real damage.

The Power of AI: A rule-based system can only ask, "Did this transaction break a rule?" An AI-powered system asks a much smarter question: "Based on everything we know, how likely is this transaction to be fraudulent?" Moving from black-and-white rules to a more nuanced, probability-based score is a total game-changer for accuracy.

Reducing Noise and Focusing on Real Threats

One of the first things businesses notice when they switch to AI is how dramatically the number of false positives drops. By understanding the subtle details of customer behavior, AI can easily tell the difference between a real buyer who just made a typo in their address and a fraudster trying to game the system.

This precision has a huge impact on your team's day-to-day work. With AI and machine learning, companies see massive improvements in both the volume of alerts and their operational costs. It’s not uncommon for businesses to see their manual review workload shrink by 20% to 60% after implementing more advanced analytics. You can discover more about how AI is reshaping transaction monitoring and its effect on financial institutions.

When you filter out all that noise, your fraud team can finally stop chasing ghosts. They can focus their time and expertise on the very few high-risk transactions that actually need a human eye, which saves money and gets legitimate orders out the door faster.

Leveraging Real-Time Data for Proactive Defense

Modern AI platforms are built for speed, processing real-time data as it flows in. The old batch systems would review transactions in a big pile at the end of the day, long after the fraud had already happened. Today's tools analyze every single payment the moment it's submitted. This is essential for stopping fraud before the package leaves the warehouse.

This instant analysis powers automated, real-time decisions:

- Instantly Approve: Good transactions from trusted customers sail through in milliseconds, creating a smooth, frictionless checkout experience.

- Instantly Block: Obvious fraud attempts are shut down immediately, preventing the loss from ever happening.

- Instantly Flag for Review: The few borderline cases get sent to your team for a manual look, blending AI's speed with human intuition.

This is the core of modern transaction monitoring—moving from a slow, reactive process to a fast, proactive defense. It turns your fraud prevention from a manual chore into an intelligent, automated system that protects your business around the clock.

Putting Proactive Dispute Monitoring Into Action

So, you understand the theory behind transaction monitoring. That's the first step. But the real magic happens when you put that knowledge to work, turning it from a general fraud detection concept into a powerful, specialized tool: proactive dispute monitoring.

This isn't just about catching a bad guy before a sale goes through. It's about preventing a perfectly good customer from turning into a costly chargeback after their purchase is complete.

Think of it like this: traditional monitoring is the bouncer at the front door, checking IDs. Proactive dispute monitoring is more like a savvy concierge inside the building, noticing a guest looks unhappy and solving their problem before they ever feel the need to storm out and write a bad review. It's all about early intervention.

This is exactly the niche where a platform like Disputely lives. It adds a specialized monitoring layer designed for one thing: stopping post-purchase disputes dead in their tracks before they officially become chargebacks and start wrecking your merchant account health.

How Specialized Monitoring Works

The whole process is built to be fast and painless. First, you connect your payment processor—whether it's Stripe, Shopify Payments, or another gateway. This usually takes just a couple of minutes and gives the system the visibility it needs to monitor your transactions.

From there, you set up some simple, automated rules. For instance, you might decide to automatically refund any disputed transaction under $30. Why? Because fighting over a small amount often costs more in time and effort than it's worth. This kind of smart automation is a game-changer.

The real power comes from intercepting alerts directly from Visa and Mastercard's own early warning networks. When a cardholder calls their bank to question a charge, these card brands send out an immediate heads-up. Disputely catches that signal instantly, opening up a critical window—usually 24 to 72 hours—for you to resolve the problem with a refund.

By taking this pre-emptive step, the dispute never escalates into a formal chargeback. The customer gets their money back, and your dispute ratio stays clean. This is a lifeline for merchants, especially if you're already dealing with something like a Shopify payment hold, which is almost always tied to high dispute rates.

The Direct Impact On Your Business

Putting this kind of targeted monitoring in place is the most practical way to tackle the biggest risks we've talked about. It's the solution to the problems that cause sleepless nights for so many business owners.

Preventing Chargebacks: Refunding alerted transactions stops the chargeback process before it even begins. This not only protects your revenue but also helps you dodge those punishing chargeback fees.

Avoiding Monitoring Programs: The only reliable way to stay off Visa and Mastercard’s expensive and restrictive monitoring programs is to keep your dispute ratio consistently low. This is how you do it.

Protecting Processor Relationships: A low dispute rate is the clearest signal you can send that you're a low-risk merchant. This helps you avoid account freezes, holds, and the ultimate nightmare: account termination.

In the end, proactive dispute monitoring is that final, essential layer of defense. It takes transaction monitoring from a passive, data-crunching tool and turns it into an active, automated shield that directly protects your ability to process payments and grow your business.

Frequently Asked Questions

Even when you get the big picture, a few practical questions always pop up when it's time to actually put a monitoring system in place. Let's tackle some of the most common ones head-on.

What’s the Main Goal of Transaction Monitoring?

At its core, transaction monitoring is all about protecting your business. For merchants, that means stopping financial bleeding from fraud and chargebacks. For the bigger financial world, it’s about complying with Anti-Money Laundering (AML) rules to keep criminals from using the system.

Think of it this way: one goal is to guard your own storefront—the cash register and inventory (that's your fraud prevention). The other is to help make sure the entire shopping mall is safe from organized crime (that's AML compliance). You need both for a healthy, trustworthy marketplace.

How Is This Different From My Basic Fraud Filters?

Basic fraud filters are pretty rigid, like a bouncer with a very simple checklist. They look at a few static things, like whether a CVV code matches. If it doesn't, the transaction is flat-out blocked. End of story.

Transaction monitoring is way more sophisticated. It's like having an experienced security detective on your team who analyzes hundreds of data points in the blink of an eye. It looks at the customer's buying history, their behavior on your site, and the context of the entire order. Instead of a simple yes/no, it gives each transaction a risk score, which leads to much smarter, more accurate decisions.

The real game-changer is adaptability. Basic filters are stuck in their ways. A modern monitoring system, however, learns from new fraud patterns as they emerge, constantly updating its defenses. It’s a proactive shield, not a static wall.

Will This System Annoy My Good Customers?

When done right, it’s actually the opposite. A smart system is incredibly good at telling the difference between a loyal customer and a fraudster in disguise. This means it can green-light good orders almost instantly.

The only time it adds a bit of friction, like flagging an order for a quick manual review, is for that tiny slice of transactions that genuinely look suspicious. This precision slashes the number of false positives—those infuriating moments when a legitimate customer gets their card declined for no good reason. By getting rid of that frustration, you actually make the checkout experience smoother and build more trust with your best customers.

Ready to stop reacting to chargebacks and start preventing them? Disputely connects directly to your payment processor, catching disputes before they can damage your merchant account. It’s time to protect your revenue and your reputation. Discover how Disputely can safeguard your bottom line.