What Does Return Item Chargeback Mean and How to Protect Your Business

Ever had a check bounce? A return item chargeback is the modern, digital version of that exact headache. It’s not about an unhappy customer disputing a purchase; it's a bank-initiated reversal because a payment simply failed to go through.

This happens most often with ACH transfers or e-checks. The core issue is a technical glitch in the payment process itself, like hitting a dead end on a financial highway.

Deconstructing the Return Item Chargeback

Think of a return item chargeback as a purely mechanical failure. It has nothing to do with customer satisfaction, product quality, or shipping times. A credit card chargeback, on the other hand, is driven by a cardholder who actively disputes a charge they don't like or don't recognize. This is a crucial difference.

Here’s a real-world scenario: A customer pays you $100 via an e-check. Your bank gives you a provisional credit for that amount, and you, trusting the payment is good, ship the order. A few days later, you get a notice. The customer's bank has rejected the payment because their account was closed.

Your bank immediately pulls that $100 back out of your account and slaps you with a fee for the hassle. That entire sequence—the rejected payment, the reversal, and the fee—is the return item chargeback.

Key Characteristics

This type of payment reversal stands out for a few specific reasons:

- Bank-Initiated: The whole process is kicked off by the banking system, not a customer complaint.

- Payment Failure Focus: The reason is always technical. Common culprits include insufficient funds (NSF), an invalid account number, or a stop payment order.

- Associated Fees: You can bet your bank will charge you a fee for processing the failed transaction.

A return item chargeback is fundamentally a bank-initiated reversal that happens when a previously credited payment is returned unpaid. Banks’ posted fees for returned items typically range from about $9 to $20 per occurrence, adding insult to the injury of the lost revenue. You can learn more about how these fees work by checking out the details on Chargeblast.

It’s easy to lump all payment reversals together, but that’s a mistake. While both a return item chargeback and a credit card dispute result in lost funds, their causes and your options for responding are worlds apart. To get a better handle on customer-driven disputes, it helps to understand the meaning of disputed charges in the credit card ecosystem. The strategies for fighting them are completely different.

Putting Payment Reversals in Context

It's easy to get tangled up trying to tell the difference between a return item chargeback, a standard chargeback, and a simple merchant refund. On the surface, they all look the same: money is leaving your account. But dig a little deeper, and you'll find they have completely different triggers and require entirely different responses from you.

Think of a standard credit card chargeback as a consumer protection mechanism. This is what happens when a customer sees a charge they don’t recognize or has a problem with a product and calls their bank. It’s a formal dispute, a red flag raised by your customer through their card network, like Visa or Mastercard.

A refund, on the other hand, is all you. It's a direct, voluntary transaction between your business and a customer. They want to return something, you agree, and you send the money back. This is a customer service tool, not a forced reversal.

So where does the return item chargeback fit in? It's the odd one out. This type of reversal has absolutely nothing to do with customer satisfaction, product quality, or fraud.

A return item chargeback is a technical, automated reversal triggered by the customer's bank. It’s not a complaint. It's simply the bank's way of saying the payment couldn't be processed, usually because of something like insufficient funds or a closed account.

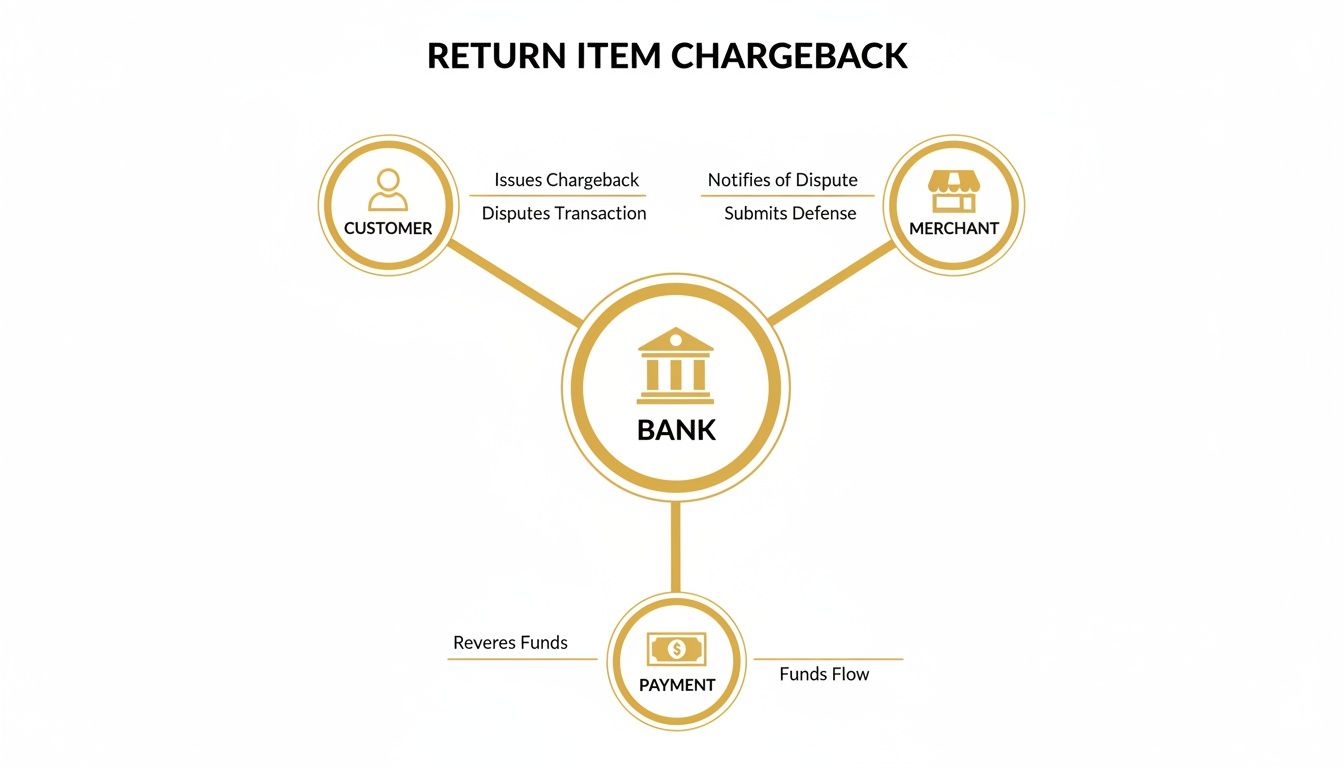

This diagram shows how the process is driven by the banking system, not the customer.

As you can see, the bank is the one pulling the strings here, creating a problem for both the merchant and the customer after a payment fails.

Key Differences at a Glance

Let’s line these three up side-by-side. Seeing the core distinctions makes it much easier to know what you’re up against when a reversal hits your account.

| Factor | Return Item Chargeback | Standard Chargeback | Merchant Refund |

|---|---|---|---|

| Who Starts It? | The customer's bank | The customer (cardholder) | The merchant |

| Primary Reason | Payment failure (NSF, closed account) | Customer dispute (fraud, product issue) | Customer service (return, cancellation) |

| System Involved | Banking Network (ACH) | Card Network (Visa, Mastercard) | Direct Merchant-Customer Interaction |

| Merchant Cost | Lost sale + Bank fee (e.g., $12-$35) | Lost sale + Chargeback fee + Potential penalties | Lost sale (revenue reversal only) |

Real-World Scenarios

To make this crystal clear, let's say you run an online subscription box service.

Scenario 1 (Return Item Chargeback): A subscriber's monthly $50 ACH payment bounces. You see a reversal with a code like "R01 - Insufficient Funds." This was automatically triggered by their bank. Not only are you out the $50, but your bank also hits you with a fee. Your only move is to reach out to the customer and get a new payment method.

Scenario 2 (Standard Chargeback): A customer forgets about their subscription and doesn't recognize the $50 charge on their credit card statement. They call their bank to dispute it. Now, you have a formal chargeback on your hands and need to submit evidence to prove the charge was legitimate.

Scenario 3 (Refund): A customer emails you wanting to cancel their subscription. As a gesture of goodwill, you process a $50 refund for their last box. This is a straightforward customer service interaction with no extra fees or penalties involved.

Each of these scenarios begins with a $50 payment reversal, but they branch off into completely different paths. Knowing whether the reversal came from a bank, a disgruntled customer, or your own team is the first crucial step in protecting your revenue.

Cracking the Code on Common Returns

When a return item chargeback lands in your system, it comes tagged with a short, cryptic reason code. Think of it as a shorthand note from the bank telling you precisely why the payment failed. Getting a handle on these codes is your first step toward fixing the immediate problem and stopping it from happening again.

Each code tells a slightly different story about what was going on with the customer’s account at the exact moment you tried to process the payment. For a merchant, these codes are pure gold—if you know how to read them.

Problems at the Customer's End

A lot of these codes point to issues with the customer's bank account. These can be anything from a temporary cash flow problem to a permanently closed account.

The one you’ll see most often is R01 - Insufficient Funds. It’s the modern-day version of a bounced check. The customer just didn't have enough money in their account to cover the charge at that specific time. This is often a temporary glitch, and retrying the payment in a few days might work just fine.

Then there's R02 - Account Closed. This one is much more final. It means the bank account you tried to charge no longer exists. Any future attempts will fail, so you need to get in touch with the customer right away for a new payment method.

R01 and R02 are critical signals for your business. An R01 code suggests a timing problem that could fix itself, but an R02 is a dead end. It requires you to act fast to update the customer's payment info and save the relationship.

Simple Slips: Data and Verification Errors

Sometimes, the issue isn't with the customer's money but with the information you have on file. A simple typo can be enough to trigger a failed transaction and a frustrating return fee.

For example, you might get an R03 - No Account/Unable to Locate. This usually means the account and routing numbers you used don't match up to a real account. It could be a slip of the finger when entering the account number or even a mistake in the customer’s name.

An R04 - Invalid Account Number is similar but points to a structural error. The account number might have the wrong number of digits, causing it to fail the bank's initial validation check. Both R03 and R04 are usually signs of a simple data entry error that you can fix by double-checking the details with your customer.

Calculating the True Financial Damage

When a return item chargeback hits, the lost sale is just the tip of the iceberg. Many merchants make the mistake of only looking at the reversed revenue, but the real financial damage runs much deeper, creating a ripple effect of hidden costs that can seriously sting your bottom line.

The first hit is obvious: the money from the sale gets yanked right out of your account. If the transaction was for $100, that revenue is gone. But the bleeding doesn't stop there. On top of that, your bank will slap you with its own penalty—the non-negotiable returned item fee.

The Costs Pile Up Quickly

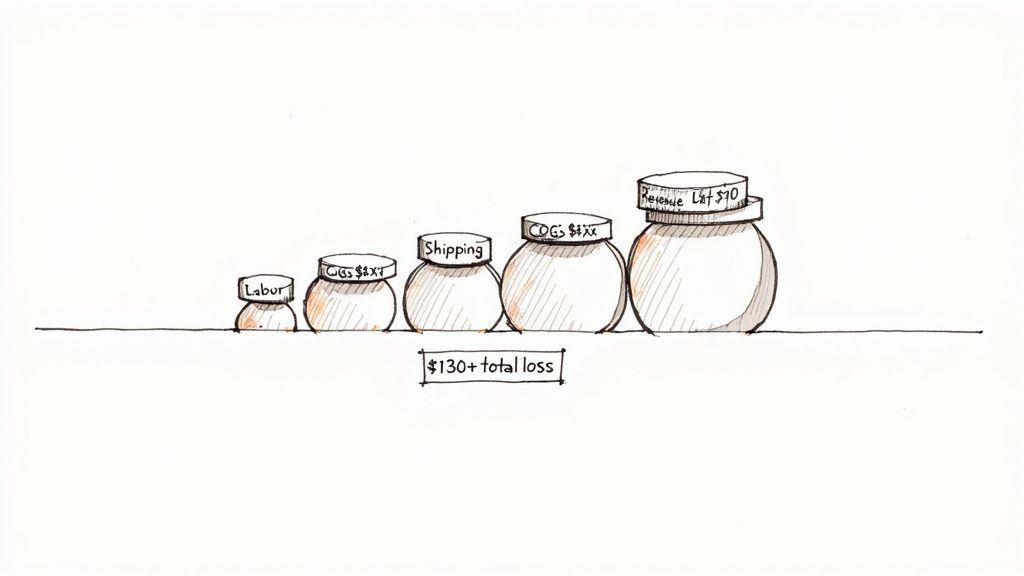

This fee is a direct punch to your profits. You've already lost the sale, and now you have to pay a penalty just for the hassle of the bounced payment. When you start tallying up all the other expenses you've already sunk into that transaction, the financial picture gets pretty grim.

Think about all the costs you've already paid that you can't get back:

- Cost of Goods Sold (COGS): If you've shipped a physical product, it's likely gone for good.

- Shipping and Handling Fees: You paid a carrier to deliver that item, and you're not getting that money back.

- Labor and Fulfillment Costs: Your team spent real time and effort picking, packing, and processing the order.

This situation, where a single returned payment on a shipped product creates a disproportionately large loss, is a classic example of asymmetric risk. For instance, if you ship a $150 order and the customer’s payment bounces, you don't just lose the $150. You’re also on the hook for the bank's return fees and have to eat the full cost of the product and shipping.

A Real-World Loss Calculation

Let's walk through a quick, realistic example to see how this plays out. Say a customer buys a $100 item from you and pays with an ACH transfer, but the payment is later returned for insufficient funds.

Here’s how the real costs break down.

| Cost Component | Amount | Description |

|---|---|---|

| Original Sale Amount | -$100 | The revenue clawed back from your account. |

| Bank Return Fee | -$15 | A typical fee charged by your bank for the failed transaction. |

| Cost of Goods Sold | -$25 | The wholesale cost of the product you shipped. |

| Shipping Costs | -$10 | The non-refundable amount you paid to the shipping carrier. |

| Total Financial Loss | -$150 | The true cost of this single failed payment. |

In this scenario, that $100 sale didn't just vanish—it turned into a $150 out-of-pocket loss. That's a 150% negative swing from just one transaction.

This is exactly why understanding the full impact of a chargeback fee is so critical. The financial hit is always much bigger than the sale price, which makes having a solid prevention strategy an absolute must for protecting your profits.

Building Your Response and Recovery Plan

While stopping these issues before they start is ideal, you still need a solid game plan for when a return item chargeback slips through. A well-rehearsed response plan transforms a fire drill into a calm, managed process that protects your bottom line. The moment that notification hits your inbox, the clock is on.

Your first move is to play detective. Dive into your bank statements and payment processor reports to match the chargeback to a specific transaction. You need to connect that reversal and its fee to an actual customer order. This isn't just about balancing the books; it's about gathering the critical facts that will guide your next step.

Assess the Situation and Choose Your Path

Once you’ve found the order, you need to figure out why the payment failed. That return code is your key. Is this something you can easily fix, or is it a lost cause?

- Correctable Errors: Think of codes like R03 (No Account/Unable to Locate) or R04 (Invalid Account Number) as simple typos. A quick, friendly outreach to the customer can usually clear things up in no time.

- Unrecoverable Issues: An R02 (Account Closed) code, on the other hand, is a dead end. You won't be able to process another payment on that account, period. Your only option is to get a new payment method from the customer.

Your immediate goal is to figure out if you're dealing with a simple data-entry mistake or a more serious payment problem. This initial diagnosis shapes your entire communication and recovery strategy, so you don't waste time chasing funds you'll never get back.

Execute Your Recovery Workflow

With a clear picture of the problem, it’s time to act. For simple fixes or issues like insufficient funds, a carefully crafted email or phone call is your best bet. Explain what happened in plain English, avoid making the customer feel blamed, and give them a simple way to provide a new payment method.

If you can't get a response or need to recover the cost of a product that’s already shipped, you might have to escalate things. This means documenting everything: the original order, proof of shipment, every email and call you made, and the official return item chargeback notice. If you end up having to pursue collections, this paper trail is absolutely essential. Turning this reactive scramble into a repeatable workflow is the key to minimizing stress and getting your money back.

Proactive Strategies to Prevent Losses

The best way to deal with a return item chargeback is to stop it from ever happening. Instead of just reacting after the money is already gone, a proactive defense strengthens your payment process from the start. It’s all about shutting down problems before they can drain your account.

Building this defense begins with confirming payment information right at the source. Implementing real-time bank account verification tools is a huge first step. These services can instantly check if an account number is valid and in good standing, which dramatically cuts down on failures from simple typos or closed accounts.

Fortifying Your Payment Gateway

If your business relies on recurring billing, like a subscription service, you need another layer of validation. Micro-deposits are a proven method for confirming that a customer actually owns and can access the bank account they provided.

You simply send two tiny, random amounts to their account and ask them to confirm the exact figures. This creates a much more secure link to their payment source, making all future transactions far more reliable.

Another simple yet powerful tactic is to add a strategic delay for high-value orders paid by ACH or check.

Resisting the urge to ship expensive goods immediately can be a business-saver. Waiting until the funds have fully cleared—not just provisionally credited—eliminates the risk of sending a product out the door only to have the payment reversed days later. That’s how you end up with no product and no money.

Leveraging Technology for Smarter Prevention

While manual checks have their place, modern tools offer a much smarter and more scalable defense. AI-powered fraud and risk prevention platforms give you a serious advantage by analyzing hundreds of data points in real time to score the risk level of every single transaction.

These systems can automatically flag payments that look suspicious, giving you a chance to step in before a problem gets worse. They spot patterns that a human would likely miss, building a solid shield against the financial leaks caused by failed payments. This is a critical part of understanding what does return item chargeback mean in the real world and knowing how to stop it.

For a deeper dive into building a complete defense, our guide on how to prevent chargebacks offers even more strategies you can put into action today.

Ultimately, the best defense is a multi-layered one. By combining a few key strategies, you can significantly reduce your exposure to these costly payment reversals.

- Real-Time Verification: Instantly check if a bank account is valid and active before you process the payment.

- Delayed Fulfillment: For big-ticket items, hold the shipment until ACH or check payments are fully settled.

- AI-Powered Monitoring: Use an intelligent platform like Disputely to analyze transaction risk and automatically flag suspicious activity.

By adopting these proactive measures, you can turn your payment processing from a potential weakness into a secure and reliable part of your business.

Got Questions? We've Got Answers

Still have a few questions floating around? Let's clear up some of the most common things merchants ask about return item chargebacks and what they mean for your business.

Can I Actually Fight a Return Item Chargeback?

Unfortunately, no. You can't dispute a return item chargeback in the same way you would a regular credit card chargeback. Think of it less as a customer complaint and more as a factual report from the bank stating a payment simply failed—usually due to something like insufficient funds. You can’t really argue with a fact.

Your best bet is to contact the customer directly to arrange for a different payment method. If that doesn't work, your only other options are to write it off as a loss or, for larger amounts, consider pursuing collections for the unpaid debt.

How Worried Should I Be About My Merchant Account?

Very. While a return item chargeback doesn't usually count against the chargeback ratio that Visa and Mastercard track, it definitely sends up red flags with your payment processor. A high number of these returns makes you look like a high-risk merchant.

This can trigger some pretty serious consequences, including:

- Higher processing fees across the board.

- Account reserves, meaning your processor holds back a chunk of your money as collateral.

- Account termination, which can be a business-ending event.

How Long Does It Take for One of These to Show Up?

This is where things get tricky, as the timing can really vary. For an ACH transfer, a return can pop up a few business days after the money initially seemed to have cleared in your account.

With old-school paper checks, the delay can be even worse, sometimes taking a week or more for the bank to send it back unpaid. This lag time is exactly why shipping expensive items before the payment is 100% settled is such a massive financial risk.

The most important thing to remember is this: a provisional credit in your account is not the same as a guaranteed payment. A return item chargeback can snatch that money back days—or even weeks—later, leaving you out the cash, the product, and hit with a new bank fee.

Stop letting surprise disputes drain your revenue. Disputely connects directly with card networks to warn you the second a customer starts a dispute. This gives you a critical window to issue a refund and stop a damaging chargeback before it ever affects your record. Protect your business and see how much you can save.